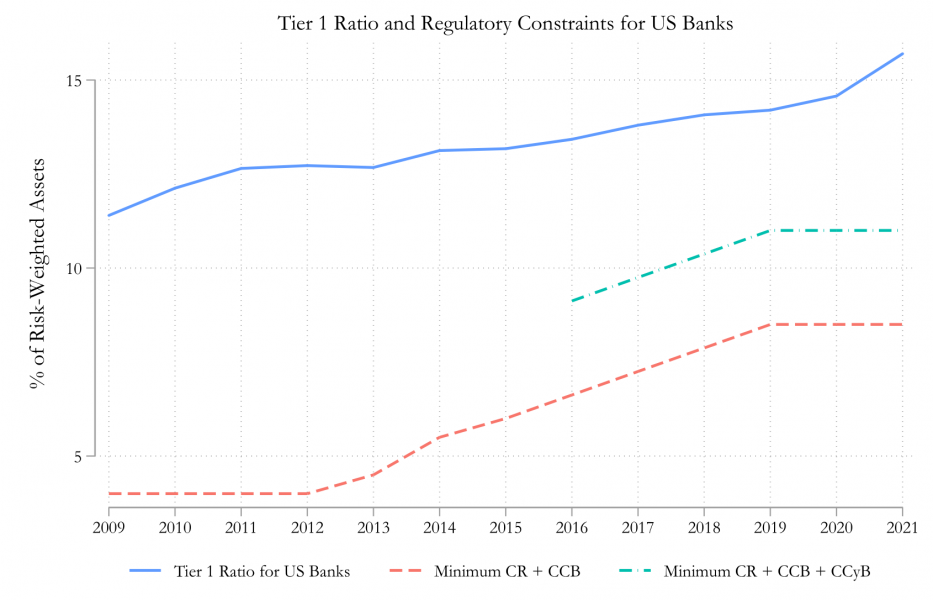

In response to the global financial crisis of 2007-08, national authorities from all over the world agreed on a new set of rules aimed at better regulating the financial system, collectively known as Basel III. One of the pillars of this new global regulatory standard is the so-called Countercyclical Capital Buffer (CCyB).

The panics are therefore self-fulfilling, in the tradition of Diamond and Dybvig (1983).

This is consistent with the view of many economists that the Great Recession was primarily driven by depressed aggregate demand, i.e. Mian and Sufi (2015).