This policy brief is based on CEPR Discussion Paper DP20610. The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

People often leave money on the table by not acting on clear financial incentives. Using Danish administrative data that jointly capture pension saving responses to tax reforms and mortgage refinancing behavior during large interest rate fluctuations, we ask: Are the same people systematically inactive across these two major decision contexts? The answer is no. Individuals who miss one opportunity are not more likely than others to miss the other. The bottom line: The costs of inaction – around 3% of annual disposable income in the first year per inactive decision – are spread across the population rather than concentrated among certain subgroups. This raises questions about the effectiveness of narrowly focused interventions and instead highlights the potential for context-specific design and communication to mitigate expensive inaction.

A growing literature in economics and finance shows that households frequently fail to respond to incentives in high-stakes financial decisions (Gomes et al., 2021). This phenomenon is observed in contexts such as mortgage and credit but also in retirement savings and investments decisions. The reasons for such inaction are still unclear. Is it a persistent trait, concentrated in a subset of people who are generally inattentive or disengaged? Or is it context-dependent, varying according to the specific decision environment or presentation of choices?

Understanding the nature of inaction is crucial for both welfare analysis and policy design. If inaction is systematic and concentrated among certain individuals, for example those with lower financial literacy or less experience, then targeted interventions such as personalized financial education or tailored nudges could be highly effective. Policymakers and financial institutions could focus resources on those most likely to miss out, maximizing the impact of their efforts.

On the other hand, if inaction is context-driven and broadly distributed across the population, then improving the environment in which decisions are made becomes more important than targeting specific groups. This would mean that interventions should focus on simplifying processes, making incentives more salient, and reducing barriers to action for everyone, rather than trying to identify and reach a particular “inattentive type.” The distinction has significant implications for how resources are allocated and how policies are evaluated.

Moreover, the costs of inaction are not trivial. When individuals fail to refinance their mortgages or adjust their pension contributions in response to favorable changes, they can forgo substantial financial gains – sometimes amounting to several percent of their annual disposable income. These missed opportunities can accumulate over time, affecting household welfare, retirement security, and overall economic efficiency. At the macroeconomic level, widespread inaction can mute the transmission of falling interest rates to household budgets, reducing the effectiveness of monetary policy. From a financial stability perspective, more efficient economic decisions—such as timely refinancing or optimal pension adjustments—can make households more robust to adverse shocks, strengthening the resilience of the broader financial system.

Prior studies show widespread inaction in both pension (Andersen, 2018) and mortgage (Andersen et al., 2020) decisions. Our contribution is to test whether the same individuals are inactive in both contexts.

Our new study uses the same quasi-experimental settings and the same underlying data as in the studies focusing separately on pension and mortgage decisions. By linking comprehensive Danish administrative records, we identify over 10,000 individuals exposed to strong incentives in both contexts, enabling a direct empirical test of whether inaction is dominated by persistent personal traits or whether they are context specific.

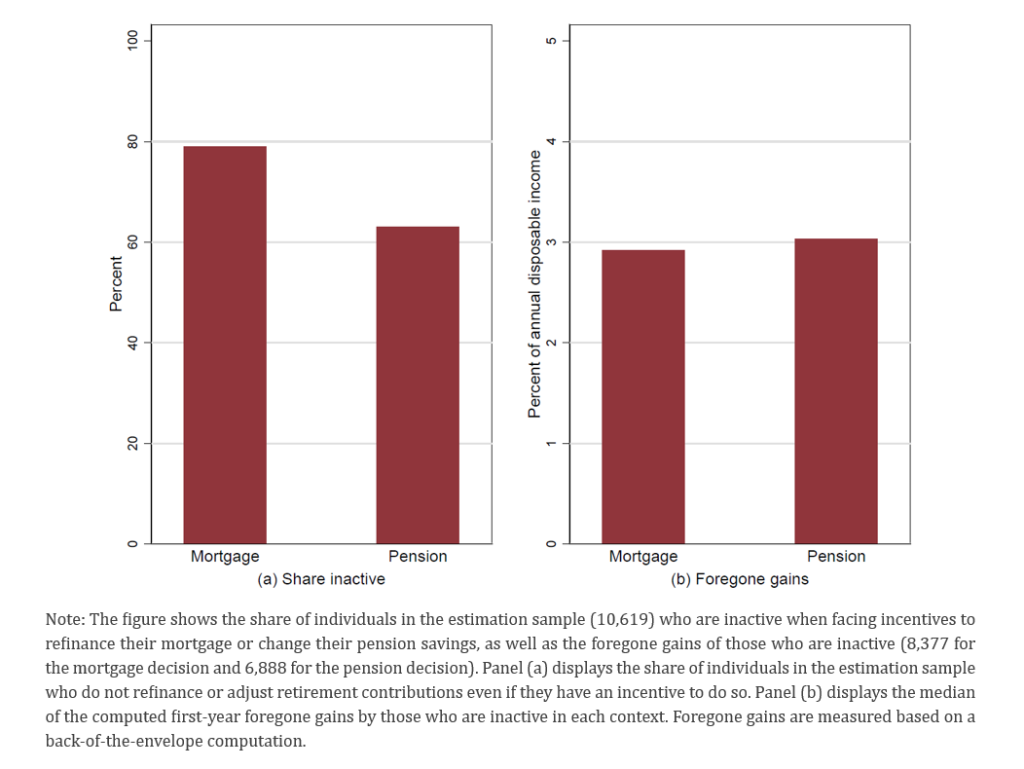

Figure 1 illustrates that we find about 65% inaction in pension decisions, in line with Andersen (2018), and we find that 79% do not refinance their mortgages when financially advantageous, in line with Andersen et al. (2020). The median first-year foregone gains are approximately 3% of annual disposable income per inactive decision – a significant amount for most households. If individuals remain inactive for several years, the cumulative losses will only increase correspondingly.

Figure 1. Inaction shares and foregone gains

The key takeaway is that inaction in pension decisions does not predict inaction in mortgage decisions, and vice versa. This striking result challenges the notion of a persistent “inactive type” and rather points to inaction being specific to the context.

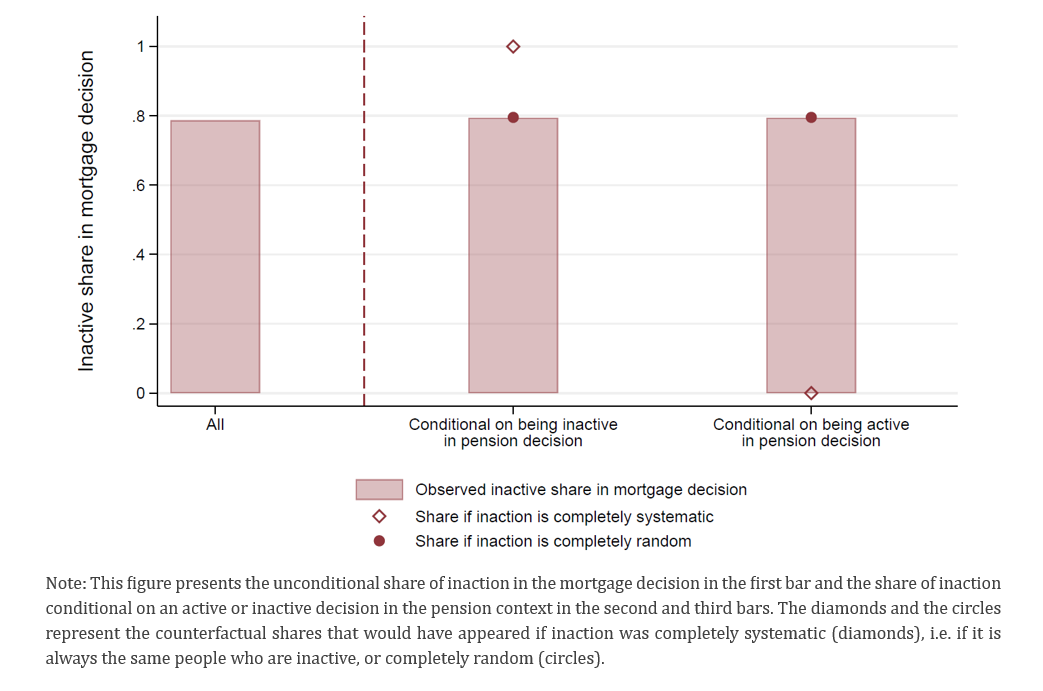

Figure 2 illustrates this key result. The overall share of inaction in mortgage decisions is represented by the first bar at 79% (same as in Figure 1). The second and third bars show inaction shares in the mortgage decision conditional on being inactive or active in the pension decision, respectively. These two would differ sharply (as indicated by the diamonds) if the same people always failed to respond to financial incentives and be identical (as indicated by the circles) if inaction is not systematic. We see a striking independence as inaction in the mortgage decision seems completely unrelated to inaction in the pension decision.

Figure 2. Independence of inaction across contexts

We also estimate a multivariate model of the systematic, person-specific share of variation in inaction across pension and mortgage decisions. The results confirm that the person-specific component is approximately zero, with a 95% confidence interval upper bound of about 3%. This result is robust to alternative definitions of inaction, different sample restrictions, and various model specifications.

However, within pensions over time, we find evidence of systematic inaction. Across two closely related pension decisions (rather than across pension and mortgage decisions), we find that roughly 35% of the variation in inaction is systematic. This implies that some people persistently act (or fail to act) within that context. This finding simply supports the view that while there is limited scope for targeting certain ‘inactive’ individuals, there is some scope for targeting certain contexts in order to reduce the prevalence of inaction.

The analysis also calculates the size of the financial incentive, i.e., the amount of money missed by being inactive, in each context. Including this information in our estimations does not give rise to any new conclusions. Inaction in one context is independent of inaction in another context, even conditional on the magnitude of the missed financial gain.

A range of observable characteristics, such as age, gender, marital status, education, financial education, income, and wealth, do indeed correlate with inaction in our data – something also found in previous studies. For example, individuals with financial education are somewhat less likely to be inactive, and certain demographic groups show modest differences in response rates. Older individuals, those with higher incomes, and those with higher education may be slightly more likely to act on financial incentives, while liquidity-constrained households and those with less education may be somewhat more prone to inaction.

However, the key insight from our work is that these observable characteristics explain almost none of the overall variation in inaction. In statistical terms, the combined explanatory power of all these factors is less than 5%. This means that while some traits are associated with a slightly higher or lower likelihood of inaction, the characteristics that we observe do not matter much. In other words, knowing someone’s education, income, or age tells us very little about whether they will miss financial opportunities or fail to respond to financial incentives.

Ultimately, our results suggest that by focusing on the design of decision environments, rather than trying to identify and target specific groups, policy makers and institutions can help more people take advantage of financial opportunities and avoid costly inaction.

Andersen, H. Y., Christensen, C. S., Kreiner, C. T., & Leth-Petersen, S. (2025). Are People Systematically Inactive Across Financial Decisions? Linking Evidence from Mortgage and Retirement Saving Decisions, CEPR Discussion Paper No. 20610.

Andersen, H. Y. (2018). Do tax incentives for saving in pension accounts cause debt accumulation? Evidence from Danish register data. European Economic Review, 106, 35–53.

Andersen, S., Campbell, J. Y., Nielsen, K. M., & Ramadorai, T. (2020). Sources of Inaction in Household Finance: Evidence from the Danish Mortgage Market. American Economic Review, 110(10), 3184–3230.

Gomes, F., Haliassos, M., & Ramadorai, T. (2021). Household Finance. Journal of Economic Literature, 59(3), 919–1000.