Paul De Grauwe and Yuemei Ji (2023c) suggest expanding the minimum-reserve requirements for banks in the euro area – e.g., by a factor of 10, thereby increasing it to 1.65 trillion EUR – and stopping to remunerate them. Only reserves held in excess of the (newly established) minimum-reserve requirement (excess reserves) will be remunerated at the interest rate on the deposit facility (currently 4%). Accordingly, the “massive subsidies” (De Grauwe and Ji, 2023a) – given to commercial banks by the Eurosystem through reserve remuneration – can be reduced substantially and taxpayers’ money can be saved.

De Grauwe’s and Ji’s article triggered a debate on distributional aspects of the current ECB’s monetary policy and on central banks’ profitability. Both are highly political questions that I cannot answer. Nevertheless, to bring the debate forward I would like to add some thoughts on

How would the introduction of a non-interest-bearing minimum-reserve requirement affect financing conditions in the euro area? According to Bindseil (2014), “unremunerated […] reserve requirements are a tax on the deposits of non-banks with banks […]” (Bindseil, 2014, p. 106). Hence, this tax increases banks’ costs of deposit financing.

Banks can pass these additional costs on to their customers in multiple ways:

Thus, unremunerated minimum-reserve requirements can dilute the restrictive monetary policy effect for bank-dependent depositors and increase the refinancing costs of banks and their borrowers. Consequently, it will not be neutral on financing conditions and will, thus, violate the “decoupling principle” (Borio, 2023). Put differently, while non-interest-bearing minimum reserves reduce the central bank’s cost burden of excess reserves, they also affect the monetary policy stance. Moreover, financial stability concerns might arise. I argue that the tax burden will be shared by depositors and borrowers, however, also banks’ profitability could suffer. The current economic environment of decreasing loan demand is likely to inhibit a full pass-through of the tax burden to customers. If unremunerated minimum-reserve requirements lead to an outflow of customer deposits and decreases bank profitability, it will weaken financial stability in the euro area’s banking sector.

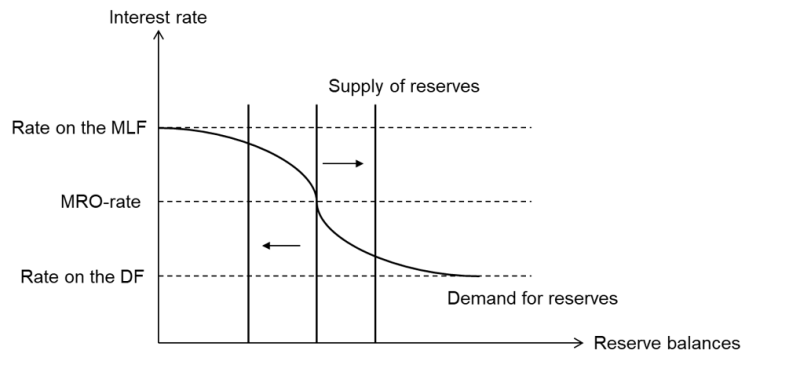

Increasing the minimum-reserve requirement by a factor of 10 needs to be handled with care. Whether money market rates are anchored to the interest rate on the deposit facility (DF, the floor of the interest-rate corridor) or to the interest rate on the main refinancing operations (MRO, the centre of the interest-rate corridor) depends on the amount of excess reserves being traded in the money market (see Figure 1). Currently,2 there are 3.7 trillion EUR available to banks in the euro area. Consequently, the amount of excess reserves is abundant and money market rates fluctuate close to the interest rate on the deposit facility, as this rate defines the opportunity cost to lending reserves to other financial institutions in the market. If, however, the amount of excess reserves is reduced considerably (e.g. through the extension of the minimum-reserve requirement), money market rates will increase and move towards the MRO-rate. This is what De Grauwe and Ji (2023a) describe as a “reserves-scarcity regime”, in which there are just enough reserves available to satisfy aggregate reserve demand. Consequently, if the Eurosystem manages to supply just as many reserves as banks demand, money market rates will fluctuate close to the MRO-rate. If it provides too little reserves, however, the interest rate on the marginal lending facility (MLF, the ceiling of the interest-rate corridor) becomes the opportunity cost to borrowing reserves from other financial institutions and money market rates will move close to the upper bound of the interest-rate corridor.

Providing the right amount of reserves to the banking system, however, is a difficult task. The thresholds at which money market rates leave the floor and at which they move close to the ceiling are unknown. Estimates of these thresholds are surrounded by large uncertainty (Åberg et al., 2021). The two episodes of significant liquidity stress in the U.S. in September 2019 and again in March 2020 are prominent examples of the complexity of predicting demand for central bank reserves especially after QE (Acharya et al., 2022). The 10-fold minimum-reserve requirement might drain too much excess liquidity. In case there are too little excess reserves left for circulation in the money market, demand exceeds supply and drives up interest rates. Consequently, the interest-rate targeting regime switches from a floor- to a corridor-system (or even to a ceiling-system). It has to be kept in mind that the minimum-reserve requirement cannot be extended boundlessly and increasing it by a factor of 10 might be too much to stay in a floor-system.

Figure 1: Controlling short-term (interbank) money market rates within a framework of three policy rates

One might argue that the effect on money market rates of draining too much reserves and leaving the floor-system is just equivalent to an increase of monetary policy rates. However, stopping to anchor money market rates at the floor of the interest-rate corridor strengthens the heterogeneity argument which I will turn to next.

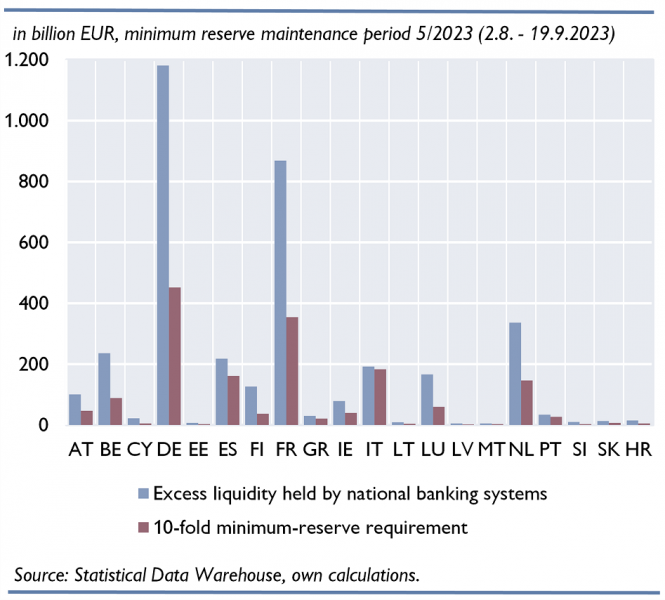

Currently, the Eurosystem provides 3.7 trillion EUR of excess reserves, which is approximately the 22-fold of actual minimum-reserve requirements. If excess reserves were distributed equally, each bank would have to put aside the 10-fold of its current minimum-reserve requirement. This amount will not be remunerated, while the 12-fold of banks’ current minimum reserves is remunerated at the deposit facility rate. The opportunity cost of the new minimum-reserve requirement for those banks is equal to the money market rate, which is approximately 4%.

However, excess reserves are not distributed equally (see e.g., Schnabel, 2023). In fact, Figure 2 shows that banks in euro area core countries3 hold 82.5% of euro area excess reserves. While in aggregate, for example, Finnish banks hold more than the 40-fold of their aggregate minimum-reserve requirement as excess reserves, Italian banks hold approximately the 10-fold. Country aggregate data give an indication of heterogeneity in the distribution of excess reserves. Nevertheless, heterogeneity at the bank level is likely to be much more pronounced.

Figure 2: Distribution of excess reserves and minimum-reserve requirements across euro area countries

Very likely, there are not only Italian banks but also Finnish banks, to continue with our example, that have insufficient reserves and therefore cannot meet the minimum reserve requirement of 10 times. These cash-poor banks need to acquire reserves first. They can achieve this by approaching the Eurosystem and participating in the main refinancing operation, where they can borrow as many reserves as they need (currently at a rate of 4.5%), provided they possess sufficient eligible collateral. However, this method of obtaining reserves is more expensive compared to using the money market, as the Eurosystem currently operates a de facto floor-system. The artificially created demand for reserves within a fragmented money market can lead to pockets of illiquidity, driving up money market rates, at least for certain banks. As a result, cash-poor banks may face higher opportunity costs compared to cash-rich banks.

The issue of differing opportunity costs between cash-rich and cash-poor banks would be exacerbated in a scenario of scarce reserves, as outlined in Section 2. If the new minimum-reserve system absorbs too many reserves and causes money market rates to move towards the middle of the corridor, the dispersion of money market rates will increase and cash-poor banks will encounter higher opportunity costs compared to cash-rich banks.

The additional tightening for cash-poor banks poses the risk of the ECB’s single monetary policy having varying effects across different regions of the monetary union.

Another source of heterogeneity introduced through the establishment of a non-interest-bearing minimum-reserve requirement stems from the fact that banks have different business models. For instance, a (local) savings bank has a relatively higher obligation to hold minimum reserves than for example a bank that is mainly financed through the issuance of longer-term bank bonds. As long as minimum reserves are remunerated at the level of money market rates and, thus, bear no opportunity costs, the difference in business models does not matter. However, as soon as minimum reserves are unremunerated and bear opportunity costs, the difference becomes perceptible. Banks with different business models, thus, are affected in different ways. On the one hand this has distributional consequences and on the other hand it again introduces heterogeneity into the transmission of the ECB’s single monetary policy. Moreover, shadow banks not subject to reserve requirements will feel the competitive advantage (as already mentioned in Section 1). If this advantage triggers a shift in customer deposits away from banks towards shadow banks, it will increase financial stability risks, given that they are less regulated.

As a by-product, however, money markets will become more liquid, because reserves held by financial institutions not subject to minimum-reserve requirements and from cash-rich banks will be channelled to cash-poor banks that have to fulfil the new reserve requirement.

As previously mentioned in this comment, my focus is primarily on examining the economic implications of implementing a non-interest-bearing minimum-reserve requirement from a monetary policy perspective. It is undeniable that the introduction of such a requirement comes with associated costs. Hence, when introducing a “tax on deposits,” it is crucial to carefully consider and evaluate the benefits in comparison to these costs.

Åberg, Pontus, Corsi, Marco, Grossmann-Wirth, Vincent, Hudepohl, Tom, Mudde, Yvo, Rosolin, Tiziana and Franziska Schobert (2019). “Demand for central bank reserves and monetary policy implementation frameworks: the case of the Eurosystem”, ECB Occasional Paper Series No. 282, September 2021.

Acharya, Viral V., Chauhan, Rahul Singh, Rajan, Raghuram G. and Steffen, Sascha (2022). “Liquidity Dependence and the Waxing and Waning of Central Bank Balance Sheets”, available at: http://dx.doi.org/10.2139/ssrn.4216001.

Bindseil, Ulrich (2014). “Monetary Policy Operations and the Financial System”, Oxford University Press, Oxford.

Borio, Claudio (2023). “Getting up from the floor”. Remarks at the Workshop “Beyond unconventional policy: Implications for central banks’ operational frameworks”, Netherlands Bank, Amsterdam, 10 March 2023.

De Grauwe, P. and Y. Ji (2023a). “Monetary policies with fewer subsidies for banks: A two-tier system of minimum reserve requirements”, VoxEU.org, 13 March 2023.

De Grauwe, P. and Y. Ji (2023b). “DP18103 Monetary Policies without Giveaways to Banks”, CEPR Press Discussion Paper No. 18103.

De Grauwe, P. and Y. Ji (2023c). “Central banks can fight inflation without massive handouts to banks”, OMFIF Reports, 5 September 2023.

Schnabel, Isabel (2023). “Back to normal? Balance sheet size and interest rate control”, Speech given at an event organised by Columbia University and SGH Macro Advisors, New York.

Overnight deposits, deposits with agreed maturity or period of notice up to 2 years, debt securities issued with maturity up to 2 years and money market papers are used to calculate the minimum-reserve requirement in the euro area (see How to calculate the minimum reserve requirements (europa.eu)).

In this article I refer to the minimum reserve period from 2 August to 19 September 2023.

For the sake of argument, we summarise Austria, Belgium, Finland, France, Germany, Luxembourg, and the Netherlands as core countries.