Exchange rate movements and channels through which they influence macroeconomic and financial environment are closely followed by policymakers in emerging markets (EM). This policy note aims to analyze how structural factors relevant to external vulnerabilities shape the course of exchange rate-inflation nexus in EMs. Taking heterogeneities in EMs into consideration, the role of structural vulnerabilities affecting the exchange rate pass-through (ERPT) is examined by implementing the Interacted Panel Vector Autoregression approach. Empirical results show that more resilient EM countries are experiencing a lower degree of ERPT during the sample period. Countries facing more prominent dollarization and current account deficit are subject to stronger ERPT, while higher inflation, higher risk premium and higher FX debt levels are associated with increasing ERPT as well. On the other hand, countries with higher reserve adequacy or higher foreign direct investment show lower ERPT compared to lower EM groups.

With the historical waves of financial liberalization and the adoption of inflation-targeting regimes, the exchange rate emerges as one of the important determinants of pricing decisions and inflation realizations in emerging markets (EM). This phenomenon is conceptualized as the exchange rate pass-through (ERPT) in the relevant literature. ERPT can be broadly defined as the degree to which exchange rate changes are transmitted into domestic prices (Campa and Goldberg, 2005; Gagnon and Ihrig, 2004).

Given that EM currencies can face large and frequent depreciation trends, the influence of local currency movements on price changes has been extensively examined by academics, policymakers, and practitioners. Since the majority of the inflation-targeting EMs also has a floating exchange rate regime, the concept of ERPT becomes an integral component of economic policy formulation as well as policies taken to preserve macroeconomic stability (Carriere-Swallow et al., 2016; Agenor and Pereira da Silva, 2019).

A particular issue, whose impact on ERPT has not been covered widely, is the sensitivity of EMs to global economic developments. The forces summarizing external vulnerabilities might have important implications on exchange rate-inflation nexus through various channels, thus lending itself for analysis in a cross-country setting. More vulnerable countries are exposed to frequent and large external shocks, which can potentially decrease the resilience of the local economic performance. Under such circumstances in EM cases, due to the increase in uncertainty and exposure to swings in global risk appetite, local financial conditions might be tightened, ultimately distorting the expectations and pricing behavior of local economic agents (Gagnon and Ihrig, 2004). The financial tightening characterized by the depreciation of local currencies accompanied by possible market volatilities also lead to amplified cost pressures. Therefore, the analysis regarding the exchange rate-inflation link with specific emphasis on structural vulnerabilities might have important implications for policymakers and practitioners to understand the dynamics more precisely.

In this note, we summarize the empirical design and baseline results obtained in Kazdal and Yılmaz (2021), affirming a cross-country analysis with a recent sample period. The study aims to investigate whether the degree of ERPT is subject to heterogeneities contingent on external vulnerabilities across EM countries.

We work with a detailed list of indicators with informative nature of different vulnerability dimensions. First, the dollarization tendencies in an economy might affect the degree of ERPT. The previous works have shown that in highly dollarized economies the pass-through from the exchange rate to domestic prices is sizeable compared to counterparties with weaker dollarization tendencies (Leiderman et al., 2006; Reinhart et al., 2014). Direct cost, balance sheet, and indexation channels tend to accommodate the influence of dollarization on ERPT. It might have direct effects on the pricing mechanism of tradable goods, but it can also have indirect implications with respect to indexation for wages, non-tradable goods, and expectations in EM countries, particularly during high uncertainty periods.

The degree of trade openness is another structural determinant of ERPT, but its effect on ERPT is found to be controversial in the literature. Some studies argue that exchange rate movements can be easily reflected in domestic prices in economies engaging in voluminous foreign trade transactions hinting at more prominent ERPT (Campa and Goldberg, 2005 and Ghosh, 2013). However, more liberal trade policies and rising trade volume may also force companies to operate in a more competitive environment possibly leading to a decline in ERPT.

The composition of imports stands as another major factor influencing both the pace and degree of ERPT. Campa and Goldberg (2002) found that ERPT can be subject to variations depending on the substitutability between imported and domestically-produced goods. If the degree of substitution is low, then the price-setting ability of the importing firms will be higher and they are less concerned about market share losses. However, if there exists stronger substitution, then the competitiveness and market share considerations might prevail, so importing firms are not able to boost their prices as much as the level implied by the currency depreciation.

The current account deficit (CAD) and its financing have also implications for EM countries in terms of inflationary pressures. These vulnerabilities regarding external balance might put pressure on exchange rates, diminish the confidence of economic agents and distort pricing behavior. In this respect, the detailed analysis may raise the question that apart from the direct effect coming through exchange rate fluctuations; CAD and its financing sources might have indirect implications on the pricing behavior of the EM firms. It should be noted here that the price increases in such countries tend to be larger than what is implied by exchange rate shocks, probably due to distortion in pricing mechanism arisen from sizeable ERPT caused by external balance vulnerabilities.

The structural vulnerabilities stemming from the FX debt of corporates in EMs stand as a potential catalyzer of ERPT, due to increased sensitivity to currency fluctuations. Firms will face difficulties to service their FX-denominated debt if this exposure is not hedged properly through natural hedging or financial derivative instruments. Thus, the mechanism through which exchange rate fluctuations affect domestic prices is more visible depending on the sensitivities against currency shocks coming from the existence of FX corporate debt. Micro-level dynamics across sectors in terms of FX sensitivities might also play a crucial role in pricing behavior. By working on such micro-level data from Turkey, Fendoğlu et al. (2020) showed that manufacturing sectors with higher net FX liabilities experience larger price swings following currency depreciation.

The country risk premium has long been considered as an indicator of investor perception regarding the countries’ overall riskiness relative to peer groups. Additionally, the country risk premium is also one of the main components of external financing costs for sovereign entities. Therefore, it may have implications in terms of financial stability as well as price stability, especially in the EM group (Korkmaz & Onay, 2018).

The level of imported content of the final demand can also be added to the abovementioned list of structural vulnerabilities potentially influencing the course and degree of ERPT. In the case of higher dependence of consumption tendencies on imported goods and the composition of imports shaped by consumption goods might mean that external shocks can have significant effects on domestic prices through direct and indirect channels (Gopinath, 2015 and Carriere-Swallow et. al., 2016).

Lastly, the level of inflation can also be considered as an indicator representing the soundness of the macroeconomic environment which might have effects on the exchange rate-inflation nexus. In the case of higher inflationary pressures, the credibility of policies might be questioned, and the persistency of external shocks increases (Taylor, 2000). The transmission of these shocks to domestic macroeconomic indicators occurs rapidly at a larger amount. A particular mechanism can work through the exchange rate shocks and pricing behavior. As stated by Taylor (2000) and Lopez-Villavicencio and Mignon (2016), firms increase their prices if they perceive exchange rate changes as permanent. Otherwise, if their expectations are aligned with the fact that the shock is temporary, then they would not adjust their prices immediately and to a larger extent. Thus, when the level of inflation is high, the persistence of the shocks increases. In such cases, firms tend to reflect increasing costs on their prices easily. Jasova et al. (2016) analyze the evolvement of ERPT in both developed and developing countries. They particularly argue that declining ERPT in EMs is closely associated with the declining inflation level. In addition to this, Mihaljek and Klau (2008) show that declining trends in both level and variability of inflation paved the way for lower ERPT in EMs.

In this study, the selected sample of EMs comprises 14 countries. They are classified as emerging and developing by the worldwide economic institutions. In particular, selected countries are Brazil, Chile, Colombia, Czech Republic, India, Indonesia, Israel, Mexico, Peru, Philippines, Romania, Russia, South Africa, and Turkey. These countries are chosen to reflect different characteristics in terms of geographical, market-based, and macroeconomic outlook. We choose to examine the period spanning post-GFC episode, so our analysis covers the period between January 2010 and October 2018. When determining the sample period, apart from data availability, exclusion of structural break during the GFC period and examination of contemporary dynamics of inflation developments become influential. The same period also brings drastic changes in capital flows shaping an interesting setting for external vulnerabilities to examine empirically.

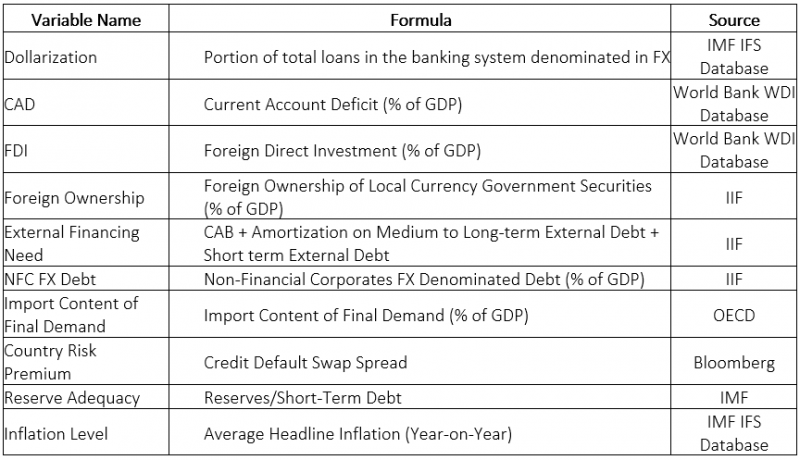

A brief review of definitions and data sources of external vulnerability indicators are presented in Table 1. Following the previous literature, we proxy the dollarization level in EMs as the share of total loans in the banking system denominated in FX. This series is provided by IMF within the scope of the International Financial Statistics (IFS) database. The ratio of CAD (and long/short term financing of CAD) to GDP and the ratio of FDI to GDP are retrieved from World Bank World Development Indicators (WDI) database to represent the structural soundness of external balance. The foreign currency debt of non-financial corporates (NFC) relative to GDP is collected from the IIF Global Debt Monitor (GDM) database. The data regarding foreign ownership of local debt markets is retrieved from the same source as well. In this study, we measure the foreign ownership with the proxy of non-resident’s share in the local currency sovereign bond market.

Table 1. Interaction Variables Formulas and Sources

Within this framework, country risk premium can be followed through Credit Default Swap (CDS) spread. CDS spread data is compiled from the Bloomberg Terminal. As another component of external/structural vulnerabilities, the import content of demand conditions is followed by total value added in final demand statistics, which is provided in the OECD Inter-Country Input-Output (ICIO) database. Although there is no consensus among academics and practitioners regarding the best indicator of the adequacy of reserves, alternative measures constituted by IMF are broadly accepted and used in the empirical analyses. Among these measures, the ratio of reserves to short-term debt metric compiled from IMF is preferred in our framework. Lastly, inflation data referring to the averages of the year-on-year changes in headline inflation is compiled from the IMF IFS database.

On top of vulnerability series being employed to categorize countries, we also employ a specific set of data in forming the ERPT mechanism through interacted panel VAR model. In our model, as an inflation indicator, headline consumer price indices for all countries are taken from IMF IFS database and monthly logarithmic differences of that series are taken. Currency movements are tracked by monthly averages of nominal bilateral exchange rates against the US dollar collected from Bloomberg. Similar to price indicators, series are transformed into logarithmic changes. One of the most controversial variables is definitely the output gap controlling for demand-side inflationary pressures. As it is widely known that the output gap measure, referring to the difference between actual and potential growth of a country, represents to what extent economic activity deviates from its long-term trend. However, creating a monthly indicator to track the course of economic activity requires further statistical analysis. To obtain monthly output gap series, we are in need of an economic activity indicator in monthly frequency and mostly preferred candidate is Industrial Production Index (IPI) because the Gross Domestic Product (GDP) can be retrieved only at a quarterly frequency for sample countries. In this context, the widely preferred methodology is using the Hodrick-Prescott (HP) filter to differentiate the trend and cycle of the IPI series. Although there are some caveats of using HP filter such as end-point bias, it is the most convenient and standard way to construct the output gap and it is easy to interpret.

To proxy for the monetary policy stance, in our panel VAR specifications, we have used the short-term market interest rates (i.e. yields on government bonds with 2-year maturities). Simple monthly averages are taken from the data retrieved from Bloomberg Terminal. Apart from that, to be able to control for supply shocks and global commodity prices, monthly logarithmic changes of Brent oil futures are included.

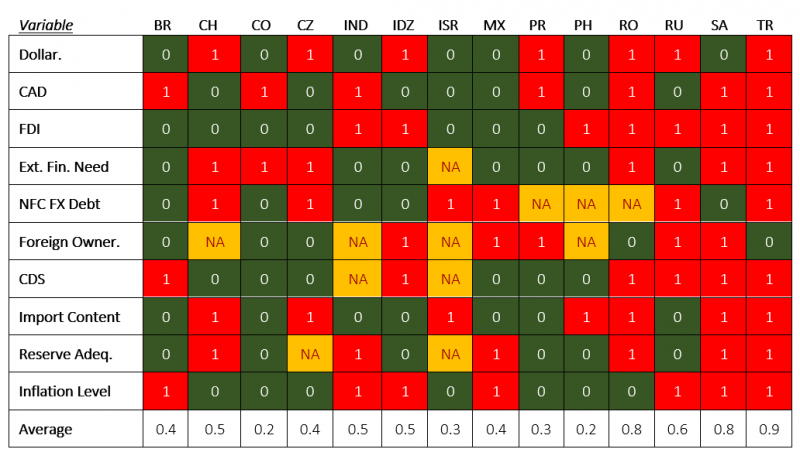

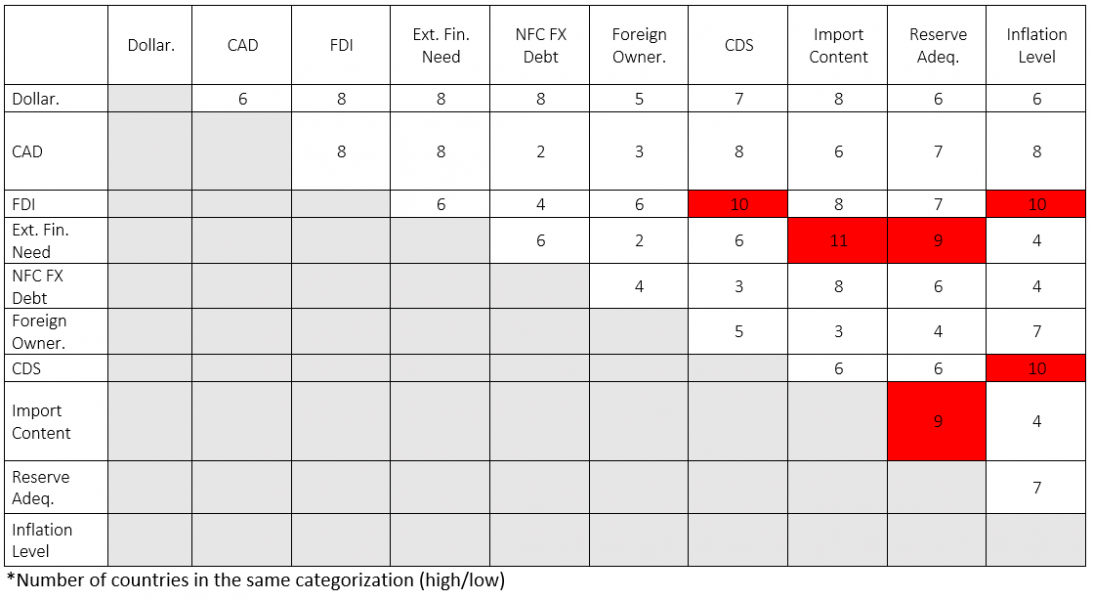

To analyze the effects of structural characteristics on ERPT, we use the Interacted Panel Vector Autoregression (IPVAR) model introduced by Towbin and Weber (2011). A structural panel VAR model with interaction terms is designed to identify potential structural determinants of transmission from exchange rate fluctuations to domestic prices in EMs. IPVAR model enables us to obtain VAR coefficients varying with dummy variables representing the external vulnerabilities. To differentiate the impact of structural on ERPT, for each vulnerability indicator, we divide the sample countries into two sub-samples arbitrarily named as “high” and “low” categories. “More vulnerable” class of countries category refers to the cross-sectional units whose average is higher than the median level of all countries over the whole course of the sample. Similarly, “less vulnerable” category countries are identified with values being lower than median levels in such categories. With this categorization, we run separate IPVAR estimations with the abovementioned categorization for each structural variable. The differences in the impact of structural determinants are isolated by comparing standardized impulse-response functions generated from IPVAR estimations.

Similar to ordinary VAR models, shocks are identified in chain-like causality among variables through Cholesky decomposition. In this methodology, variables are ordered from the most exogenous to the least exogenous one based on economic intuition. Utilizing a lower triangular restriction matrix for residuals (in line with Cholesky ordering), our technique implies that a particular variable is not affected by the contemporaneous shocks stemming from others placed later than it in the hierarchy. Considering the small open economy nature of the emerging markets, and in line with the previous studies in the literature, ordering of the selected variables is specified as follows:

![]()

In this specification, Oilt represents monthly changes in Brent oil prices. FXit demonstrates the monthly appreciation or depreciation of local currencies against USD, whereas Δiit stands for changes in interest rate. Moreover, Xit and πit denote the output gap and monthly inflation, respectively.

In this section, we present our empirical results. Before discussing estimation results, we highlight key facts about our identification strategy by providing details about country classifications. Table 2 displays the position of each sample country within high-low problematic outlook with respect to vulnerability indicators. Turkey, South Africa, Russia, and Romania turn out to be the sample countries with highly vulnerable attributes based on a broad group of indicators. Their vulnerabilities are dispersed in the sense that they are classified as highly vulnerable based on both trade and finance-related measures. On the other part of the spectrum, the low level of vulnerability faced by countries like Colombia, the Philippines, and Peru is evident when we consider the whole indicator set. In Table 3, the overlapping features of country classifications are investigated. The countries with volatile risk premia and lower degrees of permanent current account financing are also the ones with sizeable inflationary pressures. The countries facing sensitive external financing conditions also seem to be quite vulnerable regarding the import content of aggregate demand. The sample units carrying insufficient FX reserve buffers also tend to be associated with higher degrees of vulnerabilities based on external financing need and import content.

Table 2. Country Classifications for Interaction Terms in IPVAR Model

Table 3. The Intersection for Vulnerability Indicators*

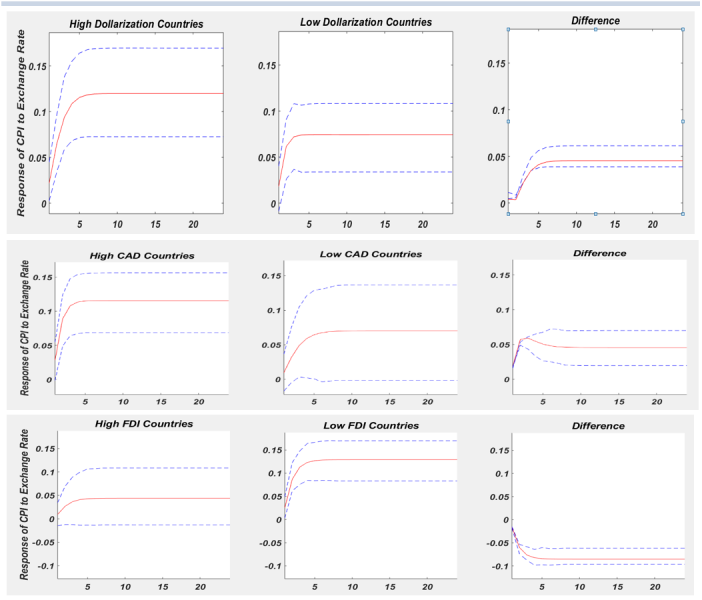

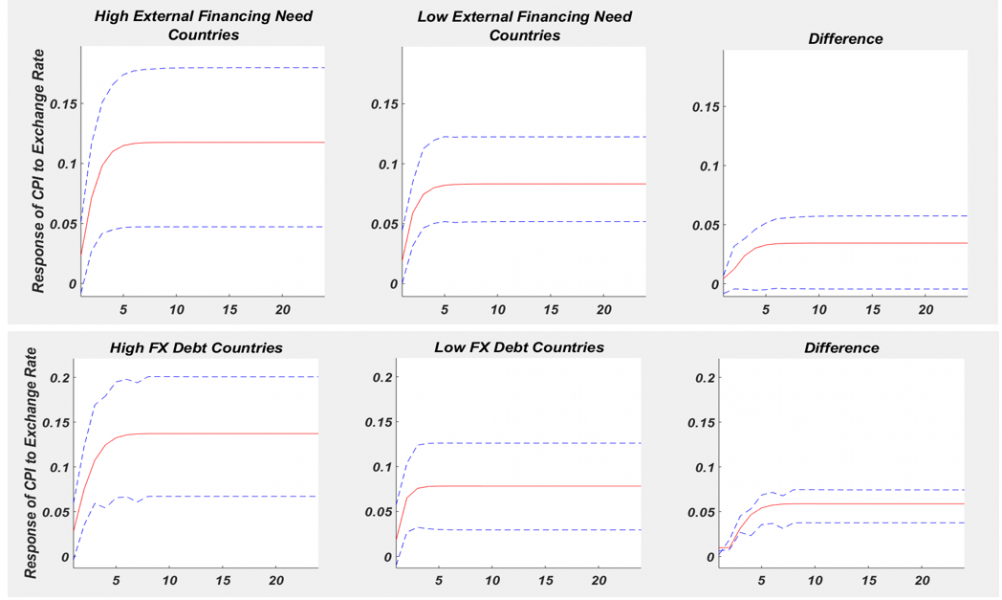

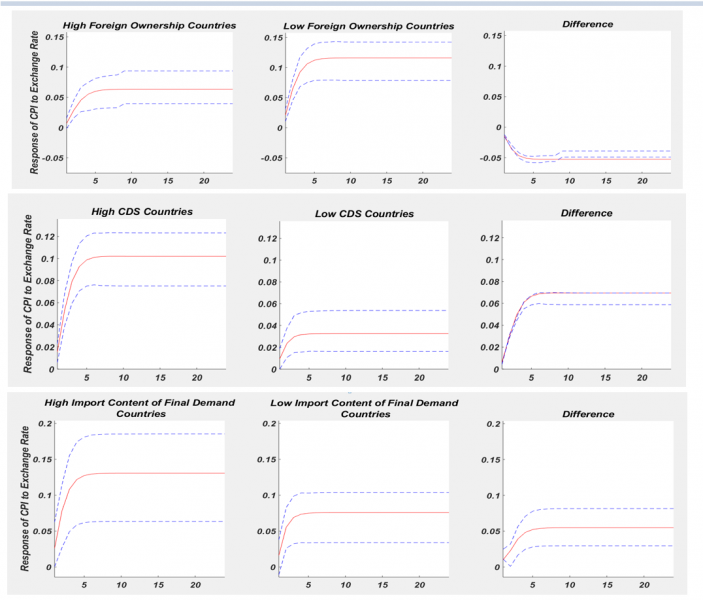

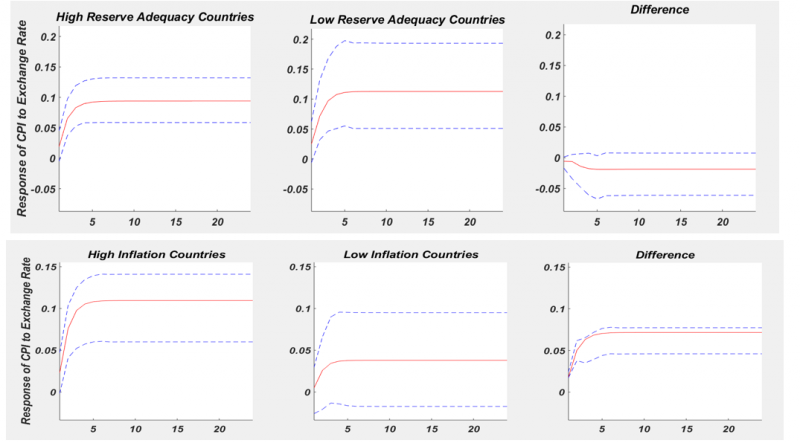

Next, we proceed with discussing IPVAR estimation results. For each of the interaction variable, cumulative impulse response functions (IRFs) are computed as the response of CPI to the exchange rate shock. Figures 1 and 2 indicate that how the cumulative impulse-response functions (representing the reaction of CPI changes to one standard deviation shock to exchange rate movements) vary with different vulnerability indicators in separate specifications. The chart in the left-hand-side and middle positions in each figure demonstrates the impulse-response function for different levels of vulnerabilities. The charts in the far-right panel of these figures depict the IRF as well as the statistical significance of the difference between two groups. In this part, the red lines represent median estimates and the dashed blue lines correspond to 90% confidence intervals obtained from bootstrapping. While the vertical axis shows the ERPT as a share of the cumulative shock, the horizontal axis presents the time horizon after the occurrence of exchange rate shock.

The empirical results indicate that as Reinhart et al. (2014) suggest higher ERPT levels are observed in countries with intense dollarization tendencies as shown in Figure 1. When countries are grouped based on current account deficit (CAD), it is found that countries with higher CAD show stronger ERPT compared to countries with less external deficits. Furthermore, results support the argument that financing of CAD with foreign direct investment (FDI) seems to matter in terms of ERPT as well. We further determine that ERPT among EM countries with higher external financing requirements is significantly more profound than the countries with lower external financing needs. The import content of total demand also emerges as a significant indicator for which countries depending on heavier importation to produce economic value added are found to experience higher ERPT as can be followed by Figure 2.

In the context of other structural weaknesses, when we move to the FX debt of non-financial corporates as a separation criterion, ERPT is found to be relatively lower in the countries with subdued FX indebtedness as suggested by Fendoğlu et al. (2020). This finding is intuitive especially when firms in EMs are known to face difficulties to service their FX denominated debts without deeper financial markets embodying appropriate low-cost financial hedging instruments. Our approach also entails the analyses based on financial market indicators representing the country-level vulnerability to global shocks. In that case, countries having higher risk premia and operating with lower reserve buffers tend to experience stronger ERPT (Figure 2).

Overall, empirical results of this study provide valuable insights on policymaking process by presenting emphasis on the role of structural vulnerabilities in inflation dynamics. It can be argued that for EM countries including Turkey, a plausible way of achieving sustainable price stability is to improve economic performance on structural dimensions.

Figure 1. Impulse Response Functions (1 Month Lag Structure)

Figure 2. Impulse Response Functions (1 Month Lag Structure)

Agénor, P. R., & da Silva, L. A. P. (2019). Another perspective from the developing world.

Campa, J. M., & Goldberg, L. S. (2002). Exchange rate pass-through into import prices: A macro or micro phenomenon? (No. w8934). National Bureau of Economic Research.

Campa, J. M., & Goldberg, L. S. (2005). Exchange rate pass-through into import prices. Review of Economics and Statistics, 87(4), 679-690.

Carriere-Swallow, Y., H. Jacome, I. Luis, N.E. Magud and A.M. Werner, (2016). Central banking in Latin America: The way forward. IMF Working Papers, 16(197): 1-42.

Fendoğlu, S., Çolak, M. S., & Hacıhasanoğlu, Y. S. (2020). Foreign-currency debt and the exchange rate pass-through. Applied Economics Letters, 27(8), 657-666.

Gagnon, J. E., & Ihrig, J. (2004). Monetary policy and exchange rate pass‐through. International Journal of Finance & Economics, 9(4), 315-338.

Gopinath, G (2015): “The international price system”, NBER Working Paper, no 21646, NBER.

Ghosh, A. (2013). “Exchange Rate Pass-through, Macro Fundamentals and Regime Choice in Latin America.” Journal of Macroeconomics 35: 163–171.

Jasova, M., Moessner, R., & Takats, E. (2016). Exchange rate pass-through: what has changed since the crisis?

Kazdal, A., & Yilmaz, M. H. (2021). External Vulnerabilities and Exchange Rate Pass-Through: The Case of Emerging Markets. Central Bank of the Republic of Turkey Working Papers (No. 2105).

Leiderman, L., Maino, R. and Parrado, E., (2006). Inflation Targeting in Dollarized Economies. IMF Working Paper 06/157.

Lopez-Villavicencio, A., & Mignon, V. (2016). Exchange rate pass-through in emerging countries: Do the inflation environment, monetary policy regime and institutional quality matter? (Vol. 18). CEPII.

Mihaljek, D. & Klau, M. (2008). Exchange rate pass-through in emerging market economies: what has changed and why? BIS Papers No: 35, 10,-130.

Reinhart, C., K. RogoZ, and M. Savastano, (2014). “Addicted to Dollars.” Annals of Economics and Finance 15(1): 1-50.

Taylor, J. B. (2000). Low inflation, pass-through, and the pricing power of firms. European economic review, 44(7), 1389-1408.

Towbin, P., & Weber, S. (2011). A guide to the Matlab Toolbox for interacted panel VAR estimations (IPVAR).

Tunç, C. (2017). A Survey on Exchange Rate Pass through in Emerging Markets. Bulletin of Economic Theory and Analysis, 2(3), 205-233.