The views expressed are those of the author and do not commit the University of Orléans. The author would like to thank Françoise Drumetz and Nicolas de Sèze for their remarks and remains solely responsible for any errors.

That the digital euro should be legal tender is usually taken for granted. This measure is supported both by the European Central Bank (ECB) in its communication on the digital euro and by the European Commission in its Proposal for a Regulation on the establishment of the digital euro (European Commission, 2023a). However, making the digital euro legal tender would raise serious practical difficulties. Furthermore, the expected benefits of this decision are unlikely to obtain. In fact, making the digital euro legal tender could even undo some the expected benefits of its launch and entail risks. Overall, the notion of legal tender appears unfit in a digital environment where agents have a wide choice of payment instruments: legal tender is a barbarous relic.

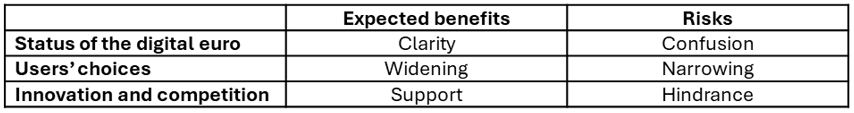

Table 1: Digital euro legal tender – Expected benefits and risks

To recall, legal tender implies that a payment in it cannot be refused by the payee. In the euro area, it is a feature attached only to the cash component (banknotes and coins) of money, although there are variations on what legal tender means in member states. Inter alia, national laws may impose restrictions as to maximal amounts that can be paid with coins or notes, with a view to limiting illicit transactions and maximising tax revenue.1

The idea that a central bank digital currency (CBDC)2 should be legal tender is predicated on the assimilation of CBDC to “a digital form of cash”. This assimilation is usually taken for granted: following a Darwinian approach, cash would have to adapt, as a living specie, to the evolution of society towards digitalization, or else would be doomed to disappear, which most people would regret. However, this adaptation is paradoxically understood as keeping its main features, including legal tender, unchanged, which creates practical difficulties (see section 2).

The “digital form of cash” (or even “digital cash”) phrase is widely propagated in the media, but it is also widely used by official institutions, starting with central banks, which usually picture CBDC as a complement to cash fitted for a digitalized economy. In the case of the European Central Bank (ECB), one can refer to ECB (2023a), quoting Christine Lagarde (“We envisage a digital euro as a digital form of cash that can be used for all digital payments.”).3 Regarding the European Commission’s proposal for a Regulation on the establishment of the digital euro (European Commission, 2023a), it states that “The objective of this proposal is to ensure that central bank money with the status of legal tender remains available to the general public” (page 2). The justification put forward is seemingly that “Legal tender status is a defining characteristic of central bank money” (page 20). However, reserves are central bank money but are not legal tender, whereas coins are legal tender but are not issued by central banks in most member states. In its opinion on the European Commission’s proposal, the ECB has expressed broad support for the provisions related to legal tender (ECB, 2023b).

However, “digital form of cash” is an oxymoron, for two sorts of reasons:

To start with, it is very likely that the majority of the public does not know what the concept of legal tender is or thinks that it is attached to the use of the legal currency (i.e. the euro in the euro area), rather than to the use of cash. One example of the confusion that surrounds the topic of legal tender status has been recently provided by a recent survey conducted by the Banca d’Italia showing that around 70% of respondents believed that cryptoassets enjoyed the same legal status as traditional currency (Banca d’Italia, 2023). However, such a confusion is unsurprising when one considers that the large choice of payment instruments economic agents can choose within and that they probably consider private money (i.e. deposits) as safe, or nearly as safe, as public money. As a result, it is likely that people do not specifically want to impose a given means of payment to the payees and rather wish the means of payment they hold is accepted by merchants. They do not view the acceptability of a means of payment primarily in legal terms, but rather in terms of convenience.

From that perspective, making the digital euro legal tender could backfire and reduce the choice by consumers of their means of payment. Indeed, merchants could choose to no longer accept private money. They would be incentivized to do so as merchant service charges or inter-PSP fees on digital euro payment services will be regulated, with a view to making them lower than equivalent charges or fees on private money (European Commission, 2023a, Article 17). Merchants would also be able to point to their customers that, by using the digital euro, they have access to a pretty wide range of “basic” payment services free of charge (European Commission, Article 13 and 17, and Annex 2). Furthermore, public administrations would also be incentivized to use the digital euro, so as to maximize seigniorage. Public expenditure, starting with salaries and social benefits, could be paid in digital euros. The individual holding limit of €3000, frequently mentioned by ECB representatives as a possible figure, would allow most wage earners, unemployed or pensioners to keep their income in a digital euro wallet or account. The payment of social security contributions and taxes in legal tender could also be encouraged or even made mandatory4 (the “waterfall” and “reverse waterfall” mechanisms (European Commission, 2023a, Article 13), which payment service providers would also have to provide “freely”, would allow making payment of whatever amount in digital euros, while respecting the individual holding limit). The risk is thus that, progressively, the bulk of payments are made in digital euro. The paradox is that the threat of creating “walled gardens” within which agents make their payments, denounced by central bankers in relation to the use of stablecoins issued by Big Tech firms (see e.g. Carstens, 2023), could then materialize at the benefit of CBDC (Pfister, 2023). This would be a return to the situation that prevailed from WW1, with the instauration of forced tender, to the 1960s, with the spreading of bank deposits to the wide majority of the population, when public money was king. It would also create a significant advantage for the issuer, and therefore for the governments, at the cost of a de facto reduction of the freedom of choice of consumers which the digital euro is supposed to widen by offering a new means of payment. The option out of private money and means of payment might end up into little option out of public money and no option out of private means of payment.

Finally, one purported benefit of launching a digital euro is to foster financial innovation and competition (ECB, 2020). However, as noted in section 2, making the digital euro legal tender could well imply giving this status to all payment services, to the extent they make use of the digital euro. As there would probably be no ground for refusing this possibility to existing behemoths in the sector, this would allow them to prevent the entry of competitors into the market. Indeed, very strong network effects and economies of scale in the payment industry imply that it is possible to make huge profits with slim margins, provided that the firm has a large market share. Conversely, an outsider entering the payment market has either to make big margins or accept to make losses during several years. The former case implies it has to bring a technological breakthrough but is not compatible with the desire to limit merchant fees (see above). The latter case implies the entering firm has to be a Big tech firm. In both cases, financial innovation and competition are likely to be hampered.

The points made in this note on the possibility of making the digital euro legal tender are quite general and would thus apply to any retail CBDC. Certainly, making a CBDC legal tender may be more justified in a context where the wide majority of payments are made in cash and the public authorities wish to encourage the modernisation of payments, i.e. in some developing and emerging economies. Conversely, in developed economies, where agents have a wide scope of payment instruments at their disposal, legal tender appears nowadays as a barbarous relic. This does not imply that the legal tender status should be withdrawn from cash, since we can live with archaisms, which in fact abound in our modern societies. Furthermore, there are fewer and fewer chances that merchants accept only cash – especially as the e-commerce market share keeps growing – or that public administrations impose to make exclusive use of cash (just as merchants, they rather try to limit it, for safety and convenience reasons). However, we should avoid playing Dr. Frankenstein and giving corpses new lives.

Banca d’Italia (2023), Surveys on Digital Literacy and Digital Financial Skills in Italy: Adults, 20 July, https://www.bancaditalia.it/media/notizia/surveys-on-financial-literacy-and-digital-financial-skills-in-italy-adults/.

Carstens A. (2023), Innovation and the future of the monetary system, 22 February, https://www.bis.org/speeches/sp230222.htm.

European Central Bank (2020), Report on a digital euro, October, https://www.ecb.europa.eu/pub/pdf/other/Report_on_a_digital_euro~4d7268b458.en.pdf.

European Central Bank (2023a), Eurosystem proceeds to next phase of digital euro project, Press release, 18 October, https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.pr231018~111a014ae7.en.html.

European Central Bank (2023b), Opinion of the European Central Bank of 31 October 2023 on the digital euro (CON/2023/34), https://www.ecb.europa.eu/pub/pdf/legal/ecb.leg_con_2023_34.en.pdf.

European Commission (2023a), Proposal for a regulation of European Parliament and of the Council on the establishment of the digital euro, 28 June, https://finance.ec.europa.eu/system/files/2023-06/230628-proposal-digital-euro-regulation_en.pdf.

European Commission (2023b), Proposal for a regulation of European Parliament and of the Council on the legal tender of euro banknotes and coins, 28 June, COM_2023_364_1_EN_ACT_part1_v6.pdf (europa.eu).

Panetta F. (2023), A digital euro: widely available and easy to use, Introductory statement at the Committee on Economic and Monetary Affairs of the European Parliament, Brussels, 24 April, https://www.ecb.europa.eu/press/key/date/2023/html/ecb.sp230424_1~f44c7ac164.en.html.

Pfister C. (2020), Central Bank Digital Currency: A Primer, SUERF Policy Note 143, March, https://www.suerf.org/wp-content/uploads/2023/12/f_a43fc3d27915b373b163da088684d4a9_10947_suerf.pdf.

Pfister C. (2023), Motives for a retail CBDC: The Good, the Bad and the Ugly?, International Review of Financial Services, forthcoming.

These variations are one reason why the European Commission proposes to regulate the legal tender status of cash in a legislative proposal which would parallel the Regulation on the digital euro (European Commission, 2023b).

Each time I refer to CBDC or to the digital euro in this note, I mean the retail (or “general purpose”) version of CBDC, accessible to the public, not the wholesale version that would only be accessible to financial institutions.

Fabio Panetta (2023) makes a similar point, although he refrains from using the phrase “digital form of cash” and instead refers to the notion of “public good”: “The digital euro could also be given legal tender status by legislators. If introduced, the digital euro would be a public good, and Europeans would expect to be able to access and use it easily, anywhere in the euro area. So, it would be more beneficial and convenient for all users if merchants that accept digital payments were obliged to accept the digital euro as legal tender”. However, that a good or a service is a “public good” does not imply either that it is produced by the public sector or that everyone should be forced to accept it. For instance, primary education is considered in all euro area countries as a public good, but citizens can send their children to schools run by the private sector.

Strictly speaking, there might be no explicit requirement to pay in digital euros but the obligation to use legal tender, combined with limits to the acceptance of cash, would de facto induce payers to use the digital euro.