By comparing business loans made by a BigTech bank with those made by traditional banks, this study finds that BigTech loans tend to be smaller, and the BigTech lender is more likely to grant credit to new borrowers than traditional banks in response to an expansionary change in monetary policy. The BigTech bank’s advantages in information, monitoring, and risk management are the potential mechanisms.

Financial technology (FinTech) has been a major phenomenon in the recent development of financial markets and its role has been unprecedentedly prominent during the COVID-19 crisis. By definition, FinTech is a broad concept that refers to the use of technology in providing financial services (Financial Stability Board 2019), and the main players can be divided into two categories: decentralized digital platforms for marketplace lending and big technology companies (BigTech) issuing credit, of which the latter is overtaking the former in terms of total credit amount and per capita credit intensity. The disruption by FinTech brings a brave new world for monetary policymakers (Philippon 2016, Lagarde 2018), and BigTech credit has become a top concern (Carstens et al. 2021, Adrian 2021). Will BigTech credit strengthen or weaken monetary policy transmission? What are the underlying mechanisms? Despite the burgeoning literature on FinTech, little is known about its implications for monetary policy transmission. Our paper, Huang et al. (2022), bridges this gap by exploring the difference in monetary policy transmission between a BigTech lender and traditional banks. Specifically, we contribute to the literature and policy debate by focusing on a new player, BigTech lenders, and comparing their responses to monetary policy with those of traditional banks. We also add to the recent discussions on the role of nonbanks in monetary policy transmission (e.g., Elliott et al. 2019; Chen, Ren, and Zha 2018).

We employ a unique data set covering the full borrowing history of sampled micro, small, and medium-sized enterprises (MSMEs) from a representative BigTech lender and traditional banks in China. The BigTech lender in our sample is the MY Bank, which is launched by the Ant Group and is one of the dominant BigTech companies both domestically and internationally. Given the leading status of China in FinTech development, findings based on evidence from China may also shed light on regulatory and monetary policies in other countries.

Our identification strategy relies on comparing the lending terms to the same firm borrowing from both two types of lenders, i.e., the BigTech lender and traditional banks, which allows us to control confounding factors that vary with firm and time, including credit demand. We explore both the extensive margin, which is captured by a new lending relationship between a lender and a firm, and the intensive margin, which is captured by the amount of newly-issued loans to a firm that is an existing client of the lender. We focus on the relative response of BigTech lending to changes in monetary policy, compared with traditional bank lending.

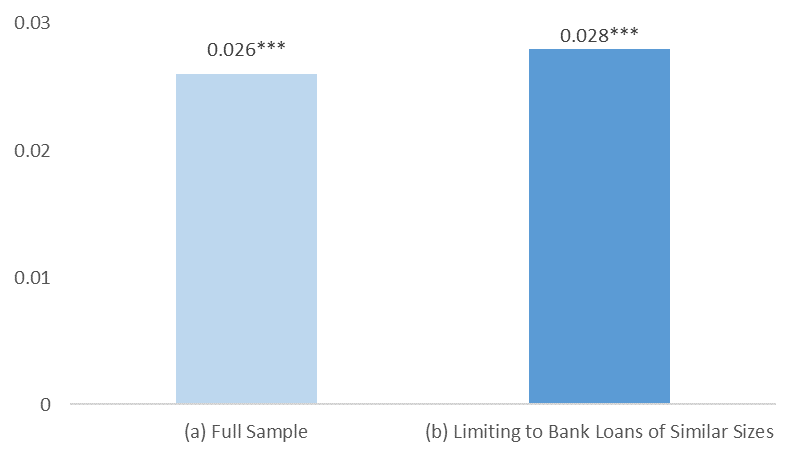

We find that the BigTech lender’s response to monetary policy is significantly different from traditional banks in the extensive margin, but not so in the intensive margin. As shown in Figure 1, using the full sample, we find that the BigTech lender is more responsive to monetary policy in the extensive margin. In other words, when monetary policy eases, the BigTech lender is more likely to establish new lending relationships with MSMEs, compared with traditional banks. Specifically, when the monetary policy rate decreases by one standard deviation, the probability of a BigTech lender building a new lending relationship with a firm is 2.6 percentage points higher than that of a traditional bank. Considering that the average probability of loan granting is 3.6% in our sample, this impact is economically large. When exploring differences between BigTech credit and bank credit, a potential concern might be their comparability with respect to credit size. To address this concern, we limit the sample of bank credits to those smaller than the 75th percentile in the distribution of BigTech credit, and the estimates in this limited sample are very similar to the baseline result using the full sample.

Figure 1: Different Responses to Monetary Policy Changes between BigTech and Banks in the Extensive Margin

Note: The figure reports the negative coefficient of the regressions in which the new lending relationship (extensive margin) is regressed with respect to the interaction between a change in monetary policy rate (∆DR007) and a dummy indicating BigTech lender, with firm-time fixed effect. The results are based on two different samples: (a) full sample and (b) limited sample by restricting bank loans to those smaller than the 75th percentile of BigTech loans. The significance level is **p value < 0.05; ***p value < 0.01.

When aggregating sampled firms’ bank credit and BigTech credit to the city level, we document that when monetary policy eases by one standard deviation, the BigTech lender issues more credit than traditional banks to MSMEs by 41.73%, which implies a very large impact on the aggregate economy. However, BigTech and traditional bank credits to firms that have already borrowed from these two types of banks respond similarly to monetary policy changes. These results suggest that the stronger role of the BigTech lender comes from expanding financial access to MSMEs, which are usually underserved by traditional banks. The extent of building new lending relationships is so prominent that the response of BigTech credit at the city level becomes much stronger than bank credit.

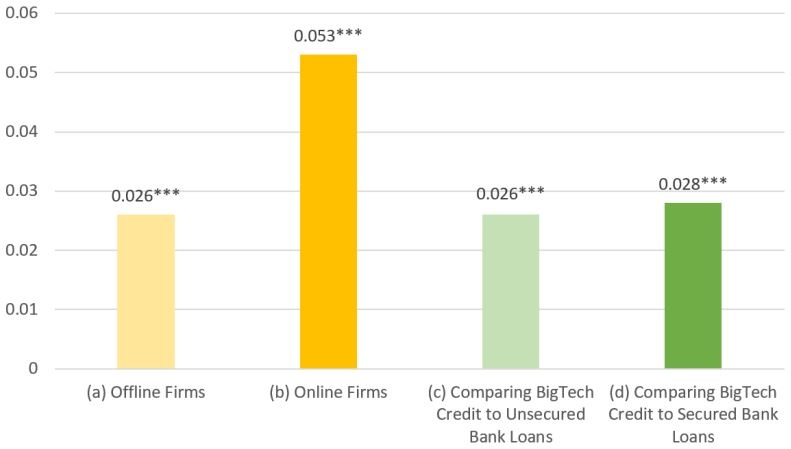

Then we move to explain the more responsive role of the BigTech lender, and we show that its advantages in information, monitoring, and risk management are the potential mechanisms. As shown in the first two columns of Figure 2, compared with traditional bank loans, BigTech lending amplifies monetary policy transmission to a larger extent for firms that have online businesses than for firms that have offline businesses only. Specifically, when the interest rate decreases by one standard deviation, the BigTech lender’s probability of expanding lending relationships to offline sellers is 0.25 percentage points higher than that of traditional banks, but it increases to 0.50 percentage points for online sellers. In addition, the last two columns show that our baseline results are more pronounced when comparing BigTech credit with unsecured than secured bank loans, though by a smaller scale. These findings are consistent with the interpretation that the BigTech lender reacts more strongly to monetary policy changes since they have better data and models for evaluating and bearing more risks.

Figure 2: Potential Mechanisms: Offline vs. Online and Unsecured vs. Secured Bank Loans

Note: The figure reports the negative coefficient of the regressions in which the new lending relationship (extensive margin) is regressed with respect to the interaction between a change in monetary policy rate (∆DR007) and a dummy indicating BigTech lender, with firm-time fixed effect. The results are based on four different subsamples: (a) offline firms, (b) online firms, (c) comparing BigTech credit to unsecured bank loans, and (d) comparing BigTech credit to secured bank loans. The significance level is **p value < 0.05; ***p value < 0.01.

In addition, monetary policy has a stronger impact on the real economy through BigTech lending than traditional bank lending. Specifically, given the same change in monetary policy, firms that accessed BigTech credit in the previous period are 10.7% more responsive in sales growth than those that did not use BigTech credit, and firms that had one standard deviation more BigTech credit are associated with a 5% stronger response in sales growth. These results suggest that BigTech credit not only responds more strongly to monetary policy than traditional banks, but also relaxes firms’ financial constraints and facilitates the transmission of monetary policy to the real economy.

To sum up, we found that a BigTech lender is more responsive to monetary policy on the extensive margin after controlling for credit demand, and this effect is stronger for online firms and when compare with secured bank credit. The policy implication from our study is that monetary policymakers should account for the amplification mechanism of FinTech, and of BigTech lenders in particular, in financial markets. Moreover, coordination between macroeconomic policies and BigTech regulatory policies is necessary to improve the use of BigTech credit for financial access and serve the real economy.

Adrian, T (2021), “BigTech in Financial Services”, Speech to the European Parliament FinTech Working Group, International Monetary Fund, Washington, DC.

Carstens, A, S. Claessens, F. Restoy, and H. S. Shin (2021), “Regulating Big Techs in Finance”, BIS Bulletin, No. 45.

Chen, K., J Ren, and T Zha (2018), “The Nexus of Monetary Policy and Shadow Banking in China”, American Economic Review, vol 108, pp. 3891–3936.

Elliott, D., R. Meisenzahl, J. Peydró, and B. C. Turner (2019), “Nonbanks, Banks, and Monetary Policy: US Loan-Level Evidence Since the 1990s”, SSRN Working Paper.

Financial Stability Board (2019), “Fintech and Market Structure in Financial Services: Market Developments and Potential Financial Stability Implications.” Financial Stability Board, Basel, Switzerland.

Huang, Y., X. Li, H. Qiu, and C. Yu (2022), “BigTech Credit and Monetary Policy Transmission: Micro-Level Evidence from China.” BIS Working Papers, No 1084.

Lagarde, C (2018), “Central Banking and Fintech: A Brave New World.” Innovations: Technology, Governance, Globalization. vol 12, pp 4–8.

Philippon, T (2016), “The FinTech Opportunity.” NBER Working Paper, No. 22476.