This note discusses the findings of a global survey of 149 leading academic researchers on bank capital regulation. The median (average) respondent prefers a 10% (15%) minimum non-risk-weighted equity-to-assets ratio, which is considerably higher than the current requirement. North Americans prefer a significantly higher equity-to-assets ratio than Europeans. We find substantial support for the new forms of regulation introduced in Basel III. The best predictor of capital requirement preference is how strongly an expert believes that higher capital requirements would increase the cost of bank lending.

In spite of sweeping regulatory reforms in banking after the Global Financial Crisis of 2007-2009, many key questions, including the optimal level of bank capital, are still debated in the literature.2 Moreover, there have been a number of notable initiatives from researchers to fundamentally change bank capital regulation (see e.g. Admati and Helwig 2013) but it is unclear how commonly these views are shared within the academic community. At this juncture, it is important to ask what have we learned from recent research regarding the current state of bank capital regulation? Which issues in bank capital regulation enjoy relatively strong consensus vis-à-vis those subject to considerable disagreement? How should these research results translate into actual regulation?

In a recent study we have surveyed leading academic researchers in banking and finance and macro-finance worldwide on their views on bank capital regulations to address these questions (Ambrocio et al. 2020). Although surveys of the literature have been recently conducted (cf. Dagher et al., 2016; BCBS, 2019a), this is the first time to the best of our knowledge that academic experts exclusively have been directly surveyed on bank regulation. We invited 1,383 academic experts to participate in the survey in the first quarter of 2019, of which 149 responded, translating to a response rate of approximately 11%, which is comparable with many methodologically similar studies.3

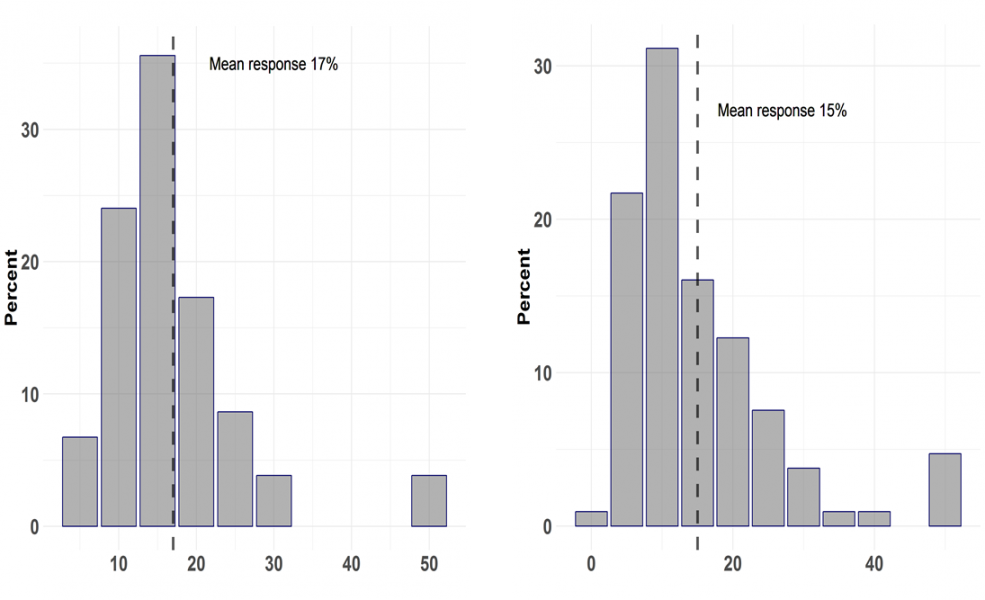

The respondents support the current overall regulatory design but are much stricter regarding the level of banks’ minimum capital requirements, particularly the non-risk-weighted equity-to-assets ratio (i.e., the “leverage ratio” requirement), which the initial Basel III recommendation sets at 3% (see Figure 1). According to the average response, banks should have approximately a minimum of 15% of common equity in relation to their total assets at all times. The median response is somewhat lower, 10%. A considerable number of respondents prefer even much higher levels of bank capital.

Interestingly, there is a significant difference between North-American respondents who on average prefer an 18% minimum equity-to-assets ratio and Europeans who on average prefer 13%. The response distribution concerning the risk-weighted minimum capital requirement is broadly similar, and the average response is remarkably close to that for the leverage ratio requirement (see Figure 1).

Figure 1. Distributions of the preferred minimum capital requirements; common equity to risk-weighted assets (left panel) and common equity to total assets, i.e., the leverage ratio requirement (right panel)

Respondents were asked to answer the following questions, part a) referring to the leverage ratio requirement and part b) to the risk-weighted requirement: “What approximate values of the following capital ratios (in terms of book value equity and in percent) is closest to your view of the level of capital that all banks should have as a minimum at all times: a) common equity to total assets b) common equity to risk-weighted assets? Possible values for the responses were limited to the range from 0% to 50% in 5 percentage point increments (e.g. 0%, 5%, 10%, 15%, etc.). The highest possible response value of 50% means 50% or higher. Mean responses in the figures are rounded to the closest integer.

The average view regarding the desirable level of bank minimum capital is not likely to be significantly affected by potential sample selection biases such as respondents’ age (the sample is quite balanced in this regard) or the strictness of their views regarding bank regulation relative to peers (there is a slight skew towards stricter respondents). A respondent’s view on the effect of capital requirements on the cost of bank lending is the most robust predictor of her preferred level of minimum capital requirements.

The majority of respondents approves of the new elements in banking regulation introduced in the Basel III reform after the Global Financial Crisis. In addition to the leverage ratio requirement, a clear majority approves of an extra capital charge on the largest, systemically important banks, a counter-cyclical component to capital requirements, and additional liquidity requirements. Somewhat weaker approval was given also to the eligibility of hybrid and bail-inable securities in fulfilling the minimum capital requirements. Notably, most respondents would favor an additional market-based capital requirement to complement the current book value-based capital requirements on banks.

In the rest of this note, we first discuss the motivation of the survey and then discuss further results that might help understand respondents’ preferences concerning the level of minimum capital requirements.

The survey approach to studying bank capital requirements can be motivated from several perspectives. First, a survey of academic experts who can be expected to be familiar with the literature but may also draw different conclusions from it, using their expert judgment, provides a complementary way of drawing together results from the literature and forming a balanced view of them. Moreover, the distribution of responses to specific questions provides information of what are the issues of bank regulation of which there is relatively high consensus vs disagreement.

Second, the economic mechanisms that determine the optimal level of bank capital requirements are subject to major modelling challenges. The optimum essentially depends on a trade-off between reducing the likelihood and social costs of banking crises while possibly restricting credit and hence short-term economic growth (cf. e.g. Aikman et al 2018).

Ideally, this question might be studied in a sufficiently realistic macroeconomic model which incorporates the possibility of a large-scale banking crisis with potentially prolonged economic consequences. The model would have to include mechanisms of how banks and bank lending contribute to economic growth, and how both of these are affected by bank capital structure. Although important steps have been taken in the recent literature, macroeconomic models are still struggling with incorporating many central aspects such as highly nonlinear effects of crises and their possibly protracted aftermaths as well as the choice of appropriate welfare criteria. Therefore, a survey of experts on the key question of optimal level of bank capital requirements provides judgement-based information that is supplemental to the current generation of formal models.

To address the survey to academic experts is motivated by the fact that political economy related factors may play a role when agreements on bank capital requirements are negotiated and assessments made of the current state of bank regulation. Even if bank regulators are well-informed of research-based evidence, the actual agreements on bank regulations may well be affected by the interests of various stakeholders such as the banking industry. Therefore, when the research question focuses on the optimal design and level of bank capital requirements vis-à-vis the actual requirements, surveying academic experts that are arguably the most impartial group of experts on the issue can be informative. In the survey we ask about the respondents’ experience (in years) in the academia as well as in the private and the public sector, which partly allows us to assess the neutrality of their views.

The selection of respondents is intended to reach as many as possible of the leading academic researchers and experts on issues of bank capital regulation.4 The survey was conducted anonymously in order to facilitate truth-telling and raise the likelihood of participation as providing full anonymity eliminates any reputational risks that participation might otherwise bring about.

The survey was launched online on 14 February 2019, and concluded on 10 March 2019. We sent invitations to 1,383 academic researchers and 149 of them replied. The first “wave” of 1,045 experts were invited to participate in the survey on 14 February 2019. Reminders were sent on 25 February and 8 March. To secure a sufficient number of responses, an additional 338 experts were invited on 25 February and were also sent a reminder on 8 March.

The survey questionnaire focused on three key aspects. Firstly, the effects of bank capital requirements; secondly, how much capital banks should have at the minimum; and thirdly, the design of regulatory requirements. We asked about the background factors of respondents such as gender, region of residence, and areas of expertise.

We also included questions regarding general views of the current state of bank regulation and resilience of the financial system. The full set of questions and response distributions are available online.5

Most respondents, 93%, currently reside in either North America or Europe. Only 11% of respondents are female. Roughly 40% of respondents identify themselves as experts while the rest consider themselves either “knowledgeable” or “aware” of issues in banking regulation. There are somewhat more respondents who specialize in banking and finance (54%) relative to those who identify themselves with macro-finance (38%). About 60% of respondents have some experience in the public sector while roughly half have some experience in the private sector. Virtually everyone (97%) has experience from the academe, and the great majority has a 15-35 year experience, with a fairly uniform distribution within that range (see Ambrocio et al. 2019, figure 2).

Table 1 gives a breakdown of the average and median preference for the minimum leverage ratio requirement and risk-weighted capital requirement by groups. Regarding gender, contrary to the hypothesis that female respondents are more risk-averse and may hence prefer higher capital ratios, there is not much difference in the average or median views across gender groups and female respondents even prefer somewhat lower capital ratios than male respondents. The only difference that appears robust is that North-American respondents prefer a higher minimum leverage ratio requirement than Europeans.

Table 1. Preferred minimum capital ratio preferences by groups

|

|

Leverage ratio requirement (%) |

Risk-weighted requirement (%) |

|||

| Group |

Subgroup |

Mean |

Median |

Mean |

Median |

| Gender |

Female |

13.8 |

10 |

13.3 |

15 |

|

Male |

14.9 |

10 |

16.9 |

15 |

|

| Region |

North America |

17.6 |

15 |

18.3 |

15 |

|

Europe |

12.6 |

10 |

15.8 |

15 |

|

| Field |

Banking and finance |

14.0 |

10 |

16.8 |

15 |

|

Macro-finance |

16.7 |

15 |

17.0 |

15 |

|

| Self-assessment |

Expert |

14.4 |

10 |

18.3 |

15 |

|

Knowledgeable |

15.8 |

15 |

15.9 |

15 |

|

|

Aware |

17.1 |

15 |

15.6 |

15 |

|

Respondents were asked to answer the following questions, part a) referring to the leverage ratio requirement and part b) to the risk-weighted requirement: What approximate values of the following capital ratios (in terms of book value equity and in percent) is closest to your view of the level of capital that all banks should have as a minimum at all times: a) common equity to total assets b) common equity to risk-weighted assets? Possible values for the responses were limited to the range from 0% to 50% in 5 percentage point increments (e.g. 0%, 5%, 10%, 15%, etc.). The highest possible response value of 50% means 50% or higher.

A potential explanation is that accounting differences in the EU and the US concerning netting rules make the reported US leverage ratios effectively lower than the European ones (see Wall 2017). To target the same level of restricting bank leverage, US-based respondents (as arguably the dominant subgroup within North American respondents) would hence prefer a seemingly higher leverage ratio requirement than European respondents.

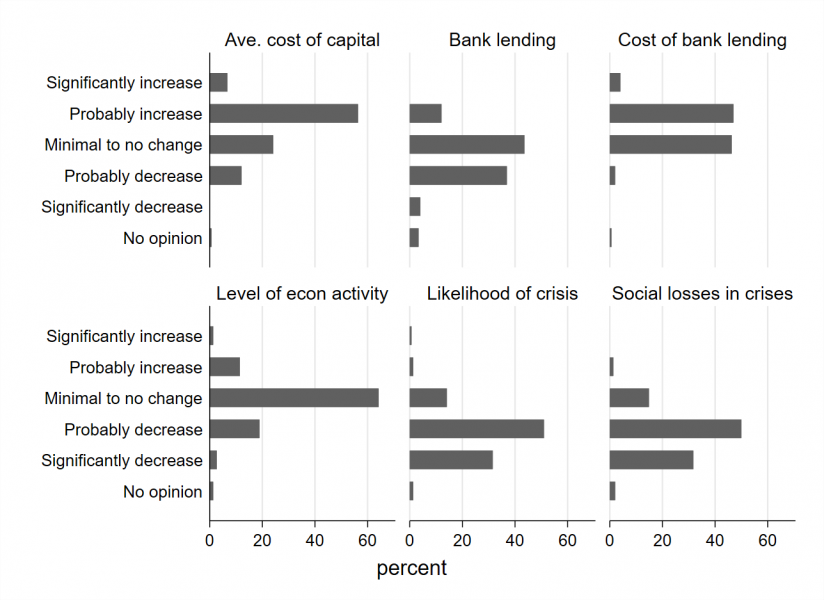

Figure 2. Breakdown of responses regarding the effects of higher capital requirements

Respondents answered the following questions: How are the following likely to be different (in the steady state) if capital requirements were higher by approximately 5 percentage points across the board and relative to Basel III recommendations: i) the weighted average cost of capital to the bank (upper left panel), ii) the provision of bank lending (upper middle panel), iii) the cost of bank lending (upper right panel), iv) the level of economic activity (lower left panel), v) the likelihood of banking crises (lower middle panel), and vi) the social losses incurred in the event of a banking crises?

Figure 2 provides a breakdown of responses to the questions on the effects of higher capital requirements. Each of these questions takes the following form: “How are the following (outcomes) likely to be different in the steady state if capital requirements were higher by approximately 5 percentage points across the board and relative to Basel III recommendations?” The outcomes asked about are “likelihood of crises”, “social cost of crises”, “provision of bank lending”, “cost of bank lending”, “economic activity”, and “weighted-average cost of bank capital”.

Responses to these questions suggest the following interpretation of our results. The average respondent prefers a relatively high capital requirement for banks (relative to the current regulatory standards) because she believes that marginal benefits of increased requirements would outweigh their marginal costs. In particular, she believes that higher requirements would probably decrease the likelihood and social costs of a crisis while having a minimal to no impact to the level of economic activity. Although she believes that the higher requirements would probably somewhat increase the weighted-average cost of bank capital and (hence) the cost of bank lending, there would only be a minimal to no change in the provision of bank lending (and hence economic activity).6

We have conducted a survey of 149 academic experts world-wide on their views on bank capital requirements and related bank regulations. As a central result we find that the average respondent prefers a considerably higher minimum leverage ratio requirement than the current norm. Hence there appears to be willingness to a rather radical overhaul of the current bank capital regulations among academics.

The high dispersion of expert views on preferred bank capital ratios indicates that considerable uncertainty may be present concerning banks’ optimal minimum capital levels. The range of optimal bank capital ratios supported by the respondents seems to be even wider than the range obtained from the research literature. One possible interpretation of this is that there are doubts among experts of whether the current empirical and theoretical modelling approaches can capture all relevant trade-offs that are needed to quantify the optimal level of bank capital requirements.

Admati, A and M Hellwig (2013), The Banker’s New Clothes: What’s Wrong with Banking and What to Do about It, 1st ed, Princeton University Press.

Aikman, D., A.G. Haldane, M. Hinterschweiger. S. Kapadia, 2018. “Rethinking financial stability”, Bank of England Staff Working Paper No. 712.

Ambrocio, G., I. Hasan, E. Jokivuolle, K. Ristolainen, 2019. Bank of Finland survey on bank capital requirements: Preliminary results. Retrieved from https://www.suomenpankki.fi/globalassets/en/research/bank-capital-survey/bofbankcapitalsurvey_report.pdf

Ambrocio, G., I. Hasan, E. Jokivuolle, K. Ristolainen, 2020. Are bank capital requirements optimally set? Evidence from researchers’ views. Forthcoming in the Journal of Financial Stability (available at https://doi.org/10.1016/j.jfs.2020.100772).

BCBS, 2019a. The costs and benefits of bank capital – a review of the literature. BIS Working Paper 37.

Dagher, J., Dell’Ariccia, G., Laeven, L., Ratnovski, L., Tong, H., 2016. Benefits and costs of bank capital. IMF Staff Discussion Note 16-04.

Freixas, X, L Laeven and J-L Peydro (2015), Systemic Risk, Crises, and Macroprudential Regulation, MIT Press.

Kashyap, A, J Stein and S Hanson, 2011. A Macroprudential Approach to Financial Regulation, Journal of Economic Perspectives 25(11), 3–28.

Wall, L.D. (2017), “Post-crisis changes in US bank prudential regulation” in Preparing for the Next Financial Crisis. Policies, Tools and Models (ed. Jokivuolle, E. and R. Tunaru), Cambridge University Press.

A forthcoming article in the Journal of Financial Stability under the same title (Ambrocio et al. 2020) is available at https://doi.org/10.1016/j.jfs.2020.100772.

See e.g. Kashyap et al. (2011), Admati and Hellwig (2013), and Freixas et al. (2015) for overviews of the literature.

The survey questionnaire was pre-tested on a limited sub-group of experts and was designed under the guidance of an Advisory Board (Mark Flannery, Seppo Honkapohja, Bill Kerr, Thomas Gehrig, Philip Molyneux, Steven Ongena, George Pennacchi, and Tuomas Välimäki).

The sample was mainly based on the top 10 % authors in relevant fields from IDEAS/RePEc, and manually checked for possible omissions as some researchers may not have an IDEAS/RePEc account.

The structure of this trade-off to determine the optimal capital requirements for banks is broadly in line with those discussed e.g. in Aikman et al. (2018) and Dagher et al. (2016).