After finishing 2020 on a high note with a vaccine light at the end of the tunnel, Europe now faces a moment of truth – a five-week delay on the vaccination front that, if left uncorrected, could cost close to EUR90bn in 2021, according to a forecast of Euler Hermes and Allianz Research economists.

After all, in vaccine economics, there is only black or white: Economies that finish the race first will be rewarded with strong positive multiplier effects supercharging consumption and investment activity in H2 2021, whereas vaccination laggards will remain stuck in crisis mode and face substantial costs – economic as well as political. Moreover, Euler Hermes is concerned about economic spillover effects fueling centrifugal political forces. Given insufficient progress on the vaccination front by mid-2021, the EU could be forced to maintain restrictions in place to avert a third wave and in turn a triple-dip. Political discontent is likely to skyrocket once countries including Israel, newly-departed EU member Britain and/or the US enter a consumption-led growth spurt in the second half of 2021. Should the EU face a delayed return to normalcy, confidence in the European project stands to suffer a substantial blow. In particular, we are concerned about the risk of a notable increase in political uncertainty and polarization – at the national as well as the European level.

After finishing 2020 on a high note with a vaccine light at the end of the tunnel, Europe now faces a moment of truth: a five-week delay on the vaccination front that, if left uncorrected, could cost close to EUR90bn in 2021. It took a few months – thank you, ECB, for holding the fort in the meantime – but eventually Europe came together in 2020 and, most importantly, put forward a common fiscal response to the Covid-19 shock via the EUR750bn EU Recovery Fund. But the negative implications associated with a delayed vaccine rollout far exceed the immediate short-term economic costs of a double-dip recession at the start of 2021. After all, in vaccine economics, there is only black or white: Economies that finish the race first will be rewarded with strong positive multiplier effects supercharging consumption and investment activity in H2 2021, whereas vaccination laggards will remain stuck in crisis mode and face substantial costs – economic as well as political. (see Figure 1).

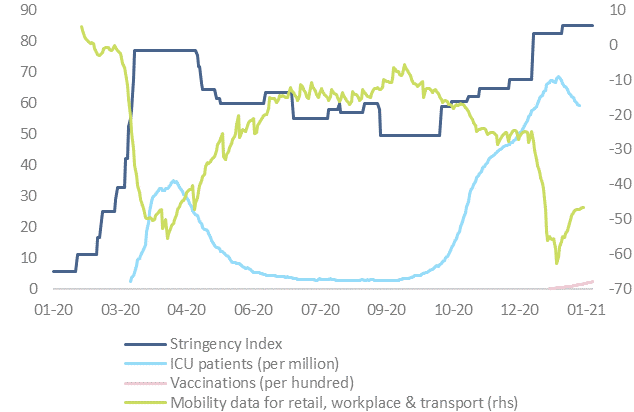

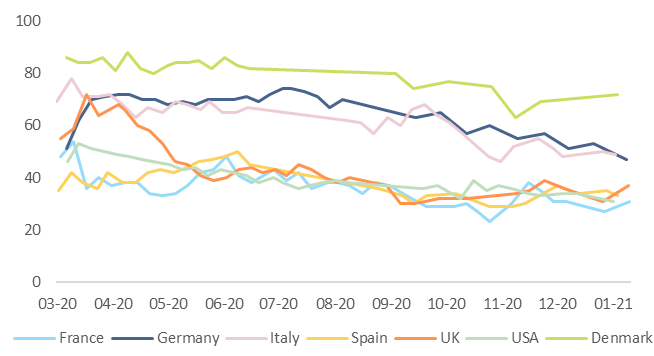

Figure 1 – Vaccine economics (example Germany)

Sources: Google Mobility, Refinitiv, Our World in Data, Allianz Research

With hurdles on the supply side (production & distribution bottlenecks) and a slow start, the EU is increasingly falling behind in the immunity race. Currently, population-adjusted average daily vaccination rates across major EU economies stand at only 0.12%. This is four-times (s)lower than in the UK and the US, where 14.4% and 9.4% of the population have already received at least one dose of vaccine, respectively, compared to a maximum 5% across key EU economies (e.g., Denmark).

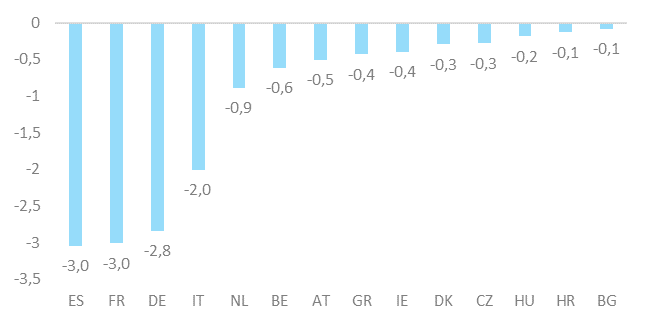

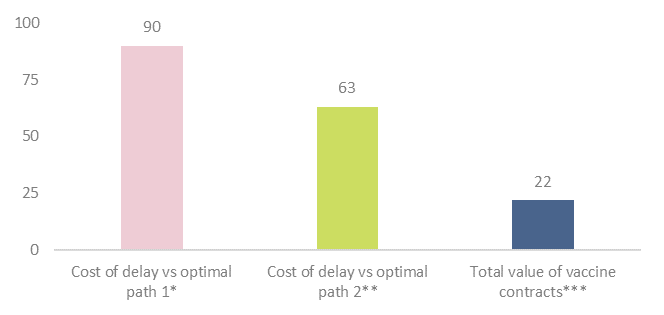

The EU Commission has recently communicated its goal of vaccinating 70% of the adult population by summer 2021. However, reaching this target would call for a vaccination pace that is roughly six times higher than currently observed (see Figure 2). In fact, our calculations show that EU countries are already five weeks behind schedule. As every week of prolonged sanitary restrictions reduces quarterly nominal EU GDP growth by -0.4pp, the current delay represents the equivalent of -2.0pp or close to EUR90bn (see Figure 3). This is more than four times the value of the agreements the EU Commission signed with vaccine producers for the 2.5 billion doses so far procured.

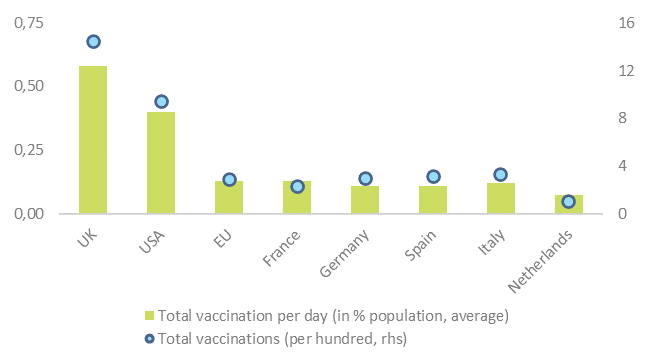

Figure 2 – Covid-19 immunity race for main EU countries

Sources: National reports via Our World in Data, Allianz Research

At the current vaccination speed, herd immunity would only be reached by end-2022. To at least allow for a sustainable economic recovery to take off in the second half of 2021, EU countries must urgently embark on a vaccination path that aims at vaccinating at-risk populations (20%-30% of the total depending on demographics) by mid-2021 to allow for an easing of sanitary restrictions without putting the healthcare system at risk. However, at the current slow vaccination pace, the immunization of the vulnerable population would call for at least a doubling of daily vaccinations administered.

Even based on this less ambitious optimal path, the delay in vaccination tallies up to three weeks, in turn carrying a cost of EUR63bn. It should be noted that these costs will continue to increase for as long as the vaccination rate continues to be below the optimal path. But conversely, this also means the delay can be quickly reduced if the vaccination rate rises significantly above that of the optimal path. This would be conceivable if the bottlenecks in production dissipate at the end of Q1 2021. For example, through the approval of a new vaccine (which in the best case only requires one shot) or the development of new production sites. If a speed of around 1% of the population is reached in this way (which would roughly correspond to the German government’s goal of vaccinating 5million per week), then by early Q3 2021 the delay would indeed be made up for.

Figure 3 – Weekly cost of targeted lockdown measures (EUR bn)

Sources: Eurostat, Allianz Research

The vaccine is the ultimate multiplier for investment and private consumption. The economic cost of the delay compares to the cost of the vaccines by a ratio of four to one. Getting the vaccination campaign on track is key as it would allow for a return to pre-crisis levels by mid-2022. Vaccine economics is about fueling confidence: restarting the service economy, unleashing forced and precautionary savings and resuming corporate investments. We calculate that the economic cost of the delay in the vaccination rollout now exceeds the cost of vaccine purchases by a factor of four. In other words, one Euro spent on accelerating vaccination (i.e. infrastructure, increase vaccine production) could save EU countries four times as many Euros in lost output.

Figure 4 – Cost of delay vs. cost of vaccine in the EU (as of 31 January 2021, EUR bn)

*Target: 70% people vaccinated in H2 2021

**Target: vaccination of vulnerable people in H2 2021

***based on disclosed price per dose and doses procured, average price if not disclosed

Sources: Eurostat, Our World in Data, Duke University, Allianz Research

The accumulated costs to-date associated with the vaccination delay already exceed the total grants that we expect the EU recovery fund to disburse in 2021. The economic fallout from a delayed return to normalcy calls for a “whatever it takes” sequel. Policymakers will continue to have to run the show in 2021-22. Expect fiscal policy support – which governments had hoped to reduce in most European economies in 2021 – to remain aggressive as public safety nets are prolonged and reinforced to prop up household incomes and keep a lid on long-term scarring of the economy.

The ECB meanwhile will be sure to continue to provide cover to EU governments’ fiscal responses. PEPP still has an unused capacity of around EUR1trn but another ammunition boost to the tune of EUR500bn would probably be necessary in 2021 to ensure favorable financing costs are maintained. The vaccination delay will hence further accentuate the lingering Covid-19 effects on the economy by reinforcing fiscal dominance, further strengthening the role of the state in economic affairs and providing another boost to debt burdens and central bank balance sheets. The expected economic recovery detour, thanks to the delayed vaccination rollout, is even on course to eclipse Europe’s Hamiltonian trial balloon moment: The cost of the vaccination delay to-date already exceeds the EUR50bn in grants we expect the EU recovery fund to disburse in 2021.

Economic spillover effects could fuel centrifugal political forces. Given insufficient progress on the vaccination front by mid-2021, the EU will need to maintain restrictions in place to avert a third wave and in turn a triple-dip. Political discontent is likely to skyrocket once countries including Israel, newly-departed EU member Britain and/or the US enter a consumption-led growth spurt in the second half of 2021. Should the EU face a delayed return to normalcy, confidence in the European project stands to suffer a substantial blow. In particular, we are concerned about the risk of a notable increase in political uncertainty and polarization – at the national as well as the European level:

i. Heightened political uncertainty around key elections. Up until now incumbent governments in many European countries have seen their popularity rise, thanks to an appreciation of how they have handled the Covid-19 crisis. However, should Europe face a delayed return to economic normality compared to other economies, expect trust in national governments to drop markedly. The result will be heightened political uncertainty at the national as well as the European level, given that some economic heavyweights are facing key elections in the next 18 months – including Germany in September 2021 and France in April 2022.

ii. “National first” is back in fashion as governments scramble to rebuild trust at home. The EU’s crisis response has been known to fall short on timing and magnitude in the past, with key examples including the great financial crisis as well as the sovereign debt crisis. Should delegating the responsibility on vaccine orders to the EU be seen as a major mistake, confidence in the EU should take a severe beating. EU national governments will likely disassociate from the EU’s botched crisis response and increasingly turn inwards to fix problems on their own in an effort to revive popular support at home. From reduced willingness to coordinate economic and/or health policy to bilateral vaccine purchase agreements, the renewed focus on national matters is worrying at a time when Europe is far from out of the woods.

Figure 5 – Approval of government Covid-19 crisis management (in %)

Sources: YouGov, Allianz Research

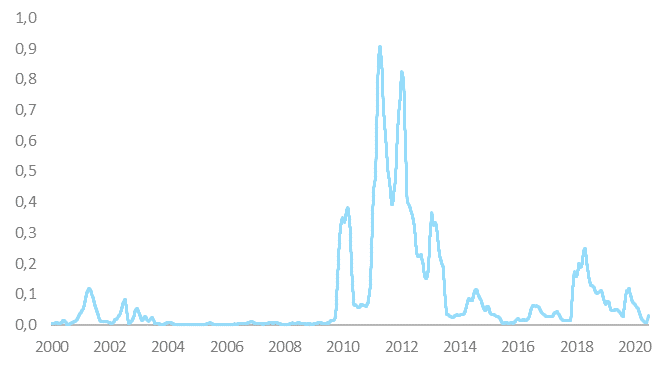

The political cost of a slow vaccination rollout could play in a league with the sovereign debt crisis and could mean extra-work for the ECB with regard to “closing spreads”. After all, the centrifugal forces would be at work at the national as well as the EU level and concern potentially every country, not just a sub-group. In general, the ECB has always had more trouble and had to deploy larger funds when spreads widened because of political tensions and break-up risks. That’s not the case for now, but the vaccination delay carries the potential to fuel turmoil (see Figure 6).

Figure 6 – ECB and “Hamiltonian moment” at work – capital markets still price very low Euro break-up risk*

*Euro Break-Up Risk measured by cross-sectional volatility of 2y and 10y redenomination premia contained in government bond yields, normalized (Country sample DE, FR, AT, NL, BE, IT, ES, PT, GR, IE, FI) For methodology see: https://www.allianz.com/en/economic_research/publications/specials_fmo/20022020_EurozoneBreakup.html

Sources: Refinitiv, Allianz Research

Disclaimer

These assessments are, as always, subject to the disclaimer provided below.

Forward-looking statements

The statements contained herein may include prospects, statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such forward-looking statements.

Such deviations may arise due to, without limitation, (i) changes of the general economic conditions and competitive situation, particularly in the Allianz Group’s core business and core markets, (ii) performance of financial markets (particularly market volatility, liquidity and credit events), (iii) frequency and severity of insured loss events, including from natural catastrophes, and the development of loss expenses, (iv) mortality and morbidity levels and trends, (v) persistency levels, (vi) particularly in the banking business, the extent of credit defaults, (vii) interest rate levels, (viii) currency exchange rates including the EUR/USD exchange rate, (ix) changes in laws and regulations, including tax regulations, (x) the impact of acquisitions, including related integration issues, and reorganization measures, and (xi) general competitive factors, in each case on a local, regional, national and/or global basis. Many of these factors may be more likely to occur, or more pronounced, as a result of terrorist activities and their consequences.

No duty to update

The company assumes no obligation to update any information or forward-looking statement contained herein, save for any information required to be disclosed by law.