The policy brief is based on BIS Working Paper No 1275. The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank, Sveriges Riksbank, Czech National Bank, Central Bank of Chile or the Bank of Greece.

Abstract

We use a large panel of 52 developed and developing economies over two decades to empirically investigate the extent to which climate risks influence sovereign yields. Transition risk is associated with higher sovereign yields, with the effect more pronounced for developing economies and for high-emitting countries after the Paris agreement. In contrast, high-temperature anomalies do not appear to be priced-in sovereign borrowing costs. At the same time, countries with high levels of debt tend to record higher sovereign yields as acute physical risk increases. In the medium term, using local projections, we find that sovereign yields respond significantly but also differently to different types of disaster. We also explore the nonlinear effects of weather-related natural disasters on sovereign yields and find a striking contrast in the impact of climate shocks on sovereign borrowing costs according to income level and fiscal space when the shock hits.

Climate change is generally acknowledged as a significant risk factor, especially for high- debt, fiscally vulnerable countries. These countries may be less well placed to deal with the challenges of severe weather events as well as the costs of the green transition. Climate change introduces a complex array of risks to public finances through multiple and often interdependent transmission channels. These include fiscal expenditures for adaptation and mitigation, re-allocation of resources from productive investments to new technologies, and the repricing of sovereign assets. Direct fiscal impacts arise from emergency aid and disaster reconstruction, while indirect effects may include lower tax revenues due to production disruptions, changes to commodity prices, and increasing spending via food subsidies.

Despite the profound implications of climate-related risks for sovereign borrowing costs, systematic analysis of this relationship remains limited. Even more striking is that, while the sovereign bond market is one of the largest asset markets and figures prominently within institutional investors’ portfolios, it has received significantly less attention in terms of climate risk pricing compared to equities and corporate bonds. In addition, existing research on sovereign bond markets has mainly focused on either physical risks – examining specific climate-induced natural disasters or climate-vulnerability and resilience indicators or chronic risk – or transition risks, with few studies addressing both sources of risks comprehensively.

In our recent research, Anyfantaki, Blix Grimaldi, Madeira, Malovana, and Papadopoulos (2025), we provide new empirical evidence through an in-depth empirical analysis based on a large cross-sectional dataset of 52 developing and developed countries and detailed climate risk data for a time period that covers about two decades, from 2000 to 2023. Specifically, we consider the two key components of climate risk: transition risk and physical risk, while recognizing the different dynamics expected from developing economies as well as the nonlinearities arising from the debt levels of a country when a climate disaster shock materializes. We connect with two strands of research: the well-established literature on the macroeconomic determinants of sovereign bond yields and the more recent literature on climate impacts in financial markets.

We consider both sources of climate risk, i.e. transition risk and physical risk. In line with previous literature, we measure transition risk as annual carbon dioxide (CO2) emissions per capita. We further differentiate physical risk into two dimensions: chronic risk measured by growth in annual temperature relative to the mean temperature between 1951 and 1980, and acute risk, measured by the frequency and severity of climate-related natural disasters – floods, storms, droughts, and wildfires – and considering both the economic and human cost. Chronic risk captures long-term, gradual climate shifts while acute risks materialize over shorter time, often with immediate and severe consequences. We use data for natural disasters from EM-DAT, one of the most comprehensive, publicly available datasets on natural disasters distributed by the Centre for Research on the Epidemiology of Disasters.1 The dependent variable is countries’ 10-year government bond yield. After controlling for macroeconomic variables – government debt as a share of GDP, inflation, GDP growth, (log) exchange rate, government efficiency and political stability indicators – and time-invariant variables, the analysis reveals the following:

For transition risk, we find that there is a significant and positive relationship with 10-year sovereign bond yields, suggesting that achieving progress in climate transition performance can offset the transition risk premium. Developing economies, which have in general implemented less green financial policies and have lower fiscal capacity, tend to experience higher borrowing costs as they navigate the transition toward greener economies. This underscores the importance of proactively managing transition risks to minimize their financial impact. Moreover, the analysis illustrates that the positive relationship between carbon emissions and sovereign yields has become stronger since the Paris Agreement for the countries with greater exposure to transition risk, suggesting that credit investors are increasingly recognizing the importance of this risk.

For physical climate risk, we find that there is no impact on sovereign bond yields for the full sample. However, for the subsample of highly indebted countries, acute physical risk (measured by the frequency and severity of natural disasters) does increase borrowing costs. This suggests that the bond market is taking into account the risks from severe climate events on vulnerable countries.

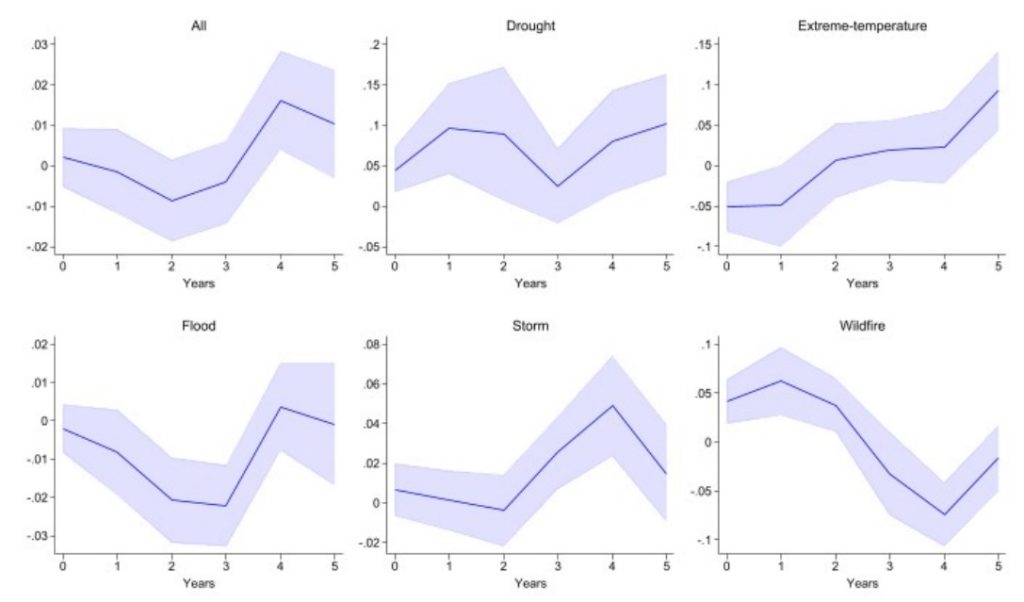

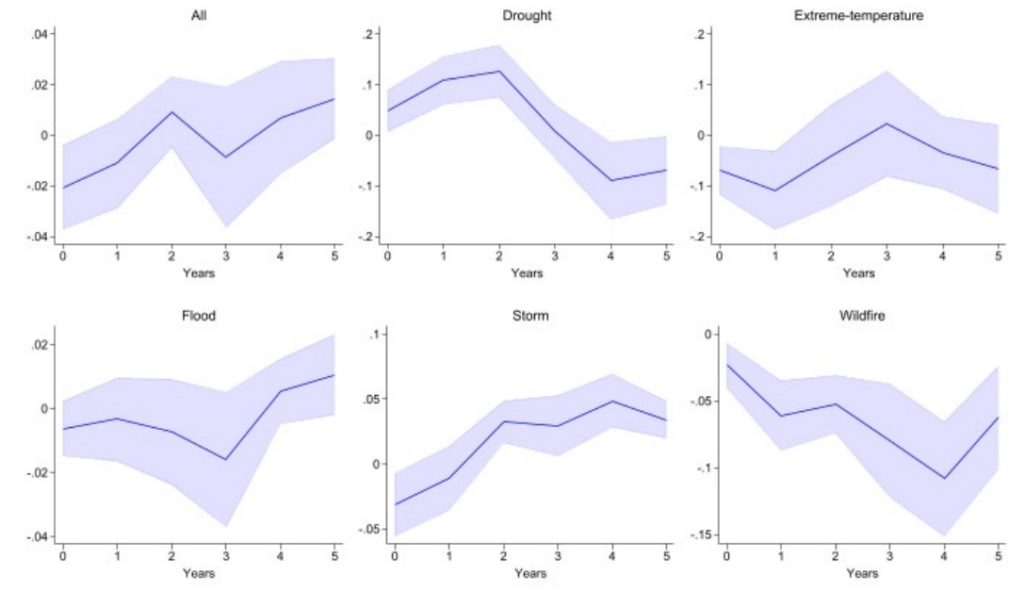

To further enhance our findings on the impact of acute risk on sovereign yields and better understand the mechanisms at play in the medium term, we use the local projections (LP) method of Jord`a (2005). In particular, we consider the impact of different types of climate – related natural disasters both in terms of their frequency and severity. Across all countries and for all types of disasters, the impact of climate-related natural disasters appears positive but relatively small. However, there is significant heterogeneity in response to different types of natural disasters and between income groups. As shown in Figure 1, the impact is immediate and steeper for more severe (e.g. droughts) and more frequent (e.g. storms) events.

Figure 1. Impact of climate shocks on sovereign yields: Frequency and Severity

a.) Disaster Frequency

b.) Disaster Severity

Notes: The figure shows impulse response functions constructed from regression results of the lag-augmented local projection model. Solid lines display the coefficients of (non-cumulative) responses of the sovereign yields over the five years following a climate shock. Shaded areas refer to 68% confidence intervals. Panel (a) shows responses to disaster frequency, measured by the occurrence of natural disasters. Panel (b) shows responses to disaster severity, measured by total damages as a percentage of GDP. Both panels cover climate-related disasters: drought, extreme temperature, flood, storm, and wildfire.

For advanced economies, the steepest and largest impact is observed from climate shocks related to extreme temperature and storms, which are respectively events with long duration and high frequency. In contrast, for emerging and developing economies, the response is more immediate and steeper for all types of disasters, emphasizing the challenges faced by these economies where the population is highly exposed to natural disaster risk due to geographic location and high dependence on agriculture and natural resources.

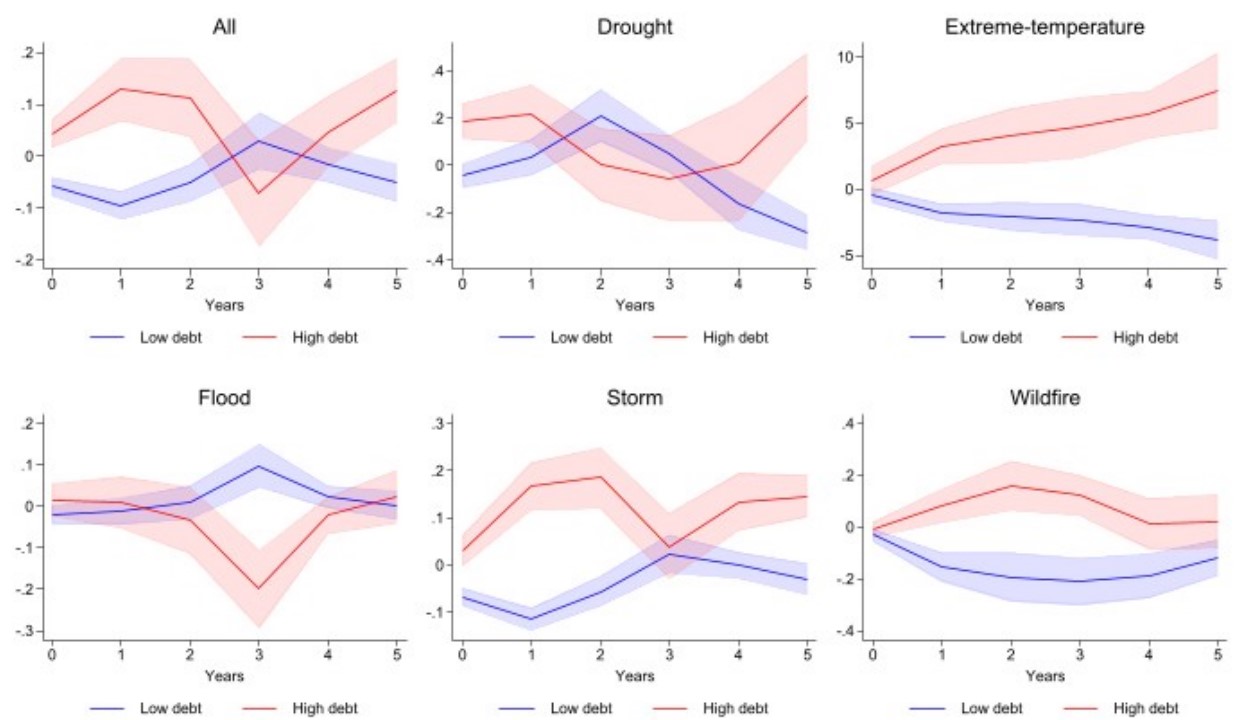

A key insight of our recent research is that available fiscal space plays a critical role in determining the magnitude and persistence of the impact of climate shocks on sovereign yields. We explore whether initial available fiscal space at the time of the shock influence the impact of climate shocks as measured by total damages (% GDP) on sovereign yields using a variant of LP to estimate state-dependent impulse response functions with the effect of climate shocks weighted by the probability of being in each state (high vs low debt). This allows for a smooth transition between the two states.2 When the shock hits, natural disasters are associated with a smaller impact for low-debt countries (Figure 2). The reason is that countries with high fiscal capacity are better positioned to implement mitigation strategies and are less-vulnerable to economic disruptions following climate-related shocks.

Our findings provide valuable insights for investors and policymakers. First, the impact from climate change might be greater than previously anticipated. Thus, policymakers need to better understand how transition efforts, such as lowering carbon emissions, affect the cost of borrowing. At the same time, the frequency and intensity of extreme weather events and natural catastrophes are increasing, a trend that may be exacerbated in the coming decades by long-term shifts in climate patterns. The differences in how climate-induced disasters affect different income groups highlight the challenges faced by developing countries where population is highly exposed to natural disaster risk. Finally, there is increasing awareness of climate change as a potential source of imbalance, especially for high-debt, fiscally vulnerable countries. We provide further evidence that there is a need for an international policy agenda aiming to address both climate and sovereign debt challenges, acknowledging that the cost of inaction compounds over time and might give rise to a vicious circle.

Figure 2. Disasters and the role of fiscal space

Notes: The figure shows impulse response functions constructed from regression results of the lag- augmented local projection model. Solid lines display the coefficients of (non-cumulative) responses of the sovereign yields over the five years following a climate shock as measured total damages (% GDP). The first panel is for all climate related natural disasters, i.e. drought, extreme-temperature, flood, storm and wildfire. Shaded areas refer to 68% confidence intervals.

ADB, A. A., Furceri, D., IMF, P. T., 2016. The macroeconomic effects of public investment: Evidence from advanced economies. Journal of Macroeconomics 50, 224–240.

Anyfantaki, S., Blix Grimaldi, M., Madeira, C., Malovana, S., Papadopoulos, G., 2025. Decoding climate-related risks in sovereign bond pricing: A global perspective. Tech. rep., BIS Working Papers, No 1275.

Cevik, M. S., Jalles, J. T., 2023. Eye of the storm: The impact of climate shocks on inflation and growth. International Monetary Fund.

Jorda`, O`., 2005. Estimation and inference of impulse responses by local projections. American Economic Review 95, 161–182.

EM-DAT focuses on large disasters, i.e. disasters with human and economic losses with at least one of the following criteria: 10 fatalities; 100 affected people; a declaration of state of emergency; a call for international assistance.

In particular, we use a model similar to the smooth transition autoregressive (STAR) model, which allows the effect of climate shocks to change smoothly between states, thus making the response more stable and precise (ADB, Furceri, and IMF, 2016; Cevik and Jalles, 2023)