Originally published by RaboResearch on July 04, 2022 – Seven Trends That Will Shape European PPAs’ Path To Growth.

Although not always following a smooth pathway, the use of power purchase agreements (PPAs) is on the rise in Europe. While PPA volumes are growing, market conditions are increasingly uncertain, and market players need time to adapt to new realities, price levels, and price fluctuations. Developers of wind and solar photovoltaic (PV) parks are becoming more cautious about hourly baseload PPAs and are increasingly reviewing the feasibility of fully merchant models. On the demand side, corporates have recently become larger PPA offtakers than utilities. With these dynamics in mind, this article analyzes seven trends that are expected to shape the way European PPA markets will develop in the coming years.

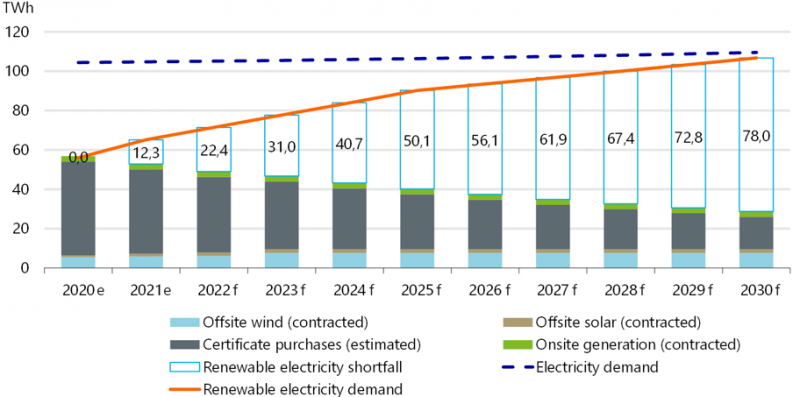

On the demand side, more and more companies are setting increasingly stringent internal sustainability targets. One of the easiest pathways for many companies to start implementing these targets is to shift their power sourcing towards renewable energy sources (RES). An example of this is the RE100 initiative in which more than 360 companies have committed to consume 100% renewable power. Combined, this group of companies consumes 380 TWh of power on an annual basis. To illustrate the magnitude of the initiative, this corresponds to more than three times the power consumed yearly in the Netherlands. As less than half of the power consumed by the RE100 signatory companies currently comes from RES, demand from this group of offtakers is expected to increase significantly. Figure 1 outlines the need for RE100 companies headquartered in Europe to progressively source higher volumes of renewable power throughout this decade if they want to achieve the target of 100% RES power consumption (80 TWh) by 2030. On top of this, some companies go beyond the RE100 commitments and push their suppliers to do the same (e.g. Apple). This snowball effect further increases corporate RES power demand.

Figure 1: Projected renewable power shortfall for selected RE100 members with a European HQ, 2020-2030f

Source: RE100, BloombergNEF 2022

PPAs are expected to play an important role in filling the strongly growing demand for RES power. To reach their targets, signatory companies can, for example, buy renewable power directly from utilities or unbundled guarantees of origin (GO1). Both options entitle companies to claim the sustainability benefit for the amount of renewable power or GOs purchased. Yet, the drawback of this strategy is that it does not provide the element of additionality2, where companies are directly involved in increasing the installed RES capacity in a certain geography. To secure both RES power consumption and additionality, companies can either invest in developing their own RES assets or enter into PPAs linked to future RES projects. As most companies don’t have the know-how and capability to build sizable RES projects, this option is often not optimal or feasible. Consequently, companies will likely revert more often to PPAs to address their growing RES power needs. This trend is already noticeable among RE100 signatory parties. In 2016, only slightly over 10% of their RES consumption was sourced through PPAs, but by 2020, that number increased to close to 30%.

While demand for RES power is increasing, it will most likely grow unevenly across Europe. Moreover, yearly RES deployment rates also differ per country. Thus, supply and demand for RES power might not always be geographically aligned. On top of that, large IT multinationals, which are used to acquiring RES power from various jurisdictions, still dominate demand for RES power. As a consequence, this geographical and/or temporal mismatch will likely drive multinationals to source more power through virtual PPAs. These instruments allow corporations to aggregate their RES power sourcing across borders.

While more cross-border virtual PPAs are likely to be signed, this trend might reverse in the long run due to risks associated with such contracts. Firstly, offtakers entering into virtual PPAs are exposed to power price risks in both their region of consumption and in the geography from which the RES power is sourced. Secondly, virtual PPAs might lead to an increasing need for flexibility in the markets where RES sources are located, as virtually sourced RES power still needs to find its physical end user locally. Thirdly, calls for actual consumption of PPA-contracted power (local-for-local) could lead to greenwashing claims against players engaging in virtual PPAs.

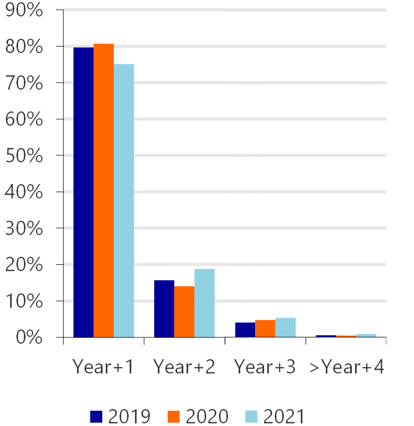

While big IT corporates can offtake long-tenured PPAs, smaller companies, and sometimes even bigger industrial companies, are not used to long-term power contracts. Firstly, such power products are still not standardized or easily accessible. The concentration of shorter-term contracts can be observed in futures power markets, where liquidity in contracts with a duration higher than three years is limited (see Figure 2). Secondly, even if liquidity increases on the supply side, the standard ten-year PPA product is, for many companies, a bridge too far from the one-year to three-year power contracts they currently hold. Long-term agreements require offtakers to be comfortable with the associated long-term risks in a market that they might not be familiar with – the power market. For such companies, new shorter-term PPAs (e.g. five- to seven-year tenor) might be a fitting first step into the long-term power procurement market.

Figure 2: Percentage of total number of futures power products traded in Germany by tenor, 2019-2021

Source: ACER 2022

But why would RES developers be attracted by short-term PPAs? After all, short-tenure contracts entail higher merchant risks, which leads to higher financing costs or equity injection requirements for developers. Well, uncertainty about long-term market conditions, and especially the attractiveness of higher pricing levels, can be a strong incentive for accepting shorter PPA maturities. Besides, short-tenure PPA supply will also come from older projects with ending subsidies. Refinancing needs to bridge the last few operational years to make short-term PPAs suitable for such projects. Consequently, we will likely see offtakers adapting to longer maturities and developers to shorter ones.

The type and duration of PPA contracts that one chooses to enter into (e.g. virtual or physical delivery, pay as produced3 or baseload,4 short or long tenure) often depends directly on one key element: pricing. As PPAs involve expectations about long-term future production profiles of weather-dependent RES power assets, price cannibalization5 will play an increasingly important role in pricing PPAs. With a growing share of variable RES in a power market, prices are expected to decrease on average while simultaneously becoming more volatile.6

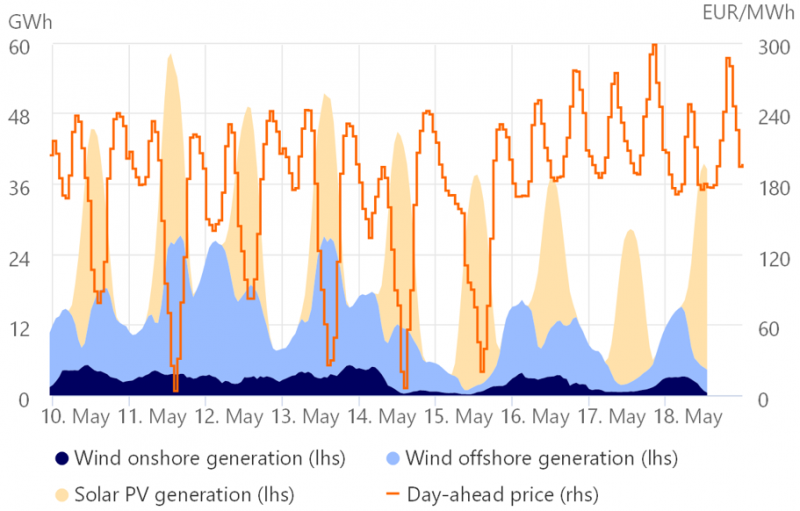

Figure 3 provides a visual representation of the negative correlation between power prices and variable RES output. This negative correlation, which leads to price cannibalization, is doubly punishing for RES owners: both the average power price and the expected captured price are expected to decrease.7 As a result, variable RES power in certain geographies already trades at a discount compared to the average power price. For example, the discount of solar PV power in Germany compared to the average baseload price was around 12% in 2020. This discount is expected to grow to 49% by 2050. Likewise, the price discount on onshore wind in Germany is expected to grow from close to 0% in 2020 to 29% in 2050 (BloombergNEF). In a world with an increasing share of supply from variable RES, this phenomenon will only be exacerbated.

Figure 3: German day-ahead market (selected days in May 2022)

Source: SMARD.de 2022

The expectation of decreasing power prices in the long run leads to divergence in pricing for different PPA products. PPAs with shorter maturities will likely be priced higher than those with longer maturities. Next to price cannibalization, RES asset owners will likely apply a higher price tag for owning the shape risk.8 Thus, as more and more wind and solar PV assets are deployed, we will see an increasing price discount for pay-as-produced PPAs compared to baseload PPAs. This price gap is in part fuelled by the fact that many companies are not comfortable with owning the shape risk under pay-as-produced PPA structures.

Until recently, most European PPA volumes have been concentrated in a few western European countries. This has started to change, as most EU countries have extensive RES pipelines, which will be partly financed through PPAs. Individually, power markets in eastern Europe are, on average, smaller than in western Europe. However, combined, they provide a sizable market. Additionally, more and more eastern Europe-based companies are setting higher internal sustainability goals, which lead to local PPA demand in those countries.

One example of a relatively young PPA market is Poland, which is already witnessing an acceleration in RES deployment, especially of solar PV and offshore wind. Poland recently reached the threshold of 10 GW of installed solar PV capacity. It is interesting to note that even when subsidies are available certain players in Poland prefer to skip them and sign PPAs instead, as they have proven to be attractive. There is even an example of a RES developer renouncing already attributed subsidies in order to sign a PPA contract instead.

The current Romanian PPA market revival represents another example of growth. Recent regulatory changes have restored the possibility to sign PPAs in Romania, a country with over 7 GW of RES projects in the pipeline scheduled for completion by 2030. Some of these projects will likely see PPA financing. Moreover, existing RES assets deployed a decade ago need refinancing, and PPAs could be the right instrument for this. It is interesting to note that in this market sleeved PPAs9 are the ones taking the lead, with energy-trading companies such as Axpo positioning themselves to help corporations get access to Romanian RES power.

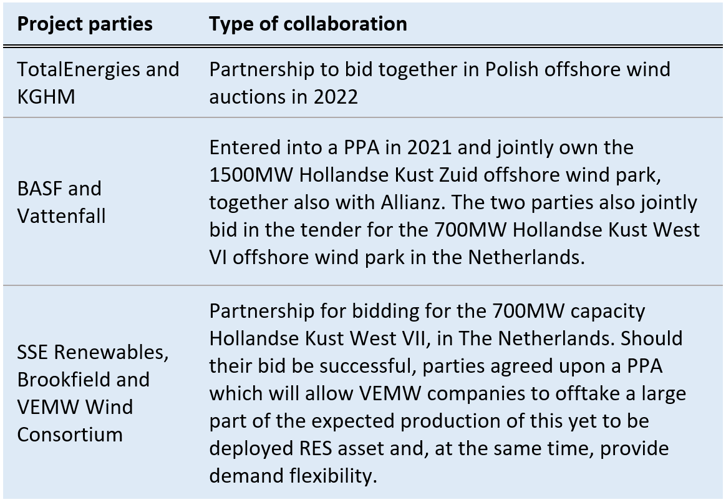

Due to the growing competition among companies trying to get a grip on RES power, RES developers and industrial companies are collaborating more closely on the deployment of RES assets. Table 1 notes a few such cases.

Table 1: Examples recent of partnerships between traditional RES developers and industrial offtakers

Such collaborations are not solely demand driven. One other main driver (at least in the Netherlands) for this closer cooperation is the growing absence of direct subsidies. For example, Hollandse Kust Zuid is the first major offshore wind project in Europe envisioned without direct subsidies. With decreasing levels of direct subsidies, RES developers are shifting their attention to partners with whom they can collaborate in the longer term. Consequently, industrial companies may already be getting involved in the bidding process, either by taking equity stakes or through envisioned PPAs. The perfect projects for such structures are new offshore wind farms, as they can provide the additionality element, access to large volumes of RES power, and a relatively more stable output compared to solar PV.10 These elements are all embedded in the projects exemplified above.

No list of forward-looking trends in power markets should overlook the power of policies. If there is one thing that recent years has reminded us, it is that the risk of disruptive policy changes is ever present in power markets. With the current high energy prices, all national governments across the EU have intervened in energy markets in various ways to shield the most vulnerable consumers from soaring energy prices. These policy changes resemble a number of retroactive adjustments in regulations about a decade ago that negatively affected the power sector. In the early 2010s, some governments11 retroactively adjusted their RES subsidy legislations, reducing the expected revenues for certain RES assets. Around the same time, in Romania, another regulatory alteration severely restricted the possibility to sign PPAs for most of the previous decade.

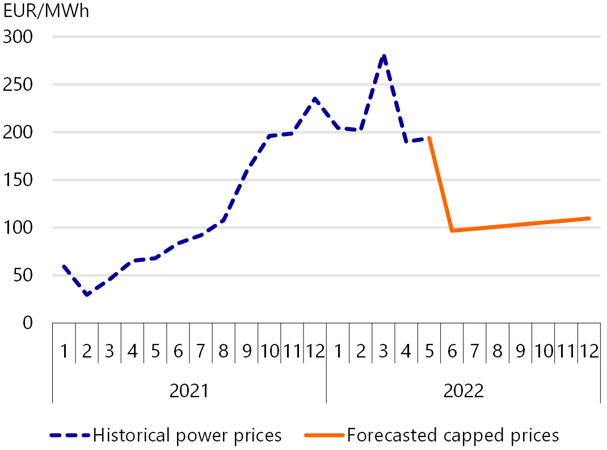

Fast-forward to 2022, one clear example of how impactful policy changes can be, currently come from Spain and Portugal. Like most European countries, these countries have implemented a series of measures aimed at protecting vulnerable consumers from high energy prices since 2021. In April 2022, an agreement with the European Commission was reached that allows Spain and Portugal to cap gas prices for half a year at EUR 40/MWh and to increase the cap monthly by EUR 5/MWh for the subsequent six months.

The gas price cap came into force in mid-June 2022. As gas-fired power plants are usually the power price setter in Spain, power prices are expected to fall by 40% to 50% in the country (see Figure 4).12 Following the enforcement of the gas price cap, power prices in the Spanish day-ahead market started decreasing. This development will impact the Spanish PPA market, as PPA pricing is closely linked to power prices. Moreover, since this measure could reduce the revenues of RES asset owners in 2022 and 202313, it deteriorates trust in the stability of Spain’s regulatory framework. In turn, this could affect the Spanish RES pipeline going towards 2030.

Figure 4: Spain’s actual and expected day-ahead power prices, 2021-2022

Source: BloombergNEF 2022

Looking at both the recent and expected trends, it is clear that demand for PPAs is on the rise in Europe. These products get increasing attention from various actors, and with the decrease in subsidy levels, their role in the energy transition is set to grow. Demand for PPAs is likely to remain strong in the coming years, as more and more companies are looking to source RES power. However, the PPA growth story is not expected to materialize without challenges and changes. As demand from newcomer companies in PPA markets will increase, PPA tenures will probably decrease, and collaborations between energy and industrial companies are expected to increase. Moreover, uncertainty over the development of power markets in the long run (e.g. cannibalization concerns) will push players to rethink what type of PPAs they would like to enter into and what price and amount of risk they are comfortable with. The exploration of new geographies is becoming an increasingly important growth and diversification path for both developers and offtakers. Last but not least, the rapidly changing environment of a market with long-term agreements reminds players that policy risks should be priced into the equation.

www.suerf.org • suerf@oenb.at

In Europe, guarantees of origin represent a certification that a certain amount of power was produced by a particular renewable asset.

Within power markets, the concept of additionality refers to investing in or sourcing power from projects that directly contribute to installing new renewable power into a power system. Under RE100, additionality is not mandatory, yet it is likely to become an increasingly important element of the initiative as companies start reporting on the commission dates of the RES assets from which power is sourced.

Pay-as-produced PPAs represent contracts wherein the offtaker commits to consume a fixed percentage of the actual production of a certain RES production facility.

Baseload PPAs represent contracts wherein a fixed power volume is agreed to be sold within each specified time unit.

Price cannibalization in power markets occurs with a higher penetration of weather-dependent power-generating technologies, such as wind or solar PV. Both academic studies and practice teach us that, as power prices are set based on the marginal cost of the marginal producer, a higher share of RES with low marginal cost will, on average, decrease power prices.

There can also arise instances wherein a higher, yet limited penetration of solar PV in a power market decreases power price volatility. This usually happens because solar PV produces power in peak hours when demand is high. Thus, in such a setting, solar PV reduces power price volatility, as it reduces instances of extreme, high power prices.

Captured price refers to the average price at which a RES facility is able to sell its power. Captured price is not represented by the average power price in a specific market but by the average power price captured by the RES facility’s production profile.

Shape risk refers to the risk associated with the production profile of a weather-dependent RES facility.

Sleeved PPAs are agreements wherein a utility acts as an intermediary between the seller of RES power and the offtaker. Examples of such agreements can be found here and here .

Representing the yearly amount of power output for each installed MW, the capacity factor is significantly higher for an offshore wind project than for a solar PV asset.

Governments that have retroactively changed subsidy levels (feed in tariffs) include Italy, Spain, Portugal, Greece, Czechia, and Bulgaria.

The marginal cost of a gas-fired power plant is much higher than the price of natural gas, as the conversion rate needs to be taken into consideration.

While this statement holds in most cases, there can be exceptions. For example, if a RES asset owner sold her expected output through hourly baseload PPAs, she might at times benefit from the gas price cap, as this measure will reduce price volatility. In a less volatile power price environment, the captured price under hourly baseload PPAs tends to increase.