The EU is losing ground on innovation, in comparison with peer economies such as the US, China and Japan. This is revealed not just by weaker spending on R&D, but also by lower business investment in intangibles, and a declining presence among top global innovating companies. While EU firms are advancing in terms of the adoption of digital technologies, in the service sector they lag firms in the US, reflecting certain structural barriers in the European context. One of these is finance, with conditions improving overall, but remaining ill-suited to supporting innovation and digitalisation, particularly as regards the underdevelopment of equity financing. These are some of the key findings of the EIB Investment Report 2018/2019, which draws on the EIB Investment Survey of firms across Europe, and a unique survey on digitalisation and skills in Europe and the US in 2018.

Investment in innovation is critical for the growth of productivity and future prosperity, while helping to address challenges like an ageing population and climate change. Innovation is about moving the technology frontier, but it is also about the adoption of new technologies. Remaining at the forefront of innovation and at the same time keeping up with adoption is what will define Europe’s long-term ability to compete in global markets.

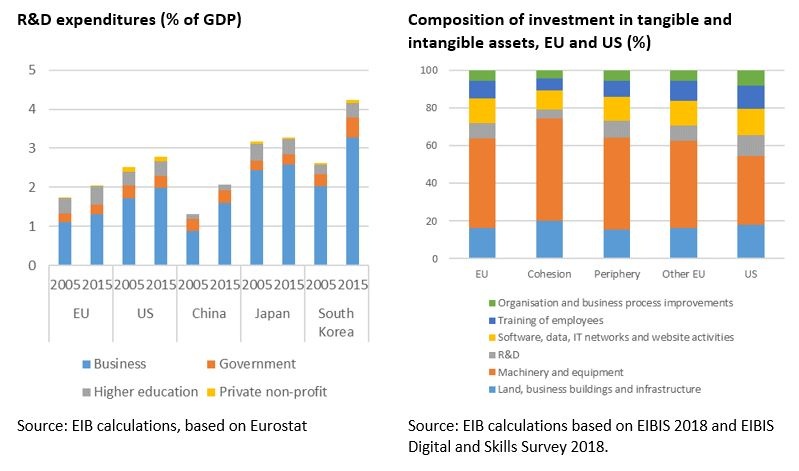

EU spending on R&D lags global competitors because of weaker business R&D. Business investment in intangibles is also lower in the EU than in the US. EU R&D investment remains stable at 2% of GDP, a level recently matched by China and below spending in the US at 2.8%. Business R&D largely accounts for the difference, being 1.3% of GDP in the EU and 2% in the US. Achieving the EU target for R&D of 3% of GDP by 2020 would imply additional annual investment of EUR 140 billion. Meanwhile, EIBIS data shows that US firms devoted 48% of total investment to intangibles as a whole, compared to 36% in the EU.

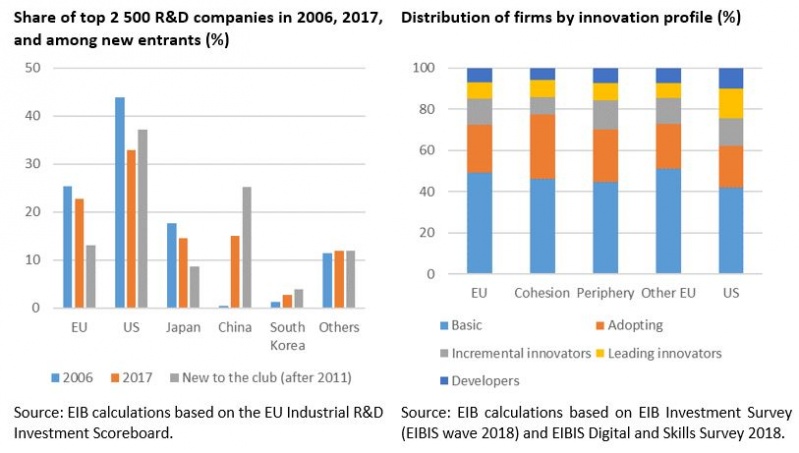

The EU is losing ground among the world’s top firms for R&D spending, with fewer new entrants in this group, reflecting the challenges EU firms face in scaling-up. Business R&D is highly concentrated, with just 2 500 firms accounting for around 90% of global business R&D, and 250 investing 70% of that. Among the top 2 500, China’s presence is growing. Moreover, the US and China represent 37% and 25%, respectively, of new entrants to the top 2 500 after 2011. With only 13% of new entrants, the EU is more reliant on long-established companies for its position in the global innovation landscape.

European weakness in “tech” is a concern, given shifts towards digitalisation and “winner-takes-all” dynamics. Among the top 2 500 companies for R&D, the EU is a global leader in the automotive industry, but has a comparatively much weaker presence in the electronics and technology sector, covering areas such as microelectronics, consumer electronics, digital infrastructure and services, and cybersecurity. The overall investment intensity of leading firms in the tech sector is also notably weaker in the EU than in the US.

Compared to the US, the EU has more firms that do not innovate at all, fewer leading innovators and more that are focused on adopting innovation. Only 8% of EU firms can be categorised as “leading innovators” that invest significantly in R&D and introduce products new to their market, compared to 16% in the US. By contrast, EU firms are twice as likely to focus on adopting existing innovations (24% vs 12%), with this figure rising to 31% in cohesion countries, signalling a process of catching-up. Survey evidence shows that innovators grow faster than other firms, and are more likely to regard external finance constraints and the limited availability of skilled workers to be obstacles for investment.

Investment in intangible assets, and not just R&D, is critical for innovation. It is necessary to consider investment in the full range of intangible assets – software, data, organisational capital, employee skills, all kinds of intellectual property rights, and so on – that are closely associated with innovation in advanced economies.

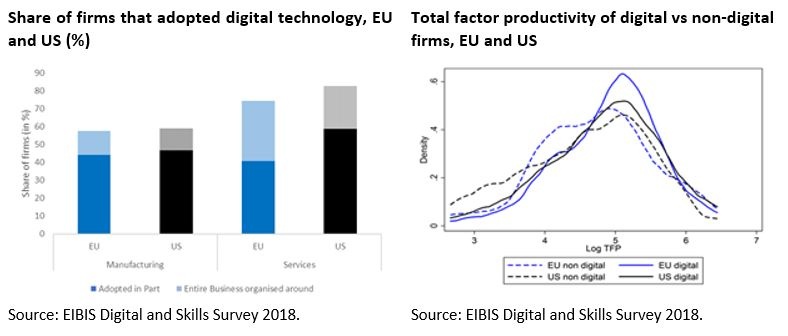

The adoption of digital technologies by EU firms lags behind that of US firms in the service sector, but not in manufacturing. While 83% of US service sector firms report adopting digital technology, only 74% have done so in the EU. In the manufacturing sector, 60% of firms have adopted such technologies, on both sides of the Atlantic. These are some of the findings of a special add-on to the EIB Investment Survey, focused on digitalisation, covering 1 700 firms in the EU and the US. Digital technologies considered include 3D printing, advanced robotics, big data, automation of routines and digital content provision.

Digitalisation is associated with improved firm performance. Firms that adopt digital technologies tend to be more productive, to invest more and to engage more in innovation activities. In both the EU and US, and by a wide margin, firms credit digitalisation with enhanced sales, with the effect estimated at around plus 10% on average.

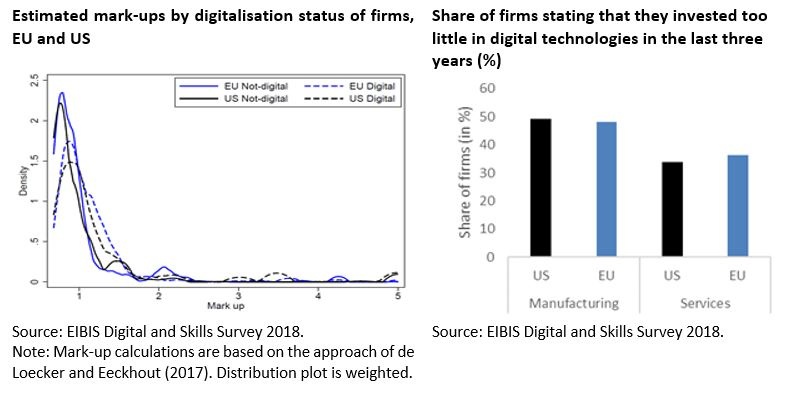

On balance, 50% of manufacturing firms and just over a third of services sector firms consider their past investments in digital technologies to have been too low. The goal of enhancing the productivity, quality and flexibility of production processes provides the main motivation for the adoption of digital technologies, particularly in manufacturing. While EU firms seem particularly motivated by efficiency gains, US firms tend to focus more on using new technologies like “big data” to open up new market opportunities.

Delaying digitalisation will come at a cost. The most technologically advanced digital firms do not expect further competitive pressures to emerge from further digitalisation in their own sector. They already enjoy higher mark-ups and expect to benefit from path dependency in innovation, confirming the “winner-takes-all” idea. This underlines the urgent need for European action to support the competitiveness of European firms in the global innovation race.

Barriers to digitalisation in Europe include the prevalence of small firms, market fragmentation and a financial system that is largely skewed towards debt finance. The larger share of small firms in Europe poses a barrier to digital adoption insofar as digital technologies often come with high fixed costs that small firms find difficult to shoulder. Market fragmentation limits firms’ ability to scale-up their digital activities, and thus reduces their incentive to invest. The heavy dependence of European firms on debt finance adversely affects young firms that want to digitalise in particular, as they often do not have pre-existing relationships with banks or much collateral to access debt finance to fund their digitalisation activities.

Policymakers need to pay attention to managing the potential risks of digitalisation. For example, there is evidence that increased automation using digital technologies often leads to a devaluation of mid-level jobs, and thus to labour market polarisation. Increased vulnerability to cybersecurity threats is also something that needs to be taken seriously. In addition, in the context of path dependency in innovation, digitalisation may have potentially negative impacts on consumer welfare, allocative efficiency and innovation activities.

Potential risks from digitalisation only enhance the need for Europe to be at the forefront of this technological wave. The potential gains from the adoption of digital technologies are large and the costs of missing the first-mover advantages of early adoption are high. Europe cannot opt out of digitalisation, so it is better to play a leading and shaping role.

Monetary conditions remain supportive of investment, but downside risks to the economic outlook are on the rise. Short-term interest rates remain negative in the euro area, and overall financing conditions continued to soften. However, this means that the expected path of monetary policy normalisation may pose risks for investment, as may developments that undermine market confidence. Global trade tensions have given rise to increasing uncertainty, something that has proven to be a key impediment to investment in recent years. Meanwhile, the process of monetary policy normalisation is leading to the emergence of asymmetric dynamics, accompanied by the repricing of risk.

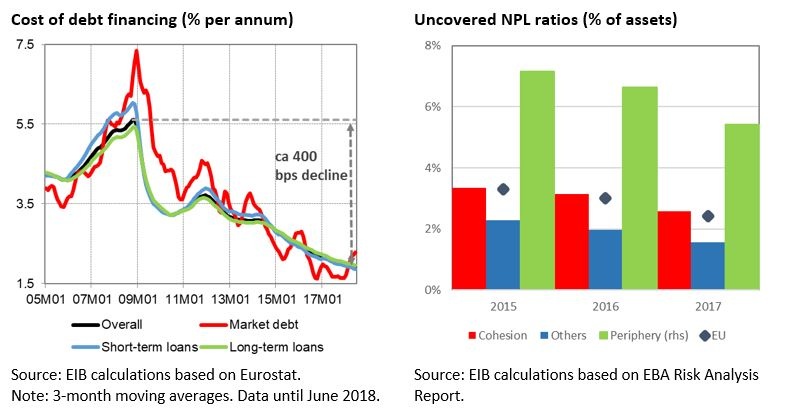

The EU banking sector has strengthened, with only pockets of weakness and vulnerability to monetary policy normalisation. EU banks have increased their capital positions in an unprecedented manner, so there is no capital shortfall overall. Ratios of non-performing loans to assets are gradually improving, although they remain significantly more elevated in the periphery countries. Monetary policy normalisation may affect bank asset valuation via possible depreciation of sovereign debt. It needs to be accompanied by the reactivation of cross-border inter-bank lending to ensure that firms that are dependent on bank lending are not adversely affected.

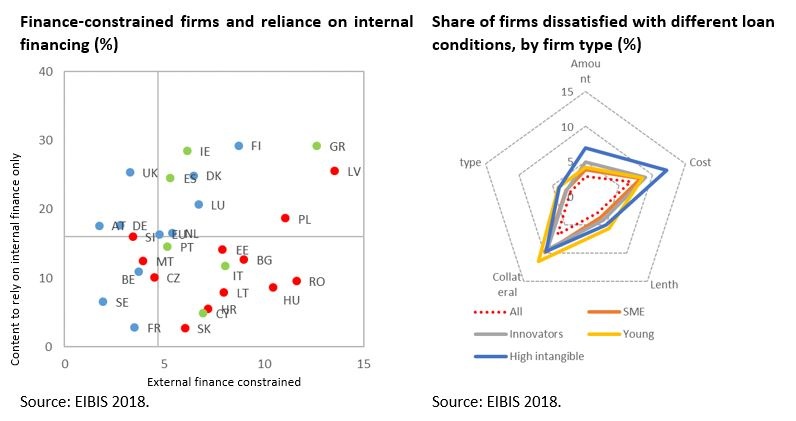

The number of finance-constrained firms in the EU has fallen to only 5%, but young, small and innovative firms are proportionally more affected. Many EU firms have undergone a process of deleveraging, particularly in the periphery countries, and EU firms overall remain net savers. Nonetheless, constraints remain in some cohesion countries, Greece and, to a lesser extent, Finland and Italy, and among firms that are small, young, engaged in innovation or that invest heavily in intangibles. Collateral requirements and financing costs are the main sources of dissatisfaction.

Large differences in firm performance call for targeted policies. Some finance-constrained firms outperform unconstrained ones in measures such as total factor productivity, employment growth and return on assets, while others notably underperform. This suggests that policies to address access to finance need to discriminate between firms with regard to performance, to alleviate constraints whilst avoiding further misallocation of resources.

The constraints faced by weaker banks in periphery countries are still being passed on to firms, revealing a degree of ongoing financial fragmentation across Europe. Whereas most firms’ satisfaction with external finance opportunities is related to their own financial heath, firms that are clients of banks with weaker financial positions are significantly more likely to be dissatisfied with the finance they have been able to obtain. The fact that foreign-owned firms in the periphery are much less likely to face finance constraints than similar, domestically-owned firms reinforces the message on continued financial market fragmentation.

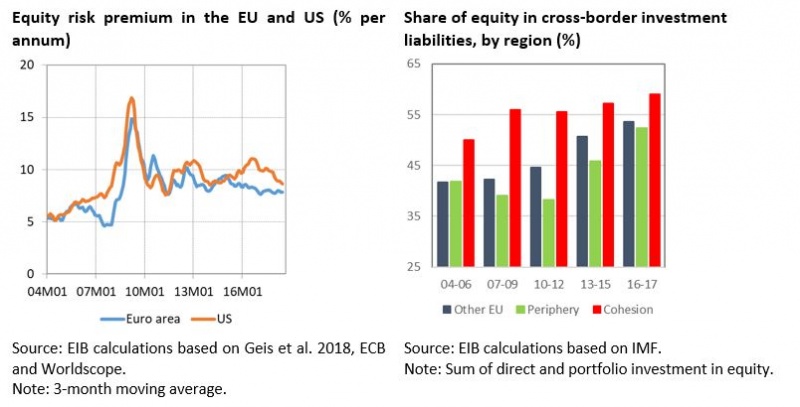

Equity financing in Europe is comparatively underdeveloped, undermining resilience to shocks, innovation and growth in new technology sectors. Private equity, venture capital and listed equity funding all lag the US and advanced Asian countries on several fronts, leaving European firms more dependent on bank lending and weakening resilience to financial shocks. A greater role for equity would promote private-based risk-sharing and improved allocation of capital across the EU. By expanding risk-taking capacity and helping to avoid the “growth-stage trap” in firm development, it would promote innovation and European competitiveness in new emerging technologies.

The cost of equity remains high and issuance activity slow. While the cost of debt now stands at around 400 basis points below its pre-financial crisis level, the cost of equity has not fallen to such an extent. The equity risk premium remains elevated and the spread between equity and debt is still larger than before the crisis.

When it comes to promoting equity financing, the devil is in the detail. Many reasons combine to explain the gap with the EU’s major competitors. On the supply side, reasons for the underdevelopment of equity include institutional and cultural factors such as corporate culture, reluctance to dilute power and tax bias in favour of debt. On the demand side, the structure and regulation of the financial sector, transaction costs and financial literacy all contribute. Ageing is likely to dampen the demand for equity further.

However, as financial integration across the EU gradually recovers, there is a promising compositional shift away from cross-border bank lending towards equity. The share of equity (both portfolio equity and foreign direct investment) in cross-border liabilities has risen in all European regions, with the share for periphery countries rising particularly rapidly. This trend provides an opportunity to foster equity financing at the EU level.

Europe needs to do more to meet the challenge of remaining competitive in the face of rapid innovation and digitalisation trends. This should include action to encourage a dynamic, innovative business sector and to overcome the fragmentation of Europe’s markets: