Since 2019 at least 30 governments have introduced or strengthened policies that screen foreign investments ostensibly on national security grounds. That 28 such policy changes occurred after 31 December 2019 led some to posit a link to the COVID-19 pandemic. While the pandemic was an important aggravating factor, the spread of digital general-purpose technologies and growing geopolitical rivalry are enduring factors that account for the greater resort to FDI screening. Consequently, few of the recently restrictive policy changes are likely to be reversed; a permanent shift in the treatment of foreign investors is underway.

Since the embrace by many governments of the tenets of the Washington Consensus, openness to foreign direct investment (FDI) has been a hallmark of sound policy. Such investments not only inject capital into host economies, they are associated to differing degrees with the transfer of technology and managerial know-how, wage premia for employees, productivity spillovers to local firms, and greater competition in local markets. Cross-border mergers and acquisitions, a prominent form of foreign direct investment, also play a key role in shifting resources within national economies towards higher value-added sectors and away from under-performing ones.

Moreover, “international investment helped economies recover from the global financial crisis of 2008/2009,” suggesting that FDI has short-term macroeconomic as well as long-term structural payoffs (OECD 2020a). Consequently, “for decades, government perceptions of the benefits of international investment has led them to progressively open their economies to foreign capital” (OECD 2020a).

While openness to FDI has not been rejected outright, in recent years a large number of governments have established or strengthened mechanisms to review foreign direct investment in their jurisdictions.2 The most common justification for doing so has been on grounds of national security.3 No longer satisfied with limits on establishment by foreign firms or on screening proposals by foreign firms to acquire local rivals on competition law grounds, numerous governments have set up institutional mechanisms to review the ongoing operations and strategic choices of foreign firms already established in their jurisdictions. Departures from National Treatment principles on market access as well as regulation of conduct after establishment or acquisition are now possible.

This change in the treatment of FDI has coincided with the COVID-19 pandemic, leading some to link the two. Given that the governments of certain large economies instituted tougher FDI screening in the wake of the Global Financial Crisis, there are certainly precedents to point to (Heinemann 2012)4. If these events are indeed linked, then it holds out the heartening prospect that recovery from COVID-19 could result in recent FDI screening measures being scrapped or falling into disuse – going some way to restoring the favourable climate for FDI.

But can analysts, business decision-makers, and policymakers be so sanguine? What if longer term, harder to reverse factors are at work? Those factors could include the combined impact of the growing dependence of business models on digital technology, associated technology races and the intellectual property and harder-to-value intangible wealth created, as well as greater geopolitical or geo-economic rivalry. The purpose of this chapter is to identify, characterise, and assess the root causes of the resurgence in FDI screen witnessed in recent years.

One factor that can be set aside is the role of binding international obligations pertaining to the resort to measures affecting foreign direct investments on national security grounds. Yoo and Ahn (2016) demonstrate convincingly that the extant World Trade Organization rules5 in this area are not workable legal disciplines, despite being part of the multilateral trade architecture since its creation in 1947.6 They also observe that “New provisions adopted in recent FTAs show slight modifications, but not yet in any significant meaningful way” (Yoo and Ahn 2016, page 844). The meaning of essential security provisions found in international investment agreements, such as bilateral investment agreements, is contested as well (Moon 2012).

As a first approximation, in the area of FDI screening there appears to be little by way of binding law to constrain governments. When it comes to soft law, however, in principle member governments of the OECD adhere to that organisation’s “Recommendation of the Council on Guidelines for Recipient Country Investment Policies relating to National Security,” adopted on 25 May 2009.

That Recommendation is organised into four parts: non-discrimination, transparency/predictability, regulatory proportionality, and accountability. Having affirmed that member governments “self judge” their national security concerns (“each country has a right to determine what is necessary to protect its national security”), two other pertinent expectations concerning the implementation of FDI screening mechanisms are:

“Tailored responses. If used at all, restrictive investment measures should be tailored to the specific risks posed by specific investment proposals. This would include providing for policy measures (especially risk mitigation agreements) that address security concerns, but fall short of blocking investments.

“Last resort. Restrictive investment measures should be used, if at all, as a last resort when other policies (e.g. sectoral licensing, competition policy, financial market regulations) cannot be used to eliminate security-related concerns.” (OECD 2009, italics in original)

Thus, compliance with the OECD Recommendation does not stand in the way of signatories adopting or strengthening screening mechanisms for foreign direct investments.

Having established that governments are largely unconstrained, attention now turns to how they have used that discretion in the area of FDI screening in recent years. The next section of this chapter addresses this matter, drawing largely on OECD sources. The third section discusses the how global economic shocks are said to influence resort to FDI screening.

That discussion of shocks is followed by an account of how shifts in the world economy may be influencing government tolerance of foreign direct investment. To that end, the spread of general-purpose digital technologies and associated business models as well as the growing rivalry between China and the United States are recounted in the fourth section of this chapter and links to FDI screening drawn. An assessment of the various rationales proffered for elevated FDI screening is provided in section five. The final section of this chapter draws together the argument and describes how discussions on FDI screening could be taken forward.

Going back to at least 1980 the OECD secretariat has produced reports on the manner in which governments address national security considerations in their policies towards FDI and multinational corporations. Although the terminology and framing of the matter has evolved over time7, the core substantive policy matter discussed in this paper is longstanding.

A report by the Working Group on International Investment Policies was published in November 1980 titled “National Treatment and Questions of Public Order and Essential Security Interests.” Note the tying of national security matters with the potentially broader policy consideration of Public Order. That report notes:

“Concepts relating to public order and security can be found in the legal systems of all Member countries. In general there is no explicit definition of these concepts; their interpretation rather depends on the specific context in which they are applied and may evolve over time according to changing circumstances” (OECD 1980, page 2).

As an indication of the sensitivity of policy interventions to secure public order and essential security, the Working Group’s report noted explicitly that such interventions were not a derogation from National Treatment. As such, OECD members were under no formal notification obligation in this regard. Nevertheless, the value of transparency in such policies was recognised and information exchange encouraged.

This report identifies four types of government measure taken against foreign firms to ensure that public order and national security objectives are met: public procurement measures; “special restrictions on investment by established foreign controlled defence related industries which could involve ‘essential security interests’” (page 7); sectoral restrictions on investments by foreign firms; means to prevent or undo “foreign takeovers of important manufacturing undertakings” (page 7). Furthermore, the examples provided were almost entirely sector-specific, suggesting little role for cross-sectoral screening mechanisms. Many sectors – not just defence-related – were mentioned in the examples provided in this report.

The OECD secretariat produced a follow-up report in 1985 with an eye to improving transparency in this area of policymaking and “to extend the application of National Treatment, the latter aiming to reduce the scope of measures restricting the activities of established foreign-controlled enterprises” (page 4). In this regard, it is noteworthy that the focus was on foreign firms already established in a jurisdiction, rather than on new investors.

A survey of OECD members was conducted in 1984, which formed the evidence base for OECD (1985). Approximately 40 relevant policy measures were identified. These measures were implemented by 12 OECD member governments, with the United States and Switzerland prominently represented. The measures were concentrated in a relatively few number of sectors. The report observes “the majority of such measures are found in sectors such as defence products, maritime transportation, communications (broadcasting), and energy production” (page 4). Differential treatment was also found in sectors deemed public monopolies. Most measures related to restrictions on investments by established firms, fewer to government procurement policy and “discriminatory” state aid (OECD 1985).

Subsequently, further reports were published. A 2008 report focused on whether security-related policy instruments implicating FDI were proportionate, an important feature of the 2009 OECD Council Recommendation mentioned earlier. “Proportionality means that restrictions on investment, or conditions on transactions, should not be greater than needed to protect national security and they should be avoided when other existing measures are adequate and appropriate to address national security concerns” (OECD 2008, page 1). Of the 11 OECD members that participated at that time in their Freedom of Investment project, six reported having investment review procedures or other measures that enable them to address essential security concerns. Those six nations were France, Germany, Japan, the Republic of Korea, Italy, and the United States.

Two OECD staff members prepared a survey of 17 government practices in respect of FDI policies and national security concerns that was published in 2016. Wehrlé and Pohl (2016) carefully parsed the extant policy regimes and identified differences in approach. Certain governments employed general, transaction-, or firm-specific restrictions on FDI, often following foreign investment reviews and “investment scrutiny procedures addressing security concerns.”

Furthermore, a clear distinction was made in Wehrlé and Pohl (2016) between rules concerning the ownership of specific assets and rules relating to the acquisition of those assets. A foreign acquisition of a national corporate asset may have occurred before the latter became “sensitive” from a national security point of view, hence the need in principle for policies pertaining to the ownership of assets and the conduct of foreign owners of those assets. It was also noted that policy regimes that limit or ban foreign acquisitions may still permit greenfield investments by foreign firms, thereby differentiating across entry mode by foreign firms. Last, to the best of my knowledge, this is the first publicly available OECD document that provides detailed information on the institutional and procedural aspects of FDI review regimes of 17 governments.8

In a July 2020 update, that was heavily influenced by the COVID-19 pandemic (more on which in the next section), OECD (2020a) noted that “only since 2018 have more than half of the 37 OECD countries put in place a cross- or multi-sectoral investment screening mechanism, compared to less than a third a decade earlier” (page 2). In fact, Figure 2 of that document shows a marked increase in the number of OECD members adopting such regimes in the years during and after the Global Financial Crisis, raising the question of whether these outcomes are linked. The percentage of OECD members with FDI screening regimes increased further after 2018, before the COVID-19 pandemic hit. OECD (2020a) argues “the exceptional economic situation caused by the COVID-19 pandemic has further accelerated policymaking in this area…” (page 3).

With respect to the qualitative development of FDI regimes, OECD (2020a) observes:

“Beyond the quantitative change associated with the greater number of mechanisms in this area, qualitative changes have significantly transformed policy practice in many advanced economies in the past five years. Most mechanisms now allow for intervention in a much broader section of the economy. Combined with the lowering of trigger thresholds, a much larger number of transactions are now potentially subject to scrutiny. Rules have become more detailed and sophisticated and are geared towards routine applications. Implementation practice has also changed in many countries, with more confident and frequent use of the instruments. Greater depth of regulation and transparency about policy practice are further indicators of a transformational change that has emerged over the past decade in many countries, deepening markedly from 2016 onwards” (page 3).

Greater detail on recent policy changes towards FDI screening can be found in a “research note” published by the OECD secretariat in May 2020. OECD (2020b) assessed developments in 62 jurisdictions, deliberately differentiating between policies affecting the acquisition and ownership of national corporate assets. Considerable diversity in approach taken was found, where a minority of surveyed governments developed “detailed and operational mechanism(s)” to take account of national security considerations. Many governments “continue to rely on often decades-old administrative authorisation requirements or similar instruments that apply to a few narrow sectors” (OECD 2020b).

Among those governments with “advanced mechanisms to manage acquisition- and ownership-related risks,” OECD (2020b) noted:

“four trends emerge: Review mechanisms are geared towards routine implementation, with responsibilities and procedures set out more clearly; other indicators document the maturing of the policy area more generally; continuous risk-management complements one-time reviews at the time of an acquisition; and State-ownership as a means to manage risk attracts renewed interest after having broadly fallen out of fashion in the 1990s” (page 11).

Consequently, it is no longer adequate to define investment screening, as Bonnitcha (2020) has, as follows:

“Investment screening…refers to requirements under the law of the host state that foreign investors attain approval prior to (or concurrently with) making a new investment, along with the associated institutional mechanisms by which such approval is granted or withheld.”

To this must be added the policy objectives, institutional mechanisms, and powers of governments as they relate to the investigation and regulation of post-establishment conduct of foreign investors on grounds of national security, essential security, public order and the like.

The OECD (2020b) report also includes an account of the spread of national security-related measures over time. Following the opening up of national economies to foreign capital in the 1980s and 1990s, by the middle of the last decade the governments of many industrialised countries expressed misgivings about foreign ownership of certain assets, industries, or infrastructures. Moreover, investments by sovereign wealth funds or government-controlled investors raised red flags as they could have been politically motivated and the decision-making vehicles concerned were said to be less transparent (OECD 2020b, page 6).

Later, and OECD (2020b) points to the year 2015, concerns about the connection between FDI and national security rose further. Furthermore, the report argues:

“The reasons why this policy area has regained attention is – in part – reminiscent of the early 2000s:

The last bullet point being something of an understatement given the developments from 2017 on.

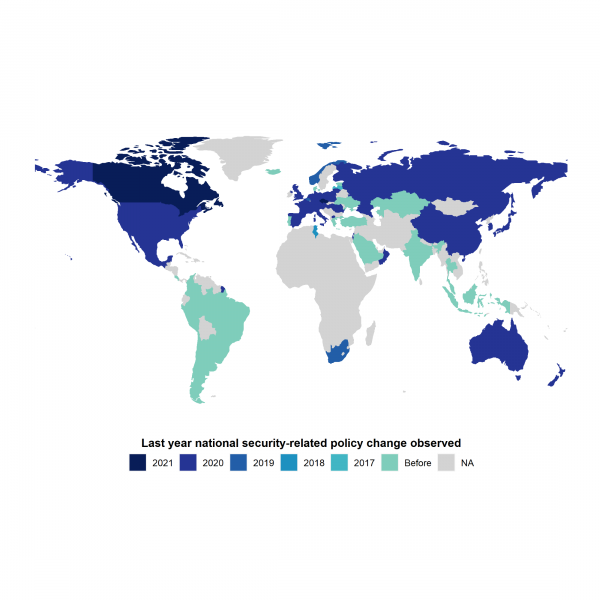

Updating the information contained in the country annexes of OECD (2020b) with information specially collected for the preparation of this chapter, it was possible to bring this assessment up to date (through to mid-March 2021). Since the start of January 2019, a total of 31 governments have introduced or reformed their FDI screening policies related to national security. Twenty-six of those governments made the last change to these policies during 2020 and two did so this year, which would constitute a widespread shift in the potential treatment of FDI should these policy interventions remain in force once the COVID-19 pandemic abates.

Figure 1 shows the last year each nation revised its FDI screening policies to take account of national security considerations. The results are striking. All but four G20 members are implicated in recent policy changes implemented since 2015. Africa is the only continent where few such policy changes have been detected since 2017. Large swathes of the globe are implicated in FDI screening policy changes implemented since the beginning of 2019.

Attention now turns to the factors responsible for this shift in treatment of foreign investors. To organise the discussion, I differentiate between factors that shocked the global economy and those more slow changing shifts in underlying economic clout, technology, and business models.

Figure 1: Every continent has seen at least one major economy implement FDI screening policy changes since 2015.

Source: OECD (2020b) augmented by own searches of pertinent government intervention.

To appreciate the links between the COVID-19 pandemic and elevated FDI screening it is necessary to observe that this pandemic induced a systemic economic crisis in addition to posing a serious threat to global public health. On account of the economic crisis, a lot of old wine (well-known rationales for FDI screening) was presented in new bottles, as will become clear. The public health dimension brought to the fore what appeared, at first, to be new policy considerations. Each is discussed in turn.

Concerns that economic crises generate “fire-sale FDI” are perennial (see, for example, Krugman 2000 and his analysis based on FDI flows during the Latin American and the East Asian financial crises). More recently, Hanemann and Rosen (2020) observed that “After the 2008-9 crisis Chinese firms ventured out to acquire discounted assets around the globe, especially those with strategic utility: iron and nickel ore, oil, and myriad other commodities that China became dependent on.”

Ten years later, the connexion between foreign acquirers and distressed local firms was made very quickly once the global economic fallout of the pandemic became apparent. Fabry and Bertolini (2020) sounded an alarm about the perils of foreign acquisitions at the start of the COVID-19 pandemic, writing in April 2020:

“Whether the recession that is triggered by the health crisis is severe but temporary or whether it is a shock that brings about structural change in the global economy, the weakening position of European companies will create many opportunities for corporate takeovers at bargain prices” (page 1).

In a 31 March 2020 briefing, Baker McKenzie (2020) noted that takeovers occur for a variety of reasons:

“…this unprecedented environment could afford opportunistic buyers the chance to acquire or invest in companies that have been weakened by the crisis. In addition, creditors may unintentionally find themselves in a position where they acquire control over a business.”

The latter point is worth bearing in mind as politicians largely framed the matter in terms of hostile takeovers. For instance, the German minister of economic affairs, Mr. Peter Altmaier, stated on 20 March 2020 that “We will not allow a bargain sale of German economic and industrial interests.”9 In a similar vein nine European heads of government wrote to the President of the European Council, Mr. Charles Michel, on 25 March 2020 and argued:

“We also need to make sure that essential value chains can fully function within the EU borders and that no strategic assets fall prey of hostile takeovers during this phase of economic difficulties.”10

In the event, many governments justified their tightened FDI screen procedures on multiple grounds, some linked to the health-related aspects of the pandemic. The statement made by Canada on 18 April 2020 is typical in this respect, making three points germane to this discussion.

“Many Canadian businesses have recently seen their valuations decline as a result of the pandemic, consistent with patterns in other major economies. These sudden declines in valuations could lead to opportunistic investment behaviour…”

“While each investment will continue to be examined on its own merits, the Government will scrutinize with particular attention under the Act foreign direct investments of any value, controlling or non-controlling, in Canadian businesses that are related to public health or involved in the supply of critical goods and services to Canadians or to the Government…”

“Some investments into Canada by state-owned enterprises may be motivated by non-commercial imperatives that could harm Canada’s economic or national security interests, a risk that is amplified in the current context. For this reason, the Government will also subject all foreign investments by state-owned investors, regardless of their value, or private investors assessed as being closely tied to or subject to direction from foreign governments, to enhanced scrutiny under the Act.”11

The European Commission framed the matter differently in advice to its Member States on how to implement their national FDI screening mechanisms during the pandemic. On 25 March 2020, the Commission argued:

“…the EU’s openness to foreign investment needs to be balanced by appropriate screening tools. In the context of the COVID-19 emergency, there could be an increased risk of attempts to acquire healthcare capacities (for example for the productions of medical or protective equipment) or related industries such as research establishments (for instance developing vaccines) via foreign direct investment. Vigilance is required to ensure that any such FDI does not have a harmful impact on the EU’s capacity to cover the health needs of its citizens.” (EC 2020, page 1)12

The Commission was concerned about foreign acquisitions of “strategic capacities” more generally, noting:

“FDI screening should take into account the impact on the European Union as a whole, in particular with a view to ensuring the continued critical capacity of EU industry, going well beyond the healthcare sector. The risks to the EU’s broader strategic capacities may be exacerbated by the volatility or undervaluation of European stock markets. Strategic assets are crucial to Europe’s security, and are part of the backbone of its economy and, as a result, of its capability for a fast recovery.” (EC 2020, page 1)

In its recommendation to Member States the Commission cast the net even wider, arguing that FDI screening should “take fully into account the risks to critical health infrastructures, supply of critical inputs, and other critical sectors as envisaged in the EU legal framework” (EC 2020, page 2). On the accompanying website for this announcement, mention is also made of the objective to “preserve EU companies and critical assets,”13 which appears even broader in scope than the considerations mentioned above.

No definition is provided for these “strategic capacities” and “critical assets” but they could include valuable intellectual property and tacit knowledge, cutting-edge research, development, and prototyping capabilities, control over production and distribution facilities, and control of infrastructures – both physical and digital – needed to support innovation, supply chains, manufactured, and distribution of pandemic-related or other high value-added goods and services. In sum, governments have come a long way from the 1970s when foreign direct investments in specifically selected sectors was singled out for special treatment.

It is important to stress that many also governments emphasised that their economies remained open to foreign direct investment. One can conclude, then, that governments felt compelled, at a minimum, to expand the scope of economic activities covered by FDI screening yet at the same time eschewed sweeping bans on FDI, preferring a case-by-case approach.

Much will depend on whether private sector participants perceive these policy innovations as constituting a broad-based obstacle to foreign direct investment. In this regard, it is telling that Baker McKenzie (2020) warned their clients: “…it now seems that some countries are using foreign investment screening to protect wider economic and social concerns triggered by COVID-19” going beyond, they contend, national security considerations.14 DLA Piper (2020) was not as direct in its advice to clients, but it did link mention of enhanced FDI review processes with the statement “proposed increasingly protectionist measures.”

Why does this matter? Policy uncertainty in its different forms is known to depress foreign direct investment. Unless managed in a very transparent manner backed up by a communication strategy that retains the confidence of the private sector, the introduction and tightening of FDI screening regimes will be seen as another burden that business must bear.

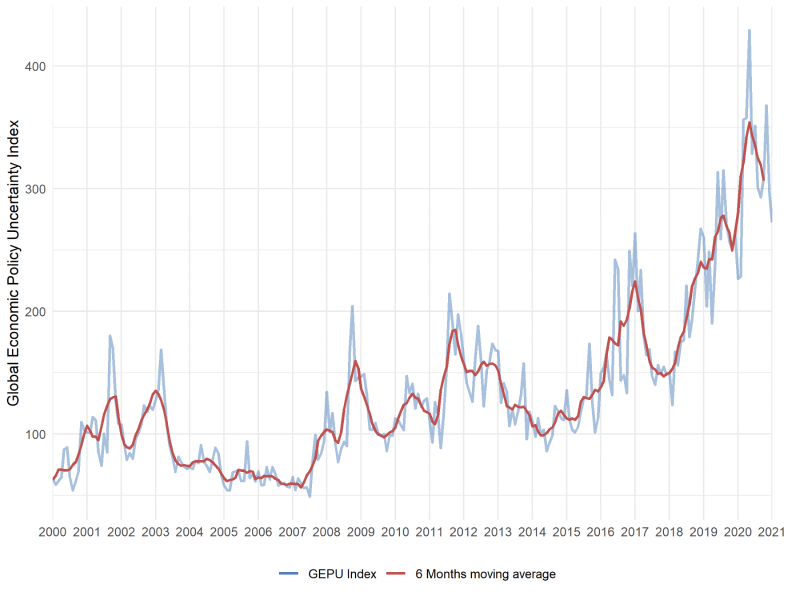

Figure 2: Any uncertainty created by FDI screening measures compounds rising levels of policy uncertainty

Lest any reader is in doubt about the current levels of policy uncertainty, Figure 2 above demonstrates that the most widely-used gauge of economic policy uncertainty15 has surged over the past decade, accelerating from 2014 on and well before either President Trump’s accession to power or the COVID-19 pandemic. The timing could not be worse.

Reflection on the arguments made in the previous section, and noting the four factors identified in OECD (2020b) for growing policymaker support for more stringent FDI screening, calls into question the argument that the “shocks” of first the Global Financial Crisis and then the COVID-19 pandemic are the primary drivers. Two other candidate explanations worth considering are the implications of ever more pervasive digital technologies and the reorganisation of industries that this has induced as well as the growing rivalry between China and the United States. Each are addressed in turn.

With respect to the spread of general-purpose digital technologies, there are at least three potentially relevant facets to consider. The first is that significantly improved information and communication technologies meant that companies could coordinate commercial activity over great distances, allowing for fine-grained matching of tasks to locations with available resources. Such hyper-specialisation would have made Adam Smith proud. Such task-location pairing was executed through ever-more complex cross-border supply chains which became profitable as containerisation slashed international transportation costs and the signing of trade agreements cut trade barriers and eased other trade costs.

The smooth operation of cross-border supply chains requires that every associated firm delivers and cooperates as planned. Some have sought to connect this development with the case for strengthened FDI screening. Fabry and Bertolini (2020) argue in the context of the European Union that “The aggressive acquisition of a company in one member state can create dependencies in an entire supply chain and therefore affect several member states” (page 1). If true, this argument might support EU-wide screening of FDI to properly take account of the EU-wide potential consequences of a foreign takeover.

Fabry and Bertolini (2020) made another argument, which may have greater resonance during crises when national policymakers fear loss of control over key commercial capabilities. They argued “As the strengthening of economic interdependence through production chains became increasingly disconnected from national strategic interests, governments have become increasingly suspicious” (page 7). The lengths that the United Kingdom and the United States went to build local vaccine production capacity in 2020 may well be a reflection of such suspicions. On this logic, such as it is, stringent FDI screening may be seen as a necessary step to sustain national control over such production capacity.

A second facet of the spread of digital technology relates to the business models of technology-based firms. Three of the five characteristics of successful business models identified by Medhora (2018) are relevant for our purposes. They are: “high upfront costs, low to zero marginal costs,” “high risk of failure, but large rents accruing to success,” and “rewards to strategic behaviour.”

Medhora (2018) emphasised that under these circumstances predatory acquisition of potential rivals by incumbents with deep-pockets can a commercially successful strategy that also creates adverse knock-on effects in terms of thwarted innovation and competition. To the extent that these transactions have a cross-border dimension they may implicate FDI screening policy, especially if the competition agency where the acquired company is operating does not take proper account of the relevant innovation-related aspects of the transaction.

The third facet relates to the companies that manufacture the equipment for, assemble, maintain, and operate national information and telecommunications infrastructures. Some of the same considerations apply to digital service providers that have legitimately obtained sensitive information concerning their users, information that could be used by a foreign intelligence service as leverage. In both cases, there are now precedents where governments have banned or heavily conditioned the acquisitions, the commercial practices, and the range of activities of foreign firms seeking to operate in their jurisdiction.

As digital technologies continue to develop and 5G and the “internet of things” is rolled out, the private sector’s responsibility for the data it acquires, stores, shares, and deploys will come under greater scrutiny. This will be the case for domestic as well as foreign firms – but foreign firms perceived as having connections to foreign governments are likely to face the toughest questioning.16 It is inconceivable that FDI screening on national security grounds would sidestep such considerations in reviewing an acquisition where such matters were pertinent.

This third facet, of course, provides a connexion to the growing geopolitical rivalry between China and the United States. Seen from the perspective of many Western observers, it is not Chinese firms per se that are problematic. Rather, it is the alleged influence of the Chinese state over those firms, legal requirements of Chinese firms to share information with Chinese state bodies, as well as the ambitious plans of the Chinese technological supremacy and, to some, hegemony, that call for more intense screening of FDI proposals by Chinese firms (Inkster 2020).

Although disagreement exists as to when this geopolitical rivalry took off, it is uncontroversial to write that it predates the COVID-19 pandemic. Several Western nations (examples being Germany, the United Kingdom, and the United States) began and in one case completed a legal overhaul of their FDI screening regime before COVID-19 became a global pandemic. That the pandemic originated in China and that, evidence notwithstanding17, enough policymakers in China’s trading partners are now convinced that their nations were too dependent on medical kit and medicine ingredients produced there, were almost certainly aggravating factors.

Another aspect of pre-pandemic geopolitical tension — namely, the pervasive subsidies said to be a key feature of China’s variant of State Capitalism —took on greater salience in the context of deliberations over FDI screening regimes once the pandemic hit.18 Dominguez-Jiménez and Poitiers (2020) put the matter starkly:

“As the Chinese share of global GDP grows, so have concerns about its use of subsidies to facilitate acquisitions. These concerns relate to the use of investment as a political tool, through the acquisition of strategically relevant companies and technologies, and the use of state aid to gain competitive advantages in European markets…”

Fabry and Bertolini (2020) articulate similar concerns but do not name China directly. This may be just as well given the tendency of some Western governments to give their firms more and more state aid in respect of foreign acquisitions and greenfield investments.

While the spread of digital technologies and geopolitical rivalry appear to be longer term shifts in the world economy, one aspect of the latter relevant to FDI screening may in fact turn out to be less important than expected. Specifically, even at the beginning of the COVID-19 pandemic, some experts questioned whether Chinese firms would undertake an overseas mergers and acquisitions spree.

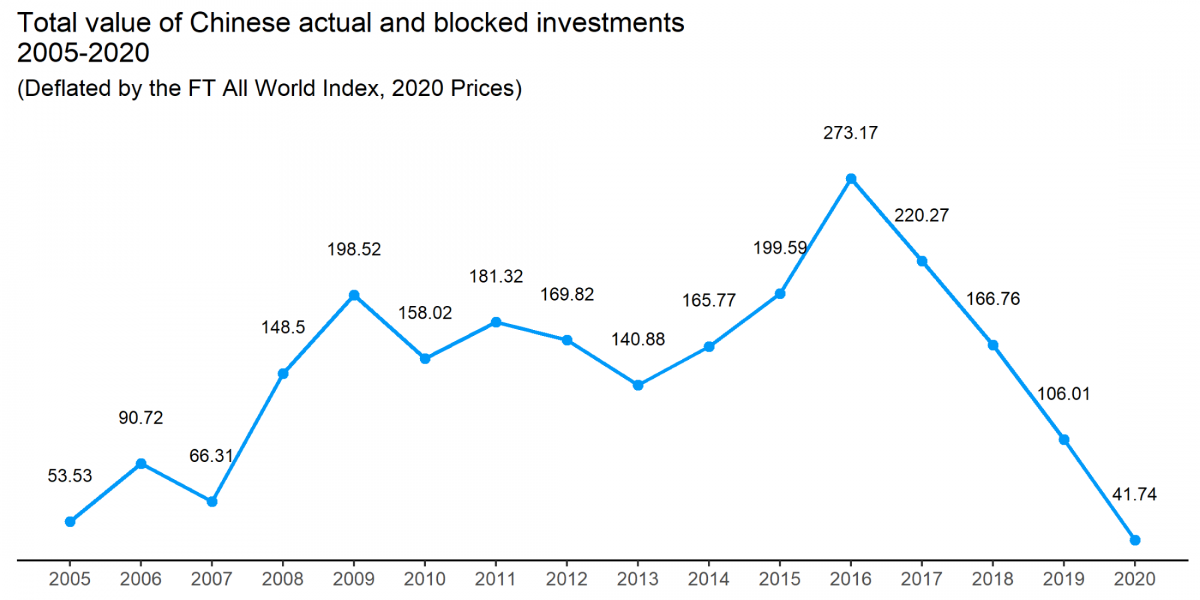

Hanemann and Rosen (2020) argue that a clampdown by the Chinese authorities on the financing of outbound FDI and tightened capital controls had already resulted in observed transaction totals falling short of their 2016 peak. Citing data from China’s Ministry of Foreign Commerce they note “The global M&A component [of total outbound FDI] shows a steep drop, with newly announced 2019 deals at $50 billion, versus $80 billion in 2018, amounting to the lowest level in eight years.”

Dominguez-Jiménez and Poitiers (2020) make similar points and conclude that “the current overall level of Chinese investment gives no reason for concern.” More generally, the latter argue that fears of an acquisition spree by firms from “non-market economies” or state-owned enterprises are, on the basis of data available, “overblown.”

Another way to ground this discussion in evidence to examine the findings those who track the largest acquisitions of capital stakes or entire companies attempted by Chinese firms. The American Enterprise Institute (AEI) has maintained a China Global Investment Tracker19 since 2005. AEI claims this tracker of corporate activity “is the only comprehensive public data set covering China’s global investment and construction [projects], which are documented both separately and together. Inaugurated in 2005, the CGIT includes 3,500 large transactions across energy, transportation, real estate, technology, and other sectors, as well as 300 troubled transactions.”

Data on completed Chinese investments as well as those “troubled” (taken to be those contested or blocked by foreign governments) was combined. Annual total values of such transactions were calculated for the years 2005 to 2020. Since the cost of acquiring companies has changed over time as stock-market valuations have risen significantly from over the past 15 years, the annual totals were deflated by an index based on the Financial Times All-World Index. Taking 2020 as the base year, the annual totals of the real value of Chinese overseas investments are reported in Figure 3 below.

In real terms the total value of Chinese acquisitions in 2016 was more than six times that witnessed during 2020, the year when the pandemic hit. To the extent that there are data collection and reporting lags for recent overseas transactions, then the total value reported for 2020 should be higher. However, it is almost inconceivable that it will be six times higher. The lower transaction totals witnessed in 2020 cannot solely be attributed to more intense FDI screening that year by China’s trading partners as the total value of acquisitions attempted in China’s trading partners in the East Asian, South Asia, Latin American, and Sub-Saharan African regions fell also.20

Figure 3: In real terms, the total value of overseas investment transactions by Chinese firms has fallen 85% since its peak in 2016.

It would seem, then, that in 2020 at least Chinese firms did not seek to acquire foreign firms at “bargain prices.” To sceptics of China, this may cut no ice. They might argue that Chinese overseas acquisitions could pick up again and that more rigorous FDI screening will be needed at that time. Still, it is interesting that once again – just like the scare over Chinese excess capacity in the steel sector – the available evidence does not support the broad-brush generalisations used to frighten policymakers and fed to journalists that don’t have enough time to check facts.

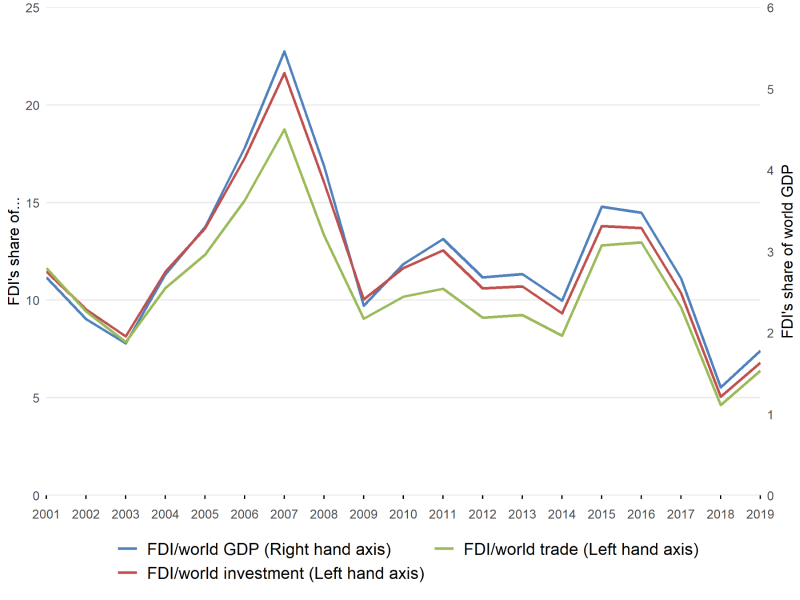

The purpose of this section is to assess the rationales provided for elevated screening of FDI. This matter is particularly important given the trend decline in FDI flows since the onset of the Global Financial Crisis. Whether measured as a share of world GDP, world investment, or world trade, the total nominal value of FDI never recovered to levels seen before the Global Financial Crisis (see Figure 4). Even before the sharp reduction witnessed during the COVID-19 pandemic these shares were all less than 0.02, implying that for every dollar of cross-border investment there were more than $48 of domestic investment. As a means for financing investment and market entry, FDI has been on the decline. This picture would be even worse had a correction for the price of assets been made. In short, FDI had become rarer, well before the COVID-19 pandemic.

Plausible reasons for the lower observed levels of FDI are falling returns on overseas investments (The Economist 2017) and elevated levels of corporate political risk (see Figure 2). The more frequent resort to stringent FDI screening comes on top of the developments, which national policymakers and the officials that advise them may not be aware of. It is one thing to argue that the objective of national policy is to maximise the benefits of FDI rather than to maximise FDI itself (Boonitcha 2020), but that statement does not automatically imply that the correct trade-offs in policymaking have been made.

According to some international investment law experts the introduction or strengthening of FDI screening may fall foul of national obligations under extant trade and bilateral or regional investment accords. For example, Boonitcha (2020) identifies three grounds for concern: violation of National Treatment provisions; imposition of performance requirements; and expropriation provisions. Moreover, whether national security exceptions have become smokescreens for protectionism is another matter (doubts on this score by leading law firms have already been referred to.) Overall, it appears there may be several legal concerns that ought to be addressed.

Figure 4: Nominal global FDI totals never recovered to levels seen before the Global Financial Crisis.

Since I am not a trained lawyer, I will confine my assessments to the apparent logic of recent FDI screening decisions.

Crisis rationale 1: Bargain prices

My first observation relates to the defence that such mechanisms are needed to stop national commercial assets being sold at “bargain prices” during economic crises. If sustained, concerns about “bargain prices” or “firesale FDI” imply the need for a mechanism that checks whether a sufficiently high price was paid for the acquired firm. What could that correct price be? Here a company’s stock-market valuation before the economic crisis would seem a natural benchmark. Indeed, to err on the side of caution one could envision a rule whereby any foreign takeover or acquisition of a large stake must be on terms dictated by the highest stock-market valuation for a local company during the year (or three years) preceding a crisis.

Taken at face value the “bargain prices” argument is, at most, a call for a minimum price rule – and not for a blanket argument against FDI during economic crises. Moreover, it is unclear why a new government bureaucracy needs to be implemented to enforce such a rule – surely the responsibility could be given to a competition agency that must review sufficiently large acquisitions anyway? Despite its salience during the COVID-19 pandemic, the “bargain prices” argument cannot justify the institutional mechanisms that many governments have put in place to screen FDI decisions during the past five years.

Another problem with the “bargain prices” argument is that it implicitly assumes that acquisition of a local firm by another local firm at firesale prices is unobjectionable.21 Yet, in an age when many foreign firms have overseas subsidiaries, some of which may have been operating commercially far longer than many “local” firms then, taken seriously, some mechanism would be needed to identify whether a locally-based firm is “local” enough. The local/foreigner distinction is fuzzier in reality than advocates of FDI screening may be prepared to acknowledge. It may not be clear to those deploying the “bargain prices” argument that they are making this assumption. Some politicians and analysts appear to be opposed to hostile takeovers of all types.22

Crisis rationale 2: Local dislocation overlooked by foreign acquirers

Another the “price-isn’t-right” argument is that the commercial fallout from a foreign acquisition for local communities and along supply chains is not taken into account in the stock-market valuation of the acquired company.

To the extent that the financial valuation of an acquired firm reflects the present discounted value of expected Free Cash Flows or of dividend payments then, on this second rationale for FDI screening, the concern arises that local dislocation caused by a foreign takeover is not taken into account by acquiring firms.

An extreme version of this argument is that a local firm is so important for a national economy that no price is high enough and that the local firm should be protected from foreign takeover. Advocates of the latter argument typically label the local firm as “strategic.” Since the onset of the COVID-19 pandemic, such firms have also been deemed “critical” or “vital.” The failure of advocates of FDI screening to provide operational definitions of these three terms should have immediately raised a red flag.

Note immediately that this is not an argument for FDI screening on national security grounds. Nor is it necessarily an argument for FDI screening on economic grounds either. An alternative approach – perhaps crude – would be to tax foreign mergers and acquisitions transactions by an amount that covers the estimated cost of the local dislocation.

One could envisage a tax that is a multiple of the pre-crisis stock-market valuation. The proceeds of that tax could be used to finance adjustments caused by the transaction in local communities and along affected supply chains. It is far from clear that the recent FDI-related institutional innovations made by governments are needed if compensation for such adjustments is the over-riding policy concern.

A more fundamental objection to this argument is that it fails to appreciate that mergers and acquisitions, both domestic and cross-border, are frequently motivated by the belief that the acquiring firm can better use the assets and capabilities of the acquired firm than the latter’s existing management. Such beliefs are not careless hunches – invariably they are backed up by the acquiring firm’s resources, including those of shareholders. Purposeful change is, therefore, a necessary condition for such mergers and acquisitions to be profitable for the acquirer and dislocation is to be expected, irrespective of the nationality of the acquiring firm.

Crisis rationale 3: “Loss” of “critical” assets

Following foreign acquisition or foreign control of a local firm, there may be a concern that “critical” assets are transferred abroad.23 These assets could be in physical form (for example, a machine) or in some other form (such as intellectual property). The implicit assumption made in much commentary is the foreign acquisition implies these assets are “lost” to the local economy or society.

This assumption needs to be challenged. In some cases – such as the foreign acquisition of a port – it may be physically impossible to move the asset from its current location. In other cases – such as the sharing of a medical technology with customers in the acquiring country’s home market – the asset need not be lost but, in fact, is disseminated across borders to a larger number of users. In a pandemic, such dissemination of medical equipment, medicines, vaccines, and the like ought to be encouraged, so long as the asset in question remains available in the nation where the firm was acquired.

In such cases, the solution is not to prevent foreign acquisitions but for policy to make clear ex ante that all such assets must remain available on commercially reasonable terms within the nation where the firm was acquired and to any of that firm’s customers abroad. Again, it is unclear why new government bodies need to be set up here. When undertaking merger reviews, competition agencies have the power to impose “behavioural remedies” very similar to those necessary to address concerns about “lost assets,” so a natural starting point is to assign any review on these grounds to a competition agency.

Inappropriate foreign access to a “critical infrastructure.”

In recent years, the claim has been increasingly made that a foreign merger or acquisition could result in access to certain national infrastructure which, in turn, could materially threaten national security, public order, cherished values, or some other important aspect of the national way of life. Parallel claims are made about the award of public infrastructure projects to certain foreign firms. Such fears may be heightened (in the eyes of some) when the foreign firm or firms in question are thought to be state-owned or state-controlled.24

Given governments have a duty to protect their populations against such harm and threats of harm, claims of this nature must be taken seriously. However, that should not give governments the right to act without reason, without respecting due process, without being accountable, and without the potential for being challenged. Nor should it preclude collective action by governments in the same region, for example.

Here better practice enforcement of competition law offers useful lessons. When a corporate act is thought to limit competition and distort market outcomes to the detriment of others, then good practice is to insist that the competition agency articulate and support with evidence a cogent theory of harm.

Typically, such theories of harm involve multiple steps between the corporate act and the alleged adverse impact on others. Laying out these steps is essential as the impact is often conditional on other intervening factors. Checking whether those factors, in fact, facilitate or attenuate the effect of the anti-competitive conduct is central to the empirical assessment of a theory of harm in competition law cases.

On my reading of the statements by policymakers and others in favour of the recent tightening of FDI screening regimes, little or no attention has been given to articulating theories of harm. All too often, fear of geopolitical rivals is fanned, systematic evidence is displaced by selectively chosen and interpreted anecdotes (“war stories”), and concerns over the manner in which such screening will be implemented are brushed aside. The result all too often is the establishment of opaque institutional mechanisms. This problem is compounded by another departure from better practice: namely, the failure to specify sectors of commercial and societal activity which fall within the scope of the new FDI screening regime.

As the nature of national security and other threats may change over time – not least as digital technologies spread and machines become ever more linked digitally (“the internet of things”) – then some reluctance to specify all of the relevant potential threats is understandable. Likewise, all of the potential theories of harm. However, that should not excuse governments from making public indicative lists of both unacceptable threats and of compelling theories of harm. Doing so will build confidence as well as shaping the expectations of domestic and foreign executives. In an era of growing uncertainty about economic and regulatory polices (recall Figure 2), the last thing policymakers need to do is to take steps that make the market for corporate control even less predictable.

To conclude, from the perspective of encouraging transparent public policy and discouraging unnecessary resort to discrimination against foreign firms, there is plenty to worry about as governments instituted or elevated FDI screening in recent years. The pandemic-related reasons proffered for heightened screening are particularly weak, many of which are merely old wine in new bottles.

The purpose of this chapter has been to document the recent strengthening of the screening of foreign direct investments, to put these recent policy developments in perspective, to understand the stated rationales for such strengthening, and to critical evaluate the latter. Given that the COVID-19 pandemic is still ongoing, and the spread of digital technologies and geopolitical rivalry show no sign of abating, then it is appropriate to warn that any conclusions drawn here could be revised, perhaps sharply, as more evidence becomes available and as government policy evolves further.

Still, a few practical conclusions can be drawn at this time. First, both recent major shocks and shifts in the world economy have furnished governments with arguments for strengthening FDI screening procedures. Second, the recent past in many respects repeats earlier episodes of tightening of screening. Third, unless governments are suddenly persuaded on other grounds to liberalise FDI regimes, then the recent ratcheting up of FDI screening procedures is unlikely to be reversed. The most optimistic outcome is a partial reversal of some tightening measures (such as the imposition of lower thresholds for reviewing foreign transactions adopted by some jurisdictions). On top of this, the uncertainty inherent in many national security-related FDI screening regimes will almost certainly deter some cross-border mergers and acquisitions.

Several of the arguments for elevated FDI screening and the manner of its implementation were challenged here, even those articulated in narrow national security terms. Given the widely held view that the U.S. Administration of Donald J. Trump abused the national security exceptions codified in General Agreement on Tariffs and Trade, national security arguments of any type from any quarter are now more likely to come under greater scrutiny than before. Some policymakers and officials may bristle at this, but they should be reminded that there is a longstanding tradition in international trade policy community of trying to reconcile legitimate non-economic objectives with open borders and with some success.

For example, while not perfect, considerable progress has been made in reconciling the regulation of food and product safety with non-discrimination objectives of the world trading system. Often, the solution lies not in challenging the policy objective, but in the design of procedures used by officials, transparency of associated procedures and decisions taken, accountability mechanisms, assurances of due process, associated communication to domestic and foreign interested parties, and a willingness to discuss these matters openly.

That the current bout of policymaking in FDI screening may be unnecessarily increasing the uncertainty over public policy faced by foreign firms and the discrimination against such firms, there is a clear case for further information collection on policy initiatives and for systematic comparisons across the regimes erected and decisions taken. Here the OECD should continue its yeoman work. Such evidence collection, plus the views of officials involved (including those officials responsible for national security) and the firms implicated, should inform the identification, discussion and, ideally, adoption of better practices.

Given the membership of the OECD does not extend to the leading emerging markets, it would not be surprising if at some point in the future associated deliberation migrated to Geneva to either the WTO or to UNCTAD. Should the WTO be revived in the coming years, then a work programme could be established on the screening of foreign direct investment in general and on the conduct of national security-related investigations into firms in particular (see Tu and Si 2020 for some ideas in this regard). In the absence of international cooperation in this area, then the domain of cross-border commercial activity subject solely to the traditional rules of non-discrimination will shrink further, representing another retreat from post-Cold War apogee of the world trading system.

Baker McKenzie (2020). “COVID-19: Impact on Governmental Foreign Investment Screening.” 31 March.

Baldwin, R., and S. Evenett (eds.) (2020). COVID-19 and Trade Policy: Why Turning Inward Won’t Work. CEPR Press.

Bonnitcha, J. (2020). “The return of investment screening as a policy tool.” Investment Treaty News. 19 December.

DLA Piper (2020). “COVID-19: National security risks lead to expanded global foreign direct investment reviews.” 11 May.

Dominguez-Jiménez, M. and N. Poitiers (2020). “Europe’s China problem: investment screening and state aid.” CELIS Institute. 2 July.

European Commission (EC) (2020). “Guidance to the Member States concerning foreign direct investment and free movement of capital from third countries, and the protection of Europe’s strategic assets, ahead of the application of Regulation (EU) 2019/452 (FDI Screening Regulation). 25 March.

Evenett, S. (2020). “Chinese Whispers: COVID-19, Global Supply Chains in Essential Goods, and Public Policy.” Journal of International Business Policy.

The Economist (2017). “Multinationals—the retreat of the global company.” Briefing. 28 January.

Fabry, E. and N. Bertolini (2020). “COVID-19: The Urgent Need for Stricter Foreign Investment Controls.” Notre Europe, Jacques Delors Institute. Policy Paper No. 253. April.

Guinea, O. and F. Forsthuber (2020). “Globalization Comes to the Rescue: How Dependency Makes Us More Resilient.” ECIPE Occasional Paper 06/2020. September.

Hanemann, T. and D. Rosen (2020). “Buying the Dip? China’s Outbound Investment in 2020.” Rhodium Group. 30 March.

Heinemann, A. (2012). “Government Control Of Cross-Border M&A: Legitimate Regulation or Protectionism?” Journal of International Economic Law. 15(3): 843-870.

Inkster, N. (2020). The Great Decoupling: China, America, and the Struggle for Technological Supremacy. Hurst Publishing.

Kenner, J. (2020). “FDI in a Post-Covid-19 World: A Threat to the European Project?” Institut Montaigne. 11 May.

Kowalski, P. (2020). “Will the post-COVID world be less open to foreign direct investment?” in R. Baldwin and S.

Krugman, P. (2020). “Fire-Sale FDI” in S. Edwards (ed.) Capital Flows and the Emerging Economies: Theory, Evidence, and Controversies. University of Chicago Press for NBER.

Medhora, R.P. (2018). “Rethinking Policy in a Digital World.” Centre for International Governance Innovation Policy Brief No. 143. November.

Moon, W. (2012). “Essential Security Interests In International Investment Agreements.” Journal of International Economic Law. 25(2): 481-502.

OECD (1980). “National Treatment and Questions of Public Order and Essential Security Interests.” Committee on International Investment and Multinational Enterprises. 20 November.

OECD (1985). “National Treatment: Examination of Member Country Measures Based on Public Order and Essential Security Interests.” Note by the Secretariat. 17 January.

OECD (2008). “Proportionality of Security-Related Investment Instruments: A Survey of Practices.” May.

OECD (2020a). “Acquisition- and ownership-related policies to safeguard essential security interests: Current and emerging trends, observed designs, and policy practice in 62 economies.” Research note. Paris. May.

OECD (2020b). “Investment screening in times of COVID-19—and beyond.” 7 July.

Reich, R. (1990). “Who is us?” Harvard Business Review, January-February edition.

Roberts, A., H. Choer-Moraes, and V. Ferguson (2016). “Toward a Geoeconomic Order in International Trade and Investment.” Journal of International Economic Law 22: 655-676.

UNCTAD (2020). “Investment Policy Responses To The COVID-19 Pandemic.” Investment Policy Monitor. 4 May.

Tu, X., and S. Li. “Lessons from the pandemic for FDI screening practices” in S. Evenett and R. Baldwin (eds). Revitalising Multilateralism: Pragmatic Ideas For The New WTO Director-General. CEPR Press. November.

Wehrlé, F. and J. Pohl (2016). “Investment Policies Related to National Security: A Survey of Country Practice.” OECD Working Papers on International Investment 2016/02. 14 June.

Yoo, J. and D. Ahn (2016). “Security Exceptions in the WTO System: Bridge or Bottle-Neck for Trade and Security?” Journal of International Economic Law. 19: 417-444.

Professor of International Trade and Economic Development, Department of Economics, University of St. Gallen, and Founder, The St. Gallen Endowment for Prosperity Through Trade, the new institutional home of the Global Trade Alert.

I thank Fabien Ruf for excellent research support on this paper. My debt to many officials at the Organisation for Economic Co-operation and Development (OECD) will become apparent. Comments are welcome and can be sent to me at simon.evenett@unisg.ch.

This is to be distinguished from the review of mergers and acquisitions in general, a matter typically falling within the purview of competition law.

Sometimes referred to as “essential security.”

Writing in 2012 Heinemann observed “In recent years, government interventions directed against the takeover of domestic firms by foreign companies have become increasingly more frequent” (page 844). He goes on to describe recent legislative and enforcement developments in the United States, Canada, France, and China, among other countries.

Specifically, Article XXI of the General Agreement of Tariffs and Trade (GATT). Delegates to the GATT are on record noting “the spirit in which these Members of the Organisation would interpret these provisions was the only guarantee against abuse.”

They observe “It is important to look at the origins of the security exception clause in order to understand how inadequate such a provision is to address current challenges” (Yoo and Ahn 2016, page 418).

References to “public order” were dropped after a while. The focus was increasingly on the national (or essential) security dimension of FDI review procedures.

The German government backed up these words with an economic stabilisation fund, financed to the tune of 100 billion euros, that offers financial support to German companies and includes provision for the state to take equity stakes in distressed companies (Kenner 2020). The quote by Mr. Altmaier was widely reported in the media see, for example, this article in the Financial Times https://www.ft.com/content/dacd2ac6-6b5f-11ea-89df-41bea055720b.

This letter is available here: http://www.governo.it/sites/new.governo.it/files/letter_michel_20200325_eng.pdf.

The full statement can be found at https://www.ic.gc.ca/eic/site/ica-lic.nsf/eng/lk81224.html.

UNCTAD (2020) notes governments “…countries either expand their screening mechanisms to cover these sectors or broaden the meaning of national security and other public interest to include health emergencies” (page 7).

See https://ec.europa.eu/commission/presscorner/detail/en/ip_20_528

See also Kowalski (2020), notably the observation “The findings suggest that the pandemic is likely to accelerate protectionist trends that were already reshaping the foreign investment policy landscape” (page 131).

For more details about the construction of this index see https://www.policyuncertainty.com/methodology.html. This index is now used by leading central banks and has been found to be negatively correlated with private sector investment in general.

These arguments might apply, for example, with as much force to Russian firms as they do to Chinese firms.

Evenett (2020) and Guinea and Forsthuber (2020).

For an overview of the consequences of rising geopolitical for global trade and investment regime see Roberts, Choer-Moraes, and Ferguson (2019).

That tracker can be access at https://www.aei.org/china-global-investment-tracker/

The AEI track does not show a single Chinese acquisition attempt or success in the Middle East in 2020.

It may not be clear to those deploying the “bargain prices” argument that they are making this assumption. Some politicians and analysts appear to be opposed to hostile takeovers of all types.

This is rendolent of the “Who is us?” debate concerning foreign direct investment in the 1990s in the United States (see Reich 1990).

A milder version of this concern is that the foreign owners of the asset in question denies or conditions service to local users, perhaps arbitrarily.

This sentence was deliberately drafted so as to highlight the fact that it is the perception of state control rather than the reality that may matter more. As a general rule, the less transparent are either a government’s policies or their links to business, the easier it is for foreign critics to make these claims without effective challenge. The campaign by the United States government – now joined by others – against Huawei may be a case in point.