This policy brief is based on Rabobank Research: Assessing the impact of US tariffs on the European automotive sector. The views expressed are those of the author and not necessarily those of the institutions the author is affiliated with.

Abstract

The EU automotive sector, a key export industry contributing 60% of the EU’s trade surplus, faces significant risks from recent US tariff measures. This report assesses the potential impact of increased US tariffs on EU car exports, particularly passenger and low-emission vehicles, which are heavily reliant on the US market. The political agreement of the 27th of July 2025 between President von der Leyen and President Trump, sets the tariff rate at 15%, which would mean an export loss between EUR 1.5 and EUR 7.5 billion. While passenger vehicles and vehicle parts are most exposed, the impact on buses and heavy commercial vehicles is minimal due to low trade volumes.

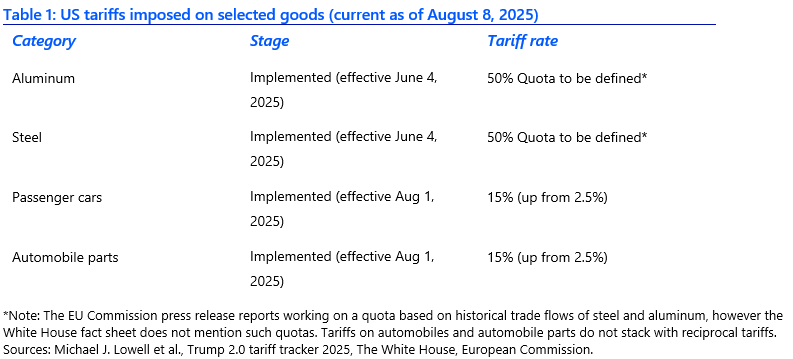

Tariffs are back at the forefront of current economic policy. The new US administration has increased import tariffs on the automobile sector, steel, and aluminum, in addition to imposing flat reciprocal tariffs on all major trading partners. The first round of new US tariffs targeted the steel and aluminum sectors and was subsequently expanded to include automobile and automobile parts (see table 1). On “Liberation Day,” April 2, 2025, the US administration also announced various reciprocal tariff rates on products from selected regions. A 20% tariff rate was applied to all imports from the EU. On May 23, 2025, the tariff rate for the EU was threatened to increase to 50%. Although tariffs on specific products have already been implemented (see table 1), retaliatory tariffs – including the May increase – had been put on hold until July 9, 2025.

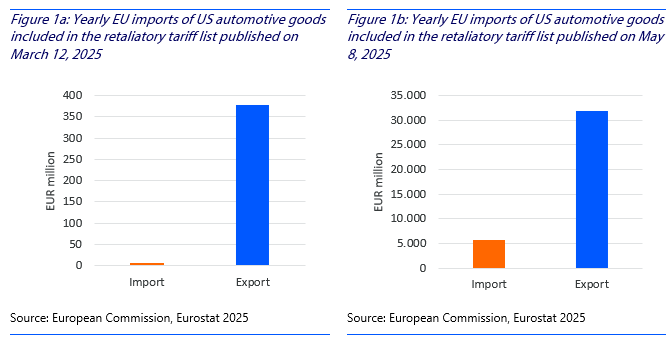

The EU responded to the US steel and aluminum tariffs by publishing a list of products subject to retaliatory tariffs on March 12, 2025. This initial list covered imports worth a total of EUR 26bn. On May 8, 2025, the EU followed up with a second list of targeted goods in response to broader US retaliatory tariffs. This second list covered EUR 95bn worth of EU imports from the US. Both lists are currently under consultation, allowing affected stakeholders, industries, and consumers to submit their views over a four-week period. If negotiations with the US fail to yield a satisfactory outcome, the EU will have a legal basis to impose tariffs on the listed products.

The first list of goods targeted a limited selection of vehicles, mostly motorcycles. In value terms, EU imports of these vehicles from the US totaled less than EUR 6m in 2024 (see figure 1a). The second tariff list includes passenger cars among its targeted products. In 2024, the EU imported EUR 6bn worth of cars from the US (see figure 1b). Interestingly, electric vehicles and vehicle parts were excluded from the list, possibly reflecting the EU’s reluctance to hinder the mobility transition and its recognition of the globalized nature of the automotive industry.

The 27th of July 2025, President von der Leyen and President Trump reached a political agreement on trade. The reciprocal tariff rate was settled at a flat 15% for all products coming to the US from the EU, with the exception of product specific tariffs such as aluminum and steel but including passenger cars and automobile parts. Table 1 summarizes the current tariff rate which are most relevant for the Automotive sector.

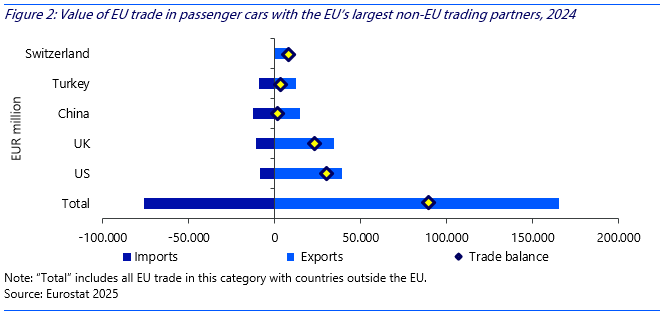

Across all vehicle categories,1 the EU exports more to the US than it imports, as we will see in the following section. As a result, there is a risk that further escalation could end up harming the EU more than the US.

In 2024, the EU exported EUR 165bn worth of cars to the rest of the world. Its two largest trading partners were the UK and the US (see figure 2). The US alone accounted for EUR 38bn in car imports (23% of total EU car exports), making it the largest market for EU-made cars. The EU had a total trade surplus of EUR 89bn, with car exports making up 60% of the overall goods trade surplus with the rest of the world. This makes the automotive industry a sector of significant economic importance to the EU, and US tariffs would threaten a substantial portion of the EU’s car exports.

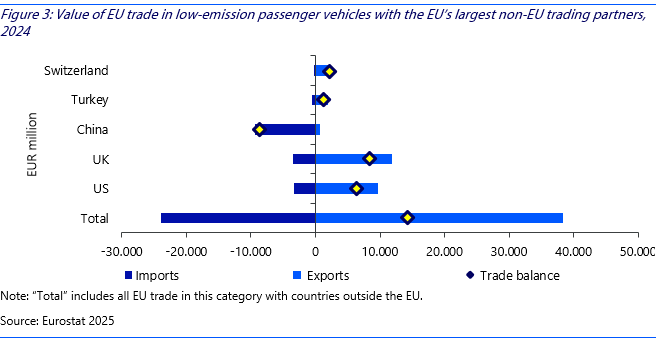

Zooming in on low-emission vehicles,2 the EU also recorded a trade surplus in this segment. Its largest export markets in this segment were also the UK (30%) and the US (25%). Combined, these two markets accounted for approximately EUR 21.3bn of exports in 2024. Total extra-EU-27 trade in low-emission vehicles, represented an export value of EUR 39bn and an import value of EUR 23bn. Given the importance of the US as an export market, tariffs on this segment could jeopardize the production of EU-made low-emission vehicles by dampening their demand in the US market.

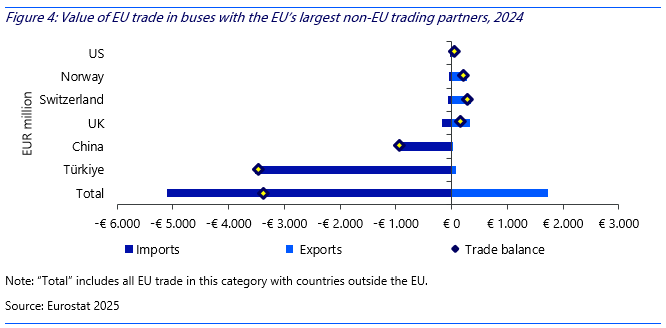

In 2024, the EU imported EUR 5.1bn worth of buses.3 The main trading partners are Turkey and China, which together accounted for the majority of imports. This is a trend that we have already observed in the electric city bus category. When aggregating all trading partners, the EU has a trade deficit of EUR 3.3bn in the bus category. Notably, the US represents less than 1% of all trade flows in this category, thus the impact of US tariffs on this segment will be limited.

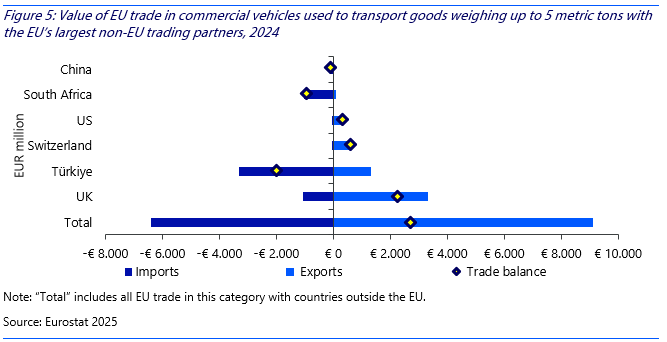

For commercial vehicles used to transport goods weighing up to 5 metric tons, Turkey is the EU’s largest export market, while most of the EU’s imports come from China (see figure 5). Overall, the EU has a positive trade balance of EUR 2.7bn in this sector. This trade category includes vans, provided their main purpose is the transportation of goods. If a van is primarily intended for passenger transportation, it is classified under passenger vehicles instead.

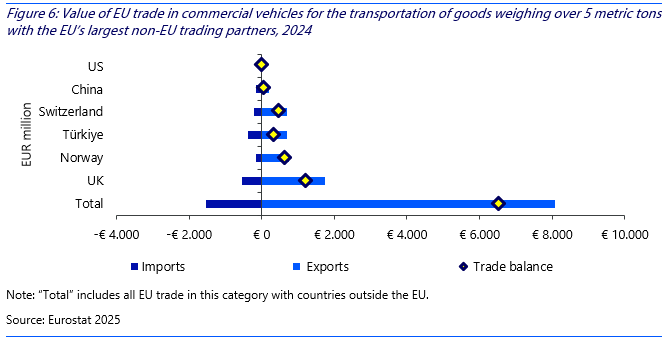

When looking at vehicles used for transporting goods weighing over 5 metric tons, the EU recorded a net trade surplus of EUR 6.5bn in this segment. Trade with the US remains limited compared to other trading partners (see figure 6). As such, this entire sector is unlikely to experience any significant impact from future changes in trade policy related to finished vehicles.

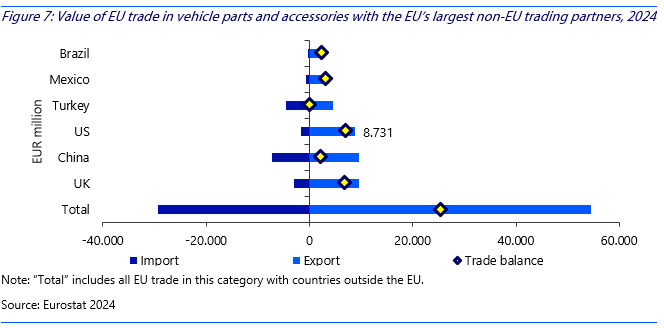

The automotive industry has a highly globalized supply chain. All major European automotive groups – except Renault Group – have manufacturing facilities in, and exports to, the US. To optimize production, vehicle parts are manufactured where it is most cost-effective and then shipped worldwide for final assembly. This business model has been supported by a low-tariff environment. In the vehicle parts and accessories segment, the EU recorded a trade surplus of EUR 25bn with non-EU countries in 2024 (see figure 7). This accounted for 17% of the EU’s overall trade surplus last year. The US is the EU’s third-largest export market in this category (EUR 8.7bn), following the UK and China. Given the importance of the US as an export market for vehicle parts, this segment is expected to be negatively impacted by the newly imposed 25% US tariff (see table 1).

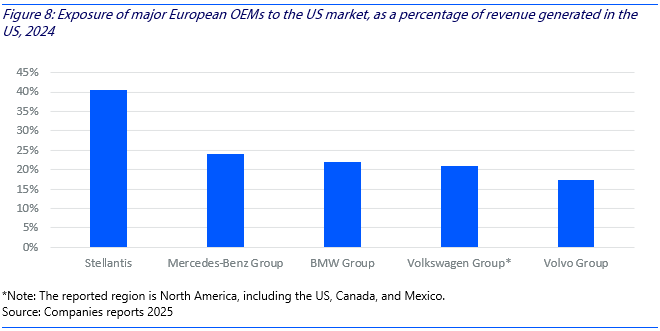

The impact of tariffs on European original equipment manufacturers (OEMs) could be significant, as a considerable share of their revenue comes from the US market (see figure 8). Even though, only parts of their supply chains are located in the US, it is unlikely they will be able to fully avoid tariffs. Additionally, production plants in the US will likely need to import vehicle parts from the EU, which are also subject to tariffs, potentially impacting their revenues.

Although 40% of Stellantis’ revenue originates from the US, the company includes several American brands within its group. Consequently, a significant share of its production is based in the US market, which may reduce its exposure to tariffs. While the Volkswagen Group includes brands with manufacturing operations in the US, Porsche and Audi do not have manufacturing facilities there and could therefore be more affected. On the other hand, Renault Group has no presence in the American market and is thus not included in the list.

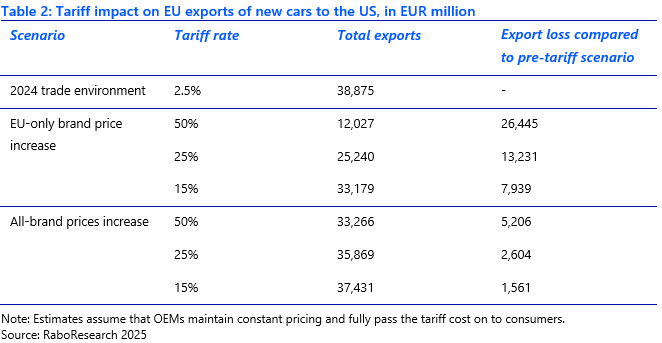

To estimate the potential economic impact on the EU from the newly implemented and proposed tariffs on automotive trade, we consider the tariff as a price increase on the final value of the vehicle. Based on the Eurostat database, we estimate the average value of a car exported to the US by segment. This allows us to model three tariff scenarios: A 50% tariff, a 25%, and the current negotiated lower tariff of 15%.

We estimate the potential impact of these price increases on vehicle demand by applying estimated price elasticity of substitution4 for individual brands and for the overall market. The price elasticity of substitution measures the willingness of consumers to change their purchasing behavior in response to price changes. For passenger vehicles, the more expensive models, have a lower the elasticity of substitution, meaning that price increases have reduced influence on consumer behavior in this segment. Conversely, cheaper models tend to have higher elasticity.

If tariffs only affect prices for EU OEMs, while exporters from other regions and US manufacturers are not impacted, we can apply the average brand elasticity to European exports. OEM’s own elasticity is measured by taking into account consumer shifts to cheaper alternatives. For example, if BMWs imported from the EU go up in price, consumers may shift to buying US-made Cadillacs –provided that Cadillac prices remain unchanged (see EU brands scenario in table 2). Under this scenario, a 50% tariff could reduce the export value of new European finished vehicles by EUR 26.4bn, while a 15% tariff could lead to a EUR 7.9bn reduction. These represent worst-case scenarios for EU automakers.

However, if all car brands in the US increase prices equally, the impact is assessed using market price elasticity. In this scenario, consumers may postpone buying a new car altogether or go to the secondhand market instead (see market scenario in table 2). This scenario will be less impactful on EU exports to the US. A 50% tariff on EU exports of new passenger vehicles would increase costs by 50% across all car brands and is likely to decrease EU exports by EUR 5.2bn. A 15% tariff would decrease exports by EUR 1.5bn.

On one hand, we know that tariffs on imported parts will also increase costs for US brands, so a scenario where only EU brands are negatively impacted is unlikely. On the other hand, a 15% price increase across all brands due to a reciprocal EU tariff is also highly unlikely, as US OEMs have supply chains within North America that would not be impacted by this reciprocal tariff and pricing strategies could also play a role if companies decide to absorb some of the tariff.

This analysis is sensitive to three key dynamics that could significantly influence our estimates:

As trade policy shifts, companies will be forced to reconsider their business models, for example, whether to onshore production to the US or temporarily lower prices. The dominant strategy will likely depend on the consistency of trade policy over the medium to long term.

Given the rapid shifts in the geopolitical landscape, we previously outlined several scenarios for how global trade could develop. The recent political agreement signed between the US and EU, suggest that a negotiated tariff without retaliation from the EU is the likeliest outcome. Although the current 15% tariff rate in passenger vehicles is higher than the 10% imposed on the UK, is better than the 25% alternative. Going forward some aspects of the deal, like the quotas on steel will still have to be negotiated. The last draft will then have to be ratified by the EU council. With a consistent trade surplus in its favor, the EU arguably has more to lose in a trade conflict with the US. The current agreement is a step in the right direction. However, the biggest loser in any high-tariff scenario will undoubtedly be the American consumer, who would face higher vehicle prices regardless of the outcome.

The vehicles considered fall under chapter 87 of the Combined Nomenclature, which is used by the EU to classify goods in international trade. This includes categories: 8702, 8703, 8704, and for vehicle parts, 8708.

Vehicles considered from the combined nomenclature of chapter 8703 are: 87036010, 87036090, 87037000, 87038010, 87038090.

Including city buses and coaches.

Benjamin Leard and Yidi Wu (2023). New Passenger Vehicle Demand Elasticities: Estimates and Policy Implications.