The paper summarizes results from three representative surveys in Austria about ownership and intended ownership of crypto assets. About 1.6% of Austrians own crypto-assets. Owners are younger, more likely to be male, more tech-affine, have higher financial knowledge and are more risk-tolerant than non-owners. Plans to purchase are strongly related to profit expectations and beliefs that crypto-assets offer advantages for payments. Perceptions of high volatility or the risk of fraud and online theft dampen the demand for crypto-assets. Overall, our results suggest that demand for crypto-assets can to a considerable extent be attributed to a profit motive. Distrust in banks or in conventional currencies is not found to be a decisive factor for (intended) ownership.

Over the past years, significant attention has been devoted to crypto-assets, like Bitcoin or Ethereum.3 Against the backdrop of claims that crypto-assets could replace conventional money as a means of payment or could serve as a new safe haven asset, it is important to observe the actual dissemination of crypto-assets among the broad public and to study the motives of consumers who are already invested or who intend to invest.

This paper aims to shed light on these issues. Specifically, we aim to provide answers on four questions: What share of the population has bought crypto-assets? Are persons who are invested in crypto-assets aware of the involved risks? To what extent does trust in institutions or in conventional money play a role for the demand for crypto-assets? Which motives drive non-owners to consider adopting crypto-assets – to make purchases, to store value or to speculate? Answer to these questions are important for consumer protection and financial regulation (Auer and Claessens 2018; Chapman and Wilkins 2019; Nelson 2018). They are also informative for assessing the future course of demand for crypto-assets.

The paper reports results from three representative surveys that have been conducted in Austria in spring and fall 2018 as well as in fall 2019. Stix (2019) provides a detailed analysis of the results from the first two surveys and conducts conditional analyses. In this paper, we update this analysis by adding data from a new survey from fall 2019 and we summarize the main findings in a descriptive way. As the addition of the third survey does not affect the findings of Stix (2019) qualitatively, this paper can therefore also be seen as a non-technical summary of the earlier full length article.

Overall, the survey results from Austria suggest a low dissemination of crypto-assets among the population with just 1.6% – averaged over all three survey waves – of Austrians aged 14 or more possessing crypto-assets. Owners of crypto-assets are more likely to hold (other) risky financial assets than non-owners, they are more willing to accept financial risks, they have more genuine interest in new technologies. Moreover, we find that owners are more likely to express a distrust in banks and to have concerns about medium-term price stability.

We also analyze purchase intentions (i.e. potential demand) among current non-owners.4 Non-owners who intend to adopt differ from non-owners who do not intend to adopt by only a few socio-economic characteristics: potential adopters are younger and are more willing to accept financial risks than non-owners who do not intend to adopt. The important separating line between these two groups, however, can be found in how attributes of crypto-assets are assessed. Specifically, potential adopters are much more likely (i) to believe in the profitability of the investment, (ii) to think that crypto-assets offer advantages for payments over existing payment methods, (iii) to more favorably assess the volatility of crypto-assets and (iv) to consider a lower risk of fraud and online theft. Stix (2019) shows that these perceived attributes affect demand in the expected way, i.e., perceptions of volatility lower potential demand for crypto-assets, profit expectations increase potential demand.

On the one hand, these results suggest that demand for crypto-assets can to a considerable extent be attributed to a profit motive, comparable to the demand for conventional risky financial assets. On the other hand, the findings also indicate that beliefs about the usefulness of crypto-assets for payments are an important driver of adoption. Stix (2019) shows that most individuals who own or who intend to purchase crypto-assets believe both in positive investment returns and in the usefulness of crypto-assets for payments. As crypto-assets are hardly used for payments, on average, it seems that these beliefs are closely tied to subjective assessments about the future use of crypto-assets for payments.

The paper contributes to a strand of recent contributions which are based on survey data. Despite some variations in findings across countries, these studies show that ownership rates are relatively low. For example, the ownership rate of crypto-assets of 1.6% together with 1.1% of former owners obtained for Austria compares well with results from a survey from the United Kingdom of December 2018 which finds that about 3% of survey respondents had ever bought crypto-assets (Financial Conduct Authority, 2019). Moreover, according to a nationally representative survey by the Federal Reserve Bank of Atlanta 2.5% of the U.S. population held “virtual currencies” in 2018. The Bank of Canada’s specialized internet surveys indicate a higher Bitcoin ownership of 5% for 2017 (Henry, Huynh and Nicholls, 2018a and 2018b). Both in the US and in Canada the ownership rate increased from 2017 to 2018.5 Fujiki (2019) analyzes survey data that may not be representative for the Japanese population but finds rather similar results regarding the sociodemographic profile of owners of crypto-assets compared to Austria.

Studies which analyze transaction data of Bitcoin accounts or other network data provide an alternative perspective (Brauneis et al. 2018; Baur et al. 2017; Glaser et al. 2014; Baek and Elbeck 2014). These papers find that Bitcoins are mainly used as a financial asset and not as an alternative currency or medium of exchange which is broadly consistent with the low use of crypto-assets for transactions that is found in survey studies (Foster 2019; Henry, Huynh and Nicholls 2018a and 2018b; Schuh and Shy 2016; Stix 2019).

The remainder of the paper proceeds as follows. Section 2 describes the data and presents some descriptive evidence. Section 3 presents a summary of the findings regarding the socioeconomic characteristics of owners. In Section 4, we analyze how persons who intend to adopt crypto-assets differ from persons who do not have such intentions. Specifically, we look at the role of profit expectations. Section 5 concludes.

The three surveys were commissioned by the Oesterreichische Nationalbank and conducted by an Austrian polling company via computer-assisted face-to-face interviews. The target population comprises of Austrian residents aged 14 or older and in each survey, the sample consists of roughly 1,400 Austrian residents that were selected via a multi-stage clustered random sampling procedure. The first survey was conducted in April/May 2018 and the second and third survey in October/November 2018 and 2019, respectively. In all surveys, questions on crypto-assets were appended to a regular survey questionnaire which mainly focuses on measuring consumer economic sentiment (cf. Ritzberger-Gru nwald and Stix, 2018). In the following, we analyze all three survey jointly – which is necessary given the very low number of owners in individual surveys. All descriptive statistics (e.g. ownership of crypto-assets) are weighted such that results are representative for the Austrian population aged 14 or over with respect to region, age, gender and size of respondents’ home town.6

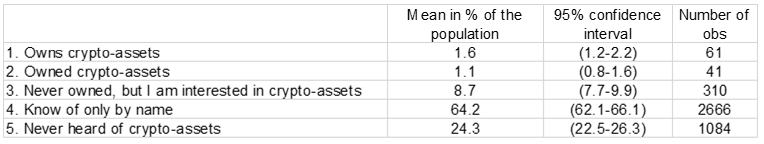

Table 1 summarizes ownership and awareness of crypto-assets. 1.6% of Austrians owned crypto-assets at the time of the surveys (with 95% probability the mean is in a range from 1.2% to 2.2%).7 About 1.1% had owned crypto-assets in the past but sold them before the respective interview. About 8.7% say that they have never owned but declare some interest in crypto-assets. Awareness in Austria (lines 1 to 4 of Table 1) is somewhat higher than in the US (67%, see Foster 2019) but considerably lower than in Canada (89%, see Henry, Huynh and Nicholls 2018b).

Table 1. Table Ownership and awareness of crypto-assets

Note: The table summarizes ownership and awareness of crypto-assets (population mean and 95% confidence interval). Results are weighted. Variables are defined in Stix (2019).

The survey contained a direct question on respondents’ motives to hold crypto-assets. Please note that in all three survey waves only 61 respondents state that they own crypto-assets, which warrants great caution when interpreting the respective results. The most commonly cited reasons are “I see [crypto-assets] as an investment with prospects of capital gains” (77% of owners stated this reason) and “interest in technology” (51%).8 The answers “to conduct payments anonymously”, “to economize on costs of transfers and payments” and “a lack of trust in the euro or in banks” was cited by between 20 to 25% of owners.9 The survey also elicited whether owners or former owners have used their crypto assets for payments. About 60% state that they have never used crypto-assets for payments and 83% have never used them for transfers to other persons (n=94). About half of those who state that they have made any payments answer that such payments typically occur less than once per month.

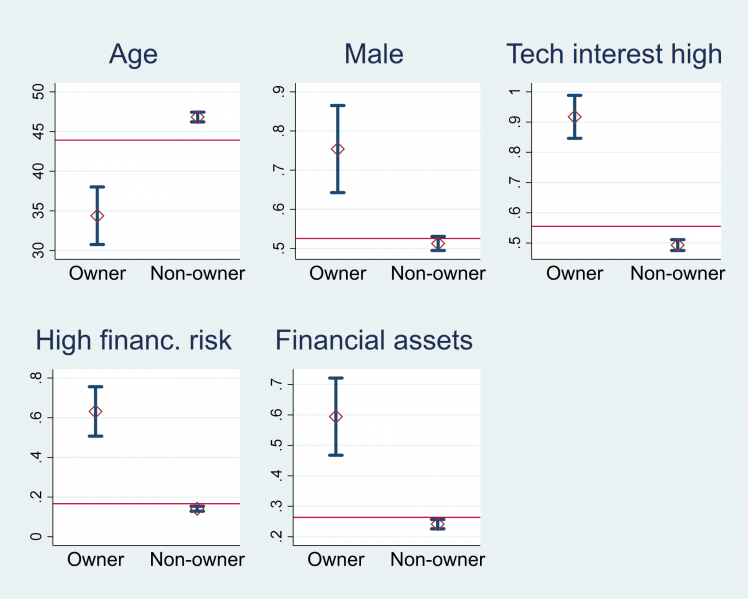

How do owners of crypto-assets differ from non-owners? Figure 1 depicts mean values and the respective 95% confidence intervals of selected socioeconomic variables for the group of owners (line 1 of Table 1) and the group of non-owners (lines 3 to 5 of Table 1).10 While the reported results reflect descriptive evidence, we note that the statistical significance of results is confirmed in conditional analyses (cf. Stix 2019 and unreported updates of the respective regressions).11

Owners are much younger than non-owners – on average 34 years whereas non-owners are on average 47 years. Also, owners are much more likely to be male than non-owners. The surveys also contain information on how survey respondents classify themselves with respect to their genuine interest “in technological developments, e.g. new devices or applications”. Not surprisingly, owners are tech-affine which separates them, by a far margin, from non-owners (as measured by the variable “Tech-interest high”).

Figure 1. Socio-economic characteristics of owners

Note: The figure shows mean values and the respective 95% confidence intervals of selected socioeconomic characteristics for owners (left) and non-owners (right). All y-axis denote percent, except for age where the y-axis denotes years. The horizontal line shows the overall population average. Variables are defined in Stix (2019).

We are interested in the financial capabilities of persons invested in crypto-assets as well as in their knowledge and risk attitudes. In this context, Figure 1 reveals marked differences with regard to risk attitudes. Specifically, a much higher share of owners is willing to accept losses from an investment if above-average profits can be expected (as measured by the risk preference dummy variable “High finance. risk”). These self-assessed risk preferences are also reflected in actual holdings of (risky) financial assets which are significantly higher for owners than for non-owners (as measured by the variable “Financial assets”).12 The dissemination of other financial assets, e.g. saving deposits, is similar across the two groups (not shown).

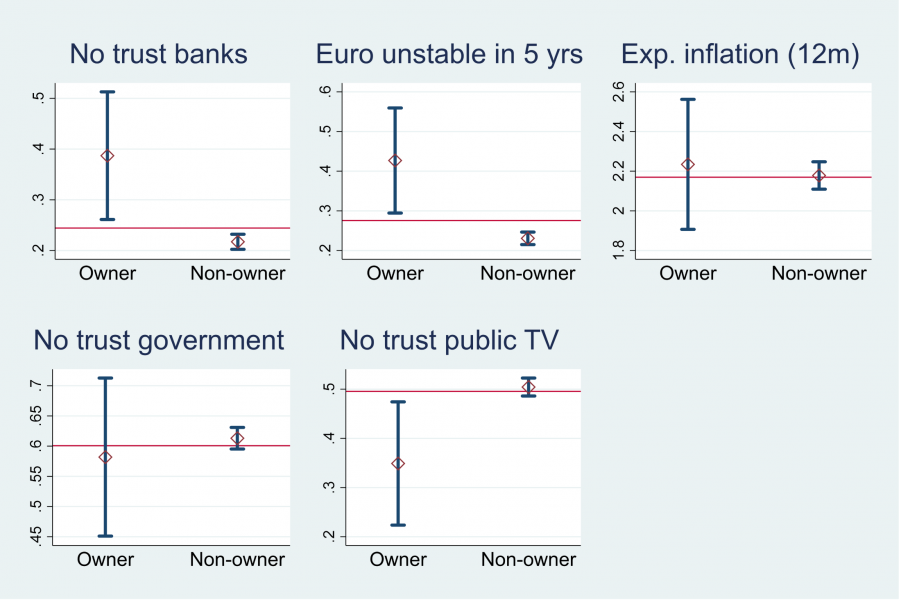

Figure 2 shows differences regarding several trust measures – again, the set of descriptive results is confirmed in conditional analyses. The analysis of trust is of relevance given the design features of Bitcoin, with an upper limit on supply and the absence of financial intermediaries (Nakamoto, 2008; Grym, 2018; Weber, 2018; Assenmacher, 2020). This implies that the demand for crypto-assets could have been fueled by distrust in banks, in central banks or in conventional fiat currencies (e.g. due to inflation expectations). In the full paper, a battery of trust measures, ranging from trust in banks, trust in the central bank, trust in the government, trust in the stability of the euro, discontent with the euro, etc. is tested. Overall, there are only two significant result of the respective regressions, namely that owners seem to have lower trust in banks than non-owners and a higher share of owners is concerned about the medium-term price stability of the euro (“Euro unstable in 5 years”). All other financial trust measures are not found to exert a significant effect. Finally, we also include a measure of trust in public TV which, arguably, should be unrelated to financial matters and find that owners have more trust in public TV than non-owners, ceteris paribus, which somewhat contradicts the idea that crypto-asset owners dislike institutions, in general.

Can we say more about the meaning of “trust in banks”, not least because this variable could comprise rather distinct dimensions like a lack of trust in bankers or a lack of trust in the safety of deposits? One of the surveys contained information on some of these aspects and, with some caution due to the lower number of observations, the evidence presented in Stix (2019) suggests that the significant effect of distrust in banks has more to do with distrust in the financial advice provided by respondents’ banks – hence investment returns of financial investments – rather than with concerns about the stability of banks.

Stix (2019) argues that the variable “Euro unstable in 5 years” can best be described as “concerns about monetary stability”. It is interesting that this variable is significant while no differences are found between owners and non-owners regarding their quantitative one year inflation expectations or regrading trust in the ECB.

Nevertheless, we note that although trust in banks and concerns about the medium-term price stability of the euro are on average lower among owners than among non-owners, still a majority of owners does trust banks and has trust in the price stability of the euro. On balance, we thus think that trust is not the decisive factor for ownership.

Figure 2. Trust and inflation expectations

Note: The figure shows mean values (in %) and the respective 95% confidence intervals for owners (left) and non-owners (right). The horizontal line shows the overall population average. Variables are defined in Stix (2019).

Stix (2019) also analyzes adoption intentions among persons who do not yet possess crypto-assets. Apart from alleviating the endogeneity problem of some of the variables – for example, persons could have developed distrust in certain institutions only after adoption –, there is the advantage to analyze how profit expectations and the perceptions of the risk of an investment in crypto-assets affect purchase intentions.

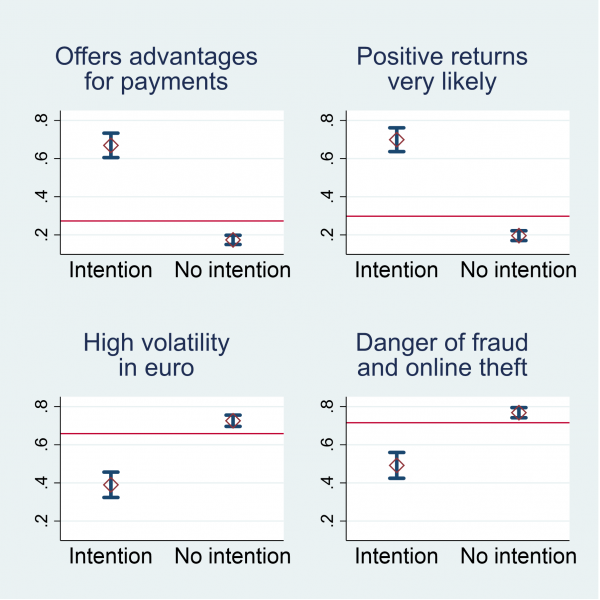

Specifically, respondents who are at least aware of crypto-assets (lines 3 and 4 of Table 1) were asked whether they intend to purchase crypto-assets.13 Moreover, survey respondents were asked about their assessment of various attributes of crypto-assets, ranging from the perceived volatility (riskiness), whether crypto-assets offer advantages over conventional payment methods, the likelihood that an investment in crypto assets generates positive returns and the danger of fraud and online theft. These variables are included in a multivariate regression and turn out to be important drivers of purchase intentions. Figure 3 displays the respective sample means, both for person with and without a purchase intention.

Persons with a purchase intention are much more likely to believe that (i) crypto-assets offer advantages for payments and that (ii) positive returns are very likely. These two beliefs are held by about two thirds of all persons who express a purchase intention. Moreover, these two beliefs are closely tied – a majority of persons with purchase intentions both expects profits and thinks that crypto-assets will become useful for payments.

A detrimental effect is found for variables that express an investment risk, like expected volatility or the danger of fraud and online theft. Survey respondents who consider this investment risky do not express a purchase intention, on average.

The results on the socioeconomic variables are mostly insignificant. In contrast to the results for ownership, trust in banks does not seem to drive potential adoption.

Figure 3. Purchase intentions and perceived attributes of crypto-assets

Note: The figure shows mean values (in %) and the respective 95% confidence intervals for respondents who express an intention to purchase crypto-assets (left) and respondents who do not express such an intention (right). The horizontal line shows the overall population average. Variables are defined in Stix (2019).

This paper’s aim was to provide evidence on four pertinent questions in relation to crypto-assets. The analysis is based on data from three surveys among Austrian consumers.

First, the results indicate that that only 1.6% of the population owns crypto-assets. Second, as regards risk attitudes we find that owners are more risk-tolerant and are more likely to be invested in other risky financial assets than non-owners of crypto-assets, on average. For example, among owners 59% possess other risky financial assets compared to 21% among non-owners. Also, 63% of owners are willing to take above-average risks if they can expect an above-average profit compared to 14% among non-owners. This suggests that owners, on average, are more likely to have experience with volatile financial investments and/or are willing to accept the risk of losses which is informative from a financial regulation and consumer protection perspective.

Third, we studied the role of trust, which is of relevance regarding the “money” and the “store-of-wealth” role that has been assigned to crypto-assets (Bouoiyour et al, 2019). Our findings show (i) that owners are more likely to distrust banks than non-owners and are more likely to have concerns regarding the medium-term price stability of the euro but, nevertheless, (ii) a majority of owners does trust banks and believes in the medium-price stability of the euro. For intended adoption, distrust in banks and concerns regarding the medium-term price stability of the euro do not seem to be important. As regards other trust dimensions, e.g. inflation expectations, trust in government, trust in the ECB, we do not find any effects. Overall, these results suggest that trust plays some role but does not seem to be a decisive factor for (intended) adoption.

Forth, ownership and planned adoption are strongly associated with a speculation motive and with beliefs about the future use of crypto-assets for payments, which is interesting given that about 50% of owners have not yet conducted any payments with crypto-assets. Furthermore, subjective assessments about volatility and the perceived risk of online fraud and theft dampen the (potential) demand for crypto-assets.

The analyses on which this paper builds represents a starting point which should be improved in several directions. First and most importantly, the depth of analysis is constrained by the low number of owners found in surveys among the general public with a “usual” sample size. To obtain more reliable results, one needs to either have a larger sample of survey respondents or to change the sampling procedure. An alternative could be non-random sampling procedures like respondent-driven sampling as proposed in Henry, Huynh and Nicholls (2018a). Second, we have only analyzed whether a person owns or does not own crypto-assets. Future work should also consider the intensive margin, e.g. the portfolio share of crypto-assets. While tentative evidence suggests that investment amounts are rather low in the case of Austria, on average across respondents, it would be worthwhile to analyze this in more depth.

Assenmacher, Kathrin (2020). Monetary Implications of Digital Currencies, Belgian Financial Forum No 4/2020, https://www.financialforum.be/en/articles/monetary-implications-digital-currencies (accessed May 8, 2020).

Auer, Raphael and Claessens, Stijn (2018). Regulating cryptocurrencies: assessing market reactions, BIS Quarterly Review, September 2018, 51-65.

Baek, C. and Elbeck, M. (2014). Bitcoins as an investment or speculative vehicle? A first look, Applied Economics Letters, 22(1), 30-34.

Baur, Dirk G., Dimpfl, Thomas and Kuck, Konstantin (2018). Bitcoin, gold and the US dollar – A replication and extension, Finance Research Letters, 25, 103-110.

Baur, Dirk G., Hong, Kihoon and Lee, Adrian D. (2017). Bitcoin: Medium of Exchange or Speculative Assets? Available at SSRN: https://ssrn.com/abstract=2561183.

Bouoiyour, Jamal, Selmi, Refk and Wohar. Mark (2019). Bitcoin: competitor or complement to gold? Forthcoming Economics Bulletin.

Brauneis, Alexander, Mestel, Roland, Riordan, Ryan and Theissen, Erik (2018). A High-Frequency Analysis of Bitcoin Markets. Available at SSRN: http://dx.doi.org/10.2139/ssrn.3249477.

Chapman, James and Wilkins, Carolyn A. (2019). Crypto “Money”: Perspective of a Couple of Canadian Central Bankers, Bank of Canada Staff Discussion Paper 2019-1.

Foster, Kevin (2019). Measuring Consumer Cryptocurrency Adoption and Use in the United States. Presentation held at the Joint Statistical Meeting 2019, Denver Colorado.

Financial Conduct Authority (2019). Cryptoassets: Ownership and attitudes in the UK – Consumer survey research report, retrieved from https://www.fca.org.uk/publication/research/cryptoassets-ownership-attitudes-uk-consumer-survey-research-report.pdf (30 April 2019).

Fujiki, Hiroshi (2019). Who Adopts Crypto Assets in Japan? Evidence from the 2019 Financial Literacy Survey, mimeo.

Glaser, Florian, Zimmermann, Kai, Haferkorn, Martin, Weber, Moritz Christian and Siering, Michael (2014). Bitcoin – asset or currency? Revealing users’ hidden intentions, Twenty Second European Conference on Information Systems, Tel Aviv 2014.

Green, C. and Stavins, J. (2018). The 2016 and 2017 Surveys of Consumer Payment Choice: Summary Results, Research Data Reports No. 18-3. Federal Reserve Bank of Boston.

Grym, Aleksi (2019). The great illusion of digital currencies, BoF Economics Review 1/2018.

Henry, Christopher S., Huynh, Kim P. and Nicholls, Gradon (2018a). Bitcoin Awareness and Usage in Canada, Journal of Digital Banking 2(4), 311–337.

Henry, Christopher S., Huynh, Kim P. and Nicholls, Gradon (2018b). Bitcoin Awareness and Usage in Canada: An Update, Staff Analytical Note 2018-23, Bank of Canada.

Nakamoto, Satoshi (2008). Bitcoin: A Peer-to-Peer Electronic Cash System, retrieved from https://bitcoin.org/bitcoin.pdf (22 October 2018).

Nelson, Bill (2018). Financial stability and monetary policy issues associated with digital currencies. Journal of Economics and Business 100, November–December 2018, 76-78

Ritzberger-Grünwald, Doris and Stix, Helmut (2018). How Austrians bank and pay in an increasingly digitalized world – results from an OeNB survey. Monetary Policy & the Economy Q3/2018, 52-89.

Schuh, Scott and Shy, Oz (2016). U.S. consumers’ adoption and use of Bitcoin and other virtual currencies. mimeo.

Stix, Helmut (2019). Ownership and purchase intention of crypto-assets – survey results, Oesterreichische Nationalbank Working Paper No. 226. Available at: https://ideas.repec.org/p/onb/oenbwp/226.html

Weber, Beat (2018). Democratizing Money? Debating Legitimacy in Monetary Reform Proposals. Cambridge University Press: Cambridge, U.K.

The article is also published in BFW digitaal / RBF numérique 2020/5.

Corresponding author. Tel.: +43 1 40420 7205; fax: +43 1 40420 7299; E-mail address: helmut.stix@oenb.at

The views expressed in this paper are those of the author. No responsibility for them should be attributed to the Oesterreichische Nationalbank or the Eurosystem. I thank Elisabeth Ulbrich for her collaboration in the design of the questionnaire and the implementation of the survey. I thank Christopher S. Henry, Gradon Nicholls and Kim Huynh of the Bank of Canada for sharing their survey questionnaire.

The term “crypto-asset” is used instead of crypto-currency or virtual-currency due to the lack the characteristics of conventional currencies.

The underlying question refers to a rather general notion of purchase intention – how likely a respondent considers purchasing crypto-assets in the future. Therefore, respective results cannot be translated into a time frame, e.g. how many consumers intend to invest in crypto in the coming year.

See also Greene and Stavins (2018) and Schuh and Shy (2016).

For a detailed description of the data and the methodology, see Stix (2019).

Ownership was 1.5% in the first two survey waves (Stix, 2019).

Respondents were provided with a list of five potential reasons and were asked to choose one or several reasons that apply.

The answer on the importance of trust increased in the latest survey. Due to the low number of observations, we cannot assess whether this increase is statistically significant or whether it reflects an outlier.

We omit former owners because their motives might differ substantially.

Specifically, if the means of a variable in Figure 1 and, later in Figure 2, differ significantly between owners and non-owners then this is also confirmed by results of multivariate regression.

Financial assets is defined as 1 if respondents possess investment funds, single company stocks, government bonds, government bills or other assets as antiques, paintings, etc. (and 0 otherwise).

From these answers we have defined a dummy variable “Purchase intention”. Specifically, “Purchase intention”=1 for respondents who agree or strongly agree to the statement that “It is very likely that I will acquire Bitcoin some time”. “Purchase intention”=0 if they do not agree to this statement. The variable is only defined for respondents who are at least aware of crypto-assets (lines 3 and 4 of Table 1).