The debate on future risks for public finances so far mainly focusses on budgetary risks from population aging. In many advanced countries, these risks are in fact already materialising in rising social spending ratios, deficits and debt.1 There is, however, another very important fiscal risk dimension. This emanates from the financial sector. It has been present in developing and emerging economies for decades. However, it has also become visible and relevant in advanced countries with the global financial crisis. During the crisis, public deficits and debt ballooned as banks needed bailouts and real economies declined.

However, there has been no systematic analysis through which channels financial developments affect public finances and which risks could materialise in the future. A first risk map and exploration of the transmission channels was developed in Schuknecht (2019). This policy note summarises the channels and elaborates on the policy implications.

There are five channels, that link the fiscal and financial sphere. 1) Direct effects on budgets from higher financing costs and changes in asset prices. 2) Indirect effects via the real economy, through automatic stabilisers, guarantees and growth effects. 3) Fiscal obligations from bank and non-bank financial sector difficulties. 4) Risks with central banks, and 5) International obligations either via international credit exposure or via international bailout programs.

As regards the first channel, there is an important risk from potentially higher costs for the financing needs of government when interest rates change. Governments with higher debt and financing needs may face a stronger reaction of financing costs as they may face both higher rates and higher risks spreads. This is particularly the case when the risk environment changes. The risk premium relative to government deficits and debt had increased by the factor of 4-8 in the context of the global financial crisis in comparison to earlier years (Schuknecht, von Hagen and Wolsiwjk, 2011). Even sudden stops occurred in countries like Greece, Ireland or Portugal.

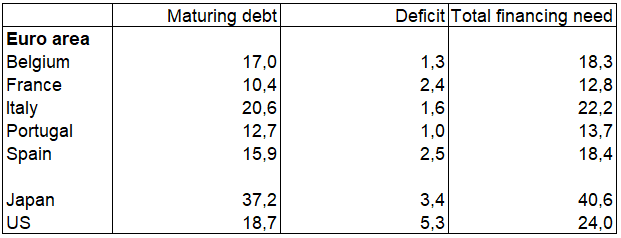

The sensitivity of public finances to changes in financing costs is palpable. Seven advanced country governments had to finance more than 10% of GDP in 2018. The figure exceeded 20% in Italy and United States and even 40% of GDP in Japan (Table 1). In the case the United States or Italy, for example, a 1% higher average interest rate would have implied almost ¼% of GDP higher interest payments just in the first year. Over time, the refinancing effect would compound.

Table 1. Government Financing Needs, Selected Advanced Economies, 2018

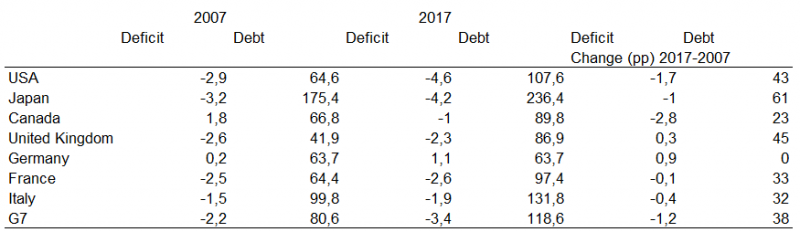

Moreover, fiscal balances in advanced countries in 2017/18 were significantly worse in most G7 countries than 10 years earlier (Table 2). The average debt ratio had increased from 80 to almost 120% of GDP in 2017. The average deficit was above 3% of GDP in 2017, also higher than in 2007 before the global financial crisis. Most G7 countries had debt ratios near the level that Italy posted in 2007. Hence, the vulnerability of governments to a worsening financial environment has increased.

Table 2. Fiscal Buffers: General Government Deficit and Debt (% of GDP)

Another noteworthy channel for financial developments affecting fiscal balances is via asset prices. When asset prices (notably house and equity prices) boom, governments yield extra revenue from transaction taxes, capital gains and wealth effects on consumption. These revenue windfalls tend to reverse when boom turns to bust (Eschenbach and Schuknecht, 2004). After 2007, declines in revenue ratios in the countries most affected by the global financial crisis were between 1% of GDP for the UK and 6% of GDP for Spain. By contrast, countries that did not face a housing bust in the crisis, like Germany, Italy or France, did not report any significant decline in the revenue ratio (Schuknecht, 2019).

What are the policy lessons? First, it is important to have sufficient fiscal buffers so that higher financing costs do not constitute major fiscal risks and sudden stops do not reoccur. Second, debt managers should seek long term financing for public debt (which has to some extend happened over the past decade). Third, tax systems should be made less sensitive to asset prices and, perhaps more importantly, not contain biases that are conducive to debt financing and asset price boom bust cycles.

Fiscal balances are sensitive to real economy developments via so-called automatic stabilisers. As revenue fluctuate broadly with real economic activity and public expenditure remain unchanged, the budget deficit falls and widens with economic upswings and downturns. In fact, budgetary sensitivities to changes in economic growth are quite significant and amount to almost 1/2 % of GDP for each percent of higher or lower growth. While this implies a large stabilisation effect of budgets without any active intervention of the state, it can also mean a significant deterioration in budget balances over an economic downturn. A major recession, like in 2009, with growth of say 5% below trend worsens the deficit by 2 or 2 ½ % just via automatic stabilisers.

Financial factors can be a major driver of economic downturns. In the global financial crisis, the growth decline was much larger than tightening financing conditions would have suggested. This is because economic confidence collapsed. However, we do not understand well when we “switch” from “regular” to non-linear relations between finance and the real economy.

Financial effects on the real economy and the availability of finance can also affect public budgets through the calling of government guarantees. For example, public-private partnership contracts may contain public support provisions. Or governments may have to step in when providers go bankrupt. Surprisingly, there are no studies on such fiscal risks that materialised in the past and data on the exposure to such risks in the future is patchy.

Finally, financial developments affect the allocation of capital which, in turn, can affect potential growth and, thereby, public finances. Borio, Kharroubi, Upper and Zampolli (2015) argued that overinvestment in the real estate and financial sector in the boom, and underinvestment in human capital (as young people started working in construction instead of studying) resulted in less human capital. When the crisis hit, the misallocated capital had to be written off. This resulted in an overly optimistic assessment of the economic and fiscal situation in boom times and less potential growth thereafter (Borio, Disyatat and Juselius, 2013).

Policy implications from these transmission channels are complex. First, there is a potential trade-off between the automatic stabilisation role of government and the risks from cyclical fluctuations for the budget. This is a tough choice: more progressive taxes and counter-cyclical spending policies would enhance economic stability while reducing that of the budget. Second, balanced budget rules may result in more pro-cyclical behaviour unless countries have accumulated sufficient buffers in good times. Third, governments should be very careful with assuming private sector risks. They need to understand what they are doing in investment projects, in public enterprises or in the financial sector so that explicit or implicit guarantees do not threaten fiscal stability. Fourth, financial sector and monetary policies can contribute to lower fiscal risks indirectly via money and credit developments that smoothen boom bust cycles and the related overinvestment and mis-allocation of capital.

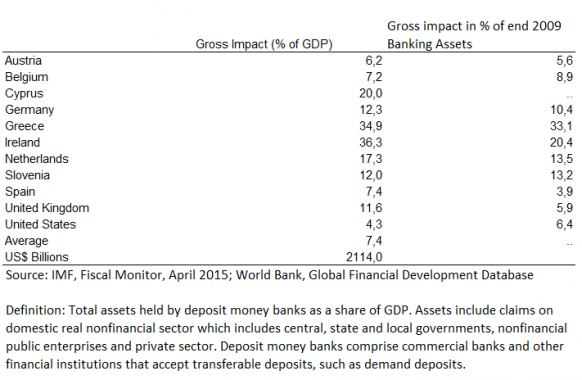

Since the global financial crisis, there has been growing awareness of fiscal risks from the banking sector. In fact, the crisis resulted in huge costs for government finances (Table 3). The magnitude ranged from 4% (United States) to 35% of GDP (Greece) in advanced countries, and several countries posted double-digit losses. By 2015, gross costs had risen to over US$ 2 trillion. Costs were also often very large as a share of banking assets. This prompted governments across the globe to demand more capital and liquidity (amongst other things) from their banks.

There are a number of factors that raise fiscal costs of banking sector difficulties. These include high and rising debt in/credit to the private sector, government guarantees (especially blanket deposit guarantees), open-ended liquidity support, regulatory forbearance, debt biases in the tax system and banking crises mutating to fiscal crises (see Schuknecht 2019 for a survey). Evidence on the quantitative relevance, however, is very limited.

Table 3. Financial Crisis Support post 2009

As a result, banks everywhere increased their capital and contingent capital and their resilience as regards short and long term funding, and they designed resolution plans etc. Moreover, under the auspices of the G20 and the FSB, derivatives markets were regulated and rules for relations with market based finance were developed. As the implementation of this agenda progressed, buffers and resilience of banks improved, especially for the systemic ones.

Still, the literature provides little guidance on risks in the financial system today. There are a number of vulnerabilities in the banking system that could again turn into budgetary costs down the road especially if financing costs start rising rapidly and significantly again. Just as regards risks to public financing costs, snapback risks could derive from an increase in the level of rates and from the risk appetite reflected in spreads.

First, a number of European countries posted significant shares of non-performing loans even 10 years after the crisis started. The list included in particular Greece and Cyprus, but non-performing loans also exceeded 10% of all loans in Portugal, Italy and Ireland at the end of 2017. Such risks continue to prevail.

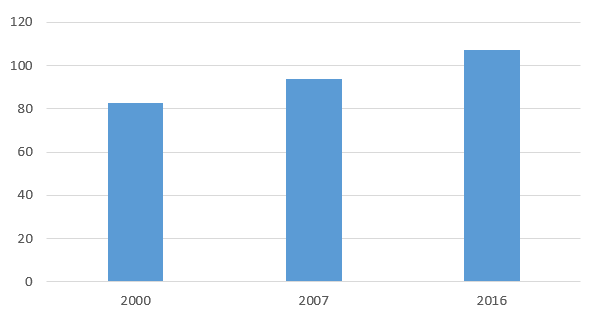

Second, private corporate sector debt, which had been one of the reasons for financial sector difficulties in the crisis, was significantly higher on average in the late 2010s than before the global crisis (Chart 1). Only few countries, including notably Spain and the United Kingdom have reported significant declines in corporate debt ratios.

Chart 1. Corporate indebtedness, Advanced Countries (% of GDP)

Source: IMF Global Debt Database

Third and perhaps most importantly, banks hold significant amounts of government debt on their balance sheets. This exposure can reach five or eight times the capital of bank, notably in Europe. Such an exposure could be particularly problematic when the debt is from poorly rated governments. The absence of concentration limits and the exemption from risk weighting (as well as other priviliges) are the reasons for such a distorted portfolio allocation in favour of government debt.

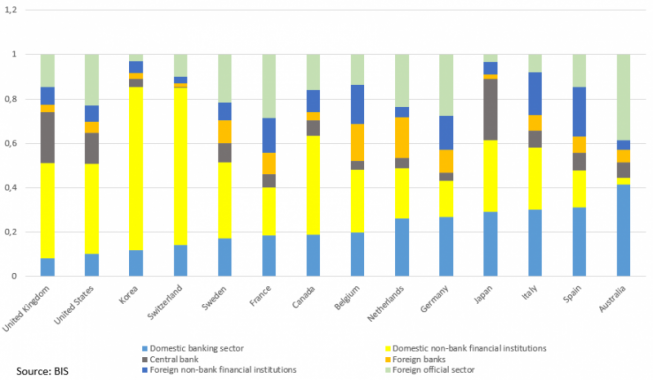

The magnitude of exposure is huge (Chart 2). In Japan and Italy, the banking sector holds about 30% of all domestic government debt—about 60 and 40% of GDP respectively. In France, Canada and Belgium, the ratio to total debt and GDP is about 20%. Any major rating downgrade or re-assessment of government debt could undermine the banking system’s health via accounting losses. Given the link between financing conditions of banks and sovereigns, the real economy would also suffer via tighter financing costs and availability (CGFS, 2011).

Chart 2. Holders of Government Debt, by Sector (2016)

The policy implications are clear and well known. Implementation of the G20/FSB regulatory agenda for banks remains essential and, fortunately, progress is significant (FSB, 2019). Moreover, the reduction of non-performing loans, and the reduction in regulatory privileges for government debt would enhance the health and resilience of the banking system so as to reduce implicit and contingent fiscal risks (see also BIS, 2017). Reducing public debt and deficits further and, thereby, improving the financial health of governments themselves would, however, be the best contribution for stopping the bank-government “doom-loop”.

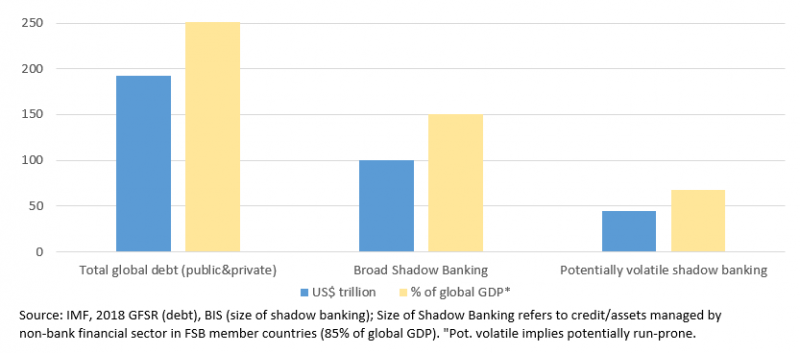

The non-bank financial system has grown much faster over the past decade than the banking system. The BIS estimates the run-prone part of “shadow banking” to be US$ 50 trillion or about 70% of global GDP. This is about one quarter of total global debt which is at a record historic high (Chart 3; see also IMF, 2018, FSB 2018). Given the role of non-banks in the global financial crisis, the G20 also agreed on a regulatory agenda for this part of the financial system. Progress has been significant as well but it is on the whole less well advanced than in the banking sector (FSB, 2019).

Chart 3. Global Debt and the Size of Shadow Banking

There are a number of vulnerabilities in this industry, that could burden budgets in the future. First, pension funds in many countries are seen to be underfunded even at 2018/2019 asset valuations (OECD, 2019). Rauh (2018) sees the underfunding in the US to amount to 20% of GDP. In a major stress scenario, funding gaps could be significantly larger in some countries. It is hard to conceive that governments would not be “asked” to share into funding shortfalls when the incomes of millions of pensioners are at stake.

Second, not only has corporate debt on average increased in the past decade but the quality of this debt has declined when it was financed via the market. The size of the corporate bond market has tripled to almost US$ 13 trillion over the past two decades. Over 50% of advanced country corporate bonds in the investment grade range were rated BBB in 2018. The corresponding figures in the past were in the 25-45% range. A much larger share of bonds was in the covenant light category, giving creditors significantly less rights. It is hard to conceive that a major downgrading wave would leave markets without turmoil which, in turn, would lead to calls for government support to fend of credit crunches and corporate bankruptcies.

Third, there continue to be risks from increasing concentration of derivative trading in Central Clearing Parties (CCPs). This is despite better rules and regulation and the fact that such clearing has increased transparency and reduced risks. Failure of an important CCP is unlikely to leave the CCP market unscathed, and calls for government/central bank bailouts/guarantees could follow. AMB was saved in 2009 to prevent a melt-down in derivative markets.

As regards policy implications, the full implementation of the G20/FSB regulatory agenda for non-banks remains essential. Again, more resilient governments are likely to help maintain stability in non-bank financial markets as well.

Still, it is worth asking whether this is enough. Do we perhaps need circuit-breakers in bond markets just as in stock markets to halt future runs? Moreover, clearer rules in government bond markets with collective action clauses and circuit breakers against runs such as standstills and prolongations would reduce the economic and fiscal costs of government debt problems. Moreover, such provisions would increase market monitoring and, thereby, governments’ incentives to build sufficient fiscal buffers (Weder and Zettelmeyer, 2018).

There are two further transmission channels: fiscal risks from central banks and international obligations. Central banks in 2018 held about US$ 10 trillion worth of government bonds or about one fifth of the total market. Losses from government debt holdings could burden fiscal balances, unless countries were willing to run central banks with low or negative equity or hide losses in transitional accounts. In any case, it is hard to conceive that a central bank holding much debt of a government that is going broke can avoid fiscal and financial dominance.

As regards fiscal risks from international financial obligations, there is plenty of evidence from past banking and financial crises. In fact, part of the losses during the global financial crisis mentioned above were of an international nature, and large international creditors such as Germany suffered particularly large losses.

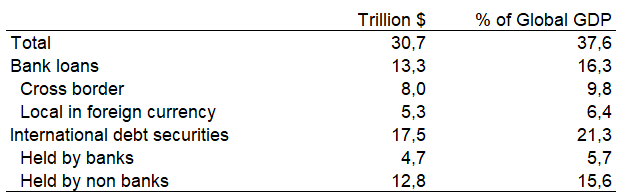

International credit includes banks’ cross border and foreign currency credit and international debt securities (BIS). In 2018, international credit exceeded US$ 30 trillion, which is almost 40% of global GDP. Almost 5 trillion worth of bonds are held by banks across border, another 13 trillion by non-banks/asset managers. Bank lending exposure (cross border or foreign currency) exceeded US$ 13 trillion (Table 4). Losses on these exposures could get banks and asset managers into trouble, with demands for government support potentially in its wake.

Table 4. International Credit

The greater global financial interdependence and international financial risks are reflected in ever bigger IMF support programs. These exceeded 10% of GDP in the case of Greece, Portugal and Ireland in the early 2010s, not counting the (even higher) regional European support. The Asian crisis programs around the turn of the millennium were all much smaller.

As regards policy implications, these facts have given rise to an extensive debate over the need for global financial safety nets. With a global GDP of US$ 70 trillion, a safety net of US$ 1 trillion (roughly 2018/19 IMF resources) can cover a 15% program for 10% of the global economy. This is not little but it is also not very much. Even a significant increase in safety nets would not change the fact that national fiscal buffers and financial resilience must be sufficient in the vast majority of the global economy.

Moreover, all the principles of financial sector prudence applying to the national level should apply in particular to the international level. International credit is an important instrument of risk mitigation across nations but this only works as long as buffers elsewhere are sufficient. Central banks should not neglect financial risks resulting from their monetary policy and liquidity measures.

The introduction of a sovereign debt-restructuring framework including prolongations and standstills could improve incentives and help make do with limited safety nets. It could limit fiscal financial risks by preventing that international governments pay for the private sector exiting a market without bail-in (Destais, Eidam, & Heinemann, 2019; Zettelmeyer, 2018).

Finally, we may want to be prepared to rethink the role of circuit breakers in international capital markets. Capital controls in the context of the Greece and Cyprus programs hold perhaps more lessons for the future than most people realise, and the OECD code on capital account liberalisation provides a rules-based international governance framework.

Financial developments can constitute significant fiscal risks via a number of transmission channels: Government financing costs, asset prices, real economy implications, banks and non-banks, central banks and international linkages. These risks, where measured and analysed, were often very large. However, we still understand too little about them and do not have a good sense of what could happen in the future. This is particularly true for risks from market-based finance and the compound effect of fiscal-financial vulnerabilities.

The note also provides a number of policy lessons: The implementation of the international regulatory agenda for banks and non-banks should continue. Regulatory priviliges for governments need downscaling. Governments should reduce debt biases in their tax system.

More reflection should also be given to circuit breakers such as trading stops in bond markets, orderly capital controls, and debt-resturcturing frameworks including prolongation and standstill procedures when debt sustainability is at risk. Credible limits on contingent and implicit liabilities in the financial sector (and beyond) protect government finances and reduce moral hazard.

Building sufficient fiscal buffers is probably the most important policy lesson. Fiscal resilience protects the stabilising role of public finances in downturns, it prevents the potential fiscal financial doom loop and it protects the credibility of central banks and international safety nets.

One way to gage the outer bounds of fiscal risks in the past is to look at public debt developments in very severe crisis episodes. It is likely that all of these effects came together in these episodes even though we do not know how much came through which channel. Amongst the European countries, the biggest debt increase affected Ireland (plus 95.7% of GDP between 2007 and the post crisis peak). The corresponding figures for Spain and Portugal were 64.9 and 62.2% of GDP. The United Kingdom saw debt increase by 47.1%. We saw earlier that the figures for the US, Japan, France and Italy were above 30% of GDP. In some countries, fiscal deficits deteriorated by over 10% of GDP in just 2 or 3 years.

These figures are truly staggering and should be seen against a G7 average near 120% of GDP in 2017/18. Borio, Contreras and Zampoli (2019) suggest that fiscal buffers of up to 60% of GDP would have been needed to deal with 99% of the fiscal risks over recent decades. And the numbers above suggest that this might well have been barely enough.

It is not clear whether a similar further increase in the next crisis could be weathered easily even with central bank assistance. Long maturity public debt financing and the “good old” Maastricht thresholds of 60% for reasonably safe debt and of a “close to balance” budget in normal times might not be so stupid after all.

BIS (Bank of International Settlement) (2017) The Regulatory Treatment of Sovereign Exposures. Basle: Discussion Paper.

Borio, C., P. Disyatat and M. Juselius (2013) Rethinking Potential Output: Embedding Information About the Financial Cycle, Basle: BIS Working Papers 404.

Borio, C. E. Kharroubi, C. Upper and F. Zampolli (2015) Labour Reallocation and Productivity Dynamics: Financial Causes, Real Consequences. BIS Working Papers 534.

Borio, C., Lombardi, M. and F. Zampoli (2016) Fiscal Sustainability and the Financial Cycle, Basle: BIS Working Paper no 552.

Borio, C., J. Contreras and F. Zampoli (2019) Banking Crises: Implications for Fiscal Sustainability. Basle: BIS Mimeograph.

CGFS (Committee on the Global Financial System) (2011) The Impact of Sovereign Credit Risk on Bank Funding Conditions. Basle: CGFS Papers No 43.

Destais, C., F. Eidam & F. Heinemann (2019) The design of a sovereign debt restructuring mechanism for the euro area: Choices and trade-offs, CEPII Policy Brief 2019-25.

Eschenbach, F. and L. Schuknecht (2004) Budgetary Risks from Real Estate and Stock Markets. Economic Policy, 313-346.

FSB (Financial Stability Board) (2018) Global Shadow Banking Monitoring Report 2017. Basle.

FSB (Financial Stability Board) (2019) Implementation and Effects of the G20 Financial Regulatory Reform. 4th Annual Report. Basle.

International Monetary Fund (2015, 2018) Fiscal Monitor. Washington DC.

International Monetary Fund (2018/2019) Global Financial Stability Report/GFSR. Washington DC.

OECD (2019) Budgeting Outlook. Paris.

Rauh, J. (2018) Fiscal Implications of Pension Underfunding. Stanford University and Hoover Manuscript.

Schuknecht, L. (2019) Fiscal Financial Vulnerabilities, SAFE White Paper No 62.

Schuknecht, L. und Zemanek, H. (2018), Social Dominance, CESIfo Working Paper 6997.

Schuknecht, L., J. v. Hagen, and G. Wolswijk (2011) Government Bond Risk Premiums in the EU Revisited. European Journal of Political Economy, 27: 26-43.

Weder, B. and J. Zettelmeyer (2017) The New Global Financial Safety Net. Struggling for Coherent Governance in a Multipolar World. In: Essays on International Finance, Volume 4.

Zettelmeyer, J. (2018) Managing Deep Debt Crises in the Euro Area: Towards a Feasible Regime. Global Policy 9:1.

In the future, rising social obligations could further undermine fiscal sustainability via higher debt and via crowding out other, more productive spending and, thus, undermining economic growth (Schuknecht and Zemanek, 2018).