The programmable euro is an important innovation to secure Europe’s long-term competitiveness in the global economy. Europe needs to act swiftly and decisively since Asian and US initiatives such as the digital Renminbi or Libra threaten to pre-empt European projects. A programmable euro needs to take account of the different requirements that a payment system in an advanced economy has to meet. These requirements are defined by the differing needs of individual user groups. For the vast majority of payment transactions, private-sector solutions – especially those provided by the banking industry – should be able to satisfy these needs of the users. Nevertheless, a European currency area that can be competitive and sovereign in the long term also requires CBDC in the form of a programmable euro issued by the ECB.

The announcement by the Libra Association in June 2019 that it would issue a private cryptocurrency with a global reach in the foreseeable future provided an important impetus to the discussion about the future of payments. During the months that followed, the Libra Association accepted the criticism of its plan and completely revised it within nine months. With the “new” Libra white paper, published on 16 April 2020, the probability of the Libra Association starting to issue a programmable euro, dollar, pound sterling and other currencies has increased fundamentally.

But the Libra project is not the only one of its kind. Numerous parallel initiatives surrounding the issue of “digital currency” can be observed around the world. A few weeks ago, the Chinese central bank launched a pilot project for a digital renminbi in several Chinese metropolises. Simultaneously, countries such as Sweden, Great Britain, Canada and South Korea are working intensively on the introduction of a central bank digital currency (CBDC). And German Finance Minister Olaf Scholz is backing “innovative European responses” to projects such as Libra. The innovative aspects of all these initiatives essentially focus on two elements: first, stablecoins2 are to be created and used as new additional private-sector forms of money. Second, money is to be given a previously unknown quality: it is to become programmable. Programmable means that digital means of payment are combined with smart contracts. The latter allow the money to be integrated into digitalised value-added processes, enabling money to be clearly allocated to individual process steps, where payment can be fully automated.

The discussion following the publication of the first Libra white paper revealed that there are a number of issues surrounding the nature of this new form of money, the future demand and the question of the issuer. To clarify the issues involved, a distinction needs to be made between the following three levels.

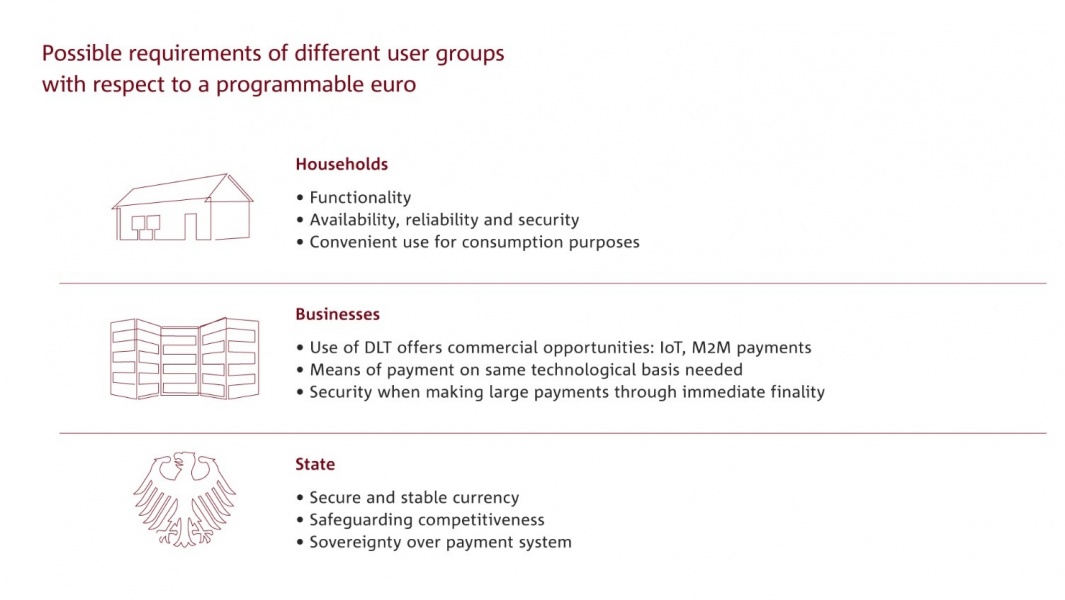

A prerequisite for the successful implementation of a future payments strategy is an accurate forecast of the future needs of different user groups. It is difficult to make such a forecast because of the problem of reliably predicting the development of a new technology and its impact on households, businesses, banks and the stability of the financial system. In the complex economies of industrialised countries, moreover, there are no uniform expectations of what a payment system is supposed to be capable of. The needs of different user groups are simply not identical.

Competitive disadvantages for European companies would be particularly likely if a programmable euro in the form of CBDC were introduced later than digital forms of other reserve currencies. Possible efficiency gains by other economies as a result of the earlier use of programmable money in local value-added processes could create macroeconomic competitive advantages that European businesses could not compensate for in the short to medium term. Without a programmable euro issued by the ECB, Europe could fall behind its international competitors.

The differing needs of different economic entities thus produce a somewhat heterogeneous picture. Although the demand for programmable money is likely to increase, CBDC will initially – as things stand today – rarely be really necessary from a user’s perspective. If it is only the functionality of a stablecoin that is desired, private-sector solutions are likely to be able to satisfy these needs. State institutions will nevertheless have to consider the possible impact on competitiveness of the introduction of a digital renminbi or Libra 2.0, for example.

Deutsche Bundesbank has repeatedly argued that the banking industry itself should offer payment solutions to satisfy new customer requirements. DLT has an especially important role to play in this context. Banks are thus called on to create a programmable euro.

Opportunities and risks of private-sector solutions

Processing payment transactions in Germany and Europe is indeed the most basic field of activity for banks and payment service providers. There is therefore no reason not to assume that private-sector solutions will also dominate the processing of payments in the future.

To enable broad acceptance of the means of payment, however, pressure to innovate and competition should not be allowed to stand in the way of the cooperation in the banking sector needed for this purpose. The natural tension between competition and cooperation must therefore once again be overcome in the interests of establishing a uniform, privately supplied digital euro in the banking sector.

But there are also risks associated with a solution developed exclusively by the private sector. Though it is true that there is probably greater technological expertise in the private sector, confidence in a currency depends first and foremost on the state monetary order and not least on the independence of the central bank. While independent central banks enjoy great confidence among broad sections of the population, a programmable euro developed by the private sector is likely to give rise, at least initially, to a number of proprietary and thus fragmented solutions. Although the market will consolidate over time, there is no guarantee that a generally accepted programmable euro will emerge from the competitive process. If there are also differences in the quality of the various private sector solutions, the overall reputation of the currency could be damaged.

In short, competition between different proprietary models of a programmable euro would only lead to incomplete interoperability between the various forms of money. But without the attribute of a generally accepted medium of exchange, an essential advantage of money disappears. A programmable euro issued along these lines would then be difficult to use as a unit of account, which would impose high transaction costs on economic exchange and make it less attractive.

This highlights the fact that private-sector solutions also carry a high investment risk that only very financially strong firms are willing to bear or that has to be backed by venture capital. A consortium or cooperation of several market participants could solve this dilemma.

With all this in mind, it is therefore clear that banks will have to overcome numerous hurdles before they are in a position to make available a programmable euro.

A programmable euro of the banking sector (bank money token)

Banks could create a private-sector solution for a programmable euro by transferring the existing bank money network to DLT. This is already technically feasible, but successful implementation requires both agreement on a DLT technology accepted by all parties involved and consensus on the joint development of a standard. Otherwise, interoperability can only be achieved by means of complex technological solutions, which would severely restrict acceptance.

Such a bank money token would not immediately be used for all purposes or for all customers. It could initially be used in securities settlement or in the area of machine-to-machine payment (IoT), where there is likely to be immediate demand, and gradually spread from there. But this kind of token would also have the potential to compete with solutions such as Libra, provided that market participants overcame obstacles to interoperability.

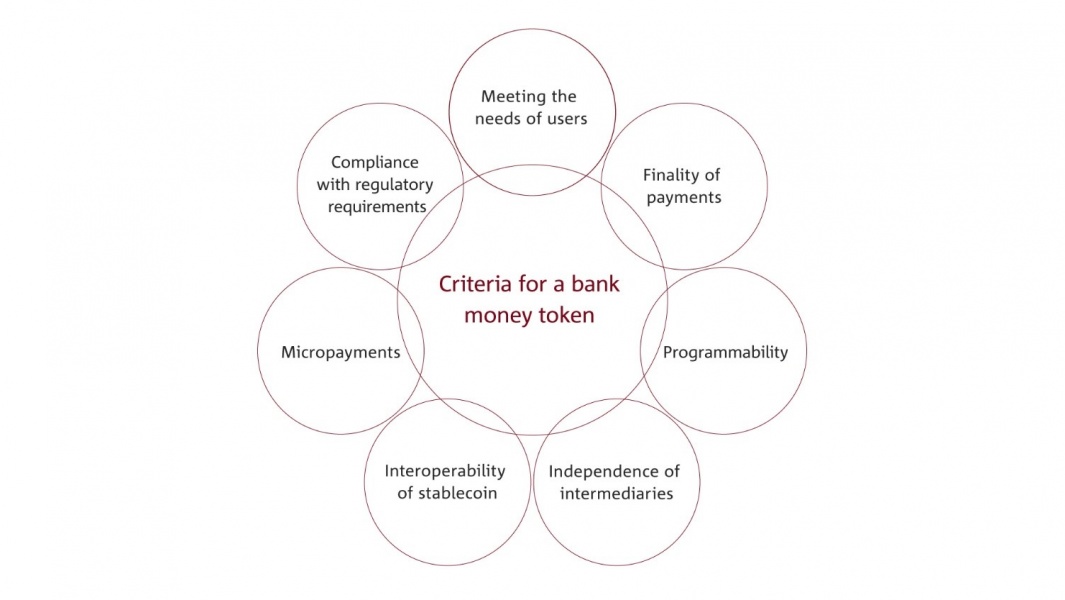

A digital euro issued by commercial banks needs to meet seven key criteria that cannot, or cannot fully, be met by a solution based on accounts and instant payment.

The technological challenges to issuing a bank money token, particularly that of ensuring interoperability, will not be easy to overcome. This is mainly because collaboration between individual institutions in the financial services sector is characterised by a tension between competition and cooperation. The European market is highly fragmented and diverse. As a result, joint initiatives are often protracted affairs and therefore slow and inflexible.

This stands in the way of a programmable euro that can address the demands of digital transformation and compete with US and Asian solutions. Policymakers and central banks are thus called on to provide significant support for the implementation process by enabling all parties involved – above all across industries – to exchange information on specific needs and set an implementation agenda.

A programmable euro outside the banking sector

Not only banks, but also fintechs and bigtechs are considering the introduction of a euro-denominated stablecoin. All projects want to exploit the advantages of DLT, such as speed and decentralisation, but each is taking its own individual approach. As a result, none of the projects can themselves fulfil the requirements of an interoperable means of payment – with the exception of Libra due to the sheer market power of the consortium behind it.

Apart from Libra, several other non-banking providers are campaigning for “self-sovereignty” and “openness” in banking. While Libra’s objective initially seemed geared to the B2C sector and is now focusing more on B2B, other projects have had their eye on the B2B sector from the outset. All have the goal of reducing settlement time to a minimum and curtailing the settlement process in order to save costs. Reducing settlement time and eliminating intermediaries will make cross-border payments easier and less expensive than they are today.3 High expectations are also placed in the idea of bringing currently fragmented business solutions for processes such as settlement, clearing or messaging to a single DLT platform. A newly created interoperability of this kind would enable broad automation using smart contracts.

From the banks’ point of view, the introduction of a CBDC would represent serious, but ultimately unavoidable, interference in the existing monetary order. Precisely how serious depends on a number of decisions concerning the technical design of the CBDC and on how attractive CBDC would be to users. The primary technical question is whether CBDC should be created in a traditional account-based form or in the form of a digital token. The next step would be for the central bank to decide whether or not to use DLT. Further decisions would then have to be made on whether or not CBDC should be interest-bearing and programmable.

Each of these decisions will lead to different forms of CBDC with different characteristics. As far as the impact on the monetary system is concerned, however, two of them will be key. First, it must be decided whether CBDC should only be available to banks and other financial institutions or whether CBDC should be a new form of money for all citizens. If the vote is in favour of a “CBDC for all”, a second decision will be needed on whether the central bank should distribute and administer the new form of money itself or whether this should be done through banks and financial service providers.

Many publications have already discussed all possible variations in detail. The quintessence of these discussions is above all that there will be no single form of CBDC – not just because different decision paths through the technological options will lead to different forms of CBDC, but also because different central banks pursue different objectives. CBDC in the Bahamas, for example, where financial inclusion of the population is the primary objective, is understandably different to CBDC in Sweden, where the e-krona is intended to give citizens access to central bank money without cash.

CBDC in the view of the private banks

The private banks in Germany consider the current banking system consisting of commercial banks and their central bank, with commercial banks having privileged access to central bank money, to be a cornerstone of the economic order and an important prerequisite for the efficient financing of the economy in Germany and Europe. To safeguard this efficiency, the introduction of an additional form of central bank money – CBDC – should disrupt the existing monetary order as little as necessary. In consequence, a future CBDC should be issued in the same way as cash and central bank funds today, namely solely in exchange for or against the lending of securities eligible for central bank borrowing. The basic money supply would hardly change, it would merely be divided among three kinds of central bank money.

Even under this approach, changes for the banking sector could naturally not be avoided. This becomes clear if we imagine a combination of CBDC and cash as a single form of central bank money available to the end customer. The introduction of CBDC would lead to an increase in the amount of cash in circulation in the economy and to a proportionate reduction in the deposits of non-banks at banks. Banks would thus have to make available a larger amount of their securities or liquidity for “cash”. How large this amount could be without affecting the rest of banking business is a question that cannot be answered at present. This also goes for the question of how to manage the volume of CBDC.

Impact on banks

A certain degree of disintermediation will be virtually unavoidable after the introduction of CBDC. But the overall impact on the German banking sector, especially the likely changes to banking and banks’ earnings, can at best be only roughly estimated as things stand since too many unknown variables have to be considered.

What is almost certain is that CBDC will, metaphorically speaking, increase the proportion of cash in circulation. The share of “historic” cash is likely to decrease and with it withdrawals from ATMs, as well as, in parallel, the volume of credit transfers and the use of credit cards and the German payment card girocard. Banks’ corporate clients, at least, are likely to have an interest in a form of money that offers greater security than bank money.

Unless banks take countermeasures, deposit accounts at banks will consequently shrink. To what extent this happens will depend on how attractive CBDC is compared to bank money and other forms of payment, on whether there will be restrictions on exchanging bank money for CBDC and on what countermeasures are taken by banks. We describe below three examples of areas where CBDC will exert pressure for change and where banks and economic policymakers will be forced to respond.

To assess the influence of CBDC on banks’ earnings, assumptions would have to be made both about the relative costs of the various refinancing options and about the development of revenue streams. It is not possible to extrapolate the current situation to a world with CBDC – in terms, for instance, of the relative cost of different forms of refinancing – since CBDC will lead to a change in the relative prices between, for example, deposits and bank bonds.

The impact on banks will naturally also depend on their response. They will doubtless not stand idly by and watch the outflow of deposits but will try to improve the attractiveness of these compared to CBDC. In what form and to what extent this happens will depend in turn on the costs relative to other forms of refinancing and naturally also on whether banks are able to develop additional services associated with the new form of money and offer them to their customers. It will therefore be crucial to maintain the attractiveness to customers of banks as a contact point for financial services even in a world with CBDC.

And even if refinancing actually does become more expensive for banks, this will not in itself determine whether the increase in costs is ultimately borne by the bank or – in the form of higher charges or higher lending rates, for instance – by its customers. This will depend primarily on the market environment and competitive situation. It is therefore quite conceivable, for example, that the consolidation process in the German banking industry could be further accelerated by CBDC.

The provision of a modern, efficient and secure payments system is one of the basic tasks of the banking industry. The private banking industry has recognised the need for a programmable euro but faces considerable challenges when it comes to its implementation. Yet the necessary cooperation within the industry and between the three “pillars” of the German banking system (private, savings and cooperative banks) is hampered not only by competition between banks but also to a large extent by competition policy, which tends to systematically underestimate the role of digitalisation when defining the relevant market. The market power of a US bigtech is too great to be challenged by a single supplier. We therefore call on policymakers to provide coordinating support for the creation of a European standard for a private-sector programmable euro.

A European currency area that can be competitive in the long term without doubt also requires CBDC in the form of a programmable euro issued by the ECB. The private banks believe that, not least in the interests of supporting the aspects mentioned above, the following four points should be taken into account.

No time should be lost in meeting the challenges outlined above. For this reason, rapid political intervention is required. The introduction of a programmable euro cannot be the task of the banking industry or the ECB alone. A process must be defined for introducing a programmable euro without delay. At European level, responsibility will lie with the European Commission. At national level, it will be up to the Federal Chancellery to act as a coordinating body to ensure a cross-industry perspective. The initial objectives in the coming months should be

After publishing two position papers in 2019 (“Facebook’s cryptocurrency Libra – questions and answers” https://bankenverband.de/media/files/190704_BDB_Libra_en.pdf and “Beyond Libra: why the economy needs a digital euro” https://en.bankenverband.de/newsroom/comments/programmable-digital-euro/) the Association of German Banks intends to make a further contribution to the debate with its current position paper (https://en.bankenverband.de/newsroom/comments/europe-answer-libra/).

Financial Stability Board (FSB): stablecoins are crypto-assets or, in a broader sense, digital assets. Stablecoins have a fixed value in relation to a specific individual asset or basket of assets.

The FSB is working on a central proposal in the context of the G20 (https://www.fsb.org/wp-content/uploads/P090420-1.pdf )