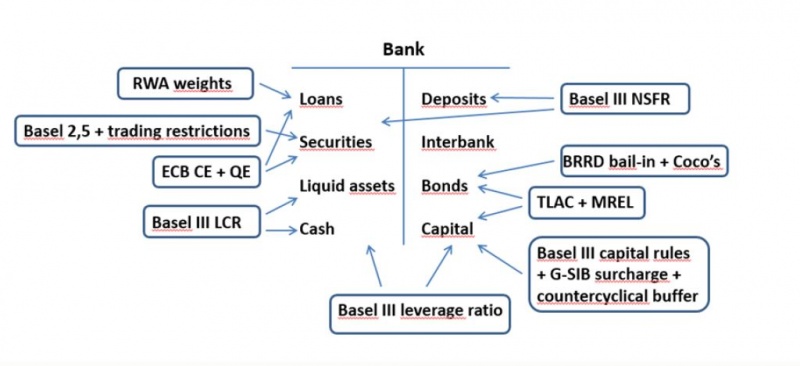

Banks are operating in a new environment. The regulatory framework has been firmly updated. The higher capital requirements of Basel 3 are the cornerpiece, but also the new liquidity requirements (LCR and NSFR) and the rules about bail-in capacity (TLAC/MREL) impose important constraints on what banks can do. On top of that banks are confronted with a challenging macroeconomic environment characterized by very accommodative monetary policy (the ECB combines low rates, asset purchases and forward guidance) causing a low for long interest rate environment. Chart 1 illustrates that this environment fundamentally affects the balance sheet of banks.

Chart 1: Impact of regulation and macroeconomic conditions on banks

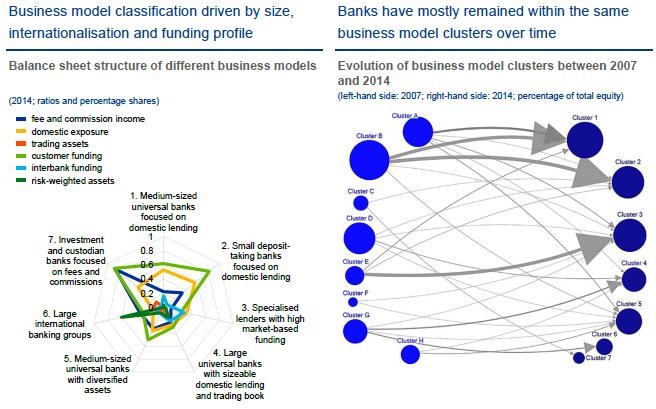

Faced with these challenges, the expectation is that banks will fundamentally restructure their business models in terms of asset and funding structure, revenue mix, and geographical scope. However, in reality business model shifts have been slow and modest, at best. The following chart is taken from the ECB 2016 Financial Stability Review. On the left hand side it shows seven business model types that ECB researchers distinguish based on bank characteristics. On the left hand side, it is shown that although some banks have switched to a different business model the overall picture is that the majority of banks have remained within the same business model cluster.

Chart 2

Source: ECB FSR 2016, Trends in bank business models

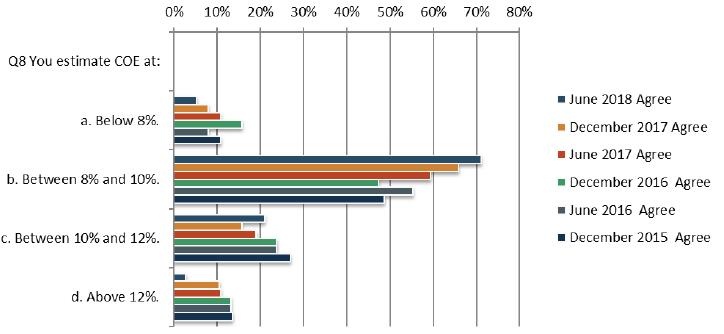

Yet, the pressure for European banks is clearly mounting. A substantial number among them remain characterized by weak profitability since their average return on equity (ROE) is lower than the cost of equity (COE), whereas long-term viability requires that ROE exceeds the COE. To illustrate this trade-off, the EBA runs a regular Bank Risk Assessment and in the 2018 questionnaire the banks’ answer to the question what they think their COE is, the majority puts the number in the 8-10% range.

Chart 3: EBA bank risk assessment questionnaire 2018

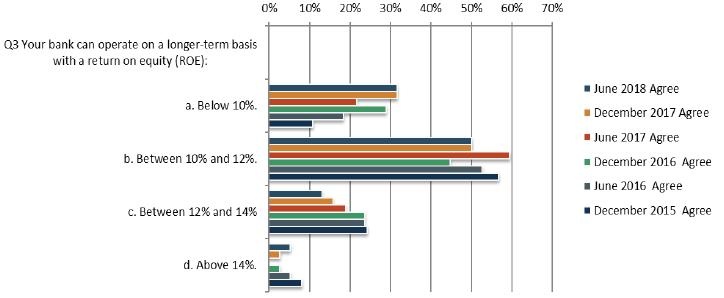

When the banks are asked what they consider to be their longer term ROE, the vast majority of the banks indicate that levels above 10% should be achievable, as can be seen in the next graph.

While these answers seem to indicate that banks think they are able to achieve viability (ROE>COE), the actual ROE numbers offer little comfort in the short run. As can be seen from the next table, again taken from the EBA bank risk assessment exercise, only a small fraction of European banks actually operates with an ROE above 10%? Hence, some modesty seems to be warranted.

Table 1

Source: EBA Risk Dashboard 2018

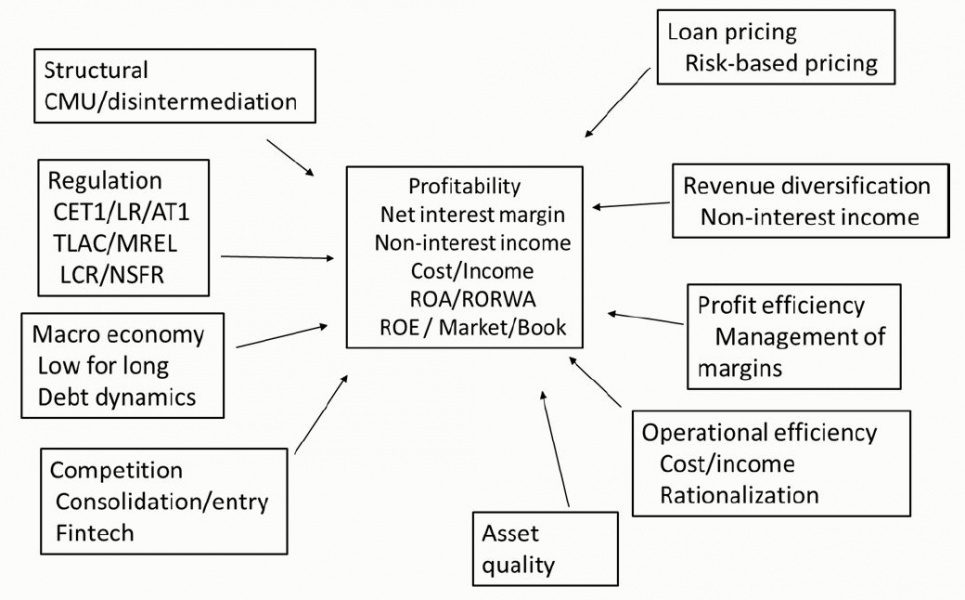

Going forward, next to being confronted with new regulation and challenging interest rate conditions, banks will feel the impact of structural tendencies (shift towards market-based financing) and competitive issues (consolidation, competition from new entrants due to e.g. PSD2, fintech). Chart 4 summarizes (on the left hand side) the effects that might negatively affect their profitability. On the right hand side is a series of potential actions that banks can undertake to mitigate some of the negative consequences and drivers to restore sustainable profitability.

Chart 4: Challenges and mitigating actions

Source: Mergaerts and Vander Vennet, Journal of Financial Stability 2016.

Summarizing the main mitigating actions for bank business models:

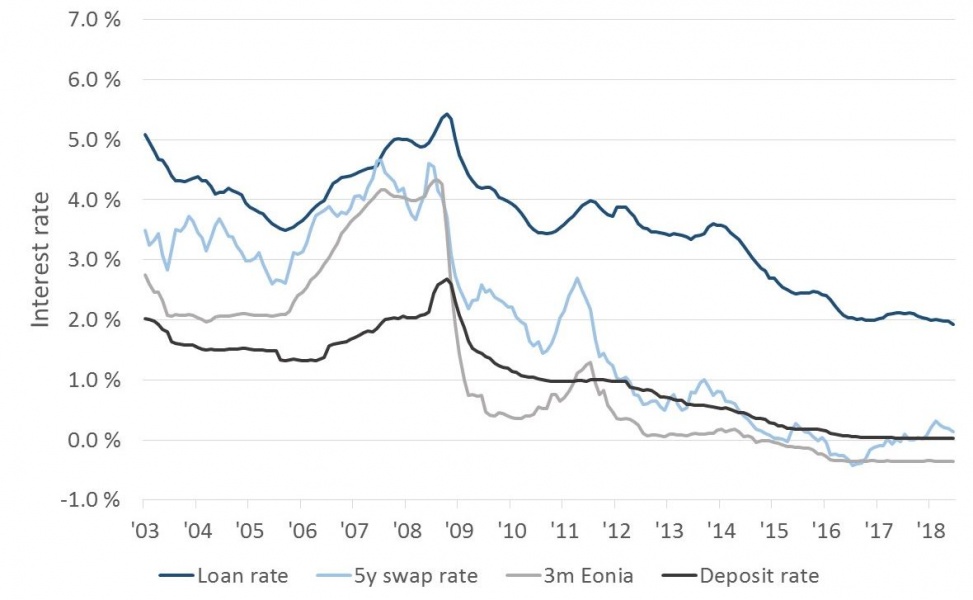

In terms of the bank’s net interest margin, the post-crisis period has witnessed a shift from deposit margin to lending margin, as illustrated in the next graph for the Belgian banks. Due to monetary policy actions and the zero lower bound on retail deposit rates, the deposit margin (between the deposit rate and the interbank rate, here 3m eonia) has even become negative. Banks have compensated that evolution by increasing their lending margin (compared to the swap rate). The crucial question is how banks will adjust the deposit margins when policy rates increase. One hypothesis is that banks will be forced by competitive conditions to follow short-term interest rate increases much faster and more complete than was the case in the past. If that should happen, will banks compromise their lending margins by lowering the risk spreads, as they have done in the pre-crisis era? Hence, sound risk-based loan pricing will be of prime importance to maintain viable margins.

Chart 5: Lending and deposit margins for Belgian banks

Source: ECB SDW

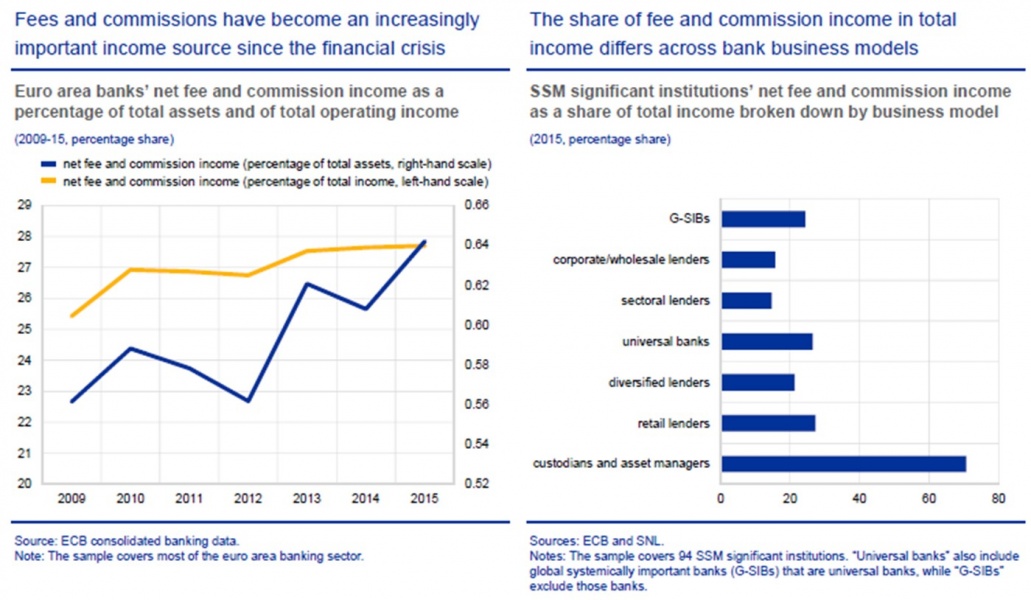

Another type of action to support bank profitability is to diversify their revenues and increase non-interest income. As the following chart from the ECB 2016 FSR illustrates, banks are pursuing this avenue, but it is equally clear that the increase in fee and commission income has been modest. There is no unlimited pool of fees available for all banks. Banks will have to focus on what their comparative advantages are in terms of non-interest income and adapt their business model accordingly. This should hopefully lead to a more diverse banking landscape. If all banks diversify in exactly the same activities, this would only increase systemic vulnerability. Society needs diversity in banking models.

Chart 6

It is also clear that banks have no other option than to improve their operational efficiency in a substantial way. There is no absolute benchmark, but as the next table shows, many banks still operate with relatively high cost/income ratios (source: EBA Bank Risk Assessment report). Simply cutting staff or branches will not do the trick. It will involve a fundamental redesign of bank intermediation.

Table 2

Source: EBA Risk Dashboard 2018

As a conclusion, the actions needed to restore viable bank profitability going forward can be summarized as follows:

The impression remains that Eurozone bank sector restructuring is progressing in slow motion. In terms of business model adaptation, the regulation overhaul is done so banks should adapt swiftly to the new regime. In the near future, technology and customer experience will drive the pace of innovation. And we will have to seek a new equilibrium between banks, non-banks and financial markets (capital markets union should accelerate the transition). In terms of bank sector restructuring, it can be noticed that the pace of entry as well as M&A remains slow. The questions is whether these forces will lead to more diversity instead of simply increasing the size of banks. Some remaining issues loom large over the future of banks, notably the necessary completion of the banking union, the treatment of sovereign exposures, and the increasing levels of indebtedness (both private and public).

This is a summary of an intervention given by the author at the SUERF/Belgian Financial Forum Conference „Ten years after the crisis: Contours of a new normal“ on 14 September 2018 at the National Bank of Belgium, Brussels.