Facebook’s announcement of its plans to launch a digital currency has attracted considerable attention. However, financial inclusion and high costs for foreign bank transfers are not the problems that are first thought of in Europe when the question is asked as to who will need digital money and for what purpose. The German private banks rate programmable digital money as an innovation with great potential that can be a key component in the next stage of the evolution of digitalisation. They will play their part in establishing a sustainable and innovative monetary system. For this purpose, a programmable account and crypto-based digital euro should be created and its interoperability with book money ensured. The condition for this is establishing a common pan-European payments platform for the programmable digital euro.

Facebook’s announcement of its plans to launch a digital currency named Libra within twelve months has attracted considerable attention but also strong opposition worldwide. Policymakers, above all, have recognised that this initiative raises the question of what the global monetary system will look like in the digital age and who will shape it in the future.

Irrespective of this, the technological innovation of the Fourth Industrial Revolution will be the engine of structural change in the global economy. These innovations have the potential to once again radically alter the way we pay and how we store value. But it will need programmable digital money to make these innovations work. It has to be fully integrated into the existing financial system in order to avoid anti-competitive proprietary payment systems. The main burden of this public-policy task rests with central banks, governments, parliaments and regulators. But one thing is certain: banks in particular are challenged as well, since innovation and digital change will permanently transform their world.

We use digital money on a daily basis; we have long been familiar with it as book money in the form of credit transfers, direct debits, cheques or card payments. In Libra, Bitcoin, as well as Alipay and M-Pesa, there are now new forms that we do not yet fully know how to handle. What is certain is, firstly, that the emergence of cryptomoney increases the diversity of digital forms of money.

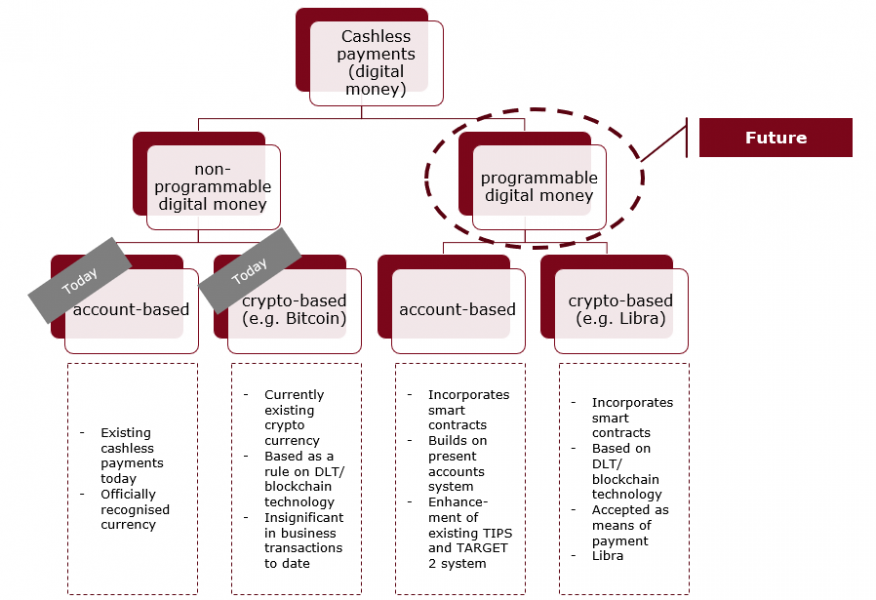

What is also certain is that – unlike with traditional digital money – the new forms of cryptomoney feature a significant technological innovation: they can be connected to so-called “smart contracts”. Smart contracts are computer protocols that map or verify contract terms and, for example, automatically initiate payments on performance of a transaction. That is why the industry also talks of “programmable digital money”. The private German banks are convinced that, in a digitalised economy, this form of digital money will rapidly gain in importance. Smart contracts can be connected not only to cryptocurrency but also to account-based book money. It therefore makes sense to distinguish between programmable and non-programmable digital money. Libra is crypto-based, programmable digital money (see chart below).

Against this backdrop, the current discussion about Libra is merely one aspect of a major issue that goes beyond the envisaged “Facebook currency”. In this position paper, the Association of German Banks explores what contribution banks can make towards a sustainable and innovative monetary system, how the general environment should be designed so that banks can operate alongside new competitors, and what is needed to ensure the stability of the financial system.

A stable currency is the basis for any economic system; ensuring one is a key element of state sovereignty. The stability of the existing monetary system must not therefore be endangered by the provision of crypto-based digital money.

Crypto-based digital money features innovation that has far-reaching implications and the potential to uncouple the money in circulation from the existing banking system. This raises a whole number of questions concerning the future design of the monetary system. Policymakers will not be able to remain spectators. Central banks in particular could play a key role in shaping this future.

The public debate is currently being fuelled by the plans announced by a Facebook-led consortium to launch a private, global digital currency called “Libra”. A global currency would be a first, since for good reason no single global currency has emerged to date. It would not only have to satisfy widely differing legal and regulatory requirements simultaneously but also to react appropriately to different economic developments. The experience made in the eurozone has shown that a single currency can be a source of considerable economic and political conflict.

Contrary to what is currently suggested, a private global digital currency competing with the official key currencies in the world economy would therefore not solve any problems. It would instead be highly likely to exacerbate economic conflict. Massive inflows and outflows of capital could, for example, seriously upset a country’s economic equilibrium. Corrective tools used so far, such as exchange rate or interest rate adjustments, would lose in effectiveness if the new form of money were to meet with a high level of acceptance. Measures geared more to tackling symptoms (creation of large-scale currency reserves, introduction of capital controls, currency market intervention) would also lose their applicability. A global digital currency, particularly one provided by a profit-oriented, listed company, is therefore not in the interests of a stable global community.

Policymakers are well aware of this1 but they have recognised a trade-off between the potential gain in efficiency, particularly in the cross-border payments sector, and the risks created that they would be quite prepared to shape.

Against this backdrop, and with the far-reaching implications of monetary policy decisions in mind, the private banks call on national and international policymakers to act responsibly. Competition with private currencies endangers state monetary sovereignty and should therefore not be allowed. The expectation that by regulating this new type of money new systemic risks can be ring-fenced, while its productivity and efficiency-boosting features can at the same time be exploited for the benefit of the international financial system, may be delusory.

To control the systemic risks of such a type of global currency, internationally coordinated and mutually compatible regulatory measures would at any rate be necessary. The experience gathered from the financial crisis has shown that this is highly time-consuming and that the international consensus can quickly become very fragile. The requirement by the G7 that a stable coin must meet the highest regulatory standards obligates international policymakers to ensure that the political processes needed for this are put in place.

This includes, above all, ensuring the functioning of the existing global monetary system in the long term. Its constitutive feature is privileged access by banks to central bank money. To allow better control of the potential risks posed by stablecoins, but also to increase such coins’ prospects of success, it has been proposed that private crypto-based forms of money be granted access to central bank money. This would, however, mean breaking with the principle of privileged access by banks at the same time. Direct general availability of digital central bank money outside the banking sector would seriously distort competition between banks and private currency providers. This could endanger the stability of the international financial system as a whole.

But, besides this risk directly endangering the banking sector, there are further systemic challenges that need to be taken into account. In the event of a high level of acceptance among social network users, the securities portfolio needed to back a globally usable stablecoin – short-term government securities denominated in stable currencies – could quickly reach a size that would be systemically important, as it would further aggravate the shortage of these so-called “safe assets”. This could become a problem for a monetary policy geared to quantitative easing. Furthermore, the lower interest rates due to the higher demand would affect the monetary policy of, for example, the ECB. And, finally, there may be a shift in the importance of the different transmission mechanisms through which monetary policy steers the economy.

As far as international capital movements are concerned, risks resulting from a stable coin’s construction principles would also be an issue. Particularly when backing is provided by a basket of currencies, portfolio regrouping may lead to increased volatility on the capital markets. A particular challenge is likely to be times in which either “reserve currencies” or stablecoins experience a loss of trust and there may as a result be massive movements of capital in one direction or the other. Any change in the composition of the currency basket may, moreover, trigger sudden changes in exchange rates.

The German private banks rate programmable digital money as an innovation with great potential that can be a key component in the next stage of the evolution of digitalisation.

How strongly digitalisation is changing the way we live, work and spend our money is something we are already experiencing on a daily basis today. As consumers, we are shopping online to an increasing extent. Platforms are connecting both companies with consumers and companies with each other, not only nationally but also internationally.

New business models are shaking up virtually all sectors and breaking up hitherto successful value chains, with far-reaching implications for national economic structures.

This disruptive process does not stop at the way we pay and store value. In its white paper on Libra, Facebook sent an unmistakable signal to this effect. The digitalisation of the economy and daily life places new demands on digital forms of money. Programmable digital money, whether account-based or distributed ledger technology (DLT)-based, will be a key element of the digital transformation and play a major role particularly in connection with smart contracts.

DLT-based smart contracts allow the correct, automated execution of contractual agreements. Fulfilment of the agreements often entails payment transactions. So that these can be made on a fully automated basis irrespective of their amount, programmable money is needed. Use of smart contracts connected to digital money could, for example, ensure automatic remuneration of holders of rights to digital goods. In the Internet of Things (IoT) as well, more and more appliances are being connected to the Web, so that data can be generated, exchanged and processed between machine and machine (M2M) and between machine and person (M2P). This interaction can also be fully automated with the help of smart contracts.

An important point in this context is that customer data is encrypted and thus transferred securely, with control over access to the data remaining with the customer. The auditability and availability of historical transaction data can significantly reduce the risk of misuse and cybercrime.

The German financial industry is currently making great efforts to remain competitive in the digitally-driven structural transformation. Yet, as far as connecting IoT processes and payment transactions is concerned, it is currently experimenting with insular solutions. A competitive payments system can, however, only be based on a common standard and a common currency, the euro. Banks in Germany and Europe can successfully support this development with programmable digital money.

Given the rapidly advancing, digitally-driven structural change and the growing importance of the IoT, the importance of programmable forms of money is likely to increase quickly as well. To maintain Europe’s competitiveness, satisfy customers’ needs and reduce transaction costs, the introduction of euro-based, programmable digital money should be considered.

The German private banks will play their part in establishing a sustainable, innovative monetary system. For this purpose, a programmable account and crypto-based digital euro should be created and its interoperability with book money ensured. The condition for this is establishing a common pan-European payments platform for the programmable digital euro.

Programmable digital money has advantages over conventional payments; above all, it delivers greater benefits for customers. While of one its key features, immediate execution of transactions, is already being implemented through the establishment of the SEPA instant payments scheme, it is not yet possible to integrate it into digital processes and smart contacts.

For this reason, an overarching European strategy should first be developed with the aim of creating an infrastructure for the implementation of digital business models and thus also allowing the integration of smart contracts. A key component of this strategy should be payments with programmable digital money. The banking industry should work together with the central banks at European level to create a payments system that addresses existing shortcomings and at the same time retains the main advantages of established payment infrastructures. Besides (legal) security, these include a high level of efficiency based on common standards and pan-European reachability. This is the only way to withstand the competitive pressure from US, and soon probably also Chinese, technology companies. It requires a European strategy with regulators and market players working hand in hand to generate sufficient momentum.

This target vision can only be achieved within a reasonable time horizon through a two-step approach: firstly, by creating a programmable, account-based euro and, secondly, by creating a crypto-based, programmable euro.

In a first step, conventional, i.e. account-based, systems should be enhanced so that they can be connected more easily to digital processes and smart contracts. The already mentioned SEPA instant payments standard can serve as the basis for this. Yet, the data models used in this standard or in these data infrastructures are too limited to already allow adequate connectivity with smart contracts. Such enhancement could be major step forward towards interconnecting conventional payments and smart contracts or other digital offerings and thus allow mapping and implementation of rules-based transactions. The required standardisation work should be driven forward by private-sector players with Eurosystem support.

The account-based solution is a key intermediate step on the way to achieving direct integration of smart contracts and payments. Building on this, crypto-based, programmable money should be created. Today, there are already offerings by individual market players, including banks, which allow the smooth integration of smart contracts and the settlement of claims resulting therefrom within one system. These are, however, proprietary solutions provided by individual players. This is why pan-European interoperability of a crypto-based euro is needed to achieve significant scalability in real economic terms. An initiative aimed at establishing technical standards and contractual rules is therefore called for here as well to ensure technical connectivity and accounting of payments.

Like with conventional payments, coexistence of private-sector and public-sector, i.e. Eurosystem-operated, infrastructures is conceivable for this purpose. As the existing supervisory and civil framework for conventional payment systems needs to be applicable to token-based solutions as well, the involvement of regulators and lawmakers is also necessary.

To create public trust in programmable digital money, compliance with the highest regulatory standards is essential. To ensure legal certainty, a legal classification of programmable digital money is necessary as well. All innovators must respect a uniform supervisory and regulatory framework. The issuance and custody of programmable digital money should also be possible under existing full banking licence rules.

If crypto-based digital money is to see worldwide proliferation, regulation must ideally be adopted at international level but at least be based on uniform, international standards. National regulatory approaches would lead to market segmentation and consequently to the emergence of exchange rates, possibly preventing exploitation of the benefits of digital money.

It must first be clarified which existing regulatory standards are applicable to programmable digital money and whether these standards take adequate account of the specificities of programmable digital money. Only if it is ensured that programmable digital money is subject to appropriate regulatory standards will there be legal certainty about handling digital money and only then will the general public trust digital money.

Regulation of programmable digital money should, moreover, be technology-neutral: not the technology used or the legal construction but, instead, the economic purpose must determine the type of regulation adopted. Regulation should, at the same time, be in proportion to the risks: a technology company that offers banking services must also be regulated like a bank.

Conversely, a company that complies with the highest standards should not be stopped from conducting cryptocurrency-related activities. A negative example in this respect is the German governments draft bill to implement the directive amending the Fourth EU Anti-Money Laundering Directive. This draft bill currently stipulates that cryptocurrency custody business may not be conducted by banks, although the directive itself does not actually call for this. As, however, particularly companies with a full banking licence have to meet the highest standards and already possess asset custody expertise, this provision of the German draft bill is unreasonable and should therefore be dropped as a matter of urgency. To ensure a level playing field and promote Germany and Europe as a centre for innovation, all companies that comply with the requisite standards must be allowed access to cryptocurrency custody business.

The German private banks expect lawmakers and regulators to lay the necessary foundations for digital innovation, especially in the banking sector.

The legal framework governing the financial sector must not only guarantee a level playing field and high standards of consumer protection and financial stability, but at the same time create the necessary space for innovation. This is the only way to ensure that Germany remains competitive.

We therefore welcome the German government’s blockchain strategy, which in the section on the financial sector highlights the obstacles to innovation, such as the need for securities to take the form of certificates, and in which the government advocates solutions that offer legal certainty. The government also rightly points out that the further development of blockchain requires “means of payment with a stable value in a blockchain environment” in order to “be able to carry out legal transactions on a delivery versus payment basis.” We believe a suitable technology-neutral legal framework is therefore needed to promote these and other innovations. It is both possible and essential to dismantle existing barriers without lowering the level of protection for consumers.

We see no need for additional, dedicated regulation of blockchain or DLT over and above the existing regulation governing securities, capital markets and banks. Rather, the existing requirements should – where necessary – be explicitly extended to DLT solutions in order to avoid regulatory gaps.

In its strategy, the German government also refers to real laboratories that offer an environment for testing innovations. A prerequisite for such laboratories is the inclusion in legislation of experimentation clauses which allow scope for testing new technologies. Unfortunately, no such experimentation clauses exist in the legislation governing the financial sector. And the regulatory equivalent of the real laboratory, the sandbox, which enables close cooperation between supervisors and innovators with the aim of swiftly creating legal certainty for innovations, has also yet to be established in Germany.

As well as a general regulatory openness to innovation, further concrete measures are needed in Germany to facilitate innovations such as programmable digital money. Ideally, approaches of this kind should be pursued at European level, too. With this in mind, we warmly welcome the European Commission’s work on blockchain. In 2018, for example, the EU set up the EU Blockchain Observatory and Forum initiative, thus sending an important signal.

European lawmakers must establish a basis in competition law to facilitate pan-European payment solutions. To enable banks to meet new competitors on an equal footing, competition policy should take account of changes in the international competitive environment and create a new framework that will establish legal certainty for cooperation between European market participants. We support a uniform European approach to defining this competitive framework.

The emergence of platform-based payment systems and programmable digital money will have an influence on the way in which the bank-based financial system is currently organised. Although the processing of payment transactions by banks is key to the smooth functioning of the financial system, both customers and banks have up to now understood this as a natural complement to – indeed almost a by-product of – banks’ deposit and lending activities. Banks see themselves as a central point of contact for customers and take a holistic approach to managing the customer relationship, including the provision of asset management services.

In a platform-dominated world, this may change. Payment transactions will become an important entry point for clients. Other types of financial services, such as lending and asset management, may then de facto become a complement to payment services. Under these circumstances, we would probably see significant changes in the banking system. In addition to the pressure of increasing competition, banks would face the loss of transaction and commission income. They would therefore have to expand their existing business models to cover services related to programmable digital money (custody, wallets, lending).

Banks will consequently be competing with international providers of programmable digital money from a weaker starting position. Since the inexpensive and stable retail banking business will face direct competition from the providers of programmable digital money, banks could lose not only customer relationships, but also financial transaction data. Furthermore, providers of programmable digital money may also encourage market concentration if they carry out their refinancing through a few large banks. This could pose growing refinancing problems for smaller banks. In a worst-case scenario, if consumers shift their savings into a foreign currency and turn their backs on traditional financial partners, banks would lose a source of direct refinancing.

Both deposit-taking and payment services can display characteristics of a natural monopoly. Transaction costs for payment services, for example, are lowest if payments can be made in a single currency used by all involved. When it comes to the deposit-taking business, there are also positive economies of scale in the management of reserves. The larger the volume of deposits, the more money can be created and, as a rule, income can be generated by interest on loans. In addition, larger payment institutions incur lower costs monitoring their borrowers.

If a social media company were to issue programmable digital money, there are reasons to believe that it could achieve a monopoly position. Take, for instance, strong network effects, the high fixed costs needed to build a parallel currency that could prove an insurmountable obstacle to potential competitors, and the exponential benefits of access to data. All this favours big international first-movers.

In addition, bigtechs could extend their growing market position in payments to other services, using data already collected to tap new markets. Bigtechs already have a significant competitive advantage due to the huge amount of data they have collected about their users. An imbalance of power of this kind in favour of a large corporation not only invites abuse of power, but also poses a threat to macroeconomic stability.

Against this backdrop, we support the investigative activities of the German and European competition authorities. As things stand, the requirements of competition law – at least in the event of a company’s market dominance – can lead to restrictions on the permissibility of collecting, consolidating and processing user data. As the Facebook decision of Germany’s Federal Cartel Office in spring 2019 shows, even existing competition law can set effective limits to a certain extent. European data protection law can be used as a benchmark for handling the abuse of a dominant market position. German and European competition law nevertheless needs to be updated, especially with respect to the definition of “market” and the control of abusive practices, so that it can keep pace with the developments resulting from digitalisation and the associated concentration processes.2

Modernised competition law could support the development of a programmable digital euro. Cooperation to this end between European banks and businesses should be facilitated, and not frustrated, by competition law. Given the global strength and position of bigtechs, it will be impossible for one company alone to create programmable digital money which will be accepted by the market in practice.

In light of the uncertainty surrounding the limits set by antitrust law on collaborative projects in the digital economy, it is particularly important to strengthen legal certainty in this area. The Commission of Experts on Competition Law 4.0 has recognised this aspect and addressed it in its recommendations.3

The user of a digital euro – whether man or machine – must be clearly identifiable. This requires a European or, better still, a global identity standard. With every form of digital money, customers should be identified using a standard that is just as strict as that which banks and other obligated entities are required to apply under current anti-money laundering rules.

The exchange of digital money – as well as of other assets in the digital world – requires the parties involved to be clearly identifiable. Otherwise, transactions will lack the necessary traceability and evidential basis not only for the parties directly involved but also for any affected third parties, such as tax authorities.

In today’s account-based monetary system, it is the account-managing bank which identifies the account holder(s), person(s) authorised to draw on the account and beneficial owner(s). In future, however, it is possible that digital money will be an integral part of a digital value-added process and that crypto-based payments will be executed directly between the parties to the underlying transaction in a legally effective way without the need for a separate payments infrastructure based on payment accounts (cf. Position 3).

Payment transactions of this kind will require a uniform digital identity standard at EU level, at least, which allows crypto-based digital money to be matched precisely and reliably to natural and legal persons. This identity standard should also enable machines to be clearly matched to their legal owners so that, in the IoT, assets can be transferred directly between machines and recorded in a manner providing legal certainty.

The uniform identity standard also needs to satisfy the high data protection requirements in the EU by using pseudonymisation techniques, for example, or a self-sovereign digital identity solution.

At the same time, the current high level of money laundering and terrorist financing prevention by payment service providers – especially banks – must not be lowered as a result of payment transactions being executed using crypto-based digital money without unambiguous identification of the parties involved. To avoid this, new approaches to customer identification must ensure the same quality as that guaranteed today by banks in the conventional processing of payment transactions. This applies not only to identification as such but also to the subsequent monitoring of transactions with a view to preventing money laundering and terrorist financing.

The processing of personal data in connection with programmable digital money requires a viable data protection strategy.

Data protection law always comes into play when personal data are involved. It is therefore important to begin by clarifying whether data of data subjects will, in fact, be processed in a digital money system. This does not necessarily have to be the case where crypto-based digital money is concerned: a procedure could conceivably be used that does not require any personal data at all. Should personal data be processed, however, then the European General Data Protection Regulation (GDPR) has to be observed in the EU. This applies even if the data are pseudonymised. And even if the operator’s registered office is outside the EU, the GDPR is still relevant if data of EU citizens are processed. It is nevertheless open to question how European data protection law can be effectively enforced in such cases.

The major points to consider when designing a viable data protection strategy include:

If these aspects cannot be satisfactorily resolved with the help of the GDPR, it would be worth considering the idea of developing a dedicated EU legal act to regulate data protection issues in the context of crypto-based digital money.

Owing to the activities of some social networks and the use of wallets operated by them, there are fears that the boundary between the social network function and actual payment function could become blurred or even be consciously crossed. The purpose limitation principle enshrined in the GDPR means that the use of personal data for purposes other than executing a payment can only be legitimised by a separate justification (e.g. separate consent). It may nevertheless be advisable to use an EU legal act on data protection in the context of crypto-based digital money to explicitly restrict the use of personal data for purposes other than payments. Alternatively, the idea could be considered of using technical procedures to protect personal data from misuse (e.g. privacy by design through pseudonymisation).

The advantages of using programmed digital money are obvious. This nevertheless raises a further data protection consideration. Personal data will be processed not only for payment purposes, but also to fulfil associated smart contracts. This means that a smart contract will broaden the legitimate purpose of data processing. For affected citizens, this multidimensionality must be transparent so that they can understand not only the functional scope of programmable digital money but also the implications for the processing of their personal data. Particularly where several functions are linked, a clear allocation of responsibilities will be especially important if data protection law is to be respected.

In light of its global reach, there is a need to clarify the legal basis on which programmable digital money may be used. Existing consumer protection standards must be observed.

Users should be able to rely on the legality of digital money. Otherwise, they risk falling victim to fraudsters and being unable to effectively enforce their rights. A digital currency that can be used globally therefore requires a globally applicable legal framework. Mere “belief” in its value and in the enforceability of claims associated with the payment instrument do not constitute a robust foundation. And though it is true that contract law could be used to establish legal claims, the question then arises as to which legal system should be applicable.

Even if a certain legal system is agreed on, moreover, this does not resolve the problem of how to enforce that law, especially in a cross-border context. Consumer protection standards such as those that apply in EU member states, for example, could be undermined or ignored if there was no way of enforcing them; the same applies to data protection.

So scepticism about the viability and sustainability of a purely contractual solution is warranted. Going forward, the question is therefore whether codification underpinned by international law may be useful and necessary. Consideration could be given to involving UN institutions such as UNIDROIT and UNCITRAL, which have considerable experience with international law-making and model laws. Why not launch a project along the lines of the Geneva Cheque Convention of the 1930s, which still provides legal certainty today? What would have to change, however, is the time frame usually associated with international law-making projects, which often spans several decades. This would need to be adapted to the speed of the digital revolution.

German tax law must clarify for income tax purposes whether programmable digital money is a currency or an economic good. The precise design of programmable digital money requires clarification to facilitate its VAT treatment. With respect to wallet management – especially in third countries – tax enforcement must be guaranteed.

If crypto-based digital money is classed as a currency, bank customers may receive income from capital assets under section 20 of the German Income Tax Act (Einkommensteuergesetz – EStG), which will be subject to capital gains tax and deducted by the bank in accordance with sections 43 et seq. of the act. This would give rise to additional obligations for banks, such as the registration and transfer of the tax and the issuance of a tax deduction certificate for the customer.

Should crypto-based digital money be deemed an economic good, section 23 of the German Income Tax Act would require profits and losses from sales to be declared under certain conditions as other income from private sales transactions in the personal assessment of the taxpayer. When it comes to Bitcoin, using previously acquired crypto-based digital money as a means of payment is regarded by the tax authorities as a sale which generates other income from private sales transactions. This means that taxpayers must document every single payment transaction and, where necessary, include it their tax return.

Based on a ruling by the European Court of Justice, the German tax authorities take the view that neither the conversion of conventional currencies into Bitcoin nor the use of Bitcoin as a means of payment is subject to value added tax. According to the tax authorities, this also applies to other crypto-based digital money provided that it is not used for purposes other than as a means of payment. In consequence, a crucial question for the tax authorities is whether the crypto-based digital money has been accepted by the parties to the transaction as an alternative, contractually agreed and direct means of payment. Only then will the use of Bitcoin – like any other legal tender – not be subject to VAT.

In addition, tax enforcement must be ensured with respect to wallet management – especially in third countries. The background to this is that the Federal Constitutional Court demands equitable enforcement of the state’s tax claim. Ways of ensuring tax enforcement include obliging wallet operators in and outside Germany to report income from crypto-based digital money, including wallets in Germany’s electronic account retrieval system and possibly requiring wallet operators to deduct capital gains tax at source.

It must be ensured throughout the EU that national tax law does not pose an obstacle to the use of programmable digital money.

Thanks to deposit guarantee schemes, deposits of bank customers enjoy a high level of protection. This level of protection should also be the benchmark for programmable digital money. In any event, providers must inform customers clearly and verifiably if no deposit protection exists.

If a bank becomes insolvent, deposits in the EU of up to 100,000 euros per depositor and bank are automatically protected by the responsible national deposit guarantee scheme. Banks are obliged to inform customers about the scope of their protection. Providers of crypto-based digital money should therefore also be obliged to inform customers clearly and verifiably about any lack of protection.

If providers of crypto-based digital money create money, it is essential to have a deposit guarantee system in place so that the level of depositor protection is not lowered.

See G7 working group on stablecoins, Investigating the impact of global stablecoins. October 2019.

See recommendations in the report of 9 September 2019 by the Commission of Experts on Competition Law 4.0 set up by the Federal Ministry for Economic Affairs and Energy.

See recommendations 13 and 14 in the report of 9 September 2019.