Interest in central bank digital currencies (CBDCs) continues to grow among central banks and academics. To date, the focus of CBDC design has been primarily on the payment assets that users hold to conduct transactions. In this paper, we show that approaches based on this type of CBDC design are unlikely to satisfy user demand. We argue that it is more important to focus on the payment system. Drawing on the experiences in Brazil (Pix) and Switzerland (Twint), we show that successful payment systems do not require users to hold system-specific payment assets, making them convenient and accessible. An important motive for the ECB to develop a digital euro is to preserve monetary sovereignty and strategic autonomy. A European payment system could ensure autonomy over such a critical infrastructure of an economy. For it to succeed, the ECB should look to and learn from the best examples.

Interest in central bank digital currencies (CBDCs) continues to grow among central banks and academics. As of January 2022, 68 central banks worldwide have publicly communicated about work on CBDC, 28 central banks have launched pilot projects, and three retail CBDC projects are already live (Auer et al. 2020a). Among advanced economy central banks, the European Central Bank (ECB) is one of the most active in CBDC research. In October 2020, the European Central Bank (ECB) published its “report on a digital euro” (ECB 2020). This report followed staff discussion papers, e.g. Bindseil (2019). In 2021, the ECB launched a digital euro project to explore what the digital euro might look like (ECB 2021). This investigation phase will last two years and-if the ECB decides to issue a CBDC-would then be followed by a three-year development phase (Panetta 2021b). However, despite the ECB’s many activities in conceptualizing a digital euro, it is still unclear what its business model should be. At the end of 2021, Bindseil et al (2021, p. 4) note that “many questions about the design of a CBDC still need to be addressed. These include the […] business model”.

The design of a digital euro has so far remained rather vague. In Bofinger and Haas (2020), we emphasize the distinction between payment asset and payment systems. While some payment systems have system-specific payment assets (e.g., the cash payment system and the commercial bank payment system), others offer only a payment system without the need to hold system-specific payment assets (e.g., the credit card payment system). Payment systems such as PayPal enable hybrid solutions because users can hold PayPal deposits directly (system-specific balances), but PayPal also allows users to conduct transactions through their bank accounts. CBDCs can thus be designed primarily from the perspective of providing a new payment asset with new or existing payment systems, or from the perspective of providing a new payment system without the need for a system-specific payment assets.

A digital euro as a new payment asset can be considered either as a substitute for traditional bank accounts and deposits or as a digital substitute for cash. Bindseil (2020) and Panetta (2021a) propose a CBDC concept for the digital euro based mainly on the idea of providing a new payment asset. They envision a hybrid/intermediated system (Auer and Böhme 2020), where intermediaries such as banks offer CBDC accounts to citizens and nonfinancial companies. In this concept, CBDCs could serve as a substitute for regular bank accounts. However, to avoid large deposit outflows from the banking system, these accounts have a cap on account balances of €3,000, which could be enforced either through a two-tiered remuneration with strongly negative rates for balances above the threshold or through a fixed cap on account balances.

The benefits to users are unclear at best. Bank accounts are already protected by the deposit insurance up to €100,000. Therefore, such a limited digital euro solution would not be attractive as a store of value. Due to the maximum amounts and the lack of an overdraft facility, users will have to maintain and monitor parallel accounts – the new CBDC and the existing bank account. The services offered by a CBDC account are also likely to be limited compared to those offered by commercial banks (Bindseil 2020). Compared to traditional bank accounts, it is questionable whether a digital euro offers users additional privacy protection, especially if transactions are handled by private intermediaries. It is more likely that existing payment service providers such as PayPal will integrate such digital euro accounts into their services.1 Compared with existing solutions, therefore, the unique selling propositions of such a digital euro as a means of payment are lacking.

A digital euro as a payment asset, stored in wallets with potential offline and privacy functions, could be seen as a substitute for cash. In its function as a store of value, cash is still superior to such a digital euro due to the ceilings on the holding of a digital euro. As recent studies on cash holdings during the pandemic show, cash continues to fulfill this function and is seen and used as a store of value, especially in times of heightened uncertainty (Auer et al. 2020b, BIS 2020, Boar and Wehrli 2021, Zamora-Pérez 2021). As a means of payment, cash offers the advantage of absolute privacy and anonymity, which is an important reason for users to continue paying with cash. Due to AML and CFT regulations, it is unlikely that a digital euro would provide the same level of anonymity as cash. In the Digital Euro Working Group, the ECB (2022a) has already stated that “[u]ser anonymity is not a desirable feature” for a digital euro. Similarly, Panetta (2022) stated that “[f]ull anonymity is not a viable option from a public policy perspective”. In terms of potential offline usability, especially during extreme events, both cash and a digital euro require their users to make precautionary holdings. Cash, however, does not even rely on electricity. In terms of the features that users value in cash – safety and absolute anonymity –, cash therefore has unique selling propositions compared with the digital euro.

Compared to traditional bank accounts and cash, existing proposals for the design of the digital euro thus lack a unique selling proposition. A CBDC payment system based on the need to hold CBDC payment assets is unlikely to be competitive with existing payment systems such as PayPal, Apple Pay, or Google Pay, which can operate with multiple payment assets that are not system-specific. This feature allows for accessible, easy, and versatile usage.

It is therefore not very likely that CBDC projects in their current form will be able to achieve the ECB’s desired objectives, in particular ensuring competition in the payments ecosystem and preserving monetary sovereignty and strategic autonomy (e.g., Lagarde 2022). However, these objectives are indeed important. Payment systems are a network industry with monopolistic tendencies, where only a few companies have significant market power (Bindseil et al. 2021). In terms of digital payments infrastructure, Europe is completely dependent on U.S. payment platforms. The war in Ukraine shows the risks of dependence on critical infrastructures that are essential for the normal functioning of an economy. A digital euro should therefore provide a domestic alternative that makes it possible to pay securely and efficiently.

In Bofinger and Haas (2020), we propose a CBDC solution that does not require system-specific payment assets, but rather a new payment system organized and/or orchestrated by the central bank. This avoids the trade-off between limited access and ease of use that existing CBDC proposals face, since no deposits are withdrawn from the banking system. For users, the need to transfer money from bank accounts to CBDC accounts is eliminated. As long as central banks maintain a cash withdrawal infrastructure, the convertibility of private money into public money is maintained. Central bank money would remain relevant at the back end of the payments infrastructure, but the central bank would also become visible at the front end with such a CBDC design (Bindseil 2022).

The Brazilian payment system “Pix”, which was launched in November 2020, provides an interesting illustrative example of the solution we have derived in the abstract for a competitive payment system orchestrated by the central bank. The Swiss “Twint” payment system shows that it is possible to implement a sovereign payment system for a currency area even without the central bank vis-à-vis the U.S. platforms.

The Pix system is an instant payment system created, owned and supervised by the Central Bank of Brazil (BCB). Participation in Pix is mandatory for financial institutions, for example, if they have more than 500 thousand active customer accounts. In this way, the BCB ensures that a large part of the population can have access to Pix. This mandatory participation ensured that a critical mass of adoption was reached quickly after the release of Pix (Duarte et al. 2022). Institutions that offer transaction accounts but are below the threshold can voluntarily choose to participate in Pix. Although it is only 18 months in operation, Pix has 114 million individual users, covering 67% of Brazil’s adult population and 9.1 million businesses, or 60% of firms with a relationship to the national financial system (Duarte et al. 2022).

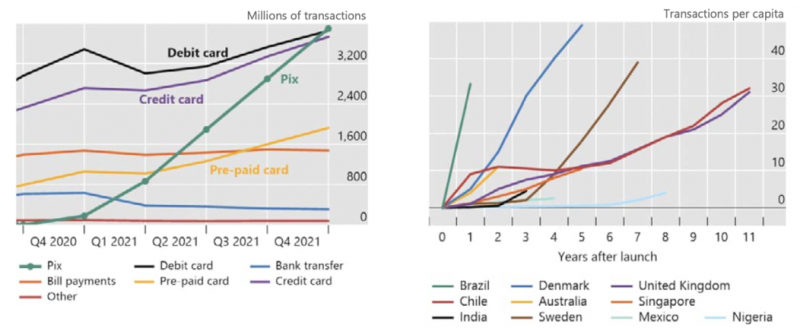

All Pix payments are processed in specific purpose accounts held by direct participants in the system in a centralized framework at BCB. Because Pix operates through users’ transaction accounts, all users are already identified by their banks or non-bank payment service providers when they use Pix. This ensures compliance with regulations such as KYC (Know-Your-Customer). A bank account is not required to use Pix, as transaction accounts can also be offered by financial institutions and FinTechs. Pix has quickly surpassed other payment systems in terms of number of transactions (Figure 1). The growth in transactions per capita since its launch is significantly higher than of other major payment systems (Figure 1).

Figure 1: Usage of Pix in Brazil in comparison to other payment systems and comparison of Pix transactions per capita after launch with other major fast payment systems.

Source: Duarte et al. (2022).

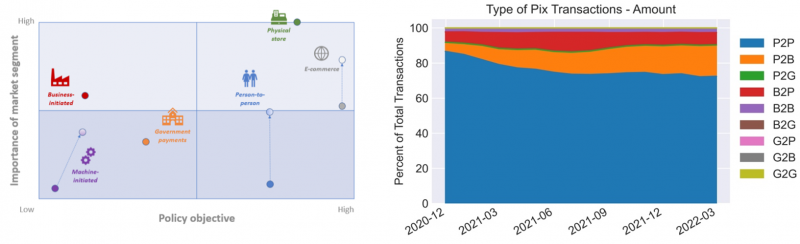

Payments in Pix are mainly triggered via smartphones and QR codes. Users can register up to 5 Pix keys, such as an email address, phone number, or taxpayer number, linked to their transaction account to easily receive payments. To avoid sharing personal information, users can also register a random key, which consists of 32 characters. Pix payments are free of charge for natural persons. Legal entities may be charged a fee for making and receiving a Pix payment.2 By controlling fees for its payment system, BCB has created a payment system that significantly reduces payment costs for merchants in Brazil. Figure 2 shows that Pix is mainly used for P2P and P2B transactions, which are also the most prioritized use cases for the digital euro.

Figure 2: Digital euro use cases prioritization and Pix share of transactions by type; P=Person, B=Business, G=Government.

| Source: ECB (2022b, p.7). | Source: BCB, authors’ calculations. |

The advantage of having the central bank operate such a payment system is described by Duarte et al. (2022, p.4): “By directly operating such a system, the central bank can define and enforce rules that govern the platform, including on costs, use of data and other technical standards.” The launch of Pix contributed to financial inclusion, as 50 million individuals conducted Pix transactions who had not made account-to-account transfers in the 12 months prior to Pix’s launch (Duarte et al. 2022). The user perspective was central to the development of Pix: “The BCB approached Pix product development with a user-centric perspective, focusing on the concrete needs of households and businesses in their payment habits, and gaps in the current system. Working together in the Pix Forum, the BCB and private PSPs defined a range of use cases, such as P2P, P2B, electronic bill pay and deferred payments to meet specific needs” (Duarte et al. 2022, p.7). Duarte et al. (2022, p.6) also note that “[t]he ease of use for individuals and the multiplicity of use cases may be one reason why actual use has increased quite rapidly – to 33.2 transactions per capita, a record among peer jurisdictions”.

A similarly successful can be observed in Switzerland with Twint. The main difference is that Twint is a purely private payment system. It was created by private commercial banks and the PostFinance which is owned by the Post AG, a company which belongs to the Bund.

Twint is a mobile payment solution that allows payments without system-specific payment assets, but users can also opt for system-specific deposits to their Twint account. Similar to PayPal, Twint can be linked to a user’s own bank account or credit card, for example. A payment is then triggered via the Twint app and the amount is debited from the bank account. Twint can be used for P2P transactions, at the POS or for online transactions. Twint primarily works with QR codes for transactions, as they can be used by anyone and are not dependent on any specific hardware. This is especially helpful for merchants who do not have a terminal. Twint is integrated and optimized for the needs of Swiss citizens, merchants and retailers. For example, it enables payment at parking meters, the purchase of public transport tickets, and integration with other providers, such as for ordering food or taking out new insurance policies. As of 2020, Twint handles over 70% of all mobile transactions in Switzerland and is regularly used by 45% of all citizens. Alternative mobile payment systems such as Apple Pay or Google Pay have significantly lower shares (Graf et al. 2022, BearingPoint 2021). Twint has thereby emerged as “by far the most prevalent solution” (SNB 2021, p.33) of all installed mobile payment apps in Switzerland. It is thus an impressive example of a domestic payment system that has managed to successfully assert itself against the dominant international payment systems.

The experience of Pix shows that it is possible for central banks to develop payment solutions that can successfully compete with existing and new payment services. Twint shows that it is also possible to develop such a payment system for an autonomous currency area with an already highly developed payment ecosystem, even without the involvement of the central bank. In the case of such advanced economies with efficient payment systems “the advantages of a CBDC are at best unclear: its potential benefits in terms of improving the ease of transactions are probably insufficient to justify the involvement of central banks in an activity that is well served by private suppliers” (Panetta 2018, p.5). However, Bindseil et al. (2021, p.23) argue that “[i]n currency zones like the euro area where no single P2P solution covers a broad section of the population, CBDC could provide fertile ground for P2P payments beyond the reach of existing private solutions.”

The need for a European retail payments strategy has also been recognized by the European Commission:

“[T]he EU payments market remains, to a significant degree, fragmented along national borders, as most domestic payment solutions based on cards or instant payments do not work cross-border. This comes to the advantage of a handful of big global players, which capture the whole intra-European cross-border payments market. With the exception of those large global players, including worldwide payment card networks and large technology providers, there is virtually no digital payment solution that can be used across Europe to make payments in shops and in e-commerce.” (European Commission 2020)

The heavy dependence on very few global payment service providers for such a critical infrastructure of an economy and the slow progress of existing European initiatives such as the European Payments Initiative represent a market failure that requires the involvement of a public body in the development and deployment of a pan-European retail payment infrastructure along the lines of Pix and Twint.

A digital euro could create such a European payment infrastructure, ensuring monetary and strategic sovereignty and autonomy. However, to achieve this goal, such a payment system must attract user demand and therefore be able to compete with existing payment solutions. A recent study on payment methods by Kantar Public (2022), commissioned by the ECB, shows that a new digital payment method can only generate interest and engagement and drive adoption if it offers “compelling advantages over current options or novel benefits that simplify daily life” (Kantar Public 2022, p.6). They also found that only few of the respondents “had recently adopted a new payment method or had actively been seeking a new one. Almost all felt well served by the range of options they currently use, and they expressed no desire for change. […] Thus, simply having access to a new payment option would not be a sufficient motive to switch” (Kantar Public 2022, p.7). These findings emphasize the importance of an easy to use solution for the digital euro without additional hurdles and with a clear added value for its users.

A central bank orchestrated payment system without system-specific payment assets meets most of the central banks’ reasons for issuing CBDCs. It provides monetary and strategic autonomy for a critical infrastructure and meets user demand for digital payment solutions. As the example of Pix shows, such a system can compete successfully with existing and new payment services.

While the ECB already offers an instant payment system with TIPS and pan-European transactions are possible with SEPA, these systems do not offer the same level of ease of use as payment systems such as Pix and Twint, as they require the use of a 22-digit IBAN number, for example, instead of allowing the use of an e-mail address or mobile number. If a digital euro is to become an easy-to-use and accessible P2P and POS payment solution for the euro area, the ECB should take its lessons from the experiences with successful payment systems such as Twint and Pix when developing a digital euro. In particular, the example of Twint shows that it is still possible to become a successful competitor in an already highly competitive payment system.

Similar to Twint and PayPal, a digital euro payment system could give its users the ability to deposit a limited amount of system-specific deposits and hold positive digital euro balances. This feature could be used in a payment system for potential offline use, cash-like privacy features for transactions (e.g., Gross et al. 2021), financial inclusion, programmability, or other features. For most transactions, these deposits would likely not be required, and users would not need to hold and move deposits across different accounts. Such a flexibility would make the system convenient and easy to use. As adoption grows, users could also appreciate and use the features offered by holding digital euros directly.

However, a standalone CBDC solution that requires a system-specific balance to complete any transaction risks central banks creating a universal prepaid card which is not the adequate response to global payment platform providers.

Auer, Raphael, and Rainer Böhme. 2020. “The technology of retail central bank digital currency.” BIS Quarterly Review, 85–100.

Auer, Raphael, Cornelli, Giulio, and Jon Frost. 2020a. “Rise of the central bank digital currencies: drivers, approaches and technologies.” BIS Working Papers, No. 880, Updated January 2022.

Auer, Raphael, Frost, Jon, Lammer, Thomas, Rice, Tara, and Amber Wadsworth. 2020b. “Inclusive payments for the post pandemic world”, SUERF Policy Note, September.

BearingPoint. 2021. “Schweizer sind Vorreiter im mobilen Zahlen.“ Press Release, 29 June, Schweizer sind Vorreiter im mobilen Zahlen | BearingPoint Schweiz. https://www.bearingpoint.com/de-ch/ueber-uns/pressemitteilungen-und-medienberichte/pressemitteilungen/schweizer-sind-vorreiter-im-mobilen-zahlen/

Bindseil, Ulrich. 2019. „Controlling CBDC through tiered remuneration.” SUERF Policy Note, Issue No. 95.

Bindseil, Ulrich. 2020. „ Tiered CBDC and the financial system.” ECB Working Paper Series, No. 2351.

Bindseil, Ulrich. 2022. “The case for and against CBDC – five years later”.

Bindseil, Ulrich, Panetta, Fabio, and Ignacio Terol. 2021. “Central Bank Digital Currency: functional scope, pricing and controls.” ECB Occasional Paper Series. No. 286.

BIS. 2020. “Central banks and payments in the digital era.” Annual Economic Report 2020, Chapter III, June.

Boar, Codruta and Andreas Wehrli. 2021. “Ready, steady, go? – Results of the third BIS survey on central bank digital currency.” BIS Papers, No. 114.

Bofinger, Peter and Thomas Haas. 2020. “CBDC: Can central banks succeed in the marketplace for digital monies?”, CEPR Discussion Paper No 15489.

Duarte, Angelo, Frost, Jon, Gambacorta, Leonardo, Wilkens, Priscilla Koo and Hyun Song Shin. 2022. “Central banks, the monetary system and public payment infrastructures: lessons from Brazil’s Pix.” BIS Bulletin, No. 52.

ECB. 2020. “Report on a digital euro.” https://www.ecb.europa.eu/euro/html/digitaleuro-report.en.html

ECB. 2021. “Eurosystem launches digital euro project.” July 14,

https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210714~d99198ea23.en.html

ECB. 2022a. “Digital euro: Privacy optoins.” April 4,

https://www.ecb.europa.eu/paym/digital_euro/investigation/profuse/shared/files/dedocs/ecb.dedocs220404.en.pdf?39c27f3bda85972b8070c318bb4e3578

ECB. 2022b. “The euro as a digital currency – state of play.” February 25,

https://www.ecb.europa.eu/paym/digital_euro/investigation/profuse/shared/files/dedocs/ecb.dedocs220225.en.pdf?ab5c786b31b09cdb53186206d8b3e78f

European Commission. 2020. “COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS on a Retail Payments Strategy for the EU”, COM/2020/592 final.

Graf, Sandro, Heim, Nina, Stadelmann, Marcel, and Tobias Trütsch. 2022. „Swiss Payment Monitor 2022 – Wie bezahlt die Schweiz?“, Ausgabe 1/2022 – Erhebung November 2021, 24 February.

Gross, Jonas, Sedlmeir, Johannes, Babel, Matthias, Bechtel, Alexander, and Benjamin Schellinger. 2021. “Designing a Central Bank Digital Currency with Support for Cash-Like Privacy”.

Kantar Public. 2022. “Study on New Digital Payment Methods.”

Kharpal, Arjun. 2022. “ China’s digital currency comes to its biggest messaging app WeChat, which has over a billion users.”, CNBC, 6 January, https://www.cnbc.com/2022/01/06/chinas-digital-currency-comes-to-tencents-wechat-in-expansion-push.html.

Lagarde, Christine. 2022. “Introductory statement by Christine Lagarde, President of the ECB, at the meeting of the Conference of Parliamentary Committees for Union Affairs of the Parliaments of the European Union (COSAC).” Conference of Parliamentary Committees for Union Affairs (COSAC), January 14.

Panetta, Fabio. 2018. “21st century cash: Central banking, technological innovation and digital currencies.” In Do we need central bank digital currency? Economics, technology and institutions”, ed. Ernest Gnan and Donato Masciandaro, pp. 23–32. SUERF Conference Proceedings 2018/2 by SUERF/BAFFI CAREFIN Centre Conference.

Panetta, Fabio. 2021a. “Evolution or revolution? The impact of a digital euro on the financial system.” Speech by Fabio Panetta, Member of the Executive Board of the ECB, at a Bruegel online seminar, February 10.

Panetta, Fabio. 2021b. “Preparing for the euro’s digital future.” Blog post by Fabio Panetta, Member of the Executive Board of the ECB, July 14.

Panetta, Fabio. 2022. “A digital euro that serves the needs of the public: striking the right balance.” Introductory statement by Fabio Panetta, Member of the Executive Board of the ECB, at the Committee on Economic and Monetary Affairs of the European Parliament. March 30.

SNB. 2021. “Survey on Payment Methods 2020.”

Zamora-Pérez, Alejandro. 2021. “The paradox of banknotes: understanding the demand for cash beyond transactional use.”, ECB Economic Bulletin, Issue 2/2021, pp.121-137.

This already happened in China, where the e-Yuan is integrated as a payment option into WeChat (Kharpal 2022).

BRL 0.01 per 10 transactions for payment service providers (Duarte et al. 2022).