Residential property prices and mortgage lending in Switzerland have risen more steeply in recent years than can be explained by fundamental factors, such as income growth. Moreover, credit risks in connection with newly granted mortgage loans have increased over the past few years. Against this background, the Swiss National Bank (SNB) has repeatedly warned of vulnerabilities on the Swiss mortgage and real estate markets and has contributed to measures aimed at containing the associated risks. As the current upswing on these markets is likely to continue, market players must remain vigilant.

“House prices hit record highs”, “Swiss mortgage rates sinking again”2 – these newspaper headlines from this year show that developments on the mortgage and real estate markets are currently a topic of hot debate in Switzerland. Average prices of single-family houses and privately owned apartments, for example, have risen by over 80% over the last 15 years. Similar growth can be observed in the volume of mortgage lending at Swiss banks. In the prevailing low interest rate environment, mortgage rates have never been so attractive.

The SNB monitors these developments very closely, since contributing to financial stability is part of its mandate. Financial stability means that financial system participants, such as banks and financial market infrastructures, are able to perform their key functions and are resilient to shocks. These key functions include lending and payment transactions.

Historical experience shows that threats to financial stability often stem from the mortgage and real estate markets.3 Crises originating in mortgage and real estate markets entail particularly high costs for the economy as a whole, for example by causing recessions that are typically long and severe.4 The most prominent recent example is the global financial crisis of 2008, which was closely connected with declining prices on real estate markets, particularly in the US, the United Kingdom, Spain and Ireland. Switzerland has its own painful example dating back to the early 1990s. After a long period of rising real estate prices, mortgage interest rates increased and prices declined significantly. This triggered a banking crisis, which in turn led to a recession and a lengthy phase of economic stagnation.

But how can this potentially damaging link between the mortgage and real estate markets, the banking system and financial stability be explained?

First, these markets represent a major concentration of risks, especially for banks and households. Mortgage claims in Switzerland are the biggest asset item on banks’ balance sheets. They account for roughly 30% of total assets in the banking system – and if one considers only the domestically focused banks that operate predominantly in the Swiss credit market, this percentage rises to 70%. Moreover, residential property is the most important asset overall of households in Switzerland, and mortgage loans are their largest liability. Around 45% of household wealth is invested in real estate, and mortgage loans account for a full 95% of household debt.5

These figures highlight a further important aspect: The real estate market is largely debt financed. Roughly 95% of mortgage loans are granted by banks. There are thus close links between the mortgage and real estate markets and the banking sector.

A final important fact is that real estate markets have historically been subject to prolonged and pronounced cycles. Such cycles can last for years or even decades. During the long upswing phases, risks tend to be underestimated, thereby leading to excessive risk-taking by households, companies, investors and banks. A downswing, by contrast, can generate the mutually reinforcing effects of falling prices and loan defaults. This can lead to severe upheavals in the banking system and entail high economic costs.

In light of the high loss potential of mortgage and real estate market crises, the SNB’s aim is to identify risks at an early stage and to take action, to contain their growth and to strengthen banks’ resilience.

Risk monitoring

In identifying risks at an early stage, we are interested in vulnerabilities on the mortgage and real estate markets and in their possible consequences for the banking sector. Vulnerabilities manifest themselves primarily in inflated real estate prices and unsustainable mortgage lending. Both entail a heightened susceptibility to corrections in the form of sudden drops in prices and sharp rises in loan defaults.

We base our assessment of these risks on a broad range of data and methods. The fact that such a broad range is required reflects the high level of uncertainty involved in measuring these risks, as well as the different strengths and weaknesses of the individual indicators used. The more indicators there are pointing to a certain development, the clearer the assessment becomes.

Among others, we use indicators at an aggregate level that have become established in specialist literature as ‘early warning indicators’ for financial crises.6 These indicators measure vulnerabilities through the deviation of prices and credit volume from the corresponding fundamentals and long-term trends. Besides aggregate data, we also consider detailed individual loan data, especially in order to assess whether the mortgage loans granted are sustainable.7 Finally, stress tests provide an essential contribution to our risk monitoring. These enable us to estimate potential losses of banks under various crisis scenarios. The potential losses can then be compared to the capitalisation of the individual banks. In this way, we can assess the relevance of vulnerabilities on the mortgage and real estate markets for financial stability, and decide on any need for action.

Macroprudential instruments

What options does the SNB have to counter potentially damaging developments on the mortgage and real estate markets? Our macroprudential instruments comprise communication, participation in national and international regulatory work, and the authority to propose the activation, adjustment or deactivation of the countercyclical capital buffer (CCyB).

Communication plays a significant role in counteracting market participants’ tendencies to underestimate systemic risks and thus to take excessive risks themselves. It is often difficult for individual market participants to assess systemic risks, since it takes an aggregated view to be able to identify unsustainable developments. As a central bank, we can provide such an aggregated view. Therefore, the Financial Stability Report, the key element in our macroprudential communication, plays an important role.

As important as communication is, it is generally not enough to contain stability risks. A regulatory framework is also required. The SNB participates at various levels in the design of this framework, both at national and international level.

At national level, the SNB cooperates with the federal government and the Swiss Financial Market Supervisory Authority (FINMA) in securing appropriate regulatory framework conditions. At the forefront are the regulatory requirements on banks’ equity capital and liquidity through laws and ordinances by the federal government and FINMA. Moreover, in Switzerland, the self-regulation rules for banks also constitute an important element. Thus, the relevant legal requirements are supplemented by rules and guidelines set by the Swiss Bankers Association, which FINMA can also recognise as a minimum standard. This instrument has been applied several times over the past few years in relation to the mortgage and real estate markets.

At international level, the SNB participates in various committees and working groups, such as the Basel Committee on Banking Supervision. The recommendations and agreements of these bodies in turn have a major influence on our national legislation. One example of this is the CCyB. It was devised at international level and introduced in Switzerland in 2012 by means of a Federal Council ordinance.

The CCyB is a key instrument for counteracting imbalances on the mortgage and real estate markets. When activated, banks are obliged to temporarily increase their equity capital beyond the levels imposed by existing capital requirements, depending on the magnitude of the vulnerabilities. The CCyB is designed to strengthen the resilience of the banking sector against the risks of excessive credit growth and also to counter any unsustainable credit growth. The capital buffer in Switzerland has so far been targeted at mortgage loans granted for residential real estate. This means that the more mortgage loans for residential property a bank holds on its balance sheet, the more additional capital it is obliged to hold.

We regularly assess whether the required capital buffer level is appropriate. If we decide that an adjustment of the buffer is required, we make a proposal to the Federal Council after consultation with FINMA.

Let me stress at this point that, although the possible applications and effects of macroprudential instruments are important in dealing with cyclical risks, they do have their limits. Measures taken by the authorities are therefore no substitute for market participants’ own responsibility – it is ultimately up to them to manage their risks.

In the following, I will elaborate on why the SNB considers the vulnerabilities on the mortgage and real estate markets to be at a high level at present. I first look at the mortgage market and then turn to the real estate market. My focus is mainly on the residential property segment, since this is where we have identified the most serious risks in the current situation.

Strong growth and increasing affordability risks in mortgage lending

Various mortgage market indicators show that, in recent years, mortgage volume has grown more strongly than can be explained by fundamental factors.

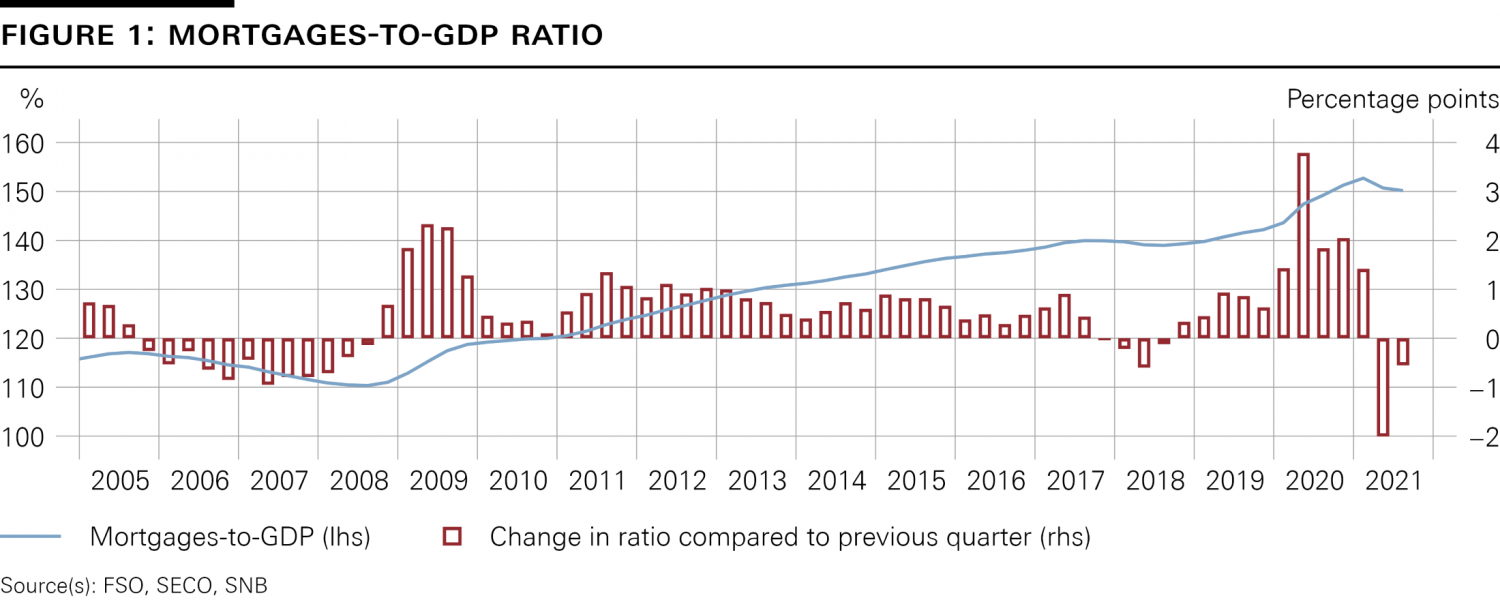

For example, Figure 1 shows that aggregate mortgage debt, as measured by the ratio of outstanding mortgage loans to GDP (the blue line), has risen sharply since 2009. The increase was particularly marked last year due to the strong decline in GDP in connection with the coronavirus crisis. We expect the ratio to decrease again somewhat as the economy recovers. Nevertheless, the current ratio of around 150% in Switzerland is high not only by international comparison, but also by our country’s own historical standards.

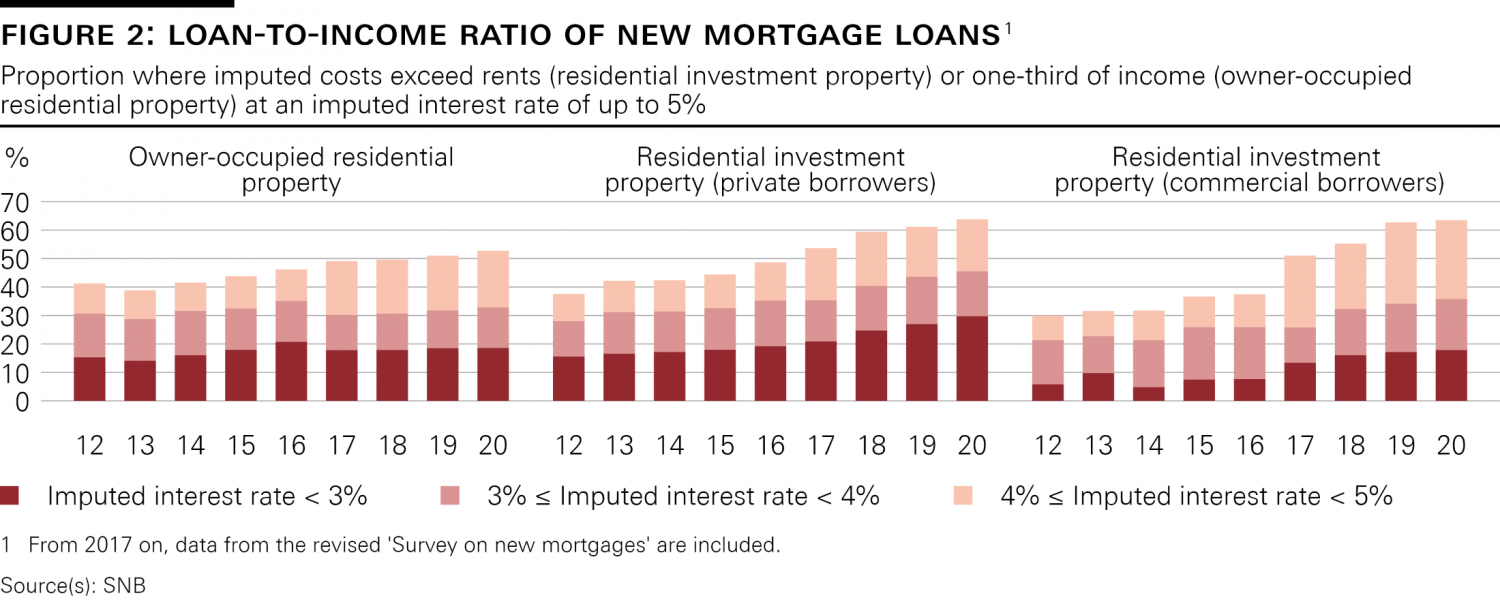

Over the past years, however, the SNB has focused less on the increase in the volume of mortgage loans than on their quality. The main focus in this context has been on affordability risk, i.e. the risk that borrowers cannot afford their mortgage costs in the long term. The following calculation represents a standard metric used by Swiss banks to assess the affordability of a mortgage loan: Affordability is deemed to be appropriate if the imputed costs of an owner-occupied residential property – i.e. the costs resulting from interest payable, amortisation and maintenance – do not exceed one-third of the borrower’s gross income. In the case of residential investment property, these costs should not exceed the rental return. The term ‘residential investment property’ comprises apartment buildings as well as privately owned apartments and single-family houses that are rented out.

Figure 2 shows the share of new mortgage loans at various imputed interest rates that do not meet the conditions of this standard metric, i.e. where the loan-to-income (LTI) ratio is too high. The data illustrate that affordability risks have risen in all segments since 2014 and are currently at historically high levels. The sharpest increase has occurred in the residential investment property segment. Between 20% and 30% of newly granted mortgage loans for residential investment property would be deemed unaffordable if the mortgage interest were to rise to 3%. Should the interest rate climb to 4%, this proportion would amount to around 40%. In the owner-occupied residential property sector, these shares would come to roughly 20% and 30% respectively.

These figures on affordability risk do not mean that, in the event of an interest rate rise, mortgage loan defaults of this magnitude would actually occur. After all, the calculation used here considers only borrowers’ income and not, for example, their general financial situation. Moreover, the figures are based solely on newly granted loans, not outstanding loans. Overall, however, the figures do show that the debt level of mortgage borrowers compared to their income has increased sharply in recent years. This means that, over the same period, borrowers have become markedly more vulnerable to interest rate rises.

Overvaluations in residential real estate

With regard to the residential real estate market, numerous indicators point towards overvaluations in this market, since price increases in recent years have been steeper than can be explained by fundamental factors. This applies across all residential segments, i.e. single-family houses, privately owned apartments and apartment buildings.

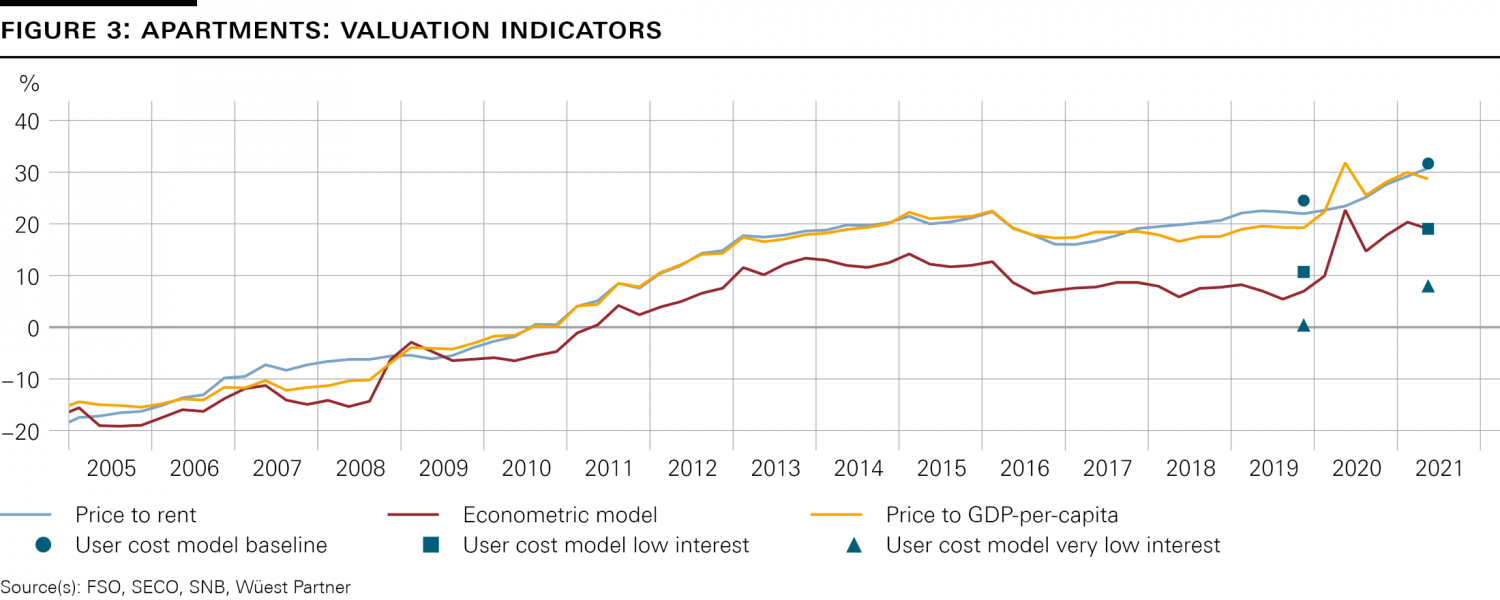

The extent of overvaluation is difficult to quantify. Figure 3 illustrates this, using the privately owned apartment segment as an example. It shows two simple indicators and the results of two models, used to measure the valuation of privately owned apartments. Both indicators, i.e. the price-to-rent ratio (in light blue) and the price-to-GDP ratio (orange), reveal an overvaluation of around 30%. An econometric model (red), which explains current prices based on developments in GDP, housing stock and interest rates, shows an overvaluation of roughly 20%.8 Finally, the ‘user cost model’ (dark blue) reveals a broad range of overvaluations, depending on different assumptions regarding future interest rate and rental developments.9 Assuming for example that real mortgage interest rates will return to their historical average of 2.6% over the long term, the resulting overvaluation amounts to roughly 30%. If, by contrast, the assumption is a real mortgage interest rate of 1% over the long term, the overvaluation decreases to around 5%.

Capital buffers ensure adequate resilience of the banking sector overall

To summarise, we are currently seeing clear signs of unsustainable mortgage lending on the one hand, and heightened risks of a price correction on the other. The relevance of these vulnerabilities is confirmed by our stress tests. They show that banks would suffer substantial losses in the event of an abrupt and steep interest rate rise combined with declining real estate prices. Affordability risks would materialise, meaning that numerous borrowers would no longer be able to pay their mortgage interest. Furthermore, many mortgages would be insufficiently covered, i.e. the mortgages concerned would no longer be fully secured by the value of the properties. In such a scenario, the capital ratios of numerous banks would drop below their target values and, in some cases, even below the regulatory minimum requirements.

Equally, our stress tests underscore the importance of the capital buffers currently held by banks, which comprise voluntarily held buffers besides the capital required by statutory regulations. With these capital buffers, our assessments suggest that most banks would be capable of absorbing potential credit losses. In other words, we consider the resilience of most banks to be adequate.

The fact that we consider banks’ capitalisation to be sufficient at present does not mean that we can relax with regard to the vulnerabilities on the mortgage and real estate markets.

That the current situation is not more precarious is due not least to the measures taken in recent years. These measures include, for example, the Swiss Federal Council’s decision in 2012 to increase the capital requirements for mortgage loans with a high loan-to-value ratio, i.e. a high ratio of the mortgage loan to the value of the pledged property. Furthermore, Swiss banks’ self-regulation rules were revised and tightened in the years 2012, 2014 and 2019, which, in particular, imposed more stringent requirements regarding the amortisation of mortgage loans and own funds brought in by borrowers. An important factor was also the activation of the CCyB in 2013 and its subsequent increase to 2% in 2014. The CCyB was deactivated in March 2020. This decision was made against the backdrop of the coronavirus crisis in order to broaden the scope for banks to lend to companies in these exceptional circumstances – in spite of the existing vulnerabilities on the mortgage and real estate markets.

The measures implemented between 2012 and 2019 were important to strengthen banks’ resilience and curb the increase in vulnerabilities.10 They could not, however, fully prevent the rise in risks. The current situation will therefore continue to demand our full attention. I would like to highlight two reasons:

First, current price developments in the residential property sector show that there is no reason to sound the all-clear. The coronavirus pandemic has not slowed down price momentum.11 On the contrary, price growth in the residential real estate market has in fact increased.

Second, the global low interest rate environment is likely to remain for some time to come. One reason is that the structural factors behind the downward trend in interest rate levels over the past decade, such as the ageing of the population and the decline in productivity growth, are still in play. Another reason is that many central banks in the advanced economies will probably be patient and take a cautious stance during the next tightening cycle. It is therefore to be expected that interest rates will remain low for some time yet, which means that incentives for increased risk-taking will remain in place.12 This could prolong the period in which growth in mortgage volume and residential property prices is higher than can be explained by fundamental factors. Moreover, the longer the current cycle lasts, the more likely it is that memories of past crises fade and that market participants increasingly disregard the risks in question.

Against this backdrop, it is important to continue to closely monitor developments on the mortgage and real estate markets. In this context, the SNB regularly reassesses the need for a reactivation of the CCyB. Given the probable continuation of the current upswing on the mortgage and real estate markets, risks to financial stability are likely to remain in the spotlight. Containing these risks will continue to require the participation and support of all market players: the authorities, the lenders, and the borrowers.

This contribution is a shortened version of a speech with the same title given on 31 August 2021 in Lucerne. The author would like to thank Jacqueline Thomet for her support in preparing this text. He also thanks Toni Beutler, Robert Bichsel, Maja Ganarin and Martin Straub, as well as the SNB Language Services.

Sources: Blick (6 July 2021), Finanz und Wirtschaft (21 July 2021), translated from the German.

On another source of systemic risk, known as the too-big-to-fail issue, see Zurbrügg F., After the storm: ten years on, how weatherproof is the Swiss banking system today?, speech held at the University of Lucerne, 6 September 2018.

Cf. Jordà, O., M. Schularick, and A.M. Taylor (2015), ‘Leveraged bubbles’, Journal of Monetary Economics, vol. 76(S): 1–20.

Cf. the SNB focus article Household wealth in Switzerland: concepts and trends in an international comparison, available online on the SNB’s data portal: https://data.snb.ch/en/topics/texts#!/doc/focus_20210429 (consulted on 30 November 2021).

Cf. Aldasoro, I., C. Borio and M. Drehmann (2018): Early warning indicators of banking crises: expanding the family, BIS Quarterly Report, March 2018. With a focus on Switzerland, cf. also Jokipii, T., R. Nyffeler and S. Riederer (2020): Exploring BIS credit-to-GDP gap critiques: the Swiss case, SNB Working Papers, 19/2020.

An important data source in this respect is our ‘Survey on new mortgages’, or ‘Hypo_B’ for short. This survey gives us comprehensive, anonymised individual loan data of newly granted mortgage loans, covering around 90% of the domestic mortgage market.

Cf. Cuestas, J.C., M. Kukk and N. Levenko (2021), Misalignments in house prices and economic growth in Europe, mimeo; and Muellbauer, J. (2018), Housing, debt and the economy: a tale of two countries, mimeo. The ECB uses a similar model. Cf. ECB, Financial Stability Review, November 2015 and May 2021.

Cf. for example Poterba, J. M. (1984), Tax Subsidies to Owner-Occupied Housing: An Asset-Market Approach. In the user cost model baseline, the long-term expectations regarding the real mortgage interest rate are set at the historical average of 2.6%. The versions ‘low interest’ and ‘very low interest’ are based on a real mortgage interest rate of 1.5% and 1.0% respectively.

Behncke (2020), for example, shows that LTV risks did in fact decrease due to the banks’ self-regulation rules in 2012 and the activation of the CCyB in 2013. Cf. Behncke S., Effects of macroprudential policies on bank lending and credit risks, SNB Working Papers, 6/2020.

Cf. Swiss National Bank (2021), Financial Stability Report. Data released since the publication of the report in June 2021 show that the price momentum is continuing unabated.

Cf. Schelling. T and P. Towbin, Negative interest rates, deposit funding and bank lending, SNB Working Paper, 5/2020.