Macroeconomic policy has undergone a revolution in just three months. But without proper guardrails and a clear exit strategy, we believe it is a slippery slope.

Serious fiscal support

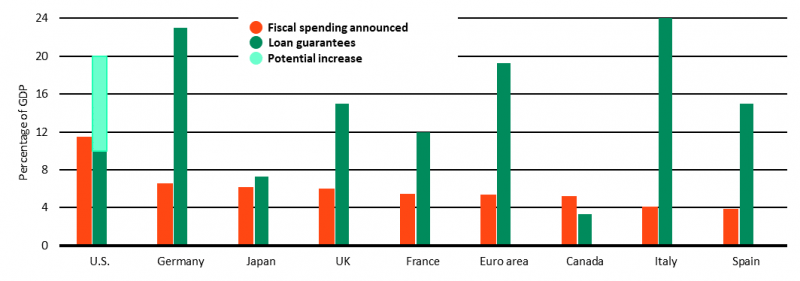

Global fiscal spending and loan guarantees as a share of GDP, 2020

Sources: BlackRock Investment Institute and finance ministries, June 2020. Notes: The chart shows actual and expected fiscal spending measures and actual loan guarantees across selected developed market economies. We add an area of potential increase to the U.S. loan guarantee bar because the structure of the U.S. programs means they can be scaled to be larger than what has been formally announced. Euro area data is the weighted average of the EMU4 (France, Italy, Germany, Spain). Forward looking estimates may not come to pass.

We have witnessed a revolution in macroeconomic policy in response to the coronavirus shock. The speed and size of the response has been greater than at any other moment in peacetime history. The core tenets of global policy frameworks and markets have been fundamentally transformed.

The scale of the fiscal policy response has surpassed the GFC in terms of discretionary fiscal stimulus and government guarantees. See the Serious fiscal support chart above. Fiscal policy mobilization on such a scale has not been seen since World War II. And in some cases, the fresh round of emergency stimulus comes on top of already sizeable budget deficits and steep upward trajectories in public debt.

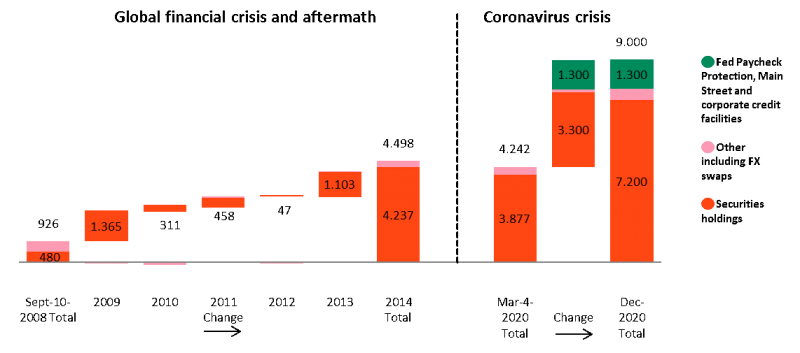

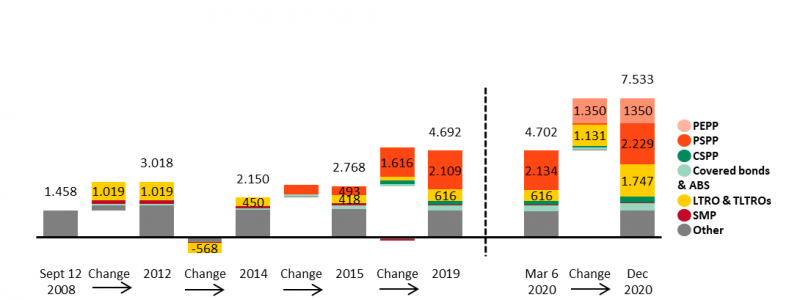

The increase in “traditional” quantitative easing (QE) – central bank asset purchases – over the past few months is already projected to be slightly above the size of the Federal Reserve’s three QE programs from 2009 to 2014 combined. The additional credit facilities via a range of special purpose vehicles (SPVs) bring the current policy action to more than twice the size of what the Fed did over five years during the GFC. The ECB’s response is approaching two thirds of the balance sheet expansion during the GFC and beyond. See the Unprecedented action chart further below.

The policy response during the GFC forced policy innovations that were seen as a revolution at the time: forward-guidance, QE, negative rates, and funding for lending programs to promote bank lending. See the table. These unconventional policies worked mostly by lowering short- and long-term interest rates – and they also worked through the financial system, affecting the non-financial private sector indirectly. Some of these policies started to blur the distinction between fiscal and monetary policy. Examples are the funding for lending programs (UK), central bank purchases of equity (Japan) and corporate debt (euro area) – as well as the introduction of yield curve control targeting a range for long-term yields (Japan). Yet this blurring still only occurred at the fringes of the policy envelope.

The policy revolution is now taking on a new dimension, with global policy frameworks being redesigned in real time as specific needs arise without much of an institutional framework. We spell out the three main aspects of this revolution below.

New tools in the box

Major central bank policy tools

Source: BlackRock Investment Institute and central banks, June 2020. Notes: The table shows which major central banks have adopted or are considering different “unconventional” policies. FX swap lines are an agreement between two central banks to exchange currencies. Regulatory forbearance is where central banks state that commercial banks may eat into capital and liquidity buffers to boost liquidity. Direct lending to public authorities is direct cash transfers from the central bank to government to finance spending.

The policy revolution has three main parts. First, the new policies are explicitly attempting to “go direct” – bypassing financial sector transmission and finding more direct pipes to deliver liquidity to a larger set of entities. These include businesses, households and foreign central banks. This is in return for a broader set of collateral such as corporate bonds and bank loans, up to and including the Fed’s Main Street facilities. The ECB and the Bank of Japan had already made baby-steps in that direction, but all central banks are now moving into unchartered territory. The U.S. and UK fiscal authorities are explicitly backing this type of central bank lending and in turn are starting to rely on direct borrowing from the central bank at the local government level. The chart below shows how important these direct policy instruments have become relative to the traditional unconventional toolkit. In the euro area, the main innovation is the pandemic emergency purchase programme (PEPP) that allows the ECB to buy government debt out of proportion to euro area country shareholdings in the bank. One consequence: going direct relies less on lower interest rates, portfolio rebalancing and inflating asset price values to deliver stimulus. So on its own, this policy revolution is unlikely to be the prelude of a decade-long, policy-fueled bull market for risk assets as we saw after the GFC.

The second aspect of this revolution is the explicit blurring of fiscal and monetary policies. The policy instruments represented by the green areas in the top chart below all involve credit risk that is explicitly backed by the U.S. Treasury. This is fiscal policy working through a Fed instrument. Boundaries have also been blurred in the use of monetary policy to keep interest rates low – buying government debt as fiscal spending surges. Aside from the few places where it is explicitly presented as yield curve control, large or even unlimited asset purchase programs are tied to maintaining low government bond yields. Temporary monetary financing has been made explicit in the UK. The third aspect of the policy revolution is the stringent conditionality around dividend payouts, share buybacks and executive compensation imposed on companies taking government support. This opens the door to unprecedented government intervention in financial market functioning and corporate governance.

Unprecedented action

Contributions to Fed and ECB balance sheets, in USD billions and EUR billions, 2008-2020

Source: BlackRock Investment Institute, Fed and ECB, with data from Haver Analytics, September 2020. Notes: The top chart shows what the Fed’s balance sheet could look like by the end of 2020 with the new facilities launched in the past two months compared with March 6 – just before it began its interventions. The balance sheet at the end of 2020 is based on estimates made by BlackRock’s Global Fixed Income economics team. These projections are based on data from the Fed’s H.4.1 (balance sheet) release and on the structure of the Fed’s facilities found on the Fed website. The purchase pace of securities is listed on the New York Fed website. The estimates also assume that the Fed will increase its planned support for its Paycheck Protection Program loan facility and expand its support for states and municipalities by several hundred billion dollars compared with the initial announcements. By comparison, the Fed pledged as much as $2.3 trillion in loans to support the economy in its April 9 announcement. Estimates of the expected increase and December 2020 totals are rounded. The funding facilities (green bars in top chart) are funded with credit loss protection provided by the U.S. Treasury and lending by the Fed. These programs also include the Term Asset-Backed Securities Loan Program and Municipal Liquidity Facility. The bottom chart shows the ECB’s comparable balance sheet expansion. PEPP is the Pandemic Emergency Purchase Programme, PSPP is the Public Securities Purchase Programme, CSPP is the Corporate Securities Purchase Programme, LTROS and TLTROS are (Targeted) Long-Term Refinancing Operations and the SMP is the Securities Market Programme. Forward looking estimates may not come to pass.

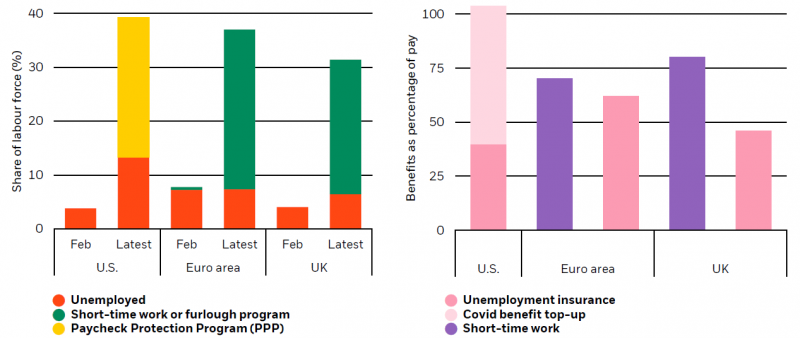

The labor market is one area experiencing an unprecedented amount of government intervention. There is a stark difference in approach on the two sides of the Atlantic. The U.S. is relying mostly on beefed-up unemployment insurance (UI) and Europe on short-time work programs. The former aims to help people who have lost their job, and the latter aims to keep people in work by paying companies to keep employees on at reduced hours. The policy choices matter in terms of the near-term recovery and any long-term scarring. The size of the U.S. and European interventions are similar, but they could have very different consequences for the distribution of lost income between consumers and companies.

The difference between the approaches lies in who bears the risk of the policy falling short, the impact on company-specific, intangible human capital and future employment dynamics. The reliance on short-time work programs has historically correlated with the strictness of labor market regulations. These programs offer greater flexibility to reduce hours worked without redundancies, equally affecting all workers in a company and allowing companies to operate at reduced capacity. And they avoid the costs of firing and re-hiring. U.S. unemployment benefits currently are slightly more generous than short-time work benefits (see the chart on the right below), mainly due to a pandemic top-up that expired in July. Workers in short-time work programs keep social security contributions and healthcare coverage, and may be better off in the long run than those on unemployment benefits as a result.

Unemployment is more disruptive even in lightly regulated labor markets – such as in the U.S. – and company-specific human capital can get lost through the churning of the workforce. It is harder to rehire than to increase the number of hours worked – especially as uncertainty may remain as economies open up. Those labor markets relying mostly on letting staff go could take longer to recover. And the risk of a cash crunch as payments work through the system lies with the worker, not the company. This is important given the temporary nature of the stepped-up benefits in the U.S. and in the UK (end of October). Cliff edges are clear. U.S. consumers are more likely to bear the brunt of the coronavirus crisis, while in Europe companies might have to face the decision on layoffs later. In the U.S., which has introduced payroll support such as the Paycheck Protection Program (PPP) for businesses, the terms – capped at 24 of costs – are less generous than in Europe. And there were some teething problems to begin with.

Historically, the U.S. labor market has been able to weather downturns better than those in the euro area. Thanks to its flexibility it recovered more quickly and avoided many of the long term-increases in the NAIRU (non-accelerating inflation rate of unemployment) seen in the euro area until the 2000s. The rise in U.S. unemployment could become more persistent given the size of the coronavirus shock, however, and raise issues associated with long-term job losses. Short-time work programs, by contrast, smooth the labor market shock more effectively than unemployment insurance even assuming comparable replacement rates – provided the shock is short lived. At the same time, such programs might slow some of the longer-term structural changes that could result from the coronavirus pandemic, and make the economy less flexible, innovative and competitive as a result. The two approaches are clearly very different.

Jobless jump

Unemployment levels and labor market policies, February and June 2020

Sources: BlackRock Investment Institute, U.S. Small Business Association, UK Revenue and Customs, UK Treasury, European Trade Union Confederation, OECD, with data from Haver Analytics, June 2020. Notes: The orange bars in the left chart show the official unemployment rate for the U.S., euro area (EMU4) and UK. The yellow bar represents the estimated proportion of the U.S. workforce on the PPP. We calculate how many workers could be supported by the loans by assuming they are paid an average wage (taken from pre-crisis data) through the eight-week period for which they are eligible for paycheck protection. The green bars show the share of the workforce registered for short time work or furlough programs. The pink bars on the right show the share of pay that is paid by UI in the U.S., and furlough schemes in the euro area and UK. For workers in the U.S. covered by the PPP, the replacement rate is 100%. Those who are then laid off would receive UI benefit at the replacement rate shown by the dark and light pink bar. In the U.S., the additional pandemic top-up payment expires after July but may be extended. The pink bars for the euro area and UK show replacement rates of conventional unemployment insurance.

This global policy revolution was inevitable and is largely going in the direction that we discussed last August. We also stressed at the time that closer coordination between monetary and fiscal policy would be a slippery slope without proper guardrails and a clear exit strategy. The risk now is that we start sliding down that slope. We have crossed the Rubicon in terms of fiscal and monetary policy coordination. Central banks are becoming ever more vulnerable to political interference and pressure as they implement policies that have clear fiscal dimensions. Currently the Fed is implementing credit support policy (as a banker), but the Treasury owns the credit risk (as the ultimate owner of the special purpose vehicle). Who gets to decide when to stop and on what basis?

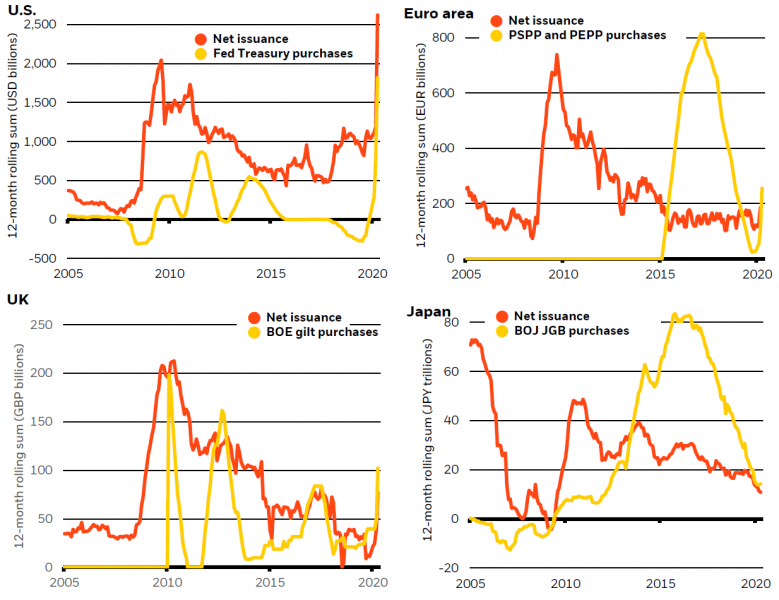

The blurring of the boundaries can be illustrated by comparing net government bond issuance to central bank purchase programs. See the charts below. In the case of Japan, the formal adoption of yield curve control has pushed BOJ purchases well above net issuance in the past few years. The same has happened in the euro area as the ECB has tried to contain sovereign spreads since 2015. Now the Fed has dramatically picked up the pace of its bond purchases to keep up with the Treasury’s net issuance. If purchases climb above net issuance, this could be interpreted as a more deliberate attempt to put a lid on bond yields. Observing a closer correlation between the pace of purchases and the pace of net issuance – as seen in the UK in the past – would be a further indication of boundaries becoming blurred.

Blurring the boundaries

Government bond issuance and central bank bond buying, 2005-2020

Source: BlackRock Investment Institute, ECB, BOE, UK Debt Management Office, Japan Securities Dealers Association, Bank of Japan, US Federal Reserve and the US Bureau of Public Debt., with data from Haver Analytics, June 2020. Notes: These charts show the net issuance of government bonds in the four economies, and the government bond buying programs of the central banks in those economies. In the euro area, the PSPP and PEPP are the ECB’s Public Securities Purchase Programme and the Pandemic Emergency Purchase Programme.

It’s important to have a clear exit strategy. Otherwise, it is not clear how policymakers would put the genie back in the bottle. There a is need for continued monetary policy coordination to avoid an uncontrolled rise in long-term yields. This implies that central banks will absorb new debt issued by governments. This amounts to de-facto debt monetization if it’s done on a large scale and over a long period – even without public entities directly tapping the central bank. Without an exit strategy from the government debt purchases or from yield curve control, it is not clear what check and balance prevents full-blown uncontrolled fiscal spending (for example, Modern Monetary Theory).

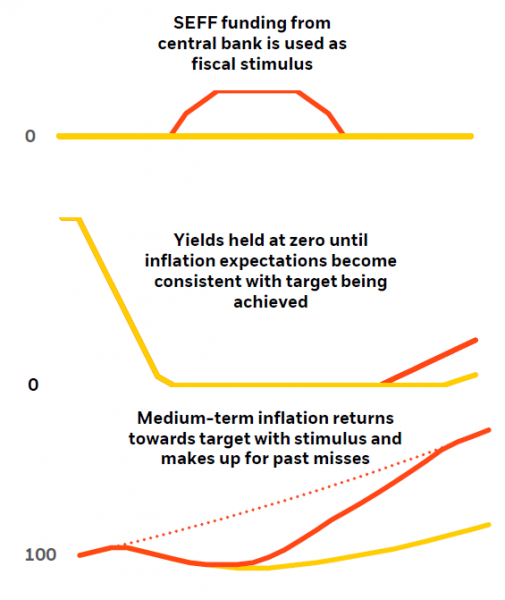

There is a clear need for an institutional framework to enable an exit. We have suggested one that explicitly ties the exit from the joint monetary-fiscal policy effort to the inflation outlook and financial stability assessment. This is what our Standing Emergency Financing Facility (SEFF) – sketched out below – could achieve. It needs an ex-ante commitment from central banks and governments to an institutional framework guiding policy coordination. If this institutional void is not filled, markets could see high inflation outcomes as we did under Fed chairs during the 1970s. Getting inflation under control would require implementing painful policies such as former Fed Chair Paul Volcker’s playbook in the early 1980s: high interest rates to dampen inflation.

These risks could be particularly acute in the in U.S. where the ad-hoc policy coordination is happening at a time when the Fed has become more explicitly part of the political debate and is under overt political pressure. In the UK, the radical shift in the BOE stance on debt monetization in the space of just a few days in April does not convey the impression of a robust policy framework, either.

Many of these policy-related risks can be mitigated if the current shock is only temporary, and the economy and markets quickly return to a more normal environment. But the longer heavy policy lifting lasts, the more the ad-hoc policy coordination will raise fundamental questions about the functioning of financial markets and the distortions from government interventions – and who bears the financial risks in the end. This concerns not only the financial risks associated with monetary policy innovations, but also the corporate bailouts and the accompanying restrictions.

One important investment corollary of the current policy revolution is the potential for an eventual shift in the inflation regime – not now given the near-term deflationary outlook but further down the road. A change in the central bank reaction function on the back of blurred boundaries between monetary and fiscal policy could create a greater inflationary bias and an upward shift in inflation expectations. Even if consumer price inflation does not react much to changes in capacity utilization or the unemployment rate, it is important to recognize that inflation expectations are a separate driver of inflation in their own right – and can become self-fulfilling.

Deficit spending, deglobalization and reregulation could all contribute to higher costs once the initial deflationary shock from the giant demand shortfall dissipates. This could translate into higher consumer price inflation. In the near-term, the downside risks to the inflation outlook are likely to dominate as the size of the negative demand shock – with consumers taking time to feel safe enough to return to shops or to leisure activities depending on new virus cases – may outweigh the negative supply shock. This means some slack will open-up on the back of the collapse in activity. Median growth forecasts from Reuters imply that it could take a few years to close the output gap. Absorbing higher costs in already squeezed profit margins becomes increasingly difficult. Output prices will likely be raised as a result.

Over the medium-term, permanent damage to production could cause inflation pressure to build earlier in the cycle than otherwise. High debt levels and implicit yield curve controls to maintain debt stability might force monetary policy to become more tolerant of inflation, potentially causing inflation expectations to become unanchored.

In action

Stylized impact of SEFF on yields and prices

Sources: BlackRock Investment Institute, August 2019. Notes: These stylized charts show the hypothetical impact of a temporary increase in fiscal stimulus financed by the central bank, as reflected in the SEFF funding (red line in top chart). The other red lines show the impact on the inflation trend relative to the inflation target (dotted line on bottom chart) and on the long-term sovereign bond yield (middle chart). The yellow lines show the hypothetical outcome if there is no stimulus. For illustrative purposes only. There is no guarantee that any forecasts made will come to pass.

We are watching several signposts for assessing the risk asset outlook during the coronavirus shock. First is how successful countries are at restarting activity and reducing social costs of the lockdown while controlling the virus spread. Second is how the joint fiscal-monetary policy is being delivered through successful and timely policy execution – especially for go-direct policies that put money into hands of entities that need help bridging cash flow shortfalls. Third is tracking whether cracks are appearing on the balance sheets of cash-constrained entities while keeping an eye on financial market functioning and plumbing.

We see policy execution risks cropping up in different places. The euro area is one. The German constitutional court decision requiring the ECB or the Bundesbank to justify its government bond purchases to the German government served as a cautionary tale of how execution can potentially be scuppered. This ruling threatened the independence of the ECB – and renewed financial fragmentation within the euro area. The ECB responded to the court and the matter seems settled for now – but we could see further challenges to the more flexible PEPP. The ruling could have put a wrench into the works of the ECB’s “whatever it takes” commitment at a time when effective policy execution was critical to safeguard the economy against damages from the coronavirus shock.

The ruling, which had immediate consequences for the ECB’s monetary policy, has led the European Union’s top court to state that it alone has the power to rule on whether EU bodies are in breach of the bloc’s rules. The dispute is partly a consequence of the blurring of boundaries between monetary and fiscal policies – and particularly problematic in the euro area due to the lack of a joint fiscal authority. The creation of a joint European debt management agency or the creation of so-called eurobonds, issued under the liability of all member states, would require a change in the European Treaty. This would trigger referendums in some countries and remains a controversial issue.

The €750 billion European recovery fund is a step in the right direction toward a common policy response by the EU to the coronavirus crisis. More evolutionary than revolutionary, it is significant for four reasons. First, the funds are intended as grants to member states hit hardest by the crisis, similar to funds distributed by the European Commission to the poorer euro area nations. Second, the overall amount at around 5% of EU GDP is meaningful on its own. Together with the measures agreed at the April EU Summit, the EU policy response announced this year now totals more than €1 trillion. Third, the additional spending is financed via the EU budget, and debt is issued under the standard EU mechanism – helping create a sizable „safe“ asset under the EU. As a result, it does not count towards national debt levels. Fourth, up to 50% of the newly issued debt could be purchased by the ECB under current rules, giving the ECB extra room to manoeuvre.

Policy fatigue is a risk. This is most acute in the U.S., where fiscal support has been delivered via discretionary programs rather than through automatic stabilizers associated with the euro area’s welfare. This means the support can be turned off abruptly – as occurred with the lapse in supplemental unemployment insurance payments. The debate in the U.S. on extending and expanding support for unemployed workers, disrupted businesses, and states and localities has so far succumbed to partisan politics before the November election, though there is still a small possibility of a deal to provide another tranche of aid.

Europe faces its own problems. Both Italy and Spain are governed by potentially unstable coalition governments. Germany’s Merkel oversees a weak coalition and is still planning to step aside. France’s Macron has lost his outright majority in parliament due to defecting lawmakers. And populism remains a potent force in many countries, helping exacerbate a drift toward European fragmentation and geopolitical tensions such as those between the U.S. and China. See the European fragmentation and U.S.-China relations risks on the BlackRock geopolitical risk dashboard.

BlackRock disclosure

This material is reprinted with permission of BlackRock. This material is intended for professional and institutional clients only. The opinions expressed in this reprint are not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

The opinions expressed are as of October 2020 and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. You can access the original article here.

Capital at risk: The value of investments and the income from them can fall as well as rise and are not guaranteed. The investor may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

©2020 BlackRock, Inc. All Rights Reserved. BlackRock® is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

This Policy Note is a partly updated version of „Policy revolution“, BlackRock’s macro and market perspectives issued in June 2020. Please see the disclosure below the article.

Elga Bartsch – Head of Macro Research, BlackRock Investment Institute

Jean Boivin – Head of BlackRock Investment Institute

Stanley Fischer – Senior Advisor, BlackRock

Philipp Hildebrand – Vice Chairman, BlackRock