In this policy note, we propose a pragmatic compromise toward solving the liquidity in resolution problem in the Banking Union. It is based on the lessons learned from COVID-19, recent estimates of the potential demand for liquidity in resolution, and on the analysis of the current policy positions of the main stakeholders.

The resolution of Banco Popular Español S.A. (BPE) in 2017 initiated a broader policy debate at the European level on how to provide liquidity to banks in resolution that face liquidity problems. The cash balance at the Single Resolution Fund (SRF), which is ex ante endowed by contributions levied on all banks in the Banking Union, would have been insufficient to manage the case at hand.2

The legal framework established under the Bank Recovery and Resolution Directive (BRRD) and the SRM Regulation (SRMR) is fairly silent on the issue of providing short-term liquidity assistance to otherwise solvent institutions in resolution. The SRF will hold funds of approximately EUR 55 to 60 billion in 2024 (at least 1% of covered deposits of all credit institutions in the Banking Union); as of 2022 the ESM backstop will double the funds of the SRF. In some extreme cases, these EUR 120 billion may still turn out to be insufficient, e.g. under a systemic scenario in which several very large banks would have to be resolved around the same time. In its recent Special Report of January 14th on the Single Resolution Mechanism, the European Court of Auditors (2021) calls for a solution to the liquidity in resolution problem.

In this policy note, we assess the institutional and political framework on the basis of recent estimates of the potential demand for liquidity in resolution and on the analysis of the current policy stance of the main stakeholders. We propose a pragmatic compromise toward solving the liquidity in resolution problem, building on the lessons learned from the positive interaction between credit quality enhancement of NFC loans via public COVID-19 loan guarantees and their increased liquidity (i.e. eligibility under standard monetary policy operations in the Eurosystem). Any solution must (i) address the collateral shortage of illiquid banks and (ii) assign a reliable source and facility that can provide even large amounts of liquidity.

This note is structured as follows: Section A presents relevant lessons learned from the COVID-19 crisis with respect to collateral shortages and credit enhancement. Section B provides an estimate of the potential demand for liquidity in resolution based on a recent ECB Occasional Paper. Section C derives four objectives of a solution to the problem based on the policy positions of the main stakeholders and proposes a pragmatic solution to liquidity in resolution for the Banking Union that fulfils all four of these objectives.

The problem of Liquidity in Resolution is the shortage of high-quality collateral. In general, the broader a central bank’s collateral framework for standard operations is, the easier it is for banks to tap central bank liquidity without requiring recourse to liquidity in resolution facilities. For the purpose of this article, we consider four very general categories of eligible collateral:

The problem of liquidity in resolution is the shortage of collateral of types 1 and 2. Collateral types 3 and 4 have substantial drawbacks regarding liquidity in resolution via ELA. Especially relevant for the Banking Union, both types differ across member states. Some countries also require government guarantees when providing ELA, while others do not. Ex ante, it is not sufficiently clear which assets could be used to provide ELA for banks in resolution and whether the government would be willing to provide guarantees. Both hampers operational certainty. Even with public guarantees, these assets were not eligible for standard Eurosystem monetary policy operations. Furthermore, the risk associated with the ACC and ELA are not shared in the Eurosystem. The reliance on ACC/ELA-eligible collateral for liquidity in resolution might strengthen the sovereign-bank nexus, which is at odds with the objectives of the Banking Union.

During the Covid-19 pandemic low quality collateral was upgraded successfully by credit enhancements. European governments provided guarantees for loans to nonfinancial corporations (NFCs). Under certain circumstances, the Eurosystem accepted these loan portfolios as collateral in standard Eurosystem monetary policy operations which significantly increased the potential for banks to generate liquidity.

Credit claims constitute a large source of potential collateral in the Banking Union. The debtor/guarantor must meet high credit standards.3 If applicable, a guarantee has to be provided by an eligible public institution or an international organization according to Article 116 and Article 118 CRR, respectively; it must be unconditional and irrevocable, it must be payable on first demand when the borrower defaults and cover the full amount of the bank’s obligation vis-a -vis the Eurosystem (including transaction costs); i.e. the Eurosystem does not have to liquefy the collateral first and then receive the shortfall from the guarantor. Some of the COVID-19 guarantee schemes in member states fulfilled these criteria. As a result, the volume of loans potentially eligible for standard monetary policy operations increased. For these loans to be actually eligible, collateral banks must fulfil additional operational requirements regarding (i) reporting, (ii) the provision of a legal opinion, and (iii) they must submit the credit claims with the accompanying documentation to a national central bank in the Eurosystem for approval. As these operational prerequisites require some time, we recommend that the submission of potentially eligible credit claims should be part of the standard resolution planning process.

In the context of COVID-19-related economic policy response, however, guarantees covering up to 100% of new loans granted to NFCs were exceptionally accepted by the competition authorities on a temporary basis (European Commission, 2019). Provided that the assets should be booked at their fair value after resolution as confirmed by an independent valuation, we conclude that credit enhancements in collateral swaps and repos in the context of liquidity in resolution would also be compatible with the objectives of the DG Competition, avoiding moral hazard and market distortions. This underscores the importance of monitoring asset encumbrance in the Failure Or Likely To Fail (FOLTF)-analysis and of a prudent valuation for the success of the resolution process. We put forth a proposal that is compatible with the current legal framework, market practice and the policy positions of the relevant stakeholders.

a. Idiosyncratic scenarios: potential need for liquidity in resolution is below EUR 100 billion

The required size of a public sector backstop plays a crucial role in the policy debate. In November 2020, the ECB released the results of the first comprehensive estimates of potential liquidity demand in resolution for the euro area (Amamou et al., 2020). The bank sample consists of 86 large euro area financial institutions, representing approximately 76% of euro area banks’ total assets.

The idiosyncratic analysis employs a simplified version of a liquidity stress test (Schmitz, 2015). By historical standards the stress scenarios are very severe. The most severe scenarios lead to outflows, and hence, to balance sheet reductions of about 45 per cent and, thus, represent very conservative extreme cases.

The authors then define three measures of potential liquidity demand in resolution. These range from the minimum liquidity required to ensure that the bank will be able to pay its obligations when due (gap 1) up to what the bank would require to maintain its resolution LCR4 at 100% at the moment it exits resolution procedures (gap 3) or even increase the resolution LCR to about 120% between the Monday after the resolution weekend to the day when the banks’ cumulated liquidity outflows reach their maximum (gap 2). In the following, we will focus on the estimated liquidity demand in resolution based on gap 3.5

Across scenarios, about two-thirds of the banks in the sample do not have any liquidity demand in resolution. The average liquidity demand in resolution across all banks and scenarios is below EUR 5 billion; across banks with a positive liquidity demand in resolution, the corresponding amount is below EUR 15 billion. For only two banks, the average liquidity demand in resolution across all scenarios is above EUR 50 billion. Even in the most severe scenario6, about half of the banks in the sample do not require additional liquidity in resolution. Two banks feature values of above EUR 100 billion and another four values of above EUR 50 billion. The ECB runs sensitivity analyses and finds that “…average liquidity needs fall by 30% to 50% if run-off rates (stress levels) are reduced by 10%, and by 50% to 80% in the case of a 20% reduction in run-off rates.” (Amamou et al., 2020, p. 51).

According to regulation, banks can use their resolution LCR HQLA buffer under (severe) liquidity stress.7 In contrast, in Amamou et al. (2020) replenishing cash buffers is estimated to account for roughly two-thirds of the expected liquidity gaps (difference between gaps 2 or 3 and the actual liabilities falling due measured by gap 1). We allow banks to use their HQLA buffers (resolution LCR)8, say, of about 40 per cent, before additional public funds are injected, which reduces liquidity demand in resolution by avoiding double counting of outflows. Consequently, no bank has a liquidity demand in resolution above EUR 100 billion and only three above EUR 50 billion, even under the most severe scenario.

Regarding the resolution of an individual bank, the ECB data suggest that most banks would not require public liquidity support in resolution and that for those that do the amounts are modest relative to the volumes available in the SRF. Even for the most extreme outliers under the most extreme scenario, the combined firepower of the SRF and its ESM backstop of about EUR 120 billion is sufficient to avoid the default of banks on amounts falling due and to address a potential further-reaching liquidity demand in resolution. The results also demonstrate that the introduction of the LCR in the EU contributes to the resolvability of banks and, thus, benefits financial stability not only in going-concern but also in gone-concern (Ittner, Schmitz 2007; Schmitz 2012). We also regard the results as robust with respect to a potential end of QE. First, quantitative easing affects, both, the volume of HQLA and that of Net Cash Outflows. The Eurosystem conducts the largest share of QE with counterparties that do not hold reserve accounts at the Eurosystem; thus, these funds are deposited at banks, the largest share as short-term deposits by non-bank financial institutions which have a 100% outflow rate under the LCR. High-quality liquid assets bought from banks do not increase the LCR but only change the composition of HQLA. Second, the resolution LCR is set at 100% regardless of QE.

b. Systemic scenarios: potential need for liquidity in resolution is likely to be below EUR 120 billion

In addition, Amamou et al. (2020) design systemic scenarios where several banks are assumed to be resolved simultaneously (as suggested by the FSB principles; Financial Stability Board, 2016 and 2018). The systemic analysis does not employ the above-mentioned simplified approach to liquidity stress tests, though. Instead, the authors apply a simple static balance-sheet approach, i.e. the asset side of the bank remains unchanged, even when it experiences substantial liquidity outflows over an extended period of time. This approach increases the potential liquidity demand in resolution significantly. Even resolution measures are assumed not to affect the banks’ static balance-sheets (only “open bank bail-in” is allowed in the model). Furthermore, Amamou et al. (2020) assume that all failing banks reach their maximum potential liquidity demand in resolution at the same time.

The systemic scenarios are very severe. Their median amounts to a combined EUR 1.4 trillion in total assets of defaulting banks or to 7.5% of the total assets of the banks in the sample. One-quarter of the simulations lead to the simultaneous failure of banks with totals assets of more than EUR 2.8 trillion. Some extreme cases include banks with total assets of almost EUR 6 trillion or 30% (!) of banking assets in the sample.

The measures of the potential liquidity demand in resolution are the same as in the idiosyncratic scenarios. For the purpose of this note, we again focus on gap 3.

Taking into account the usability of the resolution LCR buffer9 of, say, about 40 per cent, the average liquidity in resolution demand amounts to about EUR 30 billion and the 95th quantile to about EUR 110 billion (if we consider only scenarios in which the amount is positive at all). If banks would not use their resolution LCR buffers at all, the corresponding values would be EUR 44 billion and EUR 174 billion, respectively. The maximum amount of liquidity demand in resolution is an absolute extreme value. It assumes that many large SSM banks are resolved at the same time, that all of them feature very severe liquidity outflows for a prolonged period, and that these extreme outflows continue after resolution. None of these many failing banks are assumed to have regained market confidence after resolution. We regard the probability of this scenario to be below 0.01%.10

When two very large G-SIBs fail at the same time and both continue to experience very high liquidity run-offs after resolution, the average liquidity demand in resolution can be quite high. It stands at about EUR 40 billion and the extreme value at about EUR 180 billion, when banks use, say, about 40 per cent of their resolution LCR buffers11 before additional public funds are injected. Without any use of banks’ resolution LCR buffers, the average liquidity demand in resolution is about EUR 60 billion and the maximum about EUR 295 billion (95th percentile across simulations under very severe pre-FOLTF and very severe post-FOLTF run-off rates). In the latter case, two banks fail with combined total assets of about EUR 3.8 trillion.

Regarding the systemic scenarios, the ECB data suggest that the EUR 120 billion of the SRF and its backstop would be able to address the potential liquidity demand in resolution in all but the most extreme cases. We regard the latter as theoretical possibilities with negligible probabilities of below 0.1%. We believe that even such extreme cases could be solved with flexible use of available instruments, including the SRF and its backstop. This is confirmed by the ECB sensitivity analysis for the systemic scenarios which shows that “…liquidity needs can be reduced by up to 50% in the case of a 10% decrease in run-off rates, or by up to 80% if run-off rates are decreased by 20%.” (Amamou et al., 2020, p. 52).

The recent estimates of the demand for liquidity in resolution suggest that the volume is likely to be below EUR 120 billion, i.e. the combined firepower of the SRF and its ESM backstop. However, in extreme cases, we argue that banks do have enough unencumbered loans to NFCs and households for use as collateral in repo transactions via the SRF to increase the liquidity in resolution to at least EUR 180 billion.

a. Any solution must fulfil four objectives to overcome the policy stalemate

In the public debate, various experts tabled proposals to solve the liquidity in resolution problem.

Various proposals have emanated from within the Eurogroup. The euro area Ministers of Finance concurred that the work on liquidity in resolution should focus on (Centeno, 2019):

For what it is worth, the Eurogroup did reach two important agreements in 2020 (Eurogroup, 2020):

Beyond this, there appears to be no consensus on further public risk sharing among member states at least for the time being. No further-reaching proposal has gained ground so far. The diverging interests of the main players have led to a policy stalemate. To overcome this impasse, we suggest a pragmatic solution considering the experience with the various proposals. We establish four objectives for a solution to the policy stalemate:

i. Function within the current legal framework

Attempts to broadly overhaul competences of institutions or create additional resources for them (e.g. authorization for larger-scale ESM guarantees) have been met with severe political resistance. Any solution will therefore have to be found in the existing setup, even if there would be a longer-term perspective for a more ambitious design.

ii. Increase the availability of eligible collateral

In line with its statute, the Eurosystem provides credit only against adequate collateral. This applies to all facilities, even the ELA. However, a potential lack of eligible collateral eligible under the general framework has been identified on different occasions as one possible obstacle to sufficient funding for banks in resolution. Picking up on the argument made under point a. above, either the collateral framework would have to be extended for the purpose of providing resolution liquidity from new and dedicated central bank facilities, or comparatively lower-quality but otherwise eligible collateral would have to be admitted for use in repo transactions.

iii. Provide sufficient volumes of liquidity

As we argued above, the new estimates for potential liquidity gaps clarify that the liquidity demand in resolution is below EUR 100 in idiosyncratic cases and very likely below EUR 120 billion in systemic scenarios; the available resources in the SRF together with the common backstop and the NFC loans in the portfolio of the bank in resolution are enough, especially if the SRF and the ESM backstop are employed according to our proposal.

iv. Limit burden sharing and public guarantees

Member states refuse to accept unlimited exposure to liquidity in resolution demand ex-ante, as they have no active role in the resolution of large banks. A decision must be taken within 12 hours, which boils down to a yes-or-no decision based on very limited information. The same applies for the ESM governing bodies, when the common backstop is to be involved in financing resolution actions. To ensure incentive compatibility, the Single Supervisory Mechanism (SSM) and the Single Resolution Board (SRB) should ultimately be responsible for liquidity in resolution. But by itself the SRB does not have the resources and the Eurosystem, of which the SSM is part, refuses to provide liquidity in resolution without public guarantees. The European Commission ultimately signs off on the resolution scheme, but the EU budget administered by the Commission is endowed with revenues to the tune of roughly 1% of gross national income and has limited room for manoeuvre to cover contingent liabilities. Finally, the ECOFIN Council basically plays no active role in resolving banks, unless the European Commission transfers a decision to it in two specific circumstances.

The different roles and responsibilities, on the one hand, as well as the actual financial capacities, on the other hand, call for a well-balanced burden-sharing regime that addresses the four criteria listed above. Despite progress, the current framework is still incomplete. To recall, the BRRD and SRMR establish that losses are predominantly borne by shareholders and creditors of an institution and under several conditions, the SRF. But it does not create clear responsibilities with regard to providing resolution liquidity. A pragmatic and flexible solution needs to build on credit enhancement for NFC loans by the use of SRF/ESM backstop resources.

b. Our solution fulfils all four objectives

Our solution builds on the neglected role of credit claims as potential collateral. Lessons from COVID-19 measures ensure that even extreme demand for liquidity in resolution can be addressed. Estimates of the demand for liquidity in resolution and proposals to solve the liquidity in resolution problem so far assumed that certain available credit claims cannot be employed to generate liquidity. Looking at specific numbers for the Banking Union, at least on average, especially G-SIBs hold ample amounts of unencumbered assets that could be available for use as collateral.

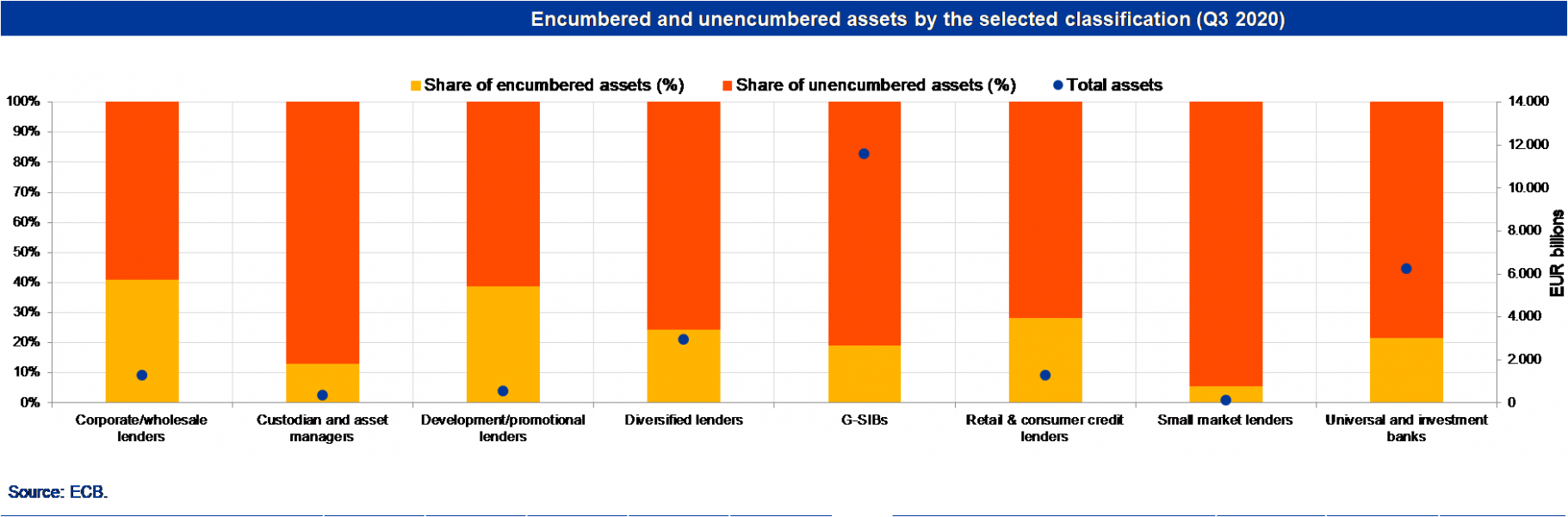

Diagram 1: High levels of unencumbered assets at large euro area banks

For SSM banks, NFC loans amount to about EUR 5,200 billion or about 20% of total assets as of Q3 2020 and the share of unencumbered assets stands at about 80 per cent (ECB, 2021). Taking into account the lessons learned from the COVID-19 pandemic, we find that the SRF, its ESM back-up, and the option to generate liquidity based on the credit enhancement of NFC loans is sufficient to address even the most extreme demand for liquidity in resolution:

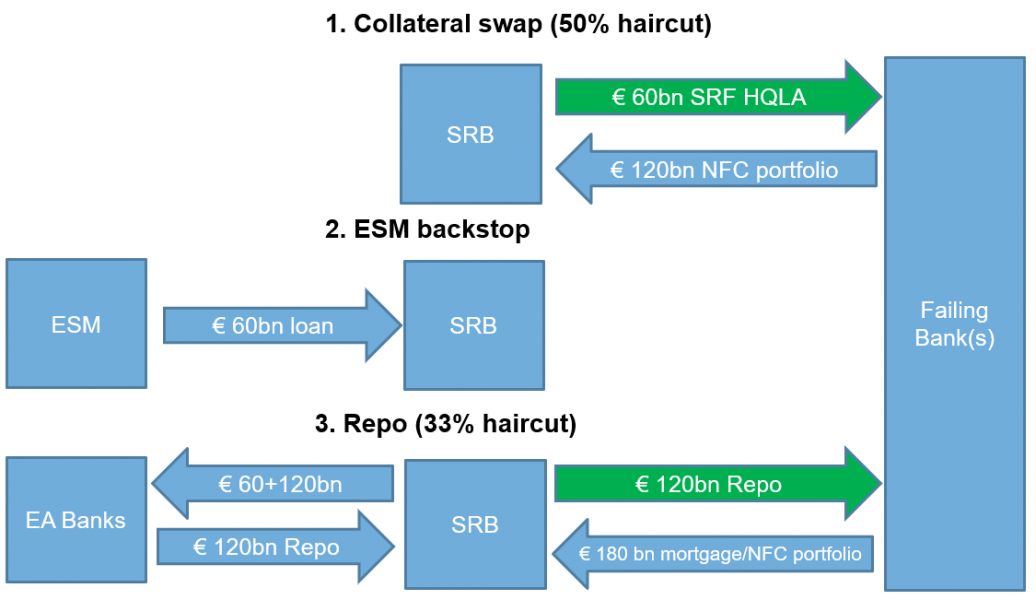

First, the SRM provides liquidity to banks in the form of a collateral swap; it provides high-quality liquid assets eligible in standard monetary policy operations held in the SRF and receives NFC loans from the bank in resolution (considering a conservative haircut of 50%). For its EUR 60 billion, the SRM receives NFC loans of EUR 120 billion as collateral.

Second, the ESM would provide further liquidity to the SRF in the form of an unsecured loan of EUR 60 billion according to the backstop agreement. The SRM now has EUR 180 billion of assets, partly illiquid (EUR 120 billion of NFC loans) and partly of high quality and highly liquid (EUR 60 billion of ESM bonds).

Third, the SRM uses the EUR 60 billion of ESM bonds as first loss tranche to enhance the credit quality of its portfolio of NFC loans and conducts market repos against it (rehypothecation). Each repo consists of 2/3 of NFC loans and a 1/3 first loss tranche as collateral against high-quality liquid assets eligible in standard monetary policy operations. Assuming a – very conservative – 33% haircut, the SRM raises EUR 120 billion in these repos, which it again passes on to the bank in resolution via a collateral swap against illiquid collateral, i.e. NFC loans or mortgages, of, say, EUR 180 billion (33% haircut). Overall, the bank in resolution has received EUR 180 billion in liquid assets. The risk for the SRM’s counterparties is very low. The first loss tranche in the form of high-quality liquid assets shields counterparties from losses, even if the portfolio of NFC loans loses 50% of value – a scenario that would clearly point to the non-viability of the bank in resolution. If the NPL ratio of its NFC loan portfolio exceeded 50%, the bank in resolution would not face a liquidity problem but would be insolvent and should not receive liquidity in resolution in the first place. Furthermore, the SRM repos its second liquidity injection for the bank in resolution also against collateral, which provides a further layer of safety for the SRM’s repo counterparties. Even in the most remote case of NPLs in the NFC portfolio, however, the SRB counterparties would still bear very little risk, as long as the SRM is solvent. This we regard as given, due to its financing structure based on obligatory contributions by euro area banks. The proposal does not entail any hidden risk sharing for member states. It does lead to a temporary increase in asset encumbrance of the bank in resolution. However, if the bank is fundamentally solvent it will gain access to private secured or unsecured funding markets to re-optimize its funding structure.

Diagram 2: Collateral enhancement, cash- and collateral flows in our proposal

The euro area banking system can provide the additional liquidity without jeopardizing its LCR or its CET1 ratio. The aggregate volume of high-quality liquid assets of SSM banks in Q3 2020 amounts to about EUR 4,600 billion (European Central Bank, 2021), so that the EUR 120 billion repo – of which EUR 60 billion are collateralized by HQLA – will only reduce unencumbered overall LCR-eligible HQLA by EUR 60 billion or 1.3%. Assuming a risk-weight for the repo of 20%, the aggregate RWA value of the SSM banks increases by 12 basis points and the CET1 ratio would decrease by 4 basis points. The average daily turnover in the secured euro money market was above EUR 500 billion (latest available data as of Q4 2018, European Central Bank, 2019) and the market will have no problem to digest the EUR 120 billion of SRM repos.

Our proposal reduces the hurdles for reform and increases the chances of overcoming the current policy stalemate by building on the Eurogroup agreements of 2019 and 2020 and by meeting the four objectives identified above under i. to iv.

Ad i. It works well within the current legal framework.

Ad ii. It resolves the shortage of collateral in situations in which HQLA and other high-quality collateral are no longer available.

Ad iii. The combined firepower of the SRF, the ESM backstop and the market rehypothecation based on the credit-enhanced NFC loan portfolio held by the SRF amounts to EUR 180 billion; this is enough to address the demand for liquidity in resolution in even the most severe idiosyncratic and almost all but the most extreme systemic scenarios. For cases in which the EUR 120 billion of the combined firepower of the SRF and the ESM loan should still be insufficient, the Eurogroup would have enough time to decide either (i) that the bank has no viable business model and has to be wound down or (ii) that the bank does have a viable business model and to arrange an ad-hoc solution based on the additional collateral the SRM has received for its second collateral swap of EUR 120 billion. It holds a portfolio of, say, additional EUR 180 billion of loans which it could rehypothecate with a substantial haircut to generate some more liquidity if really needed. The proposal builds on the lessons learned in the COVID-19 pandemic, which has shown that the liquidity of the NFC loan portfolio can be increased by credit enhancements. The proposal also avoids that banks in resolution would have to take recourse to a specific emergency facility that would stigmatize these banks and further impede rather than enhance their renewed access to private funding markets.

The recourse to the repos of the SRM with market counterparties for extreme cases constitutes the seventh “backstop” of a functioning bank: the bank would have to have exhausted its loan loss reserves, its profits, paid-in capital, then the conversion/write-down of additional tier 1 capital to enter resolution plus the resolution tools; then it would have to use 40% of its resolution LCR, the entire funding provided by the SRF, then that of the ESM backstop. That probability is very low. Also, the FSB in 2018 called for explicit exit strategies linked to transparent milestones in order to reduce exposures to a public sector backstop.

The probability that the EUR 120 billion of liquidity in resolution would not be enough is not only very low but also endogenous. Thus, we propose to reduce this probability further by (i) improving the FOLTF procedures and (ii) by strengthening resolution planning and implementation. The FOLTF decision should already be taken when it is likely and foreseeable that the bank is about to become illiquid; supervisors should not wait until the bank is finally illiquid. Resolution planning and implementation should be strengthened to ensure that particularly the largest banks in the euro area have enough unencumbered assets readily deployable, enough bail-inable liabilities to ensure that the bank in resolution has a reliable capital ratio and a viable business model that instill market confidence, so that any liquidity demand in resolution is only temporary. Our proposal is in line with the Eurogroup’s decision in 2019 to focus on the most consensual options for the refinement of current practices (Centeno, 2019), with IMF (2018b) recommendations, and with international practice. The US Federal Reserve (Fed) also requires US banks to estimate a stand-alone liquidity position for each material entity (Resolution Liquidity Adequacy and Positioning or RLAP) and an estimate of the liquidity needs in resolution (Resolution Liquidity Execution Need or RLEN) (FDIC and Fed, 2018). Starting in 2021, the SRB is implementing a similar regime. It requires banks (i) to develop an internal model that enables them to estimate their liquidity demand in resolution, (ii) to estimate their liquidity demand in resolution at the consolidated and the subsidiary level according to the main drivers, level and additional available collateral, (iii) to identify additional collateral, estimate its liquidity value and its time to cash. All these measures further reduce the demand for liquidity in resolution and, hence, the resulting exposure of the public to liquidity in resolution risk.

Ad iv. The exposure of the member states to liquidity in resolution is limited to the agreed volume of the backstop, in the short-term. In the long-term, the ESM would have full recourse to the SRB and the banks in the euro area. If the bank regains access to funding markets, the risk for the SRF and the ESM would not materialize. If the bank cannot regain access to funding markets, losses to the SRF are substantially reduced by the NFC loans held by the SRF. Remaining losses would have to borne by euro area banks. The ESM would not bear losses.

The discussion about a solution for the liquidity in resolution problem in the Banking Union has made substantial progress, but its finalization is blocked by a policy stalemate. Our proposal solves the liquidity in resolution problem and fulfills all four high-level objectives to resolve that policy stalemate: i. it functions within the current legal framework, ii. it increases the availability of collateral, iii. generates sufficient volumes of liquidity and iv. strictly limits burden sharing and public guarantees.

We show that the proposal is compatible with the current legal framework and with the policy positions of the relevant stakeholders. It builds on available bank assets to be used as collateral. Building on the most recent estimates for potential funding gaps in resolution we find that the demand for liquidity in resolution is very likely to remain below EUR 120 billion and that the combined firepower of the SRF, its ESM backstop, and the market repos based on the rehypothecated credit-enhanced NFC loan portfolio held by the SRM can generate at least EUR 180 billion of liquidity in resolution; this is enough to cover the demand for resolution liquidity even in extreme cases of systemic banking crises. The high levels of overcollateralization ensure that the exposure of the SRM’s repo counterparties is close to zero; and, in the short term, that of the member states is strictly limited to the volume of the backstop before recourse to the SRM and, in the longer term, likely close to zero.

Amamou, R., A. Baumann, D. Chalamandaris, L. Parisi, P. Torstensson (2020), Liquidity in resolution: estimating possible liquidity gaps for specific banks in resolution and in a systemic crisis, ECB Occasional Papers Series No. 250.

Centeno, M. (2019), Summing-up letter of the Eurogroup meeting in inclusive format of 13 June 2019, https://www.consilium.europa.eu/media/40105/20190613-summing-up-letter-inclusive-format.pdf

Demertzis, M., Raposo, I. G., Hüttl, P., Wolff, G. (2018), How to provide liquidity to banks after resolution in Europe’s banking union,

https://www.europarl.europa.eu/RegData/etudes/IDAN/2018/624422/IPOL_IDA(2018)624422_EN.pdf

Draghi, M. (2018), Statement at the Committee on economic and monetary affairs Monetary dialogue with the president of the ECB (pursuant to Article 284(3) TFEU) Brussels, Monday, 26 February.

DIRECTIVE 2014/59/EU OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 15 May 2014 establishing a framework for the recovery and resolution of credit institutions and investment firms https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32014L0059&from=EN

Eurogroup (2018), Terms of reference of the common backstop to the Single Resolution Fund, https://www.consilium.europa.eu/media/37268/tor-backstop_041218_final_clean.pdf

Eurogroup (2020), Summing-up letter of the President of the Eurogroup, https://www.consilium.europa.eu/media/46703/20201103-summing-up-letter-eurogroup-inclusive-format.pdf

Eurogroup (2020), Statement of the Eurogroup in inclusive format on the ESM reform and the early introduction of the backstop to the Single Resolution Fund, https://www.consilium.europa.eu/de/press/press-releases/2020/11/30/statement-of-the-eurogroup-in-inclusive-format-on-the-esm-reform-and-the-early-introduction-of-the-backstop-to-the-single-resolution-fund/

European Central Bank (2019), Euro money market study 2018, Frankfurt. https://www.ecb.europa.eu/pub/euromoneymarket/html/ecb.euromoneymarket201909_study.en.html#toc1

European Central Bank (2021), Supervisory Banking Statistics Third quarter 2020, Frankfurt. https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.supervisorybankingstatistics_third_quarter_2020_202101~9b085b2142.en.pdf

European Commission (2013), Communication from the Commission on the application, from 1 August 2013, of State aid rules to support measures in favour of banks in the context of the financial crisis (‘Banking Communication’)

https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52013XC0730(01)&from=EN

European Commission (2019), COMMUNICATION FROM THE COMMISSION – TEMPORARY FRAMEWORK FOR STATE AID MEASURES TO SUPPORT THE ECONOMY IN THE CURRENT COVID-19 OUTBREAK, https://ec.europa.eu/competition/state_aid/what_is_new/TF_consolidated_version_amended_3_april_8_may_29_june_and_13_oct_2020_en.pdf

European Court of Auditors (2021), Resolution planning in the Single Resolution Mechanism. Special Report 01/2021.

https://www.eca.europa.eu/Lists/ECADocuments/SR21_01/SR_Single_resolution_mechanism_EN.pdf

European Parliament, ECON committee on 11 July 2018, Public hearing with Elke König, Chair of the SRB Supervisory Board, presenting the SRB Annual Report 2017 https://www.europarl.europa.eu/RegData/etudes/BRIE/2018/624403/IPOL_BRI%282018%29624403_EN.pdf

Federal Deposit Insurance Corporation and Board of Governors of the Federal Reserve System (2018), Guidance for 2018 §165(d) Annual Resolution Plan Submissions By Foreign-based Covered Companies that Submitted Resolution Plans in July 2015

https://www.federalreserve.gov/newsevents/pressreleases/files/bcreg20170324a21.pdf

Financial Stability Board (2016), Guiding principles on the temporary funding needed to support the orderly resolution of a global systemically important bank (“G-SIB”) Guiding-principles-on-the-temporary-funding-needed-to-support-the-orderly-resolution-of-a-global-systemically-important-bank-“G-SIB”.pdf (fsb.org)

Financial Stability Board (2018), Funding Strategy Elements of an Implementable Resolution Plan, https://www.fsb.org/wp-content/uploads/P210618-3.pdf

Grund, S., Nomm N., Walch F. (2020), Liquidity in resolution: comparing frameworks for liquidity provision across jurisdictions, Occasional Paper Series – European Central Bank, https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op251~65a080c5b3.en.pdf?690e875c3ef452dab7a170c9c0396c45

International Monetary Fund (2018a), Euro Area Policies: Financial Sector Assessment Program-Technical Note-Systemic Liquidity Management, https://www.imf.org/en/Publications/CR/Issues/2018/07/19/Euro-Area-Policies-Financial-Sector-Assessment-Program-Technical-Note-Systemic-Liquidity-46103

International Monetary Fund (2018b), Euro Area Policies: Financial Sector Assessment Program-Technical Note- Bank Resolution and Crisis Management, https://www.imf.org/en/Publications/CR/Issues/2018/07/19/Euro-Area-Policies-Financial-Sector-Assessment-Program-Technical-Note-Systemic-Liquidity-46103

Ittner, A., S. W. Schmitz (2007), Why central banks should look at liquidity risk, Quarterly Journal Central Banking Vol. XVII No. 4, 32-40.

Schmitz, S. W. (2012), The liquidity coverage ratio under siege, VoxEU blog of 25 July 2012, reprinted in: J. Danielsson (ed.), Post-Crisis Banking Regulation – Evolution of economic thinking as it happened on Vox, CEPS Press, London, 93-103 https://voxeu.org/article/neglected-part-international-financial-reform-liquidity-regulation

Schmitz, S. W. (2015), Macroprudential liquidity stress tests, in: C. Bonner, P. Hilbers, I. van Lelyveldt, (eds.), Liquidity Risk Management and Supervision, Risk Books, London, 237-26.

Matthias Gruber, Austrian Ministry of Finance, matthias.gruber@bmf.gv.at; Stefan W. Schmitz, Oesterreichische Nationalbank, stefan.schmitz@oenb.at. The opinions expressed in this article are those of the authors and do not necessarily reflect those of the Austrian Ministry of Finance or the Oesterreichische Nationalbank.

According to the SRMR, the fund may make a contribution to the institution under resolution, if losses totalling no less than 8% of total liabilities including own funds have already been absorbed. This does not necessarily apply to liquidity assistance. In the case of BPE, creditors only incurred limited losses, as the recapitalization was carried out by the buyer and no debt was converted into equity.

Creditworthiness is assessed using Eurosystem credit assessment framework (ECAF) rules for credit claims. Debtors or guarantors can be public sector entities, NFCs and international as well as supranational institutions. The debtor or guarantor must be established in the euro area. The minimum size threshold at the time of submission of the credit claim is EUR 500,000 for cross-border use; for domestic use, the minimum threshold varies between NCBs. Governing law for credit claim agreement and mobilisation: law of a member state of the euro area. The total number of different laws applicable to (i) the counterparty, (ii) the creditor, (iii) the debtor, (iv) the guarantor (if relevant), (v) the credit claim agreement and (vi) the mobilisation agreement shall not exceed two. The credit claim shall be denominated in EUR.

We define the resolution LCR of the bank in resolution as its LCR of 100% on Monday after the resolution weekend.

The demand for liquidity in resolution in Gaps 1, 2, and 3 includes the amount of liquidity necessary to equip the bank in resolution with a 100% resolution LCR on the Monday after the resolution weekend. We disregard Gap 1, because it assumes that the entire resolution LCR/its entire HQLA buffer is used; as such it merely covers the absolute minimum of liquidity the bank in resolution requires to avoid illiquidity. The bank would have no liquidity buffer left which we regard as detrimental to the objective of regaining market confidence. We disregard Gap 2, because it assumes that the bank cannot use its resolution LCR/its HQLA buffer at all; given that the bank shrinks due to the substantial outflows of liquidity, its resolution LCR/its HQLA buffer would even increase to about 120% under extreme stress – this is implausible and at odds with the very raison d’être for a liquidity buffer. This leaves us with Gap 3. It also includes a 100% resolution LCR on the Monday after the resolution weekend but allows the bank to reduce its HQLA in line with the reduction of its liabilities/Net Cash Outflows such that its LCR remains at 100%. However, gap 3 still does not allow the bank to reduce its resolution LCR below 100% and adds outflows, that would do so, to the liquidity demand in resolution a second time.

The most severe scenario assumes very severe outflow rates before the resolution and very severe outflow rates after resolution; e.g. for stable retail deposits, the run-off rate is 18% before and 13.5% after resolution; for other retail deposits the corresponding run-off rates are 30% and 22.5%, respectively; for operational deposits, they amount to 50% and 37.5%, respectively; for non-operational deposits from credit institutions and from other financial institutions they are 100% and 75%, respectively.

Commission Delegated Regulation (EU) 2015/61 of 10 October 2014: Article 4 paragraph 3 explicitly stipulates: “By derogation from paragraph 2, credit institutions may monetize their liquid assets to cover their net liquidity outflows during stress periods, even if such a use of liquid assets may result in their liquidity coverage ratio falling below 100 % during such periods.”

The resolution LCR after the resolution weekend is not disclosed in the report. We approximate it based on the data disclosed the report.

The resolution LCR after the resolution weekend is not disclosed in the report. We approximate it based on the data disclosed the report.

The extreme value is the 95th-percentile of the distribution across the simulations run by the ECB; assuming that the simultaneous failure of so many SSM banks happens only every 25 years and that the extreme outflow rates also happen every 25 years, we derive a probability of 0.008%.

The resolution LCR after the resolution weekend is not disclosed in the report. We re-estimate it based on the data disclosed the report. The results in the text are plausible, given that, for example, the EUR 295 billion liquidity demand in resolution are about 10% of total assets; net cash outflows are on average 10 per cent of total assets (ECB 2021). Hence, a 40 per cent use of the resolution LCR (100% or EUR 295 billion) would amount to about EUR 120 billion which results in a remaining gap of about EUR 175 billion.

The level will be lower during the transition period until 2024, but may be even higher, depending on the evolution of covered deposits, which serve as the basis for determining the target level of the SRF and thus the backstop.