Disclaimer: This policy brief should not be reported as representing the views of the Bank of Italy. The views expressed are those of the authors and do not necessarily reflect those of the Bank of Italy. The brief is based on Anzuini, A., Pisano, E., Rossi, L., Sanelli, A., Tosti, E. and E. Zangari (2023), “Clever planning or unfair play? Exploring the economic and statistical impacts of tax avoidance by multinationals”, Banca d’Italia Occasional Papers No. 799.

Following the 2007-8 financial crisis, increasing concerns on tax avoidance by multinational enterprises (MNEs) drew attention from academia and policy circles alike. Profit shifting practices not only impact tax revenues and fairness, but also exacerbate global tax competition and generate economic distortions. Tax avoidance by MNEs is achieved through several complex strategies, in which tax havens and offshore financial centres typically play a prominent role. Policy initiatives adopted under the aegis of the G20 and the OECD, including the BEPS (Base Erosion and Profit Shifting) plan and the Two-Pillar agreement, attempt to address this issue, but their final impact remains uncertain. The interplay between the tax strategies of MNEs and governments’ efforts to attract investments also distorts external statistics. Indeed, residency-based reporting blurs the distinction between tax-driven and genuine investments. The recent economic literature has developed methods to better allocate both foreign direct (FDIs) and foreign portfolio investments; the application of such methods reveals a new picture of international capital flows (including for Italy), with a higher statistical incidence of tax havens.

The topic of tax avoidance has become increasingly relevant both in the academic debate and in economic policy, especially after the financial crisis of 2007-20081. In addition to adverse effects in terms of revenue losses and equity, tax avoidance can generate significant economic distortions and exacerbate tax competition between countries, triggering a “race to the bottom” in corporate taxation, which in turn may significantly limit fiscal policy choices.

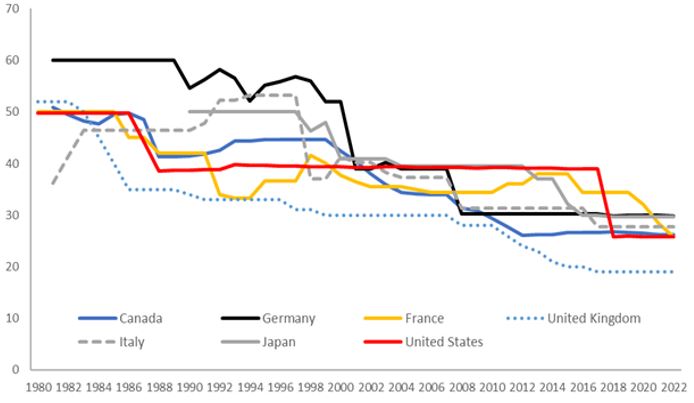

Indeed, the sharp reduction of the Corporate Income Tax statutory rates over the past decades (see figure 1), suggests a scenario of tax competition among countries, especially for paper profits. Even if at the aggregate level the weight of corporate taxation with respect to GDP has been stable over time, lower statutory tax rates imply a decrease in effective taxation for firms and investments with higher profitability rates and therefore a shift of the corporate tax burden on less profitable firms and investments2.

Figure 1: Statutory corporate income tax rates in the G7 countries, 1980-2022

Source: Tax Foundation, Corporate tax rates around the world.

In general, multinationals may combine several avoidance strategies, generating a wide array of extremely complex schemes, that typically imply an erosion of corporate tax bases in MNEs’ countries of origin and a concomitant shifting of profits to low-tax jurisdictions (the so-called Base Erosion and Profit Shifting – BEPS). The main channels are the distortion of intragroup transaction prices, the strategic location of intangible assets and the manipulation of groups’ financial structure. Tax havens typically play a prominent role in these strategies. However, tax avoidance does not necessarily imply the “engagement” of such jurisdictions, since preferential regimes are provided even by some large – and, in some cases, apparently high-taxation – countries3.

The empirical literature– mainly referring to years preceding the adoption of policy initiatives to reduce profit shifting – provides a somewhat wide range of estimates on the size of the phenomenon: on a global level, the scale of yearly revenue losses goes from $49 bn. (0.07% of GDP) to $500-640 bn. (0.6%-0.8% of GDP). In the United States, revenue losses range from about $45 bn. to $93 bn. (0.2%-0.5% of GDP)4. For Italy the estimates range from €1 bn. to €5 bn. (0.05%-0.3% of GDP). A pattern that emerges from recent estimates is that tax avoidance is highly concentrated among the largest multinationals.

Several policy initiatives have been undertaken, especially after the financial crisis, under the aegis of international institutions. The BEPS Action Plan developed by the OECD in 2015, while marking a fundamental step forward in international tax coordination through the key concept of “nexus” between place of taxation and performance of the economic activity, still left room for various tax avoidance schemes and, above all, did not address the challenges arising from the digitalization of the economy. Starting from these shortcomings, in 2021 the OECD-G20 “Two Pillars” agreement, signed by a large number of countries, introduced a partial reallocation of taxation rights (on a limited share of the profits of multinationals with a turnover exceeding €20 billion and a profitability rate above 10%) towards the market jurisdictions (Pillar One), and a minimum level of effective taxation of 15% (Pillar Two) for groups with revenues of at least €750 million.

Although the empirical evidence is still at a preliminary stage, the BEPS Plan has contributed to a greater diffusion and uniformity of anti-avoidance disciplines. As regards the two pillars, an ex-ante evaluation of the effects is complex, given both the uncertainty about the number and the size of countries effectively adopting them, and the possible behavioral reactions to the reform by companies and governments. The first Pillar undoubtedly marks a radical change in the international taxation framework, as it attributes for the first time a tax right to “market” jurisdictions, regardless of the company physical presence. However, the high turnover threshold significantly limits its scope: the additional revenues are in fact estimated between 0.5% and 1.5% of global corporate tax revenue. Despite these limitations, it constitutes a first “building block” that could pave the way for broader and more effective reforms.

As regards the second Pillar, the introduction of the 15% minimum tax may have less obvious effects than its stated purpose might suggests. The first estimates carried out by the OECD indicate additional revenues around 9% of the global revenue of the corporate tax (approximately 0.3% of world GDP). The minimum tax should lead to a reduction in profit shifting; however, its extent and timing are significantly uncertain, since tax avoidance tends to be concentrated in a few large multinationals which – due to the complex corporate infrastructure typically adopted for tax planning – may be less responsive to the reform. Tax competition for profits is expected to lessen, but production location choices may become more sensitive to taxation, intensifying competition to attract real investments. Moreover, tax competition might continue in new and less transparent forms, while it could even continue in its current forms for MNEs below the revenue threshold (€750 million) for the application of Pillar Two. For in-scope businesses, the minimum tax can increase the cost of capital. However, the lower tax sensitivity of investments of highly profitable companies, as well as the carve-outs and the invariance of taxation for companies below the threshold, could lead to a limited impact on overall investments. The reform could also introduce new distortions on the organizational choices and size of MNEs. Finally, it could have negative effects in terms of tax certainty, since some critical aspects of the current system will largely remain in place and the second pillar will add further complexity for in-scope companies.

A further relevant aspect of tax avoidance is the impact on official statistics, in particular on foreign direct investments (FDI) and portfolio investments. In fact, the avoidance patterns generate significant cross-border flows that are reported in the balance of payments both in the current account and in the financial account; in the latter case they have an impact on external financial stocks. The principle of residence, which is the basis of the compilation of balance of payments statistics, does not allow to distinguish between transactions motivated by profit shifting and those driven by “real” investments, thus reducing the ability of official statistics to reflect the actual extent of the activities and the underlying economic relationships. These measurement difficulties are exacerbated by digitalization and by the increasing importance of intellectual property products, which can be moved abroad without difficulty. In the case of Italy, the incidence of tax havens is quite high in various items of the balance of payments, both in income from direct and portfolio investments, and in the related flows and financial stocks; an example is given by the preponderant weight of countries such as Luxembourg and Ireland in the share of foreign mutual funds held by residents. Recently, the OECD has started publishing statistics in which member countries are required to indicate the share of FDI − flows and stocks, assets and liabilities − connected to special purpose entities, and data on incoming FDI stocks broken down by the ultimate investing country (in addition to the traditional reporting based on the country of immediate counterparty). The available information is still rather limited.

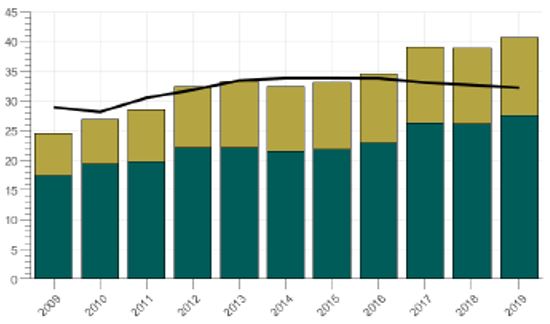

In the economic literature some methodological papers try to estimate the ultimate counterpart of both FDI and portfolio investments, thus allowing us to reconstruct a “more truthful” map of foreign positions. The estimates indicate that “phantom investments” (those without economic reasons other than tax avoidance) have almost doubled from 2009 to 2019, coming to constitute more than 30 percent of total FDI, while those that can be defined as “real” increased by only 50 percent in the same period (see figure 2).

Figure 2: Evolution of total inward FDI positions decomposed into Real FDIs and Phantom FDIs

Source: own calculations following the methodology in Damgard et al (2019).

Notes: Real FDIs (dark green bars) and Phantom FDIs (light green bars) are expressed in trillion dollars.

The black line shows the share (in percent) of Phantom FDIs.

As an example of revision of bilateral positions, China’s foreign portfolio investments would be approximately doubled in respect to official statistics; despite this, China’s official net creditor position vis-à-vis the rest of the world would be instead overestimated by 50 percent, also in relation to the underestimation of direct investments made by the United States in Chinese enterprises (about $600 billion), see Coppola et al. (2021). The countries traditionally considered tax havens generally tend to have a very high share of corporate bonds and shares issued by branches of foreign companies.

Actions aimed at guaranteeing a more effective and comprehensive system of statistical information exchange relating to the activities of multinationals are certainly desirable. A close international cooperation between compiling institutions would also help to increase the quality and the consistency of macroeconomic statistics.

Anzuini, A., Pisano, E., Rossi, L., Sanelli, A., Tosti, E. and E. Zangari (2023), “Clever planning or unfair play? Exploring the economic and statistical impacts of tax avoidance by multinationals”, Banca d’Italia Occasional Papers No. 799.

Bratta, B., Santomartino, V. and P. Acciari (2021), “Assessing profit shifting using Country-by-Country Reports: A non-linear response to tax rate differentials”, Ministry of Economy and Finance, Department of Finance, WP N. 11.

Clausing, K.A. (2020), “Five Lessons on Profit Shifting from the US Country by Country Data”, Tax Notes International and Tax Notes Federal.

Coppola, A., Maggiori, M., Neiman, B. and J. Schreger (2021), “Redrawing the Map of Global Capital Flows: the Role of Cross-Border Financing and Tax Havens”. The Quarterly Journal of Economics 136 (3), 1499–1556.

Damgaard, J., Elkjaer, T. and N. Johannesen (2019), “What Is Real and What Is Not in the Global FDI Network?” IMF Working Paper (274).

Gonzalez Cabral, A., O’Reilly, P. and F. Hugger (2023), “Effective tax rates of MNEs: New evidence on global low-taxed profit”, OECD Taxation Working Papers No. 67.

Johansson, A., Skeie, O. B., Sorbe, S. and C. Menon (2017), “Tax planning by multinational firms: Firm-level evidence from a cross-country database”, OECD Economics Department Working Papers, No. 1355.

Tørsløv, T., Wier, L. and G. Zucman (2022), “The Missing Profits of Nations”, The Review of Economic Studies, 90.

In the work we focus on the issue of tax avoidance. It refers to formally legal activities carried on with the purpose of minimizing the tax burden, while tax evasion refers to the illegal non-payment of taxes. The first behaviour is more relevant for MNEs.

This happens because for firms and investments with higher profitability rates the tax base provisions are relatively less important and the effective tax rate tends to be closer to the statutory tax rate.

Gonzalez et al. (2023).

For global and country specific estimates see Tørsløv, et al. (2022); Johansson et al. (2017). For US estimates see, among others, Clausing (2020); for Italy, see Bratta et al. (2021). A more extensive review of empirical literature is contained in Anzuini et al. (2023).