In many countries, including Sweden and the Netherlands, the pros and cons of the introduction of central bank digital currency (CBDC) are the subject of a dynamic debate. In the Dutch context, this is quite remarkable as the Dutch payments transfer system is one of the most advanced in the world. It operates virtually faultlessly, is very cost-effective and is extremely stable. Even during the financial crisis, it functioned perfectly. Moreover, it is an important source of innovation in the field of payments. For instance, the Netherlands, alongside Sweden, is leading the way when it comes to contactless payments. So there would seem to be little reason to make radical changes to the current system. But that is exactly what the Netherlands Scientific Council for Government Policy (WRR), an important adviser to the Dutch government, proposed in its report titled Geld en schuld (Money and debt) that was published in January 2019.3 The WRR explicitly recommends that every Dutch citizen should be given the opportunity to hold a payment account with the central bank. It talks about “creating an electronic equivalent of cash” (WRR, 2019, p. 237). At first sight, this might not seem to be a particularly radical idea, but further consideration shows that it could have serious consequences for the stability of the banking system and the position of the central bank. Moreover, the WRR is not very exact in its recommendation. For example, a closer look at the topic reveals that CBDC is a so-called container concept: behind the term CBDC there exists a whole range of varieties of CBDC that differ widely in technology, scope and financial-economic impact (SUERF, 2018; BIS, 2018).

Central bank digital currency (CBDC) is cashless money (money held in a payment account) that is held in an account at the central bank and can be used for payments. CBDC does not yet exist anywhere on a large scale, although some central banks do offer payment services to non-financial institutions on a limited scale.4 In the industrial countries, the Swedish central bank is currently most deeply involved in CBDC. It is investigating whether or not to introduce a CBDC, in the form of a digital version of the Swedish Krona (e-krona). But Sweden too still has to take the final decisions in this respect.

The main consideration behind the e-krona project is the rapid decline in the use of cash in Sweden. The authorities feel, that there is a real possibility that cash, viz. banknotes and coins in circulation, would entirely disappear. In that case, the central bank would no longer have a role in retail payments. Many people see this as fundamentally undesirable. It is one of the arguments used by the Swedish Riksbank when starting its work on the e-krona.5

The Eurozone, however, is nowhere near the disappearance of cash. The situation in the Netherlands, where the use of cash has already been overtaken by cashless money, is not illustrative for the rest of the Eurozone, as in most other member states cash is still king. Europe is still far away from a cashless society. Were CBDC to be introduced in the Netherlands, it would therefore by definition be an addition to the existing money-in-circulation system, including the euro notes and coins, which of course have an EMU-wide circulation.

Many possible varieties of CBDC

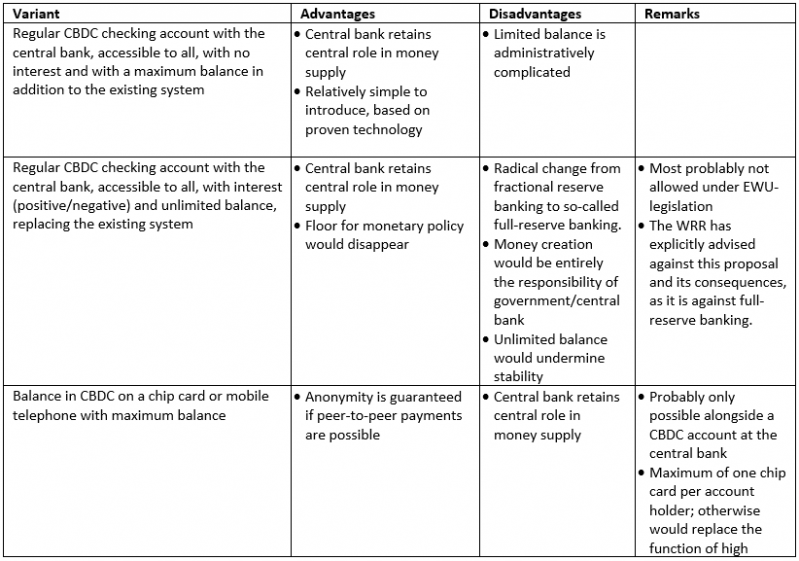

There are many possible variants of CBDC. I will restrict myself here to those that are technically feasible in the short term. This means a payment account, based on existing technology, held with the central bank as an addition to the existing system.6 At this moment, Blockchain technology is not a real alternative, as it is until now unsuitable for the handling of mass payments. This may change in the future, of course, but for the time being traditional payment technology is by far superior. The speed of a bitcoin transaction, for example, is measured in minutes. The existing retail payment infrastructure in the Netherlands, on the other hand, can successfully handle thousands of payment transaction via banking accounts in a single second, most of them with real-time settlement. As Santiago Ferna ndez de Lis wonders: ’why would central banks move away from a more to a less efficient system?’7 For the time being blockchain technology is in its infancy. For it to become competitive with existing payment technologies we will have to see improvements in its efficiency, solving the scalability problem, and strongly increasing its energy consumption efficiency.8 Maybe this will happen, maybe not. But in the near-term large-scale CBDC will only be viable when based on traditional technologies, which of course may also be expected to be further improved over time. A non-exhaustive list of possible variants is given in Table 1.9

CBDC is hard to define, but certainly not by definition an equivalent of cash

According to the BIS, the multitude of possibilities available means that it is only possible to define CBDC by what it is not: “CBDC is a digital form of central bank money that is different from balances in traditional reserve or settlement accounts” (BIS, 2018, p. 4). The BIS observes that central banks traditionally issue digital money in the form of bank reserve accounts, which are the most important part of the monetary base (M0). Sometimes, the term CBDC is used synonymously with so-called digital cash. The WRR as well speaks of “creating an electronic equivalent of cash”. This is rather confusing, as many if not most versions of CBDC are certainly not an electronic equivalent of a banknote or coin. The most important similarity between CBDC and a banknote is that both represent a liability of the central bank. But here the similarity usually stops, as most varieties of CBDC have different characteristics than a banknote. The most important difference is that a payment with a banknote or coins is completely anonymous, while a payment through a payment account, be it with a commercial or a central bank, by definition is not, as every transaction is registered in the banks’ administration. To give CBDC a similar degree of anonymity as cash, the payment account would have to be supplemented with a value-based token allowing peer-to-peer transactions to be effected.

Formerly, it was not unusual for businesses to hold a payment account with the central bank. Many central banks served non-bank financial institutions, large companies or important persons in the past. Some central banks started their life as a commercial institution that was established to stimulate economic activity. However, over time central banks have phased out these relationships, in order to focus on their role as the pivot of the financial system and, in many countries, as the supervisor of the banking industry. An important consideration was that it was illogical for central banks to directly compete with precisely the same banks they supervise.

As said, to increase the similarity with cash the central bank could decide to supplement a CBDC account with a value-based token; for instance a balance on a chip card or mobile telephone. For a CBDC payment to be equivalent to a cash transaction, it would have to allow people to effect peer-to-peer transactions. In other words, the systems would need to allow for payments to be made from one token to another without recourse to a bank account. Although this version still would not be completely anonymous, it does go a long way towards meeting many people’s preference for a degree of privacy with respect to the transactions they effect. In the e-krona project, the Riksbank of Sweden is suggesting such an option up to a maximum of perhaps SK 250 (less than € 25) per token.10

It would also be possible to set a maximum for the balance that people could hold in their CBDC account. This has certain advantages from the point of view of stability, as will be explained below, but also entails a disadvantage: it would complicate administration. One of these complications is that a market might develop for available limit space, i.e. people with a low balance in CBDC might sell the remainder of their available limit to parties wishing to hold more CBDC than officially permitted. This could create new risks in the system.11

There are indeed many different potential variants, which are discussed in varying levels of detail in the literature. The following addresses some of the aspects of CBDC that have received relatively little attention so far.

In the Netherlands, the WRR is recommending that CBDC should be introduced as a supplement to the existing system. It would then circulate alongside the existing money in circulation (both cash and money in payment accounts held with commercial banks). One important disadvantage of this situation is the potential for a substantial negative effect on financial stability. The existence of CBDC would make it very simple for people to transfer money from a regular payment account with a commercial bank to their CBDC account with the central bank. If this happened on a large scale, we could be looking at a digital bank run.

While the threat of a run on the banks in the current system of fractional reserve banking is always present, given their role in maturity transformation and the resulting liquidity risk, the consequences in today’s system are less far-reaching when compared with a situation with CBDC. Today, the most common manifestation of a traditional bank run is either that people withdraw cash from their payment account or, more often, that people and companies transfer money from their accounts at a bank perceived to be in difficulties to another bank considered to be safer. Professional funding providers can also rapidly withdraw money from one bank and transfer it to another. The banks under pressure then have an acute liquidity problem, but the liquidity of the banking system as a whole is, apart from the cash withdrawal, not affected. In such circumstances, the central banks can concentrate its lender of last resort activities on the banks in liquidity problems, as other banks may find themselves in a situation of sufficient or even abundant liquidity. If, on the other hand, a run on the banks occurred via CBDC, meaning that people transfer money from their payment account with their commercial bank to a CBDC account with the central bank, the monetary base declines, as CBDC is not part of the bank liquidity reserves. As a result, it would not only be the banks in difficulty that would experience a liquidity problem, but the liquidity of the banking system as a whole will by definition be reduced as well. Moreover, the liquidity drainage from the banking system may even get much worse. This could happen, for instance, if a strong deterioration in the confidence climate surrounding some banks were to trigger a massive transfer of money from regular payment accounts to CBDC accounts with the central bank. In other words, a run on the banking system as a whole would be easier with CBDC; as a result the consequences for the liquidity of the banking system would be more serious, and escalation would be more likely. This would make it much more difficult for central banks to fulfill their role as lender of last resort.

Central banks are thoroughly aware of this threat. However, many proponents of CBDC think that the existence of a deposit guarantee scheme would provide adequate protection (WRR, 2019). But would this really offer adequate protection if people could transfer their balances to a CBDC account at the central bank in a matter of seconds? At the least they could avoid the uncertainty with respect to how long it would take to activate the deposit guarantee system. The WRR also asserts that in this way CBDC would enforce discipline on the banks, in the sense that they would be forced to turn more to long-term capital and equity for funding. The WRR accordingly appears to underestimate the importance of the role of the banks in financial intermediation – which has great relevance to society but by definition creates liquidity risks – and the associated transformation of maturity. DNB, the Dutch central bank, has more serious concerns than the WRR regarding the negative effects of CBDC on financial stability.12

A question that is hardly ever asked is which effects the introduction of CBDC would have on the institutional position of the central bank. Commercial banks are heavily supervised, in most countries by the central bank. If every resident had access to CBDC, the national central bank (like the commercial banks) would be responsible for continuous monitoring of the payments system to prevent illegal transactions and/or tax evasion. In formal terms, it would have to meet all regulations in the field of Anti Money Laundering and the prevention of criminal transactions (the AML/CFT regulation) that today apply for commercial banks. This would require the central bank to invest heavily in customer and compliance departments and possibly an extension of its branch network. In most countries today central banks have only a very limited number of offices (in the Dutch case just one).

The question then arises: which agency would monitor the central bank to ensure it was doing this job adequately?15 Moreover, once a central bank offers CBDC to its citizens it is in direct competition with the banks it is supervising. People might therefore also question whether it would still be appropriate for central banks to continue to supervise the payments system operated by the commercial banks. As said, in many countries the central bank is also responsible for banking supervision. It is quite possible that in those countries a new supervisor would have to be created, or that both the commercial and the central banks would have to be supervised by the authority that is responsible for behavioral supervision. Whatever the case, the introduction of CBDC would also result in a fundamental change in the position of the central bank.

To date the debate has not paid enough attention to the costs of introducing CBDC, running a payments system and protecting it against hackers, and being compliant with all relevant regulation. Maintaining and securing a large-scale payments system is expensive: for each major bank, and so also for central banks, this can easily amount to hundreds of millions of euros per year, if not more. These costs consist of investing in a huge IT-infrastructure and keeping it up to date. Moreover, these systems will have to process billions of transactions per year. Protecting this system against hackers and other criminals is very costly. Probably the system will need one or even more real-time back-up systems to prevent a total standstill in the financial system in case the central bank’s system faces a failure. Moreover, the tasks described above in complying with AML/CFT regulation are very costly, as it may be very labor-intensive.

Some make the correct point that CBDC might help save on the high costs associated with physical cash handling, which is estimated to cost at least ½% of GDP in EU countries.16 However, these savings will only fully materialize in a cash-free society, which in most countries is far beyond the horizon. Even in countries where payments by debit card have overtaken cash payments, such as Sweden and the Netherlands, it is far from sure that cash will disappear completely. Recall that only a cash transaction can be fully anonymous. Even more important, when the payments systems of banks, both central and commercial, fail, cash is the ultimate back-up system.

These costs may have an adverse impact on the profitability of the central banks that offer CBDC. In many countries, the central bank transfers (part of) its profit to its shareholder(s), which is often the government. If as a result of offering CBDC-accounts central banks become structurally loss-making, this could be at the expense of government budgets.17 In which case the central bank’s budget would become a regular issue in the political debate on the government budget, which could undermine the political independence of central banks.

In theory, central banks could cover their costs from higher seigniorage income (profit made by a government for issuing new currency), although it is doubtful whether this would be allowed under European agreements.

It is, however, essential that the central bank should not be subject to any political budgetary restriction in this respect, since inadequate maintenance and/or security of a retail CBDC payments system set up by the central bank could entail serious risks for the financial system. Indeed, as an issuer of CBDC the central bank would be by far the most systemically relevant bank in any country, and certainly ‘too important to fail’. Especially if CBDC replaced regular payment accounts with commercial banks, the central bank would be the ‘single point of failure’. Hack the central bank and you’ve hacked a whole country!

In today’s context, the expectation is that if CBDC is introduced at short notice, it will be in the form of a payment account at the central bank based on existing technology and running alongside cash. Once cash finally disappeared, the possibility of peer-to-peer transactions would have to be offered as well as a card-based variant if it is to function like a banknote. However, as long as there is cash money in circulation, which will be the case in the euro zone in the foreseeable future, we do not actually need this option.

So we are left with the question of whether the alleged benefits of CBDC outweigh the not insignificant costs and other disadvantages. As already mentioned, in most countries current payments system functions rather well, and in some countries it is pretty much perfect. Furthermore, it is likely that the introduction of CBDC would require a redesign of banking supervision and Europe-wide harmonization. Therefore the main question to be answered is whether we start to spend hundreds of millions or even many billions per year on a product that delivers virtually no new services, complicates the position of the central bank, has the potential to undermine financial stability and will force us to redesign our supervisory structure. Certainly food for thought on whether or not this makes sense. For the time being, according to my opinion, the answer is no. CBDC is not ‘just beyond the horizon’. In the long run, however, innovation may change the picture.

Gnan, E. and D. Masciandro (eds., 2018), Do we need central bank digital currency? Economics, technology and Institutions, SUERF Conference Proceedings 2018/2 , Vienna 2018. Referred to as SUERF (2018).

In the literature, there are many names for payment accounts that are held with a commercial bank, such as checking accounts, bank accounts, checking deposits or payment accounts. In this note, I will consistently use the name ‘payment account’. And a commercial bank may come in many shapes, but in this note it includes in principle any bank, except the central bank.

WRR (2019), Geld en schuld: de publieke rol van banken (in Dutch, translation is forthcoming), WRR report, 100, Den Haag, January 2019.

In some countries central banks already have run CBDC pilot projects. See for example M. Bergara and J. Ponce (2018), Central bank digital currency: the Uruguayan e-peso case, in SUERF (2018).

Note, however, that the decline in the cash to GDP ratio’s in most countries is almost completely driven by the decline in large-denomination bank notes. The ratio of low-denomination notes to GDP is usually much more stable, suggesting that cash holdings by the public are more stable than many analysts think (R. Judson (1018), Big note, small note: central bank digital currency and cash, in SUERF (2018)). However, it is rather probable that velocity of low denomination cash is declining as more and more small transaction are paid with contactless payments.

In both BIS (2018) and SUERF (2018) several varieties, that differ in technology and scope, are discussed in more detail.

S. Fernández de Lis (2018), Central bank digital currencies: features, options, pros and cons, in SUERF (2018).

See also P. Pichler and M. Summer (2018), Digital money, cryptocurrencies and central banks, in SUERF (2018).

For further detail, see the SUERF publication mentioned earlier, plus BIS (2018), Central bank digital currencies, Bank for International Settlements, Committee on Payments and Market Infrastructures, March 2018, and Riksbank (2018), E-krona project, report 2, Sveriges Riksbank, Stockholm, November 2018

See Riksbank (2018. Note that it is important that people can have only one of such a value-based token. If not, these tokens may easily take over the role of large-denomination bank notes in criminal transactions.

Riksbank (2018). See also F. Panetta (2018), 21st century cash: central banking, technological innovation and digital currencies, in SUERF (2018).

DNB (2018), 2017 Annual Report Amsterdam: De Nederlandsche Bank. See also W. Engert and B. S. C. Fung (2018), motivations and implications of a central bank digital currency, and F. Panetta (2018), 21st century cash: central banking, technological innovation and digital currencies, both in SUERF (2018).

See K.S. Rogoff (2016), The curse of cash. Princeton: Princeton University Press,or M. D. Bordo and A. T. Levin (2018), Central bank digital cash: principles & practical steps, in SUERF (2018).

Today, ECB policy rates are already negative and many observers expect them to be reduced further. It is clear that the ELB is certainly lower than zero. Some commercial banks already offer negative interest rates on private savings deposits, albeit only on balances above a certain level. Most wholesale depositors already receive a negative interest rate from their bank. But the presence of cash today still makes banks reluctant to go into deeply negative territory here. Note, however, that the arbitrage between paper cash and digital can be mitigated by a graduated system of transfer fees (Bordo and Levin, 2018), or by eliminating the one-to-one ratio between cash and CBDC.

Note that the central bank will also run a substantial reputational risk.

F. Panetta, 21st century cash: central banking, technological innovation and digital currencies, in SUERF (2018). Panetta also mentions some of the costs of CBDC for central banks, but appears relatively optimistic here.

Note that the costs of running the payment systems of the commercial banks are partly covered by the fees they charge their clients and also by the income on their commercial activities. Central banks of course can also charge their clients fees to cover this costs. However, central banks usually have no commercial activities. Commercial activities are not their primary tasks, the balance sheets of central banks are driven by their monetary policy operations and their lender of last resort operations. Those activities are not by definition very profitable.