Structural challenges facing the European economy call for an accelerated European response. While maintaining competitiveness requires action on innovation, digitalisation and business dynamism, climate change demands both massive investments and an urgent shift to avoid lock-in to high carbon technological pathway. These transformations, moreover, must be socially inclusive if they are to be effective. Called by its shareholders to become the EU’s Climate Bank, the EIB’s new Climate Strategy and Energy Lending Policy foresee climate action increasing to 50% of lending by 2025, thereby supporting some EUR 1 trillion of investments by 2030. Meanwhile, the EIB will align all financing activities with the Paris agreement by the end of 2020 and the Bank will propose a dedicated Energy Transition Package to support a fair transition across Europe.

The global economy is slowing and this is reflected in the European economy. GDP growth in Europe has slowed over the last year in line with falling export demand and weakening manufacturing production. Trade disputes and Brexit are contributing to rising uncertainty and deteriorating expectations regarding the economic environment and the investment outlook.

Investment is likely to join the slowdown in the coming year. So far, the impact of slowing GDP growth on investment has been limited, but this is likely to change as the slowdown spreads to the service sector.

If this situation continues to worsen, there will be growing calls to spur investment for counter cyclical reasons. Indeed, there is a need to invest more, but not principally as a form of short-term stimulus. We have not been investing enough to keep up with rapidly changing world. We have been letting a backlog build up and now we need to accelerate our efforts before it is too late.

We have to do more to maintain and enhance the competitiveness of the European economy. This is one challenge. It means upping our game in terms of innovation, digitalisation and business dynamism.

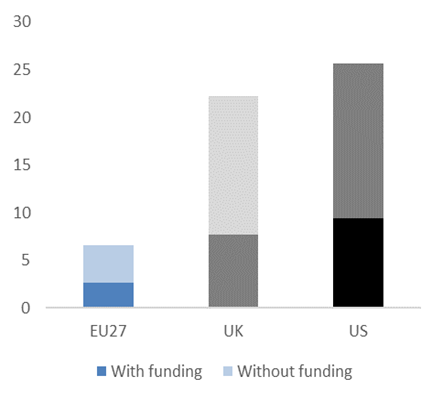

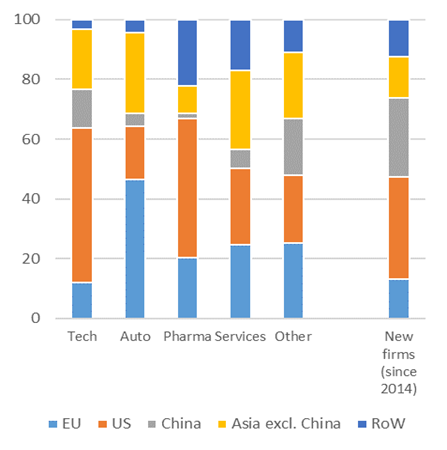

This year’s European Investment Bank (EIB) Investment Report highlights this very well: we have only a quarter of the start-ups in the EU, on a per capita basis, than they have in the US.2 In addition, European firms, particularly smaller and older ones, are struggling with the adoption of digital technologies. For 15 years, in Europe, we have been investing 1.5% of GDP less in RDI and education than our competitors in North America and parts of Asia. Many European companies are major global R&D players, but many of these are in the automotive sector (which is facing structural change) and relatively few are in the fast-growing technological and digital sectors. European companies make up only 13% of the companies that that entered the group of top R&D spenders since 2014, compared with 34% for the United States and 26% for China.

| Figure 1: Number of start-ups and scale-ups in the EU27, US and UK, per 100,000 inhabitants | Figure 2: Geographical distribution of 2018 R&D spending, by sector and among new global leading firms (%) |

|

|

| Source: Crunchbase, EIB calculations. | Source: EIB calculations based on EU Industrial R&D Investment Scoreboard. |

At the EIB, we are working hard to kick start investment in innovative projects. We do this primarily by de-risking these projects. For example when we offer risk-absorbing guarantees for other investors, we set incentives to others and, thus, help to enable sustainable, new technological pathways for a truly digital and sustainable economy. Since 2000, we have invested EUR 210bn in innovation and skills across the EU member states in this way.

Given the scale of the gap that we face, we clearly need to do more. We need a European Innovation Push, but in terms of instruments, I think, we have all the tools at hand to succeed.

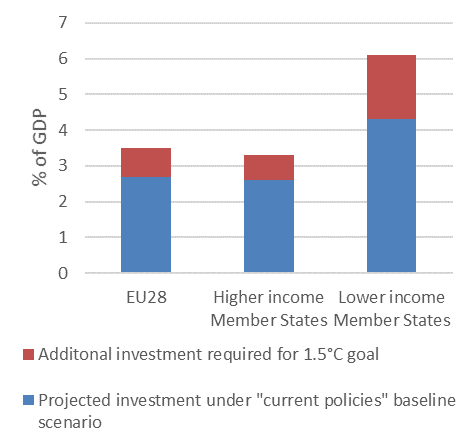

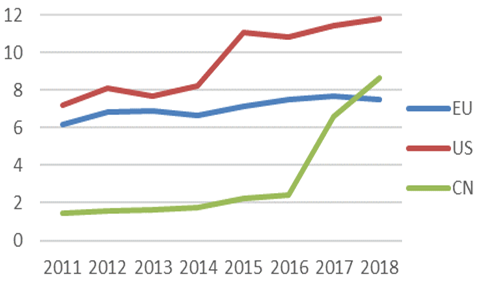

Climate change is now, finally, getting more of the attention it deserves. Keeping temperature rises to plus 2 degrees – and hopefully much less – is still feasible. But it will require rapid action to switch technologies. To achieve a net zero-carbon economy by 2050, the European Union must raise total (public and private) investment in its energy system and related infrastructure from the current level of around 2% to more than 3% of GDP on average. Even more investment is needed when the decarbonisation of transport is taken into account. Some two-thirds of investment will need to come from energy users – ordinary businesses and households. Meanwhile, expanding climate-related R&D is essential, given the importance that still-immature technologies will have in the transition. Here Europe is lagging in a way that threatens our competitiveness. The next decade will be critical. We can no longer afford to make investments now that will lock us into a high carbon technological pathway for the next decades.

| Figure 3: Energy-related investment needed, 2021-2050, for net-zero carbon by 2050 (% of GDP) |

Figure 4: Investment in climate-related R&D, 2011-2018 (EUR billion) |

|

|

| Note: Additional investment required is estimated as the difference between the scenarios consistent with +1.5oC and a baseline scenario that reflects the current EU decarbonisation trajectory (including 2030 targets). Low-income Member States (GDP <60% of the EU average in 2013): BG, CZ, EE, HR, HU, LT, LV, PO, RO, SL. Source: European Commission, EIB calculations. |

Source: BNEF. |

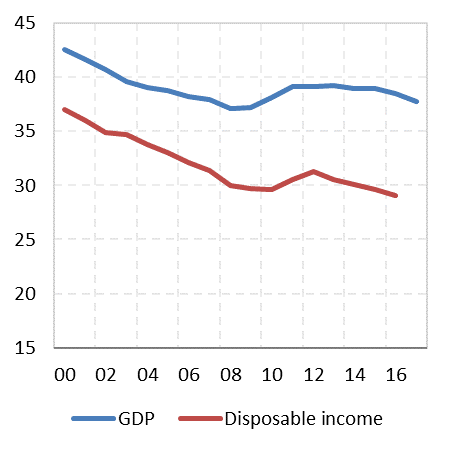

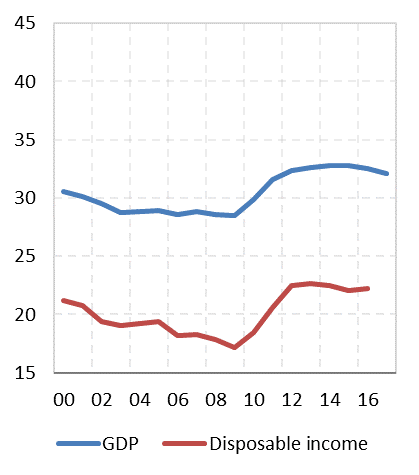

Moreover, in our rush to become more competitive and green, we must not lose sight of the importance of social inclusion. Europe’s social model is one of the foundations of this continent’s success, but it is also under strain. The Investment Report shows that regional convergence has slowed dramatically in recent years and in some parts of Europe has even come to halt. Both digitalisation and the climate transition threaten to make this trend worse.

Figure 5: Regional inequality in the European Union (coefficient of variation of GDP per capita and disposable income per capita, both in purchasing power standard)

| a. All EU regions (NUTS2 level) | b. EU regions excluding Central and Eastern Europe (NUTS3 level) |

|

|

| Source: Eurostat, EB calculations. Note: data for France, the Netherlands and Poland are missing. | |

We need to be conscious of this and work towards a just transition! The political reality is this: that if the transition to a more competitive and sustainable Europe is not one that works for all Europeans, then it will not work at all.

The European Investment Bank can play a vital role in the response to these challenges.

For decades, the EIB has flown a little under the radar, but these times are over, with the Bank being drawn more and more in to the political spotlight – and for the right reasons. One of the reasons is that the shareholders of the EIB Group, the EU Member States, are increasingly relying on their bank to deliver strategically important investments.

In recent years, this has included calls upon the Bank:

Most recently, our shareholders have called upon us to help increase Europe’s decarbonisation efforts by becoming the EU’s Climate Bank.

The truth is that the EIB has been Europe’s climate bank for a long time. Since 2012, we provided EUR 150 billion of finance supporting EUR 550 billion of investment in projects that reduce emissions and help countries adapt to the impacts of climate change. This made us one of the world’s largest multilateral providers of finance for projects supporting these objectives.

But, business-as-usual – or even incremental policy changes – is not enough to turn around the tide on climate change and it is certainly too little to deliver on the incoming Commission’s ambitious plan of making Europe the first carbon neutral continent by 2050.

This is why we presented to our shareholders a bold, new strategy for investments in climate action and environmental sustainability. After a long discussion, I am very pleased that the EIB’s Board of Directors endorsed our climate strategy and new energy lending policy two weeks ago. This shows a real commitment to transforming the European economy as well as the EIB itself.

The EIB’s new climate strategy includes three key elements:

The idea of the last point is, of course, that you cannot, on the one hand, ramp up funding for climate action and environmental sustainability and, on the other hand, fund ‘dirty’ activities that are not-Paris aligned.

In the same Board meeting in which our Board approved out climate strategy, they also made big step in ensuring that we are off to a good start on this latter point: our Board Members reached a compromise to end the financing of unabated fossil fuel projects, including gas, from the end of 2021.

This step is a milestone in the fight against global warming; in particular if it serves as an example for other IFIs and the financial sector more broadly to follow suit. Moreover, it is also just plain good banking as it reduces the risk of ending up with stranded assets on our books.

To give an example: one of the very first energy projects that the Bank financed was 60 years ago. It was a coal-fired power plant in West Berlin, Germany. This plant is still in operation today (e.g. Reuter CHP). What this means is that if we are serious about “net zero” emissions in 2050, we cannot, at the same time, fund fossil fuel projects that have a lifespan of 50-60 years – unless, we are ready to write off these assets eventually and absorb the associated losses.

The discussion at the EIB Board was not an easy one. One reason for this is that different countries and regions are affected differently by the green transition.

Currently, 41 regions in the EU are mining coal, providing jobs to about 240,000 people most of whom have limited opportunities to find alternative employment. We must make sure that these regions are not left behind in our fight against climate change.

This is why as part of our new Energy Lending Policy, we are also proposing a dedicated Energy Transition Package. In fact, at the EIB we have been supporting the “just transition” for a long time. One example I am particularly proud of, is our work with the Polish municipality of Katowice over the past 20 years. Our EUR 205 million loans contributed to its successful transition from stagnating coal-mining town to vibrant urban centre, offering new business opportunities and a healthier environment for its citizens.

Projects like these are needed to ensure broad support for a transition that is inevitable. Protest waves like the “yellow vest movement” in France have shown that the best climate action strategy does not help when you lose the support of voters in the process.

Our strategy is therefore to mainstream the consideration of climate change in everything we do. And this also means: everywhere we work.

We invest every year about EUR 6-7bn in countries outside of the EU. Our new climate and energy lending policy will apply equally to these lending operations as it does to our lending operations inside the EU.

This is an important point: China does not only have the largest number of coal power plants in the world, it also funds such plants on a massive scale in other countries: including Bangladesh, Pakistan, Indonesia, Vietnam, several African countries as well as Serbia, Tukey and Georgia. Europe needs to offer an attractive alternative to such investments. CO2 emissions know no boundaries. If we are serious about our fight against climate change, we need to make sure that also our climate policies know no boundaries.

This policy note is based on the address given by Dr Werner Hoyer at the 20th Annual Economics Conference of the European Investment Bank, held in Luxembourg, 26-27 November 2019, in cooperation with SUERF, the OECD, and Columbia University.