Disclaimer1

Central banks are on track to introduce their own digital currencies in the coming years. While central bank digital currencies (CBDC) will shore up monetary sovereignty and mitigate financial stability concerns, they also pose risks of disruption to commercial banks and the financial ecosystem.

The evolution of money into digital forms is gathering pace. The popularity of cash is on the wane: In the US, the share of cash transactions has fallen to 26% from 40% a decade ago, and digital payment solutions are capturing a growing share of transactions. Sweden and China are further ahead in replacing bank notes with digital means of transacting. As private sector innovations foster parallel networks of money, central banks face increasing pressure to provide a comparable but risk-free solution.

In this report we examine the initiatives of global central banks to develop CBDCs (central bank digital currencies). According to the BIS, research and development efforts are underway at 86% of the world’s central banks accounting for 91% of global GDP. Discussions about introducing CBDCs have also gained momentum recently with an increasing number of working papers and conferences. To frame a range of outcomes, we have analyzed BIS and IMF documents and public statements by central bankers and have engaged in dialogue with central bank officials involved in the development of CBDC.

We conclude that central banks are likely to enlist the commercial banking system to intermediate CBDC in a two-tier system. Central banks will likely want to maintain the private sector’s role rather than provide an interface and customer service for individual accounts. Major central banks such as the Federal Reserve and the ECB have been clear that their objective is not to compete with the banking system for deposits, which could disintermediate the financial system.

Central banks are energized. In the US, Fed Chair Powell in recent congressional testimony said that a digital dollar project is a “high priority project” for the Fed. The Boston Fed subsequently announced that it is set to make public its initial research on the digital dollar project. In China, the PBOC has piloted a CBDC wallet and has “airdropped” the equivalent of US$30 to selected residents in Beijing, Shenzhen and Suzhou for use at participating merchants. In Japan, the BOJ announced on April 5 that it was starting a year-long project to “test the technical feasibility of issuing, distributing and redeeming a central bank digital currency.” In the euro area, the ECB completed a round of public consultations in January and will make the results public this spring. It also noted that it will make a decision toward mid-2021 as to whether it will launch a digital euro project.

The first reason central banks are pursuing digital currencies is to maintain monetary sovereignty. The rapid proliferation of private payment networks is creating a parallel monetary system. As they gain market share, such private networks can become the primary means of transaction for many users. The concern is that money will circulate almost exclusively within the networks, beyond the central bank’s purview – posing a threat to central bank control of the monetary system.

Second, they seek to ensure financial stability. Tighter regulations will mitigate but not eliminate the risk that providers of digital money will fail to meet their obligations, with attendant financial stability risks. The reliability of a CBDC, which the central bank not only holds but creates, will be key in encouraging broader adoption while minimizing the risk of payment system disruptions from the failure of private intermediaries. Finally, CBDCs can support financial inclusion. The rise of private, narrow money networks risks excluding segments of the general public, e.g., the unbanked population.

|

As with cell phones, emerging markets are leapfrogging to digital payments: The case for introducing a public digital currency is even stronger in developing economies, where banking networks are less developed and the unbanked population is large. Private mobile payment systems in China have already gained wide acceptance, demonstrating their attractiveness. However, cash still accounts for the vast majority of transactions, and the risk of higher fee extraction and inefficiencies from the parallel development of multiple private systems suggests that benefits from a public option would be large. Even without a CBDC, the example of India is particularly instructive. Policymakers there have been on the front foot to build the public data infrastructure, which is enabling advanced and broadly accessible payments solutions. By providing national identity verification (Aadhaar), an instant real-time payment system at the central bank (United Payment Interface) and a robust legal framework on data privacy, the public sector has built a strong foundation for private sector innovation to facilitate payments and expand inclusion. With a highly modernized payments architecture and measures to boost financial inclusion (Jan Dhan), India has achieved a level of financial inclusion far greater than in other emerging markets. |

A new public digital infrastructure is needed. Central banks therefore must create a new digital public infrastructure to replace cash in order to reestablish control over the payment system. CBDCs will not push the frontier of what is possible with digital payments, but they will give central banks more leverage and reduce their dependence on private infrastructure. The initial goal will be to enable domestic transactions.

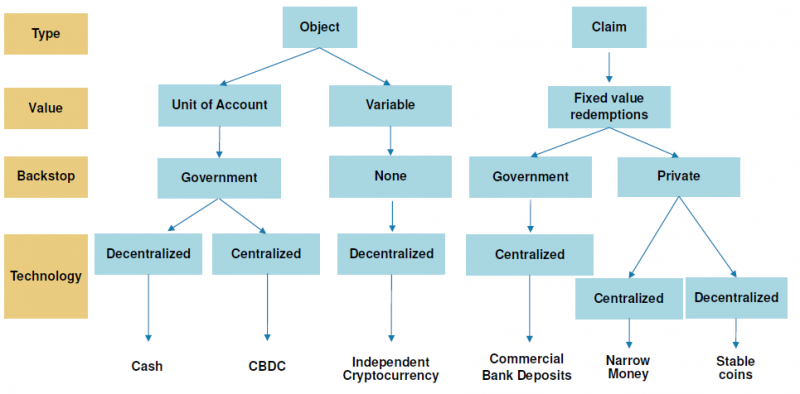

CBDCs are not cryptocurrencies but a substitute for cash… Casual observers often conflate digital currencies with cryptocurrencies. Central banks are aiming to use CBDCs as a replacement for physical cash. While digital currencies and cryptocurrencies are both bits of data, a crucial difference is that CBDCs will be issued and maintained by the central bank, which will provide the underlying architecture. A central bank digital currency is a liability of the central bank and therefore does not require deposit insurance. Commercial bank deposits, on the other hand, are the liability of commercial banks and are backed by reserves. Cryptocurrencies are typically maintained in a decentralized fashion by using distributed ledger technologies (blockchain). Cryptocurrency transactions can be anonymous, but their validation using distributed ledger technologies is highly computationally and energy intensive and hence is not efficient for wide scale usage.

… Nor will CBDCs completely replace cryptocurrencies. We anticipate that the issuance of digital currencies will probably be more disruptive to certain forms of cryptocurrencies like stablecoins and will increase competition for commercial banks. Cryptocurrencies will still exist, as they continue to serve other use cases. For instance, some cryptocurrencies can function as a store of value (much like earlier forms of money such as precious metals, which still perform that function today), as some segments of the public do not place their full faith in fiat currencies. Indeed, Morgan Stanley FX strategist Sheena Shah and US Financials sector analysts Betsy Graseck and James Faucette note that the thesis for investing in cryptocurrencies has evolved to viewing it as a new institutional asset class vs a form of digital cash that functions as a replacement payment system. To their point, investors’ interest in cryptocurrencies has risen alongside the unprecedented monetary and fiscal policy response to the pandemic.

Exhibit 1: Different forms of money differ by type, value, backstop mechanism and underlying technological approach

Source: Morgan Stanley Research

Central banks are not starting with a blank slate but instead look to take advantage of technological advances while balancing them against their objectives of monetary sovereignty, financial stability, and financial inclusion.

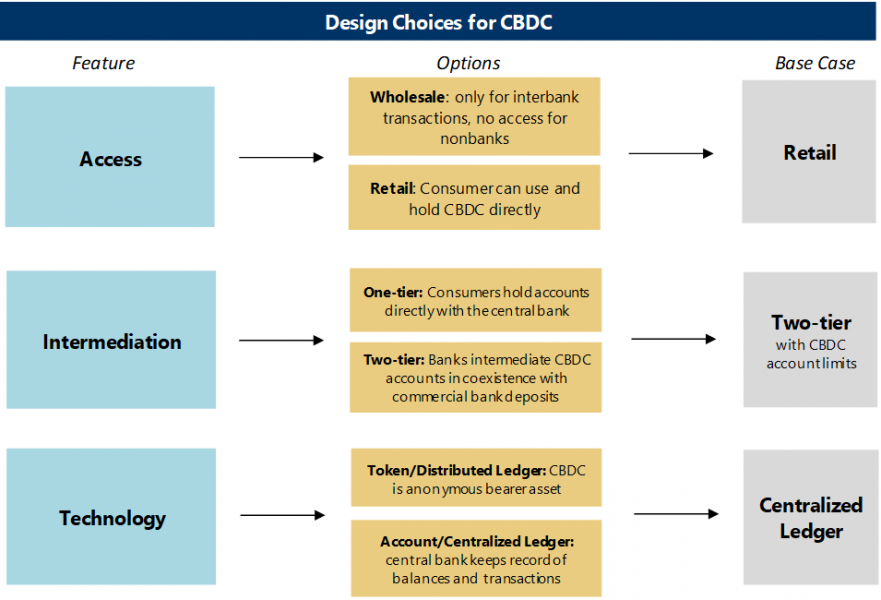

Our base case is that a retail, two-tier, account-based system is likely to emerge. The banks face three sets of design choices: (1) Who will be able to access CBDCs? (2) How will they be accessed? (3) What form will they take? We discuss the pros and cons of each design choice below. We believe digital currencies will be offered to the general public, likely via accounts to be held at intermediaries (i.e., a two-tier system).

Exhibit 2: Central banks face three major CBDC design choices

Source: Morgan Stanley Research

1) Who will have access to central bank digital currency – wholesale or retail? A wholesale system would limit the use of CBDCs to financial institutions as in the interbank market, while a retail system would allow households to hold and use digital central bank money. The proof of concept or technical feasibility of using a CBDC (and blockchain technologies) in the interbank market has been established by pilot projects at the Bank of Canada (Project Jasper) and the Swiss National Bank (Project Helvetia). While a wholesale system would be the least disruptive, preserving much of the existing financial architecture, it would not give the general public access to CBDCs and runs counter to the objective of financial inclusion. Retail CBDCs also more directly address the challenges central banks currently face in managing the modern payment system. Therefore, we think central banks are more likely to offer the public the opportunity to hold and use CBDCs – i.e., the retail option. This report focuses on the implications of the retail system.

2) How will it be accessed – one tier or two? In a one-tier system, the central bank assumes sole responsibility for launching and maintaining the system, even for individuals. They will not require an intermediary and can open and maintain accounts to transact directly using the central bank’s interface.

In contrast, in a two-tier system commercial banks would retain their role as financial intermediaries, providing the interface for consumers to transact in CBDCs. Given the risk that a one-tier system would disrupt the financial system and disintermediate the banks, policymakers are highly likely to implement a two-tier system. CBDC held in these wallets will be the liability of the central bank, and it will be easier for non-bank payment intermediaries or wallet providers to process direct CBDC transactions outside the banking system.

However, in order to improve financial inclusion and convince privacy-conscious consumers to replace cash with CBDC, central banks may look toward complementing the two-tier system with a public option. For instance, the ECB has suggested the “public option” (i.e., individuals interfacing with the central bank) may include a deposit limit of €3,000. In this hybrid system, households could open a CBDC account directly with the central bank, but functionality and maximum balance would be limited and they would be able to maintain accounts with financial intermediaries too.

3) What form will it take – token or account? The third layer of design choice will be how ownership of CBDC will be recorded. Physical cash is a bearer asset, with its ownership simply verified by possession. A digital currency issued in token form more closely resembles physical cash. This helps preserve the anonymity of transactions in CBDC but also enables its illicit use, alongside the usual pitfalls of loss and theft. In contrast, an account-based system (much like our accounts at commercial banks) would be maintained by the central bank or private operators who interface with the central bank.

Cryptocurrencies such as Bitcoin function as tokens on distributed ledgers, which preserve anonymity because no central authority is tracking and verifying individual transactions. Instead, the authenticity of individual tokens is verified by all participants in the system without identifying the owner. In contrast, standard banking functions as a centralized ledger system: For transfers from one bank account to another, the banking intermediary needs to debit one account and credit the other, which requires the identity of both the sender and the receiver. Given the computational costs and security concerns with distributed ledger technologies, central banks will most likely opt for a central ledger system. However, due to privacy concerns, they may provide hybrid solutions that allow the exchange of account-based tokens that are only traceable by the central bank.

| “I don’t think that bitcoin … is widely used as a transaction mechanism. To the extent it is used I fear it’s often for illicit finance. It’s an extremely inefficient way of conducting transactions, and the amount of energy that’s consumed in processing those transactions is staggering.” – US Treasury Secretary Janet Yellen, Feb. 22, 2021. |

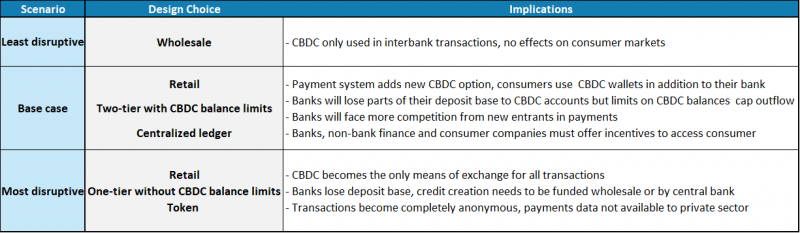

The central banks’ design choices and the speed of the rollout will determine how disruptive a CBDC will be. Since central banks are the anchor of stability in the financial system, they will most likely design a digital currency system that limits disruption of the existing financial architecture. We think central banks will recognize that a one-tier system that goes directly to depositors, with no limits on the conversion of commercial bank deposits into CBDC, will result in large transfers from commercial banks and therefore a much larger central bank balance sheet. This would disrupt the commercial bank business model and increase financial stability risks. Hence, we expect central banks to introduce a retail, two-tier and account-based system.

Exhibit 3: Disruption scenarios depend on CBDC design choices

Source: Morgan Stanley Research

Traditional banking systems will face competitive pressures. While central banks’ efforts at introducing CBDC are not intended to disrupt the banking system, it will likely have unintended disruptive effects. Central banks may aim to mitigate disruption, they will not prevent further, potentially disruptive innovation by the private sector. We foresee two areas of competitive pressures for the traditional banking system – the flow of money and the flow of data.

1) Who gets the money? Even in a two-tier system with size limits on CBDC account balances, CBDCs could create new sources of competition for commercial bank deposits. Individuals may choose to move part of their commercial bank deposits into their CBDC accounts. In 2019, the median US commercial bank checking account was $5,300; the size limit of the CBDC account will determine the risk to commercial checking accounts.

The introduction of CBDCs will likely catalyze new entrants, such as non-bank financial companies, as consumers will now be able to access CBDCs via non-bank intermediaries. As these new entrants gain in scale, they will pose the threat of disruption. Central banks will also have to decide how to regulate these new entrants and whether they will be able to access the interbank market. Currently, non-bank intermediaries depend on banks for access to the interbank market. If central banks give non-bank financial or digital payment companies limited banking licenses, these firms will be empowered to compete for the flow of funds across the economy since they will be no longer need the commercial banks. Central banks in India and Switzerland have adopted the approach of issuing limited banking licenses to payment providers, allowing them to take deposits but also placing constraints on what they can do with them.

2) Who gets the data? Data from consumers is being collected all the time, and the financial system is no different. Currently, banks and non-bank financial companies that provide payment solutions have access to the consumer’s transaction data. The information is used for credit assessment as well as cross-selling.

The introduction of CBDCs will likely accelerate the transition to digital payments and other forms of digital finance. However, with the advent of a public infrastructure, central banks will have to put in place safeguards on privacy to help preserve the anonymity of transactions. Even then, we think that financial intermediaries, especially digital payment companies, will innovate and incentivize consumers to get onto their platforms with the aim of acquiring transaction data.

As new forms of money emerge, financial systems will adapt. New ways of doing existing business and new business lines will arise. We expect CBDCs, along with fundamental changes in the infrastructure that creates and stores money, to usher in further waves of innovation and potentially disruption. As in the past, entrenched existing players stand to be the most impacted. Financial regulators hold the keys to this outcome, a function of how much they open up access to CBDCs to non-banks.

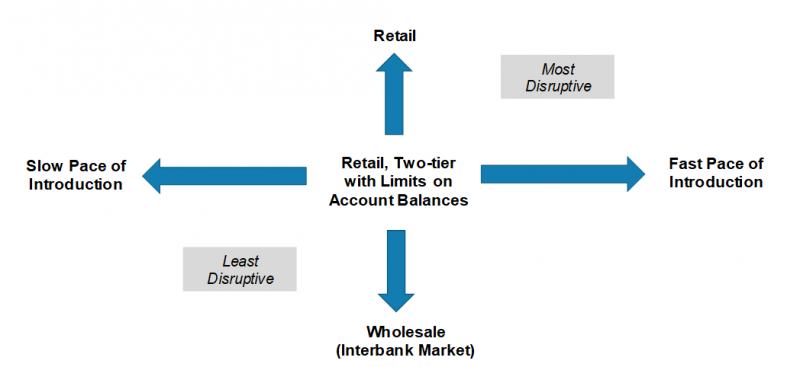

Initially, central banks’ design choices will determine the extent of disruption: We outline three scenarios for those choices:

Thereafter, the speed of introduction and network effects matter: The launch of CBDCs could make non-banks competitive and catalyze their growth, with the potential of disrupting the financial sector. Commercial banks are already responding aggressively to the rise in digital payments solutions with solutions of their own, and they will likely continue to innovate. The pace of disruption will hinge on how quickly network effects take hold. The more widely digital currencies are accepted, the greater the scope for innovation and disruption to the financial system.

Exhibit 4: Disruption scenarios for each CBDC design choice

Source: Morgan Stanley Research

CBDCs will pose new challenges to the international financial architecture. The first stage of CBDC development will focus on domestic initiatives, but we could see knock-on effects in the international monetary system. Already, some central banks like the ECB and the People’s Bank of China see the move toward digital currency as an opportunity to raise the international status of their currencies and increase their use in cross-border payments. If consumers and companies globally find one country’s CBDC easy and convenient to use for international transactions, advantages would accrue to the issuer country in financing costs and control over financial transactions, similar to the US dollar’s privileged role today. However, the internationalization of CBDC also risks creating domestic forms of digital money akin to dollarization in emerging markets, which domestic policymakers are likely to push against to preserve monetary sovereignty and independence. Unchecked, a digital dollar would pose a significant risk to emerging markets with more open capital account convertibility for its residents. The BIS has taken the lead in developing a common framework for technological development and policy coordination within the new ecosystem of digital currencies.

This article is based on research published for Morgan Stanley Research on April 12, 2021. It is not an offer to buy or sell any security/instruments or to participate in a trading strategy. For important current disclosures that pertain to Morgan Stanley, please refer to Morgan Stanley’s disclosure website: https://www.morganstanley.com/eqr/disclosures/webapp/generalresearch ; Copyright Morgan Stanley 2021.