With the coronavirus crisis, we anticipate an aggravation of the inefficiency of the allocation of financial resources in Europe, with excess idle savings from households and an increasing shortfall of equity for many companies impacted by the economic downturn. We discuss the conditions under which, on the one hand, the savings surplus could be mobilized, and on the other hand, the corporate world could accept the infusion of outside equity capital. The proposed solution, following standard Asset & Liability Management (ALM) principles, is the setup of a private equity fund offering callable, convertible and cumulative preferred shares, funded through the issuance of either (i) a pan-European bond with floating coupon assorted with the public guarantee, or (ii) an asset backed security with a senior fixed coupon and a junior equity tranche, with the collaboration of the financial sector.

Following the eruption of the Covid-19 crisis, the rather structurally clumsy financial resource allocation situation in many European countries (Gopinath et al., 2017) has suddenly worsened. On the one hand, many companies of all sizes will suffer from a deterioration of their net worth, and the rescue solutions proposed in the immediate reactions have addressed their liquidity, but not their solvency position. On the other hand, wealth inequalities amongst households have increased, with a significant fraction of the population having kept similar levels of income as before but without the possibility or the willingness to sustain their previous consumption levels due to the lockdown measures and their consequences.

In this paper, we discuss the conditions under which a change in the financial resource allocation system could successfully channel the households’ surplus towards a suitable financing source for a large majority of companies. We also analyze the key difficulty that the system might potentially meet, namely the adequacy between the structure of the assets (equity investment in companies) and liabilities (bond issuance towards the population) of the transmission structure. Some solutions are discussed, involving or not the public authorities around a guarantee of capital for the household investors.

The burst of the coronavirus crisis has worsened an imbalance in the financial circuit that is particularly acute in the European predominantly bank-based economy which, unlike in other regions of the world like in the USA, relies heavily on the role of financial intermediaries in the allocation of financial resources (Levine, 2002).

On the supply side of financial resources, the European citizens had already become heavy savers since the financial and sovereign crises (Rodriguez-Palenzuela and Dees, 2016), with more than 25% of the European GDP stuck in savings accounts prior to the Covid19 crisis. A number of unfortunate economic victims of the lockdown measures taken across countries may have had to withdraw significant amounts from their accounts in order to stay afloat or simply to survive, but evidence gathered from the banking sector indicates that the net flows to sight and savings accounts of individuals remain positive in aggregate. Logically, thanks to the heavy weight of the public sector in some countries or regions, the effectiveness of automatic or ad-hoc stabilizers, and the lack of perspectives for immediate consumption, a substantial number of households have witnessed a net increase in their financial resources. At the same time, the sudden panic in financial markets and the sharp rise in uncertainty about the future have resulted in a generalized decrease in the citizens’ appetite for financial risk. Thus, this extra money flows to banks but, unfortunately, this simply feeds an already existing bottleneck. For a number of years, commercial banks have increasingly appreciated savings from individuals for liquidity reasons, especially after their disastrous experience of the global financial crisis. But in the current interest rate and legal environment, savings are becoming a curse for their profitability. With rates on savings accounts floored in many countries, a negative opportunity cost of ECB savings at 50 bps (with the exception of the tiering mechanism), and various taxes and levies based on account balances, each new euro deposited on a bank account incurs an immediate loss for the credit institution. The longer the money stays “un-lent” by a bank, the more it costs. But financial intermediaries must also remain cautious and proportionate in their lending activities, and therefore cannot dump their credits in order to get rid of this excess money. The crisis has obviously created new borrowing needs, but the demand is not unlimited: if banks were to transmit all the resources that they gather on savings and sight accounts is a “flow-based” swing, the economy would simply be over-indebted. This is why some of the excess saving has to fall in the black hole of the ECB’s balance sheet. This is the aggravated bottleneck on the “surplus of funds” side.

On the demand side, we witness a sharp increase in the financing needs of many entities: households, independent workers, the social and cultural sector, public authorities, and companies. All are important, but the situation of the latter group is specific, because their capital structure features a mix of equity and debt in a balanced fashion. Currently, what governments and financial institutions mostly offer are subsidies or debt facilities. This does not solve a key concern for the corporate world: after having obtained resources from additional borrowing or deferred repayments – which essentially results in an increase of their liabilities, how to restore the adequate balance between debt and equity in the capital structure? This is not an acute short-term issue, but it is a crucial question for the sustainable character of the potential economic recovery. An artificially fragile corporate sector is exposed to unnecessary defaults and bankruptcies, leading to a potential vicious circle for the whole society. Given that the coronavirus crisis makes it necessary to temporarily, but sometimes significantly, increase the debt level of many companies, the sustainable answer to this problem is to foresee a solidification of their equity through a form of capital increase. Unfortunately, the groups of current shareholders of such companies are not likely to be the same persons whose financial situation has become more comfortable with the crisis. A solution might to look for external investors, but any CEO or CFO would immediately notice that, in the current situation, equity valuations are under stress and companies would have to dump their shares. Such a solution is probably not adequate, both for the motivation of the management and the creation of agency conflicts between the different categories of shareholders, especially in family-owned businesses. Thus, companies need capital but the timing is exactly wrong, and this probably hinders them to tap the market even though they are dangerously moving away from their target capital structure, as predicted by the market timing theory (Baker and Wurgler, 2002; Huang and Ritter, 2009). This is the aggravated bottleneck on the “shortage of funds” side.

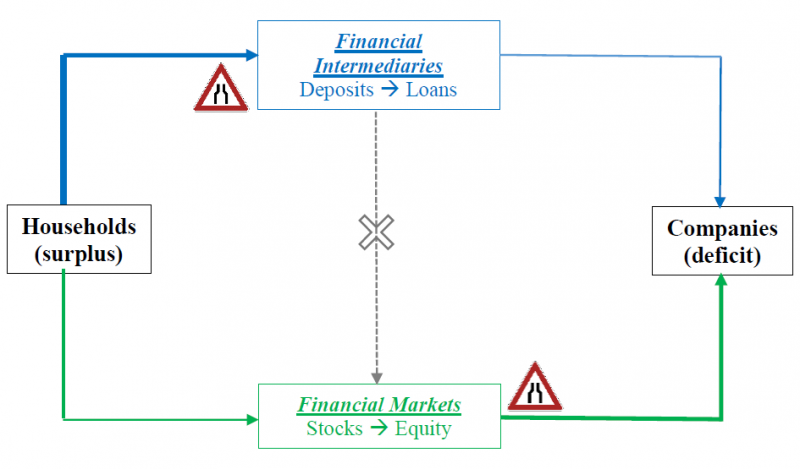

This situation can be summarized in a “Finance 1.01 class” type of simplified representation of the financial circuit, with the identification on the potential bottlenecks:

Figure 1: Coronavirus-related bottlenecks in the financial circuit

The thick arrows correspond to the excess supply (in blue) and excess demand (in green) of funding that is not met by the allocation channels in the financial circuit. The bottlenecks arise for different reasons: banks literally receive excess resources compared to what they are able and willing to lend, but companies demand additional equity resources that the market is not ready to fulfill at acceptable conditions, leading to a mismatch between supply and demand of capital.

It is important to note that a “simple” redirection of savings to equity stakes (the grey vertical arrow crossed in the middle of the graph) cannot be seriously considered because of the discouraging treatment of such investments in terms of banks’ risk-weighted assets since the advent of the Basel II Accord, and unchanged in Basel III. Insurance companies, whose investments in company shares are less disadvantageous under the Solvency 2 framework, could be more effective in channeling the households’ surpluses towards companies, but they have not benefited from the same rally towards life insurance contracts as did banks with their savings accounts. The current situation is thus showing an imbalance, that has become severe and with long-term adverse consequences for the economy, in the financial resource allocation system. Currently, this imbalance seems to be stuck in a dead-end.

In front of a disequilibrium such as the one shown in Figure 1, our perspective is to adopt a two-stage process: (i) diagnose what could be adapted financial vehicles to re-channel the surplus offering to the types of securities that match the needs of corporations; and (ii) perform and Asset & Liability Management (ALM) analysis of the junction between these products.

Potential suitable alternative to savings accounts for households

The underlying motives for excess household savings are probably numerous, but many of them are unrelated to the rational economic motivation to save money on a bank account. For a number of years, many investors have voluntarily decided to “park” their surplus cash on their savings accounts, way beyond what would be necessary in relation with their precautionary motives, with a medium to long-term intended horizon (typically above 3 years). There are many potential reasons for this seemingly irrational behavior: the perceived lack of acceptable alternative investment products, anxiety about the future personal situation, “liquidity trap” following the monetary policy of negative interest rates… The result is economically devastating: with a close-to-zero fixed interest, savers erode their purchasing power and cannot even seek consolation by hoping that their money fuels the economy, since most of it remains idle and weighs on the banks’ balance sheets.

This uncomfortable feeling is presumable reinforced at times of the Covid-19 crisis: for the people whose income has remained stable, without any possibility to consume more or even as much as before, and with the cancellation of many projects related to entertainment, tourism, or other projects, cash has started to accumulate on their accounts. At the same time, many other persons experience a personal economic drama, with a significant loss of income and capital. It is foreseeable that the persons with a surplus want to show their solidarity by reallocating their resources towards those persons with a shortfall. This can be done by philanthropy and donations, of course, but this approach has limits since the predominant anxiety in the population calls for a margin of safety that, in a nutshell, justifies the savings on non-maturing accounts. Thus, to make sense both from an economic and a societal points of view, the financial vehicle that would be suitable to re-channel the excess savings must be (i) safe, (ii) liquid, (iii) non-loss-making, and (iv) solidary.

As we will see later, there are different way to engineer a financial product that respects these four conditions. The most obvious solution is a EU-guaranteed popular loan whose proceeds would be reinvested in the European economy. But other vectors can achieve a similar objective with another structure, like the senior tranche of an asset-backed security collateralized by the value of the participations in the economy.

Potential suitable alternative to common equity for companies

Many companies find themselves in a fuzzy situation in which the pure financing securities, namely common equity and straight debt, are not able to match their medium-term needs engendered by the coronavirus crisis. For many of them, the sudden and sharp drop of their revenues first created an intense liquidity issue. Many of those that were considered as “viable” before the onset of the crisis will have hopefully received immediate help though various guarantees issued by national governments, the recourse to ad-hoc automatic stabilizers, diverse regional aids, and other subsidies. But the joint effect of the loss of income and the increase in liabilities is inevitably the degradation of the solvency position of these otherwise potentially profitable companies.

As stated above, while debt is not anymore a favorite funding option fr the medium to long term, raising new equity from outside investors has many adverse consequences. Considering the market timing approach of capital structure decisions, it can be said that the coronavirus crisis period is a “cold issue period” in which most companies are reluctant to increase their capital by attracting new investors. The lower equity valuations under market stress mechanically trigger economic and control dilution. We can reasonably anticipate that the dominant feeling of entrepreneurs and managers would then be the frustration of not being responsible for their situation. Some belong to sectors that are hardly hit by the crisis, others simply witness a collapse of the demand, but all certainly feel that this is a “deus ex machina” on which they have absolutely no control. Thus, common equity issuance outside the circle of the existing shareholders might be felt very badly. Furthermore, this operation of increase in long-term financing is generally neither voluntary nor planned. Many companies would probably appreciate a temporary aid in their solvency, but would not appreciate to keep an intruder in their capital structure forever. For all these reasons, we claim that the preferred financing vehicle for most firms must be (i) equity-like, (ii) non-voting, (iii) non-diluting, and (iv) self-destructing.

Fortunately, in the zoo of hybrid financing securities, there exist a category that fulfills relatively easily and in a simple fashion these four conditions: the callable convertible preferred stock, whose properties have been well-known since the 20th century (Ingersoll, 1977; Stein, 1992; Ramanlal et al., 1996). This security is part of the company’s equity, and is thus not part of its liabilities, unlike the closely-related subordinated debenture. It is non-voting and non-diluting by construction, but the price to pay for the company owners is a seniority with respect to common stock regarding the (capped) dividend payment and the redemption of the face value in case of capital reduction or liquidation. The cost of capital, which is typically equal to the capped dividend rate, lies somewhere between the costs of common equity and of straight debt; probably in the neighborhood of 3 to 5% for most companies nowadays. It looks close to subordinated debt, but with the important advantage – in this particular case – of not legally weighing on the liabilities side of the company, and in no way triggering bankruptcy procedures.

The callability (i.e. the right given to the company to buyback the security at a pre-specified strike price) and convertibility (i.e. the right given to the holder to convert the security into common stock at a pre-specified conversion ratio) features of the preferred stock are meant to organize its self-destruction. If the company fares well and wishes to get rid of this safety cushion, it redeems it. If the firm is successful but does not have a treasury position that is comfortable enough to serve the preferred dividend or to buy back the security, the investor converts it. Unlike the conventional ordering of the exercise decisions (typically the right to convert dominates the right to call, see François et al. (2011) for a discussion of the issues with this sequence), from a game-theoretic perspective it is useful to foresee that the right to call is predominant over the right to convert: the company first decides whether it exercises its call or not, then, conditionally on the no-exercise of the call, the investor decides whether to strike the right to convert or not. Furthermore, to be fully effective, the preferred stock should have a conversion protection period of several years, i.e. the right to convert would only be open after a certain deadline, while the right to call is immediately active. Both options can be Bermudan, i.e. they can only be struck at the security’s anniversary date. Finally, to avoid any moral hazard issue, the preferred stock should also be cumulative, i.e. no ordinary dividend can be paid out before all past due preferred dividends are paid.

The mechanism of the allocation structure

The major principle of Asset & Liability Management is to ensure that the risks on the asset and on the liabilities side of a balance sheet are tightly controlled within a desired level of risk tolerance (Black, 1975). Looking at the four conditions that must be filled by the investment vehicle offered to households, there are two necessary conditions for a potential match with the preferred stock structure:

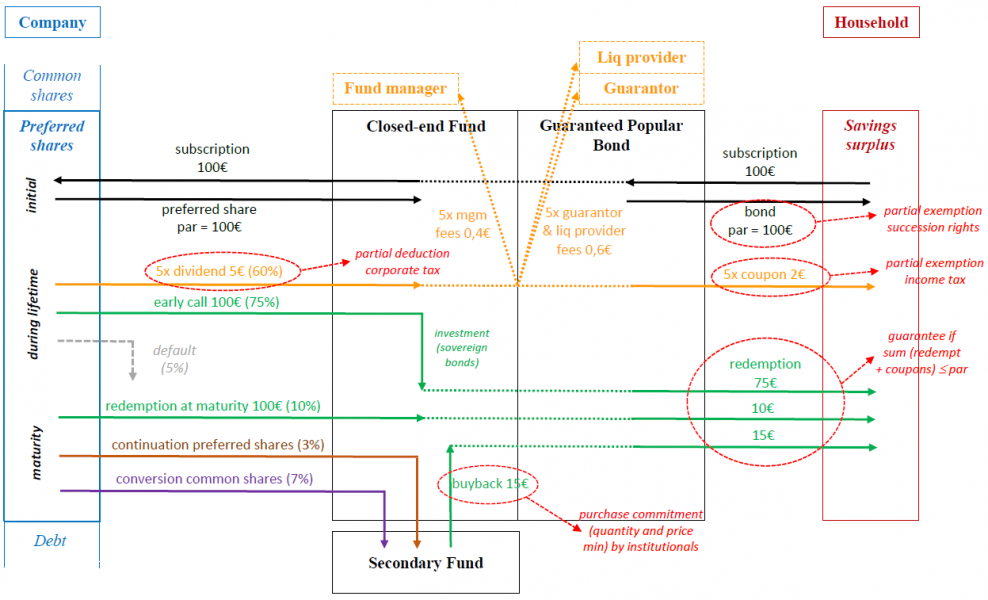

If, on the liabilities side, we consider that households who provide the resources of funds, they receive in exchange a bond with a guaranteed capital and a fixed stated maturity. On the asset side, a closed-end private equity fund, whose maturity matches that of the bond, invests in the preferred shares of firms that are willing to obtain this source of financing. At the maturity of the fund, either the guarantor or a third-party (for instance a secondary fund sponsored by professional private equity fund investors) agrees to buy back the remaining preferred or ordinary (if converted) shares. This repurchase can be done either at the market price or at a floored price (in case of a remuneration through a fee corresponding to the fair value of the repurchase option, which is a put option held by the fund).

For the ALM match to be valid, the cash flows received by the bondholders are equal to (i) the preferred dividends paid out by the companies during the lifetime of the fund, and (ii) the maximum of the guaranteed capital (floor) and the net asset value of the fund at maturity. This means that the investors have a floating rate note with a guaranteed floored yield at 0%. An illustration of the mechanism is provided in the following graph, with the following assumptions:

Figure 2: ALM Mechanism between the PE Fund and the Bond

The graph also features various incentives that could be foreseen by the national (tax) authorities in order to enhance the probability of success of the structure. For each of them, the remuneration can be included in the fee structure (direct income) or reflected in the positive externality that results from a sounder economic landscape that, in the long return, will generate more taxes, less unemployment and, ultimately, more growth (indirect income).

The burden of the guarantee

The natural way of issuing a popular loan is the associate a guarantee of the public authorities for the preservation of capital. This guarantee, which represents a put option on the loan, is funded by a commission cg paid out by the fund to the guarantor, which is similar to a Credit Default Swap (CDS) premium. Considering (generically) a five-year maturity of the bond and of the fund, and ignoring discounting effects (since interest rates are insignificantly different from 0), the fair price of this guarantee must be equal to the expected payoff of the put option, which is the maximum of 0 or the face value minus the sum of all net coupons paid out minus the liquidation value of the fund. On a yearly basis, this is equal to ![]() , where EQ is the risk-neutral expectation operator; d, g, a, f and p are the yearly rates of, respectively, the preferred dividend, the proportion of companies that pay the dividend but never call, the proportion of early calls, the management fee, and default losses; and γ, Π and μ are, respectively, the proportion of shares converted at maturity, the economic value of the converted shares, and the economic value of the shares unconverted at maturity. The crucial input of this equation is the expected yearly default rate p. Some numerical simulations show that, with a value of cg around 40 bps, the break-even yearly loss rate (assuming a loss given default of 100%) would be around 2.5%, which would already correspond to a very seriously hit economy. Thus, with reasonable assumptions, the burden of the guarantee could be affordable if properly remunerated by the credit insurance premium.

, where EQ is the risk-neutral expectation operator; d, g, a, f and p are the yearly rates of, respectively, the preferred dividend, the proportion of companies that pay the dividend but never call, the proportion of early calls, the management fee, and default losses; and γ, Π and μ are, respectively, the proportion of shares converted at maturity, the economic value of the converted shares, and the economic value of the shares unconverted at maturity. The crucial input of this equation is the expected yearly default rate p. Some numerical simulations show that, with a value of cg around 40 bps, the break-even yearly loss rate (assuming a loss given default of 100%) would be around 2.5%, which would already correspond to a very seriously hit economy. Thus, with reasonable assumptions, the burden of the guarantee could be affordable if properly remunerated by the credit insurance premium.

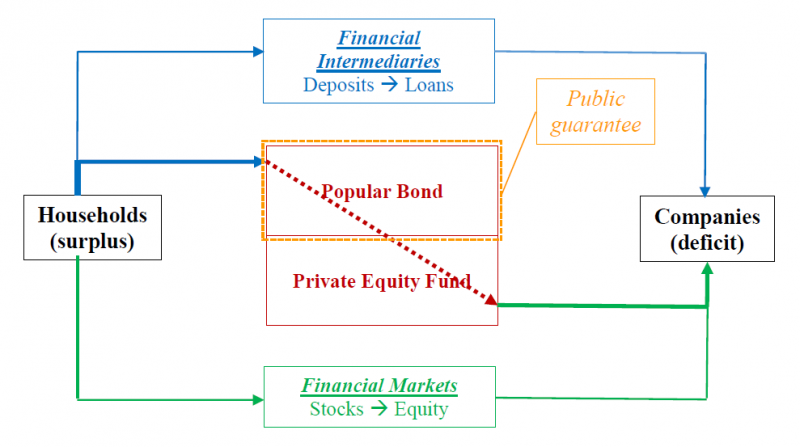

This natural channel would essentially result in a direct link between households and companies, with financial intermediaries serving essentially as a facilitator of the mechanism, as shown in Figure 3a.

Figure 3a: Public authorities-guaranteed popular bond as a resource allocation mechanism

Nevertheless, the public authorities might be reluctant to directly participate in the system. The main reason, which in our view is a fallacy, is the wrong impression that the structure would be detrimental to the European taxpayer, because it has to ultimately provide a guarantee, while it could itself fund the structure by “simply” issuing more sovereign bonds and digging further the budget deficit. The rationale is that the current state of the sovereign bond markets would enable most governments to issue medium-term bonds at a negative yield, and therefore the opportunity cost of having the fund financed by popular savings would be negative. This is an odd argument, of course, for two reasons: (i) it denies the ALM structure of the mechanism, and eventually leads to financing an equity mechanism through fixed-rate debt, and (ii) the additional state borrowing on the sovereign bond market will have an immediate effect on the cost of existing debt, plus it increases the risk of an increase in the future cost of borrowing. Furthermore, we have to remember that the initial diagnosis is that the coronavirus crisis has aggravated the issue of resource allocation in the economy, and the solution of the government bond would not contribute to solving this problem at all.

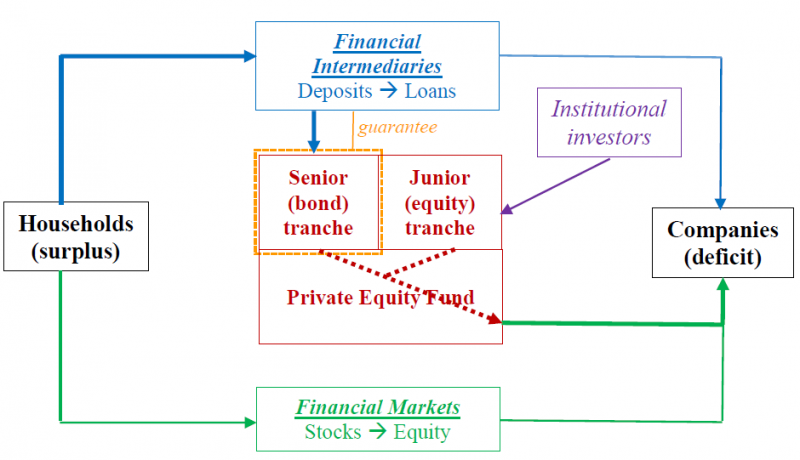

Actually, an alternative re-channeling of excess savings towards companies that are in need of fresh equity investment may be given by the financial sector itself. Considering that banks already dispose of the clients’ savings, they may themselves propose asset-backed financial products that would be similar to the popular bond above, but with a fixed coupon and the association of their own (remunerated) guarantee on the structure. In order to make sure that the large equity risk of the fund would not weigh on the banks’ creditworthiness, the funding of the structure would then be split in two parts: a senior tranche held by the household investors, possibly wrapped by a bank’s guarantee, and an equity tranche held by institutional investors attracted by the private equity structure. This would essentially lead to the alternative circuit below.

Figure 3b: Private asset-backed security as a resource allocation mechanism

Exitus acta probat. The unprecedented Covid-19 crisis has made it necessary to find create ways of quickly and efficiently solve the potential systemic problem of a generalized degradation of the solvency position of a majority of companies of all sizes, sectors and regions. This paper has provided some ideas, fueled by reasonable principles of corporate finance (hybrid financing) and risk management (ALM approach), in order to simultaneously provide potential solutions for the reallocation of financial resources in a more efficient way than the situation prevailing during the crisis.

There might be many drawbacks to the proposed mechanism. It might not stand the test of operationalization. There must also be a large adoption of its principles by the key stakeholders – politicians, financial institutions, households, companies – in order to reduce the viscosity of the transmission channel. There might also be moral hazard and adverse selection issues that hinder the effectiveness of the approach. Last but not least, the market is always right: if there appears to be no or limited appetite on either side of the financial circuit, the initiative will lose much of its appeal. It takes two to tango: if not enough money is activated to help companies, or if corporate managers find the preferred shares (which usually require a change in company statutes) inadequate, the objectives will not be reached.

But there is one thing that must be clear from the discussion: if one believes in a positive expected value creation of the large tissue of companies that could be helped with such a mechanism, this is a positive sum game. Offering the opportunity to households who can afford it to redirect their savings towards the corporate world and sharing part of this potential economic added value is fairer than condemning these people to freeze their financial surplus in idle savings accounts that provide no satisfaction to anyone. Probably, those companies that currently look at the future with anxiety would be very happy to share the value that they could create thanks to a sound and non-diluting capital infusion with those who will have shown their solidarity. Whatever will be the tool that will simultaneously help European citizens and companies, be it the one proposed in this paper or anything else, something much be done. The sooner the better.

Baker, M. and J. Wurgler (2002), Market Timing and Capital Structure. The Journal of Finance, Vol. 57, 1–32.

Black, F. (1975), Bank funds management in an efficient market. Journal of Financial Economics, Vol. 2, 323–339.

François P., G. Hübner and N Papageorgiou (2011), Strategic analysis of risk-shifting incentives with convertible debt. The Quarterly Journal of Finance, Vol. 1, 293–321.

Gopinath, G., Ş. Kalemli-Özcan, L. Karabarbounis and C. Villegas-Sanchez (2017), Capital Allocation and Productivity in South Europe. The Quarterly Journal of Economics, Vol. 132, 1915–1967.

Huang, R. and J. Ritter (2009), Testing Theories of Capital Structure and Estimating the Speed of Adjustment. Journal of Financial and Quantitative Analysis, Vol. 44, 237–271.

Ingersoll, J. (1977), A Contingent-Claims Valuation of Convertible Securities. Journal of Financial Economics, Vol. 4, 289–321.

Levine R. (2002), Bank-Based or Market-Based Financial Systems: Which Is Better? Journal of Financial Intermediation, Vol. 11, 398–428.

Ramanlal P., S. V. Mann and W. T. Moore (1996), A Simple Approximation of the Value of Callable Convertible Preferred Stock. Financial Management, Vol. 25, 74–85.

Rodriguez-Palenzuela, D. and S. Dees (2016), Savings and Investment Behaviour in the Euro Area. ECB Occasional Paper No. 167.

Stein, J. C. (1992), Convertible Bonds as Backdoor Equity Financing. Journal of Financial Economics, Vol. 32, 3–21.

Professor of Finance, HEC Liège, Liège University – g.hubner@uliege.be