A number of studies have recently documented a trend rise in firm market power in the United States. This note reviews the evidence for the euro area and finds that the market power of firms located in the euro area has remained broadly unchanged in recent years. At the same time, the euro area may be facing increasing competition from large global firms. In an increasingly digitised economy characterised by high fixed costs but near zero marginal costs, one could expect rising concentration ratios and markups. Such changes in the market structures across industries can incentivise innovation, but present challenges to maintaining competitive conditions. The reasons underlying the diverging pattern between the US and the EA ought to be further analysed to draw policy conclusions. Market power can be good for growth, provided that it spurs investment and innovation. It worsens welfare if it reflects increasing rents amid lack of competition.

Diagnosing and quantifying firms’ market power – the ability of firms to maintain prices above marginal cost – has long been a central topic for economists studying industrial organisation. On the basis of detailed firm-level data, researchers analyse the market power of firms in specific industries.

For a long time, market power was of little interest to macroeconomists, including central bankers. It first entered the field of macroeconomics as a topic of interest in the mid-1980s, but only with a narrow focus on the cyclical pattern of markups – the margin firms charge over the marginal cost of output. In part, this is because macroeconomic models are generally founded on Kaldor’s stylised facts, such as a constant labour share, constant profits and a constant capital-to-output ratio. Such models implicitly assume that there are no trend changes in firms’ market power.

Recently, however, trend changes in market power have elicited interest from macroeconomists following a number of US-based studies that challenge the underlying conventional assumption in macroeconomic models, namely that firms have constant market power. These studies document a rise in the market power of US firms over the past three decades, and especially since 2000. Such changes in firms’ market power at the aggregate level can have important macroeconomic implications. They could affect investment and the pricing behaviour of firms, but also productivity growth and, therefore, the natural rate of interest.

For a central banker, it is thus of crucial importance to understand whether and how the prevailing level of firms’ market power is evolving. In theory, it is fairly straightforward to define market power. In practice, however, it is difficult to pin down the level and evolution of market power empirically. There are two reasons for this. First, markups are not directly observable. Second, there is no one-to-one mapping between firms’ market power and point-in-time markup estimates. A firm with a small markup at any given moment can have significant market power when its pricing strategy aims to build up an ever-larger market share. As a result, assessing the level of firms’ market power requires a variety of approaches to measure markups and a broad range of indicators (such as the evolution of firm concentration and firm dynamics).

In the United States, the observation of rising firm markups and concentration rates, combined with a decline in business dynamics – in particular the entry of firms – has led to the consensus that firms’ market power is on the rise in the economy as a whole.2 At the same time, there is a lively debate about the drivers of this development. Some authors suggest that firms’ market power and concentration are driven by weakening antitrust enforcement, and link rising market power to a number of welfare-reducing secular trends, such as the decline in productivity and the rise in inequality. Others argue that market concentration and rising markups are a natural side effect of the rise of global technology giants, and see such developments as beneficial for growth, to the extent that they spur investment and innovation.

Today, let me review the euro area evidence.

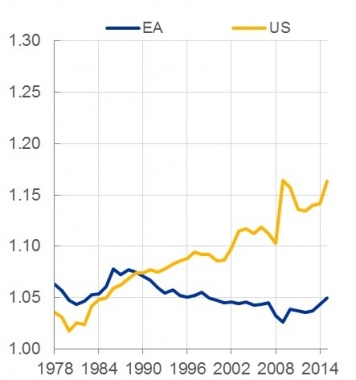

Recent work by ECB staff3 shows that the euro area economy wide mark-up has remained fairly stable over the past three decades, hovering around 10%. It has even declined marginally since the late 1990s/early 2000s, in particular in the manufacturing sector. This clearly contrasts with the evidence for the United States (see Charts 1a and 1b).

| Chart 1a: Markup evolution (total economy) | Chart 1b: Markup evolution (manufacturing) |

|

|

| Source: Cavalleri et al. (2019). Note: Calculations based on EU-KLEMS sectoral data. Last observation refers to 2015. |

Source: Cavalleri et al. (2019). Note: Calculations based on EU-KLEMS sectoral data. Last observation refers to 2015. |

Other indicators confirm the absence of any marked change in firms’ market power in the euro area. Concentration ratios have remained broadly flat over the last ten years or so4, and economic dynamism – the creation of new firms and jobs – has remained stable, albeit at a low level.

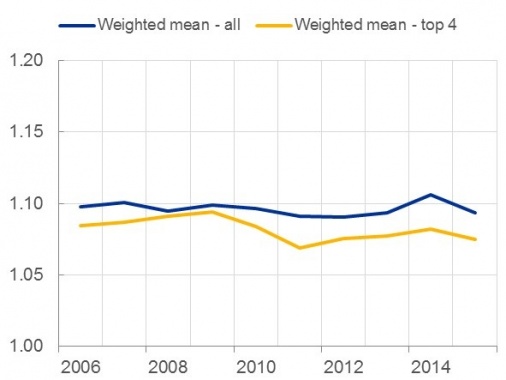

Finally, there is no evidence of emerging euro area-based “superstar firms” – firms that have a substantially greater share of sales than their peers, but a low labour share, and are pulling away from those peers over time. The largest euro area firms have, as in the case of the United States, a low labour share – the share of these firms in total sales is notably above their share of total employment in a sector. However, these firms’ market shares have not grown in recent years. Moreover, the markups of these largest euro area-based firms have remained broadly stable over the past decade, implying they have also not become more profitable (see Chart 2).

Chart 2: Evolution of weighted mean markup versus the markup of the top four firms across sectors in the four biggest euro area countries

Source: Cavalleri et al. (2019).

Notes: Calculations based on firm-level data.

Last observation refers to 2015.

At the same time, there are signs that some large and growing global firms are entering euro area markets and steadily increasing their market shares. This may explain the diverging results we find across a variety of studies on developments in the competitive landscape in the euro area.5 Studies that focus exclusively on the market power of firms located in the euro area find no noticeable change in the euro area’s competitive landscape. By contrast, studies that consider all firms that compete in the euro area suggest that there is declining competition in the euro area. This declining competition is most likely being driven by these global firms.

Market structure and market power have gone from being a field studied by microeconomists to one studied by both micro- and macroeconomists. There are good reasons for this: a change in market power could have important macroeconomic implications.

For the euro area, available evidence suggests that the market power of firms located within the single currency area has remained broadly unchanged in recent years. The positive side of this is that there is little evidence that the euro area has seen a rise in “bad” market power – market power which results in productive and allocative inefficiencies. However, on the negative side, the euro area has also not seen the emergence of superstar firms – highly productive large firms with rising market shares. Instead, the euro area may be facing increasing competition from large global firms. Moreover, in an increasingly dynamic and digitised world, significant and rapid changes in market structures across industries may occur at any point in time.

The digital transformation could change production and distribution methods and affect how firms compete with each other. Digital technologies can reduce the costs of scaling up production and entering certain markets, even across borders. And some digital products may be replicable at close to zero marginal cost. This can allow innovative start-ups to grow and gain market share rapidly once they bring a product to market, often with few employees, few tangible assets and a limited geographical footprint.6 At the same time, the development of digital technologies may entail high upfront research and development costs.

In such an environment of high fixed costs but near zero marginal costs, it may be more natural to see concentration ratios and markups rising. Temporary market power can, in these conditions, be desirable as it would incentivise innovation, which could help to stimulate productivity and potential growth in the economy. Devising structural policies in the euro area that allow firms to adopt digital technologies and that foster innovation would therefore be important.

However, these massive economies of scale and scope could also present challenges to maintaining competitive conditions. As firms gain market power, their capacity to exert political pressure to protect and increase their market power also rises.7 What started out as good market power could quickly become the bad market power creating dynamic inefficiencies. This could limit the productivity benefits from new technologies by creating obstacles to the entry and innovation of new players, as well as slowing down the diffusion of innovations to potential competitors.

Firm-level data are essential to improve our understanding of macroeconomic trends that result from the behaviour of heterogeneous firms. For the euro area, this often involves comparing cross-country trends. Such analysis tends, however, to be hindered by two basic data constraints. First, existing indicators based on firm-level data are often not comparable across countries and, therefore, analysis based on micro data often remains confined to the national level. Second, firm-level data are usually confidential. CompNet plays a pivotal role in tackling these two problems. Compnet’s dataset indeed relies on a research and statistical infrastructure based on collaboration among country teams, which allows for cross-country comparability. The confidentiality constraint is addressed through the “distributed micro data approach”, which allows the different moments of the distribution of several indicators to be calculated.

The Policy Note is based on a speech given by Peter Praet at the CompNet – EIB – IMF – ENRI – IWH Conference in Luxembourg, on 18 March 2019.

Peter Praet thanks Isabel Vansteenkiste for her support in preparing this Policy Note.

For the United States, a number of studies have documented a rise in markups using a variety of methodologies and approaches. See, for instance: De Loecker, J. and J. Eeckhout (2017), “The Rise of Market Power and the Macroeconomic Implications”, NBER Working Paper 23687, Nekarda, C. and V. Ramey (2013), “The Cyclical Behavior of the Price-Cost Markup”, NBER Working paper 19099 and Hall, R. (2018), “New Evidence on the Markup of Prices over Marginal Costs and the Role of Mega-Firms in the US Economy”, NBER Working Paper 24574. Other authors have noted a rise in concentration rates, for example: Peltzman, S. (2014), “Industrial Concentration under the Rule of Reason”, Journal of Law and Economics 57(4), Autor, D., D. Dorn, L. Katz, C. Patterson and J. Van Reenen (2017), “Concentrating on the Fall of the Labor Share”, American Economic Review 107(5), 180–185. Business dynamics have also declined significantly in the United States, as documented for instance by Decker, R., J. Haltiwanger, R. Jarmin and J. Miranda (2018), “Changing Business Dynamism and Productivity: Shocks vs. Responsiveness”, NBER Working Papers 24236.

See Cavalleri, M.-C., A. Eliet, P. McAdam, F. Petroulakis, A. Soares, and I. Vansteenkiste (2019). “Concentration, Market Power and Dynamism in the Euro area”, ECB Discussion Papers No 2253.

For details, see Cavalleri et al. (2019). Similar results were also shown in Döttling, R., G. Gutiérrez and T. Philippon (2017), “Is there an Investment Gap in Advanced Economies? If so, Why”, Proceedings from 2017 Sintra Forum on Central Banking, pp 129-193, Deutsche Bundesbank (2017), “Mark-ups of firms in selected European countries”, Deutsche Bundesbank Monthly Report December 2017, pp 53–57 and T. Valetti, G. Koltay, S. Lorincz and H. Zenger (2018), “Concentration Trends in Europe”, Mimeo, European Commission.

See, for instance, Dıez, F., D. Leigh and S. Tambunlertchai. (2018), “Global Market Power and its Macroeconomic Implications”, IMF Working Paper 18/137 and De Loecker, J. and J. Eeckhout (2018), “Global Market Power”, NBER Working Paper 24768.

See OECD (2018), “ Maintaining competitive conditions in the era of digitalisation”, OECD report to G-20 Finance Ministers and Central Bank Governors, July 2018.

See Zingales, L. (2017), “Towards a Political Theory of the Firm”, NBER Working Paper 23593.