References

Afonso, A., Huart, F., Jalles, J. T., & Stanek, P. (2022). Twin Deficits Revisited: a role for fiscal institutions? Journal of International Money and Finance, 121, 102506.

Ardanaz, M., Cavallo, E., Izquierdo, A., & Puig, J. (2021). Growth-friendly fiscal rules? Safeguarding public investment from budget cuts through fiscal rule design. Journal of International Money and Finance, 111, 102319.

Caselli, F., Davoodi, H., Goncalves, C., Hee Hong, G., Lagerborg, A., Medas, P., Nguyen, A., and Yoo, J. (2022), “The Return to Fiscal Rules,” IMF Staff Discussion Notes, 2022 (002).

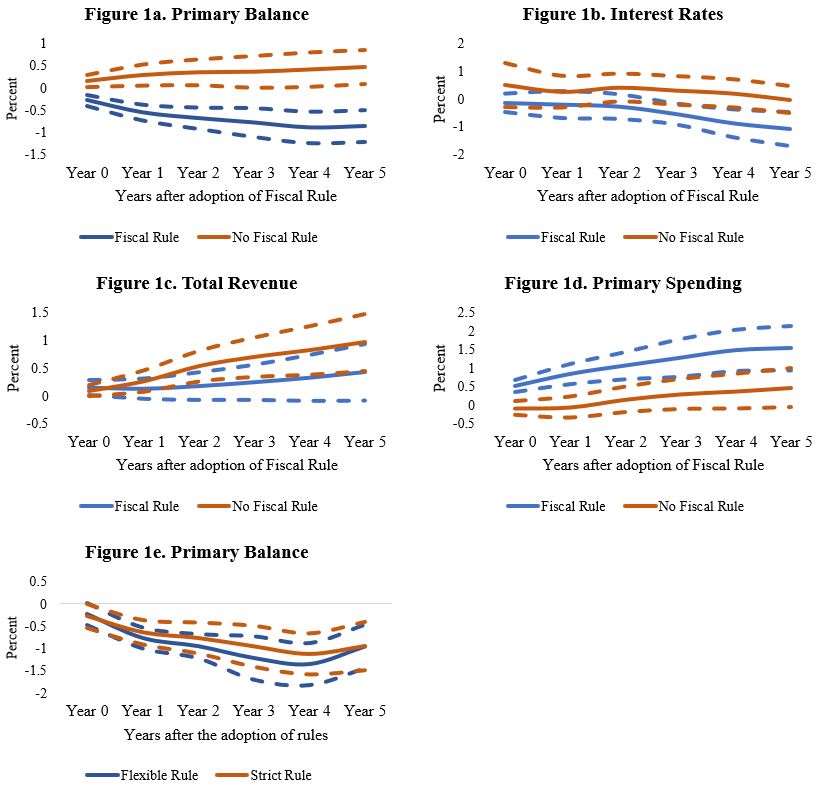

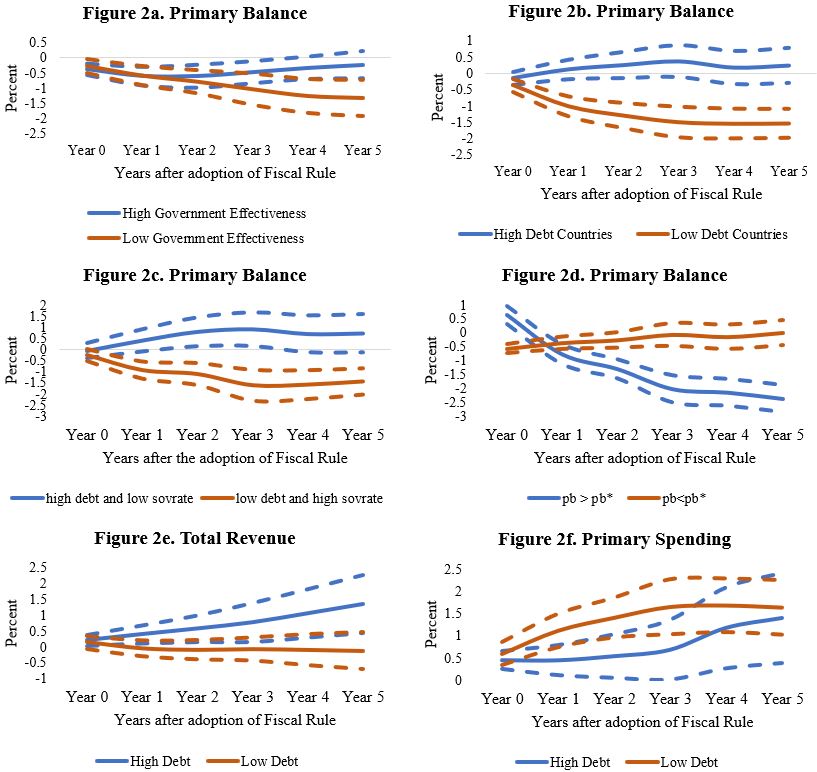

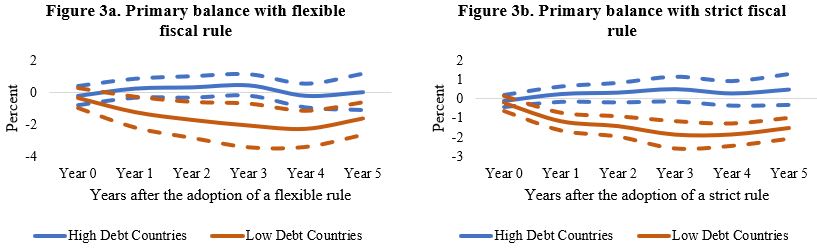

Chrysanthakopoulos, C., & Tagkalakis, A. (2024). The medium-term effects of fiscal policy rules. Journal of International Money and Finance, 103019.

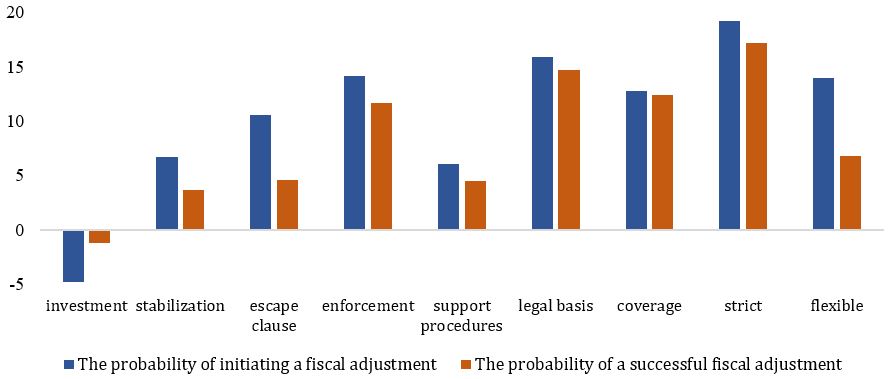

Chrysanthakopoulos, C., & Tagkalakis, A. (2023). The effects of fiscal institutions on fiscal adjustment. Journal of International Money and Finance, 134, 102853.

D’ Amico L., Giavazzi, F., Guerrieri, V., Lorenzoni, G., & Weymuller, C. (2021). Revising the European Fiscal Framework. URL: https://voxeu.org/article/revising-european-fiscal-framework-part-1-rules (accessed: 14.01.2022).

Darvas, Z., Martin, P., & Ragot, X. (2018). European fiscal rules require a major overhaul. Notes du conseil danalyse economique, 47(2), 1-12.

Davoodi, H. R., Elger, P., Fotiou, A., Garcia-Macia, D., Han, X., Lagerborg, A., Lam, R., & Medas, P. (2022). Fiscal Rules and Fiscal Councils. IMF Working Paper WP 22/11.

De Jong, J. F., & Gilbert, N. D. (2020). Fiscal discipline in EMU? Testing the effectiveness of the Excessive Deficit Procedure. European Journal of Political Economy, 61, 101822.

Fritsche, J. P., Klein, M., & Rieth, M. (2021). Government spending multipliers in (un) certain times. Journal of Public Economics, 203, 104513.

Gootjes, B., & de Haan, J. (2022a). Procyclicality of fiscal policy in European Union countries. Journal of International Money and Finance, 102276.

Gootjes, B., & de Haan, J. (2022b). Do fiscal rules need budget transparency to be effective?. European Journal of political economy, 75, 102210.

McManus, R., Gulcin Ozkan, F. and Trzeciakiewicz, D. (2021), Why are Fiscal Multipliers Asymmetric? The Role of Credit Constraints. Economica, 88: 32-69

Wiese, R., Jong-A-Pin, R., & de Haan, J. (2018). Can successful fiscal adjustments only be achieved by spending cuts? European Journal of Political Economy, 54, 145-166.

Ziogas, T., & Panagiotidis, T. (2021). Revisiting the political economy of fiscal adjustments. Journal of International Money and Finance, 111, 102312.