This note argues that the cross-border consolidation of banking is a pre-requisite for the provision of cross-border banking services in the eurozone and for stable risk sharing among its member countries. It also discusses what I see as the main obstacles to consolidation.

The creation of the euro gave an unprecedented boost to financial integration in Europe. Cross-border banking flows soared and prior to the global financial crisis most observers agreed that the euro had largely fulfilled the expectations regarding its catalytic effects on creating an integrated banking market in Europe.

The financial crisis laid bare that this was a delusion. With banking supervision still national and the ultimate responsibility for bank recapitalizations resting with individual member states, local banking crises turned into a diabolic sovereign-bank loop (Brunnermeier et al. 2016) that endangered the very existence of the euro. The role of lender of last resort in the eurozone had remained legally undefined and would only over time de facto be assumed by the ECB, allowing the crisis to deepen in the meanwhile. Against this backdrop, banking integration in Europe turned out to be fragile and provided virtually no risk sharing for its members. Cross-border banking flows quickly retrenched behind national borders (Milesi-Ferretti and Tille 2011).

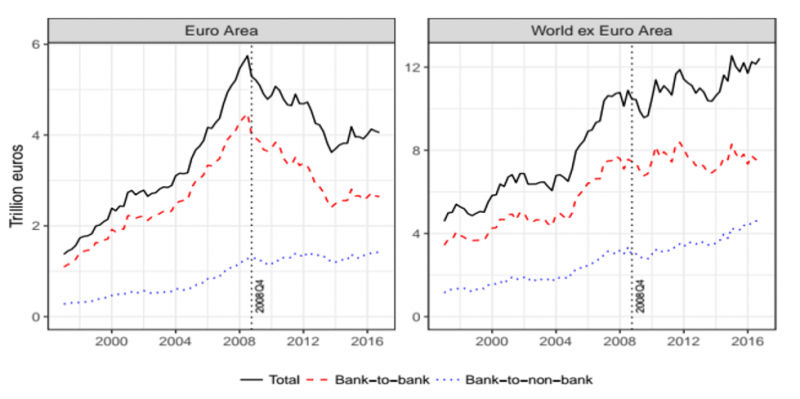

However, amid this turmoil, cross-border bank lending to the non-bank sector proved a lot more resilient. Figure (1), taken from Hoffmann, Maslov, Stewen and Sørensen (2019), shows that Europe indeed saw a boom and bust in cross-border lending. The post-crisis retrenchment was largely specific to Europe. But it is interesting that the retrenchment was also largely limited to cross-border flows between banks. Cross-border bank lending to the non-bank sector had slowly but steadily increased since the late 1990s and remained remarkably robust throughout the crisis. As I have argued in three recent papers co-authored with Bent E. Sørensen, Egor Maslov and Iryna Stewen2 this pattern holds interesting lessons for how banking integration needs to be designed for countries to reap its benefits, notably in terms of better risk sharing during crisis periods.

Figure 1: Cross-border banking positions by recipient sector for the Euro Area and the rest of the world.

Source: Hoffmann, Maslov, Stewen and Sørensen (2019) based on BIS locational banking statistics.

In the context of these papers, we think of cross-border bank-to-bank (interbank) flows as an indirect form of banking integration in the sense that funds reach their ultimate destination — the real sector (households, firms) in recipient countries — only via further intermediation by domestic banks. Conversely, we can think of cross-border lending by banks to the real sector in recipient countries as a direct form of integration. Specifically, I will argue that the cross-border provision of banking services to the domestic real sector via branches or subsidiaries of foreign banks would be a particularly potent form of direct banking integration.

Why does the distinction between direct and indirect integration matter? The short answer is that indirect (or interbank) integration provides virtually no risk sharing while increasing the exposure to external shocks.

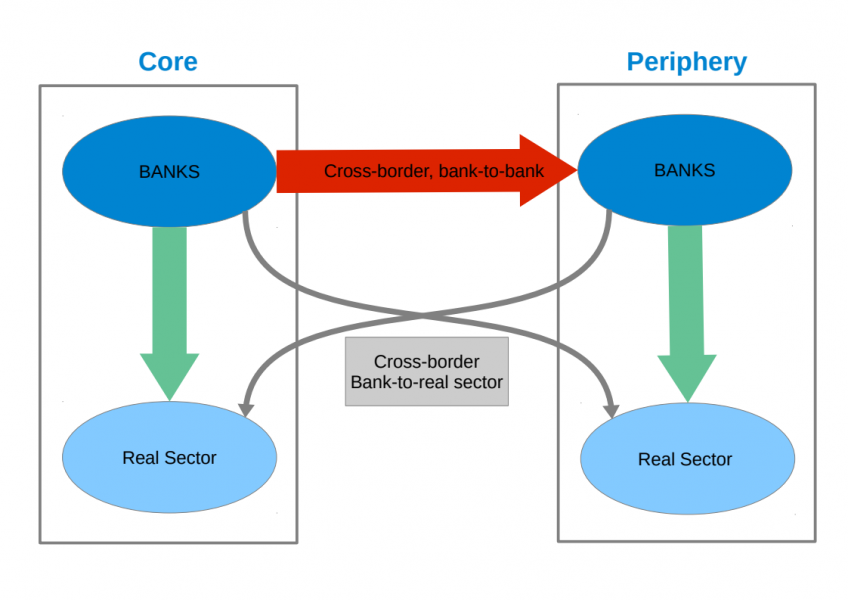

Figure 2: Schematic representation of two modes of banking integration: cross-border bank-to-bank (indirect) and cross-border bank-to-real-sector (direct).

Source: Hoffmann, Maslov, and Sørensen (2019).

To understand this argument consider Figure (2), adapted from Hoffmann, Maslov and Sørensen (2019). The figure represents the banking systems of two countries, one in the EMU core, another in the periphery. Each banking system lends to its respective real sector. There is also cross-border lending. The red, thick arrow illustrates the focus of banking integration between banks that prevailed before the eurozone crisis, with banking flows largely flowing from northern European (core) banks to banks in the southern periphery. There are also direct cross-border flows from banks to the real sector in the respective other country. Reflecting the pattern apparent from Figure (1), pre-crisis these flows were much smaller than interbank flows, which is illustrated by the thin, grey arrows.

To see the benefits that banking integration can generate, consider direct banking integration (the grey arrows) first. Direct banking integration shields the real sector in the borrowing countries from banking sector shocks (e.g. a banking crisis) in the home country. Instead of borrowing from local banks, the sector can turn to foreign banks or their branches for borrowing. Conversely, when there are negative shocks to the foreign banking sector, domestic firms still have local banks to turn to. Thus, direct banking integration effectively amounts to a diversification of funding sources for the domestic real sector.

This diversification is effectively absent in the case of interbank integration. Consider the case of a domestic banking sector crisis first. This will lead foreign banks to withdraw funding and it will lead to a reduction in credit provision by domestic banks to the real private sector. Since the private sector is totally dependent on domestic banks (i.e. the grey arrows are absent in this scenario), there will be adverse effects on the local economy very much as if there was no banking integration (or possibly worse, since the withdrawal of interbank funding can actually aggravate the situation of domestic banks in the periphery). Consider next the case of a shock to foreign (core) banks. Again, this will lead foreign banks to reduce interbank funding to the periphery banks which in turn will have to curtail lending to the real sector, which in the absence of foreign banks in real sector lending have nowhere to hide from this negative shock to credit supply.

Hence, the double-decker structure that comes with interbank integration (foreign banks lend to domestic banks first, which then recycle the funds to lend to the domestic real sector) does not generate any risk sharing benefits for the domestic real sector. The reason is simply that interbank integration does not really diversify the funding sources for the real sector, thus leaving it fully exposed to both domestic and international banking sector shocks.

Does this matter empirically? Yes, our results clearly illustrate that the mode of banking integration was a major determinant of the impact of the crisis on real-sector outcomes and that it mattered for risk sharing among eurozone countries. Specifically, in Hoffmann, Maslov and Sørensen (2019) we show that sectors with many small and medium-sized enterprises (SME)s, which are known to be particularly sensitive to fluctuations in credit supply, fared much worse in countries with high levels of interbank rather than direct integration. Also, as the results in Hoffmann, Maslov, Sørensen and Stewen (2019 b) illustrate, countries that were particularly dependent on interbank integration experienced much larger declines in consumption, while higher levels of direct banking integration lead to better outcomes in terms of cross-border risk sharing.

To understand what the benefits of more direct banking integration could be for Europe, it is instructive to turn to the recent economic history of the United States.

Until the 1980s, banking markets in the United States were segmented between states, because state-level laws generally barred entry of banks from other of states into local banking markets. Specifically, banks from outside a given state were usually not allowed to merge with that state’s banks or even to open branches in the state. Hence, regulation effectively did forbid direct banking integration through the provision of banking services across state borders. However, very much like in Europe today, markets for interbank lending were highly integrated between states.

A large academic literature (see Kroszner and Strahan (2014) for a survey) has documented that the gradual removal of these legal barriers to entry during the 1980s and 1990s had a range of positive effects on the liberalizing states. A main beneficiary were local SMEs which could insulate their access to credit from the effects of mainly local shocks. This considerably improved interstate risk sharing (Demyanyk et al. 2007) and, in particular, made risk sharing more resilient in aggregate (U.S. wide) downturns (Hoffmann and Sherbakova-Stewen 2011). This resilience of risk sharing against an area-wide (eurozone) shock was the key element that was missing among members of the euro in the recent crisis and one important reason was the lack of direct banking integration.

The U.S. experience suggests that allowing banks to provide banking services across state-borders was a major step towards reaping the full benefits from banking integration. The U.S. experience also illustrates how the improvements in the cross-border provision of financial services was ultimately brought about: the dismantling of the legal barriers segmenting banking markets between states ultimately led to waves of banking consolidation, many of which involved bank mergers across state borders. Hence, the provision of banking services across state-border ultimately happened through the formation of integrated banks that operate branch networks and internal capital markets across state-borders.

In Europe today, there are no direct legal barriers to cross-border consolidation in banking. Still, to date we have not seen any major cross-border mergers and the appetite of Europe’s biggest banking organizations to expand their branch networks across several countries in the Eurozone has so far been very limited.

In fact, the incompleteness of Europe’s banking union represents one of the major impediments to banking consolidation. Specifically, the current state of Europe’s banking union perpetuates a national fragmentation of the regulatory framework for banks which prevents consolidation across national borders from becoming economically viable.

Take deposit insurance. With deposit insurance splintered at the national level, national regulators will be extremely wary to let their own banks merge with foreign banks since major losses incurred abroad could ultimately trigger the need for the domestic deposit insurance to kick in. Note that, unlike Europe today, the U.S. had a common deposit insurance already in place long before the deregulation of state-level banking markets.

Take the resolution regime next. With the ESM, the eurozone now has a potent stabilization tool that allows to deal with major bank resolutions and allows it to undertake sizeable recapitalizations. But the ESM’s potential “customers” are effectively sovereign states, not banks.3 Hence, the ultimate responsibility for a bank recapitalization still largely rests with the national governments of the country in which a failing bank is headquartered. Again, this gives national regulators a strong incentive to view any foreign ventures of banks under their jurisdiction with a healthy dose of scepticism.

However, one of the biggest obstacles to genuine cross-border consolidation in Europe that is hardly ever discussed is the regional fragmentation of banking markets within member countries. Regional banks account for a large share of the banking market in many EMU member countries and in fact often are quasi-monopolists in their respective local markets. Many are protected by special laws and have a cooperative or public status. This requires foreign entrants to compete against local incumbents in many locally segmented markets. While modern digital technology may make entering retail markets possible in spite of this fragmentation, the lucrative market for SME lending still requires close relationships with customers and a branch network to maintain them. It is therefore no surprise that regional banks are the prime lenders to SMEs in many European countries. Legal barriers often prevent mergers between local cooperative of public banks and other, private, banks. For example, Germany’s Sparkassen are established as special entities under public law. While Sparkassen can merge among themselves, it is legally virtually impossible for a municipality to sell a Sparkasse to a private buyer or for a commercial bank to acquire a Sparkasse under private law. These legal constraints amount to a formidable set of obstacles against intra-national, let alone international consolidation.

Finally, there are also enormous political challenges to be overcome. Many governments still see the nurturing of national champions in banking as a political priority and a matter of national prestige. Due to their special status under public law, local banks are often quite closely linked with local or regional governments, adding an additional layer of resistance against consolidation. As shown by Kroszner and Strahan (1999), political economy considerations played a key role in keeping U.S. banking markets locally segmented for a long time. However, once deregulation created the right legal framework, political resistance was ultimately not able to overturn the fundamental economic forces driving the U.S. banking system towards consolidation. One could, however, speculate that it may have “helped” consolidation of the U.S. banking industry at the time that many of America’s small local and savings banks where in dire straits following the savings&loan crisis of the mid-1980s.

Brunnermeier, Markus K. and Garicano, Luis and Lane, Philip R. and Pagano, Marco and Reis, Ricardo A.M.R. and Santos, Tano and Thesmar, David and Van Nieuwerburgh, Stijn and Vayanos, Dimitri (2016). „The Sovereign-Bank Diabolic Loop and Esbies“, American Economic Review, American Economic Association, vol. 106(5), pages 508-512, May.

Demyanyk, Yuliya, Charlotte Ostergaard, and Bent E. Sørensen. „U.S. Banking Deregulation, Small Businesses, and Interstate Insurance of Personal Income“. The Journal of Finance 62, Nr. 6 (2007): 2763–2801. https://doi.org/10.1111/j.1540-6261.2007.01292.x.

Hoffmann, Mathias, Egor Maslov, and Bent E. Sørensen, „Small Firms and Domestic Bank Dependence in Europe’s Great Recession“. CESifo Working Paper No 7897/2019.

Hoffmann, Mathias, Egor Maslov, Bent Sørensen, und Iryna Stewen. (2019a). „Banking integration in the EMU: Let’s get real!“ VoxEU.org (blog), 10. Januar 2019. https://voxeu.org/article/banking-integration-emu-let-s-get-real

Hoffmann, Mathias, Egor Maslov, Bent E. Sørensen, and Iryna Stewen (2019b). „Channels of Risk Sharing in the Eurozone: What Can Banking and Capital Market Union Achieve?“ IMF Economic Review 67, Nr. 3 (September 2019): 443–95. https://doi.org/10.1057/s41308-019-00083-3.

Hoffmann, Mathias, and Iryna Shcherbakova-Stewen. „Consumption Risk Sharing over the Business Cycle: The Role of Small Firms’ Access to Credit Markets“. The Review of Economics and Statistics 93, Nr. 4 (2011): 1403–16.

Kroszner, Randall S., and Philip E. Strahan. „What Drives Deregulation? Economics and Politics of the Relaxation of Bank Branching Restrictions“. The Quarterly Journal of Economics 114, Nr. 4 (1999): 1437–67.

Kroszner, Randall S., and Philip E. Strahan. „Regulation and Deregulation of the U.S. Banking Industry: Causes, Consequences, and Implications for the Future“. In Nancy L. Rose, editor, Economic Regulation and Its Reform: What Have We Learned?, National Bureau of Economic Research, June 2014, 485–543.

Milesi-Ferretti, Gian-Maria, and Cédric Tille. „The Great Retrenchment: International Capital Flows during the Global Financial Crisis“. Economic Policy 26, Nr. 66 (1. April 2011): 289–346. https://doi.org/10.1111/j.1468-0327.2011.00263.x.

Mathias Hoffmann is Professor and Chair of International Trade and Finance at the Department of Economics, Zürichbergstrasse 14, CH-8032 Zurich, Switzerland.

E-Mail: mathias.hoffmann@econ.uzh.ch; URL: mathiashoffmann.net

This note is the summary of Mathias Hoffmann‘s panel remarks at the SUERF/Belgian Financial Forum (BFF) Conference Cross border financial services: Europe’s Cinderella?, Nov 15th 2019 in Brussels. He is grateful to conference participants for discussions and feedback.

See Hoffmann, Maslov and Sørensen (2019) and Hoffmann, Maslov, Sørensen and Stewen (2019 a,b).

The ESM toolkit does allow a direct recapitalization of systemically important institutions but only at the explicit request of a member state which needs to demonstrate that “it cannot provide financial assistance to the institutions without very adverse effects on its own fiscal sustainability, and that therefore the use of the indirect recapitalisation instrument is infeasible”. See https://www.esm.europa.eu/assistance/lending-toolkit#lending_toolkit