References

Adrian, T., Boyarchenko, N. and Giannone, D. (2019). Vulnerable growth. American Economic Review, 109(4): 1263–89.

Adrian, T., Grinberg, F., Liang, N., Malik, S. and Yu, J. (2022). The term structure of growth-at-risk. American Economic Journal: Macroeconomics, 14(3): 283–323.

Bernanke, B. S. (2015). Federal Reserve policy in an international context. Paper presented at the 16th Jacques Polak Annual Research Conference hosted by the International Monetary Fund, Washington, D.C., November 5–6, 2015.

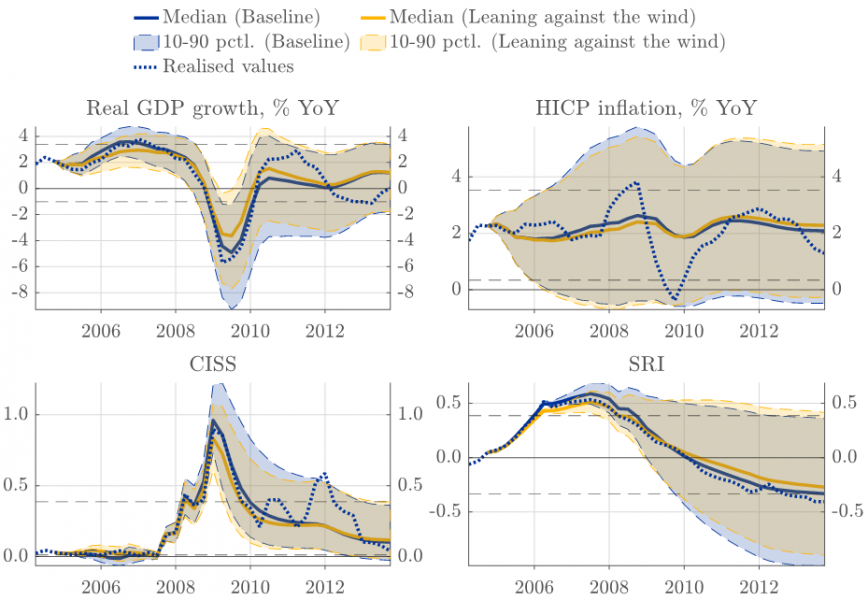

Chavleishvili, S., Kremer, M. and Lund-Thomsen, F. (2023). Quantifying financial stability trade-offs for monetary policy: a quantile VAR approach. ECB Working Paper, 2833.

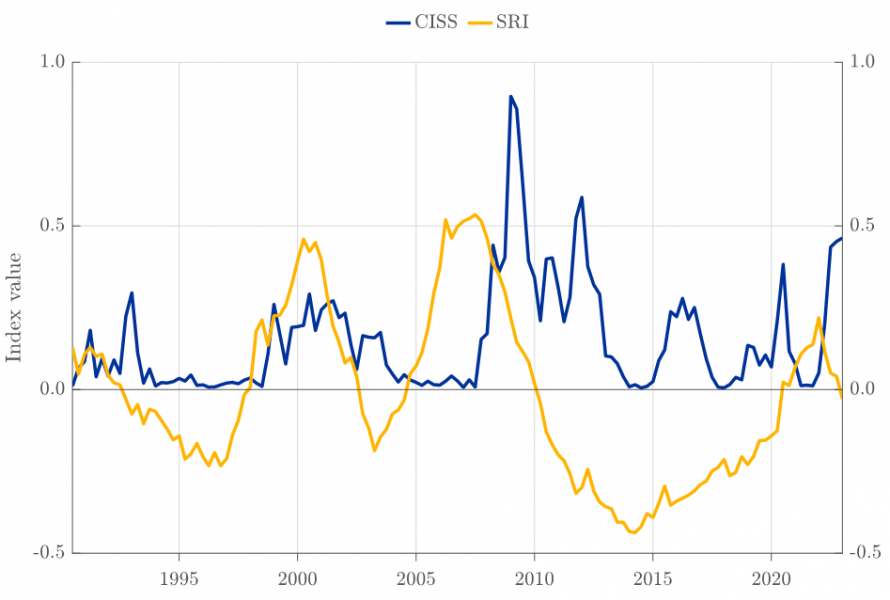

Chavleishvili, S. and Kremer, M. (2023). Measuring systemic financial stress and its risks for growth. ECB Working Paper, 2842.

Chavleishvili, S. and Manganelli, S. (2023). Forecasting and stress testing with quantile vector autoregression. Journal of Applied Econometrics, forthcoming.

Holló, D., Kremer, M. and Lo Duca, M. (2012). CISS – A composite indicator of systemic stress in the financial system. ECB Working Paper, 1426.

Kashyap, A. K. and Stein, J. C. (2023). Monetary policy when the central bank shapes financial-market sentiment. Journal of Economic Perspectives, 37(1): 53–76.

Lang, J. H., Izzo, C., Fahr, S. and Ruzicka, J. (2019). Anticipating the bust: a new cyclical systemic risk indicator to assess the likelihood and severity of financial crises. ECB Occasional Paper, 219.