By the early 2000s, an increasing number of countries had adopted a well-defined central bank framework in which the central bank was independent and accountable for achieving monetary policy goals, while its traditional responsibilities for pursuing financial stability had become less important. However, following the 2008-2009 Great Crisis, central banks again became involved in supervision. How can the role played by central banks in financial stability be explained? The aim of this policy note is to illustrate how empirical analyses can shed light on the political drivers that might explain the central bank’s involvement as a supervisor, discussing the case of macroprudential architectures, as well as the role of financial crises in explaining the politicians’ choices.

By the early 2000s, an increasing number of countries had adopted a well-defined central bank framework in which the central bank was independent and accountable for achieving monetary policy goals, while its traditional responsibilities for pursuing financial stability had become less important. Essentially, central banks were designed as monetary policy actors. The economic rationale was well known and the theoretical bottom line can be summarized as follows: for various reasons, policymakers tend to adopt a short-term perspective when using monetary tools. They use these tools to smooth out macroeconomic shocks and to exploit the trade-offs between real gains and nominal costs. However, the more markets are efficient and rational, the greater the risk that short-sighted monetary policy will generate negative macroeconomic distortions. Therefore, banning the use of monetary policy for myopic purposes became a social goal and the institutional setting gained momentum, with the aim of separating the central bank from the government and from all fiscal and banking responsibilities.

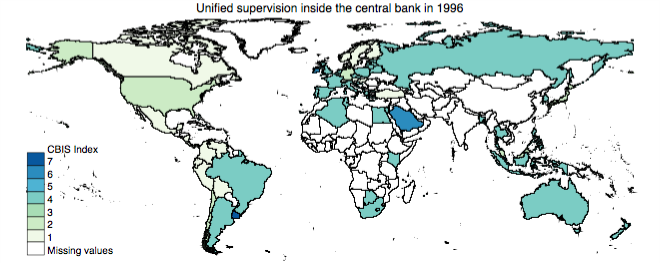

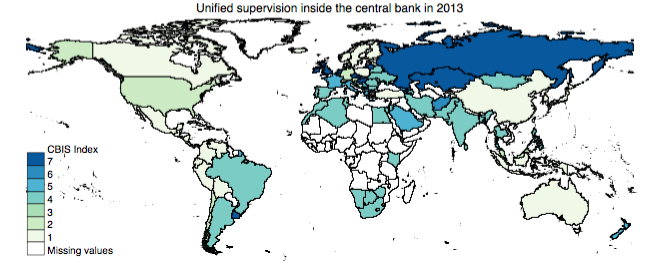

The fundamental effect was that the supervisory role of central banks generally decreased. However, following the 2008-2009 Great Crisis, central banks again became involved in supervision in many countries, suggesting a sort of “Great Reversal” towards prudential supervision in the hands of central banks (Figure 1).

Figure 1: Evolution of unified supervision inside the central bank (1996 and 2013)

Notes: This figure presents the evolution of the index of central bank involvement in supervision (CBIS) constructed in this paper. Darker colours correspond to higher central bank involvement. Source: Masciandaro and Romelli (2018a).

The 2008-2009 economic crisis highlighted the need for financial stability. In numerous countries, reforms of financial regulations were motivated by the fact that a focus solely on monetary stability and micro-supervision (i.e., the stability of individual institutions and markets) could not guarantee the safety and soundness of the financial industry.

How can the role played by central banks in financial stability be explained? From the perspective of traditional economics, the extension of central bank influence into this field has both pros and cons. In other words, this perspective does not provide a clear answer as to whether assigning a supervisory role to central banks or other independent institutions is socially optimal. Two conflicting views can be found regarding the merging of monetary and supervisory functions within the central bank: the integration view and the separation view2. The integration view underscores the informational advantages and economies of scale derived from bringing all functions under the authority of the central bank. In contrast, the separation argument suggests a higher risk of policy failure if central banks have supervisory responsibilities, as financial-stability concerns might reduce the effectiveness of monetary policy action. The extant empirical research into the relative merits of putting banking-sector supervision in the hands of central banks provides mixed results.

Therefore, policymakers must address a series of possible trade-offs between the expected benefits and costs of allowing the monetary authority to have more or less influence on macroprudential strategies. Consequently, the political economy perspective becomes relevant, as arguments supporting either the integration view or the separation view can be more or less important in the minds of those who design and implement the supervisory regime. In other words, we have to focus on the agent responsible for the institutional setting – the policymaker.

This political economy framework is based on two key assumptions. First, the gains and losses of a given central bank setting are variables computed by the incumbent policymaker, who maintains or reforms the supervisory regime based on his or her own preferences. Second, policymakers are politicians and, as such, voters hold them accountable during elections. All politicians are career-oriented agents motivated by the goal of pleasing voters in order to win elections. The main differences among various types of politicians stem from differences in the segments of the electorate they wish to please. Consequently, the question that naturally arises is genuinely empirical: Is it possible to identify common drivers that explain political choices concerning central bank involvement in supervision?

The aim of this policy note is to illustrate how empirical analyses can shed light on the political drivers that might explain the central bank’s involvement as a supervisor. To do so, this paper examines two cases. The article proceeds as follows. Section II highlights the empirical drivers that may explain central bank involvement in the macroprudential perimeter using a cross-country analysis. Section III adds a temporal dimension and discusses the possible role of financial crises. The conclusions are presented in Section IV.

Is it possible to identify common drivers that explain political decisions regarding central bank involvement in macroprudential governance? In a recent econometric cross-sectional analysis of the determinants of central bank involvement in this area, Masciandaro and Volpicella (2016) test different assumptions made in the theoretical and institutional literature. In general, the empirical results indicate that: a) central banks acting as micro-supervisors of the banking industry are more likely to be given more macroprudential powers, b) higher central bank political independence is associated with lower involvement in macro-supervision and c) central banks pursuing specific price-stability objectives are more likely to be endowed with macro-supervisory responsibilities. These results can be interpreted using a political economy perspective.

The political economy perspective differs from the extant literature in two main respects. First, while interactions between macroprudential policies and monetary policies have been studied, no research has examined the drivers of governance arrangements. Second, this perspective enriches research focusing on the effects of statutory central bank independence (CBI). Since it emerged in the 1990s, CBI has been viewed as a major determinant of macroeconomic performance. In this paper, the broader picture is enriched by exploring the relationship between CBI and an important institutional feature – macro-supervision. The results suggest that CBI is relevant not only owing to its beneficial effects on macroeconomic variables but also because it influences policymakers’ decisions.

The empirical analysis is based on data available in 2013 covering 31 countries that were heterogeneous in terms of their institutional frameworks and stages of economic development. In order to shed light on the drivers that influence the development of macroprudential settings, qualitative information must first be transformed into quantitative variables. Two main indicators can be used to measure the key features of the central bank’s role in financial supervision. The central bank’s involvement in macro-supervision is our dependent variable in the econometric tests, while the central bank’s role as a micro-supervisor serves as a proxy for its role as the leading authority in micro-supervision, as discussed above.

The macroprudential index3 (MAPP) was used to measure central bank involvement in macro-supervision and the CBBA index4 was applied to measure central bank involvement in micro-supervision of the banking industry. The latter index is a dummy variable that takes a value of one if the central bank is the main banking supervisory authority, and zero otherwise. In addition, I use an index of involvement for central banks’ micro-supervision of the financial system as a whole (i.e., banking, securities and insurance). To do so, I adopt a two-step procedure that starts from the Financial Supervision Herfindahl Hirschman (FSHH) Index. The FSHH measures the extent to which supervisory powers are consolidated using the classical index proposed by Herfindahl and Hirschman.5 In the second stage, the methodology can be used to build an index of central bank involvement in micro-supervision: the Central Bank Supervisor Share (CBSS) Index.6 As a result, we have two alternative indexes that measure the impact of the central bank’s role as micro-supervisor. The expected sign of both variables is undetermined: higher levels of either the CBBA or the CBSS are likely to be associated with higher MAPP levels if the information-gain effect prevails. The opposite is true if the capture-risk effect dominates.

In addition, it is necessary to measure two potential shortcomings that politicians may associate with deep central bank involvement in macro-supervision: too much bureaucratic independence in the institutional setting and excessive discretion in defining monetary policy. A proxy for CBI with respect to the monetary policy function can be found in the extant literature. Acknowledging that de facto independence can sometimes lead to a different framework than de jure independence – especially in emerging and developing countries7– our analysis focuses on the legal features of independence. This choice is justified by the fact that CBI cannot be ensured without proper legal provisions.

In terms of determining the most relevant index for capturing either the political or operational dimensions of CBI among those proposed in the literature,8 this study uses the GMT index9 mainly owing to its robustness. In fact, the literature on CBI generally uses two different strategies to capture the degree of CBI: a) indices based on central bank legislation (de jure) or b) indices on the turnover rate of the central bank governor (de facto).

De jure indices are more likely to capture the extent of CBI for several reasons. First, turnover rates relate the independence of central banks to the autonomy of their governors. While extensively used, this approach has been shown to be less robust in empirical estimations than the GMT index of legal independence. Second, the legal measures associated with CBI are more likely to reflect the true relationships among the central bank, the policymakers and the bankers, especially in countries where the rule of law is strongly embedded in the political culture, as in many developed economies.10 Third, it is currently most relevant to capture changes in the extent of CBI after 2008. Given that many post-crisis reforms revolved around central bank involvement in supervision, it is more efficient to restrict our attention to de jure indices that can capture such changes.11

Given this overall setting, we can frame the results regarding the drivers of central bank involvement in macro-supervision. The empirical results show that: a) central banks acting as micro-supervisors of the banking industry are more likely to be given more extensive macroprudential powers, b) higher central bank political independence is associated with lower involvement in macro-supervision and c) central banks pursuing specific price-stability objectives are more likely to be endowed with macro-supervisory responsibilities.

What is the political economy interpretation of these results? First, the empirical analysis suggests that central bank’s role as a micro-supervisor of the banking industry can be a key driver of its macroprudential involvement. In other words, micro-supervisory powers serve as a proxy for the information advantages available to the central bank and politicians seem to appreciate this feature, with the argument that goes as follows: the central banker can do effectively her role as a macro supervisor if she is also responsible for the supervision of the institutions that make up the banking system. Second, from the politicians’ perspective, greater central bank political independence, which increases the risk of an overly powerful monetary authority, seems to imply fewer macro-supervisory powers. However, it is worth noting that the potential risks in having too much power in the hands of unelected central bankers when independence is combinated with supervisory involvement could be addressed – at least theoretically – with a proper accountability design.

Finally, rule-based monetary policy focused on inflation targeting, which reduces the central bank’s discretion, weakly increases the odds of a central bank being involved in macro-supervision. Politicians seem to dislike situations in which central bankers have too much discretion. At the same time, regarding the potential conflicts of goals – inflation targeting versus banking stability – that may arise, it is worth recalling that such conflicts can arise in any institutional structure and – if we assume that the probability of conflict is exogenous – the issue becomes whether it is more efficient to resolve these conflicts internally within the central bank or between agencies if a different agency is responsible for bank supervision.

All in all, politicians appear to be wary of placing too much power in the hands of independent and/or discretionary central banks, although it is worth noting that independence seems to be the more relevant characteristic.

The stability and generalizability of the above-mentioned results regarding politicians’ incentives must be checked in future research. At the same time, other assumptions regarding what drives politicians to modify supervisory architectures over time should be tested in the field of macro-supervision. Recently, Masciandaro and Romelli (2018a) undertook an empirical analysis of 105 countries over the period 1996 to 2013. Their results suggest the existence of two main drivers of reforms. First, systemic banking crises significantly increase the probability that a country will change its supervisory structure. Second, an equally important “bandwagon” effect seems to matter – countries are more likely to change their supervisory architectures when the share of countries undertaking reforms around the world or on the same continent is high.

In their empirical analysis, the dependent variable is CBISit, which measures the degree of central bank involvement in supervision in country i in year t. Given the discrete, ordinal nature of the index, the baseline estimation uses an ordered probit model, which allows for multiple discrete outcomes to be ranked. The objects of interest are the determinants of the financial supervision architecture and, in particular, the question of whether financial crises and central bank design play an important role in influencing central bank involvement in supervision.

Masciandaro and Romelli’s (2018a) results show that the number of financial crises previously experienced by a country positively influence the incentives to increase central bank involvement in supervision. Moreover, they show a negative effect of independence on the degree of central bank involvement in financial supervision. These findings further support the idea that the greater the independence of the supervisor, the greater the fear of powerful institutions or bureaucratic misconduct. This suggests that in countries characterised by more independent central banks, politicians are less likely to put financial sector supervision in the central bank’s hands, as they fear the creation of a super-powerful bureaucratic institution.

It is also possible to analyse the extent of central bank involvement in macroprudential policy. In fact, it has been suggested12 that supervision reforms are more important in countries undertaking macroprudential policies. Hence, we might expect countries in which central banks are more involved in macro-prudential policies to also have central banks with greater overall supervisory powers. The positive and statistically significant coefficient provides strong support for this argument. Among the other explanatory variables, the negative sign for the civil law dummy and the country’s latitude signal that countries with a civil legal system and countries characterised by higher latitudes tend to have financial services supervision responsibilities outside the central bank.

All in all, we find evidence that the extent to which supervision is concentrated in the hands of the central bank is influenced by a cumulative index of past financial crises, the degree of CBI, real GDP per capita, openness and financial sector development. The positive relationships between the number of previous financial crises and the CBIS index suggests that countries that experienced more financial turmoil in the past two decades are more likely to put their supervisory architecture in the hands of the central bank.

Since the 2008-2009 financial crisis, financial stability has been a general priority. When thinking about ways to prevent financial disasters in the future, it has been natural to reconsider the relationship between central banks and financial stability. Some researchers claim13 that central bank independence, inflation targeting and financial stability represent the major changes in the monetary policy landscape in recent decades.

The crucial point is that traditional economics offers two main and contradictory results that can be summarised as opposing answers to the following question: Given two policies – monetary policy and macro-supervision policy – with their own macro goals, what is the optimal degree of involvement for the monetary agent (i.e., the central bank) in supervisory responsibilities? Thus far, two answers have been offered: the integration view and the separation view.

This article highlighted the potential usefulness of adding another perspective: the political economy view. The political economy view is based on the fact that the player who decides to maintain or reform a supervisory regime is the politician in charge. This politician follows his or her own preferences when weighing the arguments of the integration and separation views. In this perspective, the central bank’s involvement in supervision is an endogenous variable. In other words, the optimal institutional setting does not exist per se. Moreover, the central bank’s involvement is likely to change over time based on political preferences favouring the delegation of more (or less) supervisory power to the monetary authority. Today, this consideration deserves even more attention given the role of a “special” kind of politicians – the populists. Populist policies revolve around presenting solutions that are welfare enhancing in the short run for a majority of the population but costly in the long run for the overall population. Given this definition, the narratives of central bankers seem to highlight them as a natural target for populist policies. Some researchers have argued that the rise of populism may negatively affect the consensus in favour of CBI evident from the late 1980s until the 2008-2009 economic crisis.14 The same arguments could be tested when exploring the role of central banks as supervisors.

In addition, politicians are generally viewed as “Econs” – rational players in the sense of the traditional economic mainstream. Future research could explore the behavioural perspective and investigate the consequences of the fact that politicians are “Humans”, as behavioural biases might distort their decisions. In general, politicians are subject to the same sources of behavioural bias that all individuals face. In the presence of behavioural biases, the outcomes of different information sets and/or governance rules can differ. At the same time, governance rules are based on the assumptions that central bankers are bureaucrats and that bureaucrats are rational players. Recent research15 has shown how the perspectives associated with modern economics, political economy and behavioural economics can serve as fruitful and complementary tools when analysing the design and implementation of monetary policy.

Finally, while we have highlighted possible political determinants of the supervision setting, we have not discussed whether a different degree of central bank involvement in supervision might influence the stability or efficiency of the financial sector. Notably, economic and econometric analyses of the relative merits of assigning the central bank a leading role in macroprudential governance are rare.16 More generally, future research could be directed towards understanding the macroeconomic effects of alternative institutional architectures of the central bank’s supervisory role.17

Alesina, A. and Stella, A., (2010), The Politics of Monetary Policy, in Handbook of Monetary Economics, p.1001-1054.

Ampudia M., Beck, T., Beyer A., Colliard J., Leonello A., Maddaloni A. and Marques-Ibanez, D., (2019), The Architecture of Supervision, ECB Working Paper Series, n.2287.

Blanchard O., Dell’Ariccia, G. and Mauro, P. (2010), Rethinking Macroeconomic Policy, Journal of Money, Credit and Banking, Vol. 42(s1), Blackwell Publishing, pp. 199-215.

Borio, C. and Shim, I., (2007), What Can (Macro)prudential Policy Do to Support Monetary Policy?, BIS Working Papers, 242.

Buiter W.H., (2014), Central Banks: Powerful, Political and Unaccountable, CEPR Discussion Paper Series, n. 10223.

Cukierman A. (2008), Central Bank Independence and Monetary Policymaking Institutions: Past, Present and Future, European Journal of Political Economy, Vol. 24(4), 722-736.

de Haan J., Masciandaro, D. and Quintyn, M. (2008), Does Central Bank Independence Still Matter? European Journal of Political Economy, Vol. 24(4), pp. 717-721.

de Haan, J. and Eijffinger, S., (2016), The Politics of Central Bank Independence, DNP Working Papers, n.539; (2016). 399-410.

de Haan J. and Eijiffinger S., (2017), Central Bank Independence under Threat?, CEPR Policy Insight, n.87.

Favaretto, F. and Masciandaro, D., (2016), Doves, Hawks and Pigeons: Behavioral Monetary Policy and Interest Rate Inertia, Journal of Financial Stability, 27, 50-58.

Goodhart C.A. and Lastra R., (2017), Populism and Central Bank Independence, CEPR Discussion Paper Series, n. 2017.

Lim C.H., Columba, A. Costa, P. Kongsaamut P, Otani A., Saiyid M, Wezel T. and Wu X. (2013), Macroprudential Policy: What Instruments and How to Use Them? IMF Working Paper Series, International Monetary Fund, n. 238.

Lima, D., Lazopoulos, I. and Gabriel, V., (2016), The Effect of Financial Regulation Mandate on Inflation Bias: A Dynamic Panel Approach, University of Surrey, Discussion Paper in Economics, n.6.

Masciandaro, D., (2019), Central Banks as Macroprudential Authorities: Economics and Politics, in D.W. Arner, E. Avgouleas, D. Busch and SL. Schwarcz, (Eds.), Systemic Risk in the Financial Sector: Ten Years after the Global Financial Crisis, Mc Gill-Queen’s University Press, Chapter 9, 151-164.

Masciandaro, D. and Passarelli, F., (2019), Populism, Political Pressure and Central Bank (In)dependence, Open Economies Review, forthcoming.

Masciandaro, D. and Quintyn M., (2015), The Governance of Bank Supervision: Recent Developments, Journal of Economic Surveys, .29, 1-25.

Masciandaro, D. and Romelli, D., (2015), Ups and Downs of Central Bank Independence from the Great Inflation to the Great Recession: Theory, Institutions and Empirics, Financial History Review, 22(3), 259-289.

Masciandaro, D. and Romelli, D., (2018a), Central Bankers as Supervisors: Do Crises Matter?, European Journal of Political Economy, 52, 120-140.

Masciandaro, D. and Romelli, D. (2018b). Peaks and Troughs: Economics and Political Economy of Central Bank Independence Cycles. In D. Mayes, P.L. Siklos and J.E. Sturm (eds.), Oxford Handbook of the Economics of Central Banking, Oxford University Press, New York.

Masciandaro, D. and Volpicella, A. (2016), Macro Prudential Governance and Central Banks: Facts and Drivers, Journal of International Money and Finance, 61, 101-119.

Reis, R., (2013), Central Bank Design, Journal of Economic Perspectives, 27(4), 17-44.

Reis, R., (2018), Is Something Really Wrong with Macroeconomics?, Oxford Review of Economic Policy, 34(1-2), 132-155.

Rajan R., 2017, Central Banks’ Year of Reckoning, Project Syndicate, December 21st, mimeo.

Rodrik D., 2018, In Defence of Economic Populism, Project Syndicate, January, 8th.

Department of Economics and Baffi Carefin Centre, Bocconi University, and Member of the SUERF Council of Management. The author is particularly grateful to two anonymous referees for their very constructive comments and useful insights on an earlier draft. The usual disclaimer has to be applied.

The taxonomy was introduced in Masciandaro and Quintyn (2015).

Lim et al. (2013).

Masciandaro and Volpicella (2016). See also Masciandaro (2019).

Masciandaro and Quintyn (2011).

Masciandaro and Quintyn (2011).

Cukierman (2008).

Grilli et al. (1991) developed the index, which was updated by Arnone et al. (2009).

For surveys, see Alesina and Stella (2010), Reis (2013), Masciandaro and Romelli (2015), and de Haan and Eijffinger (2016).

de Haan et al. (2008).

Masciandaro and Romelli (2018b).

Blanchard et al. (2010).

Reis (2018).

Buiter (2014), de Haan and Eijffinger (2017), Goodhart and Lastra (2017), Rajan (2017), Rodrik (2018), Masciandaro and Passarelli (2019).

Favaretto and Masciandaro (2016).

Borio and Shim (2007), Lima et al. (2016).

Ampudia et al. (2019).