This Policy Brief is based on ECB Working Paper Series No 2918. The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank (ECB) or the Bank for International Settlements (BIS).

This paper provides insights into the determinants of currency choice in cross-border bank lending, such as bilateral distance, financial and trade linkages to issuer countries of major currencies, and invoicing currency patterns. Cross-border bank lending in US dollars, and particularly in euro, is highly concentrated in a small number of countries. The UK is central in the international network of loans denominated in euro, although there are tentative signs that this role has diminished for lending to non-banks since Brexit. Offshore financial centres are pivotal for US dollars loans, reflecting, in particular, lending to non-bank financial intermediaries in the Cayman Islands, possibly as a result of regulatory and tax optimisation strategies. The empirical analysis suggests that euro denominated loans face the “tyranny of distance”, in line with predictions ofgravity models of trade, in contrast to US dollar loans. Complementarities between trade invoicing and bank lending are found for both the euro and the US dollar.

Dominant currencies provide the issuer with important economic, financial and strategic advantages, so it is important to understand why some currencies have a more prominent international role than others. We offer insights into the determinants of currency choice in cross-border bank lending, such as bilateral distance, financial and trade linkages to issuer countries of major currencies, and invoicing currency patterns.

Using granular data from the bilateral BIS locational banking statistics, we are able to reveal several new stylised facts and provide robust and nuanced supporting evidence of the complementarities between the choice of currency for cross-border bank lending and trade invoicing (Emter, McQuade, Pradhan and Schmitz, 2024).

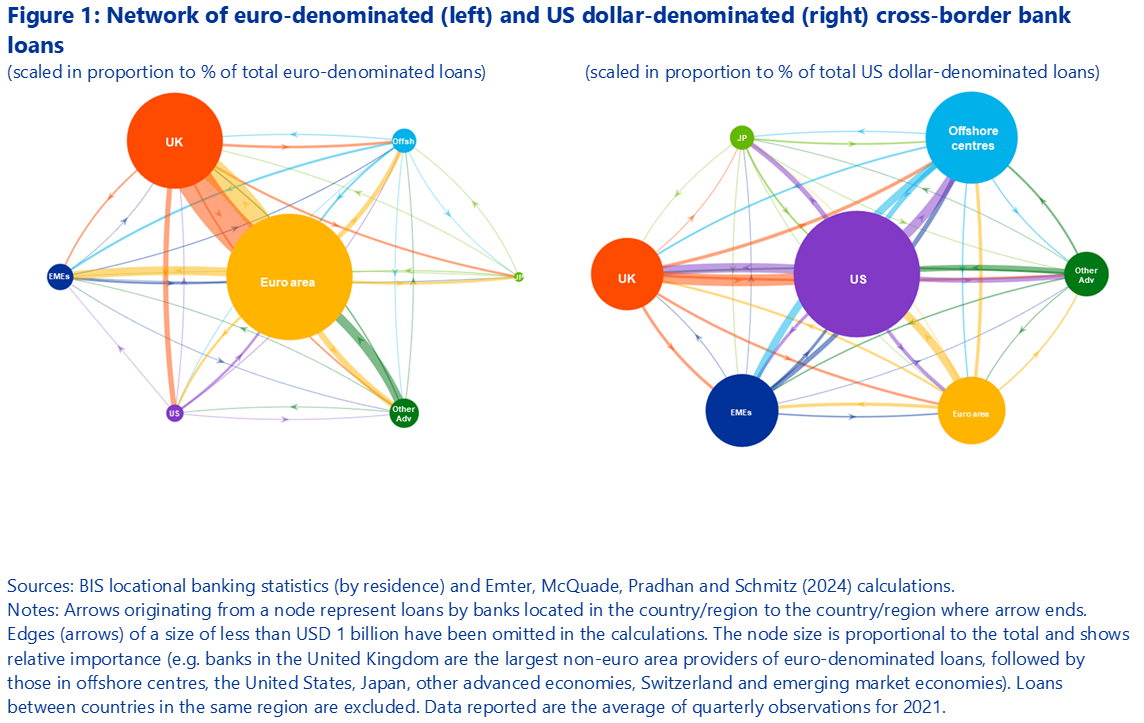

Cross-border bank lending in US dollar and particularly in euro is highly concentrated in a small number of countries. The United Kingdom is central in the international network of loans denominated in euro (Figure 1, left panel), although there are tentative signs that since Brexit this role has diminished for lending to non-banks. Offshore financial centres are pivotal for US dollar loans (Figure 1, right panel) reflecting, in particular, lending to non-bank financial intermediaries in the Cayman Islands, possibly as a result of regulatory and tax optimisation strategies.

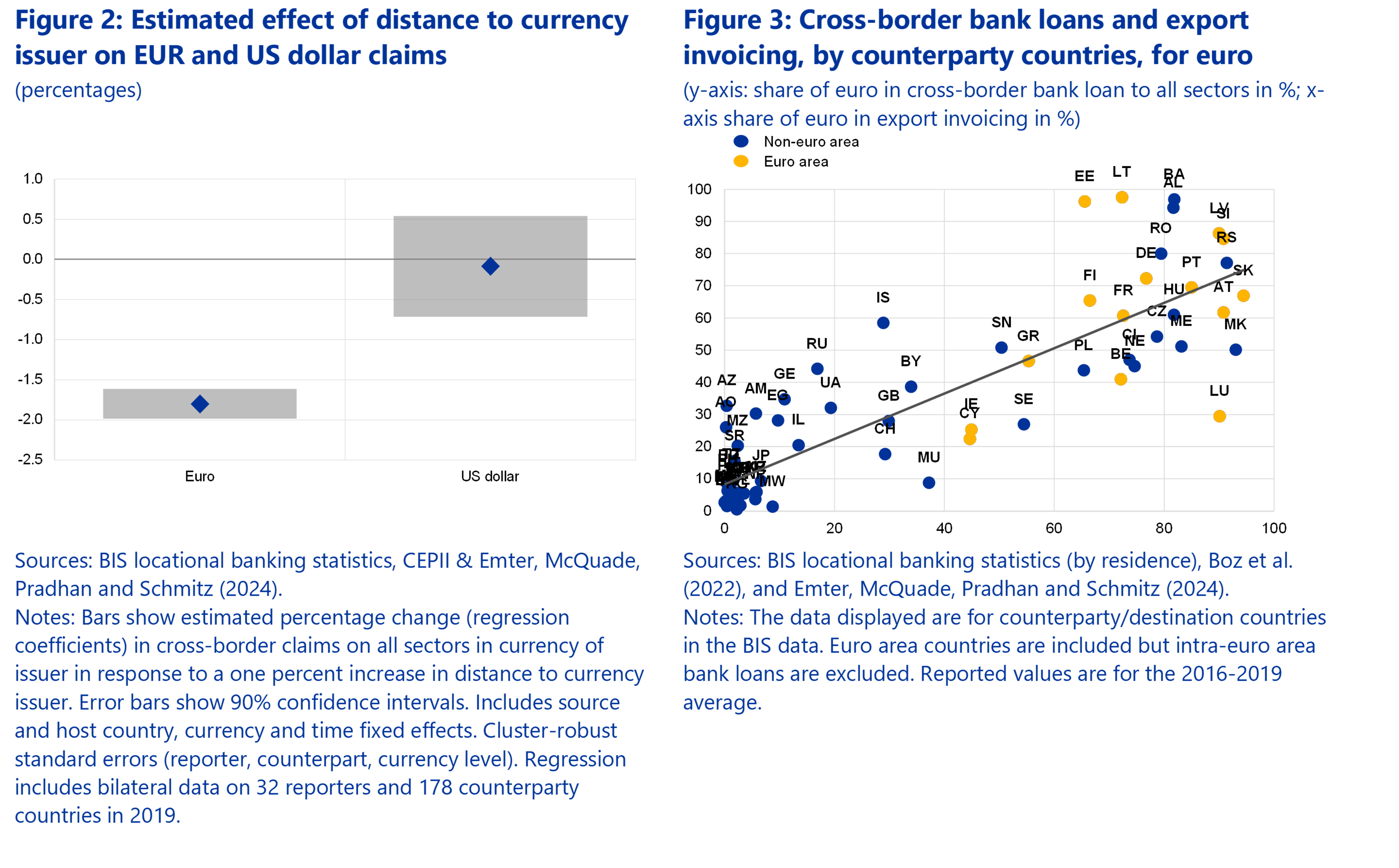

Our empirical analysis in Emter et al. (2024) suggests that, in contrast to US dollar loans, euro-denominated loans face the “tyranny of distance”, in line with predictions of gravity models of trade (see, for example, Mehl, Sabbadini, Schmitz, and Tille, (2024)). Figure 2 shows the coefficients estimated using regression analysis. The results imply that if both the source and destination countries are far away from the euro area they are likely to lend less bilaterally in euro, whereas this distance effect is negligible for bilateral lending in US dollar.

Complementarities between trade invoicing and bank lending are found for both the euro and the US dollar. Figure 3 shows that, consistent with economic theory (Gopinath and Stein, 2021), there is a strong correlation between trade invoicing and bank lending in euro.

Overall, the analysis confirms that the euro’s role in cross-border bank lending is more regional, while the use of the US dollar is global. These results have implications for policy. Stronger trade and financial links to the euro area foster international use of the euro, so preserving the openness of international trade and financial markets could support the global appeal of the euro.

Boz, E., Casas, C., Georgiadis, G., Gopinath, G., Le Mezo, H., Mehl, A., & Nguyen, T. (2022). Patterns of invoicing currency in global trade: New evidence. Journal of International Economics, 136(100).

Emter, L., McQuade, P., Pradhan, S.-K., Schmitz, M. (2024). Determinants of currency choice in cross-border bank loans. (Working Paper Series No. 2918). European Central Bank.

Gopinath, G., & Stein, J. C. (2021). Banking, Trade, and the Making of a Dominant Currency. The Quarterly Journal of Economics, 136(2), 783–830.

Mehl, A., Sabbadini, G., Schmitz, M., & Tille, C. (2024). Distance(s) and the volatility of international trade(s). European Economic Review, forthcoming.