The views expressed are those of the authors and not necessarily their institution. Comments from Anders Balling and participants at seminar at the IMF are gratefully acknowledged.

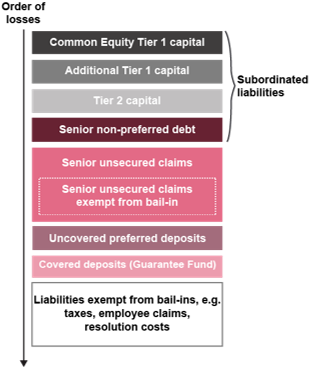

The idea with the current European resolution scheme is that investors and creditors will be bailed in to cover losses and recapitalize a failing bank. This mechanism protects public funds.

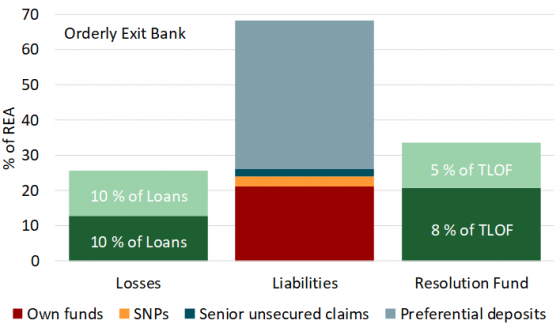

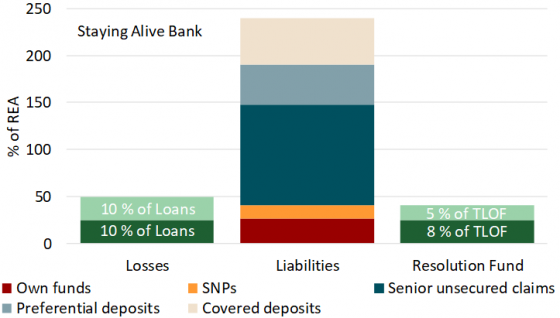

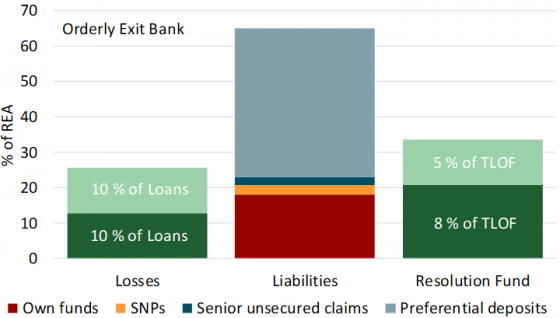

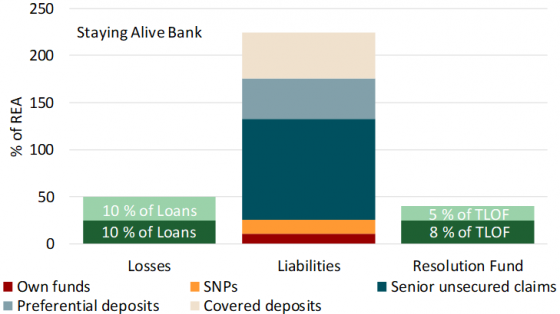

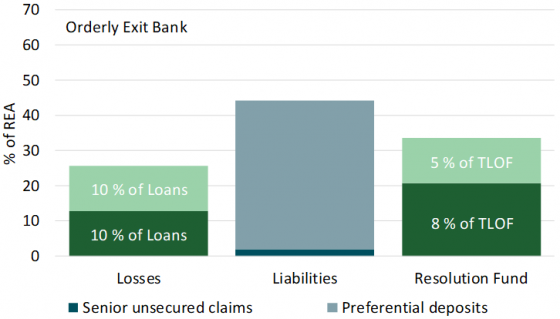

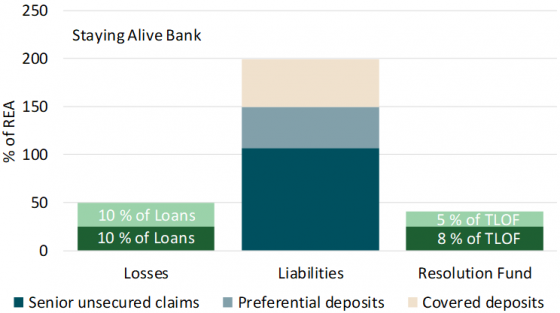

A resolution fund can contribute to cover losses and recapitalize a failing bank. However, in order for the resolution fund to cover losses, liabilities amounting to 8 % of TLOF has to be written down or converted into capital. And in this situation the fund can contribute with 5 % of TLOF to cover losses and recapitalize the bank.

Goodhart and Avgouleas (2014) query the possibility to handle systemic crisis through bail-in.

Avgouleas and Goodhart (2019) describe how incentives should work.

Ringe (2017) also describes why bankruptcy is not appropriate for banks.

Avgouleas and Goodhart (2019) raise the question that a bail-in can result in spillovers.

Gelpern and Veron (2019) show that national insolvency procedures leave space for bank bail-outs.

SRB (2019) and EBA (2019).

PWC (2020) and Deloitte (2022).

Standard & Poor’s Financial Services (2022).

Ringe (2017).

Berg and Bech (2009).

Time will hopefully reveal what went wrong in relation to Silicon Valley Bank. An obvious question is why supervisors did not intervene earlier following the losses on securities in the banking book that discarded mark to market practices. Another question is why authorities abandoned the initial bail-in strategy, in particular given the large amount of presumably liquid securities that could have generated a reasonable cash advance to uninsured depositors.