This paper discusses two concerns that central bankers have associated with CBDC, namely (i) risk of structural disintermediation of banks and centralization of the credit allocation process within the central bank and (ii) risk of facilitating systemic runs on banks in crisis situations. The paper proposes as solution a two-tier remuneration of CBDC. While the first tier would be attractively remunerated, the second would not. By choosing the per capita allowance of tier one deposits and the remuneration rates of the two tiers, the central bank can control the quantity of CBDC such that it is predominantly used as means of payment, and not as large scale store of value.

Both academics and central banks have recently started to analyze merits and dangers of introducing central bank digital currencies (CBDC), i.e. some form of central bank money handled through electronic means and accessible to the broad public.2 CBDC could therefore be considered a third form of base money, next to (i) overnight deposits with the central bank, currently available only to banks, specific non-bank financial firms, and some official sector depositors; (ii) banknotes, being universally accessible but arguably of limited efficiency and relying on old technology. Some publications distinguish the case of “wholesale” and “general purpose” CBDC, the former being only accessible to certain firms, while the latter universally accessible to all households. This paper discusses issues relating to general purpose CBDC implemented in the form of deposit money. A number of quite diverse benefits of CBDC have been put forward in the literature. The more important ones are briefly discussed below.

Efficient retail payments

CBDC offers a number of advantages with regards to the convenience, efficiency, stability and accessibility of retail payment. While electronic payments with all their efficiency gains have been possible for some decades on the basis of commercial bank money, offering electronic payments directly in central bank money could have additional advantages. A comprehensive analysis of these justifications of CBDC can be found for example in Sveriges Riksbank’s (2018) second report on the e-krona project. Collapsing demand for cash in the absence of CBDC would imply that citizens would no longer have access to the central bank balance sheet. In that state of the world, trust in the currency would entirely depend on trust in financial intermediaries issuing and managing commercial money.

Prevent illicit payment and store of value with central bank money

This argument, which assumes a discontinuation or at least strong reduction in the role of banknotes, is developed in most detail by e.g. Rogoff (2016). Obviously, this motivation of CBDC would not apply if CBDC circulate as anonymous token money even for high amounts. Some, like Ha ring (2018), who are strongly pre-occupied with the privacy of payments and fear that internet retailers and state authorities use payments data to eventually curb the freedom of citizens, will not agree with this specific argument for CBDC.

Allows overcoming the ZLB as one may impose negative interest rates on CBDC

For example, Dyson and Hodgson (2016) argue that “if digital cash is used to completely replace physical cash, this could allow interest rates to be pushed below the zero-lower bound.” Rogoff (2016) develops this argument in detail. By allowing overcoming the zero-lower bound (“ZLB”) and therefore freeing negative interest rate policies (“NIRP”) of its current constraints, a world with only digital central bank money would allow for – according to this view – strong monetary stimulus in a sharp recession and/or financial crisis. This could not only avoid recession, unemployment, and/or deflation but also the need to take recourse to non-standard monetary policy measures which have more negative side effects than NIRP. Opponents of NIRP will obviously dislike this argument in favor of CBDC, and will thus see CBDC potentially as an instrument to overcome previous limitations of “financial repression” and “expropriation” of the saver.

Financial stability and banks’ moral hazard

This argument in favor of CBDC relate to the vision that CBDC is a tool to make feasible the “sovereign money” idea, i.e. a monetary system in which banks would no longer “create” sight deposits and thus means of payment (Ha ring, 2018, 214-223, Mayer and Huber, 2014). For example, Dyson and Hodgson (2016) consider that CBDC “can make the financial system safer: Allowing individuals, private sector companies, and non-bank financial institutions to settle directly in central bank money (rather than bank deposits) significantly reduces the concentration of liquidity and credit risk in payment systems. This in turn reduces the systemic importance of large banks and thereby reduces the negative externalities that the financial instability of banks has on society. In addition, by providing a genuinely risk-free alternative to bank deposits, a shift from bank deposits to digital cash reduces the need for government guarantees on deposits, eliminating a source of moral hazard from the financial system.” (See also Huber, 1999, 5-6).

Seignorage income redirected to state (and citizens)

For example, Dyson and Hodgson argue that CBDC “can recapture a portion of seigniorage and address the decline of physical cash…” Also e.g. Mayer and Huber (2014) give much prominence to the assumed fiscal advantages of sovereign money. They estimate that e.g. in the euro area annual additional state revenues would be in the order of magnitude of more than EUR 100 billion (assuming a pre-2008 interest rate level). Obviously, with the current low levels of interest rates, and the outlook on future interest rates as it is priced in yield curves, this argument has become rather irrelevant for the time being.

To isolate the more obvious, humble case for CBDC, namely that it could serve as an efficient retail mean of payment, from the perceived danger that CBDC leads unintendedly to a sovereign money financial system (as it would boost so much the relative attractiveness of central bank money relative to bank deposits) it seems essential to be able to steer the issuance of CBDC in such a way that it serves the efficiency of retail payments, without necessarily putting into question the monetary order by making CBDC a major form of store of value. It will be argued in this paper that such a steering is feasible, and with less fundamental change than inherent e.g. in the proposal of Kumhof and None (2018). The well-tested tool of tiered remuneration seems to be a way to ensure that the volume of CBDC will be well-controlled. A system of financial accounts calibrated towards the euro area will illustrate the mechanics and implications of CBDC and will allow presenting flow of funds implications.

CBDC has both found support, and caused strong concerns, with regards to its impact on the structure and scale of bank intermediation. Advocates of “sovereign money” see bank disintermediation as precisely the goal of CBDC. Already Huber (1999, 18), a strong advocate of “sovereign money”, had correctly identified the financial account implications of central bank money replacing bank-issued sight deposits. Others have equally strongly rejected the idea of CBDC inflating the central bank balance sheet at the expense of deposit funding of banks. For example, Pollock (2018), in a testimony to the Subcommittee on Monetary Policy and Trade of the Committee on Financial Services United States House of Representatives, argues that CBDC would lead to various distortions precisely because of bank disintermediation. In sum, according to Pollock (2018): on one side the central bank would benefit from an unfair competitive advantage in deposit collection and amass undue power and market share (also likely misusing its regulatory powers to further strengthen its unfair advantages), on the other hand it would have competitive disadvantages in credit provision, which it would however ignore, leading to inefficiency, conflicts of interest and financial losses that eventually the taxpayer would have to bear.

CPMI-MC (2018, 2) also express somewhat similar concerns that structurally, CBDC could have negative effects on credit allocation and thereby economic efficiency. Also Carstens (2019) reiterates such worries. Finally, CMPI-MC (2018, 2) emphasizes the cross-border issues that CBDC may create. Indeed, also for banknotes, foreign demand has been a major factor in recent decades (e.g. Jobst and Stix, 2017). According to this view CBDC, if offered in the same perfectly elastic way as banknotes, could facilitate further the cross-border access to central bank money.

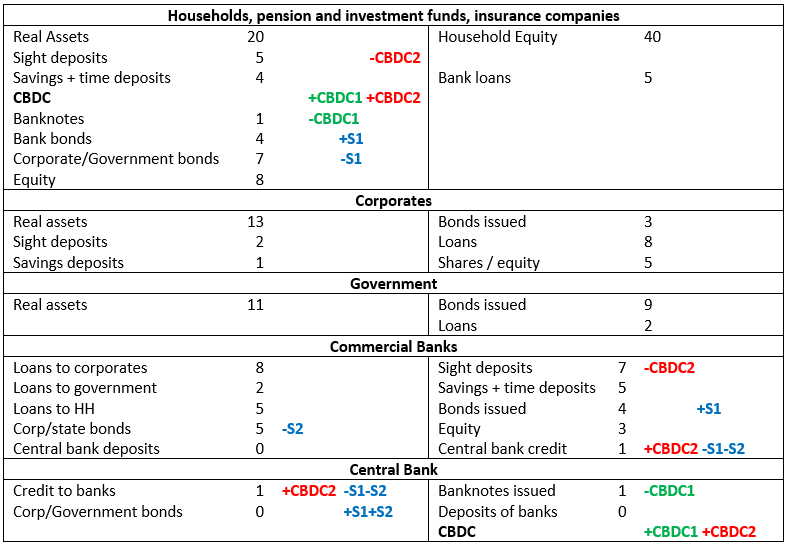

Below the creation of CBDC is captured in a financial account system, which very broadly replicates the euro area financial accounts as of Q2 2018 (as provided in the ECB Statistics Warehouse or the ECB Economic Bulletin). The accounts are simplified in particular with regards to netting and that the non-bank financial sectors (OFIs and ICPFs, i.e. “other financial institutions” and “insurance companies and pension funds”) have been left away, or been broadly integrated into the household sector. Also, the ECB’s asset purchase program is not reflected.

If households substitute banknotes with CBDC, then central bank and commercial bank balance sheets do not really change. However, if households substitute commercial bank deposits with CBDC, then this would imply a funding loss for commercial banks and could lead to “disintermediation” of the banking sector. In particular sight deposits with low remuneration could be expected to shift at least to some extent into riskless CBDC, leading to a loss of commercial banks’ funding of equal size. Banks would have to try to offer better conditions on their deposits in order to protect their deposit base as much as possible – but this would imply higher funding costs for banks and a loss of commercial bank “seignorage”. Below, the creation of CBDC has thus been split into two parts: CBDC1 which substitute banknotes and CBDC2 which substitute deposits with banks. It seems most likely that indeed CBDC would do both of those, but it is unclear with what weights. The effect of CBDC1 on the rest of the financial accounts is neutral, but the effects of CBDC2 are not: CBDC2 lengthens the central bank balance sheet as central bank credit will have to fill the funding gaps of the banks. The central bank may want to avoid this effect by purchasing government and corporate bonds, whereby the source of the bonds could be either households or banks, being captured in the financial accounts by S1 and S2, respectively. In the former case, it has been assumed here that the households will not keep the money obtained in the form of bank deposits, but would purchase bank bonds that the banks would in addition issue (however, from a financial account perspective, it makes no difference if the purchases of bonds by the central bank from households imply additional deposits with banks or additional capital market investments of households into bank bonds).

While CBDC1 appears uncontroversial as it merely substitutes one form of central bank money into another without changing the rest of the financial system, CBDC2 increases the dependence of banks on central bank credit and decreases sight deposits with the banking system. Both S1 and S2 have positive effects in the sense that they reduce again the dependence of banks on central bank credit. CBDC2 will obviously have effects on funding costs of the banking system, as typically central bank credit and bond issuance are more expensive than the remuneration rate of sight deposits (except in unusual circumstances, as the ones prevailing e.g. in the euro area since 2014, in which obtaining credit from the central bank was partially possible for banks at negative rates, while sight deposits of households with banks remained non-negative). Moreover, a larger recourse to central bank credit could lead to collateral scarcity issues and the question whether the central bank collateral framework becomes so crucial from a credit allocation perspective that one would observe an effective centralisation of the credit provision process. Both effects will be analysed further in the next two subsections.

Figure 1: Financial accounts representation of CBDC (numbers in trillion of euro)

Effects on bank funding costs of CBDC2

Following Juks (2018, section 4.2-4.3), one needs to understand what impact CBDC will have on average funding costs of banks, and therefore on bank lending rates (see also e.g. Engert and Fung, 2017). In addition, it should be understood how this may impact monetary policy interest rate setting of the central bank and the seignorage income of the central bank. Bank funding costs will obviously increase because a cheap funding source (sight deposits) decreases, and more expensive funding sources (central bank credit or bank bond issuance) have to take over. The central bank would have to compensate the implied tightening of financial conditions caused by a decrease of cheap sight deposit financing of banks by lowering the monetary policy rate. The extent of the required lowering of short-term interest rates would depend on the size of CBDC2, on the relative share of bank funding in the economy, and on the spread between the other bank funding rates with the monetary policy operations rate. Moreover, substitution effects from bank-based to capital market-based financing of the economy would impact on the overall needed adjustment of central bank rates. The fact that bank funding is only one part of overall funding of the economy implies that the central bank will not reduce the short-term interest rates in a way that bank funding costs are stabilized, but only partially so. Therefore, in the new equilibrium, banks will have lost competitiveness and will lose some market share relative to other forms of funding (though capital markets and non-bank intermediaries).

Increase of banks’ reliance on central bank credit, collateral constraints, and centralisation of credit allocation process?

To what extent could CBDC undermine the decentralised, market-based financing of the real economy by increasing massively the central bank balance sheet, and thereby making it, either via increased central bank securities holdings, or via an increased funding of banks through central bank credit, an important (but potentially inefficient) element of the credit allocation process?

State liabilities can be stores of value for households, in particular if they are matched, in the state balance sheet, by real assets that the state owns. However, probably the state would not want to become a financial intermediary for household savings, which would happen if the state re-invested proceeds from issuing debt to households in the form of financial assets, or in the form of real assets not linked to state tasks, just for the sake or re-investment. This logic may also be applied to central banks in a somewhat different way as central banking starts from the liability side: to the extent they issue means of payment, they need to re-invest the proceeds from doing do. However, the central bank probably does not want central bank money to become a large-scale store of value, i.e. investment vehicle, as this would mean that the central bank would become a financial intermediary. Turning to the asset side of the central bank balance sheet, one may note different views of central banks on what is the best match with its monetary liabilities: The Fed and the Bank of England systematically invested the proceeds from the issuance of banknotes into government paper. The Deutsche Bundesbank in contrast traditionally considered exposures of the central bank to the government as problematic and therefore preferred assets in the form of loans to banks collateralised with high quality securities or bills of exchange.

In view of the outstanding levels of government debt in developed economies (end 2018 levels for e.g. the euro area and UK around 85%; US around 105%; Japan around 235%), and the much lower level of banknotes in circulation so far (around 10% of GDP for advanced economies, and 8% for emerging economies, see e.g. Riksbank, 2018, 6) it would appear that there would be some scope for CBDC2 to be matched on the central bank asset side with higher holdings of government bonds, such that neither (i) the reliance of banks on central bank credit would need to increase, nor (ii) would the central bank have to hold a credit risk intense portfolio of securities. Whether the government bonds would come from the private non-bank sector or from the banks should not matter in the sense that the supply elasticities of the different sectors should reflect the value each sector assigns to government bonds, and therefore buying the bonds from the cheapest sources could naturally be assumed to be welfare maximising. In any case, currently at least the central banks of the UK, Japan and the Euro area hold large QE related portfolios that created large amounts of excess reserves of banks, that would provide scope for CBDC2 of at least the size of banknotes in circulation before reserve scarcity would emerge (without any further purchases of government bonds). Moreover, once the potential for matching CBDC with government exposures would have been exhausted, the central bank can still try to minimise the impact of the lengthening of the central bank balance sheet on the credit allocation process by aiming at diversified exposures to the private sector (e.g. outright holdings of various securities types and issuers proportional to market capitalisation; credit operations with banks against a broad collateral set).

In so far, it could be argued that there is some scope for CBDC2 before the central banks would have to enter or extend particular credit exposures to the private sector, and thereby play a potentially larger role in the credit allocation of the economy, which may eventually be negative for the overall efficiency of the economy. Only if CBDC2 takes even much larger dimensions, such as desired by the promotors of sovereign money, then an issue relating to the centralisation of credit would emerge.

Cyclical bank disintermediation through CBDC

Mersch (2018), amongst others, has emphasized the destabilizing effects of CBDC in a financial crisis, namely its facilitation of a run on the banking system. CPMI-MC (2018, 2) also supports the view that CBDC could make worse bank run dynamics in a crisis. A run on commercial banks can take three forms in principle3, if one makes the distinction from the perspective of where the deposits flow to, namely: “R1”, into deposits with other banks, i.e. within the banking system; “R2”, into banknotes, i.e. the classical physical bank run where queues could arise in front of bank branches and ATMs; “R3”, into non-bank deposits with the central bank, which in the past decades was limited to deposits of official sector institutions, but in the future could be facilitated by CBDC. Note that R2 and R3 are observable in aggregate accounts while R1 is not. Indeed, R1 does not become visible in the aggregate accounts until the bank benefitting from deposit inflows has paid back all of its central bank credit. Moreover, R1 would have to be extracted from the excess reserves of banks which are also influenced by R2 and R3 (and, in reality, there are obviously not only two banks).

E.g. Kumhof and Noone (2018, 34) are well aware of the possibility to address CBDC’s potential structural and cyclical bank disintermediation through applying unattractive and/or negative interest rates on CBDC. However, they are skeptical that the tool of negative interest rates will always be sufficiently effective in crisis times, also because of political constraints on imposing highly negative rates. In this section, it is proposed to solve the problem of political acceptance of very low interest rates on CBDC by differentiating remuneration according to the amount of deposits held, i.e. “tiering”. Actually, such reserve tiering systems have often been applied by central banks for the remuneration of deposits, and exactly for the purpose to control the total amount of deposits. Under such a system, a relatively attractive remuneration rate is applied up to some quantitative ceiling, while a lower interest rate is applied for amounts beyond the threshold. The Eurosystem has applied such tiering systems for deposit accounts of public sector institutions, notably of domestic government and foreign central banks or sovereign wealth funds. Regarding the remuneration of government deposits, for example, article 5 of the Eurosystem’s DALM guideline4 specifies that a two-tier system applies as follows:

Similarly, the Eurosystem reserve management services (ERMS5), granting accounts to foreign central banks and public sector funds, also typically foresee the differentiation between a more attractive rate applying up to some limit, and a less attractive one without limits. If the remuneration rate for tier two deposits is sufficiently unattractive, then the amount of such deposits should be low, or even zero. The central bank should also be able to counter, through an as aggressive as needed lowering of tier two remuneration rates, the inflow of additional deposits in a financial crisis context.

In sum: central banks have ample experience with tiered remuneration systems. These could be readily applied to deposit-based CBDC and could address the structural and the financial crises related bank disintermediation issues without exposing households using CBDC for payment purposes to (perceived) final repression. Of course, an undue structural or transitionary increase in CBDC at the expense of banks could also be addressed by a single tier system in which the interest rate applying to CBDC in general would be sufficiently low (or temporarily lowered). However, a two-tier system seems to have important advantages:

The central bank could also provide a commitment with regard to the quantity of tier one CBDC. For example, it could promise to always provide per capita a tier one quota of e.g. EUR 3000, implying an amount of total tier one CBDC for households of around EUR 1 trillion (assuming an eligible euro area population of 340 million; the allowances of minors could be either set to zero or they could be allocated to a parent’s CBDC account). To recall: banknotes in circulation in the euro area are somewhat above EUR 3500 per capita (summing up currently to around EUR 1.2 trillion); securities holdings of the Eurosystem (including both investment and policy portfolios) are currently around EUR 3 trillion; and the banking system has excess reserves close to EUR 2 trillion. Everything else unchanged, there would thus still be no need for large scale credit operations with banks if CBDC of a total amount of EUR 1 trillion would be issued now. The central bank could moreover commit to increase the tier one CBDC quota when the amount of banknote in circulation decreases. An amount of EUR 3000 for tier one CBDC could be interpreted as covering the average monthly net income of euro area households, such that the normal payment function of money would be covered. CBDC tier one allowances for companies would not necessarily have to be high, as it could be argued that the main objective of CBDC is to serve citizens. When estimating how tier one CBDC allowances would be translated into total CBDC volumes, it should on one side be taken into account that not all CBDC accounts will be opened rapidly, and maybe some households will never open an account, or will not hold the full tier one allowance on the account. On the other side, some households will be willing to hold tier two allowances.

For corporates (financial non-banks and non-financials), the tier 1 allowance could be set to zero, or alternatively it could be calculated to be proportional to some measure of their size and thereby presumed payment needs. Simplicity and controllability of the assignments would be essential. If foreigners would be eligible to open accounts, then they would always have a tier one ceiling of zero. Finally, a deposit based CBDC framework could in principle be complemented by an anonymous token-based CBDC. If so, then the anonymous token-based part would be remunerated at the same level as account-based tier two CBDC.

The tier 1 remuneration rate r1 could be set in principle at a relatively attractive level, which could be the rate of remuneration of banks’ excess reserves, and it could in addition be specified that it could never fall below zero. Tier 1 CBDC could even be remunerated at the central bank target short term market interest rate (the operational target rate). This would make tier 1 CBDC certainly more attractive than sight deposits with banks, as the latter rarely have such a remuneration and since banks may be considered, despite deposit insurance, as slightly less secure than the central bank. Still, as tier 1 deposits are limited, this should not lead to a dislocation of deposits beyond the aggregate ceiling. The tier 2 remuneration rate r2 should be set such that tier 2 deposits are rather unattractive as store of value, i.e. less attractive than bank deposits or other short-term financial assets, even when taking into account risk premia. The two rates could co-move in parallel with policy interest rates, with in addition some special provision when the zero lower bound territory is approached. The rates would themselves not be regarded as policy rates. Moving the rates would simply serve keeping a similar spread over time to other central bank rates, and thus in principle to other market rates. This would stabilize over time the incentives to hold CBDC (except in crisis situations in which r2 should be even lower compared to r1). Of course, the existence of banknotes, which are invariably remunerated at zero, creates a variable spread between the remuneration of banknotes and CBDC, which may also have quantitative effects on both.

Initially, for example the following remuneration could be considered by the ECB: r1 = max(iDFR, 0); r2 = (iDFR – 2%), i.e. r1 would equal the rate of remuneration of excess reserves, with however a zero lower bound applying, while r2 would be two percentage points below the remuneration of excess reserves, however without floor. Alternatively, the remuneration rate of tier two could be set to never exceed zero, but to get negative when the deposit facility rate falls below 2%, i.e. r2 = Min(0, iDFR – 2%). This would ensure that tier two CBDC is never more attractively remunerated than banknotes in circulation. Moreover, the remuneration rate of tier two CBDC could be lowered exceptionally in crisis times, i.e. such as to be lower than what would be implied by the remuneration formulas mentioned above, such as to prevent a run on the banking system into CBDC.

This paper tried to further demystify CBDC, also by representing it in a simple system of financial accounts which allows capturing its flow of funds implications. Moreover, the paper revisited the question how to address the risk, rightly stressed in the literature, that CBDC could structurally, or cyclically (in relation to financial crises) disintermediate the banking system. A simpler and less innovative alternative to the approach of Noone and Kumhof (2018) is developed, which relies on a tiered remuneration of CBDC, in line with long-tested central bank logic and practice. It was at the same time acknowledged that the control of CBDC quantities is not equivalent to the control of the impact of CBDC on the financial system, since CBDC might be a catalyst for the further shrinkage of bank balance sheet at the benefit of non-bank intermediaries, in particular if CBDC accounts offer relatively comprehensive account services such that many households may no longer feel a need to have a deposit accounts with banks.

As remarked by Carstens (2019, 10), central banks are not there to “put a brake on innovations just for the sake of it”, but to ensure that implications of major changes are well understood so “that innovations set the right course for the economy, for businesses, for citizens, for society as a whole”. From this perspective, this paper may suggest that central banks could be somewhat open to studying CBDC, although the overall business case6 and the precise risks to change the financial system in a disruptive way need further analysis. This conclusion seems similar to the one of Juks (2018), although Juks is less assertive on the tools to address possible unwarranted effects of the introduction of CBDC. The overall business case for CBDC will also still depend on preferences of households as money users and voters. In progressive countries, in which the demand for banknotes falls rapidly and in which conspiracy theories about a deliberate attempt of authorities to strengthen control of citizens and/or enhance the ability to exert financial repression power through the discontinuation of banknotes may be less popular, a business case for CBDC seems relatively plausible. In contrast, in countries which are, with regard to money, conservative and emotional, and are possibly even characterized by mistrust into central banking, introducing CBDC would probably have more costs than benefits until sentiments change.

Barrdear, J. and M. Kumhof (2016), “The macroeconomics of central bank issued digital currencies”, Bank of England, Staff Working Paper No. 605.

Barontini, C. and H. Holden (2019), “Proceeding with caution – a survey on central bank digital currencies”, BIS Paper No. 101.

Bindseil, U. and M. Corsi, B. Sahel and A. Visser (2017), “The ECB collateral framework explained”, ECB occasional paper nr. 189.

Cabrero, A., G. Camba-Mendez, A. Hirsch, F. Nieto (2002), „Modelling the daily banknotes in circulation in the context of the liquidity management of the ECB”, ECB WP 142.

Carstens, A. (2019), “The future of money and payments”, Speech held in Dublin, 22 March 2019.

Coeure , B. (2018), “The future of central bank money”, Speech, Geneva, 14 May 2018.

Dyson, B. and G. Hodgson (2016), “Digital cash: why central banks should start issuing electronic money,” Positive Money.

Engert, Walter and Ben S. Fung (2017), “Central bank digital currencies: motivations and implications”, Staff Discussion Paper 2017-16, Bank of Canda.

European Central Bank (2016), Guideline (EU) 2016/2249 of the European Central Bank of 3 November 2016 on the legal framework for accounting and financial reporting in the European System of Central Banks (ECB/2016/34) (recast), published in the Official Journal of the European Union L 347/37, 20December 2016. “

Häring, N. (2018), Die Abschaffung des Bargelds und die Folgen, Bastei Lübbe Taschenbuch.

Huber, J. (1999), “A proposal for supplying the nations with the necessary means in a modern monetary system,” Der Hallesche Graureiher 99 – 3, Revised version October 1999.

Jobst, C. and H. Stix (2017), “Doomed to disappear? The surprising return of cash across time and across countries”, CEPR Discussion Paper No. DP12327.

Juks, R. (2018), “When a central bank digital currency meets private money: effects of an e-krona on banks”, Sveriges Riksbank Economic Review, 2018:3, 79-98.

Kumhof, M. and C. Noone, (2018), “Central bank digital currencies – design principles and balance sheet implications”, Bank of England, Staff Working Paper No. 725.

Leinonen, H. (2019), “Electronic central bank cash: to be or not to be”, Journal of Payments Strategy & Systems, 13, 20-31.

Mayer, T. and R. Huber (2014), Vollgeld. Das Geldsystem der Zukunft. Unser Weg aus der Finanzkrise. Tectum.

Mersch, Y. (2017), Digital base money: An assessment from the ECB perspective, ECB.

Mersch, Y. (2018), Virtual or virtueless? The evolution of money in the digital age, Lecture at the Official Monetary and Financial Institutions Forum, London, 8 February 2018.

Nessen, M., P. Sellin and P.A. Sommar (2018), “The implications of an e-krona for the Riksbank’s operational framework for implementing monetary policy”, Sveriges Riksbank Economic Review, 2018:3, 29-42.

Pollock, Alex J. (2018), Testimony to the Subcommittee on Monetary Policy and Trade of the Committee on Financial Services, United States House of Representatives, Hearing on “The future of money: Digital currency, July 18, 2018.

Sveriges Riksbank (2017): The Riksbank’s e-krona project – Report 1, September.

Sveriges Riksbank (2018): The Riksbank’s e-krona project – Report 2, October.

European Central Bank, Directorate General Operations. Opinions expressed in this paper are my own ones, and not necessarily those of the ECB. I would like to thank for their helpful comments Dirk Bullmann, Benoit Coeure , Reimo Juks, Michael Kumhof, Clare Noone, Martin Summer, Jens Tapking, Fabrizio Zennaro, and participants to the 46th Economic Conference of the OeNB in co-operation with SUERF on 2/3 May in Vienna as well as participants to the conference on the Future of Central Banking in Talloires/France on 26 May 2019. All remaining errors are mine of course.

Recent publications include Engert and Fung (2017), CPMI-MC (2018), Kumhof and Noone (2018), Sveriges Riksbank (2018), Armerlius et al (2018), Juks (2018), Nessen et al (2018) – see also the further literature referenced there. According to the survey of Barontini and Holden (2019, 7), 70% of responding central banks are currently engaged in CBDC work. Five central banks would be progressing on, or running pilot projects (p. 8).

Juks (2018, section 5) also distinguishes three forms of runs, although not identical ones. Still the conclusions are rather similar.

GUIDELINE OF THE EUROPEAN CENTRAL BANK of 20 February 2014 on domestic asset and liability management operations by the national central banks (ECB/2014/9), as amended by GUIDELINE OF THE EUROPEAN CENTRAL BANK of 5 June 2014 amending Guideline ECB/2014/9 on domestic asset and liability management operations by the national central banks (ECB/2014/22).

In this note, it was assumed that CBDC would be a success, and that it could even be such a success as to threaten bank commercial intermediation. This is the scenario that has worried prominent central bankers. Others have however provided valid arguments questioning the business case of CBDC, and have recalled episodes from the 1990s in which earlier related initiatives failed (see Leinonen, 2019).