References

Bruno, V. and H. S. Shin (2015), “Capital flows and the risk-taking channel of monetary policy”, Journal of Monetary Economics, 2015, vol 71, pp 119-132.

_ and _ (2023), “Dollar exchange rate as a credit supply factor – evidence from firm-level exports”, BIS Working Papers No. 819.

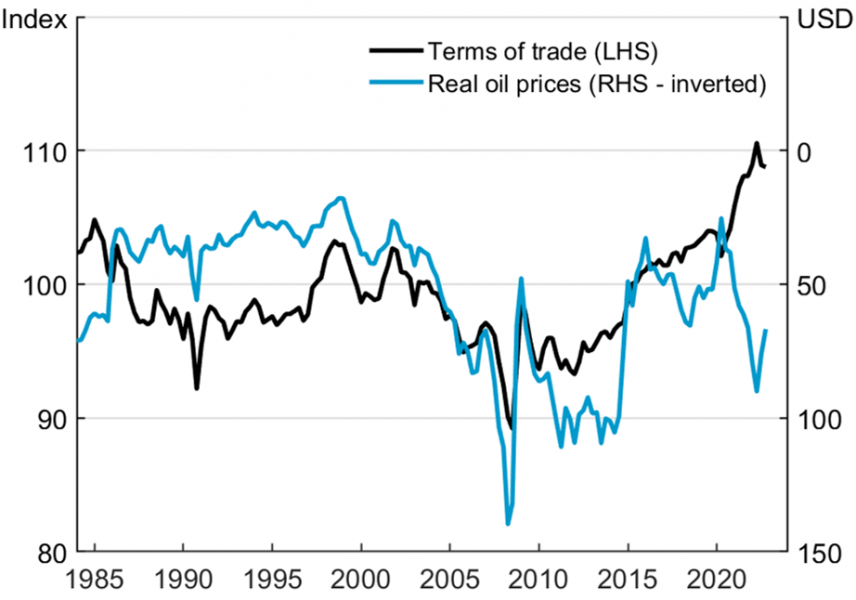

Chen, Y. and K. Rogoff (2003), “Commodity Currencies”, Journal of International Economics, vol 60, pp. 133-160.

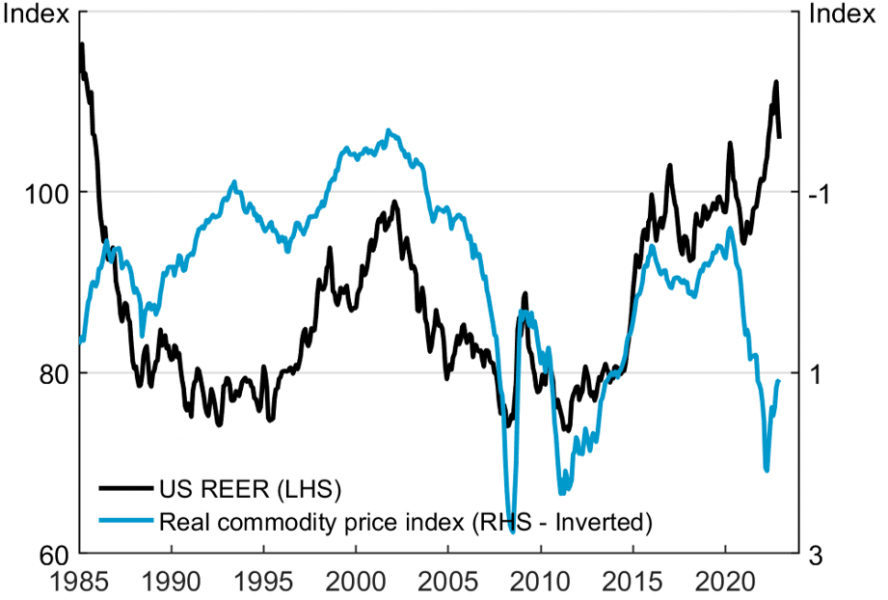

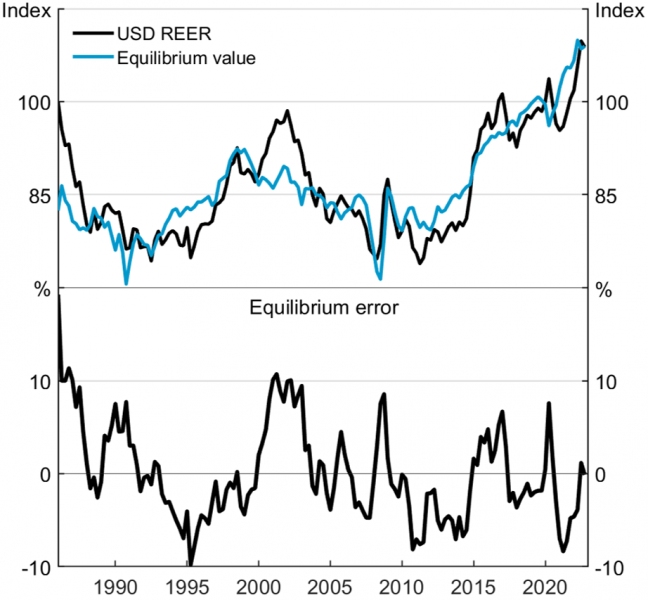

Hofmann, B, D Igan and D Rees (2023), “The changing nexus between commodity prices and the dollar: causes and implications”, BIS Bulletin, no, 74.

Manalo J., D. Perera and D. M. Rees (2015), “Exchange rate movements and the Australian Economy”, Economic Modelling, vol 27, pp. 53-62.

Rees, D. M., (2023). “Commodity prices and the US Dollar”, BIS Working Papers No. 1083.