This note will be published in the Revue française d’économie. The views expressed in this paper are those of the authors and do not necessarily reflect the views of the ECB or the Eurosystem. We would like to thank Lea Bitter for compiling Table 1 as well as Ulrich Bindseil, Lorenzo Burlon, Yannick Lucotte, Manuel Muñoz, Christian Pfister, Oscar Soons and Ignacio Terol for comments.

This note discusses the possible consequences for monetary policy implementation, transmission and the monetary policy stance of issuing a central bank digital currency. The European Central Bank (ECB) is preparing a possible introduction of a digital euro, which would promote public policy objectives, offer a digital retail payment solution available to everyone, and ensure that the monetary system keeps up with digital advances. We argue that for realistic take-up scenarios and with appropriate design features, demand for a digital euro would not have any significant impact on the monetary policy stance and its smooth transmission. Moreover, the risk that a cash-like CBDC undermines the profitability of the banking sector seems limited. Overall, we conclude that, with appropriate provisions in place, the central bank would be able to conduct monetary policy with a CBDC broadly in the same way as it does now.

Following a two-year investigation phase into the use case and the most important design features of a digital euro, on 18 October 2023 the European Central Bank (ECB) announced the start of a two-year preparation phase for the possible introduction of a digital euro.1 A digital euro, a publicly available digital currency that can be held by euro area citizens to make retail payments, would be a liability of the central bank, like cash and reserves.2 However, it would be different from cash in that it is digital – existing virtually on some ledger, whereas cash is physical – held in the form of paper bills or coins. A digital euro would also be different from central bank reserves because reserves can be held only by a limited set of counterparties of the central bank, typically banks, whereas the digital euro would be intended for consumers and merchants. This paper discusses the possible consequences of issuing a central bank digital currency for monetary policy implementation, transmission and the monetary policy stance.

The case for a digital euro is based on three arguments.3 The first is rather fundamental and follows from the digitalisation of our financial system, including the payment system, and the dwindling use of physical cash. Due to its nature as a central bank liability, public money acts as the anchor of today’s two‐layer monetary system and is thereby crucial to its functioning (Ahnert et al. (2023a)). In fact, commercial bank money is a promise to convert private money on demand and at par into public money. In the eyes of the consumer, commercial bank money is widely regarded as equivalent to public money. This equivalence depends, however, on the availability of a retail public money such as cash that allows the public to easily convert private money into safe public money.4 In a digital world with a declining use of physical cash, it is therefore quite natural for the central bank to provide a digital form of public money (central bank digital currency or CBDC) to preserve its role as an anchor of stability in the monetary system. More generally, this convertibility supports confidence and trust in the broader payment system and ensures the uniformity of the unit of account (Panetta, 2021; Brunnermeier and Landau, 2022). Ahnert et al. (2023a) also argue that public digital money in the form of a CBDC may help retaining monetary sovereignty if global stablecoins became widely used. Without a CBDC, Brunnermeier et al. (2019) warn that the rise of global stablecoins could threaten monetary sovereignty, in the sense that their use as a means of payment may lead to them also being used as a unit of account in contracts, etc. (see also Arner et al. 2020). The digital euro thus can be seen as a necessary step to ensure that the monetary system keeps up with digital advances.

Secondly, the digital euro would offer a digital retail payment solution that is available to everyone, everywhere in the euro area, with a high level of privacy and without cost for consumers. It would offer Europeans the option to pay digitally throughout the euro area. This is particularly important in a monetary union like the euro area with still somewhat fragmented national banking and retail payment systems. Three crucial elements to achieve this are ease of use, widespread acceptance and broad access. While the importance of the first element is self-evident and depends on the technical solution and design features chosen, the second element would be supported by giving legal tender to the digital euro. The last element points to the importance of financial inclusion and the benefits from network effects in a two-sided payments market (see Ahnert et al., 2023a). The ECB has emphasised that a digital euro will enable the use of public money on digital platforms and is a complement to cash, which will continue to be provided on demand.

The third set of arguments is about promoting public policy objectives, such as competition, innovation and resilience in retail payment services (Usher et al. 2021). Introducing a public digital money would follow a welfare-maximising motive, in contrast to the profit maximisation motive of private actors (see Agur et al., 2022). A digital euro would spur competition for payments services, making payments cheaper. For banks and other payment service providers, the digital euro would act as a springboard for the development of new pan-European payment and financial services, stimulating innovation and making it easier to compete with large, non-European financial and technology firms. It would contribute to levelling the playing field between larger and smaller intermediaries – which are typically less able to keep pace with innovation – by allowing all of them to offer more technologically advanced products at a competitive price (Panetta 2022b). Moreover, it would also enhance the integrity and safety of the European payment system at a time when growing geopolitical tensions make it more vulnerable to attacks on critical infrastructure (Panetta and Dombrovskis, 2023). But public policy objectives pertain to even broader issues. Ahnert et al. (2023a) point out how network externalities that are present in the use of a medium of exchange are reinforced by the access to data that arise from trading on large platforms. These network externalities could lead to a dominance of BigTech companies in the payments market, providing a motivation for central banks to introduce a CBDC. Especially in the payment market, network effects and the monetisation of payment data can create market power and inefficiencies (see e.g., Garratt and Van Oordt, 2021; Ahnert et al., 2022). A digital euro can help protect privacy by addressing the externality coming from the fact that giving information is key for the benefit of network platforms but exposes individuals to discrimination.

The ECB has emphasised that a digital euro would be like cash and is intended to be mainly used as a means of payment and not as a store of value. While those two functions cannot be cleanly separated, the use of a digital euro as an asset to invest part of one’s wealth is prevented in order to reduce the risk of financial disintermediation and financial instability (Bindseil et al., 2022; European Central Bank, 2020a; Group of Central Banks, 2020). The legislative proposal on the establishment of a digital euro reflects these concerns.5 First, like cash, the regulation foresees the digital euro initially to not bear interest. Second, it is assumed that there will be holding limits for citizens and merchants. These holding limits will be implemented by a waterfall mechanism that transfers any holdings of digital euro in excess of a certain threshold automatically to an account with a digital euro provider, and a reverse waterfall mechanism whereby a digital euro account could be automatically topped up towards the holding limit when a payment is made.

The remainder of this article discusses the monetary policy implications of introducing a digital euro. It first discusses the implications of issuing a digital euro for the size and composition of the ECB’s balance sheet and the operational framework. As a digital euro would be a novel means of payment, demand is uncertain and difficult to predict, and could be potentially volatile.6 Introducing it as an additional liability (in addition to cash and reserves) on the central bank’s balance sheet may affect the design of its operational framework, tilting the odds towards a supply or demand-driven floor system that is less reliant on a precise forecast of liquidity needs. A large demand for a CBDC could also constrain the central bank’s policy space; both for interest rate and balance sheet policies. Regarding interest rate policy, a non-remunerated CBDC without any holding limits could harden a zero lower bound for the policy rate, which might constrain negative interest policies and diminish the efficacy of central bank’s asset purchases (Pfister, 2019). A high demand for CBDC could also constrain the amount of assets that remain available for the central bank to purchase for quantitative easing or even the available collateral for its regular lending operations. We will argue that – with appropriate safeguards such as the holding limits and an associated waterfall mechanism in place – monetary policy implementation is unlikely to be constrained by the introduction of a CBDC.

Section 3 investigates the potential impact on financial intermediation, in particular the potential effects on banks’ deposit base and their lending to the economy. Our review of the literature suggests that these effects are uncertain and can go in opposite directions depending on the structure and competition of the banking sector. Moreover, with the above-mentioned safeguards in place, bank disintermediation effects are likely to be small. Section 4 then analyses the consequences a CBDC might have on the transmission of monetary policy. In a world without any frictions, the provision of CBDC would be neutral with respect to the monetary policy stance and the real economy (Brunnermeier and Niepelt, 2019). With financial frictions and the likelihood of bank disintermediation, however, effects on the monetary policy stance and transmission may arise. Nevertheless, the central bank would be able to factor in any resulting effects when implementing and calibrating the appropriate monetary policy stance.

Section 5 discusses the possible use of a CBDC as an additional policy instrument. While in principle the interest rate on a CBDC could be used as an additional policy tool to target other objectives such as the liquidity premium on bank deposits or the exchange rate, in practice the adjustment of a second policy rate might bring limited benefits to the overall stabilisation of the economy. Moreover, it may be difficult to explain to the public and possibly dilute monetary policy communication. As a result, the ECB currently has no intention to use the digital euro as an active additional policy instrument. In sum, we conclude that, with appropriate provisions in place, the central bank would be able to conduct monetary policy broadly in the same way as it does now.

Introducing a digital euro could affect how the ECB implements its monetary policy. Digital euro balances held by euro area citizens will appear on the ECB’s balance sheet as an additional liability next to the two other currently existing forms of central bank money, i.e., banknotes and bank reserves. The take‐up of a digital euro may have implications for the size and structure of the ECB’s balance sheet. In turn, this can impact the choice of the operational framework (corridor versus floor or ceiling system) as well as the space for balance-sheet and interest-rate policies.7 Moreover, it will also affect balance sheet risk and seigniorage revenue.

The demand for digital euro will determine its impact on the size and composition of the ECB’s balance sheet. This demand will strongly depend on the design features of the digital euro and how it compares with other existing means of payment – in particular banknotes and bank deposits. The more the digital euro resembles cash (high level of privacy, easy to use and not remunerated), the larger the expected substitution out of banknotes and the smaller the overall impact on the size of the central bank’s balance sheet. The closer the digital euro is, instead, to bank deposits (remunerated at competitive rates, offering a variety of digital payment services and easy to accumulate in large amounts), the larger the expected substitution out of bank deposits.

Given the multitude of possible CBDC design characteristics and the absence of concrete examples in advanced economies, uncertainty around estimates for aggregate CBDC demand is large. Studies gauging the possible demand for a CBDC therefore have to make assumptions on the potential design characteristics and generally also assume the absence of holding limits. For Canada, Li (2023) estimates CBDC demand to be in a range between 4% and 52% of households’ liquid assets by applying a structural model to a Canadian survey dataset. The lower (upper) range of the estimates corresponds to a scenario where CBDC-specific effects are cash-like (deposit-like). Li (2023) also finds that allowing banks to respond to CBDC is likely to reduce the uptake because banks will be induced to make deposits more attractive by increasing their deposit rates. Important design attributes for the attractiveness of a CBDC include its usefulness for budgeting, anonymity, bundling of bank services and the rate of return. Gross and Letizia (2023) simulate an agent-based model that yields a CBDC-in-total-money share of 1% to 20% for the euro area, with the lower bound characterising a CBDC that is perceived as cash-like whereas the upper bound applies to a deposit-like CBDC. Bijlsma et al. (2021) conducted a survey on the intention to set up a hypothetical CBDC account in the Netherlands. They found that roughly half of the Dutch public would open a CBDC current account. Intended usage is highest among people who find privacy and security important. The amount that respondents want to deposit in a CBDC account depends on the interest rate offered. Based on a survey of more than 2000 residents in Austria, Abramova et al. (2022) found that, although about two-thirds of the respondents had not heard about a digital euro, more than half of them expressed some interest in it. Similarly, Bidder, Jackson and Rottner (2023, 2024) found in a 2023 survey of German households that just under half of the respondents expressed a desire for digital euro if it is unremunerated, while this number rose to close to 60% if the digital euro offered the same remuneration as the respondents’ current account. These shares are somewhat higher than the results from an earlier, 2021 wave of the same survey, showing that 40% of respondents could imagine using a digital euro (Bundesbank, 2021). Zamora-Pérez et al. (2022), however, caution that ensuring adoption of a new payment instrument might be challenging.

Given the wide range of demand estimates, Adalid et al. (2022) use illustrative scenarios to provide a flavour about the order of magnitude of the deposit substitution linked to different levels of CBDC issuance in the euro area. They explore two polar cases for the euro area: a low demand scenario, where CBDC is only moderately used for retail payments, and a high demand scenario, where it is intensively used for retail payments and as a store of value. Finally, they also consider a scenario where demand is high, but CBDC issuance is capped through holding limits. The assumptions for each of these scenarios are chosen for illustrative purposes based on current consumer payment preferences in the euro area. The low-demand scenario results in a CBDC take-up of about EUR 0.5 trillion and the high-demand scenario of about EUR 7 trillion. For the capped scenario, the authors assume the full exhaustion of an individual holding limit, set at EUR 3,000 per euro area citizen, resulting in a total take-up of about EUR 1 trillion. Preliminary analysis across different monetary policy scenarios suggests that an overall digital euro take-up of around EUR 1 trillion could be accommodated without, or with only a moderate, impact on the monetary policy stance and its smooth transmission (Panetta, 2022c).

As interest rates declined to the effective lower bound after the Global Financial Crisis, most central banks in advanced economies further eased their monetary policy stance by injecting additional liquidity through quantitative easing and unconventional refinancing operations (e.g. ECB’s TLTROs). As a result, they currently operate a floor system, where banks hold excess liquidity at the central bank (in the form of excess reserves) and the money market rate at which banks trade reserves with each other and non-bank financial institutions is close to the deposit facility rate, the floor of the corridor of central bank facilities.8 For example, in the case of the ECB excess liquidity was of the order of EUR 5 trillion in 2022 and the money market rate was trading somewhat below the deposit facility rate. In such an environment, the rather extreme scenario mentioned above in which all euro area residents would onboard the digital euro and fully exhaust a EUR 3,000 limit per person is unlikely to have a material impact on the overnight money market rate. The existence of abundant excess reserves and a floor system has often been used as a modelling assumption in the academic literature (Andolfatto, 2021; Garratt et al., 2022). Abad et al. (2023) investigate the impact of CBDC demand on the monetary policy stance and distinguish between two operational framework regimes: a floor system and a ceiling system. They find that for CBDC adoption in the order of EUR 3,000 per capita or less (i.e., below 9% of GDP), CBDC demand is absorbed by a fall in excess reserves and a floor system continues to prevail. For higher take-ups, the central bank would only continue to operate in a floor system in a scenario of abundant reserves around the time of the introduction of a digital euro. Lamersdorf et al. (2023) develop a model of the interbank market showing that, as excess reserves decrease, interbank market rates tend to increase. This leads banks to access more frequently the central bank’s lending facility, which ceteris paribus results in tighter bank lending conditions.

Most central banks in advanced economies are currently reducing their balance sheets through quantitative tightening (QT) and, in the case of the ECB, by letting special lending facilities such as the TLTROs run off. As excess liquidity is falling, central banks will have to decide on the features of the future operational framework and the size of their balance sheet in the new steady state. The introduction of a digital euro – whose usage could be hard to predict – could be an additional factor for the ECB not returning to a corridor system like the one that was in place before the Global Financial Crisis. A more volatile demand for reserves reinforces the argument for preferring monetary policy implementation in a floor system with ample reserves, rather than a corridor system, in which the central bank allocates reserves by conducting refinancing operations to keep the money market rate close to the centre of the corridor. Liquidity demand estimates might be particularly uncertain during the introduction and adoption phase of a CBDC since data on this new liability do not exist. Assuming that adoption would be gradual, however, the total volatility of all autonomous liquidity factors (i.e., CBDC, banknotes and government deposits) may increase only marginally initially. In the presence of potentially large forecast errors, trying to maintain the money market rate close to the midpoint of the corridor may then require different strategies, such as a narrower spread between the central bank interest rates for liquidity providing and absorbing operations, a higher minimum reserve ratio or more frequent fine-tuning operations.

If in the new steady state a floor system is maintained – where ample reserves keep money market rates close to the central bank’s deposit rate – the demand for CBDC may eventually push excess reserves below the level demanded by banks and generate upward pressures on money market rates. This may require an increase of the amount of reserves needed for a smooth implementation of monetary policy in a floor system (Caccia et al., 2023). Meller and Soons (2023) find that in 2021 a demand for digital euro in the amount of a EUR 3,000 holding limit per person would not have led to unusual shifts in banks’ funding structure and would have had little impact on the Eurosystem’s balance sheet beyond a swap of counterparties from banks to households. Even in a situation with less excess liquidity or with a segmented interbank market, in which banks trade only with national counterparties, these conclusions do not change significantly. Money market rates could increase if liquidity shortfalls emerge in segments of the interbank market into which liquidity does not flow freely. However, these incipient upward pressures may be reduced by a commensurate injection of reserves by the central bank through outright purchases of government bonds or other assets, thereby keeping ample reserves.9

In a ceiling system, where the amount of reserves is demand-driven and elastically supplied, the policy rate is determined by the interest rate at which the central bank lends to the banking system: the ceiling of the corridor. In this case, the size of the corridor between the central bank lending and deposit rate will determine the cost of holding reserves and the overall amount of reserves demanded. If the corridor is very narrow as, for example, recently decided by the Bank of England (2022), the opportunity cost of holding reserves will be small and banks would have the incentive to hold a larger amount of reserves to minimize the cost of meeting their payment obligations and reserve requirements (see e.g. Keister 2012). In this case, changes in the demand for liquidity and central bank funding coming from a rise in CBDC demand would automatically be accommodated at the central bank’s borrowing facility rate and should not have an impact on the monetary policy stance.10

Under extreme conditions, i.e. without any safeguards such as a holding limit to cap excessive demand, a CBDC could constrain the central bank’s policy space. If the central bank’s balance sheet were to expand massively to accommodate CBDC issuance, the central bank could run out of assets to hold, depending on what applicable laws allow in terms of eligible assets for purchase (Bank for International Settlements, 2018).11 Limits to asset purchases have been particularly relevant for the ECB, which has set specific issuer and issue share limits for its asset purchase programmes (see e.g., Hammermann et al., 2019). Such constraints could be especially problematic in the event of a run into CBDC because the demand for safe assets that the central bank traditionally holds could increase substantially in such a state (Meaning et al., 2021).

In contrast, if the central bank’s balance sheet expands through lending operations to banks (as in a demand-driven operational framework), the policy space might be limited by the availability of collateral. Williamson (2022), however, argues that the central bank uses safe collateral backing CBDC more efficiently than banks, which are subject to incentive problems due to a limited commitment friction. Although CBDC issuance may lead to bank disintermediation, it can raise welfare by reducing overinvestment and increasing the effective stock of safe collateral in the economy. For central banks that accept a wide range of collateral like the ECB, however, this constraint is unlikely to bind. Moreover, the central bank could decide to ease its collateral requirements. A CBDC-induced expansion of its balance sheet would be more likely but also easier for the central bank to implement in an environment with low excess liquidity, as collateral buffers are larger. By contrast, the availability of collateral or purchasable securities would be lower in the presence of high excess reserves, hindering a further balance sheet expansion.

Major central banks that investigate CBDC have declared that they envisage a cash-like design that does not bear interest (European Central Bank 2023b; Bank of England 2023; Bank of Canada, 2023; Sveriges Riksbank, 2023). A larger balance sheet and a higher net interest margin in the case of a non-remunerated CBDC means more seigniorage income. However, a larger balance sheet also means more risk and less policy space in circumstances in which the central bank wants to use its balance sheet as a policy instrument. Gross and Letizia (2023) argue that with a zero or low CBDC interest rate, seigniorage first increases from rising CBDC demand and an expanding balance sheet. As CBDC rates rise further, CBDC interest expenses start to dominate and seigniorage falls. If the CBDC paid positive interest, any substitution of CBDC for currency would decrease the central bank’s net interest income. As long as the expected yield of the assets that finance the lengthening of the central bank’s balance sheet resulting from the introduction of a CBDC exceeds the remuneration of the CBDC, seigniorage would increase. However, a larger balance sheet comes with the risk of higher potential losses if interest rates were to rise unexpectedly, as noted by Infante et al. (2022).

Defining seigniorage more broadly as the overall income from issuing money (banknotes and deposits at commercial banks), CBDC has the potential to affect both the overall value and the distribution of seigniorage. As CBDC might entail lower cost than banknotes, overall seigniorage could increase if banknotes are substituted for CBDC. In addition, seigniorage may shift from commercial banks to the central bank if CBDC substitutes for bank deposits (Bank for International Settlements, 2018).

A prominent concern in the discussion of retail CBDC is that it might lead to bank disintermediation if bank customers switch from bank deposits into digital currency, thus leading to deposit outflows from the banking sector. An outflow of deposits might trigger different adjustment strategies for banks, see Auer et al. (2024), which – depending on the measures chosen – would have different implications for various bank metrics such as the Net Stable Funding Ratio or the Liquidity Coverage Ratio but also for asset encumbrance, net interest income or the size of the balance sheet. Because deposits are a relatively cheap and stable source of bank funding, a CBDC could lead to a rise in banks’ funding cost, higher lending rates and ultimately to a contraction in credit and investment. In this section, we review the literature on the impact of a CBDC on bank funding costs and net interest margins as well as the role of competition in the deposit market before turning to the response of the central bank to a possible tightening of banks’ financing conditions. Our review of the literature suggests that these effects are uncertain and can go in opposite directions depending on the structure and competition of the banking sector and the central bank response. Any bank disintermediation effects are likely to be small, in particular with safeguards such as holding limits in place.

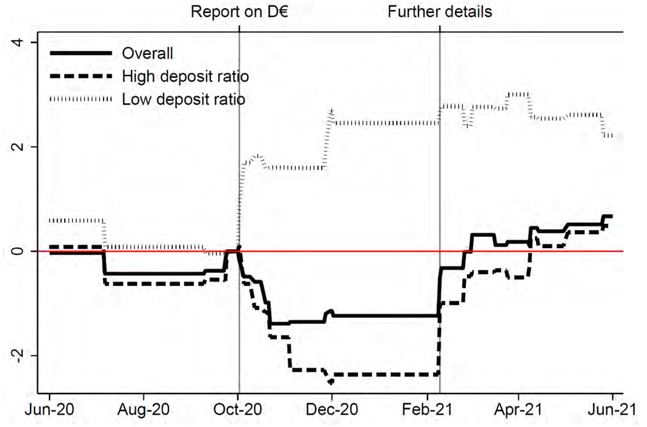

Burlon et al. (2022) use the reactions of bank stock returns to digital euro news to deduce the impact of introducing a digital euro on bank profitability as perceived by market participants. Figure 1 shows the cumulative impact of digital euro news on abnormal returns of euro area banks’ stock prices. Banks’ valuations decreased after the ECB stated its intention to intensify work on a digital euro in early October 2020 (European Central Bank 2020b, Panetta 2020). The drop was concentrated among banks with a higher reliance on deposit funding and was reversed in early February 2021 when potential limits on individual holdings and other qualifications about the digital euro project that could mitigate deposit substitution were communicated to the public (see Panetta 2021).12

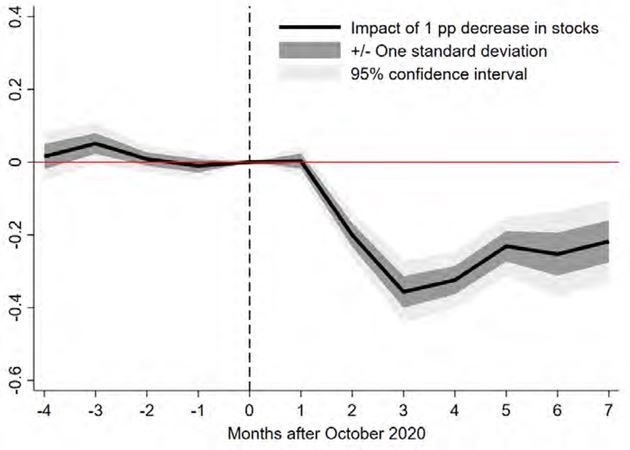

Burlon et al. (2022) also investigate whether the reaction of stock prices had translated into bank lending conditions. Using corporate loan data from AnaCredit (the European credit register), they estimate that a one percentage point drop in stock market returns attributable to digital euro news was associated with a decrease in loan volumes of over 0.3% (Figure 2). However, consistent with the recovery of stock market returns observed since early February 2021, the impact on lending disappeared following the discussion of safeguards to restrict the amount of digital euro in circulation. Assuming that a CBDC is a superior store of value than cash, Muñoz and Soons (2023) show that – despite some bank disintermediation – lending decreases less than proportionally with the decrease in deposits and in most cases social welfare rises when a CBDC is introduced.13

Figure 1: Stock market reactions to digital euro news by euro area banks

Notes: Each line shows the cumulated abnormal returns up to the latest key event, relative to the level on 1 October 2020. The solid line shows the average across all banks in the sample. The dashed and dotted lines show the average within two groups of banks: those with deposit ratio above or below the median, respectively. The two grey vertical lines indicate the publication of the ECB report on a digital euro on 2 October 2020 and the interview on 9 February 2021 (Panetta, 2021). Source: Burlon et al. (2022).

Figure 2: Predicted change in loan volumes to firms associated with a negative reaction of bank stock prices to digital euro news

Notes: The solid line shows, for each monthly horizon from October 2020 indicated on the horizontal axis, the impact of a 1 pp decrease in (cumulated) abnormal returns in October 2020. Shaded areas represent confidence intervals based on standard errors clustered at the bank level. Source: Burlon et al. (2022).

The empirical analysis presented above suggests that bank analysts perceive the risk of the digital euro undermining bank profitability as limited given its design features which make the digital euro close to cash.

As shown by Brunnermeier and Niepelt (2019), with perfect markets, CBDC issuance would be neutral with respect to bank financing, provided that the central bank supplies reserves to banks at the same conditions as the lost deposit funding. However, with financial frictions and imperfect markets, a sizeable demand for CBDC could affect the funding cost of banks to the extent that banks need to replace “cheap” deposit funding with more expensive market funding or borrowing from the central bank.14 Keister and Sanches (2022) propose a model, in which banks raise funds in a perfectly competitive deposit market. In this setting, the introduction of a CBDC crowds out deposits, raises banks’ funding costs, and leads to a decline in bank lending. Chang et al. (2023) distinguish between two opposing margins through which CBDC affects bank deposits: Poorer households switch from deposits to CBDC because it is more costly for them to access bank accounts whereas richer households increase their deposit holdings as deposit rates increase. Whited et al. (2023) estimate that a one-dollar introduction of CBDC replaces bank deposits by around 80 cents on the margin. Bank lending falls by one-fourth of the drop in deposits because banks partially replace lost deposits with wholesale funding. This substitution raises banks’ interest-rate risk exposure and lowers their resilience to negative equity shocks.

Burlon et al. (2022) develop a quantitative macro-banking DSGE model for the euro area that captures the main transmission channels through which the introduction of CBDC could affect the banking sector and the real economy. They investigate a variety of CBDC policy rules and calculate the optimal amount of CBDC in circulation. The model features two types of households: patient households (i.e. savers) who hold a variety of financial and monetary instruments, of which bank deposits, cash, and CBDC provide liquidity services, and impatient households (i.e. borrowers) who borrow funds from banks against housing collateral (Iacoviello 2005). Savers own all firms in the economy and obtain bank lending against the firm’s capital. Banks borrow from savers (in the form of deposits) and lend to impatient households and firms (in the form of loans). Banks operate subject to capital and liquidity (reserves) requirements and obtain complementary funding from the central bank against eligible collateral (i.e., government bonds). The central bank sets the lending facility rate according to a simple Taylor-type rule and the interest rate on reserves to maintain a constant corridor between these two policy rates. CBDC policy is characterised either by a simple CBDC quantity rule that sets the central bank’s CBDC supply or by an interest rate rule that determines the interest rate on CBDC.

The transmission of CBDC issuance to the economy works through two main channels. First, an increase in the amount of CBDC in circulation is associated with a decline in savers’ holdings of cash and deposits due to the imperfect substitutability between the three assets that provide liquidity services. In response, banks reduce their reserve holdings in line with their reserve requirements. This has two main consequences for the central bank’s accounts. First, its balance sheet expands as the issuance of CBDC is not fully offset by the decrease in reserves and cash. Second, central bank profits soar due to an increase in assets and a shift from reserves to CBDC, as the equilibrium interest rate on CBDC turns out to be negative and lower than those on cash or reserves. The increase in seigniorage relaxes the government budget constraint and puts downward pressure on taxes, thereby promoting private consumption, economic activity, and bank lending. This is called the ‘fiscal expansion effect’ of issuing CBDC. Second, banks reallocate their liabilities from deposits to central bank funding and their assets from private sector loans to government bonds. The asset reallocation is driven by an increased demand for government bonds as collateral for central bank borrowing. As a consequence, bank lending margins compress, which tends to adversely affect bank loan supply and real GDP. This is called the ‘bank disintermediation effect’ of issuing CBDC.15 Under a calibration that intends to capture a ‘new normal’ with positive interest rates, the bank disintermediation effect of a permanent issuance of CBDC is larger than the fiscal expansion effect. But overall, the effects on lending and economic activity are small and do not outweigh the benefits of issuing a CBDC. Qualitatively similar effects are found in Assenmacher et al. (2023).

The degree of competition in the deposit and loan markets is a key factor in determining the impact of CBDC on bank intermediation. Models with imperfect competition in deposit markets generally see a lesser risk of disintermediation. In Gong et al. (2023), Chiu et al. (2023) and Andolfatto (2021), market power enables banks to artificially restrain deposit supply and keep funding costs low. In this setting, a remunerated CBDC presents consumers with a potential outside option, and thus forces banks to compete more fiercely by raising deposit rates. As long as the CBDC remuneration is not too high, this increases deposit volumes and, ultimately, bank lending.16 Cirelli and Nyffenegger (2024) study the impact of CBDC in a general equilibrium model that combines market power in the deposits market with leverage constraints. When market power is the predominant friction, CBDC introduction increases bank lending but the result reverses when leverage constraints are binding for banks. Garratt and Zhu (2021) study the resulting implications in a setting with heterogeneous banks. Since deposits in smaller banks provide less convenience to depositors (e.g., through smaller branch and ATM networks), their deposit base is more vulnerable to an increase in CBDC remuneration, which may lead to a more concentrated banking sector. The results of Mishra and Prasad (2023) suggest that the share of CBDC in total assets is highly sensitive to the nominal rate of return on CBDC. This is consistent with the findings of Whited et al. (2023) and Li et al. (2023) that a non-remunerated CBDC would result in a much smaller shift from bank deposits into CBDC. These findings suggest that, overall, the increased contestability in the market for deposits will only occur when CBDC bears interest.

Agur et al. (2022) investigate optimal CBDC design and conclude that – in the absence of network effects – the optimal CBDC design is not remunerated (see also Pfister, 2020). In the presence of network effects, however, it becomes optimal to impose a negative interest rate on CBDC to strike a balance between maintaining a variety of different payment instruments (CBDC, bank deposits and cash) and minimising costs from structural disintermediation, especially when the latter is connected to frictions such as relationship lending.

The results discussed in the previous sections raise the question whether the central bank could close banks’ funding gap through its own lending operations. This is formally examined by Brunnermeier and Niepelt (2019), who provide conditions for CBDC neutrality in this context. More generally, the size of the disintermediation effects very much depends on the response of the central bank, which in turn will depend on its operational framework. After evaluating how a CBDC could affect different transmission channels, we conclude that, according to available models, the effect of monetary policy shocks on output and inflation is unlikely to change drastically in an economy with a CBDC.

In Burlon et al. (2022), the central bank expands its collateralised lending to the banking sector. In their case, the disintermediation effect will depend on the spread between the cost of borrowing from the central bank and deposit funding and on the central bank’s collateral policy including the haircut on collateral. The narrower the spread between the central bank lending facility rate and the deposit rate, which itself will also be determined by the central bank deposit facility rate, the smaller the disintermediation effect. The easier the collateral policy of the central bank, the smaller the disintermediation effect.

Gust et al. (2023) analyse the disintermediation effect in a simple banking model for the US with an overall balance sheet cost and a synergy between deposits and loans, i.e., deposits facilitate the generation of loans. In their case, the central bank holds solely government bonds on its asset side. They show that the extent to which the Fed actively manages the reserves it supplies to banks will have an important impact on the degree of disintermediation. If the central bank keeps the balance sheet constant, then a rise in CBDC will be reflected in a fall in reserves. This will contribute to a rise in the interest rate on deposits and wholesale funding and contribute to a drop in lending to the economy. In contrast, if the central bank keeps the level of reserves constant, wholesale funding rates will increase by less and the disintermediation effect will be smaller.

As mentioned in section 2, Abad et al. (2023) study the effect of introducing CBDC under different operational frameworks. In their model, neutrality in the sense of Brunnermeier and Niepelt (2019) does not hold because a non-remunerated CBDC generates a lower average return on the households’ optimal liquidity basket, which leads to less savings, a decline in investment and physical capital, reducing output and consumption. Abad et al. (2023) investigate different central bank policies aimed at maintaining the floor system by increasing the amount of reserves to their level prior to the introduction of CBDC. Under these floor-system-preserving policies, long-run real outcomes are the same as without such policies, which only imply a reshuffling of assets and liabilities between commercial banks and the central bank.

Another way in which the introduction of an unremunerated digital euro could impact monetary policy is by hardening the zero lower bound constraint for policy interest rates. In a negative interest rate environment, CBDC holdings would be relatively more attractive compared to other liquid assets. In such an environment, a zero-remunerated and elastically supplied CBDC would constrain the lower bound to zero, reducing the monetary policy space (Bindseil and Panetta, 2020). Indeed, CBDC introduction could raise the effective lower bound because it does not bear the storage costs that currently apply to banknotes and that limit the arbitrage with physical currency (Armelius et al., 2018). In the recent low-interest-rate episode, however, banks have been reluctant to set retail deposit rates below zero although in many jurisdictions they faced negative interest on their reserves at the central bank. This rate-setting behaviour of banks would give consumers little incentive to switch from bank deposits into CBDC and suggests that the transmission of policy rates to retail deposit rates might not change much. The situation is different, however, for larger depositors, mostly firms, that have been subject to negative deposit interest rates. Empirical evidence shows that negative deposit rates for firms stimulated the economy as firms reduced their deposit holdings and invested in alternative assets, including capital formation (Altavilla et al., 2022). If the supply of a non-remunerated digital euro were very elastic, banks would be even more hesitant than now to lower the interest rate on deposits below zero out of fear that they would face an outflow of deposit funding. These reflections have been one argument to cap the amount of digital euro households and firms can hold (Panetta, 2022a).

It has been argued that a – possibly negative – interest bearing CBDC could overcome the effective lower bound on interest rates (Bindseil and Panetta 2020, Bindseil 2022). For this to be the case, however, two other conditions would need to be in place. First, to fully eliminate the lower-bound constraints, cash would need to be phased out, which has already been excluded by major central banks (see Group of Central Banks 2020). Second, a negative interest rate on CBDC would lower its attractiveness to consumers and might impair its usefulness as a means of exchange. Bindseil (2022) therefore proposes a tiered remuneration that exempts part of the CBDC holdings from negative rates.

Meaning et al. (2021) argue that an attractive, interest-bearing CBDC could strengthen the interest rate channel of monetary policy transmission. If households and businesses would shift resources to and from CBDC in response to differences between the rate on CBDC and deposit rates, market interest rates would become more sensitive to changes in the (non-CBDC) policy rate. In contrast, Piazzesi et al. (2022) note that the interest rate channel could be weakened if CBDC carries a convenience yield that results from its use for transactions. A rise in the policy rate would trigger a decline in spending and lower the convenience value of CBDC, leading CBDC holders to shift back into bank deposits and bonds. This shift would put downward pressure on the rate for bank deposits and bonds and partly undo the effects of original policy tightening. Garratt et al. (2022) identify a trade-off between an enhanced monetary policy pass-through from the policy rate to deposit rates and negative consequences for market concentration in the presence of a remunerated CBDC.

Effects of a CBDC on the bank lending channel are likely to be ambiguous as well. A greater reliance of banks on wholesale funding would contribute to a faster passthrough of policy rate changes to lending rates, thereby strengthening the bank lending channel. To the extent that CBDC leads to bank disintermediation, however, the bank lending channel overall would lose importance (Meaning et al., 2021). Hemingway (2023) proposes a ‘liquidity risk channel’ of banks’ deposit financing. In absence of liquidity risk, banks’ deposit rates increase one-for-one with the policy rate, even after the introduction of a CBDC. With liquidity risk, however, an increase in the CBDC remuneration will increase the cost of deposit financing and thereby put downward pressure on deposit rates.

Piazzesi and Schneider (2020) model CBDC as a “deposits-only” technology because central banks plan to issue CBDC to consumers without performing other services that banks offer to their customers, such as credit. Given that banks reap synergies from offering deposits together with credit lines as long as liquidity needs from deposits and loans are not perfectly correlated (Kashyap et al., 2002), the joint provision of both products allows banks to economize on costly liquidity holdings. A replacement of bank deposits by CBDC implies a loss of synergies and thus a decline in credit provision, which can lower welfare, even if payments with CBDC are cheaper than those with bank deposits. As argued by Infante et al. (2023), a CBDC that is designed to be a close substitute for bank deposits could reduce the convenience yield of short-duration safe assets, which in turn could raise the neutral rate of interest, r*, potentially reducing the incidence and severity of zero lower-bound episodes.

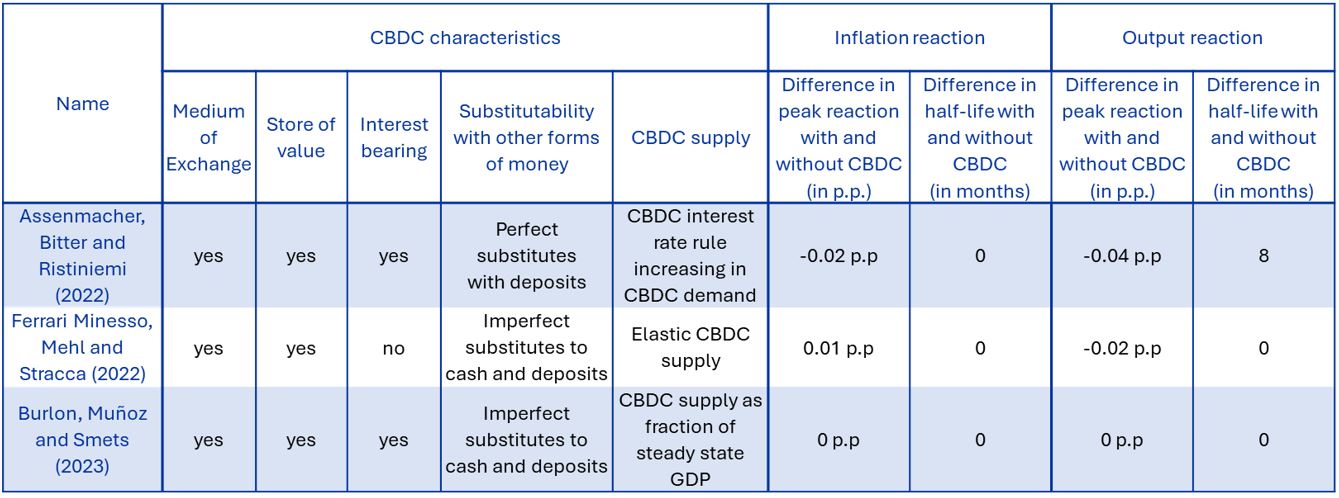

While existence of a CBDC is likely to affect multiple monetary policy transmission channels through the banking system, the overall impact could be relatively contained. A comparison of a 25 basis points monetary policy shock with and without CBDC across the model frameworks of Assenmacher et al. (2022), Burlon et al. (2023) and Ferrari Minesso et al. (2022) suggests that monetary policy remains similarly effective in the presence of CBDC. While the models differ in how they model CBDC as well as in their general structure and dynamics, the impact of CBDC on the effects of a monetary policy shock is small and similar across all frameworks. The differences in the peak impact on inflation reach up to 0.02 percentage points, and the differences in peak impact on output up to 0.04 percentage points. Likewise, the persistence of the shock’s impact, measured by its half-life, remains mostly the same (Table 1). Das et al. (2023) also assess the effects of CBDC on monetary policy transmission to be relatively minor in normal times but caution that they could be more significant in an environment with low interest rates or financial market stress.

Table 1: Comparison of the effects of a monetary policy shock on inflation and output across models with and without CBDC

Currently the proposed legislation imposes a cash-like zero interest rate on the digital euro and foresees holding limits to minimise its use as a store of value. In its Opinion on the digital euro17 of 31 October 2023, the ECB stated that it is not developing a remunerated digital euro. However, it also notes that, to further its monetary policy mandate, it must remain in control of the remuneration of all liabilities on its balance sheet. This implies that the digital euro will not bear interest and this interest rate cannot be used as an additional monetary policy instrument.

As argued above, setting a variable interest rate on CBDC could strengthen the transmission of conventional policy rates to bank deposit and lending rates. For example, CBDC remuneration could be linked to the relevant policy rate, which could induce banks to adjust rates on bank deposits more quickly, thereby strengthening the transmission of policy impulses to bank lending conditions. If the remuneration of CBDC were set at some fixed spread below the policy rate, the rate on CBDC might turn negative even more frequently than the policy rate.

But a remunerated CBDC could also give the central bank an additional tool for targeting other objectives, such as the liquidity premium on bank deposits or the exchange rate (George et al., 2020). By operating as a means of exchange, CBDC opens up new channels for monetary policy to affect output and inflation. Assenmacher et al. (2022) link a New Monetarist model to a New Keynesian model with financial frictions and show that the central bank can separately target the store‐of‐value and the means‐of‐exchange function of money by steering the supply of CBDC. This offers an additional channel for stabilising the economy by exploiting a trade‐off between payments efficiency, bank funding conditions and the opportunity cost of holding money. This is in line with Keister and Sanches (2022), who conclude that welfare is often maximised when the central bank uses the CBDC interest rate to increase total real money balances and lower the equilibrium liquidity premium, although this results in some bank disintermediation.

Burlon et al. (2023) also analyse welfare-maximising CBDC quantity and interest rate rules. They show that – in particular in response to financial shocks – a countercyclical CBDC policy rule, which increases CBDC quantities and interest rates in response to negative shocks, can help stabilise the economy. A positive CBDC shock stimulates the economy very much like a conventional monetary policy shock. The main difference is that such an expansionary shock involves a rise in the interest rate on CBDC to make holding CBDC more attractive. This is also the finding of Kumhof et al. (2023). By counteracting financial shocks, CBDC policy helps stabilising aggregate demand and inflation. In the estimated DSGE model of Kumhof et al. (2023), the optimised CBDC interest rule that responds systematically to the credit gap improves welfare by over 1% of steady-state consumption.

Jiang and Zhu (2021) present an analytical framework with a deposit-like CBDC that is a perfect substitute for bank deposits. The interest rate on CBDC therefore fully determines the rate on deposits. With perfect competition on the deposit market, the pass-through from the policy rate to the loan rate and quantity is stronger with a CBDC because the deposit rate is fixed by the CBDC rate and does not react. When the deposit market is not fully competitive, banks do not fully pass-through the increase in the CBDC rate to the deposit rate and the pass-through of the policy rate is weakened. In addition, with imperfect competition the pass-through also depends on the level of the policy rate. Jiang and Zhu (2021) conclude that – to maximise the effect on lending, the CBDC rate should be increased when the policy rate is reduced.

Since CBDC is used as a means of payment, it affects the economy through the liquidity premium on liquid assets that provide utility not only by their remuneration but also by their convenience yield as a means of transaction. This allows the central bank to exploit another transmission channel, in addition to the usual transmission from the policy rate to intertemporal consumption and investment decisions. In practice, however, using a second interest rate that has to be lowered when the policy rate would be raised, would certainly be challenging from a communication perspective. Moreover, the results from Jiang and Zhu (2021) suggest that the effect on lending that changes in the CBDC rate generate varies with the level of the policy rate. Overall, central banks thus seem well advised to not foresee an active role for CBDC remuneration in the setting of the monetary policy stance.

In this paper, we surveyed the literature on CBDC and discussed the implications of issuing a CBDC for monetary policy implementation and transmission. Overall, the introduction of a CBDC can be expected to improve welfare since it embodies a more efficient technology than cash. Moreover, it is usable in a digital environment, thereby complementing cash and offering consumers a wider variety of choices. It may also improve welfare as a competitor to private digital money by lowering rents in a non-competitive banking sector and incentivising banks to shift towards a safer portfolio.

To date, central banks including the ECB do not intend to use CBDC as an additional policy tool, for various reasons. First, CBDC is intended as a means of exchange and a complement to cash. It is therefore natural to keep its design cash-like by setting a zero remuneration. Second, using the interest rate on CBDC as an additional instrument to stabilise the economy might pose challenges to monetary policy communication and dilute the effect that policy rate changes have on longer-term interest rates which are ultimately important for investment and the real economy. Finally, with an unremunerated CBDC competition with bank deposits is attenuated, which helps to contain bank disintermediation and potential detrimental effects on bank credit and the economy.

The legislative proposal for the digital euro requests the ECB to develop instruments to limit the use of the digital euro as a store of value.18 In addition to zero remuneration, holding limits will be an important feature of the digital euro to that effect. These holding limits reduce the risk of significant bank disintermediation. They act as a circuit breaker in times of financial turbulences when CBDC could become particularly attractive, thereby contributing to deposit outflows and worsening financial instability. Holding limits also alleviate the hardening of the zero lower bound that a zero-remunerated CBDC could entail. Finally, they also exclude a large expansion of the central bank’s balance sheet, thereby reducing the risk it constrains policy space when quantitative easing policies are needed. Nevertheless, also a cash-like CBDC can present challenges to monetary policy implementation. As a CBDC will be a completely new payment product, demand will initially be difficult to estimate, which can affect liquidity management and the choice of the best operational framework. Overall, we conclude that, with appropriate provisions in place, the central bank would be able to conduct monetary policy broadly in the same way as it does now.

The literature on CBDC has expanded significantly over the past years and generated important insights into the possible effects of CBDC issuance, but also more broadly with respect to the modelling of monetary exchange, monetary policy operations, the monetary policy transmission mechanism and financial stability issues more generally.

Abad, J., Nuño G., and Thomas, C. (2023). CBDC and the operational framework of monetary policy. BIS Working Paper 1126, September 2023.

Abramova, S., Böhme, R., Elsinger, H., Stix, H., and Summer, M. (2022). What can CBDC designers learn from asking potential users? Results from a survey of Austrian residents, Working Papers 241, Oesterreichische Nationalbank.

Adalid, R., Álvarez-Blázquez, Á., Assenmacher, K., Burlon, L., Dimou, M., López-Quiles, C., Martín Fuentes, N., Meller, B., Muñoz, M. A., Radulova, P., Rodriguez d’Acri, C., Shakir, T, Šílová, G., Soons, O., and Ventula Veghazy, A. (2022). Central bank digital currency and bank intermediation. ECB Occasional Paper, (2022/293).

Agur, I., Ari, A., and Dell’Ariccia, G. (2022). Designing central bank digital currencies. Journal of Monetary Economics, 125, pp. 62-79.

Ahnert, T., Hoffmann, P., Monnet, C. (2022). The digital economy, privacy, and CBDC, ECB Working Paper 2662.

Ahnert, T., Assenmacher, K., Hoffmann, P., Leonello A., Monnet, C. and Porcellacchia D. (2023a). The economics of central bank digital currency, International Journal of Central Banking, forthcoming.

Ahnert, T., Hoffmann, P., Leonello, A. and Porcellacchia, D. (2023b). CBDC and financial stability. ECB Working Paper 2783, European Centra Bank.

Altavilla, C., Burlon, L., Giannetti, M., Holton, S. (2022). Is there a zero lower bound? The effects of negative policy rates on banks and firms, Journal of Financial Economics 144(3), pp. 885-907.

Andolfatto, D. (2021). Assessing the impact of central bank digital currency on private banks. The Economic Journal, 131(634), pp.525-540.

Armelius, H., Guibourg, G., Levin, A. and Söderberg, G., 2020. The rationale for issuing e-krona in the digital era. Sveriges Riksbank Economic Review, 2(2020), pp. 6-18.

Arner, D., Auer, R., and J. Frost (2020), Stablecoin: risks, potential and regulation. BIS Working Papers, 905.

Assenmacher, K., Berentsen, A., Brand, C., and Lamersdorf, N. (2021). A unified framework for CBDC design: remuneration, collateral haircuts and quantity constraints. ECB Working Paper 2578, European Central Bank.

Assenmacher, K., Bitter, L., and Ristiniemi, A. (2022). CBDC and business cycle dynamics in a New Monetarist New Keynesian model. ECB Working Paper 2811, European Central Bank.

Assenmacher, K., Ferrari Minesso, M., Mehl, A., Pagliari, M.S. (2023). Managing the transition to central bank digital currency. ECB Working Paper 2907, European Central Bank.

Auer, R., J. Frost, L. Gambacorta, C. Monnet, T. Rice, and H. S. Shin (2022). Central bank digital currencies: motives, economic implications and the research frontier. Annual Reviews of Economics 14, 697-721.

Auer, S., Branzoli, N., Ferrero, G., Ilari, A., Palazzo, F., and Rainone, E. (2024). CBDC and the banking system. Questioni di Economia e Finanza 829, Banca d’Italia.

Bank for International Settlements (2018). Central bank digital currencies. Committee on Payments and Market Infrastructure and Markets Committee.

Bank of Canada (2023). A digital Canadian dollar: What we heard 2020-23 and what comes next. Report on digital dollar consultations.

Bank of England (2022). Short term repo facility—Provisional Market Notice, 4 August 2022.

Bank of England and HM Treasury (2023). The digital pound: a new form of money for households and businesses? Consultation Paper, February 2023.

Berg, T., Keil, J., Martini, F. and Puri, M. (2023). Payment Firms, Cryptocurrencies, and CBDCs. Available at SSRN: https://ssrn.com/abstract=4402740.

Bidder, R., Jackson, T., and Rottner, M. (2023). Retail CBDC household views: the case of Germany. Unpublished paper.

Bidder, R., Jackson, T., and Rottner, M. (2024). CBDC and banks: disintermediating fast and slow. Unpublished paper.

Bijlsma, M., C. van der Cruijsen, N. Jonker and J. Reijerink (2021), What triggers consumer adoption of central bank digital currency. TILEC Discussion Paper DP2021-009, May 2021.

Bindseil, U. (2022). Central Bank Digital Currencies in a World with Negative Nominal Interest Rates. In: Heckel, M., Waldenberger, F. (eds) The Future of Financial Systems in the Digital Age. Perspectives in Law, Business and Innovation. Springer, Singapore.

Bindseil, U. and Panetta, F. (2020), Central bank digital currency remuneration in a world with low or negative nominal interest rates, VoxEU, 5 October.

Bindseil, U., Panetta, F., and Terol, I. (2022). Central Bank Digital Currency: functional scope, pricing and controls. ECB Occasional Paper, (2021/286).

Bitter, L. (2020). Banking crises under a central bank digital currency (CBDC). Beiträge zur Jahrestagung des Vereins für Socialpolitik, ZBW – Leibniz Information Centre for Economics, Kiel, Hamburg.

Brunnermeier, M. K., and Landau, J.-P. (2022). The digital euro: policy implications and perspectives. Study requested by the ECON committee, European Parliament.

Brunnermeier, M. K., and Niepelt, D. (2019). On the equivalence of private and public money. Journal of Monetary Economics, 106, pp.27-41.

Brunnermeier, M. K., James, H. and Landau, J.-P. (2019). The digitalization of money. NBER working Paper 26300. National Bureau of Economic Research.

Burlon, L., Muñoz, M. A., and Smets, F. (2022). The optimal quantity of CBDC in a bank-based economy, American Economic Journal Macroeconomics, forthcoming.

Caccia, E., Tapking, J., and Vlassopoulos, T. (2023). Central bank digital currency and monetary policy implementation. Mimeo, European Central Bank.

Carapella, F. and Flemming, J. (2020). Central bank digital currency: A literature review. FEDS Notes November 9, Board of Governors of the Federal Reserve System.

Chang, H., Grinberg, F., Gornicka, L., Miccoli, M., and Tan, B. (2023). Central bank digital currency and bank disintermediation in a portfolio choice model, IMF Working Paper 236.

Chiu, J., Davoodalhosseini, S. M., Hua Jiang, J., and Zhu, Y. (2023). Bank market power and central bank digital currency: Theory and quantitative assessment. Journal of Political Economy 131(5), pp. 1213-1248.

Cirelli, F. and Nyffenegger, R. (2024). CBDC and bank lending: the role of financial frictions. Available at SSRN: https://ssrn.com/abstract=4678281.

Das, M., Mancini Griffoli, T., Nakamura, F., Otten, J., Soderberg, G., Sole, J., and Tan, B. (2023), Implications of Central Bank Digital Currencies for Monetary Policy Transmission, IMF Fintech Note 2023/010.

Deutsche Bundesbank (2021). What do households in Germany think about the digital euro? First results from surveys and interviews, Monthly Report, October 2021, pp. 65-84.

Eren, E., Jackson, T., and Lombardo, G. (2022). Efficient disintermediation with CBDC. Unpublished paper.

European Central Bank (2020a). Report on a digital euro, Frankfurt.

European Central Bank (2020b). ECB intensifies its work on a digital euro, Press Release, Frankfurt, 2 October 2020.

European Central Bank (2023). A stocktake on the digital euro: Summary report on the investigation phase and outlook on the next phase. 18 October 2023.

European Central Bank (2023b). Digital euro: The next step in the advancement of our currency. 18 October 2023.

Ferrari Minesso, M., Mehl, A., and Stracca, L. (2022). Central bank digital currency in an open economy. Journal of Monetary Economics, 127, pp. 54-68.

Garratt, R. J. and Van Oordt, M. R. (2021). Privacy as a public good: a case for electronic cash. Journal of Political Economy 129 (7), pp. 2157–2180.

Garratt, R., and Zhu, H. (2021). On interest-bearing central bank digital currency with heterogeneous banks. Available at SSRN 3802977.

Garratt, R., Yu, J., and Zhu, H. (2022). How Central Bank Digital Currency Design Choices Impact Monetary Policy Pass-Through and Market Composition. Available at SSRN 4004341.

George, A., Xie, T., and Alba, J. D. (2020). Central bank digital currency with adjustable interest rate in small open economies, Policy Research Paper #05-2020, Asia Competitiveness Institute Policy Research Paper Series.

Gong, X., Han, H., and Zhu, Yu (2023). Bank market power and central bank digital currency: A case of imperfect substitution. Unpublished paper.

Gorton, G.B. and Zhang, J. (2022). Protecting the Sovereign’s Money Monopoly, U of Michigan Law & Econ Research Paper 23.

Group of Central Banks (2020). Central bank digital currencies: foundational principles and core features. BIS report no 1 in a series of collaborations from a group of central banks (Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, Board of Governors Federal Reserve System, Bank for International Settlements).

Greenwood, R., Hanson, S., and Stein, J. C. (2018). The Federal Reserve’s Balance Sheet as a Financial Stability Tool. In: Evanoff, D. D., Kaufmann, G. G., and Malliaris, A.G. (eds.) “Innovative Federal Reserve Policies During the Great Financial Crisis”, Chapter 3, World Scientific Publishing Co. Pte. Ltd, pp. 63-124.

Gross, M., and Letizia, E. (2023). To demand or not to demand: Quantifying the future appetite for CBDC. IMF Working Paper 23/9, International Monetary Fund.

Gust, C., K. Kim and R. Ruprecht (2023). The effects of CBDC on the Federal Reserve’s Balance Sheet. Finance and Economics Discussion Series 2023-068. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2023.068.

Hammermann, F., Leonard, K., Nardelli, S., and von Landesberger, J. (2019). Taking stock of the Eurosystem’s asset purchase programme after the end of net asset purchases, Economic Bulletin 2019 (2), European Central Bank.

Hemingway, B. (2022). The impact of central bank digital currency on bank deposits and the interbank market. Working Paper 110, Lietuvos Bankas.

Iacoviello, M. (2005). House prices, borrowing constraints, and monetary policy in the business cycle, American Economic Review 95(3), pp. 739-764.

Infante, S., Kim, K., Orlik, A., Silva, A. F., and Tetlow, R.J. (2022). The macroeconomic implications of CBDC: A review of the literature. Finance and Economics Discussion Series (FEDS) 76.

Jiang J. H., and Zhu, Y. (2021). Monetary policy pass-through with central bank digital currency. Bank of Canada Staff Working Paper 2021-10.

Kashyap, A. K., Rajan, R. G., and Stein, J. (2002). Banks as liquidity providers: An explanation for the coexistence of lending and deposit-taking. Journal of Finance 57(1), pp. 33-73.

Keister, T. (2012). Corridors and floors in monetary policy, Liberty Street Economics, Federal Reserve Bank of New York, 4 April 2012.

Keister, T., and Sanches, D. (2023). Should Central Banks Issue Digital Currency? The Review of Economic Studies 90(1), pp. 404-431.

Kumhof, M., Pinchetti, M., Rungcharoenkitkul, P., Sokol, A., (2023). CBDC policies in open economies. Available at SSRN: https://ssrn.com/abstract=4388834.

Lamersdorf, N., Linzert, T., and Monnet, C. (2023). CBDC, monetary policy implementation and the interbank market. Unpublished mimeo.

Li, J. (2023). Predicting the demand for central bank digital currency: A structural analysis with survey data. Journal of Monetary Economics, 134:73-85, March 2023.

Li, J., Usher, A., Zhu, Y. (2023). Central bank digital currency and banking choices. Unpublished paper.

Malloy, M., Martinez, F., Styczynski, M.-F., and Thorp, A., (2022). Retail CBDC and US monetary policy implementation: A stylized balance sheet analysis. Finance and Economics Discussion Series 2022-023. Board of Governors of the Federal Reserve System.

Meaning, J., Dyson, B., Barker, J., and Clayton, E. (2021). Broadening narrow money: monetary policy with a central bank digital currency. International Journal of Central Banking 17(2), pp. 1-42.

Meller, B., and Soons, O. (2023). Know your (holding) limits: CBDC, financial stability and central bank reliance. ECB Occasional Paper 326.

Mishra, B. and Prasad, E. (2023), A Simple Model of a Central Bank Digital Currency, NBER Working Paper 31198, National Bureau of Economic Research.

Muñoz, M. and Soons, O. (2023). Public Money as a Store of Value, Heterogeneous Beliefs, and Banks: Implications of CBDC, ECB Working Paper 2801.

Panetta, F. (2020). We must be prepared to issue a digital euro, Blog post by Fabio Panetta, Member of the Executive Board of the ECB, The ECB Blog, 2 October 2020.

Panetta, F. (2021). Interview with Der Spiegel. Interview with Fabio Panetta, Member of the Executive Board of the ECB, conducted by Tim Bartz. 9 February 2021.

Panetta, F. (2022a). More than an intellectual game: exploring the monetary policy and financial stability implications of central bank digital currencies. Opening speech by Fabio Panetta, Member of the Executive Board of the ECB, at the IESE Business School Banking Initiative Conference on Technology and Finance, Frankfurt am Main, 8 April 2022.

Panetta, F. (2022b). Public money for the digital era: towards a digital euro. Keynote speech by Fabio Panetta, Member of the Executive Board of the ECB, at the National College of Ireland, Dublin, 16 May 2022.

Panetta, F. (2022c). The digital euro and the evolution of the financial system. Introductory statement at the Committee on Economic and Monetary Affairs of the European Parliament. Brussels, 15 June 2022.

Panetta, F. and V. Dombrovskis (2023). Why Europe needs a digital euro, Contribution by Fabio Panetta, Member of the Executive Board of the ECB, and Valdis Dombrovskis, Executive Vice-President of the European Commission, The ECB Blog, 28 June 2023.

Pfister, C. (2019). Central bank digital currency: one, two or none? Working Paper #732, Banque de France.

Pfister, C. (2020). Retail CBDC remuneration: the sign matters. SUERF Policy Note 205, November 2020.

Piazzesi, M. and Schneider, M. (2020). Credit lines, bank deposits or CBDC? Competition & efficiency in modern payment systems. Unpublished paper, Stanford University.

Piazzesi, M., Schneider, M. and Rogers, C. (2022). Money and banking in a New Keynesian model. Unpublished paper, Stanford University.

Sveriges Riksbank (2023). E-krona pilot, phase 3. April 2023.

Usher A., Reshidi E., Rivadeneyra F. and Hendry S. (2021). The positive case for a CBDC. Bank of Canada Staff Discussion Paper.

Whited, T. M., Wu, Y. and Xiao, K. (2023) Will central bank digital currency disintermediate banks? HIS Working Paper 47, Institut für Höhere Studien, Wien.

Williamson, S. (2022). Central bank digital currency: welfare and policy implications. Journal of Political Economy 130 (11), pp. 2829-2861.

Zamora-Pérez, A., Coschignano, E. and Barreiro, L. (2022). Ensuring adoption of central bank digital currencies – An easy task or a Gordian knot?, ECB Occasional Paper 307, European Central Bank.

See https://www.ecb.europa.eu/paym/digital_euro/html/index.en.html.

For an overview of the literature, see Carapella and Flemming (2020), Ahnert et al. (2023a), Auer et al. (2022) and Infante et al. (2022).

See Panetta and Dombrovskis (2023) and European Central Bank (2023a).

The combination of banking supervision and regulation, deposit insurance, and the central bank as lender of last resort ensure that private money can always be converted, at par, into cash. This public safety net guarantees that bank deposits satisfy the “no questions asked” principle and can act as an effective medium of exchange (see Gorton and Zhang, 2022).

See the proposal for a regulation of the European Parliament and of the Council on the establishment of the digital euro; available at https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52023PC0369.

Uncertainty around CBDC demand will be discussed in section 2 in more details. Holding limits would contribute to reducing CBDC demand and therefore its potential volatility.

The implications of introducing a CBDC for the monetary policy framework and the balance sheet of the central bank are discussed in Abad et al. (2023), Ahnert et al. (2023), Caccia et al. (2023), Gust et al. (2023), Infante et al. (2023) and Malloy et al. (2022).

In the case of the ECB, the recourse to the main refinancing operations has been very limited since mid-2017 because of large excess reserves. Correspondingly, the main refinancing operations rate and the marginal lending facility rate became irrelevant for the determination of money market rates.

See Lamersdorf et al. (2023); Infante et al (2023). Ample central bank reserves may also prevent excessive liquidification of less liquid assets on the banks’ balance sheet (Greenwood et al., 2018). Eren et al. (2022) argue that, in a situation of “excessive” reserves, the reserve absorption through CBDC could increase welfare and boost bank lending to the real economy.

This assumes that the central bank operates a fixed-rate full allotment procedure and abstracts from daily fluctuations that may arise within the periodic marginal lending facilities.

Bitter (2020) recalls that the type of assets that the central bank purchases play also an important role for the impact that CBDC issuance has on the economy.

Berg et al. (2023) find that also US payment firms’ stock returns react significantly to central bank announcements on CBDC.

Bidder et al. (2024) find that unlimited CBDC is welfare reducing because it increases the risks of bank runs. By introducing holding limits, however, agents can benefit from increased competition in the banking sector whereas the holding limit contains financial fragility in crisis periods.

The impact on banks’ funding cost will partly be determined by the spread between the central bank’s deposit and borrowing rate (the so-called corridor) and other terms and conditions the central bank imposes, such as collateral requirements. See also Assenmacher et al. (2020) on the impact of interest rate spreads and collateral requirement on bank disintermediation.

Note that the negative effect on bank interest rate margins may be reversed under a negative interest rate policy (on reserves) if there is a zero lower bound on deposits.

Ahnert et al. (2023b) warn that, on the one hand, a higher CBDC remuneration raises bank vulnerability by increasing consumers’ withdrawal incentives. On the other hand, banks in that case react by offering a more attractive deposit remuneration, which reduces financial fragility. The overall relationship between bank fragility and CBDC remuneration is thus U-shaped.

Available at https://ecb.europa.eu/pub/pdf/legal/ecb.leg_con_2023_34.en.pdf.

Article 16 of the Proposal for a Regulation of the European Parliament and of the Council on the establishment of the digital euro, available at https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52023PC0369.