The views expressed are those of the authors and do not necessarily reflect those of the National Bank of Slovakia (NBS).

Macroprudential Policy (MPP) has been part of the economic policy toolkit in Europe for about 20 years. Pioneered in the then transition economies of Central, Eastern and South-Eastern Europe, it became a mainstream policy area across Europe after the Global Financial Crisis. After two decades, a recent conference, jointly organized by the National Bank of Slovakia, the Bank of Finland and SUERF, brought together leading academics and macroprudential policymakers to take stock and to provide some guidance on the future development of MPP.1 The conference addressed the question what have we learned about the efficiency of the numerous MPP tools that are mainly used to tame economic and financial cycles and to strengthen the resilience of financial sectors? Did MPP help to cushion the crises that Europe experienced over the past two decades? What were the success factors and what were the mistakes? And how may MPP help to address the challenges that the European economy is currently facing, e.g. the transition towards a more market- and tech-based financial system, the transition to a sustainable economy and the possible shift to higher steady-state inflation. This Policy Brief summarises the main conclusions from the conference and the main remaining questions going forward.

The main rationale for Macroprudential Policy (MPP) has been known for a long time. That the financial system, including the banking system, which still dominates the financial system in Europe, behaves in a procyclical way has been discussed for decades. According to the “financial-instability hypothesis” developed by (Minsky 1982), the financial system excessively accumulates debt during good times. This excess is then corrected during recessions through deflation and economic crisis. Various negative externalities, including pecuniary externalities, interconnectedness externalities or aggregate demand externalities (Kenç 2016) are driving the cycle and provide good economic reasons to implement macroprudential policies.

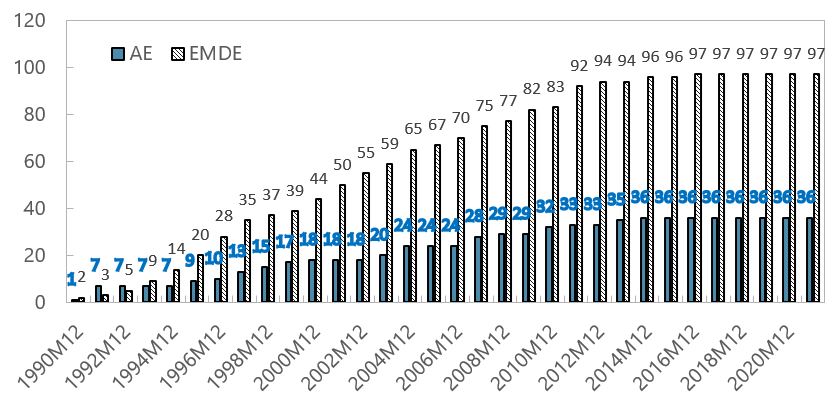

Chart 1: The number of economies using macroprudential measures is growing over time

Notes: AE – advanced economies, EMDE – emerging market and developing economies.

Source: the IMF’s integrated Macroprudential Policy (iMaPP) Database, originally constructed by (Alam, et al. 2019).

Macroprudential policy aims at ensuring the stability of the financial system as a whole. This is crucial to prevent substantial disruptions in credit supply and other vital financial services that are necessary conditions for stable economic growth. MPP encompasses a large number of tools. Some resemble traditional microprudential (banking supervision) tools, e.g., additional capital and liquidity requirements for banks in response to the build-up of systemic risk. Other MPP measures target borrowers’ behavior, e.g., by specifying loan-to-value (LTV) and debt service-to-income (DSTI) limits for loans. Broadly speaking, capital-based measures (CBMs) and borrower-based measures (BBMs) are the most widely used types of MPP measures.

MPP has been institutionalized at the European Union (EU) level since 2014, but MPP-type actions have existed for much longer. Central banks across Europe have been using MPP-type measures since 1945 (Kelber and Monnet 2014). Current macroprudential measures, however, started to be used approximately 20 years ago. In Central and Eastern Europe (CEE) MPP measures were often used to deal with foreign currency lending, e.g., in Croatia, Poland, and Hungary (Hüttl 2015). Spain used so called ‘dynamic provisioning’ to cushion its exuberant housing market in the early 2000s. In response to the Global Financial Crises (GFC), MPP has become a mainstream policy area across the EU.

From a policy perspective, a lot was learned during the last two decades. It is now widely accepted that one crucial aspect of successful macroprudential policy is to act early in the cycle. Macro-financial risks are building up during boom phases of economic and financial cycles and should be tackled as soon as possible. However, whereas the costs of macroprudential tightening, such as a reduction of bank lending and the exclusion of certain households from the residential real estate market, are visible immediately, the benefits of these measures are only recognized in the longer term. This implies that strategic foresight is necessary. The COVID-19 pandemic, although not a typical financial crisis, proved this point. A lot of macroprudential authorities were unable to ease capital-based measures, thus supporting bank lending during the economic downturn following the outbreak of COVID-19, because macroprudential capital buffers were not introduced in time.

Successful macroprudential policy is impossible without good data. To effectively implement borrower-based measures (BBMs) as well as capital-based measures (CBMs), it is crucial to identify where macro-financial risks are accumulating. By now, the use of individual micro-level data has become increasingly common for analysing risks related to both Residential Real Estate (RRE) (Giannoulakis, et al. 2023) and Commercial Real Estate (CRE) (Horan, Jarmulska and Ryan 2023). The use of granular data enables the proper calibration of BBM limits, and the appropriate setting of structural buffers that are not applied on the whole banking sector portfolio but only on selected, riskier sectors such as CRE. For the time being, however, only some macroprudential authorities have access to individual loan data, including information on the borrowers. And even for most of those authorities, substantial gaps remain. Granular information on the financial position of households and firms is e.g. normally not available with sufficient frequency. Moreover, official data on CRE is still lacking and can only partly be substituted by market data and market intelligence.

Clear and responsible communication is essential for sufficiently early and successful implementation of macroprudential tools. It is essential to exactly define the goals and the risks associated with various macroprudential measures. Using data-driven cost-benefit analyses and actively communicating with banks, the general public and other stakeholders can facilitate the introduction of measures and increase their acceptance, especially when they are politically sensitive such as BBMs. Regarding CBMs, clear forward guidance to banks and sufficient lead times are crucial, given that banks typically have medium-term capital objectives and planning horizons.

To avoid leakages, macroprudential authorities are typically well advised to implement comprehensive packages of MPP tools. As mentioned above, a broad set of CBMs and BBMs is available. These complement each other rather than serving as substitutes. CBMs increase the resilience of the banking sector and are more suitable to address the stock of accumulated risk. BBMs, on the other hand, focus more on the flow of risks. Even within the group of BBMs different aspects are captured by different tools. Loan-to-value (LTV) limits help lower losses‑given default (LGD), while debt service-to-income (DSTI) limits address the probability of default (PD) of new clients. Debt-to-income (DTI) limits can be useful in preventing borrowers’ over-indebtedness.

Empirical research provides increasing evidence that macroprudential policy can dampen downside risks to economic growth stemming from loose financial conditions (Brandao-Marques, et al. 2020). There is also substantial evidence that BBMs significantly and positively affect the quality of credit extended to households. Having sufficiently tight BBMs in place early enough, results in milder dampening effects on consumption during financial crises. However, the studies show also that careful calibration of these measures is needed, given that the impact of BBMs tends to be nonlinear. If BBM limits are too tight, there is little marginal effect in reducing the risk and they are more likely to induce regulatory arbitrage (Alam, Alter, et al., Digging Deeper—Evidence on the Effects of Macroprudential Policies from a New Database 2019).

There is also some empirical evidence that MPP can help to prevent financial crises, although many questions remain. There is a wide consensus that credit booms tend to precede financial crises (Mendoza and Terrones 2008). Optimal MPP should prevent such credit booms and reduce the likelihood of financial crises to occur. However, supporting evidence for this is mainly found when specific MPP instruments are used, mainly BBMs. The finding does not hold for all parts of the MPP toolkit (Araujo, et al. 2020). Moreover, research suggests that the optimal MPP policy is very complex to design, nonlinear in nature and changing over time.

Theoretical models are also contributing increasingly to our understanding of the impact of macroprudential policy. Especially for CBMs and risk weights, a specific form of BBMs, time series showing their impact in practice are still short, severely complicating empirical analyses. Therefore, theoretical models for the impact of MPP are often used as a substitute for empirical research and can help shaping MPP decision processes. Sophisticated theoretical dynamic general equilibrium (DGE) models can e.g. be used to capture endogenous bank defaults, resulting from borrower defaults (Clerc, et al. 2015) and (Mendicino, et al. 2020).

There are, however, many challenges in developing sufficiently detailed theoretical approaches due to some specific features of MPP. To measure the effectiveness and efficiency of MPP measures, it is essential to clearly define and understand the overarching goal and intermediate objectives of MPP. Given that many MPP tools are similar to measures used by other policies, notably banking supervision, it is often difficult to disentangle the impact of macroprudential and microprudential measures. The ultimate objective, financial stability, is in itself very complex, given that the various risks to financial stability are complex, hard to measure and interconnected. Theoretical macroprudential research thus must come to grips with highly nonlinear systems and potentially multiple equilibria. For the time being, finding an MPP equivalent to the Taylor rule for monetary policy thus appears unlikely (Bianchi and Mendoza 2018).

As more and more experience with the practical use of MPP is gained, its shortcomings are also becoming more obvious. These weaknesses of MPP need to be addressed (ESRB 2022). First, macroprudential policy should be streamlined to reduce the complexity arriving from a complex objective and many complementary tools. Second, given the evolving financial system in the EU and the slow but gradual shift towards non-bank financial intermediation, macroprudential policy should be broadened beyond the banking system. Third, macroprudential policy should account for new important financial stability risks, including cyber risks and risks stemming from the green transition. Finally, although this aspect has become less pressing now, MPP should be readied for a possible new economic steady-state with higher interest rates and higher inflation than what we have seen over the last decade.

A more flexible use of CBMs would help to increase banks’ resilience early in the cycle. EU law currently conditions the activation and increase of the countercyclical capital buffer (CCyB) on a material increase in systemic risk. However, that might be already too late, given lags in data availability, the time needed for decision-making and the 12-month implementation phase. During the release phase, parallel minimum capital requirements, such as the leverage ratio or MREL2 may restrict the ability of banks to dip into releasable macroprudential capital buffers. It would be preferable to enable an increase in the CCyB already when authorities expect rather than observe an increase in cyclical risks and to streamline the regulation enabling the usage of released CCyB capital when needed.

Some degree of European harmonization regarding the use of BBMs could enhance their application. Currently BBMs are not included in EU legislation and their application depends entirely on the macroprudential framework in the respective countries. However, given that BBMs directly affect households’ credit availability, it is politically often difficult to introduce them when many stake-holders are involved. This is typically the case when macroprudential committees rather than single institutions (typically central banks) are in charge. Introducing some common definitions and a minimum level of harmonization, while respecting the principles of subsidiarity and proportionality, may thus reduce the inaction bias in BBM implementation that was observed in the past. National responsibility for activation should, however, be maintained and there should be enough flexibility to take divergent national legal frameworks into account.

The importance of non-bank financial intermediation has grown significantly since the Global Financial Crisis. Moreover, digitalization has brought new players, such as peer-to-peer lending platforms and payment service providers to the market. While this shift towards a higher share of non-bank financial institutions brings benefits, it also creates new risks and vulnerabilities for the financial system. Macroprudential policy should thus also be enabled to respond to a build-up of systemic risks in non-bank financial institutions. For this to happen, increased data-collection, monitoring, and risk analysis frameworks are essential. If necessary, macroprudential tools such as BBMs or CBMs should be adjusted to make them usable for non-banks as well. Moreover, new macroprudential tools reflecting the new risk landscape in financial intermediation may be needed, while taking the risks associated with additional complexity into account.

The recent increase in inflation and the tightening of monetary policy significantly transformed the macro-financial environment for macroprudential policy. There is no general advice on how to use MPP in the current situation due to the considerable uncertainties regarding macro-financial vulnerabilities and the macroeconomic outlook. Some guiding principles can be identified though. The key issue to look at before adjusting CBMs, is the current state and outlook for banking sector resilience. Is it likely to worsen, remain stable or – less likely – increase? Looking at BBMs, the situation is more open, given that a tightening of monetary policy typically has a downward effect on real estate markets. Overall, it appears appropriate that at this stage MPP should focus on preserving the resilience of the financial system. In contrast, the need to ‘tame the cycle’ and to prevent dynamic shocks to the financial cycle has clearly receded (Detken, Klacso and Martin 2023).

Macroprudential policy should also consider rising new challenges, in particular cyber risks and climate risks. Cyber (in)security has already been recognized as an important systemic risk by international institutions such as the International Monetary Fund or the European Central Bank. To address systemic cyber risks early on, the macroprudential framework likely needs to be extended beyond classic financial stability risks alone. More digitalization of financial transactions also means a potentially faster pace of bank runs. Such a change should be taken into account by MPP, at least in a form of higher frequency deposit data collection and possibly changes in liquidity requirements (Cera, Pietsch and Sowinski 2023). Turning to climate risks, the systemic nature of the physical risks associated with climate change and the transition risks related to the de-carbonisation of the economy is now widely acknowledged. Future research is needed to explore how CBMs can increase the resilience of the financial sector against climate-related losses and how MPP measures can promote the transition to a green economy.

In the last two decades, particularly after the Global Financial Crisis, macroprudential policy has become a very important policy in the EU and most other parts of the world. Empirical and theoretical research suggests that MPP helped to increase the resilience of the financial system and to reduce the riskiness of banks’ loan portfolios, in particular during the rather long period of extremely low interest rates. However, there is still a long journey ahead of us in understanding the overall impact of individual MPP measures and the combination of these measures on the financial system and the real economy.

A range of legal frameworks have been put in place and some of them appear to have more substantial drawbacks than others. Committee structures seem e.g., more likely to result in inactivity biases than single-institution MPP decision making. Sufficiently early MPP action is, however, an important precondition for MPP to achieve its goals.

Close and continuous monitoring and analysis of the financial system and the overall environment is crucial for MPP to succeed. Many MPP authorities have by now developed very sophisticated surveillance and analysis frameworks. That said, remaining data gaps are often substantial. Moreover, to capture possible new sources of systemic risks, such as climate change and cyber risks, these frameworks must be further developed and refined to capture these new sources of risks.

Alam, Zohair, Adrian Alter, Jesse Eiseman, Gaston Gelos, Heedon Kang, Machiko Narita, Erlend Nier, and Naixi Wang. 2019. “Digging Deeper—Evidence on the Effects of Macroprudential Policies from a New Database.” IMF Working Paper WP/19/66.

Araujo, Juliana, Manasa Patnam, Adina Popescu, Fabian Valencia, and Weija Yao. 2020. “Effects of Macroprudential Policy: Evidence from over 6,000 Estimates.” IMF Working Paper 20/67.

Bianchi, Javier, and Enrique Mendoza. 2018. “Optimal Time-Consistent Macroprudential Policy.” Journal of Political Economy 126 (2).

Brandao-Marques, Luis, Gaston Gelos, Machiko Narita, and Erlend Nier. 2020. “Leaning Against the Wind: A Cost-Benefit Analysis for an Integrated Policy Framework.” IMF Working Paper WP/20/123.

Cera, Katharina, Allegra Pietsch, and Andrzej Sowinski. 2023. “Financial stability considerations arising from the digitalisation of financial services.” ECB Financial Stability Review November 2023.

Clerc, Laurent, Alexis Derviz, Caterina Mendicino, Stephane Moyen, Kalin Nikolov, Livio Stracca, Javier Suarez, and Alexandros Vardoulakis. 2015. “Capital regulation in a macroeconomic model with three layers of default.” International Journal of Central Banking 11: 9-63.

Detken, Carsten, Jan Klacso, and Reiner Martin. 2023. “Macroprudential policy in the high inflation environment: Sailing uncharted waters.” SUERF Policy Brief No 626.

ESRB. 2022. “Review of the EU Macroprudential Framework for the Banking Sector.” European Systemic Risk Board Concept Note.

Giannoulakis, Stelios, Marco Forletta, Marco Gross, and Eugen Tereanu. 2023. “The effectiveness of borrower-based macroprudential policies: a cross-country analysis using an integrated micro-macro simulation model.” ECB Working Paper Series No 2795.

Horan, Aoife, Barbara Jarmulska, and Ellen Ryan. 2023. “Asset prices, collateral and bank lending: the case of Covid-19 and real estate.” ECB Working Paper Series No 2823.

Hüttl, Pia. 2015. “Foreign loan hangovers and macroprudential measures in Central Eastern Europe.” Bruegel Blog Post.

Kabundi, Alain, and Francisco Nadal De Simone. 2020. “Monetary policy and systemic risk-taking in the euro area banking sector.” Economic Modelling 91: 736-758.

Kelber, Anna, and Éric Monnet. 2014. “Macroprudential policy and quantitative instruments: a European historical perspective.” Banque de France Financial Stability Review 18: 151-160.

Kenç, Turalay. 2016. “Macroprudential regulation: history, theory and policy.” BIS Papers No 86.

Mendicino, Caterina, Kalin Nikolov, Juan Francisco Rubio-Ramirez, Javier Suarez, and Dominik Supera. 2020. “Twin Defaults and Bank Capital Requirements.” CEPR Discussion Papers 14427.

Mendoza, Enrique, and Marco Terrones. 2008. “An Anatomy of Credit Booms: Evidence from Macro Aggregates and Micro Data.” NBER Working Paper No. 14049.

Minsky, Hyman. 1982. “The Financial-Instability Hypothesis: Capitalist Processes and the Behavior of the Economy.” Hyman P. Minsky Archive 282.

Ernest Gnan, SUERF; Zuzana Fungáčová, Bank of Finland; Esa Jokivuolle, Bank of Finland and SUERF; Ján Klacso, Národná banka Slovenska; and Reiner Martin, Národná banka Slovenska and SUERF, were the scientific coordinators of this conference.

Minimum Requirement for own funds and eligible liabilities.