This note summarises the main findings from a review of a sample of studies on the long-term impact of Brexit on GDP and welfare for both the UK and EU27 economies. Brexit is a lose-lose situation for both the UK and the EU27, but the UK is found to be much more affected by Brexit than the EU27. In an orderly no-deal scenario, the range of losses across the studies is very wide, especially for the UK, reflecting great uncertainty. Small open economies closely related to the UK are worse hit than other EU Member States. This is the case for Ireland due to geographical proximity, for Luxembourg with its economy specialising in financial services, and for Cyprus and Malta as they are Commonwealth countries, followed by the Netherlands and Belgium. A trade agreement could limit the losses from Brexit substantially both for the UK and the EU Member States. This justifies the economic interest for both the UK and the EU Member States to reach and implement a deal on their future relationship.

On 23 June 2016, UK citizens voted in a referendum to leave the EU. On 25 November 2018, the EU Council endorsed a deal concluded between the UK Government and the European Commission on both a Withdrawal Agreement (WA) and a Political Declaration (PD) on the future relationship between the EU and the UK. At this stage, the House of Commons has rejected the deal three times. The current political situation since the resignation of British Prime Minister Theresa May and the non-binding nature of the PD as well as its wording in general terms still leave many options open for the future relationship. Against this background, this note draws on the main takeaways from a survey that encompasses various Brexit scenarios (Bisciari, 2019).

That paper reviews many official and academic studies on the long-term impact of Brexit on GDP or welfare for both the UK and EU economies. This note focuses on studies reporting results for individual EU countries.

The main Brexit transmission channel in the long term is trade. Trade between the UK and the 27 remaining EU Member States may become hindered by barriers that had been dismantled thanks to the EU’s Single Market and Customs Union. In an orderly no-deal Brexit, their bilateral trade will face the World Trade Organisation (WTO)’s most favoured nation (MFN1) tariffs on goods and non-tariff barriers (NTBs) on both goods and services. NTBs can take many forms, including rules of origin, customs handling costs, differences in regulation, standards, etc. On top of bilateral trade barriers with the EU27, in a hard Brexit scenario, the UK will no longer benefit from existing EU free trade agreements (FTAs) with third parties like Canada. On the other hand, by leaving the Customs Union with the EU, the UK would be free to define its own trade policy, concluding for example FTAs on its own.

Some Brexit impact assessments include additional transmission channels such as foreign direct investment (FDI), migration, the exchange rate and contributions to the EU Budget. Financial services are in general considered as just a service that can be traded and financial institutions are companies that can be relocated. However, the specific situation of the City of London and the financial stability issues are largely omitted. As our focus is on the long term, any potential short-term disruptive effects from a disorderly Brexit2 are not taken into account and the uncertainty channel will only receive scant consideration. A drop in productivity may also be added as a transmission channel, especially for the UK.

Empirical long-term impact studies show that Brexit will lead to losses in welfare and GDP for both the UK and the EU27 relative to a baseline scenario where the UK stays in the EU (EU-like scenario). This does not necessarily mean that real GDP will decline at any moment in time.

The loosest future post-Brexit relationship between the EU and the UK would result from a no-deal exit (WTO scenario). Less costly scenarios3 include FTAs like those implemented between the EU and distant countries such as Canada (CETA) and South Korea or a customs union similar to that between the EU and Turkey. An even softer Brexit would allow access to part or all of the EU Single Market which is the case for neighbouring countries like Switzerland or Norway, the latter being a member of the European Economic Area (EEA).

The note is structured as follows. Section 2 is devoted to the impact of a WTO scenario for the UK versus the EU27 treated as a bloc. For the same scenario, section 3 considers the estimated impact of the trade channel on individual EU countries. Section 4 illustrates to what extent various agreements may mitigate these Brexit losses both for the UK and the EU countries. Section 5 concludes.

When comparing a WTO scenario relative to a baseline where the UK remains in the EU:

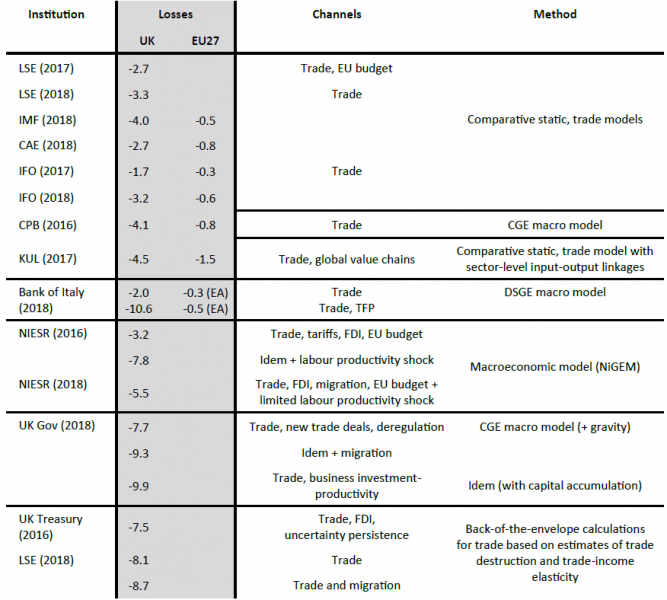

Table 1 – Long-term impact on GDP/welfare of Brexit in a WTO scenario

(percentage point of GDP/welfare deviation from an EU-like scenario)

Note: LSE (2017) = Dhingra et al. (2017); LSE (2018) = Levell et al. (2018); IMF (2018) is a Selected Issue in the Article IV Consultation Report on the euro area in July; CAE (2018) = Vicard (2018); IFO (2017) = Felbermayr et al. (2017); IFO (2018) = Felbermayr et al. (2018); CPB (2016) = Rojas-Romagosa (2016); KUL (2017) = Vandenbussche et al. (2017); Bank of Italy (2018) = Pisani and Vergara Caffarelli (2018); NIESR (2016) = Ebell and Warren (2016); NIESR (2018) = Hantzsche et al. (2018).

For the UK, the highest GDP losses induced by Brexit (over 5 percentage points) are found in:

If we limit this study to models considering the trade effects of Brexit, then the maximum GDP loss for the UK remains below 5 %, varying from 1.7 % in IFO (2017) to 4.5 % in KUL (2017). For the EU as a bloc, the maximum loss is no more than 1.5 % of GDP (also in the KUL study).

These studies reported in the upper part of the table are the only ones that feature results for most of the individual EU countries. They focus on the Brexit trade channel and rely on the same two-step methodology:

For most countries, the KUL model delivers the highest losses from Brexit as it takes GVC and input output linkages in production into account, making full use of sectoral data and parameters (trade elasticities, NTBs per sector, etc.). It also includes a “no trade diversion” assumption: hence, countries cannot divert any loss in trade with the UK by trading more with other countries.

The CPB study is the only study to consider a time dimension and to allow for two factors of production, including capital stock on top of labour. Thanks to this, capital accumulation through investment plays an amplifying role and sector-specific production changes may lead to a shift of inputs, such as labour and capital, and production between sectors. The CGE macroeconomic model used also features increasing returns to scale.

As illustrated in Bisciari (2019), other differences across these studies may stem from the data, the size of the trade shocks applied (in particular, NTB changes) or some specifications of the model (especially key parameters such as trade elasticity).

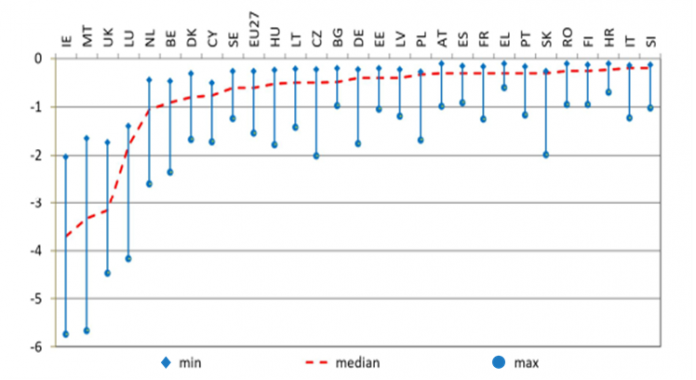

With a view to comparing the impact of Brexit on all individual Member States, we have computed the minimum, maximum and median across the studies for which results were available.

Figure 1 – WTO scenario losses may differ across studies but the ranking of countries is fairly similar

(percentage points of GDP/welfare deviation from an EU-like scenario, results from seven studies)

Countries are ranked by decreasing median GDP/welfare losses. LSE (2018) is left aside as their approach is similar to LSE (2017).

Sources: Dhingra et al. (2017), Felbermayr et al. (2017 and 2018), IMF (2018), Rojas-Romagosa (2016), Vandenbussche et al. (2017) and Vicard (2018), Bisciari (2019) calculations.

Several lessons can be drawn from this comparison:

The ranking of the losses is largely determined by the degree of openness with respect to the UK. This openness may be in terms of geographical distance or based on historical connections such as Commonwealth membership (Cyprus and Malta).

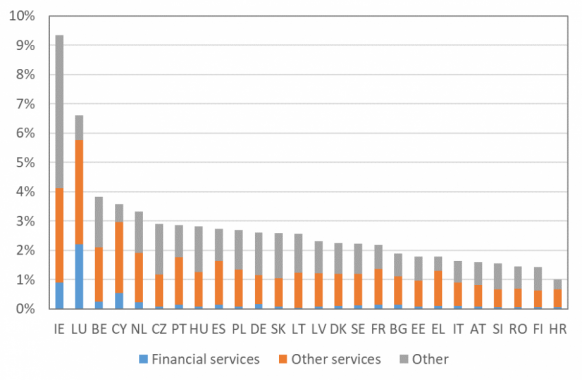

Figure 2 – Exposure of value added to exports to the UK

(share of GDP exported to the UK, 2015)

Malta is not shown as its exposure to the UK economy is close to 16 %, mostly due to non-financial services.

Sources: Monitoring Brexit (2019) and own calculations based on OECD trade in value added data for the year 2015.

According to recently released OECD trade in value added data, the share of the value added produced in most EU27 countries that is generated by final demand of UK origin increased between 2011 (the base year used for the OECD’s trade in value added data and thus the starting point of most Brexit impact estimates surveyed) and 2015. By way of example, the exposure of Belgium’s value added to UK demand went up from 3.2 % of GDP in 2011 to 3.8 % of GDP in 2015. The impact of Brexit determined in the seven studies under review may thus be somewhat underestimated.

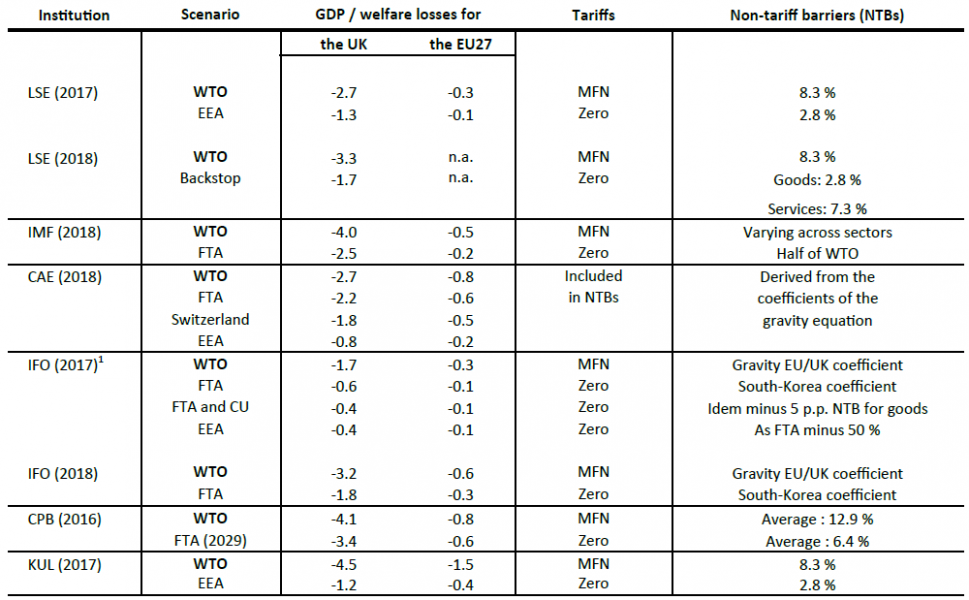

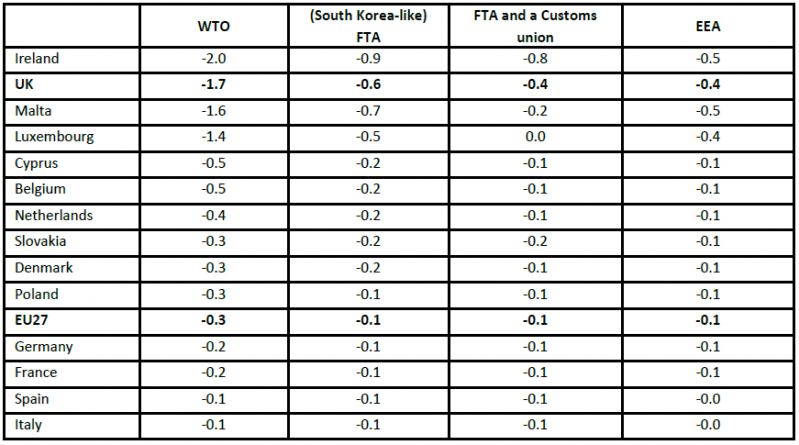

All studies reporting results for individual EU countries have considered at least one other scenario where the EU and the UK conclude a kind of trade agreement. In all these scenarios, tariffs are cut to zero for all goods while NTB increases are set at a lower value than under the WTO scenario. FTAs are defined and treated in different ways across the studies. The same applies for the EEA. From IFO (2017), Bisciari (2019) has selected three scenarios of trade relationship between the EU and the UK on top of the WTO.

The LSE (2018) has also proxied a backstop scenario along the lines of the Protocol on Northern Ireland as part of the WA. According to this, there would be a single customs territory7 between the UK and the EU27 avoiding the need for tariffs, quotas or checks on rules of origin, while Northern Ireland would keep full access to the EU Single Market under conditions of regulatory alignment. LSE (2018) has therefore assumed higher NTBs for services than for goods.

Table 2 – Long-term impact of various Brexit scenarios

(percentage point of GDP/welfare deviation from an EU-like scenario)

Note: papers are quoted as in Table 1.

1 On top of the WTO scenario, from IFO (2017), we selected three scenarios for trade relations between the EU and the UK:

‘FTA’: the UK still leaves the Single Market and EU Customs Union but concludes an ambitious FTA with the EU featuring zero tariffs and, in terms of NTBs, the estimated trade-cost-reducing effects from the EU‑South Korea FTA.8

‘FTA and a customs union (CU)’: compared to scenario 2; it is assumed that trade between the EU and the UK will not require proof of origin where the administrative cost is found to average 5 %. NTBs for goods are therefore reduced by a further 5 percentage points.

‘EEA‑like’: compared to scenario 2, NTBs are reduced by an additional 50 %9 since the UK is assumed not to leave the Single Market in this case (it only leaves the Customs Union).

The main conclusions are as follows:

In IFO (2017), moving from a WTO scenario to a South-Korea-like FTA would cut the losses incurred in a WTO scenario by more than half for most Member States. Adding a customs union or full access to the Single Market yields further benefits. For most countries11, more losses are recovered under a Norway scenario (EEA) than under an improved FTA cancelling out rules-of-origin costs.

Table 3 – GDP losses in various Brexit scenarios

(deviation from an EU-like scenario, in percentage points)

Scenarios as defined in Table 2.

Scenarios as defined in Table 2.

Source: IFO (2017).

Macroeconomic simulations12 of the November Deal tend to show that a significant share of the economic loss under a WTO scenario may disappear for the UK both in the backstop scenario and in a free trade area for goods combined with an FTA for services as intended in the PD.

Uncertainty remains a key word when talking about Brexit. Will Brexit happen and when? With or without a deal? What sort of Brexit will emerge? In the meantime, the uncertainties are weighing on business investment and economic activity in the UK. And, even when the nature of Brexit is actually known, the precise estimate of the impact of any particular scenario is itself surrounded by uncertainty. Reflecting this great uncertainty, Brexit losses vary widely from one study to another, especially for the UK.

Under all scenarios, Brexit is a lose-lose situation for both the UK and the EU economies in that GDP or welfare will grow by less under Brexit scenarios than if the UK remains in the EU. The UK is found to be much more affected by the trade effects of Brexit than the EU27 and most of its Member States. In an orderly no-deal (WTO) scenario, the UK losses may even exceed 10 % of GDP.

In general, however, if just the trade channel is considered, even taking global value chains into account, the UK losses are found to remain below 5 % of GDP. Small open economies closely related to the UK are hit harder than the other EU countries due to geographical proximity, because of specialisation of their economy in financial services or because they are Commonwealth countries. In the four main euro area countries, losses are likely to be lower than the EU27 average (0.6 of a percentage point of GDP).

Under all scenarios, the economic losses due to Brexit are estimated at unchanged policies. However, one of the main aims of Brexit for the UK is to take back control of its borders and policies. The UK could thus mitigate the economic losses by activating new trade and/or regulatory policies. The UK would be more able to do so in hard Brexit scenarios (such as the WTO) where it will regain more autonomy than in soft Brexit scenarios since a closer relationship with the EU would require less independent policies.

Reaching a trade agreement for the future relationship between the UK and the EU could limit GDP losses both for the UK and the EU Member States compared to a no-deal scenario. If the relationship goes no further than an FTA like that between the EU and South Korea, the losses are in general expected to be halved. If the UK remains in the Single Market or the Customs Union, the GDP losses induced by a WTO scenario could be even more contained. Most of the economic loss under a WTO scenario may disappear for the UK both in the backstop provided by the Protocol on Northern Ireland and in the free trade area for goods and the FTA for services implied in the Political Declaration.

Bank of England (2018), EU withdrawal scenarios and monetary and financial stability, A response to the House of Commons Treasury Committee, November.

Banque nationale de Belgique, SPF E conomie et Bureau fe de ral du Plan (2019), Monitoring Brexit, note de synthe se, Janvier.

Bisciari P. (2019), A survey of the long-term impact of Brexit on the UK and the EU27 economies, NBB, Working Paper 366, https://www.nbb.be/doc/ts/publications/wp/wp366en.pdf.

Conefrey T., G. O’Reilly and G. Walsh (2019), “The Macroeconomic Implications of a Disorderly Brexit.” Box B, Quarterly Bulletin, no. 1, Central Bank of Ireland, 23-30.

Dhingra S., H. Huang, G. Ottaviano, J.P. Pessoa, Th. Sampson and J. van Reenen (2017), “The Costs and Benefits of Leaving the EU: Trade effects”, Economic Policy, 32(92), 651–705.

Ebell M. and J. Warren (2016), “The long-term economic impact of leaving the EU”, National Institute Economic Review, 236, May, 121-138.

Felbermayr G., J. Gro schl. I. Heiland. M. Braml and M. Steininger (2017), Brexit’s Economic Effects on the German and European Economy. study commissioned by the German Federal Ministry for Economic Affairs and Energy (BMWi), CESifo. Munich, June.

Felbermayr G, J. Gro schl and M. Steininger (2018), Brexit through the lens of new quantitative trade theory, IFO institute Paper, March.

Hantzsche A, A. Kara and G. Young (2018), The Economic effects of the Government’s proposed Brexit Deal, NIESR, London, 26 November.

IMF (2018), “Long-term impact of Brexit on the EU”, Selected Issue, Euro area, Article IV Consultation Staff paper, July.

Levell P., A. Menon, J. Portes and Th. Sampson (2018), The Economic Consequences of the Brexit Deal, Centre for Economic Performance (London School of Economics and Political Science) and The UK in a Changing Europe, London, November.

Llewellyn D. T. (2019), Analysing the Economics of Brexit and World Trade, SUERF Policy Note 72, May.

Pisani M. and F. Vergara Caffarelli (2018), What will Brexit mean for the UK and euro area economies? A model-based assessment of trade regimes, Temi di Discussione/Working Papers 1163, Bank of Italy, January.

Rojas-Romagosa H. (2016), Trade effects of Brexit for the Netherlands, CPB Background Document, The Hague, June.

Tetlow G. and A. Stojanovic (2018), Understanding the economic impact of Brexit, Institute for Government, October.

UK Government (2018), EU Exit: Long-Term Economic Analysis, November.

UK Treasury (2016), HM Treasury analysis: the long-term economic impact of EU membership and the alternatives, 19 April.

Vandenbussche H., W. Connell and W. Simons (2017), Global value chains. trade shocks and jobs: an application to Brexit, CEPR Discussion Paper 12303.

Vicard V. (2018), Une estimation de l’impact des politiques commerciales sur le PIB par les nouveaux modèles quantitatifs de commerce, Focus du Conseil d’Analyse e conomique, n°22, juillet.

“For WTO member states such as the UK, a MFN tariff is the maximum tariff that can be imposed on the import of a particular good from any other WTO member country with which it does not have a preferential trade agreement” (Tetlow and Stojanovic, 2018).

In late November, the Bank of England (2018) examined the short- to medium-term impact of a disorderly Brexit for the UK. Conefrey et al. (2019) have investigated the consequences for Ireland.

For a full description of Brexit institutional scenarios, see notably Bisciari (2019) and Llewellyn (2019).

When a CGE model includes time dynamics, the wording CGE macro model is used throughout the note.

NiGEM stands for the National Institute Global Econometric Model. Produced and developed by the NIESR, it is a widely used macroeconomic model, also in Brexit studies.

The wide variation for Malta may reflect the difficulties in the treatment of highly services-oriented economies and errors in WIOD data.

The scope of this customs union is wider than that between the EU and Turkey as it covers all goods (except fishery and aquaculture products).

The EU-Korea agreement that has been into force since 2011 is one of the EU’s most ambitious FTAs. It is the closest to the CETA for which no data are yet available as it has only recently been implemented.

The distance between the trade-cost-reducing effects of an ambitious FTA (scenario 2) and full membership of the EU is reduced by 50 %.

This does not prevent that, relative to a Remain baseline, some sectors may win in some Brexit scenarios or that some EU countries may win under some soft Brexit scenarios.

The exceptions are countries where services represent a high share of exports: the UK, Malta, Luxembourg and Cyprus.

See Bisciari (2019) for a comparison of both a NIESR simulation on the basis of NiGEM (Hantzsche et al., 2018) and UK Government (2018) on the basis of a CGE macro model.