This policy brief is based on Gillman, Benk and Csabafi (2023). The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with. The authors are grateful to the Hayek Endowment Fund at the University of Missouri – St. Louis.

Abstract

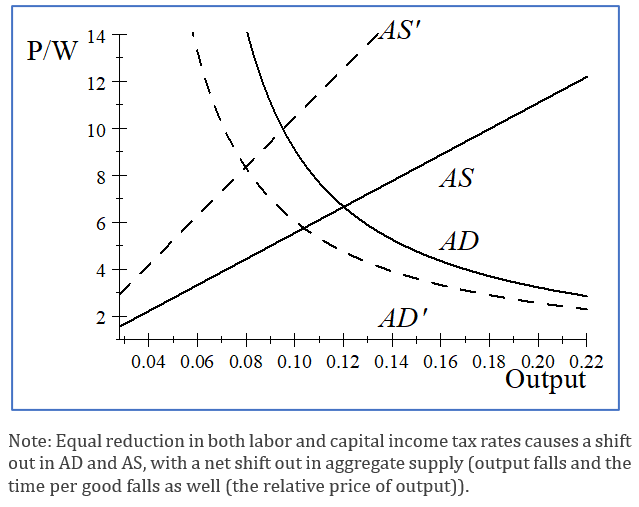

Supply-side policy analysis is difficult since it is founded upon the premise of aggregate supply (AS) featuring more prominently than aggregate demand (AD) that traditional macroeconomics draws rather than derives rigorously. We show here that the key to the derivation is to specify a relative price of output in terms of time given up per good (the inverse of the real wage) that is derived from the classic Ramsey (1928) model. We then apply it to show how productivity increases, and tax rate reductions cause both aggregate supply and demand to shift out, but with a net shift out in the AS curve, as derived from the Ramsey model rigorously. We show a “productivity multiplier” by which all variables increase. This gives the first derivation of a fully microfounded AS-AD analysis of supply-side economics that shows how tax reductions increase output. In the related paper, we also include the implied Laffer curves for supply-side economics tax cuts, that can fit again upon a napkin.

We all know Laffer curves, and many have been derived in the literature. These show that too-high tax rates can be reduced with the benefit of more revenue, originally back-of-the-envelope material that can and has been made rigorous although without a rigorous aggregate supply and demand derivation. As supply and demand is the heart of economics, using a rigorous aggregate supply and demand in Macroeconomics could be useful. This is because the other part of supply-side economics is that supply shifts out by more than demand, which again is a back-of-the-envelope macroeconomics diagram yet to be made rigorous. Rigorous aggregate supply and aggregate demand analysis has never been derived in any academic journal until our paper that uses the basic Ramsey (1928) economy that underlies all DSGE models today. This makes difficult going to the next step of showing how a productivity increase or tax rate reduction can cause a net shift out in aggregate supply, which is the heart of supply-side economics besides the Laffer curve.

As this brief is based on Gillman, Benk and Csabafi (2023), there we contribute both sets of analyses, first by showing how to derive aggregate supply and aggregate demand (AS-AD) analysis in the Ramsey dynamic model, then by showing how productivity increases and tax rate decreases can induce a net shift out in supply, and finally by illustrating as a by-product that we have a Laffer curve within this seminal Ramsey model, none of which has been done to date. This contributes to making the policy debate better founded, by putting the “supply-side” focus on productivity improvement and tax rate reductions on the same platform of the model underlying modern dynamic macroeconomics: that of Ramsey (1928).

We have the Ramsey labor market in textbooks everywhere, such as Williamson’s, but not the goods market. Both policy makers and academics should find this puzzling: a red flag of sorts that something fundamental is eluding us. Colandar’s (1995) dictum that AS-AD analysis is just a “story we tell” rather than a rigorous analysis of markets is the ubiquitous consensus. Colander has been unchecked and remains conventional wisdom today (The only exception is Gillman (2021), who briefly illustrates AS-AD for the case of Solow growth and Lucas (1988) endogenous growth to motivate a structural transformation theory based on human capital).

This leaves us unable to do a back of napkin Supply Side analysis based in rigor. This holds back supply side discussion as a simple phenomenon that everyone can discuss. It makes it ephemeral. It makes it the time of Ronald Reagan and David Stockman and not fit for today’s standards. Yet productivity growth remains a main goal of economic policy and tax rate reduction marches onwards across the globe, as in the US 2017 Tax Reduction Act. If economists can give bones to this skeleton of the past, then policy makers can enliven their own analyses with a savior ghoul turned human, almost as in Dune’s (1969) ghola that becomes human when he climatically destroys the plan to kill Dune’s Messiah and then is resurrected for three thousand years in the fourth Dune series book.

Reviving efforts to improve productivity and furthering tax reform is arguably a good idea, and one that can be stated simply in the goods market using what defines Economics to all generations: supply and demand. This paper shows first how to create the Neoclassical aggregate supply and demand (AS-AD) that exists in the Ramsey (1928) musculature that underlies modern macroeconomic models including the New Keynesian model. This is other than a simple task since it is widely accepted and so relegated to end chapters of famous widely used textbooks.

The key is that in the Ramsey model, one can develop both the aggregate supply of goods and the aggregate demand for goods such that each depends only upon the equilibrium real wage rate and the equilibrium capital stock. Thus, we have that output demanded is a function of the wage rate and the capital stock. This is done by solving the Ramsey (1928) consumer problem optimization problem, solving for consumption along the balanced growth path (BGP that in the original Ramsey model is a zero-growth rate), finding investment on the BGP that equals the maintenance of capital depreciation, and adding them together to get the demand for output. We show how this yields a demand that one can graph.

Immediately here, before going on to aggregate supply, we face the issue of what is the relative price of goods. In Macroeconomics with microfoundations such as the Ramsey (1928) economy, there is no such thing as a nominal price. There are only the relative prices in terms of how much of one good must be given up for another. Forget just referring to a numeraire and then using the dollar price of goods: this is not a relative price as in all of microeconomics despite textbooks widely adopting this in macroeconomics today. This is the error of the textbooks and the way down the rabbit hole of an ill-defined aggregate demand, and aggregate supply that is not consistent as Colander (1995) famously argues.

If the capital stock is a state variable as it is in the Ramsey (1928) model, then in equilibrium the only real price of good is the amount of time that must be given up to get a unit of the aggregate output good, given the equilibrium. The price of time is the real wage. Now one can certainly express the price of time as the nominal wage divided by the nominal output price, in units of goods per time given up. Conversely, what is the dramatically overlooked is the relative price of output. It is in units inversely given as the time required per good, the inverse of the real wage. This is the dollars per good divided by the dollars per time, to get units of time per good. Broadly speaking, using the inverse of the real wage does not resonate with students or economists in any resounding way that would break open how to show AS-AD. So, we can just use the dollar price divided by the dollar wage rate when graphing AS-AD, since this is more approachable. The world is only time, goods, and the accumulated stock of capital from using time and goods to create it, making AS-AD graphs with output on the horizontal axis, the relative price on the vertical axis, and the AS and AD written as functions of the equilibrium capital stock. This is then easily graphed.

Deriving aggregate supply is immediate by substituting in the goods producer’s demand for labor into the output production function to get precisely a functional form for output as a function of the relative price and the equilibrium capital stock. Setting this supply equal to demand, using the equilibrium condition of the Ramsey Euler condition that the real return to capital is equal to the rate of time preference plus the depreciation rate, and then using the firm’s first order condition stating that the marginal product of capital equals the real interest rate, one can solve for the equilibrium capital to labor ratio. Now substitute this into the marginal product of labor condition to solve for the real wage and then have one equation for aggregate supply being equal to aggregate demand in the one unknown that is the capital stock. This allows solution for the equilibrium capital stock to be derived in closed form. Then one simply graphs the two AS and AD functions as dependent upon the relative price of goods in terms of time give up and the equilibrium capital stock. This gives the microfounded AS-AD model that underlies all modern macroeconomics.

Productivity already exists exogenously in the AS-AD model by virtue of the Ramsey (1928) Cobb-Douglas production function for output. Flat rate taxes on both labor and capital income are readily introduced, as in Figure 1, where the tax rate reduction shifts AS and AD from the dashed to the solid lines.

Figure 1. Supply-Side Economics

The analysis of a productivity increase and tax rate reduction allows one to see the following:

A. An increase in productivity shifts out the AS curve by more than the AD curve, as in Supply Side Economics. The relative price of goods falls, while output increases. This is because of two features. The productivity increase directly enters the AS curve and an increase in productivity by this alone shifts out the AS curve. But in addition, the equilibrium capital stock rises when productivity rises and this further shifts out the AS curve. Meanwhile the only effect on the AD curve is that the capital stock increase causes the AD curve to shift out some, but nearly as much as the AS curve, giving the result of a net supply side effect when productivity rises. However, note that AD does shift out as well and that this is a long run effect (often ignored in empirical work imposing sign restrictions).

B. Regarding taxes in the model, first consider the case of an equal tax rate on both labor and capital income (such as an initial 35% rate as in 2016 in the USA), with the tax revenue returned to the consumer in a lump sum fashion (standard assumption for tax rate analysis). In this case, a reduction in the tax rate as in Figure 1 causes the AS curve to shift out by more than the AD curve, as the equilibrium capital stock again rises. The relative price of goods falls as output increases similar to the result with a productivity increase. We decompose this joint tax rate effect by seeing whether it is the labor income tax or the corporate income tax that may be driving the result of a net shift out of demand. With only a labor income tax rate reduction, AS and AD shift out by the same amount in the Ramsey (1928) model, meaning that the relative price is constant but output rises, with neither a net shift out in AS or AD as they both shift by the same amount. However, the capital income tax reduction alone causes a large net shift out n supply. In turn, this causes the combined tax rate reduction of both labor and capital income tax rates to create a net shift out in supply. In this sense, we see that the tax rate reduction causes a classic Supply Side Economics net shift out in supply when both income tax rates are equally reduced or when just the corporate tax rate is reduced.

Note that here we derive AD as a Hicksian one with utility held constant. We also derive in the article a Marshallian one in which prices and the capital stock are allowed to change.

We derive AS-AD in a first microfounded internally consistent way in a journal article to illustrate how to conduct back-of-the napkin Supply Side Economics with AS-AD. Indeed, one can draw a net shift out in supply, and a fall in the relative price of output, when either productivity increases or a flat tax rate on both labor and capital income in reduced, or when just the capital income tax rate is reduced. We introduce the concept of the productivity multiplier as labor, capital and output variables all grow in equal proportion to the productivity increase and make clear what is Supply Side Economics in AS-AD analysis in modern macro. In the Ramsey (1928) model, the labor income tax reduction alone lacks a net shift out in supply, but the corporate tax rate reduction results in that. In qualification, with Lucas (1988) endogenous growth, labor income tax rate reduction may cause a net supply shift as the growth rate will increase with tax rate reduction. This remains the next step in the analysis.

This brief emphasizes the benefits of both productivity enhancement and tax rate reduction through more efficient government spending programs. We also show how tax revenues are reduced in AS-AD analysis, with associated Laffer curves (not shown) that are also appropriate for napkins, but this qualified that any real-world tax reform would also raise economic growth while Ramsey (1928) assumes zero growth. In extension of Ramsey (1928) to a Lucas (1988) endogenous growth framework as in Gillman (2021), tax rate reductions unambiguously increase the economic growth rate. A final note is that with productivity rising continually as in the Neoclassical growth model, the relative price of goods continually falls, a hugely overlooked fact. The time per good of an equal-quality good indeed has fallen dramatically as society progresses and as Harberger (1998) presciently emphasized.

Colander, David, 1995. “The Stories We Tell: A Reconsideration of AS/AD Analysis,” Journal of Economic Perspectives, 9(3, Summer): 169-88.

Gillman, Max, 2021. “Steps in industrial development through human capital deepening,” Economic Modelling, Vol. 99, June, No. 105470.

Gillman, Max, Szilard Benk and Tamas Csabafi, 2023. “Supply-Side Economics with AS-AD in Ramsey Dynamic General Equilibrium,” Economic Analysis and Policy; vol. 80(C), pages 505-531, December. https://doi.org/10.1016/j.eap.2023.08.020

Harberger, Arnold, 1998. A vision of the growth process. Am. Econ. Rev. 88, 1–32 Mar.

Lucas, R. E., Jr., 1988. “On the Mechanisms of Economic Development,” Journal of Monetary Economics, vol. 22(1), 3-42. 5147-5166.

Ramsey, F. P., 1928, “A Mathematical Theory of Saving,” The Economic Journal, Vol. 38, No. 152 (Dec.), pp. 543-559.