References

Anufriev, M. and Hommes. (2012). Evolutionary Selection of Individual Expectations and Aggregate Outcomes in Asset Pricing Experiments. American Economic Journal: Microeconomics, 4, 35-64.

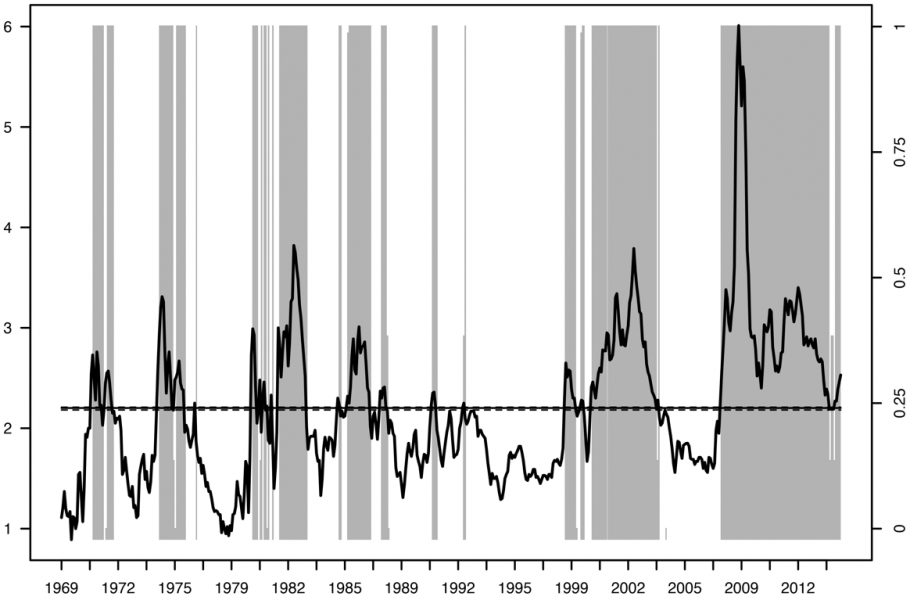

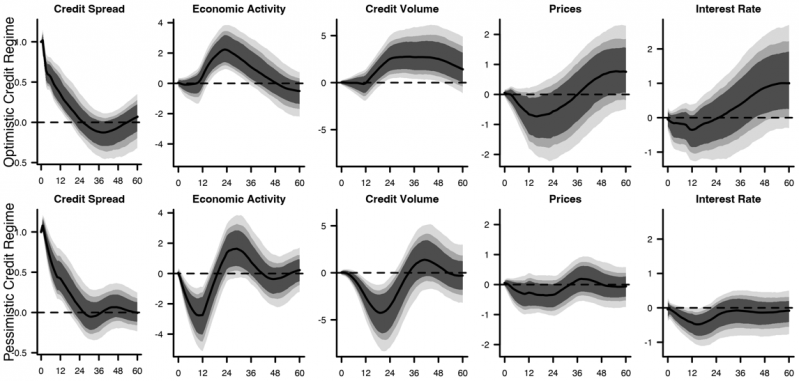

Boeck, M. and Zörner, T. O. (2023). The Impact of Credit Market Sentiment Shocks. Journal of Money, Credit and Banking. https://doi.org/10.1111/jmcb.13109.

Bordalo, P., Gennaioli, N., and Shleifer, A. (2018). Diagnostic Expectations and Credit Cycles. Journal of Finance, 73, 199-227.

Kahneman, D. and Tversky, A. (1972). Subjective Probability: A Judgment of Representativeness. Cognitive Psychology, 3, 430-454.

López-Salido, D., Stein J. C., and Zakrajšek, E. (2017). Credit-Market Sentiment and the Business Cycle. Quarterly Journal of Economics, 132, 1373-1426.