See Borio (2012), The financial cycle and macroeconomics – what have we learnt?, BIS working paper, no. 390 (link); Claessens, Kose and Terrones (2011), Financial cycles: What?, How? When?, IMF working paper, no. 76 (link); Laeven and Valencia (2018), Systemic Banking Crises Revisited, IMF working paper, no. 206 (link); Jorda, Schularik, Taylor (2013), When Credit Bites Back, Journal of Money, Credit and Banking, vol. 45, issue 2 (link).

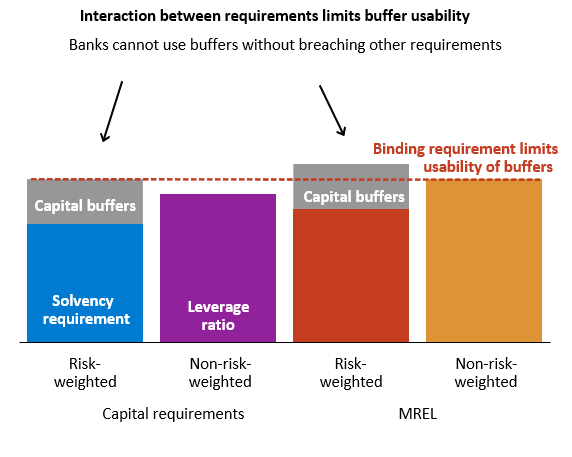

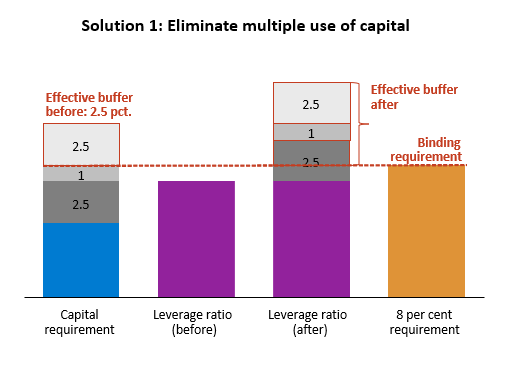

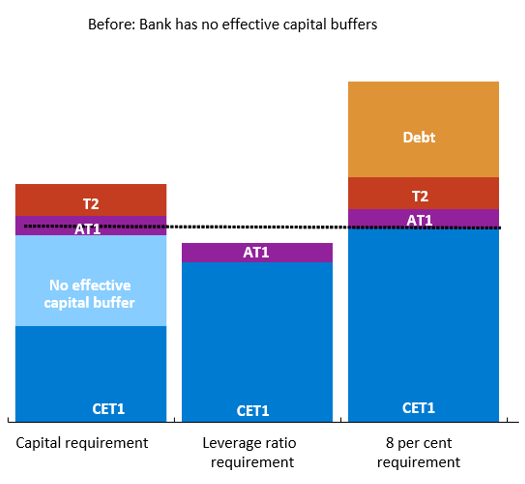

Several analyses indicate that the effective size of the capital buffers is limited due to an overlap between requirements, see, for example, ESRB (2021), Report of the Analytical Task Force on the overlap between capital buffers and minimum requirements (europa.eu)(link).

ESRB (2021), Report of the Analytical Task Force on the overlap between capital buffers and minimum requirements (europa.eu) (link).

They account for around 80 per cent of total lending to Danish households and companies.

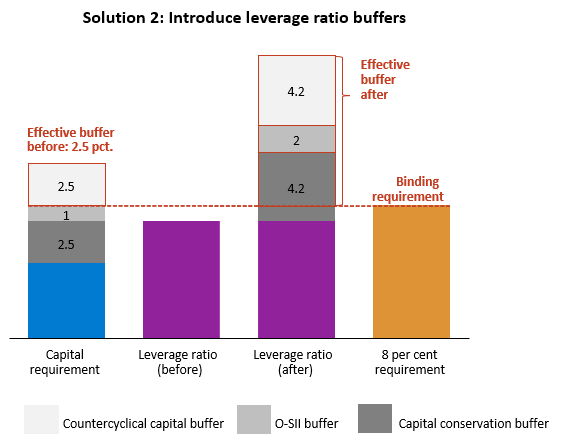

G-SIBs stands for Global Systemically Important Banks. Under the Capital Requirements Regulation, CRRII, the leverage ratio buffer for G-SIBs was to apply from 1 January 2022. However, this has been postponed until 1 January 2023 to enable the institutions to respond immediately and effectively to the consequences of covid-19.

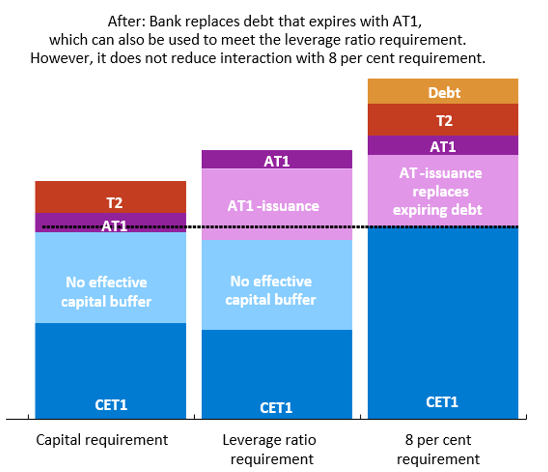

In accordance with the Capital Requirements Regulation, the Commission must consider whether to introduce a leverage ratio buffer that mirrors the SIFI buffer from the risk-based framework (a SIFI leverage ratio buffer). The proposal entails that only the SIFI buffer will be introduced in the leverage ratio framework, in accordance with the same model as for G-SIBs. This issue has been discussed separately from the discussion on how to increase the effective size of the capital buffers.

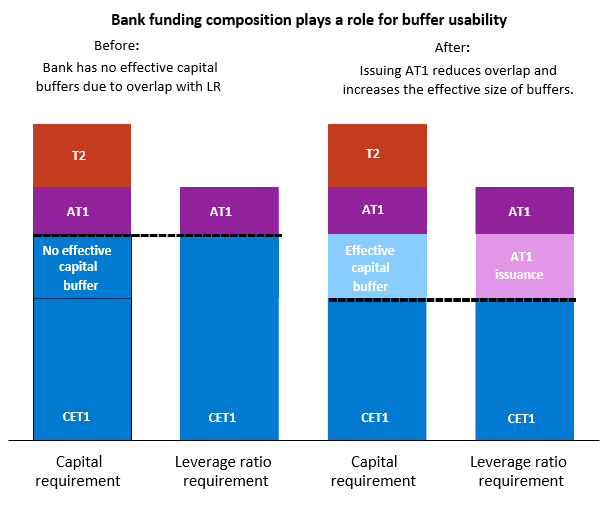

The leverage ratio requirement can be met with both AT1 and CET1, while the MREL can be met with senior non-preferred debt, AT1, Tier 2 or CET1.