Originally published by RaboResearch on September 15, 2022 – The complex task of reforming the EU’s electricity market. Since then, the policy interventions debate on EU’s electricity markets further crystalized in some aspects. For example, to ease the liquidity constraints that certain energy companies face, besides banks and governments stepping in to help with credit facilities, the European Commission put forward two measures to address this issue. The first one relates to increasing from EUR 3 bn to EUR 4 bn the threshold from which companies are subject to margin calls. The second one enlarges for a temporary 12 months period the spectrum of assets that can be used as collateral to cover futures power contracts to include also uncollateralised bank guarantees and public guarantees. Furthermore, national governments

introduced various retail power price caps and demand reduction measures. Yet, there are aspects that need further clarification. For instance, the heated debate on how or if to intervene in the natural gas markets is still ongoing. The discussion concentrates now on exploring ways to implement dynamic natural gas price corridors and on creating an new LNG linked natural gas price benchmark as an alternative to the Dutch TTF benchmark. Moreover, we know that member states can implement revenue caps on the inframarginal producers of up to EUR 180/MWh for the period between December 1, 2022 and June 30, 2023. However, we lack clarity on how member states will act upon this. Member states can choose freely the way they implement such caps in their local legislation, and this brings additional uncertainty over the next few months.

It’s no longer news that the EU has buckled under the burden of soaring energy prices. These are hitting consumers and businesses very hard, and there is no short-term alleviation in sight.

As the situation intensifies, the discussion related to potential legislative intervention into electricity markets has heated up. To address the root cause of the problem, for example, theEuropean Commission (EC) published its REPowerEU strategy earlier this year. REPowerEU is aimed at accelerating the energy transition while at the same time ensuring energy security and supply diversification in the short run. At national levels, support measures that target private households and SMEs1 through tax reductions and retail electricity price regulation have, for example, been widely adopted across the EU.

On September 14, the President of the EC, Ursula von der Leyen, lifted the veil on the EU’s recently announced ambitions to reform the electricity market. In her State of the Union Address 2022, Ms. von der Leyen stressed that the current market design based on merit order wasn’t fit for purpose anymore. That is one of the major drivers for the EC to carry out an urgent reform of the electricity markets. She also stated that the reform shouldn’t be a quick fix. Even so, she has also said that this initiative would be fast-tracked, while long-term reforms – as already introduced in the EC’s communication on “Short-Term Energy Market Interventions and Long Term Improvements to the Electricity Market Design” – will continue through their corresponding impact assessment.

While a structural market reform might be needed, given the urgency of the energy crisis, governments cannot afford to stray away from some level of intervention with temporary targeted measures. Thus, the proposals currently on the table are short-term emergency interventions intended to help the EU better cope with high energy prices. Real market reform will follow.

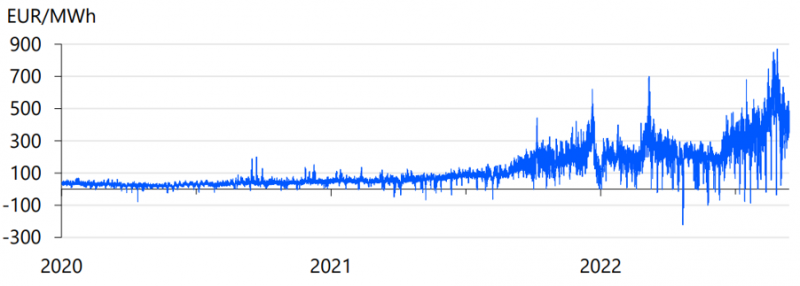

Wholesale electricity prices across Europe are currently trading at levels unthinkable just two years ago, when electricity was trading on average at price levels of EUR 40/MWh to EUR 50/MWh. The current wholesale day-ahead electricity price levels (see an example from the Netherlands in Figure 1) have spurred countless discussions about the way electricity markets operate and have opened debates on both the necessity and the opportunity for governments to intervene in these markets.

Figure 1: Dutch day-ahead hourly prices since 2020

Source: Entso-e

A multitude of factors have created a perfect storm for electricity markets. The main contributor to the skyrocketing electricity prices in Europe has been the hike in natural gas prices, driven mainly by geopolitical developments. Most European countries to some extent rely on natural gas to fulfill their electricity needs. In those countries (see our previous article), gas-fired power plants fueled by the currently expensive natural gas are often the wholesale electricity price setter.2

Why does a high electricity price matter? Electricity, and energy in general, represents the backbone of our economies and is an essential need for private individuals. A sharp drop in the affordability of electricity can severely affect the budgets of households, companies, and governments. To put things in perspective, 2,865 TWh of electricity were generated across the EU in 2021. If the EU were pay EUR 400/MWh for each MW consumed in a year (around ten times higher than the price two years ago), it would cost EUR 1.1 trillion, a figure almost as high as the GDP of Spain. This is not the case, as many long-term electricity contracts were signed before 2022 at much lower and more affordable prices than the ones mentioned above. However, if the current high gas prices endure, the financial impact will be extremely challenging for individuals, companies, and governments.

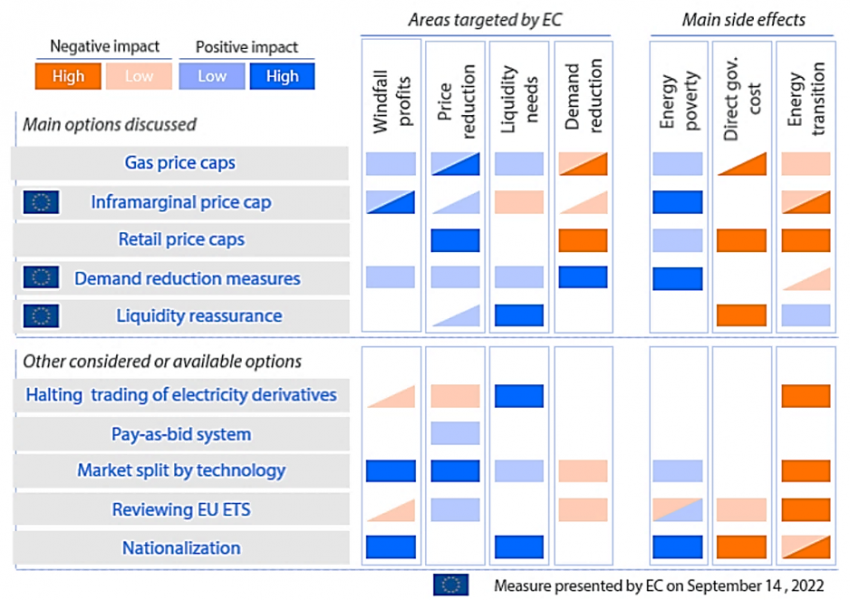

Throughout 2022, discussions related to emergency measures and a potential market reform of the EU’s electricity markets have prompted the EC to target four different areas:

One of the prime reasons to intervene in the wholesale electricity system design is solidarity. While most companies and consumers are hit by the high prices, fossil fuel companies and some electricity generators benefit enormously from the current situation. This is especially the case for owners of electricity generation facilities with low marginal costs (e.g. hydro, nuclear, solar, wind power plants). At the current electricity prices, these players can earn revenues many times higher than their marginal costs. This situation is prompting governments to look for ways to capture these so-called windfall profits. The funds raised from such extraordinary taxes could be spent to support the most vulnerable parts of society. This could either be done indirectly through lower electricity prices or directly through money redistribution.

Ms. von der Leyen’s State of the Union speech revealed highlights of the intervention measures to be introduced by the EU. For example, the proposal for a Council Regulation specifically includes a revenue cap mechanism aimed to deal with windfall profits and a target to reduce electricity consumption. Reforming a market is a complex task and there is no perfect solution. Each of the intervention options considered have their own drawbacks and unintended negative side effects, and any intervention in a market would normally require very careful consideration and weighing, as well as a long preparation time.

For illustrative purposes, Figure 2 contextualizes the newly announced intervention proposals among all available reform options. It also depicts the complexity and the debate related to market policy interventions. Some of the proposals that have been heavily debated and might be introduced at a later stage, such as a cap on the gas price or variants of the introduced measures, are also included.

Figure 2: Intervention options in electricity markets and their potential impact

Source:RaboResearch, 2022

A high-level conclusion is that the proposed interventions would broadly have a positive impact on energy poverty, but are not likely to stimulate the energy transition. The following sections will explain each of the options presented in Figure 2, their advantages and shortcomings, and what Ms. von der Leyen specifically proposed on September 14.

The following section touches upon five heavily debated options. The list of proposals and potential actions is lengthy, especially if we consider variations of the different intervention options and deeper interventions in electricity markets. For example (in)direct nationalization, with its pros and cons, is also being considered (e.g. Uniper in Germany) or, in some places has already been put into motion (e.g. EdF in France). Appendix A includes a number of other noteworthy potential options considered for intervening in the EU’s electricity market.

One of the most widely discussed solutions is to cap natural gas prices. This can be done in various ways. In the current debate, imposing a cap on natural gas prices would indirectly translate to a price cap on wholesale electricity prices. While such a solution artificially reduces wholesale and, subsequently, retail electricity prices, it could backlash in various ways.

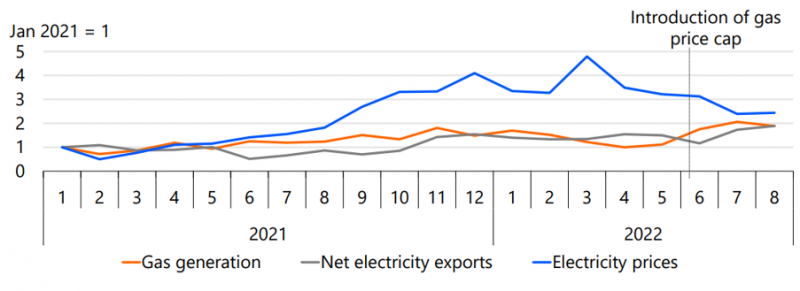

Let us take Spain and Portugal as an example. After obtaining an exception from the EC in April 2022, Spain and Portugal capped natural gas prices at EUR 40/MWh and agreed to increase the cap monthly by EUR 5/MWh over the subsequent six months. The difference between the capped natural gas price and the market price is paid only to gas-fired power plant generators, not to the submarginal technologies. As intended, spot wholesale electricity prices did decline after the cap was implemented (see Figure 3).

Figure 3: Spanish case study on capping natural gas prices

Source: BloombergNEF 2022

At the same time, the profits generated by inframarginal producers, the ones which are not price setters, also decreased. In practice, this measure could therefore also be considered an artificial tax on windfall profits of inframarginal electricity generators. As time passes, we start to see a number of unintended negative side effects (see Table 1).

Table 1: Unintended negative effects from capping national gas prices in Iberia

| Occurrence |

Unintended effect | |

| Exports of cheaper electricity increased | Net electricity exports from Iberia to neighboring countries more than doubled between June and August 2022 compared to the same period in 2021. If a similar gas price cap to subsidize electricity were to be applied across the EU, we could, in theory, see a similar effect with increased flows of cheaper electricity toward the UK or between countries within the EU. The real impact might be limited though, as it will depend on limitations in interconnection availability. | |

| Increased (artificial) competitiveness of gas-fired plants | Gas-fired electricity generation from June to August 2022 increased by over 55% year-on-year in Spain. This was partly because the capped natural gas price suddenly made gas-fired power plants more competitive again. This surge in production also relates to the fact that the more efficient combined heat power (CHP) generators were not included in the initial package. As a consequence, CHPs provided only 3% of Spain’s electricity in August 2022 compared to 10% in August 2021. | |

| Limited incentive for demand reduction | Probably the biggest drawback of focusing solely on electricity price reduction is that it does not incentivize demand reduction, which is one of the EU’s key ambitions. An instrument only focused on reducing electricity prices will not provide signals for demand sobriety. This could ultimately lead to gas shortages in the event of a cold winter. In the Iberian case, the gas price cap scheme is funded primarily4 through a charge on end users benefiting from this measure. In this way, demand growth remains partly contained as it is not fully insulated from the high gas market prices. |

Source: RaboResearch, BloombergNEF, 2022

The Iberian approach is an in-between option along the spectrum of ways that gas price caps can be applied. For example, one could envision a similar gas price cap to the one set in Spain, but with the cost fully supported by the government. Such a measure would leave governments with an open-ended bill to be footed from taxpayer money in line with increasing gas prices. In addition, such a cap would not stimulate a reduction in demand as much as its absence would.

An alternative would be to limit natural gas prices without subsidizing electricity generators with the difference between the market price and the set price cap. This solution could solve the open-ended budget implications for governments, but also has majors risks of its own. Capping natural gas prices without compensating for the potential price difference can lead to (more) natural gas shortages. There may not be any company willing to buy gas and deliver electricity under such price levels, as they may risk bankruptcy during the process. Considering these risks, betting on such a gas cap price would mean betting on the cap to lead to lower gas market price levels. Yet, the liquefied natural gas (LNG) market is already very tight as the EU wants to capture a major part of the world’s available LNG capacity. On top of that, Russia threatens to fully stop flows if a generalized price cap is imposed. Thus, it is unclear if national governments, or even EU as a whole, have enough market power to reduce natural gas prices through a cap.

While some sort of cap on natural gas prices is among the most discussed topics lately, European governments have so far failed to reach a consensus. Yet, this discussion hasn’t closed and the possibility remains that price caps on natural gas will be put forward following the next meeting of the EU energy ministers on September 30, 2022.

To conclude, the EEX, one of the major power markets operators in Europe, gave a warning about some of these risks previously. In a report published in April 2022, the EEX drew an elegant parallel: “Capping gas market prices is like capping a thermometer: Even if the display is capped at a maximum, the temperature may nevertheless rise in the background without anyone noticing.”

Instead of looking at ways to limit the cost of natural gas-fueled marginal producers, another approach could be to tax or cap revenues of inframarginal producers. This could, for example, be done by setting inframarginal price caps per technology which would work as a revenue clawback.5 This solution, which got increasing traction, appears to be sensible, as it offers a more tailored approach to capturing windfall profits. In turn, the amount raised by governments through capturing windfall profits could be used for redistribution to the most vulnerable consumers or businesses. Moreover, if implemented in combination with demand reduction measures, all else being equal, ‘taxing’ inframarginal producers will not alter market price signals as wholesale electricity prices would remain untouched.

Considering these advantages, the EC opted for a version of this option in the proposal launched on September 14. More specifically, the EC proposed a fixed price cap of EUR 180/MWh to be applied to renewable, nuclear, and lignite producers, initially until March 2023. Coal- and gas-fired power producers are exempt, as they are considered price-setting technologies.6 The EC expects member states to be able to collect up to EUR 117bn in additional funds by implementing this inframarginal revenue cap. The funds can be used both for redistribution to the most vulnerable and for investments tailored to speed up the energy transition.

This might seem like the perfect solution, but what are the drawbacks? Even if this measure is not a major market design alteration, it is still a complex task to undertake, especially if we want to it to be efficient and fair. Being one of the most debated proposed measures and one actually put forward by the EC for implementation, we analyze it in more depth in Table 2.

Table 2: The complexities of applying taxes or price caps on inframarginal producers

| Point of attention | Why? |

| Well-designed measures to reduce risks of avoiding the caps | To be efficient, the design of such measures should ensure that inframarginal producers are not able to find ways around the caps. For example, if the inframarginal price caps will only apply to day-ahead markets (where the merit order curve applies directly through the pay-as-clear7 mechanism), inframarginal producers will be incentivized to sell their output through the continuous intraday and futures markets or through bilateral contracts.

If we want to apply inframarginal taxes to all type of contracts, the solution of capping inframarginal producers becomes even more complex as capped and not capped producers will compete in a pay-as-bid8 manner on these markets. Moreover, a poorly designed inframarginal cap could penalize electricity producers who already hedged their production through futures or bilateral contracts (e.g. Power Purchase Agreements9). NordPool, a major power market operator in Europe, has, for example, called for disentangling past and long-term contracts from the current proposals. In a white paper they suggest not taxing electricity that has been hedged at prices way below the current prices. Companies that were prudent and secured long-term contracts would otherwise be penalized. In the long run, such a measure could hurt investments since it would translate into higher regulatory risks. Therefore, investors might consider the overall risk-reward profiles of financing new electricity generation facilities as less attractive. To partly deal with these complexities, the EC proposed a cap high enough to make sure that long-term pre-crisis contracts will not be affected.10 To further cater this, the cap will be applied only to realized market revenues of the amount of electricity produced (MWh). |

| Adjustments of the inframarginal price cap | The inframarginal price to be put in place might need adjustments over time, which could create additional market uncertainty. For example, if the marginal cost of an inframarginal producer were to rise significantly, we might end up with higher electricity prices from inframarginal producers than from gas-fired ones. In this situation, the gas-fired power generators would become inframarginal producers. When setting inframarginal caps, it is crucial to think through what could happen if the relative input prices were to change. Floating cap formulas could be used to tackle this complexity. Once again, the EC opted for a rather ‘safer’ option of applying an inframarginal price cap way higher than the marginal costs of inframarginal suppliers. To further avoid this risk, the EC excluded coal-fired power plants from the price cap mechanism. |

| Money redistribution | Money redistribution is a massive task, and making sure that it is done in a fair way is an even bigger task. Targeted measures to help the most vulnerable parties are needed and so far there are not many examples of well-designed ways of dealing with this challenge. |

| Competition distortion | Finally, setting a price cap per technology can lead to distorting competition in the short term, as within the same type of producer you might have different marginal costs (efficiency rates) and different levels of CAPEX to amortize. Instead of applying different caps per each technology, the EC proposes a single price cap for all inframarginal producers. By doing so, price competition among inframarginal technologies, both within national boundaries and at the EU level, remains unaltered.An additional complexity lies in the fact that sellers in electricity markets, especially in the day-ahead market, can also represent corporate groups or are just traders. There is a need to find the best way to trace back which inframarginal price should be allocated to each seller in the electricity market. Metering, disentangling exact generation levels, and assigning them to each traded product can be cumbersome. |

Source: RaboResearch, 2022

Table 2 showcases the important role of fine-tuning when setting a price cap mechanism on inframarginal producers. Details matter, as they can lead to a shallow or deep intervention. Details determine the percentage of windfall profits captured and, implicitly, the potential impact on future investments (in the energy transition). The EC decided to pursue a less invasive option which reduces many of the complexities that can arise from setting such a cap. Yet, by doing so, only a part of the windfall profits are actually being captured. On the positive side, the foreseen impact on future investments in clean energy sources is contained.

In addition to their interventions in wholesale electricity markets, governments are already intervening in retail electricity markets. In many countries, various taxes have already been reduced or scrapped. Moreover, proposals to cap retail electricity prices are being put forward or are already implemented (e.g. in Romania and the UK).

Such caps partly mute the higher price signals that would otherwise most likely stimulate a reduction in demand. On top of that, this has open-ended budgetary implications in line with subsidizing a natural gas price cap. To give an example, since the gas and electricity retail price caps were introduced in Romania in March 2022, the estimated governmental cost of supporting this measure more than doubled to around EUR 8bn, or about 3% of GDP.

Nevertheless, we need to protect the most vulnerable individuals and essential industries. If governments choose to utilize retail electricity price caps, policymakers should at least consider adding limits such as a maximum individual consumption covered by these caps .

Options aimed at reducing electricity prices do not stimulate the currently much-needed demand reduction. Similarly, addressing windfall profits through money redistribution11 does not stimulate demand reduction either. Given the fact that the security of the EU’s electricity (energy) supply is at stake, efforts to limit or reduce electricity demand will play a vital role in policies. Thus, governments are looking for ways to complement measures aimed at reducing windfall profits and electricity prices with measures focused on demand reductions. These look beyond low-hanging fruit such as lowering thermostat temperatures or reducing non-necessary lighting at night. For example, EU countries have committed to reduce their gas consumption by 15% in the winter of 2022, although on a voluntarily basis. An alternative could be to reward (subsidize) reductions in consumption. There are already many such examples in the private sector across the EU.

On top of this, the EC proposes ways of imposing stricter demand reduction targets, especially reducing electricity demand in peak hours by 5% and overall electricity demand by 10%. Member states can freely choose the ways in which they want to achieve these goals.

Beyond what has been discussed above, governments should pay close attention to the fact that prices on futures electricity markets, which historically were rather stable, are experiencing increasingly high volatility. This increased volatility creates liquidity constraints for utilities due to margin calls12 that tend to be updated daily and follow the spot electricity price movements. As power prices increased manifolds over the past year, the margin calls also increased exponentially. Equinor estimates that the funds needed to cover these margin calls could reach EUR 1.5 trillion. Should electricity prices continue to increase, this extremely worrying figure could grow further.

If we draw a parallel with the discussions about taxing windfall profits, some companies might profit greatly from selling their electricity output at higher prices. However, at the same time, this can prompt short-term liquidity issues.13 Thus, if we only tax the windfall profit and don’t address the potential liquidity constraints of electricity producers, we can end up with companies not being able to keep paying their current liabilities or even going bankrupt.

The EC and governments across the EU are already stepping in to provide credit facilities to struggling energy suppliers (e.g. in Germany, Finland, and Sweden) even if this entails risks.14 There were also calls for letting the European Central Bank (ECB) provide such facilities. Yet, this option was ruled out by the ECB’s chief, Christine Lagarde. Instead, the EC will continue to develop the liquidity tools discussed at the Extraordinary Energy Council on September 9. In her State of the Union Address on September 14, Ms. von der Leyen referred to this workstream tailored toward easing liquidity concerns. Options to ease liquidity concerns include lowering collateral requirements and applying interventions to reduce electricity price volatility. Additionally, alternatives to cash as collateral could be considered. Yet these options may lead to lower securitization. Besides, there have been calls to temporarily halt futures electricity markets, an option presented in Appendix A.

Any action taken in regard to intervening in electricity markets must be carefully considered. At the moment, the EC and national governments have limited options to manoeuvre and none of them are perfect. In addition, a significant market intervention from the EC sets a risky precedent and may lead to many unintended negative side effects, as illustrated throughout this article. For example, electricity market players might not take proactive steps to prevent a crisis like the current one from happening again, but might rather expect the EC to step in and solve future problems. Yet, the dilemma is that not intervening might aggravate the social and economic unrest across the region. High energy prices are already causing protests across the EU.

But even if there is a major intervention, by trying to impact electricity prices we are only addressing the symptoms. The root of the problem is the fact that we need to improve the EU’s energy security level. The EU can use this crisis to accelerate the path toward net zero. REPowerEU, the push toward fast-tracking the energy transition, combined with energy sobriety, can help.

The energy crisis is partially sparking an economic crisis. Yet, while such calamities historically come and go, at the end of the day, we still have to deal with the climate crisis. If, in the process of solving the current energy end economic crisis, we move faster on the path toward net zero, this is an advantage in the long run. Drawing a parallel with earlier in the Covid-19 pandemic, recall how we were hoping for a vaccine to help us solve the problem. In the current crisis, even if it is improbable that we will return to what we used to call ‘normal’ anytime soon, the ‘vaccine’ is: utilizing every tool for power generation we have at hand and looking for alternative electricity sources. This still means adapting to a more energy-sober lifestyle, but also investing faster in renewables, energy efficiency (demand reduction), better grids, more flexibility, etc.

Of course, this ‘vaccine’ will take a lot of time to deploy and has its complications and limitations. Therefore, while going through this crisis, we must make sure that we protect vulnerable among us.

To conclude, these emergency times require(d) a strong step-up at the policy and governance level. The EU has a track record of taking a significant amount of time before daring to take any big step when critical decisions are needed. But in the case of addressing the energy crisis and potential interventions in the electricity market, relevant parties within the EU engaged swiftly to search for solutions before too many diverging national initiatives were put in place.

A solidly founded debate at a technical level has been conducted with exceptional speed. This has resulted in a wave of proposals and initiatives from the EC since the spring of this year. The proposed interventions announced on September 14 included a variety of solutions that are based on the consensus of all of member states.

Undeniably, the proposals could be more ambitious or more specific. A bigger set of market issues could also have been included in the effort. Still, we should recognize the EU’s achievements in navigating this energy crisis. The wider structural reform proposal is being fast-tracked, in parallel with multiple ongoing discussions to address side issues such as ensuring liquidity support to electricity generators. The way ahead will call for carefully monitoring the national implementations and the efficiency of the measures, therefore minimizing unintended negative side effects.

It is worth noting, in our view, is that the current proposed interventions will primarily address the symptoms, not the root cause of the problem. They will focus more on providing relief to the high energy prices while doing little to reduce demand or to accelerate the much-needed energy transition. However, multiple other EC workstreams are working in parallel to address initiatives to support the energy transition, like an initiative to simplify the permitting process for renewable power projects.

With so much attention being devoted to short-term electricity markets, it is often overlooked that the majority of power is still being traded through long-term contracts, either futures markets or bilateral contracts. Halting futures markets, means halting a big part of electricity markets.

A market closure is not welcomed, as EEX explains, as these markets reflect the physical reality of demand and supply,. By closing markets, you move price formation to bilateral contracts with much less price transparency. Prices might not be reduced, but will become less transparent. A complete ban on long-term electricity contracting would move the pressure to spot markets. This could give certain players increased market power, which could accentuate the problem. A classic example of players being squeezed into spot markets is the 2000-2001 California electricity market crisis, when entering into long-term electricity contracts was restricted based on the electricity market design at the time. The times, of course, are not the same, and the electricity market design in Europe is different. Yet this example highlights how limiting access to long-term electricity contracting can harm the electricity system.

Taking this even further, if a full ban on long-term contacting of power were to be imposed, it could also mean banning PPAs, which play an important role in speeding up the deployment of renewable assets. Moreover, in retrospect, without a futures electricity market in place, the current electricity price crisis would be way bigger.

We could also envision markets moving from pay-as-clear to pay-as-bid. This would mean that instead of applying marginal pricing for all players, sellers would receive the price they bid in the market. While pay-as-bid as a short-term solution for day-ahead electricity markets does not seem to be in the cards for now, it is important to mention it. It’s often regarded as an ‘easy’ solution for capturing windfall profits in the spot-auctioned electricity markets. However, changing the current system from pay-as-clear to a pay-as-bid within the spot-auctioned power markets would represent a major electricity market design reform. Such initiatives require time, as they need to be carefully investigated before being implemented. Yet, even if we were able to make this change rapidly, this solution will still unlikely to significantly change the total cost we pay for electricity. The reason for this, without going too much into detail, is that within a pay-as-bid system, the strategic behavior of market players would make them bid price levels close to that of the expected marginal cost producer.

Another less discussed option would be to split the wholesale electricity markets into two parts: one for low marginal cost producers (e.g. renewables, nuclear) and one for high marginal cost producers (e.g. coal and gas). In this setting, the two markets would run auctions in parallel and have two separately clearing prices to be paid to generators. Consumers would pay the weighted average price of the two markets. This would most likely translate into lower prices.

In line with pay-as-bid, such a measure would translate into a deeper power market reform and would require a much longer time to properly think it through and implement. This solution is, for example, being considered in the UK within the country’s ongoing consultation for a new electricity market design.

Should such a measure be considered, futures markets and bilateral contracts (PPAs) must be carefully considered. Without taking into account how to deal with these markets, it will be much more attractive for low marginal cost producers to look toward long-term deals rather than offering their product on the spot markets. This could move volumes from a transparent market to non-transparent bilateral agreements. Besides, technology-agnostic markets tend to stimulate cost competition. If we split the market into subgroups, we might end up with less innovation.

Last but not least, this option addresses windfall profits at the expense of seriously impacting investment in new renewable capacities. In this setting, the average captured price by renewables will get very low, given their weather dependency.

Another indirect proposed intervention that could lead to lower electricity prices is to intervene in the EU Emissions Trading System (EU ETS).15 Countries such as Poland have constantly been pushing for altering the EU ETS system. This could either be done by temporarily halting the system or by massively increasing the supply of emission allowances (EUA) by using the Market Stability Reserve or frontloading auctions such that EUA prices collapse. The result would be lower electricity prices as gas- and coal-fired power plants, among others, have to pay for the GHGs (greenhouse gases) emitted while producing energy. And this would be done at the expense of destroying the essential price signal that the industry requires to launch corresponding decarbonization investments.

Moreover, we would still have high electricity prices, as the EUAs are just a fraction of current total wholesale electricity prices. In addition, the main benefactor is likely to be coal-fired power plants. They would have to pay less for CO2 emissions and could also likely keep part of the EUA price reduction for themselves if electricity prices were still set by natural gas-fired power plants.

Besides, unlike the money paid for securing non indigenous gas, money received for EUAs stays within the EU. These funds can be spent by governments to accelerate the energy transition and to a certain extent also to help those most affected by the current crisis. Thus, EUAs are already partly playing a role in taxing windfall profits.

To conclude, it will be hard to get consensus on letting the EUAs collapse. Some countries are affected more than others by EU ETS. Most notably, Poland incurs the highest per MWh cost as coal-fired power plants dominate electricity production there. Other countries like France, which has a much less carbon-intensive electricity sector, are less affected. Last but not least, reducing the power of EU ETS will make coal and gas more competitive and renewables relatively less competitive. This will give the wrong signal about the EU’s energy transition ambitions.

Small and medium-sized enterprises.

Through interconnections, the price-setting impact of natural gas-fired power plants can spill over to neighboring countries.

Simply put, these are profits much higher than the profitability margins companies were used to.

The scheme is also funded in part through a ‘congestion income’ collected based on the cross-border electricity flows between France and Spain.

A revenue clawback is a mechanism through which part of revenues received must be returned to the government.

Hydro-pumped power plants are also exempt as their business model relies on both buying electricity (for storing water) and selling (producing) electricity.

In a market where prices are set based on a pay-as-clear mechanism, each seller/buyer receives/pays the same price, based on the marginal cost of the marginal producer.

As opposed to pay-as-clear, in a pay-as-bid cleared market, sellers who are selected for the transaction receive the amounts they bid in the market.

Various EU countries, including Denmark, France, Italy, and Poland, already started redistributing money to the population to help citizens cope with increasing energy bills.

When entering in an electricity futures contract, players have to provide the clearing house with cash warranties as margins. Once the contract is delivered, the margins are returned. The initial margin amount required is calculated as the largest theoretical loss someone could incur in case of a default. This amount is usually updated on a daily basis and its value is linked to developments in spot electricity prices. The higher the price volatility, the higher the margins required. If electricity prices increase (or decrease), sellers (or buyers) are required to deposit more cash.

As margin calls for sellers increase when electricity prices increase, sellers risk suffering significant liquidity constraints if electricity prices keep rising, despite also being able to benefit from selling at high prices. On top of that, rising interest rates for securing credit facilities can further increase the liquidity problem.

It is important that the help provided to utilities ensures a level playing field. Furthermore, for governments, risks include the fact that credit facilities might be needed for long periods of time. For example, long-term contracts signed at very high price levels translate into high margins that companies need to put down as collateral. These margins will remain high even if electricity prices return to more normal levels. Should such a situation occur, the margin calls will decrease on the sell side but increase on the demand side.