Given the recent inflationary surge and banking turbulence, this policy note assesses the responsibility of major Western central banks (CBs). It complements my policy brief (#679: “The current Polycrisis vs the Global Financial Crisis”), which concludes that “CBs were perceived as key firefighters against crises and may now be criticized by some as pyromaniacs regarding their missions of monetary and financial stability”. For monetary (in)stability, the note reviews the inflationary factors at play, the role of the labor markets and the need for a strategic rethinking. For financial (in)stability, it discusses whether financial concerns may prevent CBs from restoring price stability and cases of either or both fiscal/financial dominance with consequences for the international monetary system. Focusing on the USA, the Euro Area, and the UK, it shows that CBs cannot be the sole firefighters and, hence, become the scapegoats for shocks that stress their limits.

Anyone who isn’t confused doesn’t really understand the situation. E. R. Murrow, Journalist, 1908-65.

In June 2023, several indicators on Western Advanced Economies (hereafter WAE, notably the USA), which are key for their central banks (CBs), painted a situation that had not been observed for decades:

In reality, we are living in a “polycrisis” that adds geopolitical wars (involving trade, energy, food, and finance, to the sequels of the COVID-19 shock. Given the inflationary surge and recent banking turbulence, I noted there that “CBs were perceived as key firefighters against crises and may now be criticized by some as pyromaniacs regarding their missions of monetary and financial stability”.

Let’s qualify this tough criticism by looking in turn at these two missions (and potential failures) in which CBs are involved. Here I focus on the major WAE (namely the USA, the EA, and the UK). Other large economies would deserve specific analyses. For instance, I leave aside Japan, which is still trying to get out of “deflation”, a situation in which China seems to be entering.

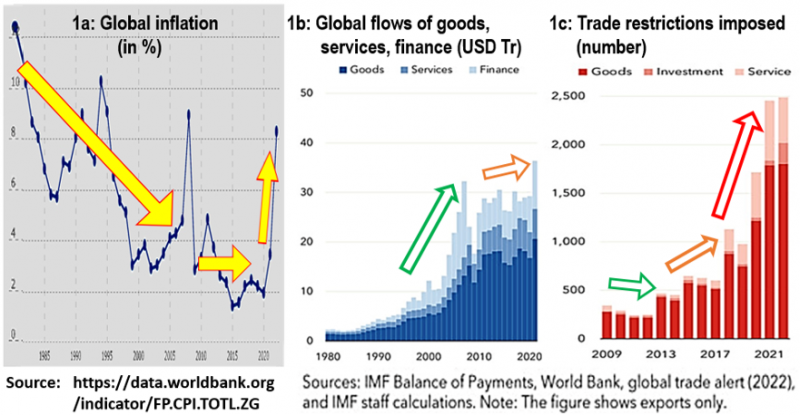

Price stability is a key goal of monetary policy, or “the” primary one for most CBs, de facto if not de jure. True, global inflation had decreased from double-digit peaks in the early 1980s-90s to around 3% in the last decade, before sky-rocketing in 2021-22 (Chart 1a). Structural, cyclical, and exceptional factors have been at play. They explain why the current labor markets and stagflation differ from those of the mid-1970s, and they help evaluate if there is a need for a CB’s strategic rethinking.

Chart 1: Globalization and slowing inflation until the rise of trade barriers

#1. Structural factors: Globalization left space for fragmentation, while “climateflation” is looming.

A wave of economic and financial globalization started in the 1990s (Chart 1b). Notably, this corresponded to the progressive integration of China as the “world factory”, India as “service provider”, and Russia as “energy supplier” (in particular for Central Europe). Lower costs in emerging economies made imports cheaper and put competitive pressure on firms’ margins and wages in advanced economies. Even during the GFC, trade barriers continued to be removed (see Chart 1c).

Nevertheless, as standards of living increased in emerging countries, this disinflationary process slowed down. It stalled with the Russian annexation of Crimea and resulting sanctions (2014), and with a rebound in trade barriers favored by the Trump Administration (2017). In 2020, the COVID-19 shock dislocated many global supply chains. In 2022, the Russian invasion of Ukraine prompted a second, larger, and tougher round of sanctions. Meanwhile, US-Chinese tensions are climbing again over both trade and Taiwan. Fragmentation seems to be with us now for a long time.

Among other structural factors, climate change and AI are looming, but analyzing their effects on inflation goes beyond this paper. Let’s just say here that climate change already increases inflation via mitigation and adaptation costs, including those related to physical risks (e.g., flooded factories) or transition risks (e.g., obsolete processes). For instance, the European Central Bank (ECB) is by now distinguishing “climateflation, fossilflation and greenflation” (see I. Schnabel). By contrast, the inflationary impact of AI looks less obvious. AI raises productivity gains and reduces some costs, but it affects employment, increases inequalities, and may jeopardize competition (see D. Acemoglu et al.).

More generally, CBs shall take all structural factors and their shifts into account when defining their strategy or reactions, and adapt to them as appropriate (cf. below the digital impact on finance).

#2. Cyclical factors: After the slow and long post-GFC recovery, COVID-19 opened one of the sharpest and possibly shortest cycles ever, as fears or bouts of recessions affect various countries in 2023.

COVID-19 was an unprecedented supply shock that initially made inflation negative in several advanced economies. This could have morphed into a deflationary spiral. Given the uncertainty and urgency of the crisis, WAE CBs relaxed their monetary policies, even if such policies are supposed to be more effective against shocks affecting the demand side first. Actually, huge fiscal supports were also activated, which would have boosted interest rates without the CBs’ accommodation.

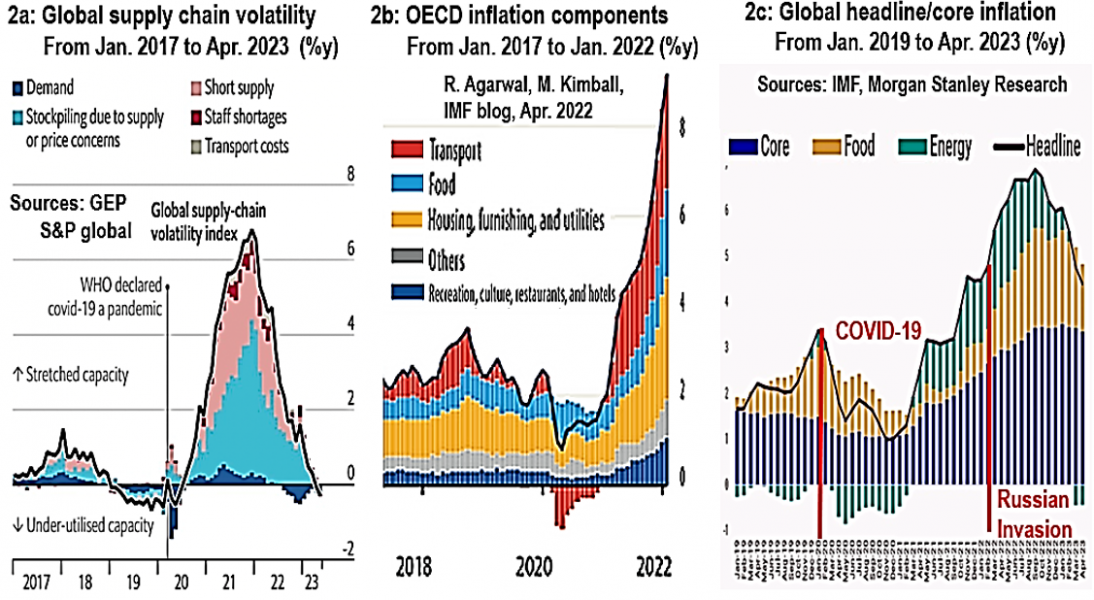

Yet, in 2021, supply factors remained important. Chart 2a illustrates their positive contributions to a supply-chain volatility index: mainly a spontaneous shortage of supply (pink) and a voluntary stock piling (pale blue); and, to a smaller extent, transport costs (grey) and a shortage of staff (red). Stock piling actually mixed supply and demand behaviors. This was the case with electronic chips, stored by intermediaries after being exported again. O. Blanchard called it a “toilet paper effect,” analogous to the storage of toilet tissue by panicking consumers at the start of the pandemic. By contrast, the contribution of mere demand (dark blue) to this volatility index remained moderate even after 2020. Nevertheless, this does not exclude that excess support for demand may also have fueled inflation.

Chart 2: Cyclical/exceptional factors: (2a) Supply-chain volatility; (2b/2c) Inflation components

https://www.imf.org/en/Publications/fandd/issues/2022/03/Future-of-inflation-partI-Agarwal-kimball

Indeed, Chart 2b breaks down various components of OECD inflation. After their fall in early 2020, most components bounced back as consumers spent money that had remained idle at the heart of the crisis, whether savings or subsidies. First, a catching-up process in goods implied higher energy prices and, hence, transport costs (in red). Then, in 2021, the demand for services grew, as illustrated by the rise of the “recreation, culture, restaurants and hotels” component (in dark blue).

Just before the Russian invasion of Ukraine on February 24, 2022, Chart 2b and 2c show, respectively, that OECD inflation was reaching 9% and global inflation was approaching 7%. Yet, these surges, not observed for 15 years, were still deemed by the IMF and CBs as transitory. This view was supported by receding supply-side volatility factors as of the end of 2021 (see Chart 2a again).

#3. Exceptional factors: The unforeseen and lasting Russian war in Ukraine has affected both core and expected inflation. CBs reacted but are now perceived as having done so too late.

The outbreak of war at the borders of NATO and the European Union was a new, sudden, and huge supply shock. It especially affected the cost of energy and food. Chart 2c shows an abrupt rise in the inflationary role of these two factors as of March 2022. True, the base effect for energy vanished after 2023 Q1, but “fossilflation” may become a structural factor as suggested above.

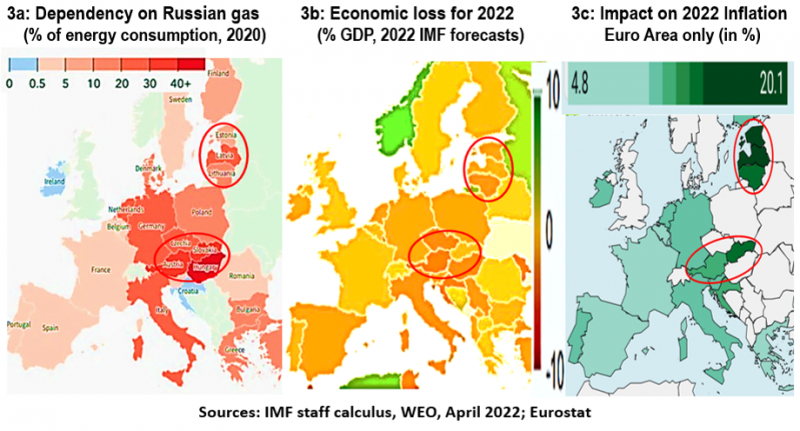

Regarding Europe, Charts 3a maps its gas dependency on Russia before the war. Chart 3b shows the impact of the war on growth in 2022 as it was forecast by the IMF in April 2022; and Chart 3c, the effect on inflation in the EA. Countries more dependent on Russia, like the Baltics, are circled in red. All have reduced their dependency, but their inflation remains very sensitive to the cost of energy.

Chart 3: The European case example of dependency on Russian gas and its impact on growth and inflation

How did authorities react? Fiscal policies had often already shifted from the “whatever it takes” approach of 2020 to shielding only specific items or people. The major Western CBs also modified the stance of their monetary policies in order to tackle stagflation, which is the worst scenario they may have to face. Indeed, monetary policy has then to avoid the risks of both a deflationary recession and an expectation-driven inflationary spiral.

In terms of liquidity, some major CBs had previously stopped reinvesting the amount of maturing bonds they had purchased via Quantitative Easing (QE), when tackling COVID-19. Then, most began to sell those bonds back to banks to mop up excessive liquidity (Quantitative Tightening, QT). This process has been gradual so as not to destabilize financial markets (see below for more on this).

In parallel, or soon after, CBs started to hike interest rates that had been dropped or maintained very low during COVID-19. Given the specific stimulus of massive US fiscal plans and the earlier rise of core inflation, the FED fired up as soon as March 2022. The hiking cycle of the Bank of England (BoE) has been slower and bumpier, including for fiscal and financial reasons also explained below.

#4. Role of the labor markets: Unemployment or wages have evolved differently from those of the mid-70s, and also among the major G7 areas under review, compounding inflationary pressures.

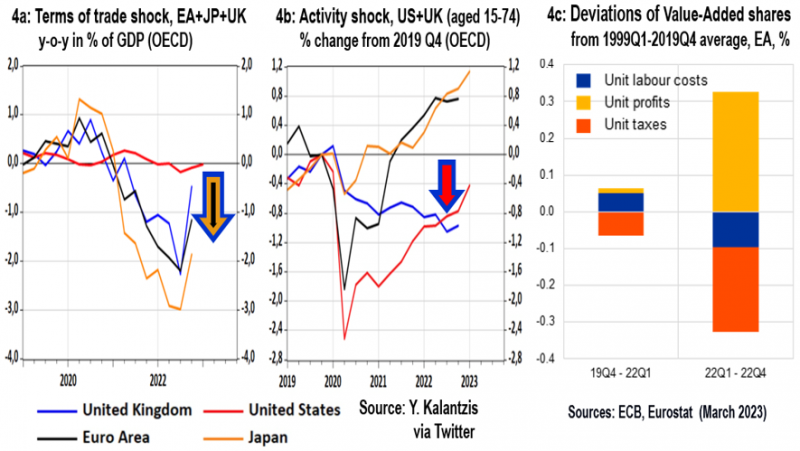

In the mid-70s, OECD stagflation meant both surging unemployment and surging inflation, triggered by the first oil shock (end 1973). The present WAE stagflation also displays weak growth, but paradoxically combined with tight labor markets, notably for demanded skills. This adds to inflation expectations, possibly reviving the Phillips curve. Yet price and wage settings have evolved, which complicates “policymaking in an age of shifts and breaks” (Ch. Lagarde). Thus, CBs monitor higher unit labor costs, e.g., in the EA, and/or the risk of a price-wage loop fueling inflationary expectations, e.g., in the USA.

As regards differences among major G7 areas. Chart 4a recalls the persistence of the terms-of-trade shock hurting growth in the EA (black line), Japan (yellow) and the UK (blue). This contrasts with the less foreign-dependent USA (red line) and, hence, the still decent US growth rates. Chart 4b in turn shows the loss in labor activity of people aged 15-74: not yet absorbed in the USA and again in the UK, but quickly offset by the EA social model or kept smaller in Japan. Indeed, the latter two areas do preserve employment at the expense of productivity and, hence, higher unit labor costs: see for the EA the positive blue square for the period 2019 Q4 – 2022 Q1 displayed in Chart 4c (measured as deviations from average).

Chart 4c also reveals even larger unit profits than usual (in yellow) in 2022 Q1 – 2022 Q4. This may fuel the “greedflation” thesis, in which many EA firms benefited from higher, more volatile prices and exacerbated inflation pressures. But it will not convince those who argue firms only tried and preserved their margins.

Chart 4: Negative US and UK labor activity shock (4b) versus EA concerns about unit labor costs (4c)

#5. Need for strategic rethinking? The ways to conduct monetary policy and the risk of fiscal dominance shall be reassessed, even if the jury is still out to confirm a new paradigm. In fact, most issues at stake are not novel, but their relevance is renewed, as briefly illustrated by four examples.

First, should the inflation target be changed? It is set at around 2% in most advanced areas. Now that the disinflationary process may become more costly, O. Blanchard revamps his proposal to raise it (to 3%). True, 2% is not taboo. Yet, this may damage the CB’s credibility as an opportunistic option. On the other hand, if the target can be credibly raised, this should raise inflation expectations and, hence, nominal market rates without changing expected real rates … those which matter in economics!

Second, how long are monetary lags? Namely, is there enough in the pipeline as headline inflation recedes in mid-2023? For M. Friedman, lags are “long and variable” (one to two years). For the French CB Governor, F. Villeroy, let’s wait, as lags may be slower for three reasons: the stronger balance sheets of firms and households thanks to COVID-19 subsidies and/or savings; the general increase in fixed rate mortgages; and the higher GDP share of services that are less interest-sensitive. For the Dallas FED Governor, Ch. Waller, viewed as hawkish, lags have become shorter because “big shocks travel fast” and “size matters” with non-linear effects. He also notes that, thanks to forward guidance, the US yield curve started to steepen as early as September 2021, six months before the first hike.

Both may be right, with some shorter lags (below 1 year) and others delayed (after 2 years). This is partly why both the FED and ECB have shifted from forward guidance to “pure” data-dependency. Meanwhile, economists already wonder whether the neutral rate will be higher after this cycle. This matters, inter alia, for the sustainability of public debt ratios, which depends on the relative speeds of changes in the numerator (interest rate) and in the denominator (growth rate).

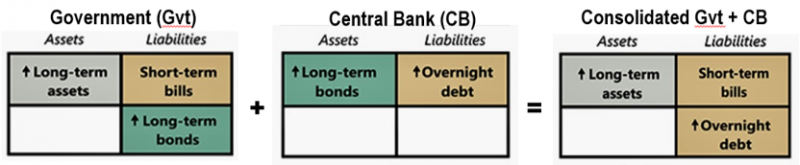

Third, shall the QE advantages be challenged? First, if the balance sheets of the Government and the CB are merged, long-term sovereign bonds repurchased by CBs have de facto become short-term liabilities vis-à-vis banks with excess liquidity redeposited at the CBs (see Table 1). This is largely why the ECB has just decided not to remunerate any longer required reserves. Second, QT now implies losses since higher long-term rates have decreased the value of securities that CBs sell back. True, QT losses should be compared to both previous profits partly redistributed to shareholders, and the lower service of public debt for many years. Besides, CBs are not profit-driven. However, some fear their operational independence may be questioned if their shareholders have to compensate for huge losses.

Table 1: Balance sheets of the government, central bank and their consolidation

Last but not least, is there a risk of “fiscal dominance” over monetary decisions (as hinted by the previous example)? Governments and CBs may act in concert to stabilize the economy, or even coordinate, especially at times of crisis. This is what happened in 2020 when the lockdowns put the economies in a “medically-induced coma”. As with doctors, the provision of exceptional medicine (liquidity) may turn out to have been excessive. Fiscal policy also practiced a sort of “helicopter money”, either directly (Trump’s checks to households) or indirectly (by subsidizing firms or reducing taxes). Meanwhile, QE prevented a crowding out of the private sector by banks that were buying larger bond emissions to finance larger fiscal deficits. But then, the financing of disproportionate fiscal deficits may have implied excessive money growth (as suggested by Morgan Stanley for the USA).

True, monetary policy is not conducted in a vacuum. However, during and after crises, fiscal constraints may overburden CBs. The same may happen with financial concerns.

Transmitting clear monetary signals requires stable and resilient financial systems. Most major CBs have thus been progressively tasked with a financial stability mission, whether officially or indirectly. Let’s see how financial turbulence may have conflicted with the conduct of monetary policy or, more generally, whether growing financial wars challenge the international monetary and financial system.

#1. Banking turbulence: They have remained hitherto limited despite regulatory/supervisory holes.

In short, after 2009, reforms in financial regulation and supervision have helped to: first, strengthen the capital and liquidity ratios of banks, required to have more transparency and better governance; second, limit the “Too-Big-To-Fail” (TBTF) problem by better monitoring globally systemically important banks (G-SIB) and improving ways to close insolvent financial institutions; and last, regulate entities or activities of the shadow banking sector, or restrict the exposure of banks to the latter. Thus, as summarized in my 2023 paper, finance was part of the 2008 problem and part of the 2020 solution.

Why then the banking turbulence in March 2023? The US banks that failed were mid-sized ones, partly left aside from regulatory reforms during the Obama Administration and further exempted under the Trump one. Moreover, they were badly managed and poorly supervised, notably for liquidity/interest rate risks. The electronic possibility of instantaneous deposit outflows and the role of social media in propagating rumors created a new type of “snapshot bank run”. US regulatory proposals are now under review. More generally, asset and liability management and supervision may have to live with this new type of shock (see U. Bindseil et al. on how to respond to such outflows).

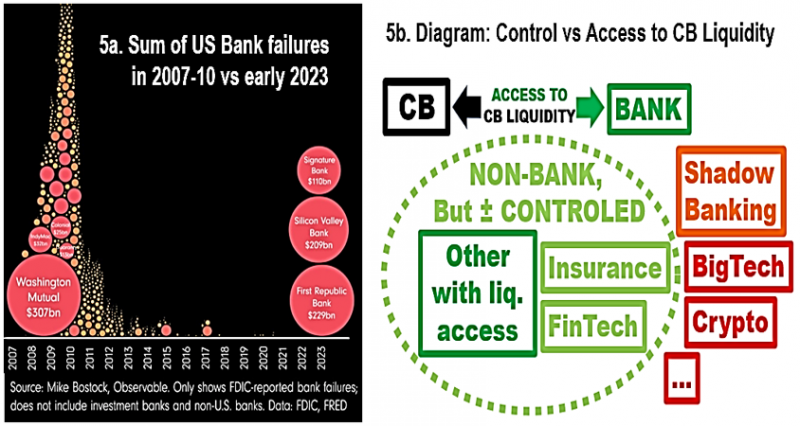

Yet, there was little contagion to Europe, albeit Chart 5a shows the 2023 sum of bankrupt capital ($ ½ trillion) approached that of 2008-10. Basel standards seem to have been better applied in Europe, except in the specific and well-known case of Credit Suisse (with an additional TBTF dimension).

Chart 5: Comparison of US bank failures in 2008-11 and 2023; Access to CB liquidity in return to control

#2. Separation principle: CBs may rescue illiquid banks but not insolvent ones so as to avoid “financial dominance”. Yet new risks also emerge from and for non-banks.

Banking insolvency requires a bailing in by the shareholders or a bailing out by the state. By contrast, CBs are supposed to deal with illiquid but solvent banks. This separation principle remains key to avoid “financial dominance”. Otherwise, CBs may be constrained when hiking key rates as needed to restore price stability, especially as “hiking cycles generally coincide with bank distress” (see I. Schnabel). On the other hand, at times of crisis, illiquidity and insolvency are harder to disentangle.

Only banks (dark green in Diagram 5b) access CB liquidity as they issue the bulk of money, which is a common good. In return, they are strictly “controlled” (meaning “regulated” and “supervised” in terms of risks taken). Insurance companies (pale green) do not access CB liquidity, nor do FinTechs or most other financial intermediaries that do not receive deposits. Yet, many of those may be owned by banks. This may also blur the separation principle, notably during crises, like with the rescue of the bank ING when the collapse of Lehman Brothers jeopardized ING’s insurance activities and, hence, the stability of the whole conglomerate.

Worse, better bank regulations may have counterproductive effects. Shadow banking (orange) has grown, and contagion risks persist. This is compounded by the competition of BigTechs, without speaking about the crypto-sphere (all in red). BigTechs increasingly interfere in the monetary and financial areas via payment services or their attempts to launch stablecoins (cf. DIEM). They benefit from the regulatory principle “same activity, same rule”. Yet, their mere size is clearly a problem.

#3. Policy conflict: In the fall of 2022, the UK turmoil was an astonishing experiment on the combined risks of fiscal and financial dominance. It offered economists an unbelievable laboratory test.

In a nutshell, the surprising announcement of an ill-founded fiscal deficit by the British Government under Liz Truss triggered a surge in long-term rates. This jeopardized, inter alia, the balance sheets of some UK non-bank financial intermediaries, like pension funds. Short of liquidity, the latter could not easily sell their illiquid assets, like forests. As a result, the BoE had to reverse its recent process of QT, which was justified by excessive inflation, via a temporary QE “whatever the scale”.

Under market pressure, Liz Truss had to resign, and QT could be reengineered. Yet, the BoE has since been viewed as often “behind the curve”, given the high UK interest-rate sensitivity.

#4. Sanctions and financial wars: Sanctions can be effective, but with unintended effects challenging the “Pax Americana”, including via payment systems, and, for some, even the role of the dollar.

Trade and financial sanctions often go together to limit circumvention. Applied to Russia and, for different reasons, China, they are effective. But they also penalize the people of targeted countries, often more than the authorities, and spill back via retaliation, inflation and fragmentation. The IMF has computed that fragmentation, compounded with trade, debt and climate problems, could cost up to 7% of world GDP (see also the Atlantic Council Dashboard). Here I only illustrate three points of concern for CBs. Although based more on anecdotal evidence than research, those three may potentially affect the stability and efficiency of the International Financial System.

First, the role of crypto transfers. Given their opacity, they may only help circumvent sanctions in addition to the risks they hide. This is one more reason to regulate them, as voted for in Europe.

Second, the quest for financial sovereignty (or, at least, for shelter from sanctions given the extra-territorial rules of US banks). The Western ownership of the main international payment systems has contributed to alternative projects. This is notably the case in the BRICS (e.g., the Chinese CIPS) and new trade agreements to not to pay with dollars. This also includes the launching of Central Bank Digital Currency (CBDC), including in Europe. A goal is to preserve monetary autonomy against foreign and/or private stablecoins, notably dollar-backed ones. But once again, CBDC is generally explored through an intermediated process involving banks, with safeguards to avoid destabilizing the banking sector.

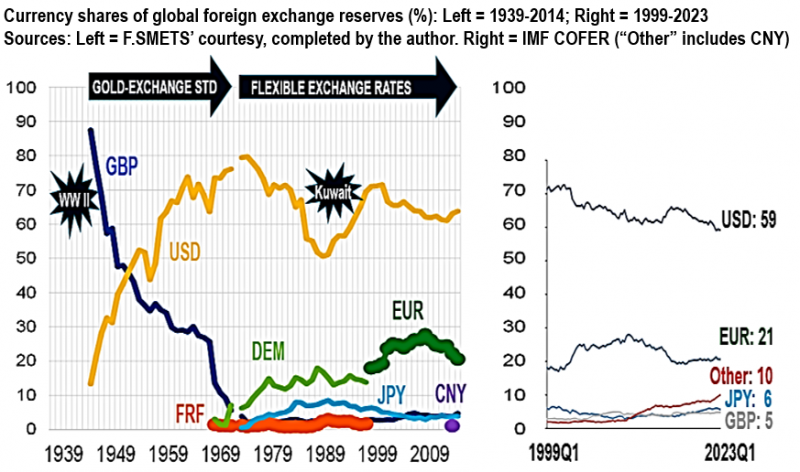

Last, the prediction by some of a “de-dollarization” (questioning the role of the dollar as the primary invoice and/or reserve currency). Recent research illustrates the impact of sanctions on trade and on the use of the dollar as an invoice currency (see Antoine Berthou, Banque de France). Nonetheless, so far, Chart 6 suggests it takes huge shocks and lasting sequels to unwind the network prevalence of a reserve currency. For the dollar to dethrone the pound, a World War and a new exchange-rate regime were needed. The collapse of the latter regime, the Kuwait war, the Euro creation, and the Yuan internationalization have only slowly reduced its role hitherto.

Chart 6: Share of the dollar in the total of reserve currencies, officially held by central banks or treasuries

These three concerns would require another paper. Let’s just add before concluding that, while they may matter for CBs (or even push them to react, as with CBDC), they go far beyond the CBs’ realms.

To sum up, central banks are neither pyromaniacs, who light new fires when trying to extinguish others, nor panaceas who can put out all fires, at the risk of otherwise being overburdened.

When considering their mission of price stability, this note summarizes the complex changes in structural, cyclical, and exceptional factors behind the recent surge in inflation. Compounded by surprising shifts in the labor market, these changes justify further work on their monetary strategies, including the impact of climate change and AI.

Similarly, regarding financial stability, the note demonstrates how financial concerns may hamper their action in view of restoring price stability. In addition to the risk of fiscal dominance, the note also provides illustrative cases of financial dominance that may jeopardize the separation principle. Last, it evokes further looming financial shocks, including digital ones at the international level.

True, central banks had been excessively praised for reducing inflation until the mid-2000s, which owed a lot to globalization. Then, during and after the Global Financial Crisis, they were overly solicited as “the only game in town”. Now, uncertainty requiring prudence and unprecedented geopolitical shocks having surprised them, they may be seen as having been too permissive with the benefit of hindsight. Yet, they cannot be the sole firefighters. And they should not become the scapegoats for shocks that stress the limits of their power when the “boundaries of the stability region” are tested (see the 2023 Annual Report of the Bank for International Settlements).