According to the evidence, euro area banks have a strong preference for smoothing dividends over the cycle. This implies the bulk of the adjustment to shocks that hit bank profits is borne by retained earnings, thereby generating bank equity and, arguably, credit supply volatility. Based on several recent empirical studies, this policy note warns about the potential link between the dividend policies of euro area banks and the adjustment mechanisms through which they improved their capital ratios in the aftermath of the Great Recession. Then, a DSGE modeling approach is adopted to assess the effectiveness of dividend-based macroprudential rules in complementing capital requirements to promote bank soundness and sustained lending over the cycle. What I shall call “dividend prudential targets” seem to induce significant welfare gains associated to a Basel III-type of capital regulation through their smoothing effects on retained earnings and credit supply.

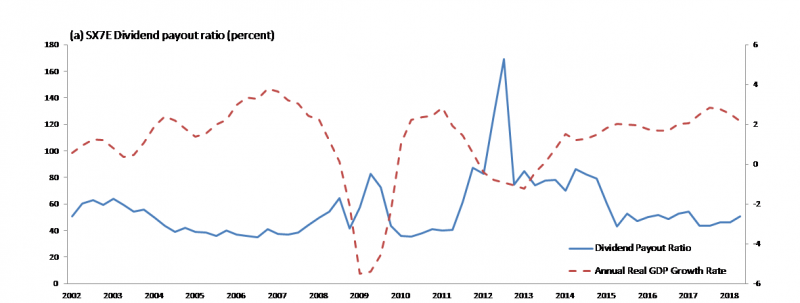

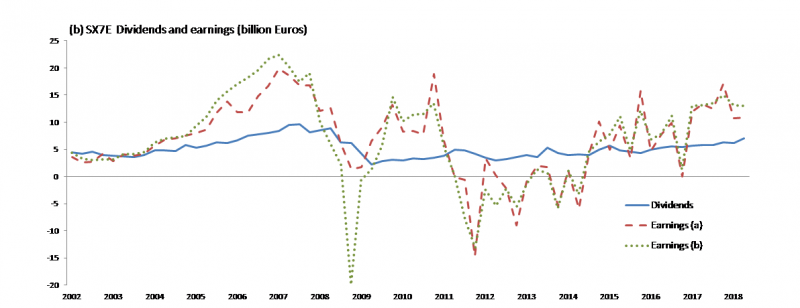

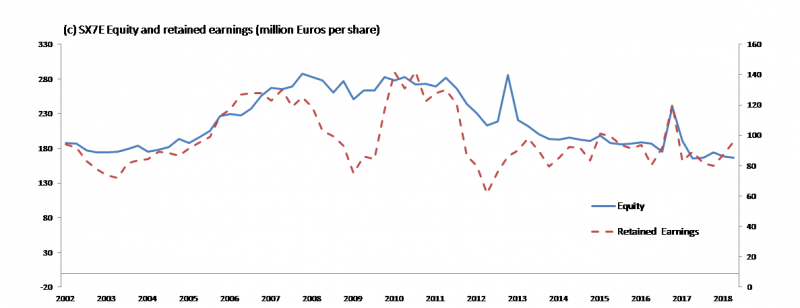

Conditional on the fulfilment of their corresponding capital requirements, banks in the euro area have a substantial degree of freedom to set their own payout policies. For the period 2002:I-2018:II, figure 1 describes some of the key patterns of dividends and earnings for a group of institutions that is considered to be representative of the euro area banking sector; the Euro Stoxx Banks Index (i.e., the SX7E). The euro area banking system seems to have a strong preference for paying large amounts of dividends in cash and for smoothing them over the cycle, thereby forcing retained earnings to borne the bulk of the adjustment in the face of shocks that hit bank profits.2 As a consequence, and given the procyclicality and relatively high volatility of bank earnings, two important patterns emerge: (i) the dividend payout ratio is notably countercyclical (figure 1a), and (ii) retained earnings – the core component of banks’ own resources – represent an important source of volatility for bank equity and, arguably, for bank assets (see figure 1c).

To the extent that existing capital regulation says little about the adjustment mechanisms through which banks should meet their capital requirements, this art of dividend policy can notably influence the way in which credit institutions tend to adjust their capital ratios.3 The joint consideration of several recent empirical studies points to the existence of a potential link between the dividend policies of euro area banks and the adjustment mechanisms through which they improved their capital ratios in the aftermath of the Great Recession.

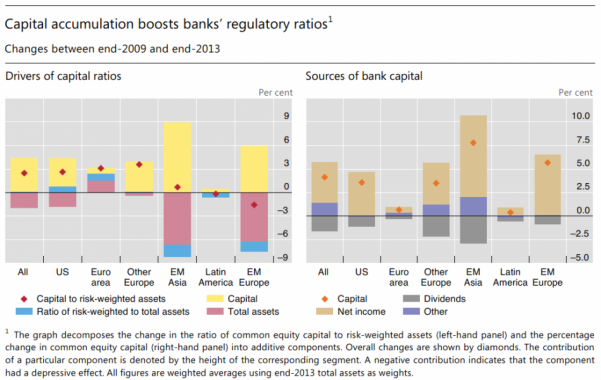

Cohen and Scatigna (2016) show that for the period 2009-2013 the euro area banking sector was boosting regulatory capital ratios, foremost via asset shrinking, while virtually the rest of the world was doing so primarily by means of capital increases (see figure 2). This evidence is aligned with the main findings in Gropp et al. (2018). Taking the EBA 2011 capital exercise as a quasi-natural experiment, these authors conclude that European banks which had to raise their core tier 1 capital ratios in response to the mentioned exercise did it by reducing their levels of risk-weighted assets rather than by increasing their levels of capital. More precisely, they engaged in asset shrinking rather than in risk reduction. A reduction in total assets that has been mainly attributed to a reduction in outstanding customer loans, with effects on the real economy.

This evidence deserves special attention from the policymaker. To the extent that issuing new equity in times of market stress is particularly costly, this kind of payout policies may be crucial to understand the preference of euro area banks for meeting capital requirements through asset shrinking in times of uncertainty and economic downturn.

There are several reasons which potentially justify public intervention to tackle this issue. First, despite the lack of consensus about the factors underlying dividend smoothing, there is a vast literature arguing this pattern is costly (according to some authors, due to the presence of market frictions). Second, regardless of whether a strong link between dividend smoothing and capital ratio adjustments really exists or not, giving the right incentives for bank managers and owners to tolerate a higher dividend volatility (and, thus, smoother retained earnings and bank equity), should contribute to bank soundness and sustained lending over the cycle. In addition, the fragility of an incomplete monetary union in times of economic uncertainty and financial stress, may give managers additional incentives to assign a signaling role to payout policies, thereby strengthening their preference for dividend smoothing.

Figure 1: Bank dividends and earnings in the euro area. 2002:I – 2018:II

Note: (1) SX7E stands for the Euro Stoxx Banks Index. In figure 1(a), the payout ratio is calculated as total common dividends multiplied by 100 and divided by income before extraordinary items less minority and preferred dividends. In figure 1(b), dividends include regular cash as well as special cash dividends for all classes of common shareholders, while earnings(b) are calculated as net income minored by total cash preferred dividends and other adjustments. Financial time series plotted in figures 1(a) and 1(c) have been computed as the capitalization-weighted sum of the SX7E members whereas those represented in figure 1(b) have been calculated as the simple sum of the same credit institutions. (2) When applicable, the secondary y-axis corresponds to the dashed line. Sources: Bloomberg, Eurostat, and Muñoz (2019).

Figure 2: Decomposition of the changes in the risk-weighted capital ratios

Sources: Cohen and Scatigna (2016) and BIS Annual Report (2014)

In the recent past, several authors have defended the importance of retaining earnings to build capital buffers, and the relevance of restricting dividend payouts when capital levels fall below a minimum threshold (a proposal that was incorporated in the Basel III Accord). See, e.g., Goodhart et al. (2010), Acharya et al. (2012), Admati et al. (2013) and Shin (2016).

To the best of my knowledge, however, there hasn’t been developed any work in which a DSGE modeling approach is adopted to assess the relevance of bank dividend regulation as a macroprudential tool in a world of capital requirements. Existing theoretical work on bank dividend-based prudential regulation is very limited, adopts a different methodological framework, and tends to focus on the particular case in which regulated institutions do not comply with capital legislation, disregarding the potential benefits of regulating bank payout policies, even when financial institutions meet their capital requirements.

On these grounds, in Muñoz (2019) I develop a DSGE model with certain financial frictions and a banking sector to assess the effectiveness of dividend-based macroprudential rules in complementing capital requirements to promote bank soundness and sustained lending over the cycle.

The proposed model incorporates the following key features: (i) bank capital accumulation out of retained earnings (i.e., inside equity financing), (ii) endogenous bank dividend policies, and (iii) a set of financial frictions that makes bankers to optimally adjust capital ratios through the retained earnings and credit supply channel in order to simultaneously smooth dividends and meet their target capital ratios.

The main role of the banking sector in this model is to allow for resource transfers between savers and borrowers. Bankers face a balance sheet constraint and a borrowing constraint which can be interpreted as a capital adequacy restriction. The latter implies regulatory capital ratios are binding in a neighborhood of the steady state. This assumption is important in order to focus the attention on the effects of a possibility not considered in the Basel III Accord. To regulate bank dividend policies even when credit institutions comply with capital requirements.4

There is little agreement on why corporations really smooth dividends and what determines their propensity to smooth (see, e.g., Leary and Michaely 2011). Thus, I opt to remain agnostic about the underlying causes behind dividend smoothing and only attempt to reproduce this pattern in a standard but simple manner. In particular, I allow for two mechanisms through which bank dividend smoothing can potentially take place in the model: (i) bankers’ preferences (which are represented by a CES utility function), and (ii) equity payout adjsutment costs, in the spirit of Jermann and Quadrini (2012). These are, probably, two of the most widely followed approaches to generate a pattern of dividend smoothing in a simple DSGE model (see, e.g., Jermann and Quadrini 2012, Iacoviello 2015, and Begenau 2019).

The first mechanism is consistent with a strand of literature arguing that dividend smoothing relates to managers’preferences (see, e.g., Fudenburg and Tirole 1995 and Wu 2018). The second one is aligned with recent evidence suggesting payout policies based on dividend smoothing strategies are costly to corporations (Brav et al. 2005). Whether the pattern of dividend smoothing is generated by the banker’s preferences or by the dividend adjustment cost function heavily depends on the parameterization of the two. As discussed in Muñoz (2019), due to empirical and theoretical reasons, the model has been calibrated such that dividend smoothing is induced by bankers’ preferences, implying the role played by the dividend adjustment cost function in this model is limited to the specification and transmission of the proposed regulatory scheme (and that its corresponding coefficient can be basically interpreted as a policy parameter).

In the same way Angelini, Neri and Panetta (2014) specify a target for dynamic capital requirements, the proposed model incorporates a regulatory target for bank dividends which depends on a macroeconomic indicator of the choice of the regulator. Given its relevance in macroprudential policy decision-making, I have chosen the credit-to-output gap to be such macroeconomic indicator.

The main difference between their approach and the one followed in Muñoz (2019) is that, in the latter, the extra cost bankers can incur when deviating from what I shall call “dividend prudential target” (henceforth DPT) is not taken as a deadweightloss. Rather, the paper assumes such cost takes the form of a penalty payment or sanction that is collected by the prudential authority and directly transferred as a net subsidy to the non-financial sector of the economy.

The basic model: the transmission mechanism

In a first stage, I present a stylized version of the model to clearly identify the transmission channel through which the proposed policy rule operates, and to quantitatively assess its potential to tame the credit cycle in the face of financial (collateral) shocks. In order to do so, I consider three scenarios: (i) the baseline scenario (absence of macroprudential rules), (ii) a policy scenario in which the prudential authority seeks to minimize the asymptotic variance of a certain macrofinancial indicator with respect to the coefficients of the dividend prudential target, and (iii) an alternative policy scenario in which the prudential authority solves the same optimization problem with respect to the coefficients of a dynamic capital requirement.5 I assess the effectiveness of the proposed rule for alternative macrofinancial indicators.

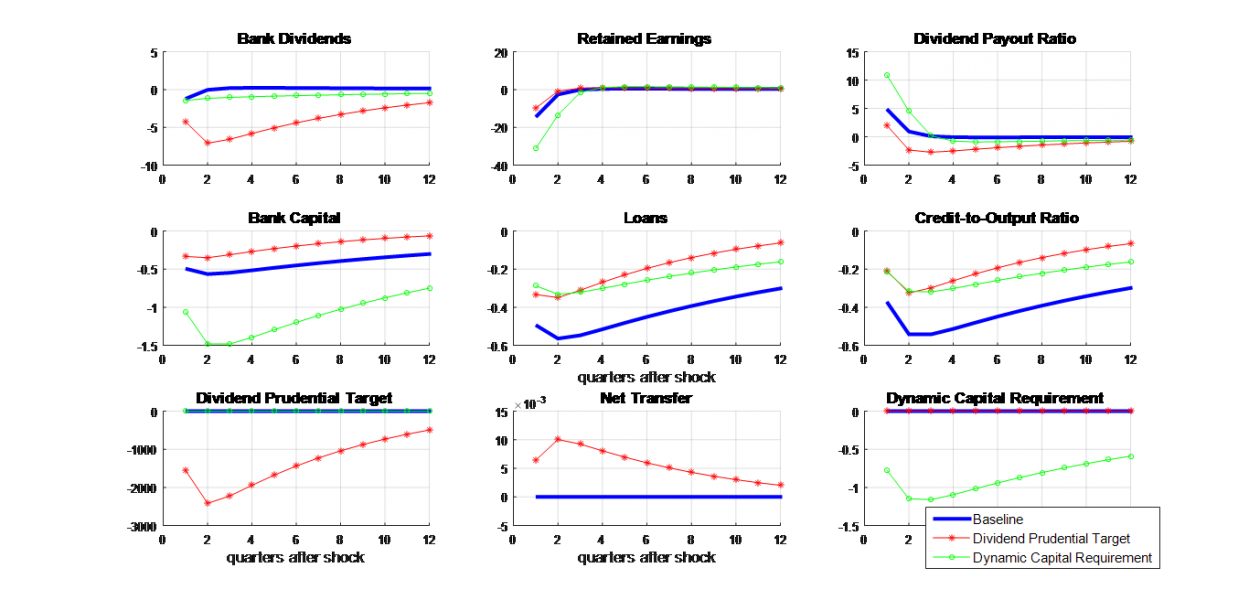

Figure 3 plots some selected impulse responses of the economy to a housing collateral shock under the three scenarios, for the case in which the DPT reacts to the credit-to-GDP gap, and the macrofinancial indicator whose asymptotic variance is minimized by the prudential authority is also the credit-to-GDP gap. Optimized DPTs – which are countercyclical and highly responsive – call for procyclical, relatively more volatile bank dividends. As a consequence, the rule has an important smoothing effect on retained earnings, bank equity and, ultimately, on credit supply and the credit-to-GDP ratio (balance sheet effect). Since the CCyB does not operate through the retained earnings smoothing channel, the potential of dynamic capital requirements to smooth the credit cycle tends to be somewhat more limited than that of DPTs. Importantly, DPTs are flexible enough so as to allow bankers to optimally deviate from the prudential target.6 That implies the sanction bankers must pay when deviating from the target is countercyclical, meaning the resources collected by the public authority and transferred to the non-financial private sector are countercyclical. That is, they involve a high payment to households and/or entrepreneurs when these agents need it the most; when the marginal utility of their consumption is relatively high. In other words, DPTs are associated to a sanctions regime that acts as an insurance scheme to the real economy.

Figure 3: The transmission mechanism. IRFs to a negative financial shock (basic model)

Note: Variables are expressed in percentage deviations from the steady state. The solid line refers to the baseline scenario. The starred line corresponds to an alternative (policy) scenario in which the optimized prudential rule is a dividend prudential target. The dotted line relates to an alternative (policy) scenario in which the optimized prudential rule is a dynamic capital requirement.

Source: Muñoz (2019)

The extended model: welfare effects and policy interactions with capital requirements

In order to improve the dynamics of the model and its mapping to quarterly euro area data, the model is extended in three main directions. In contrast to the basic model, this version incorporates: a second type of household with a lower subjective discount factor (impatient households), physical variable capital as a productive factor, and a variety of exogenous shocks which allow for a more comprehensive analysis of dividend prudential targets.7

Importantly, in this version of the model households are assumed to be the owners of all existing financial and non-financial corporations. This approach permits to carry out a sensible welfare analysis that restricts to households without neglecting any consumption capacity generated in the economy. Such quantitative exercise contributes to shed some light on the welfare effects of dividend prudential targets as well as on the interactions between such policy instrument and a Basel III-type of capital regulation.

In particular, welfare-maximizing dividend prudential targets are shown to have important properties: (i) they are effective in smoothing the financial and the business cycle by means of less volatile bank retained earnings, (ii) they induce welfare gains associated to a Basel III-type of capital regulation through various channels,8 (iii) they mainly operate through their cyclical component, ensuring that long-run dividend payouts remain unaffected,9 (iv) they are flexible enough so as to allow bank managers to optimally deviate from the target (conditional on the payment of a sanction),10 and (v) they are associated to a sanctions regime that acts as an insurance scheme for the real economy.11

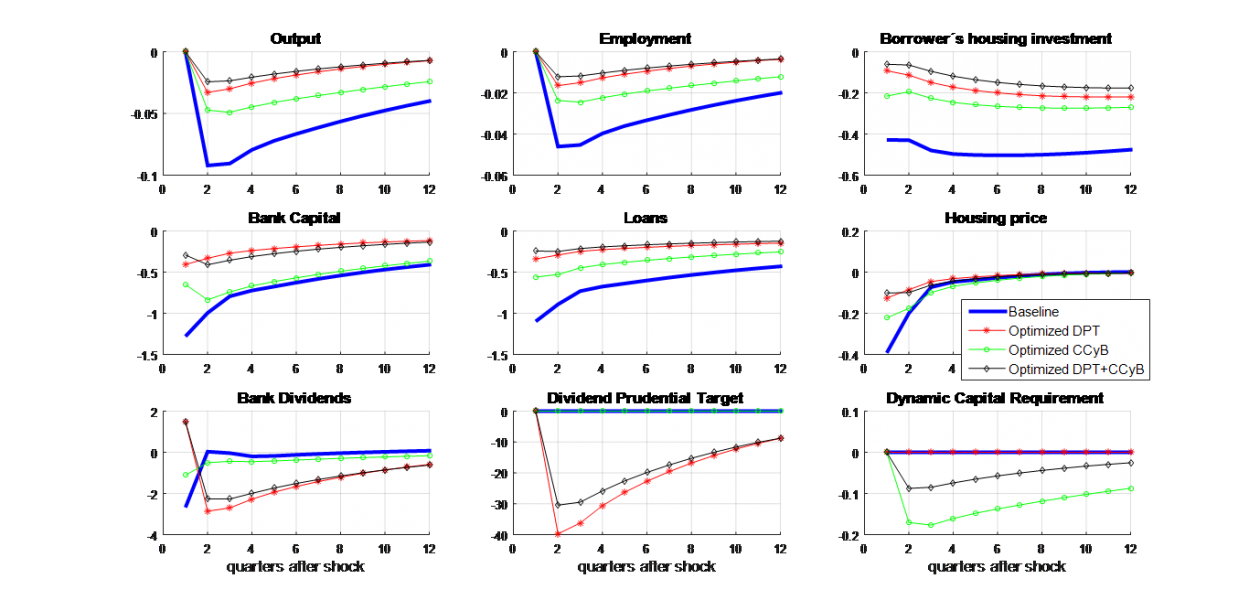

Figure 4 presents the impulse response functions of several key aggregates to a bank equity shock under four different scenarios in the extended model. Both, optimized DPTs (starred line) and optimized CCyBs (dotted line) are effective in smoothing key aggregates of the real economy, such as housing investment, employment and real GDP. Jointly optimized DPTs and CCyBs tend to be a more effective policy than any of the optimized rules in isolation (diamond line). This is especially true for the case of the CCyB since, as already discussed for the case of the basic model, the smoothing effect DPTs have on bank equity tends to make this instrument more effective in taming the credit cycle than the CCyB. As shown in Muñoz (2019), these results apply to a variety of exogenous shocks.

Figure 4: Impulse-responses to a negative bank equity shock (macroprudential policy scenarios)

Note: Variables are expressed in percentage deviations from the steady state. The solid line refers to the baseline scenario. The starred line corresponds to an alternative (policy) scenario in which welfare has been maximized with respect to the cyclical parameter of the dividend prudential target. The dotted line relates to an alternative (policy) scenario in which welfare has been maximized with respect to the cyclical parameter of the dynamic capital requirement. The diamond line makes reference to an alternative (policy) scenario in which welfare has been maximized with respect to both cyclical policy parameters.

Note: Variables are expressed in percentage deviations from the steady state. The solid line refers to the baseline scenario. The starred line corresponds to an alternative (policy) scenario in which welfare has been maximized with respect to the cyclical parameter of the dividend prudential target. The dotted line relates to an alternative (policy) scenario in which welfare has been maximized with respect to the cyclical parameter of the dynamic capital requirement. The diamond line makes reference to an alternative (policy) scenario in which welfare has been maximized with respect to both cyclical policy parameters.

Source: Muñoz (2019)

The prevailing financial regulatory framework says little about the adjustment mechanisms through which banks should meet their capital requirements. Based on this context, the DSGE model I propose and calibrate for quarterly data of the euro area suggests bank dividend smoothing is costly to society.

On these grounds, I specify a dividend-based regulatory scheme that gives bankers the right incentives to optimally allow for dividend payouts to borne a more relevant proportion of the adjustment in the face of shocks that hit bank profits. Since they operate through a different transmission mechanism (the retained earnings channel), dividend prudential targets are shown to be an important complement of existing capital regulation. The positive welfare effects induced by bank equity and credit supply smoothing more than offset those triggered by increased bank dividend volatility to bank owners. That is, optimized dividend prudential targets are welfare improving.

Nonetheless, the results and conclusions presented in this policy note and in the related paper (i.e., Muñoz 2019) should be taken with caution. The simplicity of the model is instrumental to clearly identify the transmission mechanism through which the proposed policy rule operates and to carry out a number of quantitative exercises. Yet, it comes at the cost of abstracting from a number of ingredients which are present in reality and that could possibly change some of the results. On the one hand, assuming a positive probability of bank failure, as in Clerc et al. (2015), should reinforce the argument in favor of this complement to the existing macroprudential toolkit. On the other hand, incorporating bank outside equity financing in an environment in which bank owners can substitute their shares for alternative assets at a relatively low cost, may make the policy proposal less attractive.

Despite the relevant properties of dividend prudential targets, alternative specifications of dividend-based prudential rules could be considered as well. First, a tax on bank distributed earnings that comprises a macroprudential component as the one that characterizes DPTs could also be effective in smoothing the credit cycle. However, it would have to be well designed in order not to be more “intrusive” than DPTs.12 Second, setting an upper limit on payout ratios can potentially prevent “excessive” dividend payouts during the economic downturn. Nevertheless, as long as it is binding during the lower phase of the cycle and due to its asymmetric nature, this limit is more likely to induce a reduction in the overall amount of dividends payed over the cycle and to be less effective in smoothing the credit cycle, respectively.13

Acharya, V., Gujral, I., Kulkarni, N., and H. Shin, (2012). “Dividends and Bank Capital in the Financial Crisis of 2007-2009.” Working paper, NYU-Stern and Princeton University.

Admati, A., DeMarzo, P., Hellwig, M., and P. Pfleiderer, (2013). “Fallacies, Irrelevant Facts, and Myths in the Discussion of Capital Regulation: Why Bank Equity is Not Expensive.” Working Paper, Stanford GSB.

Allen, F., and R. Michaely, (2003). “Payout policy.” In Handbook of Economics of Finance, edited by G.M. Constantinides, M. Harris and R. Stulz, 337-429. North-Holland. Amsterdam: Elsevier.

Angelini, P., Neri, S., and F. Panetta, (2014). “The Interaction between Capital Requirements and Monetary Policy.” Journal of Money, Credit and Banking, 46, 1073-1112.

Bank for International Settlements (2014): 84th Annual Report, 2013/14.

Begenau, J., (2019). “Capital Requirements, Risk Choice, and Liquidity Provision in a Business Cycle Model.” Journal of Financial Economics (forthcoming).

Brav, A., Graham, J. R., Harvey, C. R., and R. Michaely, (2005). “Payout policy in the 21st century.” Journal of Financial Economics, Elsevier, 77(3), 483-527.

Clerc, L., Derviz, A., Mendicino, C., Moyen, S., Nikolov, K., Stracca, L., Suarez, J., and A. Vardoulakis, (2015). “Capital Regulation in a Macroeconomic Model with Three Layers of Default.” International Journal of Central Banking, 11, 9-63.

Cohen, B. H., and M. Scatigna, (2016). “Banks and capital requirements: channels of adjustment.” Journal of Banking and Finance, 29, S56-S69.

Fudenberg, D., and J. Tirole, (1995). “A Theory of Income and Dividend Smoothing Based on Incumbency Rents.” Journal of Political Economy, 103(1), 75-93.

Goodhart, C. A., Peiris, E. U., Tsomocos, D., and A. Vardoulakis, (2010). “On Dividend Restrictions and the Collapse of the Interbank Market.” Annals of Finance.

Gropp, R., Mosk, T., Ongena, S., and C. Wix, (2018). “Banks Response to Higher Capital Requirements: Evidence from a Quasi-Natural Experiment.”Review of Financial Studies, 32 (1), 266–299.

Iacoviello, M., (2015). “Financial Business Cycles.” Review of Economic Dynamics, 18, 140-164.

Jermann, U., and V. Quadrini, (2012). “Macroeconomic Effects of Financial Shocks.” The American Economic Review, 102, 238-271.

Leary, M. T., and R. Michaely, (2011). “Determinants of Dividend Smoothing: Empirical Evidence.” Review of Financial Studies, 24(10), 3197-3249.

Muñoz, M. A. (2019). “Rethinking Capital Regulation: the Case for a Dividend Prudential Target.” ESRB Working Paper Series 97, European Systemic Risk Board.

Shin, H.S., (2016). Bank capital and monetary policy transmission, The ECB and its Watchers XVII conference, Frankfurt, 7 April 2016.

Wu, Y., (2018). “What’s behind Smooth Dividends? Evidence from Structural Estimation.” Review of Financial Studies, Society for Financial Studies, 31(10), 3979-4016.

Gross Domestic Product: Gross domestic product at market prices, Chain-linked volumes (rebased), Domestic currency (may include amounts converted to the current currency at a fixed rate), Seasonally and working day-adjusted. Source: Eurostat.

Dividend Payout Ratio: Fraction of net income payed to shareholders in dividends, in percentage. Calculated as: Total Common Dividends*100 / Income Before Extraordinary Items Less Minority and Preferred Dividends. Capitalization-weighted sum of the SX7E members. Source: Bloomberg.

Dividends: Dividends paid to common shareholders from the profits of the company. Includes regular cash as well as special cash dividends for all classes of common shareholders. Excludes return of capital and in-specie dividends. For the cases in which dividends attributable to the period are not disclosed, dividends are estimated by multiplying the Dividend per Share by the number of Shares Outstanding. Simple sum of the SX7E members. Seasonally adjusted data (TRAMO/SEATS). Source: Bloomberg.

Earnings (a): Income before extraordinary items and discontinued operation but after minority interest, preferred dividend, and other adjustments. Calculated as: Pretax Income – Income Tax – After Tax (Income) Loss from Affiliates – Minority Interest – Preferred Dividends – Other Adjustments. Simple sum of the SX7E members. Seasonally adjusted data (TRAMO/SEATS). Source: Bloomberg.

Earnings (b): Net income available to common shareholders. Calculated as: Net Income – Total Cash Preferred Dividend – Other Adjustments. Simple sum of the SX7E members. Seasonally adjusted data (TRAMO/SEATS). Source: Bloomberg.

Retained Earnings: Cumulative undistributed earnings. Includes net unrealized gain (loss) on securities held for sale and other items included in accumulated comprehensive income (net of tax). Includes deferred compensation to officers. Retained earnings are decreased by the amount of treasury stock. Reserves resulting from revaluation of assets in many countries are included as a part of shareholders’ equity and are included. Normalized by the number of shares outstanding. Capitalization-weighted sum of the SX7E members. Seasonally adjusted data (TRAMO/SEATS). Source: Bloomberg.

Total Equity: Firm’s total assets minus its total liabilities. Calculated as: Common Equity + Minority Interest + Preferred Equity. Simple sum of the SX7E members. Seasonally adjusted data (TRAMO/SEATS). Source: Bloomberg.

Manuel Muñoz is Senior Adviser for Financial Affairs at the Spanish Ministry for Economy and Business. The views expressed in this paper are those of the author and do not necessarily reflect the views of the institutions he is affiliated to. I am indebted to Javier Andrés and Luis A. Puch for invaluable support and guidance. I also thank Jorge Abad, Pablo Aguilar, Jordi Caballé, Eudald Canadell, Ángel Estrada, María José Fernández, Jordi Galí, Samuel Hurtado, Laura Mayoral, Galo Nuño, Johannes Pfeifer, Jesús Saurina, Javier Suárez, Dominik Thaler and Carlos Thomas for very helpful comments and suggestions, as well as participants at various seminars and conferences, including those kindly organized by the Bank of Spain and the National Securities Market Commission (CNMV). I am responsible for all remaining errors.

These patterns are consistent with the main findings of a vast empirical literature on corporate payout policies. According to the evidence, large, established corporations distribute a significant percentage of their profits in the form of dividends and they tend to smooth those payouts over the cycle (see, e.g., Allen and Michaely 2003).

In order to increase its regulatory capital ratio, a bank can either raise capital (numerator) or decrease total risk-weighted assets. The denominator can be reduced either by shrinking total assets or by reducing risk. The numerator can be increased either by issuing new equity or by retaining more earnings. In this regard, banks can target higher retained earnings either by boosting total profits or by reducing their dividend payout ratio.

According to the Basel III regulatory framework, credit institutions face no restrictions on their payout policies provided that they comply the minimum capital requirement plus the so-called conservation buffer (10.5% of risk-weighted assets).

Both prudential policy rules comprise a microprudential component – which in the case of the dividend prudential target relates to the dividend payout targeted by the prudential authority in the absence of financial fluctuations – and a macroprudential component that reacts to deviations of the selected macroeconomic indicator from its steady state level.

Figure 3 makes clear that, in order to induce the required effects on bank dividends, the DPT has to be substantially more volatile than dividend payouts.

Thus, two types of households coexist, one being net savers (patient households) and the other one being net borrowers (impatient households). In equilibrium bank loans are now extended to credit constrained households and entrepreneurs.

In particular: (i) they contribute to compensate the negative welfare effects induced by hikes in regulatory capital ratios that bring about a more restrictive and relatively more volatile credit supply, and (ii) they reinforce the effectiveness of the CCyB in smoothing the financial and the business cycle.

This property basically implies the total amount of dividends received by bank owners over the entire cycle remains roughly unchanged. Since the main negative welfare effect of optimized DPTs affects bank owners (and is induced by increased bank dividend volatility), this property may be important for such type of agent to be “willing to tolerate” the policy measure in practice and, ultimately, for the proposed policy rule to be implementable.

In practice, this kind of flexibility could also be decisive in order for the regulatory scheme to be implementable. Allowing for deviations permits bankers to manage additional risks which are not considered in this model (e.g., the risk of a severe fall in the equity price in response to a dividend cut).

In the model, deviations from the prudential target are allowed but penalized by the prudential authority. In Muñoz (2019), I assume the penalty payments collected by the public authority are directly transferred to bank owners (i.e., to those who borne the bulk of the negative effects related to DPTs) in the form of a net subsidy, an assumption which guarantees that even this type of agent benefits from the regulatory scheme under consideration.