This policy brief is based on BBVA Research Working Paper 25/06. The views expressed here are those of the authors and do not represent those of BBVA, its management or executive directors.

Abstract

This paper delivers the first comprehensive estimate of the dynamic fiscal multiplier of defence spending for the EU-27 by exploiting exogenous accrual-based government defence outlays and a combination of linear and non-linear Local Projection methods. The linear estimates imply that a 1 percent-of-trend-GDP increase in defence outlays raises aggregate output by about 1.4 percent within one year, peaking at 1.6 percent in year two, and converging to zero in the medium-term, an effect mainly driven by capital-intensive procurement. Quantile Local Projections reveal pronounced multiplier convexity–multipliers exceed 1.75 percent in deep downturns but fall below 0.75 percent in expansions–while Smooth-Transition functions show that ample fiscal headroom and low import dependence each boost multipliers above unity, yet when both conditions reverse, the multiplier collapses to zero or negative values. These results underscore the importance of capital-intensive procurement, counter-cyclical timing, fiscal credibility, and domestic supply-chain resilience, and call for coordinated EU-wide fiscal rules and procurement standards to safeguard economic stability, fiscal policy effectiveness and collective security.

The European Commission’s Readiness 2030 initiative signals a renewed commitment to strengthening Europe’s collective defence capacity through a significant scaling-up of public military spending of €800 bill. over the next 5 years. As strategic autonomy rises on the EU agenda and geopolitical uncertainty persists, the allocation of public funds to defence is poised to become a major fiscal driver in the coming years. Against this backdrop, assessing the macroeconomic consequences of such defence outlays is critical—especially within a context of constrained fiscal space, rising debt levels, and competing public priorities. The economic case for increasing military budgets must be carefully weighed, not only in terms of security returns, but also in light of their capacity to support or crowd out economic activity.

This Policy Brief presents a summary of Sarasa-Flores (2025), which revisits the classic guns-versus-butter dilemma in the specific context of Europe: when governments allocate resources to defence, what is the measurable impact on output, and does it depend on how and when the money is spent? While prior research has provided robust evidence of military spending multipliers in the United States (Ramey and Shapiro, 1998; Ramey and Zubairy, 2018), ranging from 0.7 to 1.5, and in global panels, reaching up to 1.7 in developed countries (Sheremirov and Spirovska, 2022), the European context remains underexplored, particularly with regard to composition effects and the role of state-dependent factors such as output distribution, fiscal space and military import reliance.

The paper analyzes a panel of all 27 European Union (EU-27) countries over the period 1995–2023 on an annual frequency, drawing upon data from Eurostat’s COFOG (Classification of the Functions of Government) on defense spending, the ESA 2010 framework on expenditure components, and standard macroeconomic variables.

One of the primary questions when evaluating the economic impact of defense expenditure is the size of its fiscal multiplier—that is, how many euros of GDP are generated for every euro spent on defense outlays—and the persistence of these effects over time. For instance, public spending allocated to military R&D (Antolín-Diaz and Surico, 2022) or to intellectual property products (Basso, Pidkuyko, and Rachedi, 2025) may generate elevated long-lasting economic effects.

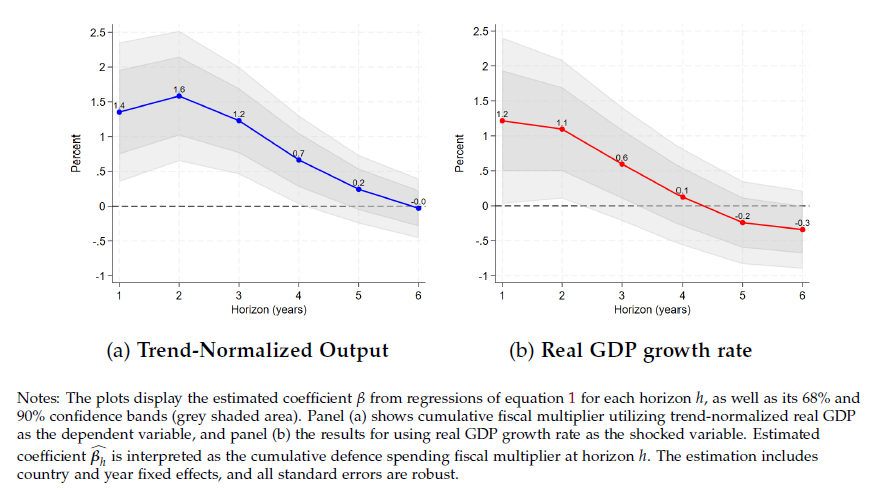

After confirming the exogeneity of the defense-related fiscal shock, a set of local projections regressions are estimated to compute the dynamic cumulative fiscal multiplier of defense spending (Jorda and Taylor, 2025), allowing for a time-evolving impact of consecutive expenditure shocks on output. Following the normalization of the shock and real GDP in terms of trend GDP (as in Ramey and Zubairy, 2018), the results—illustrated in Figure 1—show that the fiscal multiplier of defense spending in Europe exceeds one in the short run (ranging from 1.4 to 1.6), but gradually converges to zero in the medium term. The transitory nature of the effect on real GDP growth suggests that European defense spending has not historically produced structural or persistent economic impacts—an outcome that appears closely linked to its expenditure composition. Furthermore, defence spending shocks exert negative and statistically significant effects on unemployment rates, thus mirroring the output effects.

Figure 1. Cumulative Defence Fiscal Multipliers

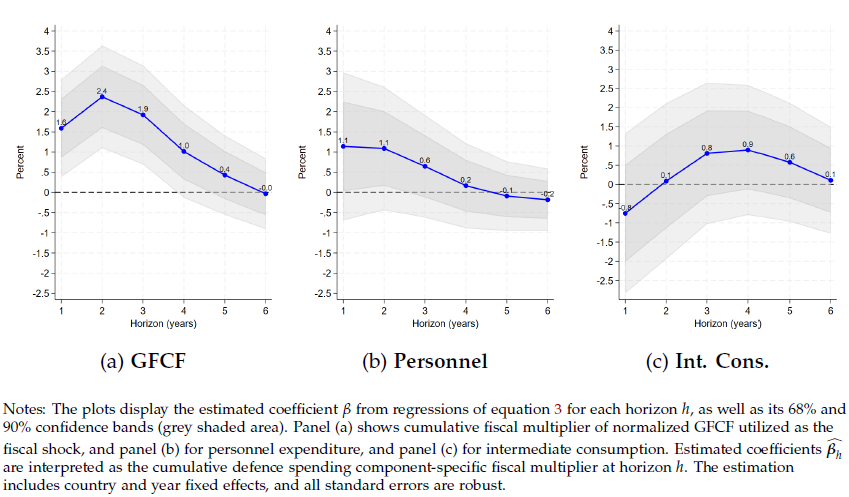

Do the size and persistence of defence-spending multipliers vary across budget lines? The distinction is economically meaningful: compensation of employees (e.g., soldiers’ wages) raises disposable income and primarily boosts private consumption, whereas outlays for infrastructure, equipment and weapons systems expand the public capital stock, crowd-in private investment, and can generate durable productivity gains in case technology investment plays a starring role (Aschauer, 1989; Baxter and King, 1993; Abiad, Furceri and Topalova, 2016).

By exploiting ESA 2010 functional classification of defence spending, estimated component-specific fiscal multipliers display which categories of military outlays deliver the largest “bang for the euro” in the EU-27, while accounting for synergetic and substitution effects between spending items. As presented in Figure 2, capital-intensive purchases (GFCF outlays) deliver the highest and most persistent defence multipliers, while payroll and intermediate items yield modest or transient effects. It is also important to underscore that, historically, the allocation of defense expenditure to research and development (R&D) activities has been both limited and on a declining trajectory. This pattern is intrinsically linked to the transitory nature of the fiscal multiplier observed across all expenditure components. When extrapolated to the aggregate level, the findings suggest that the elevated short-term multiplier is predominantly attributable to investment in military equipment, which tends to generate a substantial—though ultimately non-productive—crowding-in effect over the medium term. This dynamic is further reinforced by an initial surge in wage-related spending, which has traditionally constituted approximately 50% of total defense expenditure in Europe.

Figure 2. Cumulative Defence Fiscal Multipliers: Spending Composition

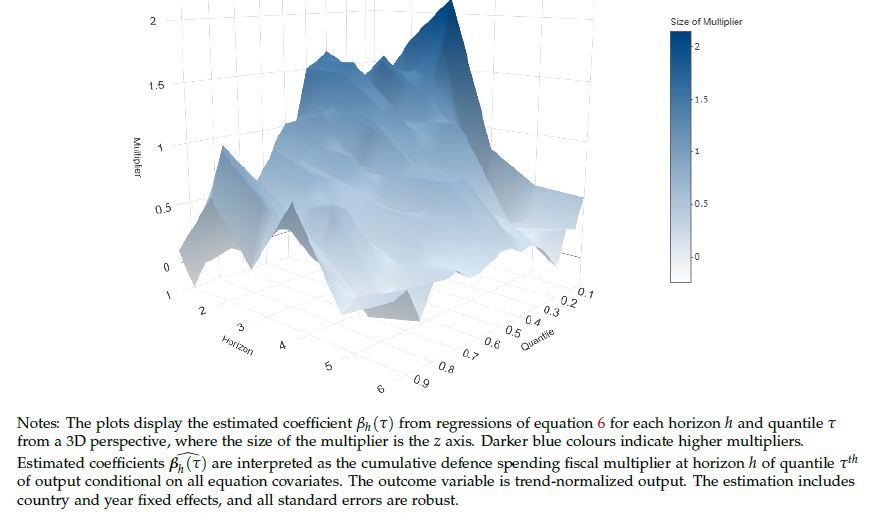

In practice, governments step in when output is collapsing (COVID-19), when it is merely sluggish, or occasionally when it is already at full capacity (wartime booms). Because the marginal household, firm and monetary authority differ across these states, theory predicts the output response to a spending shock should be state-contingent, not constant. Fiscal expansions in times of economic slack may convey larger crowding-in effects, as a result of the prevailing underutilization of economic resources. To uncover these potential non-linearities as regards to output, a total of 120 regressions are estimated via Quantile Local Projections—spanning a six-year forecast horizon across 20 distinct percentiles of the output distribution (Linnemann and Winkler (2016); Adrian, Boyarchenko and Giannone (2019); Jordà et al. (2022)). Figure 3 shows, in a 3D perspective, how in deep downturns, characterized by output gaps predicted in the lowest quantiles, the short-run multiplier almost doubles compared with expansions, reaching up to 2%. An analogous downward pattern across quantiles emerges when assessing the effects on the distribution of the unemployment rate.

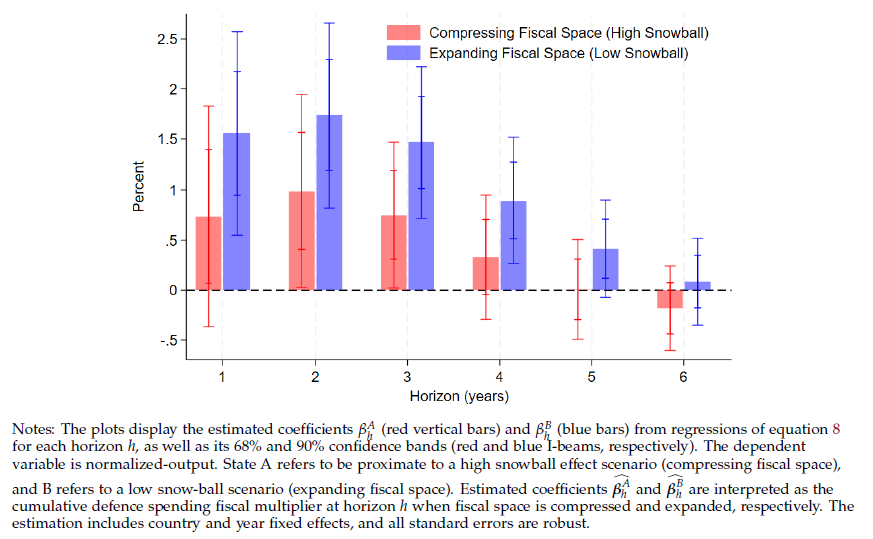

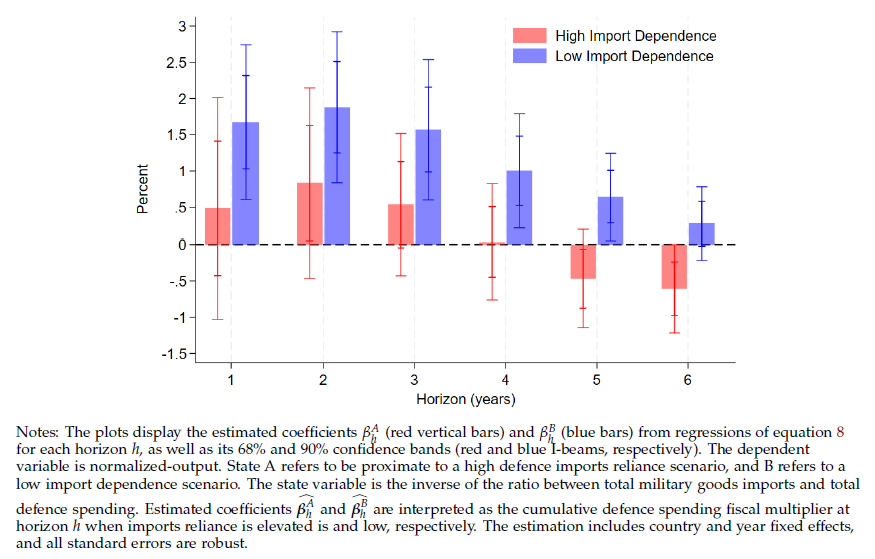

Additional dimensions of potential non-linearities explored in the paper arise from the government’s ability to finance current and future defence outlays, the so-called fiscal space (measured by the snowball effect), and the reliance on foreign sources for military goods (evaluated by the total value of country-specific military imports, extracted from UN Comtrade Data, relative to total defence spending). As regards to the fiscal space, standard theory predicts that the output payoff of discretionary spending hinges on the credibility of public finances: when debt sustainability is in doubt, private agents may anticipate future consolidation, risk premia can rise, and monetary authorities may react pre-emptively, all of which attenuate the multiplier. And related to imports reliance, when a large fraction of defence procurement and consumption leaks abroad, the domestic demand impulse is diluted, ceasing to produce a significant fraction of what is consumed nationally, thus, lessening the size of the multiplier.

Figure 3. Quantile Local Projections: Cumulative Defence Fiscal Multipliers by Output Quantile

Via Smooth Transition Local Projections (a la Auerbach and Gorodnichenko, 2012), Figures 4 and 5 present how ample fiscal headroom and low reliance on foreign military goods (respectively) each independently boost multipliers above unity (almost doubling respective contrary regimes), whereas, specially, high external imports dependence can even provide extraordinary crowding-out effects in the medium-term (negative multipliers). Furthermore, the combination of both sources of non-linearities suggest that in the worst-case regime, where fiscal space is compressed and import dependence is high, the multiplier is effectively zero or even negative at all horizons.

The findings presented in the paper carry important implications for European defence and fiscal policy coordination. They suggest that maximizing the macroeconomic return to defence outlays requires prioritizing capital-intensive procurement, deploying additional spending counter-cyclically during downturns, preserving fiscal headroom to avoid destabilizing debt-interest feedback loops, and strengthening domestic defence supply chains to curb leakages abroad. In combination, coordinated EU-wide fiscal rules and procurement standards can help member states avoid the “worst-case” regime in which fiscal credibility and external dependence jointly erode the effectiveness of public defence spending, ensuring that defence augmentation simultaneously bolsters Europe’s security and its macroeconomic stability.

Figure 4. Cumulative Defence Fiscal Multipliers: Fiscal Space State-Dependence

Figure 5. Cumulative Defence Fiscal Multipliers: Imports Reliance State-Dependence

Abiad, Abdul, Davide Furceri, and Petia Topalova. 2016. “The macroeconomic effects of public investment: Evidence from advanced economies.” Journal of Macroeconomics, 50: 224–240.

Adrian, Tobias, Nina Boyarchenko, and Domenico Giannone. 2019. “Vulnerable growth.” American Economic Review, 109(4): 1263–1289.

Antolin-Diaz, J., & Surico, P. (2022). The long-run effects of government spending. Centre for Economic Policy Research.

Aschauer, David A. 1989. “Is Public Expenditure Productive?” Journal of Monetary Economics, 23(2): 177–200.

Auerbach, Alan J., and Yuriy Gorodnichenko. 2012. “Measuring the Output Responses to Fiscal Policy.” American Economic Journal: Macroeconomics, 4(2): 1–27.

Basso, H. S., Pidkuyko, M., & Rachedi, O. (2025). Opening the black box: aggregate implications of public investment heterogeneity. Documentos de Trabajo/Banco de España, 2501.

Baxter, Marianne, and Robert G. King. 1993. “Fiscal Policy in General Equilibrium.” American Economic Review, 83(3): 315–334.

Jordà, Òscar, and Alan M Taylor. 2025. “Local projections.” Journal of Economic Literature, 63(1): 59–110.

Jordà, Òscar, Martin Kornejew, Moritz Schularick, and Alan M Taylor. 2022. “Zombies at large? Corporate debt overhang and the macroeconomy.” The Review of Financial Studies, 35(10): 4561–4586.

Linnemann, Ludger, and Roland Winkler. 2016. “Estimating nonlinear effects of fiscal policy using quantile regression methods.” Oxford Economic Papers, 68(4): 1120–1145.

Ramey, Valerie A., and Matthew D Shapiro. 1998. “Costly capital reallocation and the effects of government spending.” Vol. 48, 145–194, Elsevier.

Ramey, Valerie A., and Sarah Zubairy. 2018. “Government spending multipliers in good times and in bad: evidence from US historical data.” Journal of Political Economy, 126(2): 850–901.

Sheremirov, Viacheslav, and Sandra Spirovska. 2022. “Fiscal multipliers in advanced and developing countries: Evidence from military spending.” Journal of Public Economics, 208: 104631