Trade in services was overshadowed by trade in goods in the Brexit debate, undeservingly so as services account for almost a half of the UK cross-border exports and the EU is a major market for UK services exporters. Leaving the EU Single Market in services will cause increased regulatory costs of trading services and could have significant effects on the volume and composition of UK services exports under any exit deal. The highest rise in trade costs is to be expected in professional services, such as legal services, architecture, engineering, and accounting. With a rise in cross-border trade barriers there would be a relative increase in the proportion of services provided via a more costly physical presence within the EU. Regulatory heterogeneity among the EU members towards third countries will be an additional factor behind significant shifts in the sector and geographic composition of the UK services exports.

Services are a key sector of the global economy, accounting for the bulk of GDP in most countries and for a significant – and increasing – share of global trade. According to WTO data, cross-border trade in services (mode 1 and 2)1 accounted for 23.2% of total global trade in 2017 (see Box 1 for a description of modes of services trade). The share of services in trade becomes even higher if sales of services through foreign affiliates of multinational companies are added (Francois and Hoekman, 2010). In addition, services are traded indirectly as a part of value added embodied in merchandise products (so-called ‘mode 5’ of services trade as defined in Cernat and Kutlina-Dimitrova, 2014).

|

Box 1. Modes of services trade Services have unique characteristics that greatly affect their tradability. The two most obvious characteristics include intangibility and non-storability; however, typically they also require differentiation and joint production, with customers having to participate in the production process. In order to capture these aspects and to allow for trade in services that also require joint production, the WTO defines trade to span four modes of supply:

|

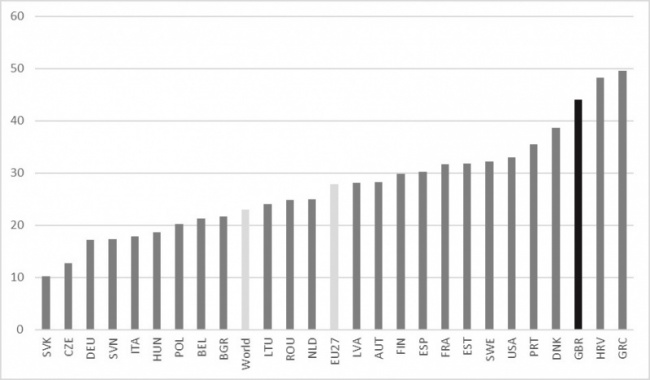

Still very often when politicians and the media talk about trade they often focus on goods, implicitly implying that it is of higher importance compared to services. Trade in services was largely overlooked in the Brexit debate, and undeservingly so as the UK is the second biggest exporter of services in the world and has one of the highest shares of services in total exports among leading economies (see Figure 1).

Moreover, the EU2 is a major market for UK services, having accounted for about 49% of total UK services exports in 2017 (a similar magnitude is observed for goods as well). For the EU the question is important as well because the UK is its third biggest services supplier after the US and Germany – according to Eurostat data, in 2017 the country accounted for about 9% of EU services imports (including intra-EU trade).

Figure 1. Share of cross-border services exports in total exports in 2017*, %

*Excluding outliers Luxembourg, Cyprus, and Ireland.

Source: WTO

In order to assess the possible consequences of the UK leaving the single market, it is important to understand the role of services in the country’s economy. We will proceed with analysing the characteristics of the UK services sector. Next, we will analyse the benefits of the UK from participation in the Single Market and what it can lose in terms of market access post-Brexit. Lastly, we will discuss possible Brexit effects on the UK services trade in general and assess which services sectors are likely to see the highest increase in services trade costs.

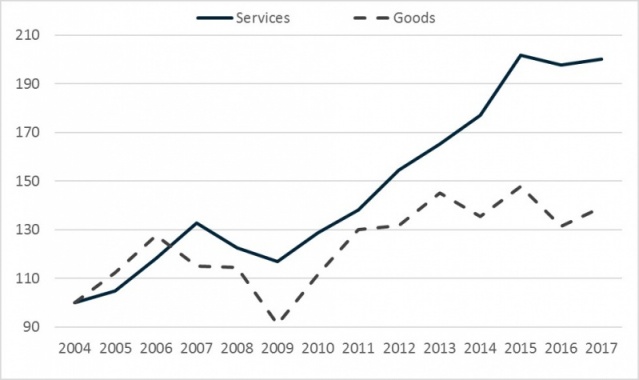

Services accounted for 45% of total UK exports in 2017, about 19 p.p. higher than on average in the EU – and their share increased post-crisis by about 7 p.p. The services sector has played an important role in mitigating the effects of the global crisis on the UK economy as services exports have been more resilient compared to merchandise exports. Figure 2 shows that during 2004-2017, exports of services mostly grew more dynamically than exports of goods and experienced a less sharp decline in the wake of the global financial crisis.

Figure 2. Indices of UK total goods and services exports value, 2004=100

Source: Eurostat

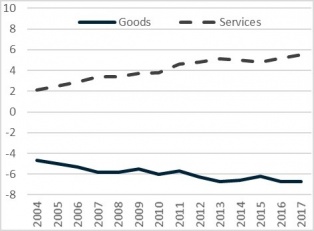

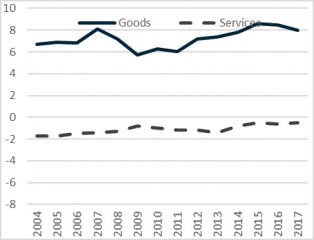

Figure 3 shows that UK economy differs sharply from Germany in terms of the contribution of net exports of goods and services to the current account balance. In contrast to Germany, the UK had a big deficit in merchandise trade over 2004-2017. A substantial surplus in services trade (equivalent to 5.5% of GDP in 2017) was nearly as big in terms of absolute value as the negative merchandise trade balance (-6.7% of GDP in 2017). Trade with the EU accounted for around a half of the UK’s surplus in services trade in 2017, thus a decline in services exports post-Brexit could cause significant changes in the current account composition.

Figure 3. Net exports of goods and services as share in GDP*, %

| UK | Germany |

|

|

*Including intra-EU trade.

Source: Eurostat

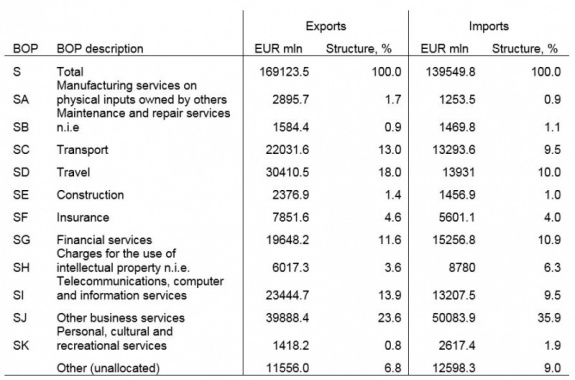

When one talks about sector specialization of British services exporters, London being a financial hub first comes to mind. But UK is competitive in a broad range of other services, with other business services being most prominent in cross-border trade. Table 1 shows sector structures of the UK cross-border services trade with the EU. ‘Other business services’, which include research and development, and professional and management consulting services, account for the highest shares in both exports and imports (though probably there exists some overlap between financial services and consultancy). Financial services is the second biggest sector in trade with the EU. Travel and telecommunications services are the third and fourth biggest export sectors.

Table 1. Sector structure of UK cross-border services trade (Modes 1+2) with the EU in 2016

Source: Eurostat

Zooming in on the other business services sector reveals that legal, accounting, management consulting, and public relations services account for the highest share of the sector’s total exports (33.5% in 2016 according to WTO data). The second biggest subsector is architectural, engineering, scientific, and other technical services (14.6%), followed by advertising, market research, and public opinion polling services (10.1%). In the transport sector, air transport accounts for almost two thirds of exports.

As a member of the Single Market, the UK has access to a market of over 500 million consumers, the free flow of data with other EU members, and passporting rights, which allow financial companies to sell services in any EU country without having to set up a branch there. Passporting rights are a very important reason behind the use of the UK as an EU base by US and Japanese financial firms. Outside the single market, international services firms selling into a foreign market largely do so from affiliates based in the country they are exporting to.

UK services trade with the rest of the EU, at least in some sectors, is far more reliant on cross-border supply from the UK’s territory into the other. Whereas 67% of UK commercial banking services supplied to the EU are exported cross-border, the same is true for only 28% of those sold to the rest of the world (Lowe, 2018).

There is also free movement of people, which is important for companies in the professional services sector who employ European staff in the UK or send workers on trips to the EU to consult clients, provide technical support to users of software products, draft legal contracts etc.

The EU has been the only group of countries to conduct multilateral services policy reforms (other countries normally carry out unilateral reforms, and the contribution of the GATS to services reform has been negligible). The Directive on Services in the Internal Market, adopted in 2006 and transposed by the Member States by the end of 2009, was intended to remove discriminatory barriers, cut red tape, modernise and simplify the legal and administrative framework and improve information exchange and cooperation of Member States.3 Though discriminatory barriers to services trade have remained quite significant as national regulatory regimes continue to segment services markets through heterogeneous regulations (Kox and Lejour, 2007; Borhert, 2016), many studies show the EU has achieved the most advanced services trade liberalization among existing regional trade agreements (Francois and Hoekman, 2010; Monteagudo et al., 2012).

|

Box 2. Nature of non-tariff measures in services trade Services trade, though free of import tariffs, is typically a subject of non-tariff measures and services regulations which impose significant trade costs on services providers. Regulation in services is driven by both efficiency and equity concerns due to the possibility of market failure in many services sectors, and problems of imperfect and asymmetric information (Francois, J., Hoekman, B., 2009). Peculiarity of services trade barriers in comparison with merchandise trade ones is that many trade barriers primarily affect fixed costs of service providers and are sunk market-entry costs (Kox, H., Lejour, A., 2007). The restrictions to services supply can be classified in several dimensions:

Even in the case when services regulations are not discriminatory and were designed to meet legitimate economic or social objectives, they may they still hamper trade as regulatory requirements in a given export market are additional to the ones a service provider faces at home and other export markets. Thus it is not only stringency of national product market regulations that matters, but also bilateral heterogeneity of each pair of countries. |

How severely Brexit affects the UK’s services trade will depend on the form it takes and what kind of a deal with the EU the UK government manages to achieve. If the UK opts for a divorce solution that precludes it from participation in the EU single market in services, it will inevitably face increased regulatory costs of trading services. An extreme outcome will be trading under the WTO rules in the case of a so-called hard Brexit, when the UK would lack any preferential access to the Single Market. While the WTO has somewhat lowered barriers to trade in services, the scope of liberalization was rather limited as many commitments under the General Agreement on Trade in Services (GATS) are non-binding. WTO members have the right to retain measures relating to qualification and licensing requirements and technical standards, so long as they are not an unnecessary barrier to trade (and there is no precise definition of “unnecessary”). In the case of financial services, members are allowed to take measures to ensure the integrity and stability of the financial system (Lowe, 2018).

As migration concerns were crucial for Brexit, this is probably the most binding constraint on the UK government and full free movement is not likely to be a part of any deal. This significantly limits available options for the UK services trade post-Brexit.

The EU’s recent FTAs with South Korea and Japan offer little more than standard GATS provisions in cross-border services trade, and significantly less than single market membership. FTAs do not do much to address regulatory issues around authorizations and licensing, with the processes varying between member states.

Lowe (2018) provides examples of limited scope of services trade liberalization in EU FTAs and of heterogeneity of services trade provisions to the third countries in different EU members.

It is possible for the UK and EU to agree on more advanced services liberalization than previous EU agreements, but in order to achieve this any preferential access to the EU market that the UK might seek would need to be part of a comprehensive agreement,4 otherwise the EU would be obliged to immediately extend more favourable conditions to all the other trading partners in line with the guiding most favoured nation (MFN) principle (Borhert, 2016).

However, the available options of more comprehensive agreements, such as membership in the European Economic Area are unlikely to find much support from the UK government due to political considerations. CETA and CETA+ appear to be more realistic options, however they envisage a limited scope of services trade liberalization. The latter implies improved coverage of services, particularly financial services. The UK could possibly secure mutual recognition that covered some professional qualifications and licensing for various sectors, but any deepening of services commitments would trigger unconditional MFN clauses in the EU’s other FTAs, which could be an obstacle (Catalfamo and Arts, 2018).

There have not been many quantitative estimates of the Brexit effects on services trade. Ebell (2017) attempted to quantify the effects of exiting the Single Market using gravity modeling and came up with 61% decrease in UK-EU services trade, which translates to a 26 per cent fall in total UK services trade. According to her results new FTAs will not manage to offset the losses. This result could be overly pessimistic; however, it is clear that a significant reallocation of services production away from the UK is to be expected.

With a rise in cross-border trade barriers one could expect that fewer services would be exported through Mode 1+2, and there would be a relative increase in the proportion of services provided via a more costly commercial presence within the EU-27. The process has already started even though Brexit has not taken place yet, as political uncertainty since the referendum and failure of the UK government to find internal consensus about a deal has forced companies to activate their contingency plans. It is most visible in the financial sector where more than 250 firms have moved or are moving business, staff, assets or legal entities away from the UK to the EU – and these numbers are likely to increase significantly in the near future. Banks have moved or are moving around £800 billion in assets from the UK to the EU, insurance firms are moving tens of billions of assets, and asset managers have transferred more than £65 billion in funds (Benson, Hamre and Wright, 2019).

Given the heterogeneity of services trade regulations among the EU members, UK services providers will likely face different market access conditions in each member state. As Table 2 shows, Germany is the biggest importer of British services among the EU member states (see Table 2), followed by France and the Netherlands. Regulatory divergence with these countries will play the most important role if the UK loses its access to the Single Market due to Brexit.

Table 2. Geographic structure of UK cross-border services trade (Modes 1+ 2) in 2017

Source: Eurostat

The US is the most important market for UK services exporters outside the EU (20.5% of total services exports in 2017), but substantial reorientation of British services exports to this and other non-EU markets is unlikely as geography matters to services trade almost as much as to trade in goods. Eaton and Kortum (2018) find that a standard gravity formulation with exporter–importer fixed effects captures bilateral trade both in services overall and in eight categories of services nearly as well as trade in goods, with similar distance elasticities. Evidence suggests that services exports are usually quite localized geographically due to such factors as need of face to face interactions complementing cross-border trade, inconvenience of operating in different time zones etc.

In order to identify the countries with which the UK is likely to face the highest rise in trading costs post-Brexit, we use data on the STRI (services trade restrictions index) compiled by the OECD (see Box 3) at the available estimates of trade restrictiveness for EU members.

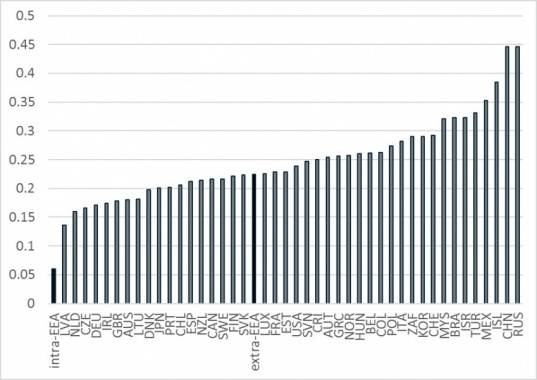

Figure 4 compares services trade restrictions of EEA member states and other countries. Inside the EEA the average STRI in 2018 was at 0.06, almost four times lower than the region’s restritcions to trade with the third countries. The most restrictive countries in the sample are Russia and China. Among the EEA members there is considerable difference in terms of STRI levels: Latvia, Netherlands, and Czech Republic are among the most open countries, and Poland, Italy, and Iceland have the highest average restrictions.

|

Box 3. OECD STRI methodology The OECD STRI database contains indices that are a measure of MFN restrictions and does not take into account any specific concessions. It was assembled by analysing laws and regulations in 34 OECD countries and Brazil, China, India, Indonesia, Russia, and South Africa. The policy measures are grouped under the same five policy areas in all sectors, and are turned into an index using a scoring and weighing technique that is based on a number of studies and expert meetings (see Geloso Grosso, 2015). The indices take values from 0 to 1, 1 indicating the highest non-tariff measures (NTMs) (market completely closed to foreign service providers), and 0 means a fully liberalized sector. The STRI database provides information not only on the level of restrictions in force in each country, but also on the extent to which regulatory systems in different markets resemble each other. Indices of regulatory heterogeneity are constructed by pairwise comparison of countries, measure by measure and sector by sector. The scores are aggregated using the same weights as for the STRI indices. The resulting STRI regulatory heterogeneity indices capture differences in the set of regulatory requirements by country pair and sector (Benz, 2019). |

Figure 4. Total STRI by country in 2018, simple average across all sectors

Source: OECD, authors‘ calculations

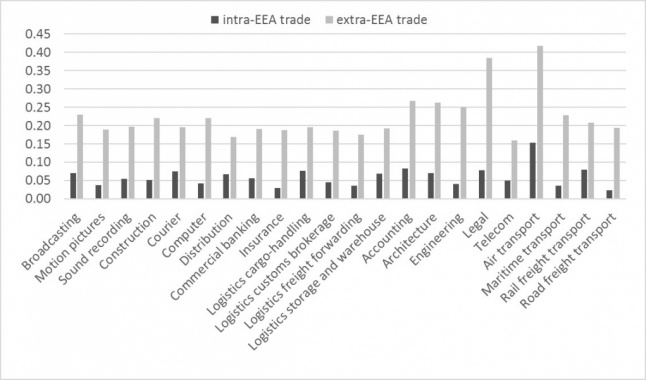

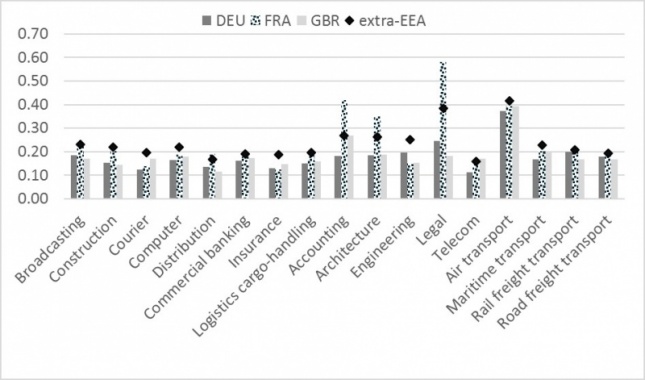

Zooming in on different sectors reveals that inside the EEA the highest STRI levels are observed in air transport, rail freight transport, accounting and legal services (see Figure 5). Countries outside the Single Market face the highest barriers to trade with the EEA members in air transport and a range of professional services: legal services, accounting, architecture, and engineering – in these sectors the UK is likely to experience the highest increase in trade costs. The highest relative differential between intra-EEA and extra-EEA services trade restrictions was recorded in road freight, maritime transport, insurance, and engineering.

Figure 5. EEA STRI in 2018, simple average across countries

Source: OECD, authors‘ calculations

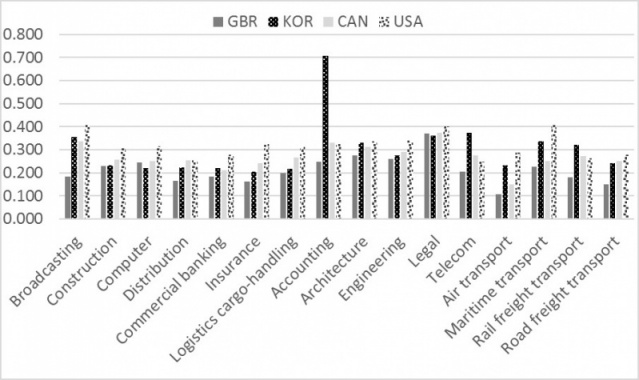

Figure 6 compares the current level of restrictions the UK faces in services trade within the Single Market with restrictions in trade with South Korea (that has an FTA with the EU), Canada (CETA agreement), and USA (no FTA). The first conclusion to make is that currently the UK has the lowest barriers to trade in all the sectors and they are likely to rise post-Brexit. A magnitude of the rise will of course depend on the divorce agreement the UK manages to reach. The highest relative rise is most likely in those sectors that currently face the highest barriers under other preferential trade agreements – air transport, broadcasting, insurance, and accounting.

Figure 6. Regulatory heterogeneity of EEA and selected partner countries in 2018, simple average

across countries

Source: OECD, authors‘ calculations

Figure 7 illustrates regulatory heterogeneity among the UK and its main services trade partners Germany and France. France is more restrictive towards imports from the non-EEA countries than Germany, in particular in legal services, accounting, and architecture, where STRI values are significantly higher compared to Germany or the EEA on average. At the same time these sectors have lower values of STRI in Germany than on average in the EEA, therefore it is likely that Germany’s share in the UK exports of these services will increase post-Brexit.

Figure 7. STRI in 2018, extra-EEA STRI values calculated as simple average across countries

Source: OECD, authors‘ calculations

Services trade, in particular with the EU, plays an important role in the UK economy. However, it was largely omitted from the first round of Brexit negotiations and the debate in the UK itself around withdrawal from the EU regardless lobbying attempts by representatives of the British financial firms. As a member of the Single Market UK has access to a market of over 500 million consumers, the free flow of data with other EU members, and passporting rights, which allow financial companies to sell services in any EU country without having to set up a branch there. How severely Brexit affects Britain’s services trade will depend on the form it takes, however under all feasible options the UK will inevitably face increased regulatory costs of trading services.

With a rise in cross-border trade barriers there would be a relative increase in the proportion of services provided via more costly commercial presence within the EU. The process has already started even though Brexit has not yet happened, triggered by political uncertainty and is most visible in the financial sector where more than 250 firms have moved or are moving business.

The biggest losses for the UK services sector would take place if the country crashes out of the EU without any agreement and has to trade with the bloc on the WTO terms, which envisage limited scope of liberalization under the GATS.

Concluding an FTA with the EU will still mean a significant rise in the barriers to services trade for the UK. As the EU’s recent agreements with South Korea and Japan show, FTAs do not address regulatory issues around authorizations and licensing, with the processes varying between member states.

It is possible for the UK and EU to agree on more advanced services liberalization than previous EU agreements, but in order to achieve this any preferential access to the EU market that the UK might seek would need to be part of a comprehensive agreement, otherwise the EU would be obliged to immediately extend more favourable conditions to all the other trading partners. However, politically feasible options of such a agreement are deals similar to CETA, which offers limited scope of liberalization.

Armour, J. (2017), “Brexit and financial services”, Oxford Review of Economic Policy, Volume 33, Number S1, 2017, pp. S54–S69.

Benson, C., Hamre, E. F., and Wright, W. (2019), “Brexit & the City – the impact so far”, Ecommerce reports, March.

Benz, S. (2019), “Intra-EEA STRI Database: Methodology and Results”, OECD, TAD/TC/WP(2018)13/FINAL

Berden, K., J. Francois, S. Tamminen, M. Thelle, and P. Wymenga (2009), ‘Non-Tariff Measures in EU-US Trade and Investment: An Economic Analysis’, Final report, Ecorys.

Berden, K., J. Francois, S. Tamminen, M. Thelle, and P. Wymenga (2013), ‘Non-Tariff Measures in EU-US Trade and Investment: An Economic Analysis’, IIDE Discussion Papers 20090806, Institue for International and Development Economics.

Bochert, I., B. Gootiiz, A. Mattoo (2012), ‘Policy Barriers to International Trade in Services: Evidence from a New Database’, Policy Research Working Paper, WPS6109, The World Bank.

Borhert, I. (2016), ‘Services Trade in the UK: What Is at Stake?’ UK Trade Policy Observatory, Briefing paper 6.

Catalfamo, J. and Arts, A. (2018), “Outside the Single Market, what kind of deal can Britain’s services sector hope for?”, https://blogs.lse.ac.uk/brexit/2018/06/06/outside-the-single-market-what-kind-of-deal-can-britains-services-sector-hope-for/

Cernat, L. and Z. Kutlina-Dimitrova (2014), ‘Thinking in a Box: A ‘Mode 5’ Approach to Service Trade’, DG TRADE Chief Economist Notes, No 2014-1.

Deardoff, A. V. (2001), ‘International Provision of Trade Services, Trade and Fragmentation’. Review of International Economics, 9 (2), pp. 233-248.

Dhingra, S., H. Huang, G. Ottaviano, J. P. Pessoa, T. Sampson and J.V. Reenen (2017), ‘The Costs and Benefits of Leaving the EU: Trade Effects’, CEP Discussion Paper No. 1478.

Eaton, J. and Kortum, S. (2018), “Trade in goods and trade in services”, forthcoming in Lili Yang Ing and Miaojie Yu, eds., World Trade Evolution: Growth, Productivity, and Employment, Routledge.

Ebell, M. (2017), ‘Will new trade deals soften the blow of hard Brexit?’, National Institute of Economic and Social Research, January.

Francois, J. and B. Hoekman (2010), ‘Services Trade and Policy’, Journal of Economic Literature, 48(3), pp. 642-92.

Francois, J., M. Manchin, H. Norberg, O. Pindyuk and P. Tomberger (2013), ‘Reducing Transatlantic Barriers to Trade and Investment: An Economic Assessment’, IIDE Discussion Papers 20130401, Institute for International and Development Economics.

Francois, J. and K. Reinert (1996), ‘The Role of Services in the Structure of Production and Trade: Stylized Facts from a Cross-Country Analysis’, Asia-Pacific Economic Review, 2(1), May.

Francois, J. and J. Woerz (2008), ‘Producer Services, Manufacturing Linkages, and Trade’, Journal of Industry, Competition and Trade, 8(3), December, pp. 199-229.

Geloso Grosso, M., F. Gonzales, S. Miroudot, H.K. Norda s, D. Rouzet, and A. Ueno (2015), ‘Services Trade Restrictiveness Index (STRI): Scoring and Weighting Methodology’, OECD Trade Policy Papers No. 177. Paris: OECD Publishing, 2015.

Kee, H.L. and A. Nicita (2017), ‘Short-Term Impact of Brexit on the United Kingdom”s Export of Goods’. Policy Research Working Paper No. 8195, World Bank.

Kox, H., and A. Lejour (2007), ‘Trade in Services and the Dissimilarity in Domestic Regulation’. CPB NBEPA, August.

Leitner, S.M., M. Marcias, D. Mirza, O. Pindyuk, J. Siedschlag, R. Stehrer, R. Sto llinger and Z. Studnicka (2016), ‘The Evolving Composition of Intra-EU Trade’, wiiw Research Reports 414, The Vienna Institute for International Economic Studies, wiiw.

Lowe, S. (2018), “Brexit and Services: How Deep Can the UK-EU relationship go?” Centre for European Reform, December.

Montalieu, T. and I. Rabaud, (2010), ‘Measurement of Restrictions in Trade in Services: A Critical Assessment’, Laboratoire d’Economie d’Orleans, Working paper No. 2010-03.

Monteguado, J., A. Rutkowski and D. Lorenzani (2012), ‘The Economic Impact of the Services Directive: A First Assessment Following Implementation’, European Economy, Economic Papers 456.

When not stated otherwise, trade in mode 1+2 is considered when talking about services trade.

Throughout the article, EU refers to EU-27 unless stated otherwise.

See https://ec.europa.eu/growth/single-market/services/services-directive/in-practice/quick-guide_en

The EU has a reservation specifying that the MFN clause does not apply at all if the Union enters into a sufficiently deep relationship with a third country.