Monetary policy implications of three different forms of digital money – cryptocurrencies, stablecoins and central bank digital currency (CBDC) – are discussed. Because of their limited adoption and lack of moneyness, cryptocurrencies are unlikely to constrain monetary policy in the foreseeable future. Stablecoins, by contrast, could reach a critical size, in particular if they were sponsored by large companies with a sizeable potential user base. CBDC would constitute a digital representation of the official currency that is accessible to everybody and could entail material consequences for monetary policy and financial stability. At the current stage, central bankers mostly feel that a convincing monetary policy motivation is missing or are concerned about the disruptive potential for financial stability. As digitalisation of payments is evolving quickly, the assessment of costs and benefits associated with CBDC may change in the future.

While physical cash has been around for centuries, digital payments started to develop only from the 1960s on. In 1958, American Express launched one of the first credit cards with the aim to facilitate payments when travelling. Further important steps in the digitalisation of payments were the invention of the magnetic machine-readable strip on plastic cards and the proliferation of bank accounts. These developments reached a new level with the advent of the internet and online shopping in the late 1990s. In 1998, Paypal enabled payments on the internet while in 2007 M-Pesa started to offer payment services on mobile phones. Only one year later, the blockchain concept underlying Bitcoin was published (Nakamoto 2008). It took another two years until the first trading platform for Bitcoin was set up and the first purchases against Bitcoin were documented (see Berentsen and Schär 2017).

Whereas up to 2008 payments innovations had built on sovereign monies, Bitcoin and other cryptocurrencies differ in that they function as a currency on their own without any fixed link to existing currencies. Moreover, they do not have an identifiable issuer with their supply being governed by an algorithm. Stablecoins make use of distributed ledger technology such as blockchain as well to allow for peer-to-peer transactions but are issued by private entities. They feature a mechanism in order to stabilise their value and to limit the volatility that is characteristic for cryptocurrencies. Finally, a central bank digital currency (CBDC) would be issued by the central bank as a digital representation of its official currency. While central bank reserves are digital central bank money, currently only banks can hold them whereas CBDC would be accessible also for non-banks. So far, no central bank has launched a proper CBDC though many are researching it (Barontini and Holden 2019, Boar et al. 2020).

Overall, these developments have the potential to fundamentally change the payments and financial services landscape as we know it today. In the following, we will discuss each of these three different forms of digital currencies and their implications from a monetary policy perspective. Notice that this contribution does not discuss digital money on banks’ deposit accounts because the existing system of monetary policy implementation and transmission builds on the current two-tier banking system with money creation and credit provision through commercial banks. Bank regulation, deposit insurance and access to the central bank’s lender-of-last-resort function have been designed to deal with the risks associated with this form of money.

Bitcoin is the first and most well-known cryptocurrency though nowadays it is by no means the only actively traded one. In April 2020, more than 2000 cryptocurrencies with a positive market value were listed on coinmarketcap.com, with Bitcoin accounting for about two thirds of the market capitalisation. Although a commonly accepted definition of cryptocurrencies is lacking, typical features of cryptocurrencies include that they are traded peer-to-peer on a decentralised system without a central clearing institution.2 The system defines the rules for the creation and ownership of new units of the cryptocurrency and keeps track of existing units and their ownership. Cryptographic tools are used to prove ownership, validate transactions and prevent double spending of the same unit of the cryptocurrency (Lansky 2018).

Monetary policy implications of cryptocurrencies are very limited to date. This is also reflected in the fact that their share of worldwide market capitalisation compared to traditional monetary aggregates is low, amounting to less than 2% of euro area monetary aggregates M1 or M3.3 Their limited acceptance and their high volatility suggest that this conclusion is unlikely to change soon. From a financial stability perspective, cryptocurrencies have not been a matter of concern as the exposure of the financial sector is low though, depending on regulatory developments, this could rise in the future (ECB Crypto-Asset Task Force 2019).

Cryptocurrencies are not a liability of an identifiable issuer. Like fiat money, they have no intrinsic value and their price is solely driven by supply and demand. Supply is usually governed by an algorithm and increases at a fixed, predetermined rate. Demand for a cryptocurrency can originate from different sources, i.e. from transactions demand as well as speculative demand that in turn is based on expectations about future demand.4 Although it is difficult to obtain clear evidence, some of the demand for cryptocurrencies may also be linked to illegal transactions. Foley et al. (2019) estimate that in 2017 about 46% of the demand for Bitcoin resulted from illegal activities. This share tends to decline the more the overall use of Bitcoin in transactions increases and the more other, even more obscure, cryptocurrencies appear.

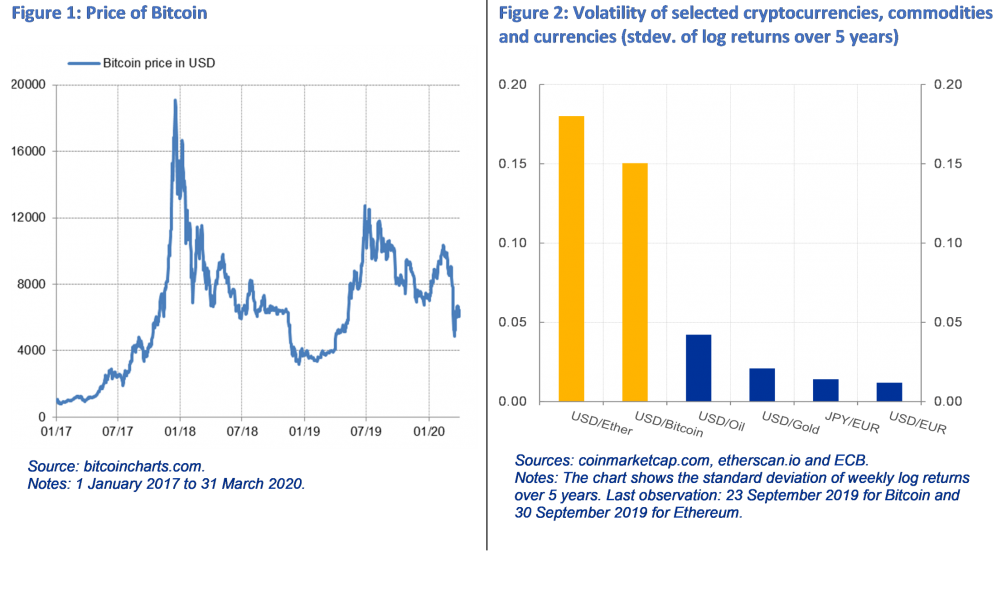

Figure 1 shows the evolution of the price of Bitcoin in US dollar from January 2017 to March 2020. It is evident that the price of Bitcoin has experienced large swings over this period. Many of the peaks and troughs concur with either positive news, such as an increased interest in or larger acceptance of Bitcoin – or negative ones, such as hacking attacks, theft or fraud; see Faia et al. (2019) for a list of news events. Figure 2 compares the volatility of the US dollar price of two cryptocurrencies, Bitcoin and Ether, to that of other assets. Overall, the volatility of Bitcoin and Ether in US dollar exceeds that of other major currency pairs by a large margin. It is also several times higher than the volatility of other speculative investments such as gold or oil.

Overall, it can be concluded that cryptocurrencies currently do not perform the basic functions of money as a unit of account, a medium of exchange and a store of value. They cannot be considered as a unit of account since prices of goods and services are not quoted in any cryptocurrency anywhere. Although Bitcoin has been designed as a means of transactions, the number of transactions in Bitcoin is modest.5 At the same time, the mining process that is necessary to verify transactions is energy intensive, which has raised environmental concerns and led to questioning the potential of Bitcoin as a currency (Mishra et al. 2017). Finally, the high volatility of cryptocurrencies makes them unsuitable as a store of value.

Stablecoins take advantage of the distributed ledger technology but feature a mechanism to limit the volatility resulting from the purely supply-and-demand driven valuation of cryptocurrencies. In the simplest case, a stablecoin is fully backed by deposits in a specific currency and thus can be seen as a ‘tokenisation’ of this currency on a distributed ledger.6 As long as the custodian of these deposits is regarded as credible, the stablecoin should trade at par with the underlying currency. A prominent example of such a stablecoin is Tether that is fully backed by liquid funds in US dollar and tracks the US dollar closely. Other types of collateral, e.g. with longer maturities or denominated in various currencies, are possible as well and can lead to more volatility in the value of the stablecoin (see the examples shown in Bullmann et al. 2019).

Stablecoins received much attention when Facebook announced its plan to launch Libra. Libra intends to offer cheap payments services to its users through a global currency and financial infrastructure that is built on a blockchain and backed by a reserve of low-volatility assets in currencies from stable and reputable central banks (Libra Association 2019). While other stablecoins have been launched long before Libra was announced, distinguishing features of Libra are its potentially large user base resulting from the close link with Facebook and its global scale, entailing the possibility of broad-based adoption.

Global stablecoins such as Libra can affect monetary policy through various channels. If a significant share of prices in an economy were to be fixed in a global stablecoin, domestic monetary policy would become unable to directly influence them. In addition, a global stablecoin may affect lending rates through its implications on bank funding, with the potential effects differing between jurisdictions that have a widely-used, stable currency and countries with smaller, less stable currencies. For the latter, domestic users could consider a global stablecoin a more stable store of value and decide to shift deposits from the domestic banking system into the global stablecoin, which could erode domestic banks’ depositor base and result in higher bank funding costs. These concerns are less acute in jurisdictions with large and stable currencies that will potentially form part of the collateral reserve underlying the global stablecoin. On the one hand, residents have little incentive to shift out of the domestic currency. On the other hand, when a currency is part of the reserve, some of the funds that are shifted into the global stablecoin would be reinvested in the domestic banking system. On net, for these currencies the domestic financial system therefore could experience either an outflow or an inflow of funds, depending on the domestic and foreign demand for the global stablecoin and the own currency’s share in the reserve. Exchange rates could also be affected by these flows or by a recalibration of the individual currencies’ weights in the reserve basket.

Although for reserve currencies capital flows induced by global stablecoins may well balance out, the investment of the reserve could still affect the funding structure of domestic banks and the transmission of domestic monetary policy. Currently, bank deposits are predominantly held by households, i.e. by a large number of small, relatively price-insensitive depositors, which makes deposits a reliable and cheap funding source for banks. If deposits were managed by the a global stablecoin’s reserve fund instead, they could become more expensive and volatile for banks. Apart from bank deposits, a global stablecoin’s reserve would presumably be invested in short-maturity safe assets, which are asset classes that many investors are required to hold by regulation and that are in short supply. Safe asset scarcity would be exacerbated if the reserve were to be invested more conservatively than banks’ assets. Moreover, in an environment of low interest rates globally, the return on the reserve from such assets would be low, raising questions about the financing and the profitability of the global stablecoin project.

Any loss of confidence in the value of the reserve could lead to a run on the global stablecoin and central banks may feel compelled to step in if this run threatened to spill over into the broader financial system or – through wealth effects – into the real economy. In the case of Libra, it is not foreseen at the current point in time that the Libra Association would grant credit in Libra or, in other words, that leverage in Libra would develop. Such an evolution, however, is not difficult to imagine. To the extent that Libra is used for purchasing services on Facebook, Facebook could easily create claims in Libra that customers would have to settle later. This would result in an under-collateralisation of Libra, meaning that holders of Libra unknowingly might acquire a claim against the Libra Association that was not be fully backed by the reserve.7 The G7 Working Group on Stablecoins (2019) therefore stressed that the significant risks inherent in stablecoins would need to be addressed appropriately and that any stablecoin arrangement would need to adhere to necessary standards and requirements and to comply with the laws and regulations in the jurisdictions in which they would operate.

In principle, stablecoins are better capable of serving as a means of payment and a store of value than genuine cryptocurrencies though they have not gained a lot of traction to date. Global stablecoins potentially could deliver great benefits to their users by addressing the lack of access to financial services of a large part of the world’s population and the inefficiency of cross-border retail payments that are often slow and expensive. At the same time, private entities that operate such global stablecoin arrangements would need to ensure sound governance and appropriate management of the risks inherent in such schemes.

The development of cryptocurrencies and stablecoins has raised the question whether central banks should consider issuing a digital representation of their own currency that is accessible for all citizens. Currently, no central bank has issued a CBDC though several are considering such a move and even more are researching potential use cases and associated risks (Barontini and Holden 2019, Boar et al. 2020). Motivations for investigating a CBDC focus on the efficiency and cost of currency operations as well as the efficiency and safety of payment systems (Fung and Halaburda 2016). In addition, if usage and acceptance of cash were to decline significantly, a central bank could issue a CBDC as a digital complement to cash (Sveriges Riksbank 2019). Monetary policy issues to date have not been central in these discussions though it is clear that CBDC would also have implications for monetary policy, monetary transmission and financial stability.

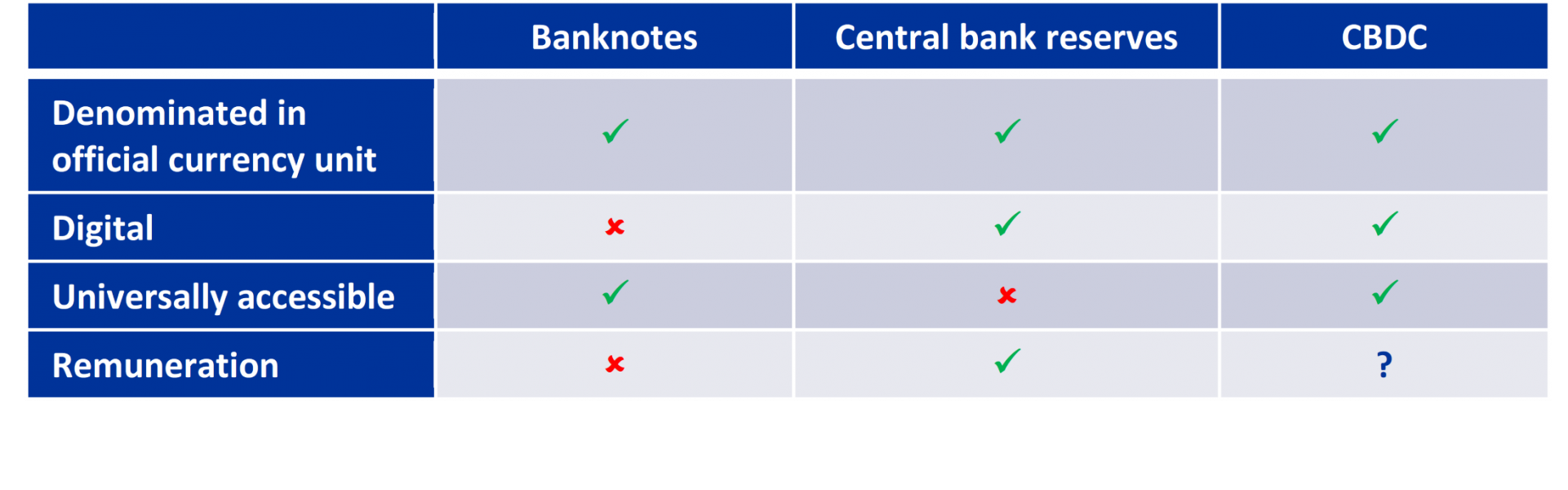

Table 1. Features of different types of central bank liabilities

In contrast to cryptocurrencies and stablecoins, a CBDC would be issued by the central bank and denominated in the official currency unit.8 As can be seen from Table 1, a specific form of a digital central bank liability already exists, namely central bank reserves. Whereas reserves are digital, they are not universally accessible because only banks can hold them on their central bank account. Today, the only liability of the central bank that can be used by everybody are banknotes but these are not digital.

Monetary policy and financial stability implications of CBDC would depend on how quickly and extensively it would be adopted. In this context, the design features of CBDC are important as they determine the attractiveness of CBDC and thus directly influence potential demand. If holders of CBDC would only shift their cash holdings into CBDC, i.e. swapping one central bank liability against another, the effects on the financial sector would be limited. By contrast, substitution between CBDC and bank deposits could have more far-reaching effects. Banks would lose deposits and would have to replace them with other types of funding that are typically more expensive, either from wholesale markets or from the central bank. How this would affect bank lending rates – and thus ultimately consumption and investment decisions – is less clear as this does not only depend on banks’ funding margins but also on competition on the credit market (Armelius et al. 2018, Juks 2018). To the extent that banks had to resort to additional lending from the central bank, the central bank’s balance sheet would expand, which could, on the one hand, increase seigniorage revenues but, on the other hand, lead to more risk on its balance sheet if the central bank had to accept riskier collateral.

The remuneration of CBDC is another important design feature. If CBDC were to be remunerated with the policy rate, interest rate transmission to household deposit rates could become more direct (Coeure 2018), thus giving the central bank a stronger grip on retail interest rates. By contrast, if CBDC were to be designed with a zero interest rate, a larger part of private sector money holdings would become unresponsive to interest rate changes. Currently, the zero interest rate on cash determines the effective lower bound on policy rates though they can be set somewhat below zero because storage of cash entails inconvenience and risk. By contrast, such cost would not be present with CBDC, so that the remuneration of CBDC is likely to establish a ‘hard’ lower bound for interest rates. Even if a CBDC could in principle carry a negative interest rate, eliminating the effective lower bound completely would in addition require phasing out cash.9

Another general concern with CBDC is that it could exacerbate systemic financial crises. Compared to cash, depositors can shift out of bank deposits into CBDC more easily. Thus, the argument goes, CBDC could make bank runs more frequent and more severe (Cœuré 2018). One should keep in mind, however, that also nowadays deposits can easily be moved from one bank to another if depositors lose confidence into a specific bank. The argument that CBDC facilitates bank runs thus only applies if confidence in the whole financial sector is lost – a situation in which the central bank usually takes action also in the current setting.

In sum, CBDC would be able to fulfil the functions of money as a unit of account, a means of payment and a store of value to a much greater extent than cryptocurrencies or stablecoins and could even take the role of legal tender. Views differ, however, on whether CBDC would be necessary or desirable from a monetary policy or financial stability perspective (Mersch 2018, Constâncio 2017).

The digital payments landscape is evolving quickly and electronic payments are booming. This article discussed some of the implications for monetary policy of these different forms of digital money. Because of their limited adoption and lack of moneyness, cryptocurrencies are unlikely to constrain monetary policy in the foreseeable future. Stablecoins, by contrast, could reach a critical size, in particular if they were sponsored by large companies with a sizeable potential user base. Central bank digital currency would constitute a digital representation of the official currency that is accessible to everybody. Although enlarging the number of users of digital central bank money does not seem to constitute a sweeping change, consequences for monetary policy and financial stability could be material.

At the current stage, costs and benefits from issuing CBDC are not clear and central bankers either feel that a convincing monetary policy motivation is missing or are concerned about the disruptive potential for financial stability. In addition, many important issues are still open and require further research, such as the safety and robustness of the technology, privacy and the implementation of regulatory requirements. As digitalisation of payments is evolving quickly, the assessment of costs and benefits associated with CBDC may change in the future. Some observers envisage a rebundling of the functions of money that links payments to an array of data services on a specific platform. In such a world, CBDC could ensure that public money remains a relevant unit of account (Brunnermeier et al. 2019).

Armelius, Hanna, Paola Boel, Carl Andreas Claussen and Marianne Nessén (2018): The e-krona and the macroeconomy, Sveriges Riksbank Economic Review, Special issue on the e-krona, 2018:3, 29-42.

Barontini, Christian and Henry Holden (2019): Proceeding with caution – a survey on central bank digital currency, Bank for International Settlements, BIS Papers No. 101.

Berentsen, Aleksander and Fabian Schär (2017): Bitcoin, Blockchain und Kryptoassets – Eine umfassende Einführung, Books on Demand, Norderstedt.

Bindseil, Ulrich (2020): Tiered CBDC and the financial system, European Central Bank, Working Paper No. 2351.

Boar, Codruta, Henry Holden and Amber Wadsworth (2020): Impending arrival – a sequel to the survey on central bank digital currency, Bank for International Settlements, BIS Papers No. 107.

Bolt, Wilko and Maarten R.C. van Oordt (2018): On the value of virtual currencies, Journal of Money, Credit and Banking, forthcoming, DOI: 10.1111/jmcb.12619.

Brunnermeier, Markus K., Harold James and Jean-Pierre Landau (2019): The Digitalization of Money, Princeton University, https://scholar.princeton.edu/markus/publications/digitalization-money.

Bullman, Dirk, Jonas Klemm and Andrea Pinna (2019): In search for stability in crypto-assets: are stablecoins the solution?, European Central Bank, Occasional Paper No. 230.

Cœuré, Benoît (2018): The future of central bank money, Speech given at the International Center for Monetary and Banking Studies, Geneva, 14 May 2018.

Constâncio, Vítor (2017): The future of finance and the outlook for regulation, Remarks given at the Financial Regulatory Outlook Conference organised by the Centre for International Governance Innovation and Oliver Wyman, Rome, 9 November 2017.

ECB Crypto-Assets Task Force (2019): Crypto-assets: Implications for financial stability, monetary policy, and payments and market infrastructures, European Central Bank Occasional Paper No. 223.

Faia, Ester, Sören Karau, Nora Lamersdorf and Emanuel Moench (2019): On the transmission of news and mining shocks in Bitcoin, available at https://ssrn.com/abstract=3478510.

Foley, Sean, Jonathan R. Karlsen and Tālis J. Putniņš (2018): Sex, drugs and bitcoin: How much illegal activity is financed through cryptocurrencies?, Review of Financial Studies, forthcoming. Available at SSRN: http://dx.doi.org/10.2139/ssrn.3102645.

Fung, Ben S.C. and Hanna Halaburda (2016): Central bank digital currencies: A framework for assessing why and how, Bank of Canada, Staff Discussion Paper 2016-22.

G7 Working Group on Stablecoins (2019): Investigating the impact of global stablecoins, https://www.bis.org/cpmi/publ/d187.pdf.

Juks, Reimo (2018): When a central bank digital currency meets private money: Effects of an e-krona on banks, Sveriges Riksbank Economic Review, Special issue on the e-krona, 2018:3, 79-99.

Lansky, Jan (2018): Possible state approaches to cryptocurrencies, Journal of Systems Integration 2018/1, 19-31, DOI: 10.20470/jsi.v9i1.335.

Libra Association (2019): The official Libra white paper, https://libra.org/en-US/white-paper/.

Mersch, Yves (2018): Virtual or virtueless? The evolution of money in the digital age, Lecture given at the Official Monetary and Financial Institutions Forum, London, 8 February 2018.

Mishra, Sailendra P., Jacob Varghese and Suresh Radhakrishnan (2017): Energy consumption – Bitcoin’s Achilles heel, Available at SSRN: http://dx.doi.org/10.2139/ssrn.3076734.

Nakamoto, Satoshi (2008): Bitcoin: A peer-to-peer electronic cash system. https://www.bitcoincash.org/bitcoin.pdf.

Sveriges Riksbank (2019): Payments in Sweden 2019.

Scorer, Simon (2017): Central bank digital currency: DLT, or not DLT? That is the question, https://bankunderground.co.uk/2017/06/05/central-bank-digital-currency-dlt-or-not-dlt-that-is-the-question/.

The views expressed here are those of the author and do not necessarily reflect those of the European Central Bank or the Eurosystem.

ECB Crypto-Asset Task Force (2019) prefers the term crypto-assets instead of cryptocurrencies and defines crypto-assets as assets recorded in digital form that are considered valuable by their users as an investment and/or means of exchange but that are neither a financial claim on, nor a financial liability of any natural or legal person.

Source: Coinmarketcap.com and ECB.

For a model that analyses the valuation of cryptocurrencies along these lines, see Bolt and van Oordt (2018).

Worldwide transactions in Bitcoin per day reached an all-time high of 0.4 million in December 2017 and stood at around 0.3 million in February 2020 (blockchain.com). These figures are several orders of magnitude smaller than total payment transactions in the European Union that amounted to 140 billion in 2018 (European Central Bank Statistical Data Warehouse), i.e. an average of more than 380 million per day.

Less common are so-called algorithmic stablecoins that feature a mechanism to restrict supply in order to stabilise their value. Such mechanism needs to contract supply sufficiently quickly to achieve stabilisation, e.g. by buying back coins in circulation using a reserve fund or requiring a set of users (market makers) to take up excess supply. Though such stabilisation should work in theory, in practice a loss of confidence may lead to a collapse in the value of the stablecoin.

In this context, it becomes important whether holders of Libra actually acquire a claim against the reserve and how the legal relations are set up.

Although the interest in CBDC has partly been generated by the development of distributed ledger technology, a CBDC would not need to use it (Scorer 2017). As this question relates to the technological features of CBDC and is less relevant for the monetary policy implications, we do not discuss it here.

If CBDC was introduced in an environment of negative interest rates, demand for CBDC would most likely be insignificant. Bindseil (2020) therefore advocates a tiered remuneration system that applies a non-negative interest rate to a minimum amount of CBDC needed for payments whereas balances exceeding this minimum are to be remunerated at a rate below the policy rate.