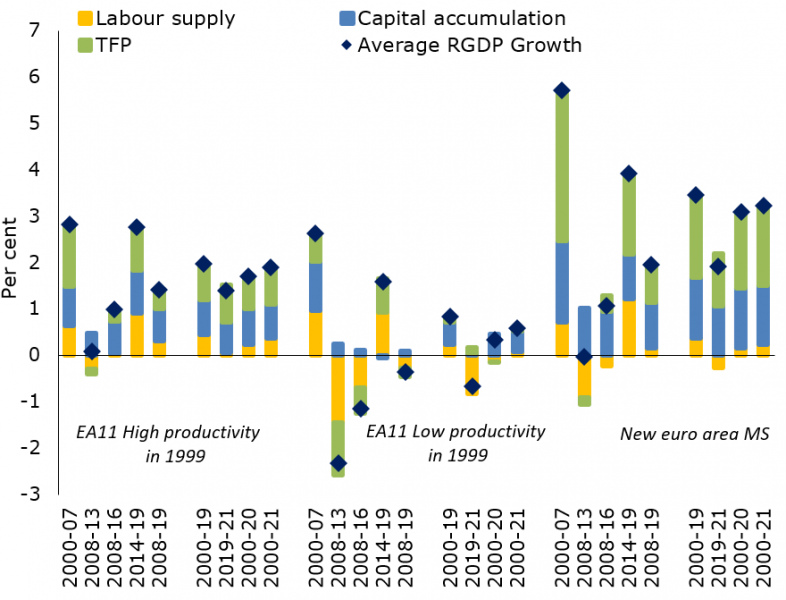

Graph 7: Decomposition of average annual GDP growth in EA-19

Note: Luxembourg is excluded. Source: Eurostat.

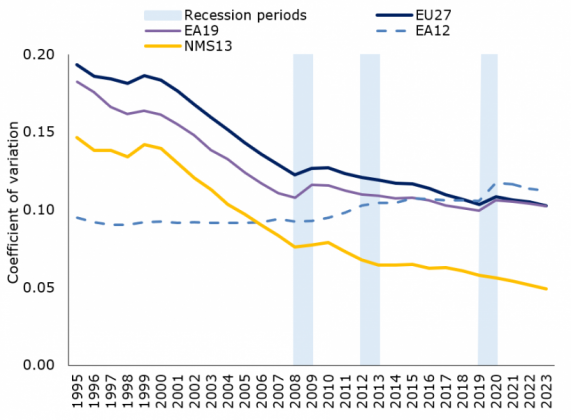

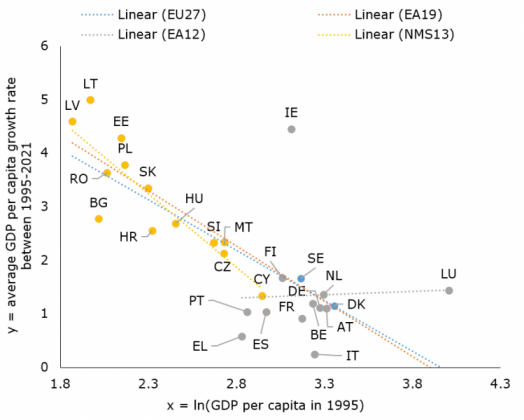

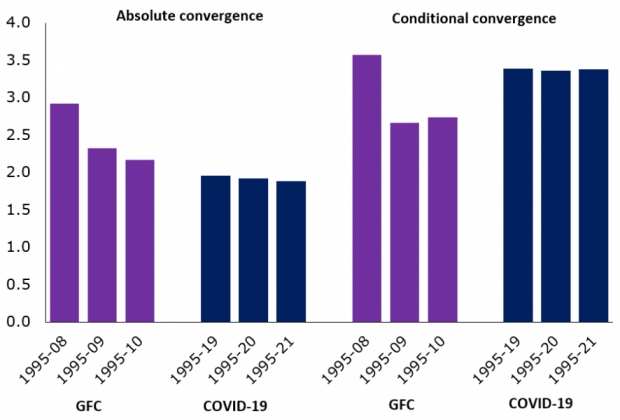

The COVID-19 crisis was like no other and had more severe consequences on countries particularly exposed to contact intensive sectors. Some of the most affected economies already experienced below EU average per capita income levels in 2019. At the same time, there were great concerns that the COVID-19 shock could further reduce the degree of convergence across the EU and lead to further divergences. The preliminary evidence provided in this paper, however, suggests that the COVID-19 shock is likely to have been significantly less damaging to the convergence process than the global financial crisis. Some of the channels that played out after the global financial crisis were probably not in play during the COVID-19 crisis.

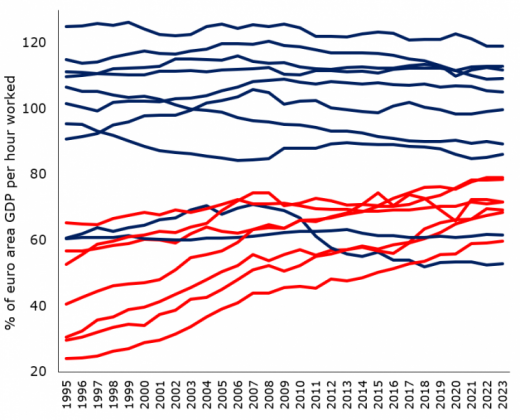

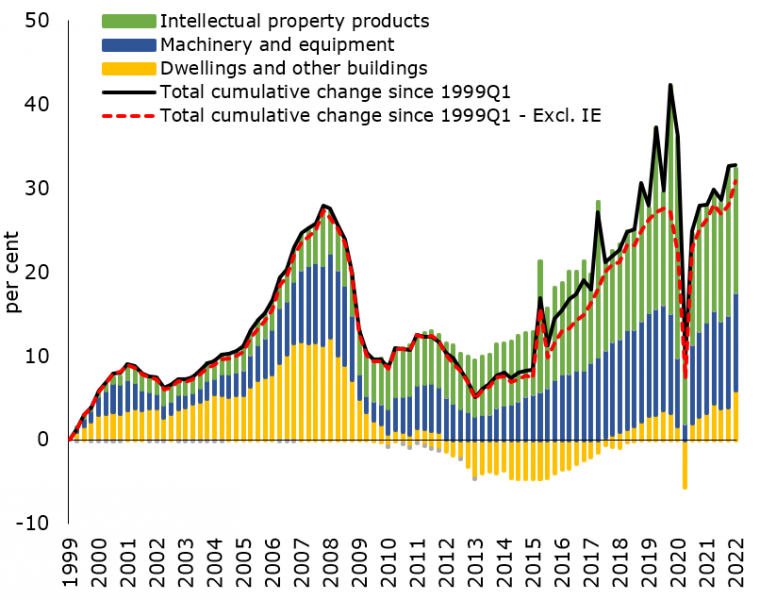

This paper provides further evidence for the growth-enhancing role of trade, and physical and human capital. The latter driver of growth is particularly relevant in the context of the unprecedented skill shortages that emerged during the recovery from the COVID-19 crisis. The importance of human capital as a driver of growth also highlights the key role of skill policies in addressing the root causes of labour shortages. Finally, this paper further stresses the need to continue tackling structural economic weaknesses, in particular through investments and reforms needed to improve productivity growth, a main driver for income convergence.

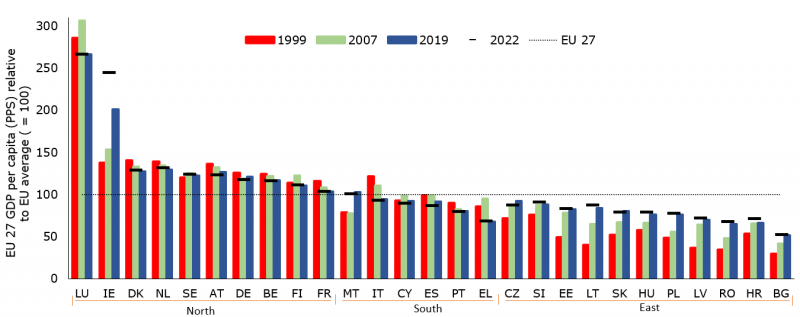

Income convergence is defined in terms of GDP per capita. This study focuses on all European Union Member States (EU-27) and euro area countries (EA-19) Member States respectively. EA12 includes the former euro area Member States (Austria, Belgium, France, Finland, Germany, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain and Greece). New Member States (NMS-13) include Cyprus, Czechia, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Slovakia, Slovenia, Bulgaria, Romania and Croatia.