Despite significant international financial support, low-income countries (LICs) are likely to be more affected by the crisis than advanced or emerging countries. Strengthening the IMF’s financial safety net for LICs is in everyone’s interest, in order to prevent these countries from becoming weak links in global risks, such as those related to health or climate change.

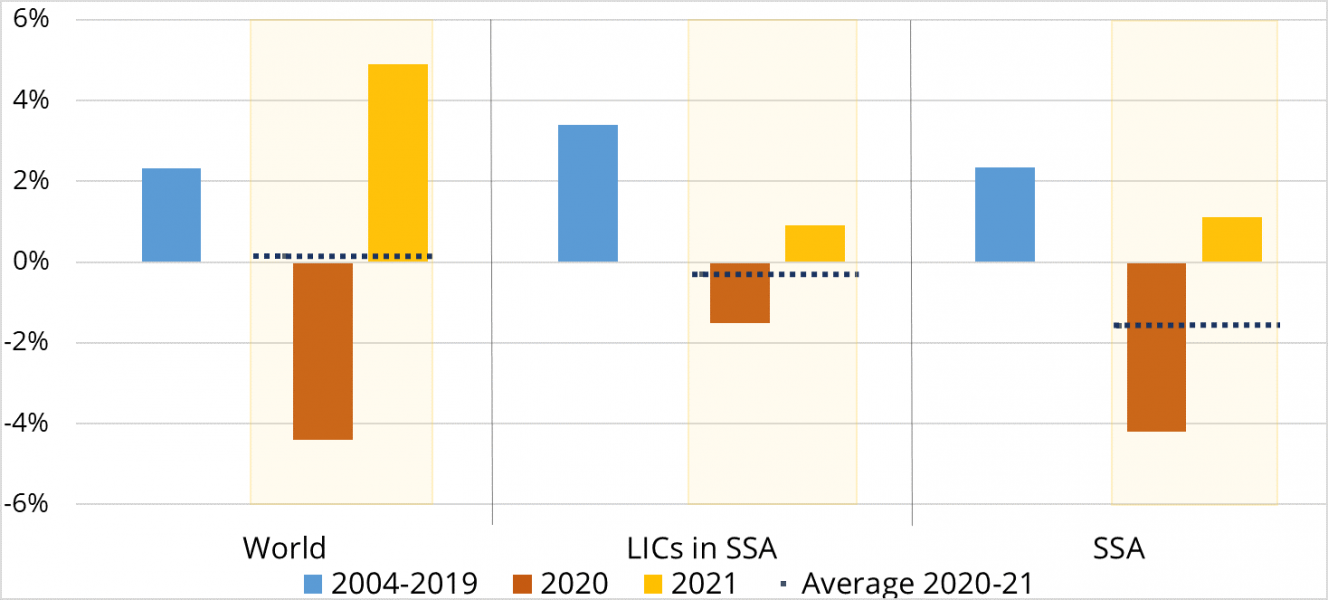

Chart 1: Average per capita GDP growth

Source: IMF (WEO, REO, April 2021).

The Covid-19 crisis has highlighted the vulnerabilities of LICs to global shocks, largely due to their low level of development. Health risks remain significant, while vaccination programmes have barely started and are still underfunded. The risks of slow or fragmented spreading as well as local outbreaks appear to be higher than in advanced countries, due to the shortcomings of health systems. They add, due to possible cross-epidemic effects, to the heavy epidemiological burden, especially for the most vulnerable populations.

The long-term socio-economic consequences are expected to be particularly severe in developing countries, especially in sub-Saharan Africa (SSA). Even though the economic recession has been more subdued on average in LICs, the crisis is causing delays in growth, making it difficult to achieve sustainable development goals. According to the IMF’s April 2021 forecast, per capita GDP is set to fall by 1.6% in SSA in 2020-21, while it is expected to rise in the rest of the world (see Chart 1). This divergence can be partly explained by low fiscal (50% of LICs are at high risk of debt distress) and monetary leeway, due to external constraints. In addition to the initial rise in poverty, longer-term effects on human development are anticipated due to increased malnutrition, worsening access to health systems, and loss of education due to school closures, leading to the worsening of poverty traps.

In view of the risks of long-term damage to LICs, there is a case for rapidly strengthening the IMF’s financial safety net. Its aim is to meet the sharp escalation in their financial needs (USD 450 billion by 2025 according to the IMF), generated by a crisis of unprecedented magnitude and of systemic nature. It can also, in the longer term, contribute to reducing the vulnerability of LICs caused by climate change, among which the expected rise in epidemic risks is only one aspect.

A financial safety net centred on LICs was developed by the IMF in the wake of the 1997 and 2009 crises. In 1999, the IMF’s Enhanced Structural Adjustment Facility (ESAF) was replaced by the Poverty Reduction and Growth Facility (PRGF), at a subsidised rate (currently 0%). Unlike the ESAF, whose conditionality was based primarily on stabilisation and structural adjustment objectives, the PRGF is based on economic and social development objectives and poverty reduction strategies in coordination with the multilateral development banks. These programmes have also been associated with major debt restructurings under the Heavily Indebted Poor Countries Initiative. Financed by voluntary contributions, loans and grants from member countries, the PRGF has been significantly strengthened since 2009, both financially, notably through the reallocation of SDRs from rich countries including France, and operationally through a reform of its concessional financing facilities.

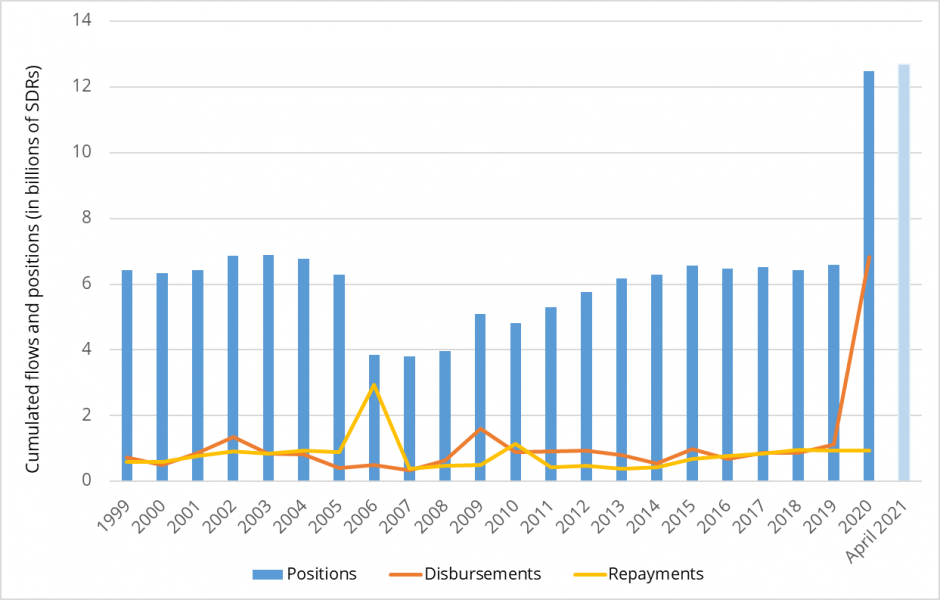

The Covid-19 crisis has shown the need for ambitious reform, including a scaling up of the IMF financial safety net. Thanks in part to the existence of a rapid credit facility and the temporary increase in access ceilings, the IMF was able to respond quickly to the crisis, affecting more than two-thirds of PRGF-eligible countries, with a six-fold increase in new commitments in 2020, reaching SDR 12.5 billion outstanding at the end of December (Chart 2). This includes the Debt Service Suspension Initiative (DSSI) whereby bilateral creditors are suspending debt service payments from the poorest countries until the end of 2021. However, this effort has been insufficient to meet the external financing needs of LICs, notably because the latter are skyrocketing and other concessional financing, notably bilateral, is more constrained.

Chart 2: Credit positions and flows since 1999

Source: IMF (Financial Data Query, April 2021)

In order to best meet the needs of LICs arising from the crisis, the IMF estimates that it is necessary to increase its commitments by more than USD 60 billion by 2025, which implies additional funding from the PRGF. With this in mind, the SDR allocation of USD 650 billion adopted by the G20 offers an opportunity: a reallocation of this magnitude from rich countries to the PRGF would only account for a small fraction of the new allocation to G7 countries (15%), but would have significant leverage effects, particularly for Africa. Resources would also need to be raised to subsidise loans. Although this appears more difficult to achieve, solutions are possible, such as taking advantage of the capital gains that could be generated by IMF gold sales.

In order to enhance this safety net, it is also necessary to broaden access to these resources. The limits on access to IMF concessional facilities (e.g. 5% of GDP for Chad) have been declining relative to the size of the potential shocks since 2009. These limits could be increased to at least bring them in line with those of other IMF facilities. Moreover, these access limits, calculated on the basis of a member country’ share in the IMF’s capital (quota), are essentially dependent on GDP. One possibility would be to index them on an indicator that also incorporates external vulnerability factors, particularly climate change, in the spirit of the FERDI proposals.

Another lever to better address vulnerabilities would require a more profound reform of the IMF’s commitments to poor countries. Several avenues could be explored:

The third lever is based on an orderly treatment of the LICs’ debt risks. The Common Framework for Debt Treatment adopted by the G20 in 2020 seeks to ensure a broad participation of creditors with fair burden sharing in addition to that of Paris Club creditors. It is therefore an essential component of the financial safety net for poor countries.

The health crisis has highlighted the interdependence in the management of global public goods. This would require a revival of multilateralism and a focus on weak links, justifying a more ambitious reform of the financial safety net for LICs.

This article was first published in Banque de France‘s Eco Notepad as blog post n°217.